Market Overview:

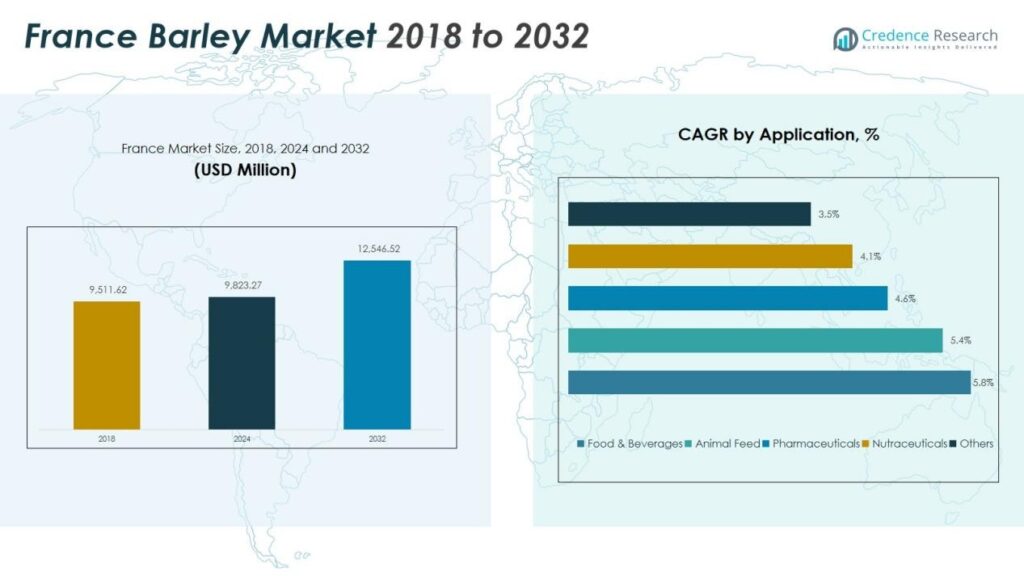

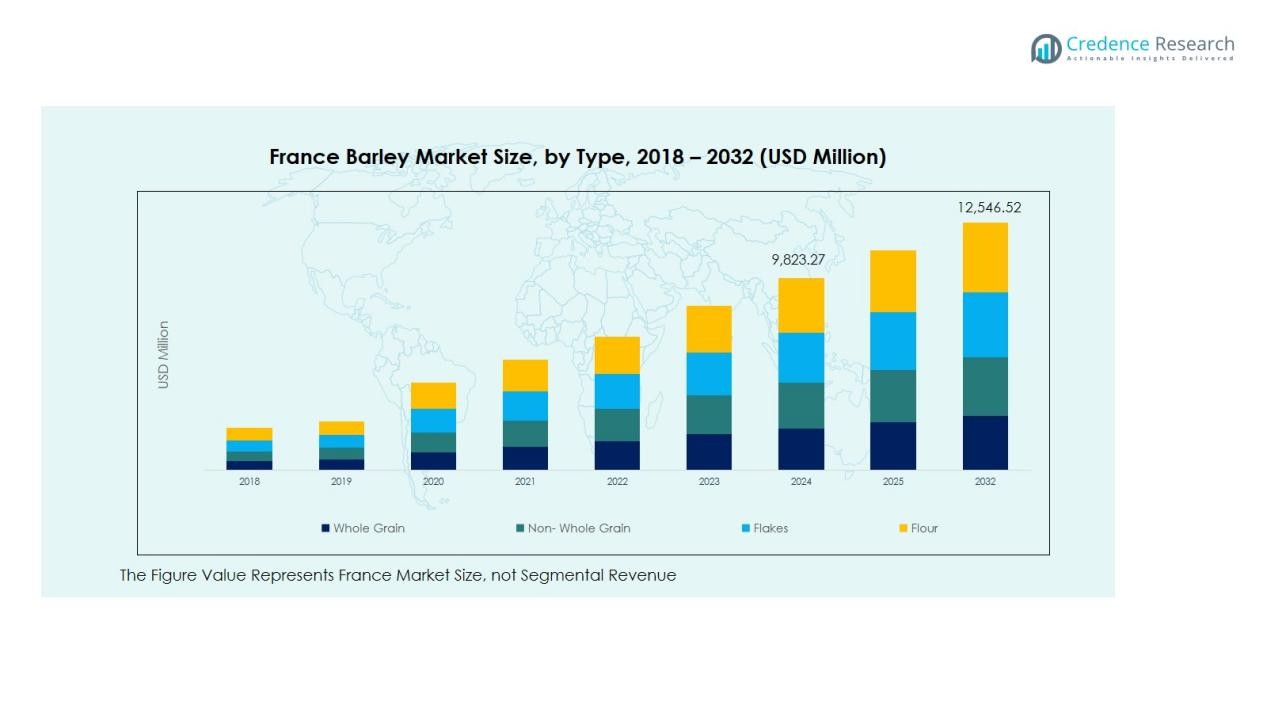

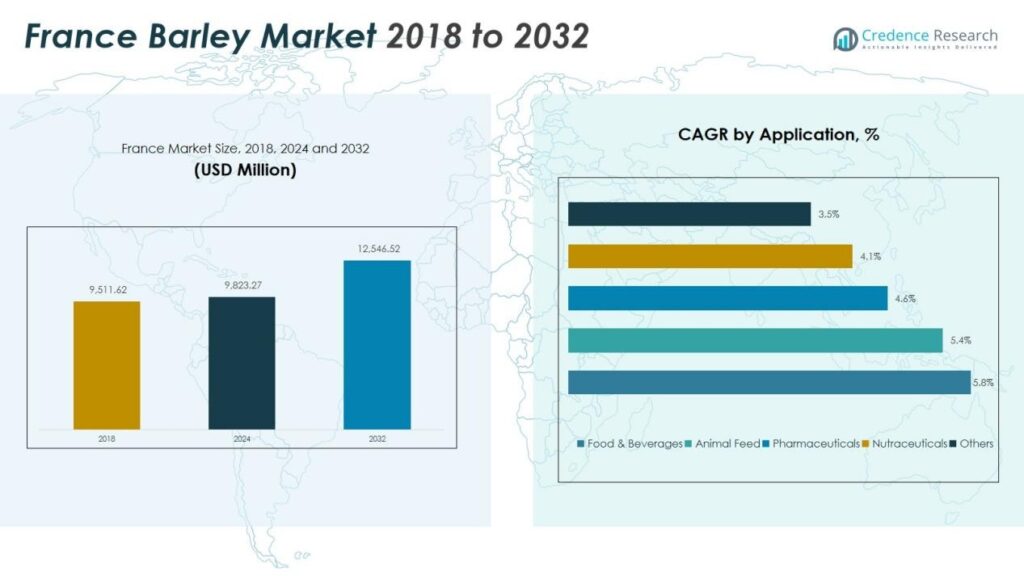

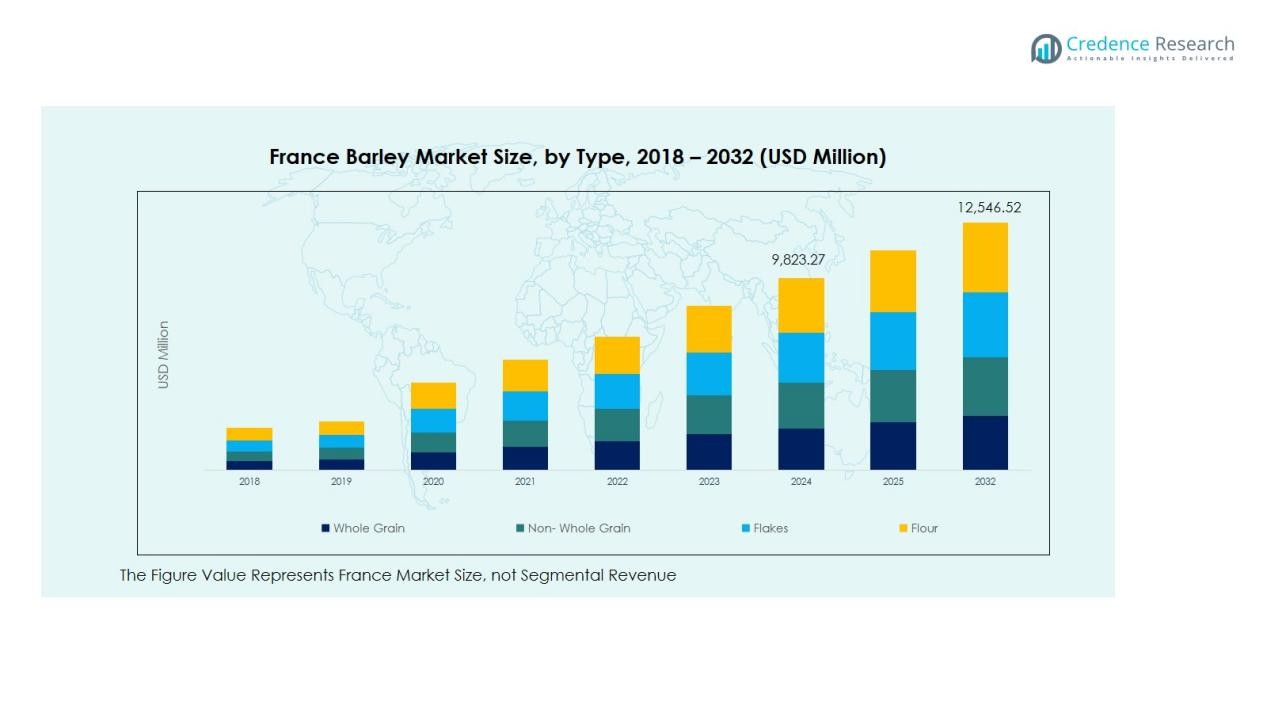

The France Barley Market size was valued at USD 9,511.62 million in 2018 to USD 9,823.27 million in 2024 and is anticipated to reach USD 12,546.52 million by 2032, at a CAGR of 3.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Barley Market Size 2024 |

USD 9,823.27 Million |

| France Barley Market, CAGR |

3.11% |

| France Barley Market Size 2032 |

USD 12,546.52 Million |

Key market drivers include the robust performance of the beer and spirits industry, which relies on high-quality malting barley. Increasing consumer preference for craft beverages, premium malts, and health-focused grain products further boosts demand. Advancements in seed varieties, sustainable farming practices, and precision agriculture enhance yield stability and quality consistency, supporting long-term market competitiveness. Additionally, the growing use of barley in livestock feed and functional foods reinforces its multi-industry relevance.

Regionally, barley cultivation is concentrated in northern and northeastern France, particularly in regions such as Normandy, Hauts-de-France, and Grand Est, where favorable agro-climatic conditions and fertile soils prevail. Strong logistics infrastructure, well-developed supply chains, and proximity to major malting facilities strengthen regional output. France’s strategic export channels, especially to Europe and North Africa, further support its role as a major barley supplier in the global market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The France Barley Market stood at USD 9,823.27 million in 2024 and is projected to reach USD 12,546.52 million by 2032, expanding at a CAGR of 3.11%, driven by strong demand from brewing, distilling and health-focused food applications.

- Northern and Northeastern France together account for 48–50% of total production due to favorable soils, consistent climate and proximity to major malting facilities, while Central and Western regions hold 32–34% supported by diversified cultivation and strong feed demand.

- Southern France accounts for 16–18% and remains the fastest-growing region, driven by specialty barley varieties, craft brewery demand and resilience-focused farming suited to warmer climates.

- The type segment is led by malted barley with 41% share, followed by whole grain at 27%, supported by strong consumption in brewing, distilling and whole-grain food categories.

- The application segment is dominated by food & beverages at 46%, while animal feed holds 33%, driven by stable livestock demand and barley’s nutritional suitability across feed formulations.

Market Drivers:

Strong Demand from Brewing and Distilling Industries

The France Barley Market gains significant momentum from its well-established brewing and distilling sectors. Breweries and distilleries require premium malting barley, which creates steady procurement cycles throughout the year. Craft beer expansion strengthens this demand and encourages farmers to focus on high-quality varieties. Large distillers maintain stringent quality specifications, which supports investment in advanced cultivation practices. It reinforces France’s position as a dependable supplier of malting-grade barley.

- For instance, Malteries Soufflet, a major French maltster, achieved an annual malt production of 2.3 million tons in 2024, much of which was supplied to breweries including Kronenbourg and Carlsberg.

Rising Preference for Health-Focused and Whole-Grain Foods

Growing consumer interest in nutritious and high-fiber foods strengthens the role of barley in the French food sector. Food manufacturers incorporate barley into cereals, bakery items and functional food products, which elevates its visibility in health-oriented product lines. The France Barley Market benefits from this diversification and gains opportunities beyond traditional beverage applications. Product developers value barley’s nutritional profile, which includes fiber, vitamins and trace minerals. It drives steady inclusion of barley-based formulations across retail shelves.

- For instance, Tipiak, a well-known French food company, operates within a global market that sees generally increasing consumer interest in healthy, whole-grain products like barley due to their nutritional benefits, such as high fiber content.

Advancements in Seed Varieties and Agronomic Practices

Improved seed genetics and modern agronomic methods enhance yield consistency and quality across key producing regions. Farmers adopt precision farming tools that support efficient water, fertilizer and soil management. The France Barley Market gains productivity advantages through mechanized harvesting and better post-harvest handling. Research institutions and cooperatives promote high-yield and disease-resistant varieties, strengthening field performance. It improves the reliability of supply for maltsters and food processors.

Expansion of Sustainable and Climate-Resilient Farming Systems

Sustainability initiatives shape long-term production strategies and improve environmental performance across France’s barley belt. Producers implement soil conservation, crop rotation and low-input farming systems that elevate resource efficiency. The France Barley Market aligns with national goals for lower emissions and improved land stewardship. Demand for sustainably sourced barley grows in the beverage and food industries, encouraging certification-backed farming practices. It supports stronger market positioning in both domestic and export channels.

Market Trends:

Growing Shift Toward Premium Malting Barley and Specialty Varieties

The France Barley Market reflects a clear trend toward premium-grade malting barley driven by rising demand from craft breweries and distilleries. Producers focus on specific protein levels, grain uniformity and flavor characteristics that meet strict industry requirements. Interest in heritage and specialty barley varieties increases, supporting niche beverage formulations. Maltsters encourage farmers to adopt varieties with higher conversion efficiency and improved process performance. Export buyers prioritize French malting barley for its consistency and traceability standards. It strengthens France’s role in supplying premium-quality barley to regional and global markets. The trend supports higher value realization for producers and processors.

- For instance, Soufflet Malt (part of InVivo Group), following its acquisition of the United Malt Group in late 2023, is the world’s largest maltster with an annual production capacity of approximately 3.6 to 3.7 million tonnes of malt across approximately 41 industrial sites/facilities in over 20 countries

Expansion of Sustainable, Low-Carbon and Technology-Enabled Production Systems

Sustainability expectations reshape production patterns across key barley-growing regions, and the France Barley Market aligns with national and EU environmental goals. Farmers adopt regenerative practices that improve soil health and reduce dependency on chemical inputs. Precision tools strengthen decision-making in irrigation, fertilization and crop protection, which improves yield reliability. Demand from breweries and food companies for verified low-carbon supply chains supports adoption of certification programs. Traceability systems gain importance, driven by consumer interest in responsibly produced grains. It enhances transparency across the value chain and supports stronger buyer–producer relationships. The trend positions France as a forward-leaning player in sustainable barley production.

- For instance, Malteries Soufflet, a major French maltster, has engaged over 4,000 farmers in its ‘Sowing Good Sense’ sustainable supply chain program, which includes practices like reduced tillage and optimized fertilizer use that directly lower the synthetic fertilizer use per hectare.

Market Challenges Analysis:

Climate Variability and Pressure on Yield Stability

The France Barley Market faces persistent challenges from unpredictable weather patterns that disrupt planting schedules and harvest quality. Producers encounter yield fluctuations caused by heat stress, irregular rainfall and disease outbreaks. Maltsters require consistent grain characteristics, which heightens the impact of climate variation on supply reliability. Farmers invest in resilient seed varieties, yet gaps in performance remain during extreme seasons. Input costs rise when growers adjust fertilizer and crop protection strategies to manage weather-driven risks. It creates uncertainty for long-term production planning. The challenge influences both domestic supply and export commitments.

Price Volatility and Competition from Alternative Crops

Input price movements and fluctuating global grain markets create cost pressure across the France Barley Market. Farmers evaluate profitability each season, and higher-margin crops such as wheat or oilseeds often compete for acreage. Demand cycles from breweries and feed manufacturers remain stable, yet market prices shift due to global supply conditions. Storage, logistics and compliance requirements add operational burdens for smaller producers. Contracting arrangements help stabilize income, but not all growers have access to these options. It limits predictable revenue streams for many producers. The challenge influences strategic decisions throughout the value chain.

Market Opportunities:

Rising Demand for Premium Malt and Specialty Barley Products

The France Barley Market gains strong opportunities from the expanding craft beer, distilling and specialty malt segments. Breweries and distillers seek premium barley with defined flavor profiles, which creates room for contract farming and varietal diversification. Demand for heritage grains and specialty malts supports higher-value production across key regions. Food manufacturers explore barley for functional ingredients, which broadens applications in cereals, baked goods and health-focused products. Export markets show interest in French malting barley due to quality assurance and traceability. It strengthens France’s potential to expand its footprint in high-value barley categories. The opportunity aligns well with evolving consumer preferences.

Growth Potential from Sustainable, Low-Carbon and Technology-Driven Agriculture

Sustainability commitments across the food and beverage industry open new avenues for suppliers who meet environmental standards, and the France Barley Market aligns with this transition. Producers can adopt regenerative methods that improve soil health and enable access to sustainability-linked contracts. Digital tools support more precise crop management, which improves yield quality and operational efficiency. Maltsters and food companies value verified low-carbon barley, which creates scope for certification-based premiums. Expansion of traceability platforms enhances market credibility and strengthens buyer relationships. It positions French producers to lead in responsibly sourced barley. The opportunity supports long-term competitiveness in domestic and export channels.

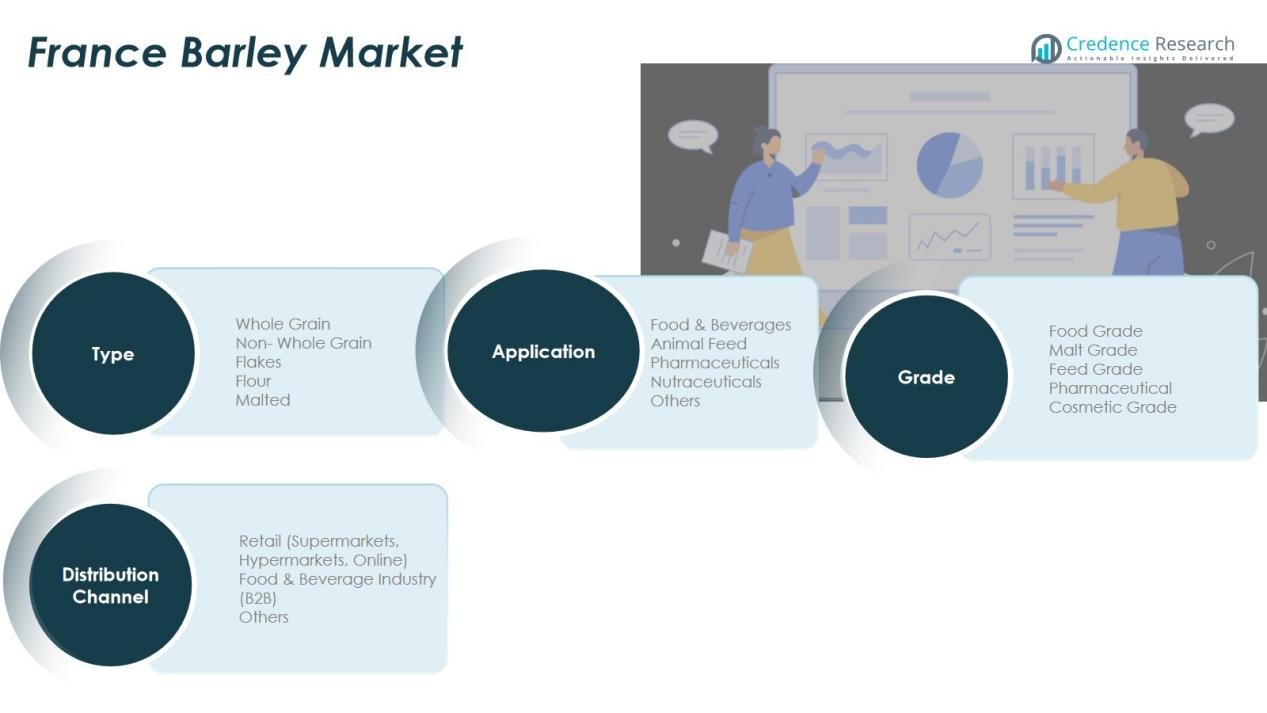

Market Segmentation Analysis:

By Type

The France Barley Market demonstrates balanced growth across key product types, driven by demand from food, feed and malt industries. Whole grain and malted barley hold strong positions due to their critical role in brewing and distilling. Flakes and flour segments gain traction in health-focused food categories where fiber and whole-grain attributes support product innovation. Non-whole grain formats serve both industrial and food-processing needs. It benefits from continuous improvements in milling and malting technologies that enhance product quality and consistency.

- For instance, Malteries Soufflet, a leading French maltster, significantly expanded its operations in 2023 by completing the acquisition of United Malt Group, the world’s fourth-largest malt producer. This strategic merger created the world’s largest malt company, with a combined annual production capacity of 3.7 million tonnes of malt across 41 facilities in 20 countries.

By Application

Application-wise, the France Barley Market supports a diverse set of industries, each driving steady consumption. Food and beverages remain the dominant segment, supported by the country’s extensive brewing heritage and growing interest in barley-based functional foods. Animal feed maintains significant volume due to stable livestock requirements and barley’s nutritional value. Pharmaceuticals and nutraceuticals use barley fractions for specialized formulations, which strengthens premium demand. It gains opportunities from rising interest in natural and fiber-rich ingredients within the French wellness sector.

- For Instance, Avril Group, a leading agribusiness, continued its efforts in 2024 to promote more competitive and environmentally friendly livestock farming, focusing on reducing imported soy in animal feed by developing alternative plant proteins from peas, fava beans, and sunflowers, through its subsidiary Sanders.

By Distribution Channel

Distribution patterns in the France Barley Market reflect a mix of retail and industrial flows that ensure broad accessibility. Retail channels, including supermarkets, hypermarkets and online platforms, support rising consumer interest in barley-based foods. The food and beverage industry segment dominates channel share, supported by strong procurement networks maintained by maltsters, breweries and large food processors. Other channels serve small manufacturers and regional buyers with flexible sourcing options. It benefits from efficient logistics and well-integrated supply systems across major producing regions.

Segmentations:

By Type

- Whole Grain

- Non-Whole Grain

- Flakes

- Flour

- Malted

By Application

- Food & Beverages

- Animal Feed

- Pharmaceuticals

- Nutraceuticals

- Others

By Grade

- Food Grade

- Malt Grade

- Feed Grade

- Pharmaceutical

- Cosmetic Grade

By Distribution Channel

- Retail (Supermarkets, Hypermarkets, Online)

- Food & Beverage Industry (B2B)

- Others

Regional Analysis:

Strong Production Concentration in Northern and Northeastern Regions

Northern and northeastern France anchor national barley production due to favorable soils, stable temperatures and efficient farm structures. Key regions such as Hauts-de-France, Normandy and Grand Est supply a major share of malting-grade barley for domestic and export markets. Farmers in these zones adopt advanced agronomic practices that support yield consistency and quality improvement. Proximity to large malting plants strengthens regional competitiveness and reduces transportation costs. The France Barley Market benefits from dense supply chains that link growers, cooperatives and processors. It reinforces the region’s role as the core production hub.

Central and Western Regions Gain Strength Through Diversified Cultivation

Central and western regions contribute to market balance by supporting both feed and food-grade barley segments. Areas such as Centre-Val de Loire and Pays de la Loire maintain mixed farming systems that allow producers to shift between cereals based on market conditions. Feed barley demand from livestock clusters in these zones sustains steady acreage. Food processors and local breweries support modest but consistent demand for premium-quality grains. The France Barley Market gains resilience from this diversified production base. It enhances supply stability during fluctuating weather patterns.

Southern Regions Emerge with Niche and Value-Added Opportunities

Southern regions show gradual expansion in barley acreage driven by interest in specialty and drought-tolerant varieties. Producers in Occitanie and Provence-Alpes-Côte d’Azur explore barley options that match regional climatic challenges. Growth in craft breweries and specialty malt projects creates targeted demand for region-specific varieties. Export buyers show interest in barley sourced from these areas due to distinct grain characteristics. The France Barley Market gains long-term opportunities from this emerging cluster of value-added production. It strengthens national diversity in barley quality and end-use potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Malteurop Groupe S.A.

- Soufflet Group

- Boortmalt (Axereal Group)

- Vivescia Industries

- Cargill France

- Heineken France

- Groupe Avril

- Brasserie Kronenbourg (Carlsberg Group)

- InVivo Group

- Lesaffre Group

Competitive Analysis:

The France Barley Market features a structured competitive landscape led by major agribusiness, malting and food-processing companies. Key participants include Malteurop Groupe S.A., Soufflet Group, Boortmalt (Axereal Group), Vivescia Industries, Cargill France, Heineken France and Groupe Avril. These companies hold strong positions through integrated supply chains, modern processing facilities and long-term partnerships with barley growers. Large maltsters drive demand for premium malting barley and maintain strict quality standards that shape farming practices. Food and beverage companies support stable procurement cycles through established sourcing frameworks and sustainability programs.

Competition intensifies around high-quality grades, export market access and innovation in specialty malts. Companies invest in technology upgrades, traceability systems and climate-resilient sourcing models to strengthen reliability. It benefits from strong collaboration between cooperatives, maltsters and breweries, which improves supply efficiency and product consistency. Strategic expansions and capacity upgrades continue to define competitive positioning across the market.

Recent Developments:

- In May 2025, Malteurop inaugurated a new biomass power plant in Seville, Spain, representing a €40 million investment and targeting a 75% reduction in greenhouse gas emissions at their malting facility as part of a major decarbonisation strategy.

- In August 2024, Sanders, a subsidiary of Avril, completed the acquisition of Soufflet Agriculture’s animal nutrition activities, launching the new brand Nuoo and strengthening its position in France’s livestock nutrition market.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Grade and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The France Barley Market will advance through stronger demand from brewing, distilling and health-focused food sectors.

- Innovation in specialty and heritage barley varieties will support premium positioning and value differentiation.

- Climate-resilient seed development will enhance yield stability across major producing regions.

- Sustainability requirements from breweries and food manufacturers will accelerate adoption of low-carbon and traceable supply chains.

- Digital agriculture will improve field management, input efficiency and quality monitoring.

- Expansion of functional foods will elevate the role of barley in fiber-rich and clean-label product portfolios.

- Feed demand will remain steady due to consistent livestock needs and barley’s nutritional advantages.

- Export opportunities will strengthen, driven by global interest in high-quality French malting barley.

- Investments in malting capacity and modern processing infrastructure will improve supply reliability.

- It will benefit from stronger collaboration between cooperatives, processors and regional breweries, which supports long-term market stability.