Market Overview

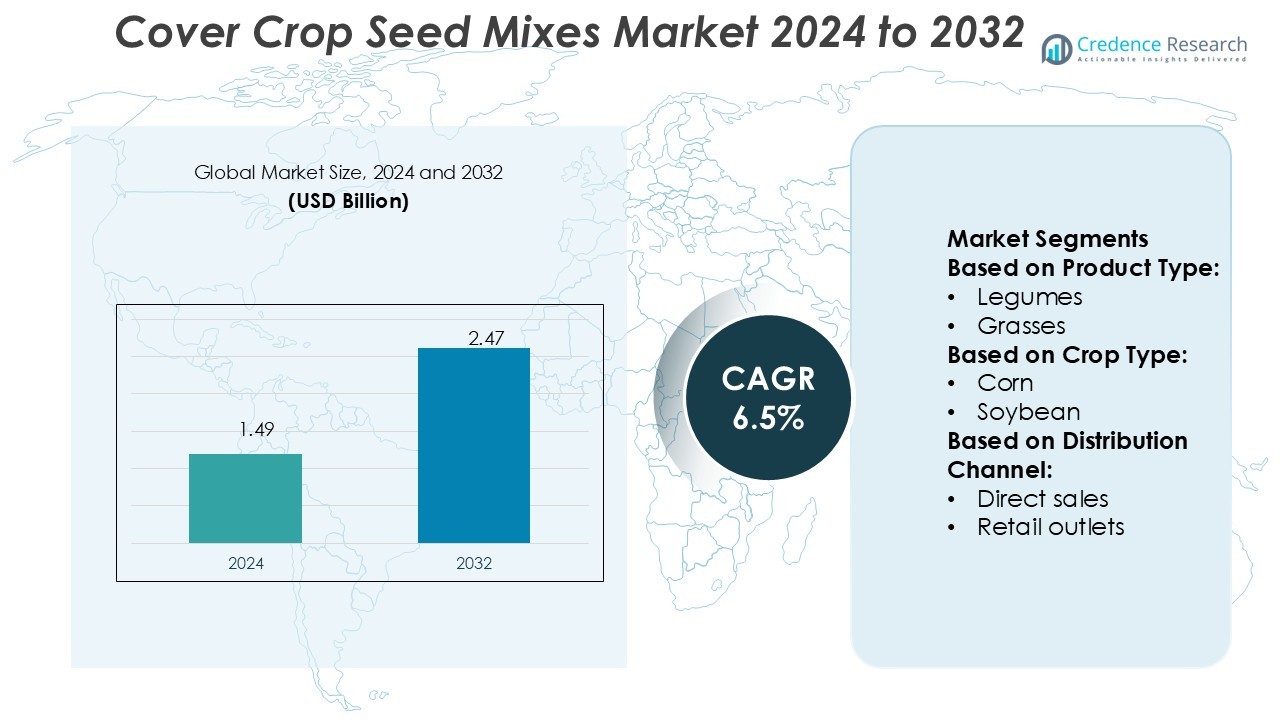

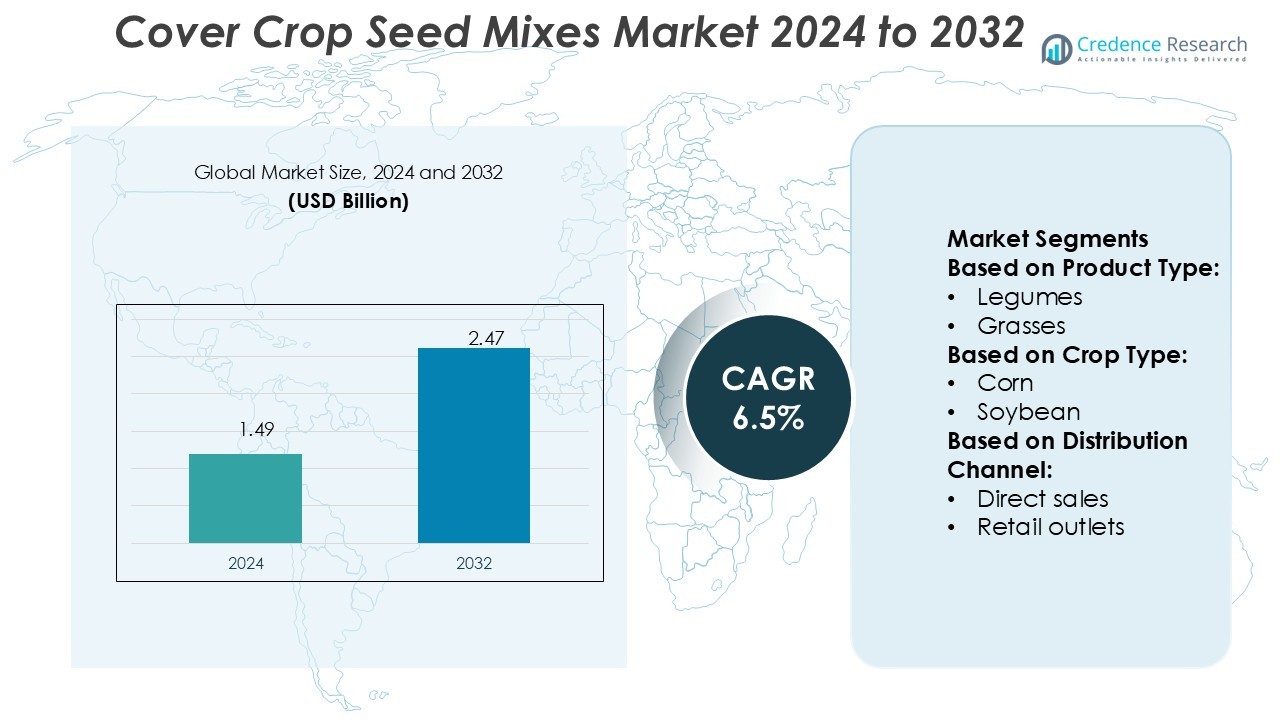

Cover Crop Seed Mixes Market size was valued USD 1.49 billion in 2024 and is anticipated to reach USD 2.47 billion by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cover Crop Seed Mixes Market Size 2024 |

USD 1.49 Billion |

| Cover Crop Seed Mixes Market, CAGR |

6.5% |

| Cover Crop Seed Mixes Market Size 2032 |

USD 2.47 Billion |

The cover crop seed mixes market is driven by the strong presence of leading companies such as Gandy, Bourgault Industries, Kuhn, Hiniker Agriculture Products, AGCO Corporation, Unverferth Farm Equipment, Kelly Engineering, Salford Group, Great Plains, and Fennig Equipment. These players are focusing on expanding their product portfolios, advancing precision seeding technologies, and building strong distribution networks to meet growing global demand. North America leads the global market with a 37% share, supported by high adoption of regenerative agriculture practices, government incentives, and strong carbon credit programs. Strategic collaborations, product innovation, and investments in sustainable farming solutions continue to strengthen the competitive position of top market participants.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cover Crop Seed Mixes Market was valued at USD 1.49 billion in 2024 and is projected to reach USD 2.47 billion by 2032, growing at a CAGR of 6.5%.

- Strong adoption of regenerative agriculture and precision farming technologies is driving market expansion, supported by government incentives and carbon credit programs.

- Intense competition among major companies is encouraging product innovation, portfolio diversification, and the development of advanced seeding equipment.

- High initial costs and limited access to financing in developing regions remain key restraints, slowing large-scale adoption among small and medium farmers.

- North America dominates with a 37% regional share, while the legumes segment holds the largest product share due to its strong soil fertility benefits and cost-effectiveness.

Market Segmentation Analysis:

By Product Type

Legumes dominate the cover crop seed mixes market with the highest market share. This segment benefits from its ability to fix atmospheric nitrogen, improving soil fertility and reducing the need for synthetic fertilizers. Common legume cover crops such as clover and vetch help enhance soil structure and moisture retention. Their cost-effectiveness and strong contribution to sustainable farming practices drive large-scale adoption. Grasses and brassicas follow closely due to their role in erosion control and weed suppression, but legumes remain the most preferred choice among growers for both economic and environmental benefits.

- For instance, Bourgault manufactures seeding equipment, including the 4420 Deep Knife Drill (DKD). This drill uses a deep knife to place fertilizer at depths of 120 to 165 mm, followed by a separate, shallower seed knife to precisely place legume seed, which enhances nitrogen fixation.

By Crop Type

Corn holds the largest market share in the crop type segment. Farmers growing corn often integrate cover crop seed mixes to enhance nitrogen availability and improve soil organic matter. This practice supports better yield performance and reduces fertilizer dependency. Soybean and wheat are also significant users, benefiting from improved soil structure and pest management. Corn’s extensive acreage and reliance on nitrogen fixation keep its demand high, while diversified crop rotations in soybean and wheat farming further expand adoption of cover crop systems.

- For instance, KUHN’s CCX 9000 cover crop seeder, when mounted on the Excelerator vertical tillage tool, allows operators to seed cover crops across 3.4 m to 10.4 m widths while tilling simultaneously.

By Distribution Channel

Direct sales account for the largest share of the distribution channel segment. Large-scale farmers prefer direct procurement to ensure seed quality, cost savings, and technical support from suppliers. This channel allows better customization of seed mixes to match soil and crop conditions. Retail outlets and cooperatives also hold notable shares, serving small and medium growers with easy access. Online retail is growing steadily as e-commerce platforms expand in rural regions. However, direct sales remain the most dominant channel due to strong farmer-supplier relationships and bulk purchasing benefits.

Key Growth Drivers

Rising Focus on Soil Health and Regenerative Agriculture

The growing emphasis on regenerative agriculture is driving strong demand for cover crop seed mixes. Farmers are adopting these seeds to enhance soil organic matter, reduce erosion, and improve moisture retention. Legumes and grasses help fix nitrogen and promote soil biodiversity, leading to healthier and more resilient farming systems. Government programs and subsidies promoting sustainable practices further support this shift. This increasing awareness of long-term soil health benefits is encouraging more growers to include cover crops in their crop rotation systems.

- For instance, Hiniker’s double-disc openers, offered in their cover crop seeding line, use 16-inch diameter discs and 12-inch diameter press wheels to precisely place seed at controlled depths with minimal soil disturbance.

Strong Policy Support and Incentive Programs

Government initiatives and incentive programs are playing a critical role in market growth. Subsidies for cover cropping, carbon credit schemes, and conservation grants are encouraging farmers to adopt seed mixes at scale. Several countries are integrating cover crop usage into their climate-smart agriculture frameworks. This policy support reduces farmers’ upfront costs and makes adoption more viable, especially in large-scale farming. As environmental regulations tighten globally, these incentive structures are expected to accelerate demand further in both developed and emerging markets.

- For instance, PTx Trimble OutRun kit has been demonstrated on Fendt 900 Vario tractors, enabling autonomous fertilization and tillage operations during trials.

Expanding Adoption of Precision Agriculture Technologies

The integration of precision agriculture technologies is enabling farmers to use cover crop seed mixes more effectively. Advanced seeding equipment, soil sensors, and data analytics tools are improving application accuracy and yield outcomes. Farmers can now tailor cover crop mixes based on soil conditions, crop type, and seasonal requirements. This optimization reduces input waste and increases profitability. The growing digitalization of agriculture, along with rising adoption of precision farming techniques, is significantly boosting the efficiency and scalability of cover crop practices.

Key Trends & Opportunities

Growing Demand for Multi-Species Cover Crop Mixes

Multi-species seed mixes are gaining traction due to their ability to offer multiple agronomic benefits. These blends combine legumes, grasses, brassicas, and broadleaves to improve soil structure, control weeds, and enhance biodiversity. Farmers are increasingly adopting these blends to reduce pest pressure and build climate resilience. This trend aligns with regenerative farming strategies and supports long-term soil fertility. Seed companies are expanding their portfolios with region-specific multi-species solutions, creating new opportunities for tailored and value-added offerings in the market.

- For instance, Unverferth’s One-Pass Cover Crop Seeder (for Rolling Harrow 1245/1245D) uses a hydraulically powered air delivery system and a 40.5 cu ft hopper to meter seed via chevron rollers across diverse species.

Rising Integration with Carbon Farming Initiatives

Cover crop seed mixes are playing a crucial role in carbon sequestration strategies. Farmers are leveraging cover crops to build soil carbon stocks and participate in carbon credit programs. This integration offers an additional revenue stream, boosting adoption. Corporates and governments are investing in carbon farming projects, increasing seed demand. As carbon markets expand globally, farmers adopting cover crops are well-positioned to benefit financially while contributing to climate mitigation. This creates a strong growth opportunity for seed suppliers and solution providers.

- For instance, Kelly offers 50,000-acre wear warranties on ground-engaging tools (non-blade discs) to assure durability during long seasons of carbon-focused operations.

Expansion in Emerging Agricultural Economies

Emerging markets in Asia, Latin America, and Africa are witnessing rapid expansion in cover crop adoption. Rising awareness of sustainable farming, combined with government-led training and financing programs, is driving uptake. These regions have large untapped agricultural land suitable for regenerative practices. International organizations and private companies are investing in knowledge transfer and seed supply chains. This expansion presents a major opportunity for market players to establish localized distribution networks and gain early-mover advantages in high-potential regions.

Key Challenges

High Initial Costs and Limited Financing Access

The high initial investment required for cover crop seed mixes remains a barrier, particularly for small and medium farmers. Many growers face limited access to credit and financial incentives, restricting adoption. While the long-term benefits are clear, the upfront costs for seeds, planting equipment, and labor discourage widespread use. Without consistent funding mechanisms or accessible subsidies, the adoption rate may remain slow in cost-sensitive markets, creating a significant challenge for both farmers and seed suppliers.

Knowledge Gaps and Technical Barriers

Limited technical knowledge and agronomic expertise are slowing adoption of cover crop seed mixes. Many farmers lack proper guidance on selecting the right seed blends, managing crop rotations, and timing planting schedules effectively. Poor implementation can lead to reduced yields or weed competition, discouraging future use. Extension services and training programs are often inadequate, especially in emerging economies. Bridging this knowledge gap through targeted education, advisory support, and digital tools is critical to overcoming this key market challenge.

Regional Analysis

North America

North America holds the largest share of the global cover crop seed mixes market at 37%. Strong adoption of regenerative agriculture and soil health initiatives drives market expansion. The U.S. Department of Agriculture’s cost-share programs and carbon credit opportunities encourage large-scale adoption. Farmers increasingly use multi-species seed blends to improve nitrogen levels and reduce erosion. High awareness levels, strong distribution networks, and advanced precision farming technologies further strengthen market growth. Canada also contributes significantly through sustainable farming initiatives focused on climate resilience and soil restoration practices, supporting continued regional dominance.

Europe

Europe accounts for 29% of the global cover crop seed mixes market. The region’s strong regulatory support for soil conservation and climate-smart agriculture fuels adoption. The Common Agricultural Policy (CAP) provides financial incentives for farmers using cover crops to enhance biodiversity and carbon sequestration. Countries like Germany, France, and the Netherlands lead in multi-species seed mix usage. Organic and conservation farming practices are widely adopted, further boosting demand. The European Green Deal and Farm to Fork Strategy continue to drive long-term growth by integrating cover cropping into national sustainability frameworks.

Asia Pacific

Asia Pacific holds a 21% market share and represents one of the fastest-growing regions. Rapid agricultural modernization and increased focus on soil regeneration are driving market expansion. Countries like India, China, and Australia are investing in cover crop programs to boost soil fertility and reduce dependence on synthetic fertilizers. Rising awareness among farmers and government-led training programs are supporting large-scale adoption. Emerging private seed suppliers are expanding their product portfolios, offering region-specific blends. This growing momentum positions Asia Pacific as a key future growth engine for the global cover crop seed mixes market.

Latin America

Latin America accounts for 8% of the global cover crop seed mixes market. Brazil and Argentina lead the region, driven by large-scale crop cultivation and the need for sustainable farming practices. Farmers increasingly adopt legumes and mixed species to restore soil fertility and improve water retention. Regional governments are promoting conservation agriculture through technical assistance and incentive programs. Multinational seed suppliers are also expanding their presence to meet rising demand. Although market penetration remains lower than in North America and Europe, growing awareness and policy support indicate strong future growth potential.

Middle East & Africa

The Middle East & Africa region holds a 5% share of the global market. Adoption is growing steadily, supported by pilot programs focusing on soil moisture retention and climate resilience. Countries with water-stressed agricultural systems are turning to cover crops to improve soil structure and reduce erosion. International development organizations are actively funding training and seed distribution initiatives. While market maturity remains low, expanding conservation agriculture projects and donor-backed programs are improving adoption rates. Strategic investments in local seed production and farmer education are expected to accelerate market growth in the coming years.

Market Segmentations:

By Product Type:

By Crop Type:

By Distribution Channel:

- Direct sales

- Retail outlets

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cover crop seed mixes market features strong competition among leading players such as Gandy, Bourgault Industries, Kuhn, Hiniker Agriculture Products, AGCO Corporation, Unverferth Farm Equipment, Kelly Engineering, Salford Group, Great Plains, and Fennig Equipment. The cover crop seed mixes market is shaped by continuous innovation, strategic partnerships, and geographic expansion. Companies are focusing on developing advanced seeding technologies, including precision applicators and variable rate systems, to improve efficiency and reduce input costs for farmers. Strong investments are being made in research and development to create region-specific solutions that enhance soil health and yield outcomes. Market participants are also expanding their distribution networks and forming collaborations with seed suppliers to offer integrated solutions. This dynamic competition is accelerating product innovation, increasing market penetration, and strengthening overall industry growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Rasi Seeds, ICAR, and IGFRI signed an MoU to enhance the production and availability of high-quality forage seeds for India’s dairy sector. The collaboration aims to improve livestock nutrition and boost milk productivity through better forage cultivation.

- In November 2024, Corteva introduced a proprietary and novel non-GMO hybrid technology for wheat, which is expected to ensure substantial yield improvements to the crop. The new method boosts yield potential by 10% while utilizing the same quantity of land resources.

- In May 2024, Nuseed Carinata and Omega-3 Canola Production System contract programs for 2024 was recently announced by Nuseed. Now available throughout the Southern United States, the Nuseed Carinata program assists farmers in improving agronomic conditions and soil health, supporting sustainable farming practices and raising productivity. This, in turn, has a beneficial effect on the market for cover crops by promoting a wider adoption of the product.

- In June 2023, Takii unveiled a new advanced seed production facility in Karacabey, Turkey. The plant, situated in the Bursa province, has been established to improve the company’s production process for both flower and vegetable seeds.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Crop Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of regenerative agriculture practices worldwide.

- Demand for multi-species seed mixes will grow due to their soil health benefits.

- Precision agriculture technologies will enhance seeding efficiency and productivity.

- Carbon credit programs will boost farmer participation in sustainable practices.

- Government incentives will continue to support large-scale adoption.

- Emerging economies will offer strong growth opportunities for suppliers.

- Seed innovation will focus on region-specific and climate-resilient varieties.

- Distribution networks will expand through direct sales and digital platforms.

- Collaborations between equipment manufacturers and seed suppliers will increase.

- Awareness and education programs will accelerate market penetration among farmers.