Market Overview

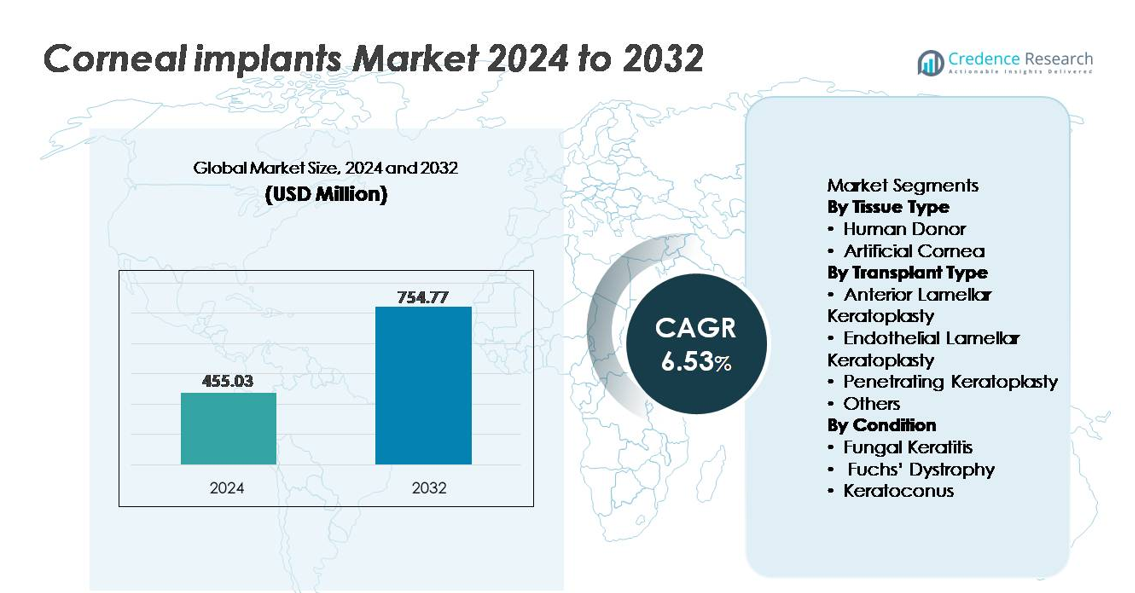

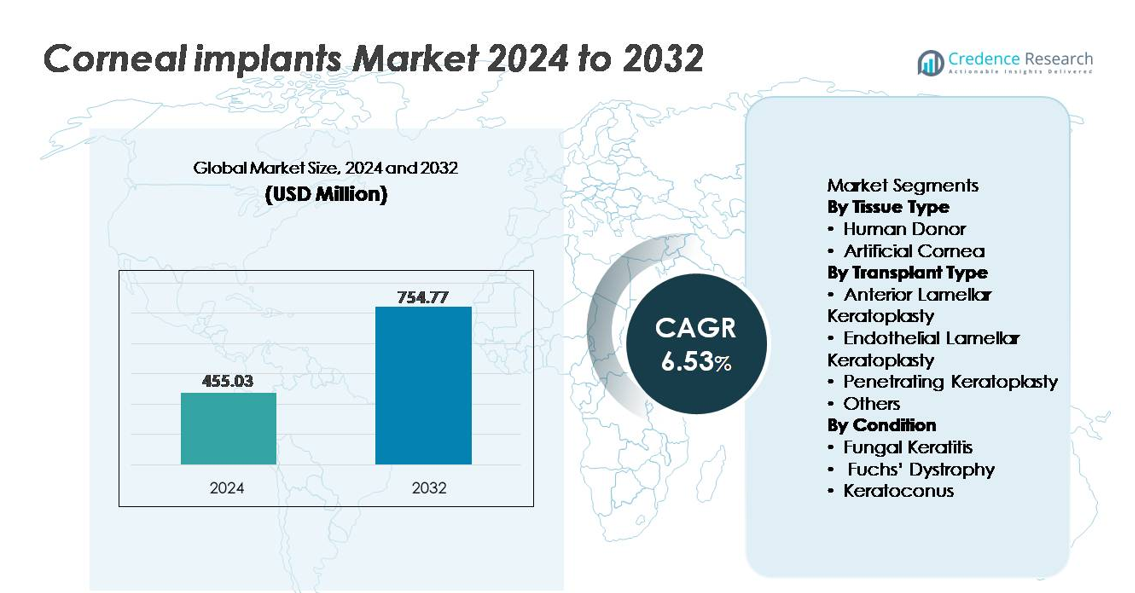

The global corneal implants market was valued at USD 455.03 million in 2024 and is projected to reach approximately USD 754.77 million by 2032, registering a CAGR of 6.53% throughout the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Corneal Implants Market Size 2024 |

USD 455.03 million |

| Corneal Implants Market, CAGR |

6.53% |

| Corneal Implants Market Size 2032 |

USD 754.77 million |

The corneal implants market features a competitive mix of medical device manufacturers, biotech innovators, and eye bank networks including CorNeat Vision Ltd., Florida Lions Eye Bank, Aurolab, AJL Ophthalmic SA (Intacs), Keramed, Inc., Massachusetts Eye, Alcon Inc., DIPOTEX, CorneaGen, and Alabama Eye Bank. North America remains the leading regional market, accounting for approximately 38% of total global share, driven by strong donor tissue availability, advanced transplant infrastructure, and high adoption of lamellar keratoplasty. Europe follows with a substantial share supported by government-backed donor programs and standardized clinical protocols, while Asia-Pacific continues to emerge as a high-growth region due to rising unmet need and expanding surgical capabilities.

Market Insights

- The global corneal implants market was valued at USD 455.03 million in 2024 and is projected to reach USD 754.77 million by 2032, reflecting a CAGR of 6.53% during the forecast period.

- Rising prevalence of corneal blindness and age-related endothelial disorders remains a key market driver, with increasing demand for minimally invasive lamellar keratoplasty supporting greater implant utilization.

- Advancements in artificial corneas, bioengineered tissues, and regenerative therapies are emerging as significant trends, creating new opportunities in markets facing donor shortages.

- The competitive landscape features medical device companies and eye bank networks, with North America leading due to infrastructure strength, while human donor implants hold the dominant segment share across most surgical procedures.

- Regional dynamics reveal North America at 38% market share, followed by Europe at 29%, and Asia-Pacific at 24%, with growth restrained in emerging markets by limited donor access and high surgical costs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Tissue Type

Human donor corneal implants represent the dominant segment, accounting for the largest share due to established clinical outcomes, widespread surgeon familiarity, and long-standing integration into transplant programs. Their organic compatibility reduces rejection risk and supports better sensory nerve regeneration. However, increasing donor shortages and rising demand for timely procedures drive interest in artificial corneas. Synthetic and bioengineered artificial corneas are emerging as alternatives for patients unsuitable for donor grafts or multiple graft failures. Advances in flexible biomaterials, polymer scaffolds, and nanostructured surfaces continue to expand the adoption potential of artificial corneas across high-need patient groups.

- For instance, CorNeat Vision’s CorNeat KPro utilizes an integrating nanofiber skirt composed of electrospun polymers engineered at fiber diameters below 900 nanometers, enabling bio-integration without requiring donor cells.

By Transplant Type

Endothelial lamellar keratoplasty holds the dominant market share, driven by precision surgical outcomes, reduced recovery times, and lower complication rates compared to full-thickness transplants. Its targeted approach preserves healthy corneal layers and decreases the likelihood of graft rejection. Anterior lamellar keratoplasty is preferred for selective stromal conditions, while penetrating keratoplasty remains essential when multiple corneal layers require replacement. Emerging techniques within the “Others” category including customized laser-assisted grafting are gaining attention for their ability to improve visual clarity through structural personalization and enhanced postoperative stability.

- For instance, Alcon’s VERION Image-Guided System provides high-precision digital eye registration and supports toric IOL alignment with documented angular accuracy in the sub-degree range. The platform tracks ocular rotation to maintain stable intraoperative orientation. These capabilities improve visualization and planning in procedures that require precise corneal incisions or centration.

By Condition

Fuchs’ dystrophy remains the dominant condition segment as it contributes significantly to global corneal transplant demand, supported by rising incidence among aging populations and earlier diagnosis enabled by advanced imaging. Endothelial dysfunction drives the preference for minimally invasive endothelial keratoplasty techniques, strengthening demand for targeted implants. Fungal keratitis forms a substantial need cluster in tropical and developing regions, largely due to environmental exposure and delayed treatment. Keratoconus continues to expand as a treatment area with younger patient demographics and the growing adoption of graft-sparing interventions that delay or reduce the need for full corneal replacement

Key Growth Drivers

Increasing Prevalence of Corneal Disorders and Vision Loss

The growing burden of corneal diseases including Fuchs’ dystrophy, keratoconus, infectious keratitis, and trauma-related injuries continues to drive demand for corneal implants globally. As populations age, the incidence of endothelial cell degeneration increases, generating sustained surgical volume. In developing regions, untreated infections, contact lens misuse, and occupational hazards remain major contributors to corneal opacity. Rising awareness of surgical interventions, earlier diagnosis through high-resolution imaging, and improvements in referral networks strengthen market penetration. Additionally, public and private healthcare initiatives supporting screening, subsidized transplants, and donor tissue procurement enhance access to treatment in underserved regions, creating multi-tiered demand growth.

- For instance, diagnostic platforms such as Topcon’s Casia2 swept-source OCT capture 50,000 A-scans per second, enabling early detection of corneal endothelial dysfunction and keratoconus progression with micrometer-level precision. Public and private initiatives supporting screening and donor procurement continue to improve access in underserved regions, contributing to multi-tiered demand growth.

Advancements in Bioengineered and Synthetic Corneal Substitutes

Technological progress in biomaterials, regenerative medicine, and tissue engineering has accelerated the development of artificial corneas as reliable alternatives to donor implants. Polymer-based scaffolds, biointegrative hydrogels, and nanocomposite materials reduce rejection risks while improving durability and optical clarity. Bioengineered corneas developed using decellularized matrices and cultured stromal cells expand opportunities where donor availability is limited. Customizable implants that mimic natural curvature and achieve enhanced tear film stability are improving patient outcomes. These innovations support application in complex cases and repeat graft failures, positioning synthetic corneas as a scalable and globally deployable solution.

- For instance, the Boston KPro Type I features a PMMA front plate with an 8.5 mm diameter and a central optical stem measuring about 3.35 mm in diameter. The design provides stable optical power and long-term clarity for patients with repeated graft failures or severe corneal opacities. The prosthesis remains one of the most widely used artificial corneal devices in complex corneal repair.

Global Expansion of Eye Banks and Donor Tissue Preservation Capabilities

Significant investments in eye banking infrastructure and enhancements in corneal tissue preservation have improved availability, safety, and transplant timing. Extended viability solutions enable long-distance transport and support international distribution networks, optimizing tissue utilization. Digitized donor registries, streamlined consent processes, and public awareness campaigns are increasing voluntary donation rates in both developed and emerging markets. Training programs that support surgeon proficiency in lamellar keratoplasty further boost adoption. As healthcare systems prioritize sight-restoration initiatives, coordinated donor management and preservation technologies ensure consistent supply, reducing surgical backlogs and supporting market growth

Key Trends & Opportunities

Rising Shift Toward Minimally Invasive and Layer-Specific Corneal Surgery

A sustained transition from full-thickness penetrating keratoplasty to minimally invasive, layer-specific procedures represents a major opportunity. Techniques such as DMEK and DSAEK reduce recovery time, enhance visual outcomes, and minimize graft rejection, driving patient preference and payer support. As laser-assisted dissection, intraoperative optical coherence tomography, and microinstrumentation evolve, surgeon confidence and precision continue improving. This trend enables personalized intervention for early-stage disease and promotes staged approaches that preserve native tissue. The demand for implants compatible with microincisional techniques offers long-term innovation potential for manufacturers.

- For instance, Zeiss’s RESCAN 700 intraoperative OCT provides real-time imaging with axial resolution of 5 microns, enabling surgeons to verify graft positioning during DMEK/DSAEK without interrupting the procedure.

Commercialization of Next-Generation Artificial Corneas and Regenerative Therapies

The pipeline for next-generation artificial corneas, stem-cell–based regeneration, and gene-modulated therapies creates significant commercial opportunity. Scalable lab-manufactured substitutes reduce donor dependence and open avenues for off-the-shelf distribution models. Meanwhile, autologous cell expansion and induced pluripotent stem cell solutions are gaining attention for restoring functional endothelial layers without grafting. Regulatory support for advanced therapies, coupled with venture funding in ophthalmic biotech, accelerates development cycles. As clinical validation strengthens, regenerative solutions may transform treatment for progressive disorders and younger patients, opening a long-horizon revenue stream.

- For instance, Aurion Biotech’s investigational cell therapy AURN001 administers approximately 1.0 million (1.0 x 10⁶) cultured corneal endothelial cells in combination with a rho-kinase inhibitor via a single injection, which has shown promise in restoring function without transplanting donor corneal tissue.

Key Challenges

Limited Global Access and Persistent Donor Tissue Shortages

Despite technological advancements, inadequate donor supply remains a fundamental barrier to universal treatment access. Many low- and middle-income countries lack eye banking networks or rely heavily on international procurement. Cultural hesitation toward organ donation, logistical restrictions, and inconsistent preservation capabilities exacerbate shortages. High surgical costs and resource-intensive procedures restrict penetration in markets with limited ophthalmic infrastructure. These limitations create a treatment gap, delaying surgeries and increasing complications, particularly in cases of infectious keratitis or trauma where rapid intervention is critical.

Surgical Complexity, Postoperative Complications, and Risk of Graft Rejection

Corneal transplantation demands specialized expertise, and outcomes depend heavily on surgeon skill, postoperative care, and patient compliance. Risks such as graft failure, infection, astigmatism, and chronic inflammation remain significant, especially in repeat transplants or immune-compromised patients. Layer-specific techniques, while beneficial, present steep learning curves and require high-cost equipment. Rejection and long-term endothelial cell loss continue as clinical challenges, limiting graft longevity. Additional barriers include variable patient adherence to immunosuppressive regimens, contributing to avoidable failure rates and rising healthcare expenditures

Regional Analysis

North America

North America holds the dominant position in the corneal implants market, accounting for approximately 38% of global share, driven by a well-established eye care infrastructure, high surgical volumes, and strong insurance reimbursement frameworks. The U.S. leads the region due to advanced availability of donor tissues, a robust network of accredited eye banks, and early adoption of endothelial keratoplasty procedures. Rising prevalence of age-related endothelial disorders, particularly Fuchs’ dystrophy, supports sustained demand. Ongoing clinical research in artificial corneas and regenerative therapies further reinforces regional leadership and attracts strategic investment from biotechnology developers.

Europe

Europe represents around 29% of the global market, supported by national donor programs, standardized clinical protocols, and publicly funded transplantation services. Countries including Germany, France, and the U.K. contribute significantly to procedure volumes, driven by high diagnostic rates and increasing adoption of minimally invasive lamellar keratoplasty. Awareness initiatives for eye donation and robust regulatory oversight improve patient access and quality outcomes. The region also sees growing interest in bioengineered corneal substitutes for complex cases, particularly where graft rejection risk remains high. Cross-border collaboration in research elevates Europe as a competitive innovation hub.

Asia-Pacific

Asia-Pacific accounts for approximately 24% market share and represents the fastest-growing regional opportunity due to large untreated patient populations, rising prevalence of infectious keratitis, and increasing investment in ophthalmic surgery centers. Countries such as China, India, and Japan are expanding their eye bank networks and adopting advanced imaging for early disease diagnosis. However, donor shortages continue to challenge procedure capacity, fueling interest in artificial and lab-grown corneal substitutes. Improving medical tourism, cost-competitive surgery, and government-led blindness prevention programs position Asia-Pacific as a long-term expansion market for international implant manufacturers.

Latin America

Latin America captures about 5% of global market share, with growth influenced by increasing healthcare modernization and gradual expansion of corneal transplantation training programs. Brazil and Mexico lead procedural adoption, supported by improving surgical capabilities and growing partnerships with international non-profit eye donation organizations. However, variability in donor availability, economic limitations, and uneven access across public and private healthcare systems remain challenges. Rising awareness of treatable corneal blindness and support for subsidized procedures contribute to gradual market expansion, especially as more regional clinics adopt lamellar keratoplasty techniques.

Middle East & Africa

The Middle East & Africa region accounts for roughly 4% of the global corneal implants market, driven primarily by unmet clinical needs, limited donor supply, and higher prevalence of trauma and infectious keratitis-related corneal opacity. Wealthier Gulf countries increasingly adopt advanced transplant technologies through medical tourism and specialty surgical centers. Meanwhile, many African nations depend on imported donor tissues and humanitarian support, creating supply constraints that delay interventions. Growth potential lies in targeted eye bank development and adoption of synthetic corneas, which may offer viable alternatives where donor infrastructure remains underdeveloped.

Market Segmentations:

By Tissue Type

- Human Donor

- Artificial Cornea

By Transplant Type

- Anterior Lamellar Keratoplasty

- Endothelial Lamellar Keratoplasty

- Penetrating Keratoplasty

- Others

By Condition

- Fungal Keratitis

- Fuchs’ Dystrophy

- Keratoconus

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the corneal implants market is characterized by a mix of established medical device manufacturers, biotechnology innovators, and eye bank organizations that collectively drive supply, technology development, and clinical adoption. Leading players focus on expanding portfolios for both human donor grafts and artificial corneas, supported by advancements in biomaterials, regenerative cell therapies, and lamellar-specific implant designs. Strategic partnerships with research institutions, regulatory approvals for next-generation synthetic corneas, and investments in clinical validation shape the innovation cycle. Companies are prioritizing markets with high transplant volumes and limited donor availability, positioning artificial substitutes as scalable, cross-border solutions. Efforts to reduce postoperative complications, extend implant longevity, and improve optical clarity remain central to competition. Emerging firms are gaining traction by offering customizable implants tailored to different surgical procedures, while established players leverage distribution networks and training programs to deepen market penetration. Competitive differentiation increasingly depends on precision outcomes, durability, and surgeon support services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, CorNeat Vision Ltd. announced that its synthetic cornea implant CorNeat KPro restored perfect 20/20 vision to a patient blinded by shingles-related corneal scarring the first case of its kind, marking a major clinical milestone.

- In November 2024, CorNeat Vision publicized its synthetic tissue patch device CorNeat EverPatch entering the market in the U.S., broadening its offering beyond corneal implants to tissue substitutes for ocular surgery.

- In June 2024, CorneaGen officially launched its CTAK (Corneal Tissue Addition for Keratoplasty) offering, delivering gamma-irradiated, sterile, non-immunogenic donor tissue inlays pre-cut and customized for patients with keratoconus, marking a shift toward tissue-addition solutions instead of full graft replacement

Report Coverage

The research report offers an in-depth analysis based on Tissue type, Transplant type, Condition and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for corneal implants will rise as early diagnosis of degenerative corneal diseases expands across global healthcare systems.

- Adoption of bioengineered and synthetic corneas will accelerate to address persistent donor shortages.

- Minimally invasive, layer-specific keratoplasty techniques will become standard practice in advanced surgical centers.

- Regenerative medicine and stem-cell–based therapies will play a larger role in corneal restoration and repair.

- AI-assisted imaging and surgical planning will enhance procedural precision and outcomes.

- Medical tourism will grow as cost-competitive regions increase corneal transplant capabilities.

- Long-term implant durability and reduced rejection risk will remain core R&D priorities.

- Public awareness campaigns will positively influence organ and tissue donation rates.

- Collaborations between biotech developers and academic institutions will accelerate innovation pipelines.

- Wider reimbursement support will improve accessibility for advanced corneal implant procedures.