Market Overview

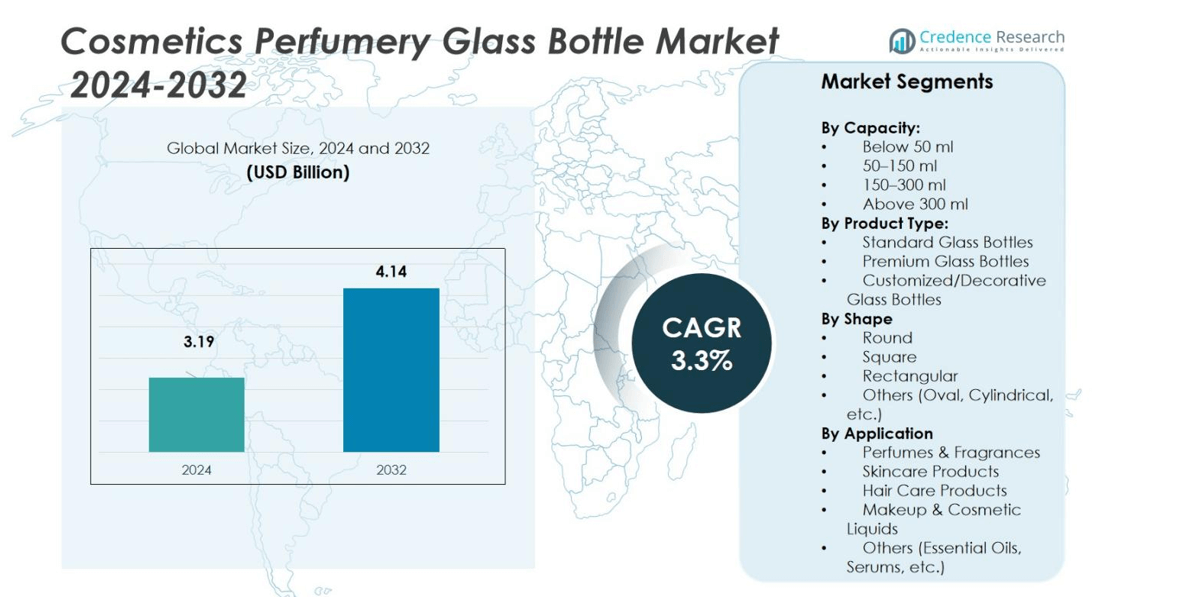

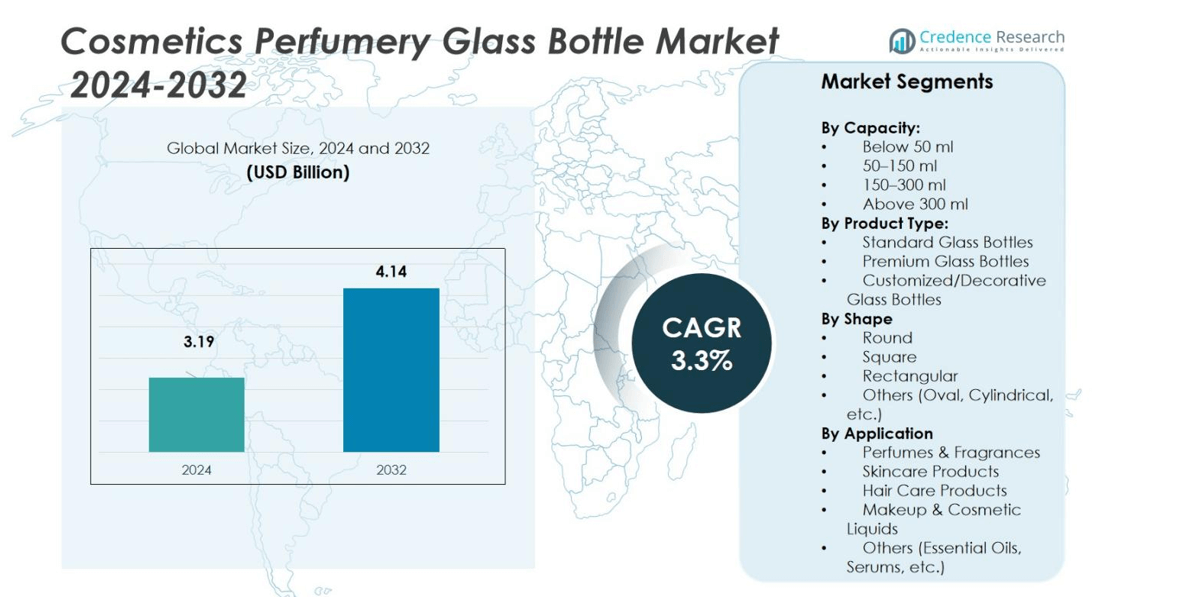

The Cosmetics Perfumery Glass Bottle Market size was valued at USD 3.19 billion in 2024 and is anticipated to reach USD 4.14 billion by 2032, growing at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cosmetics Perfumery Glass Bottle Market Size 2024 |

USD 3.19 billion |

| Cosmetics Perfumery Glass Bottle Market, CAGR |

3.3% |

| Cosmetics Perfumery Glass Bottle Market Size 2032 |

USD 4.14 billion |

The Cosmetics Perfumery Glass Bottle Market is highly competitive, with leading players such as Verescence, Gerresheimer AG, HEINZ-GLAS GmbH & Co. KGaA, Bormioli Luigi S.p.A., Stoelzle Glass Group, Vidrala S.A., Zignago Vetro S.p.A., Saverglass SAS, Piramal Glass Private Limited, and Coverpla S.A. dominating the global landscape. These companies focus on advanced glass manufacturing, decorative finishing, and sustainable packaging solutions to meet growing demand from luxury and mass-market brands. Europe leads the global market with a 33% share in 2024, driven by its rich perfume heritage, design excellence, and stringent sustainability standards, followed by Asia Pacific with 28% and North America with 27%, reflecting expanding beauty and fragrance consumption across these key regions.

Market Insights

- The Cosmetics Perfumery Glass Bottle Market was valued at USD 3.19 billion in 2024 and is projected to reach USD 4.14 billion by 2032, growing at a CAGR of 3.3%.

- Rising demand for premium and luxury packaging drives market expansion, supported by growing consumer preference for recyclable and refillable glass bottles in cosmetics and fragrances.

- Customization, aesthetic differentiation, and the use of advanced decorative techniques such as laser engraving and metallization are key trends enhancing brand identity.

- The market is moderately consolidated, with major players like Verescence, Gerresheimer AG, and Stoelzle Glass Group leading through innovation and sustainability-focused strategies.

- Europe leads with 33% share due to its strong perfume heritage, followed by Asia Pacific with 28% and North America with 27%; among product segments, premium glass bottles hold the largest share at 47%, driven by demand for high-end and visually appealing cosmetic packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Capacity

The 50–150 ml segment dominates the Cosmetics Perfumery Glass Bottle Market, accounting for over 42% share in 2024. This capacity range is favored by major perfume and cosmetic brands due to its portability, affordability, and suitability for premium packaging designs. Brands use this size for both mid-range and high-end products targeting daily-use consumers. The increasing demand for travel-friendly formats and gifting options further drives growth. Additionally, sustainability initiatives promoting lighter glass bottles within this capacity range support cost-efficient production and reduced carbon footprint during logistics.

- For instance, Verescence has partnered with Givaudan to create eco-designed perfume bottles, highlighting their focus on sustainable and luxury packaging tailored to premium cosmetics and fragrance products.

By Product Type

The premium glass bottles segment leads the market with a share exceeding 47% in 2024, driven by rising demand for luxury perfumes and skincare packaging. These bottles feature superior clarity, decoration, and customization options that enhance brand image. Manufacturers increasingly invest in advanced techniques such as frosted finishes, metallic coatings, and engraving to cater to prestige brands. The shift toward sustainable luxury, including recyclable and refillable bottles, also fuels adoption. Growing disposable incomes and brand differentiation efforts among global cosmetic leaders sustain the dominance of this premium segment.

- For instance, Berlin Packaging collaborated with Doft New York to develop custom-shaped glass bottles that enhance the skincare line’s brand identity while incorporating sustainable features, reflecting the trend of eco-friendly yet luxury packaging in 2024.

By Shape

The round-shaped bottles segment holds the largest market share of approximately 45% in 2024, attributed to its classic aesthetics and production efficiency. Round designs offer better durability, easier labeling, and smooth filling line compatibility, making them preferred by both mass-market and luxury brands. These bottles are commonly used across perfumes, lotions, and serums due to ergonomic handling and balanced shelf presence. Meanwhile, square and rectangular designs cater to niche and designer products seeking unique visual appeal. Consistent innovation in mold design and decoration techniques continues to strengthen round bottle demand.

Key Growth Drivers

Rising Demand for Premium and Luxury Packaging

The growing preference for high-end fragrances and skincare products fuels demand for premium glass bottles. Consumers increasingly associate elegant packaging with brand quality and exclusivity, pushing companies to invest in advanced glass finishing and custom designs. For instance, luxury brands are adopting crystal-clear glass and intricate decorative elements to differentiate products. This trend strengthens brand identity and drives repeat purchases, supporting long-term market expansion for luxury packaging formats within the cosmetics and perfumery sector.

- For instance, Coty partnered with Verescence to launch Chloé perfumes in eco-designed glass bottles, featuring crystal-clear transparency and intricate geometric shapes, reinforcing luxury appeal.

Sustainability and Eco-Friendly Packaging Initiatives

Sustainability is a core growth driver as brands and consumers prioritize recyclable and refillable packaging. Leading manufacturers are replacing plastic components with eco-conscious glass alternatives, aligning with environmental regulations. The introduction of lightweight glass bottles reduces emissions during transport while maintaining durability. Many companies now offer refill systems that lower waste and appeal to eco-aware buyers. This green transformation across production and design stages fosters innovation and positions glass packaging as a responsible and future-proof material choice.

- For instance, AB InBev developed the world’s lightest longneck beer bottle, reducing its weight from 180 to 150 grams, which cut CO₂ emissions by 17% per bottle. This innovation supports the company’s goal to reduce CO₂ emissions by 25% across its value chain by 2025.

Expansion of the Global Beauty and Fragrance Industry

Rapid urbanization, rising incomes, and social media influence are fueling global cosmetic and perfume consumption. Emerging economies in Asia-Pacific and Latin America are becoming vital growth hubs, supported by expanding retail networks and e-commerce accessibility. International beauty brands are increasing local production to meet diverse regional preferences. The surge in product launches, especially limited-edition fragrances, further boosts glass bottle demand. As beauty routines evolve and gifting trends rise, glass packaging continues to gain prominence as a symbol of luxury and authenticity.

Key Trends & Opportunities

Customization and Aesthetic Differentiation

Personalized packaging has emerged as a major trend, with brands offering distinctive shapes, textures, and colors to capture attention. Custom glass molds, embossing, and laser engraving techniques allow brands to create unique identities that enhance consumer connection. The rise of digital printing and short-run production enables limited editions and small-batch collections. These innovations increase perceived product value, offering opportunities for manufacturers to provide premium design services tailored to niche brands and influencer-led cosmetic lines.

- For instance, Estée Lauder collaborated with renowned artist Monica Rich Kosann to launch engraved lipstick cases, using laser etching and custom motifs for a premium, collectable appeal.

Technological Advancements in Glass Manufacturing

Continuous advancements in glass-forming and coating technologies present strong opportunities for manufacturers. Techniques like 3D printing, automated molding, and chemical strengthening enhance both design flexibility and production efficiency. The adoption of UV-resistant and anti-scratch coatings extends product life while improving aesthetics. Smart packaging integration, such as QR codes for authenticity verification, also attracts digital-savvy consumers. These developments help companies improve quality standards, minimize waste, and stay competitive in a market increasingly driven by innovation and performance.

- For instance, Stoelzle Glass Group introduced its Lumi Coat UV filter solution in 2024, improving light protection while retaining product transparency for premium cosmetics.

Key Challenges

High Production and Energy Costs

Manufacturing glass bottles requires energy-intensive melting and forming processes, leading to elevated operational expenses. Fluctuating energy prices and raw material costs such as silica and soda ash impact profit margins. Smaller manufacturers face challenges in maintaining competitiveness against large-scale producers with advanced automation. Moreover, the push for sustainable production increases investments in eco-friendly furnaces and recycling systems. Managing these rising costs while meeting stringent quality expectations remains a critical concern for industry participants.

Competition from Alternative Packaging Materials

The growing use of lightweight plastics, aluminum, and hybrid materials poses a significant challenge to the glass packaging industry. These alternatives offer cost efficiency, durability, and reduced breakage risks during transport. Many brands targeting mass-market segments favor PET and acrylic bottles to lower expenses. To counter this, glass manufacturers must emphasize sustainability benefits and develop thinner, stronger glass variants. The shift in consumer behavior toward convenience and affordability pressures glass producers to balance premium appeal with practical usability.

Regional Analysis

North America

North America holds a market share of 27% in 2024, driven by high consumption of luxury cosmetics and fragrances. The U.S. leads regional growth with strong brand presence and advanced packaging innovations. Consumer preference for eco-friendly, recyclable glass packaging has prompted companies to invest in lightweight and refillable designs. Premium perfume brands increasingly collaborate with local glass manufacturers to create distinctive bottle shapes. The growth of online beauty retail platforms and private-label cosmetics further supports demand, while sustainability commitments by key players enhance market stability.

Europe

Europe dominates the Cosmetics Perfumery Glass Bottle Market with a share of 33% in 2024, supported by its strong luxury fragrance heritage and advanced glassmaking expertise. France, Italy, and Germany host leading manufacturers known for design precision and sustainability standards. The region’s mature cosmetics industry and premium branding culture drive continuous innovation in decorative glass packaging. Regulations promoting recyclable materials have accelerated the transition to eco-friendly designs. Growing exports of European perfumes to Asia and North America further strengthen regional production and reinforce Europe’s leadership in premium glass packaging.

Asia Pacific

Asia Pacific accounts for a market share of 28% in 2024, fueled by expanding beauty industries in China, Japan, South Korea, and India. Rising disposable incomes and the growing influence of K-beauty and J-beauty trends have increased demand for elegant and compact glass packaging. Regional manufacturers are investing in automation and decorative techniques to cater to both local and global brands. The surge in online cosmetic sales and a growing middle-class consumer base amplify growth. Sustainable packaging initiatives and local manufacturing expansion make Asia Pacific a rapidly emerging hub for glass bottle production.

Latin America

Latin America captures a market share of 7% in 2024, driven by rising fragrance consumption in Brazil, Mexico, and Argentina. Urbanization and the popularity of affordable luxury perfumes are fueling demand for aesthetically designed glass bottles. Regional manufacturers are focusing on cost-effective production while maintaining visual appeal to attract mass-market cosmetic brands. Increasing retail penetration and e-commerce channels enhance accessibility. However, economic fluctuations and import dependencies on raw materials limit scalability. Investments in localized glass production facilities and sustainable packaging initiatives are helping regional players strengthen their market position.

Middle East & Africa

The Middle East & Africa region represents a market share of 5% in 2024, supported by growing demand for luxury perfumes, especially in GCC countries. The cultural importance of fragrances and the expansion of international cosmetic brands across the region contribute to market growth. Local manufacturers are introducing premium glass packaging tailored to regional design preferences and ornate aesthetics. Urbanization and higher disposable incomes among young consumers drive premium product adoption. However, limited regional production capabilities result in import reliance, prompting global players to explore joint ventures and partnerships for localized supply solutions.

Market Segmentations:

By Capacity:

- Below 50 ml

- 50–150 ml

- 150–300 ml

- Above 300 ml

By Product Type:

- Standard Glass Bottles

- Premium Glass Bottles

- Customized/Decorative Glass Bottles

By Shape

- Round

- Square

- Rectangular

- Others (Oval, Cylindrical, etc.)

By Application

- Perfumes & Fragrances

- Skincare Products

- Hair Care Products

- Makeup & Cosmetic Liquids

- Others (Essential Oils, Serums, etc.)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cosmetics Perfumery Glass Bottle Market features prominent players such as Verescence, Gerresheimer AG, HEINZ-GLAS GmbH & Co. KGaA, Bormioli Luigi S.p.A., Stoelzle Glass Group, Vidrala S.A., Zignago Vetro S.p.A., Saverglass SAS, Piramal Glass Private Limited, and Coverpla S.A. These companies dominate the market through strong product portfolios, advanced manufacturing capabilities, and partnerships with global cosmetic brands. Competition is driven by design innovation, sustainability, and cost optimization. Major players invest heavily in decorative technologies like metallization, embossing, and UV coatings to enhance visual appeal. Strategic collaborations with luxury perfume houses strengthen brand loyalty and long-term contracts. Sustainability remains a key differentiator, with leading manufacturers developing recyclable, lightweight, and refillable bottles to meet eco-conscious demand. Additionally, regional expansion and digitalization in supply chain operations allow companies to improve production efficiency, customization capabilities, and speed-to-market, reinforcing their competitive edge in the global cosmetics packaging sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Verescence

- Gerresheimer AG

- HEINZ-GLAS GmbH & Co. KGaA

- Bormioli Luigi S.p.A.

- Stoelzle Glass Group

- Vidrala S.A.

- Zignago Vetro S.p.A.

- Saverglass SAS

- Piramal Glass Private Limited

- Coverpla S.A.

Recent Developments

- In October 2024, Stoelzle Glass Group introduced its Lumi Coat UV filter technology, designed to enhance light protection while maintaining bottle clarity for premium cosmetic applications.

- In October 2024, SGD Pharma unveiled cosmetic bottles containing 20% post-consumer recycled (PCR) glass at its Zhanjiang facility, demonstrating the feasibility of high cullet integration in primary beauty packaging.

- In September 2025, Berlin Packaging previewed its new “Future.Fill™” connector system and signature refillable bottle collections during the Luxe Pack Monaco show, signaling a push toward circular economy packaging in beauty

Report Coverage

The research report offers an in-depth analysis based on Capacity, Product Type, Shape, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable and recyclable glass packaging will continue to shape future innovations.

- Luxury and premium segments will expand as brands emphasize aesthetic differentiation.

- Lightweight and refillable glass bottle designs will gain strong adoption among global manufacturers.

- Asia Pacific will remain the fastest-growing region due to urbanization and beauty industry expansion.

- Automation and digital printing technologies will enhance design precision and production speed.

- Collaborations between perfume brands and packaging designers will drive customized solutions.

- Smart glass packaging with QR codes and traceability features will attract tech-driven consumers.

- Recycled glass usage will rise as companies align with circular economy goals.

- E-commerce growth will boost small-capacity and travel-friendly glass packaging formats.

- Increasing competition will push manufacturers to balance sustainability, design innovation, and cost efficiency.