Market Overview:

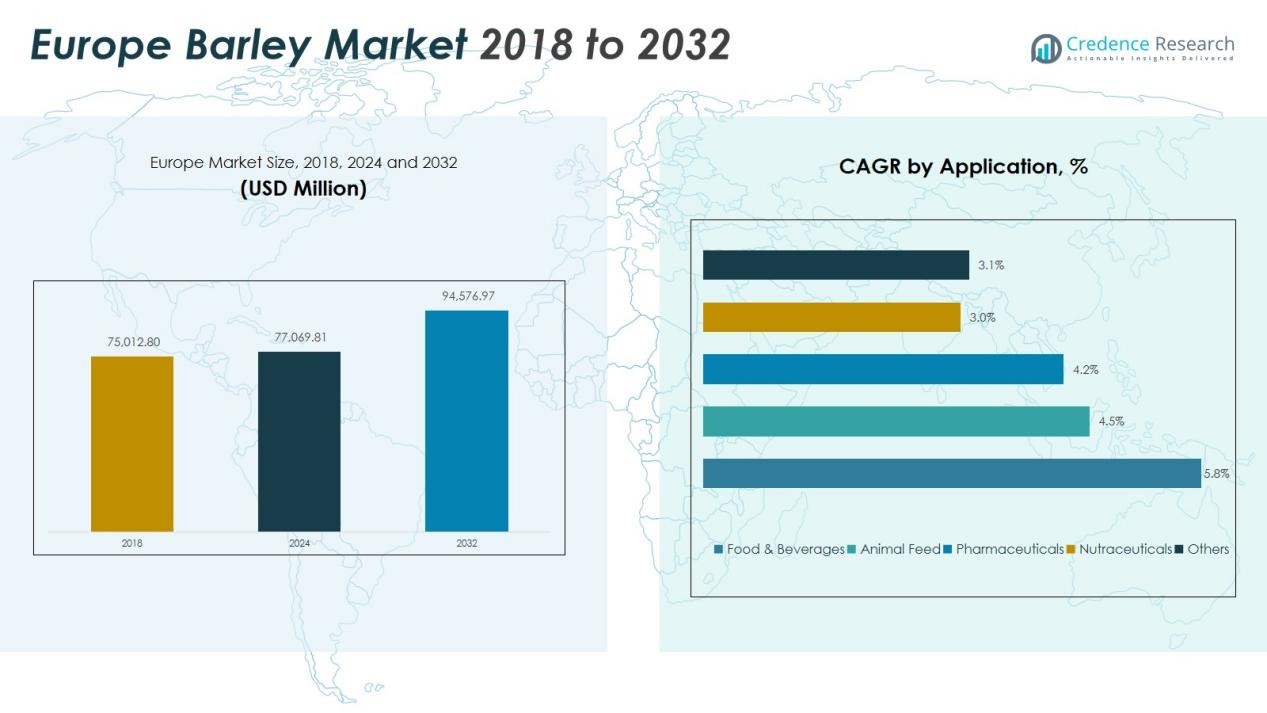

The Europe Barley Market size was valued at USD 75,012.80 million in 2018 to USD 77,069.81 million in 2024 and is anticipated to reach USD 94,576.97 million by 2032, at a CAGR of 2.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Barley Market Size 2024 |

USD 77,069.81 Million |

| Europe Barley Market, CAGR |

2.60% |

| Europe Barley Market Size 2032 |

USD 94,576.97 Million |

Growth in the Europe Barley Market is driven by rising consumption of malt-based beverages, expanding applications of barley in health-focused food products, and the increasing adoption of sustainable farming practices. Demand for high-quality malt barley remains robust due to the region’s established brewing and distilling sectors. The shift toward high-fiber and nutritious grains in food processing further strengthens market potential, while advancements in seed varieties and agronomic techniques support higher yields and quality consistency.

Regionally, major barley-producing countries such as France, Germany, the United Kingdom, and Spain dominate the European landscape, benefiting from favorable agro-climatic conditions and well-developed supply chains. Central and Eastern European nations are witnessing growing participation, driven by improving agricultural infrastructure and rising exports. Collectively, these regions contribute to Europe’s position as a leading global producer and supplier of premium barley.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Barley Market reached USD 77,069.81 million in 2024 and is projected to hit USD 94,576.97 million by 2032, expanding at a CAGR of 2.60%, driven by strong malting demand, rising use in functional foods, and sustained adoption of sustainable farming practices.

- Western Europe holds the largest share at 47–50%, supported by advanced farming systems, premium malt processing capacity, and strong beer and spirits production clusters.

- Central & Eastern Europe accounts for 28–30%, enabled by expanding cultivation areas, mechanized farming, and strengthening export capability, while Southern Europe contributes 18–20% due to growing malted-beverage demand despite climate-linked yield fluctuations.

- The fastest-growing region is Central & Eastern Europe (approx. 3.1–3.4% CAGR, 28–30% share), driven by infrastructure upgrades, high-yield seed adoption, and rising export integration with Western European maltsters.

- Segment distribution shows malting barley holding 42–45% share due to dominant brewery and distilling demand, while food and feed applications collectively account for 50–53%, supported by increasing use in cereals, bakery products, and livestock nutrition.

Market Drivers:

Strong Demand from Brewing and Malting Industries

The Europe Barley Market gains significant momentum from the region’s mature brewing and distilling sectors. Demand for malt barley remains high due to the strong presence of premium beer, craft beer, and spirits manufacturers. It ensures consistent procurement of high-quality barley varieties that support flavor, color, and processing efficiency. The industry’s long-standing focus on malt innovation strengthens supply chain stability and encourages growers to invest in quality-enhancing practices.

- For instance, Soufflet Malt and HEINEKEN Beverages announced a commercial partnership to build a new local malting facility in South Africa. This facility will have an annual production capacity of nearly 100,000 tonnes and is designed to produce 50% fewer emissions than the industry average by using trigeneration and solar energy.

Rising Adoption of Nutritious and Functional Grains

Consumer interest in health-focused food products elevates the role of barley across bakery, breakfast cereals, and functional foods. The Europe Barley Market benefits from barley’s high fiber content, beta-glucan levels, and nutritional value that align with wellness-oriented consumption patterns. Food manufacturers increase barley integration to meet clean-label and nutrient-rich product demands. This shift supports long-term growth by diversifying barley’s applications beyond traditional use segments.

- For instance, Cargill’s inclusion of barley beta-glucan in its product formulations has shown to help reduce cholesterol by up to 7% in clinical trials as published in peer-reviewed studies.

Expansion of Sustainable and Low-Input Farming Practices

Sustainability commitments across Europe encourage barley cultivation due to its relatively low input requirements and adaptability to varying soil conditions. It supports farmers by reducing production costs and improving long-term soil health. The crop’s resilience to environmental stress aligns with regional climate objectives and agricultural sustainability policies. These factors strengthen barley’s position as a preferred cereal in environmentally conscious farming systems.

Advancements in Seed Technology and Agronomic Efficiency

Continuous research on high-yield and disease-resistant barley varieties enhances productivity and quality consistency. The Europe Barley Market benefits from innovations that improve malting characteristics, grain uniformity, and resistance to climatic challenges. Investments in precision farming, irrigation efficiency, and crop monitoring elevate overall production performance. These advancements enable growers to meet the stringent quality requirements of food, feed, and malt industries.

Market Trends:

Growing Emphasis on Premium Malt Quality and Diverse End-Use Applications

The Europe Barley Market observes a clear shift toward high-quality malt varieties driven by demand from premium beer, craft breweries, and specialized distilleries. Producers focus on grain uniformity, improved protein levels, and enhanced malting characteristics to meet evolving industry standards. It supports stronger linkages between growers and malt processors, enabling greater traceability and quality control. Food manufacturers expand barley use in high-fiber, clean-label, and wellness-focused products that appeal to health-conscious consumers. Feed producers also strengthen their reliance on barley due to its balanced nutritional profile and cost advantages. The trend broadens barley’s value proposition across multiple industries and reinforces its strategic position within the European agricultural landscape.

- For instance, Boortmalt, the world’s leading malting company with a production capacity of 3.1 million tonnes across 27 malting plants, successfully generated the first Verified Impact Units (VIUs) in Europe in March 2025, achieving average savings of 2.3 tons CO₂e per hectare in barley cultivation, reducing greenhouse gas emissions by nearly 90 percent while improving grain quality for sustainable malt production.

Rising Focus on Climate Resilience, Sustainable Production, and Precision Agriculture

Climate variability accelerates the need for resilient barley varieties that perform well under heat, drought, and disease pressure. The Europe Barley Market benefits from stronger investments in seed technology, crop genetics, and soil health management. It encourages farmers to adopt sustainable practices that reduce input dependency and improve long-term productivity. Precision agriculture gains wider adoption, supported by digital tools that enhance monitoring, yield forecasting, and resource optimization. Supply chain players prioritize sustainability certifications and traceability programs to meet regulatory and consumer expectations. These trends collectively support a more efficient, climate-ready, and future-oriented barley production ecosystem across Europe.

- For instance, Syngenta’s HYVIDO® hybrid barley seeds have demonstrated consistent yield improvement. For the 2025/26 AHDB winter barley Recommended List (RL), new varieties such as SY Quantock achieved a UK treated yield of 109% of control varieties, and SY Kestrel achieved a treated yield of 104% of controls

Market Challenges Analysis:

Climate Variability and Production Uncertainty

The Europe Barley Market faces growing pressure from unpredictable weather patterns that disrupt planting schedules and yield consistency. Prolonged heat, irregular rainfall, and rising pest incidence reduce overall crop quality and increase production risks. It forces growers to adjust management practices and invest in more resilient seed varieties. Supply chains experience volatility due to fluctuating harvest outputs across major producing countries. Breweries and malt processors encounter procurement challenges when grain characteristics drift from industry specifications. These conditions elevate operational complexity and reduce long-term planning flexibility across the market.

Price Volatility, Input Cost Pressure, and Competitive Crop Choices

Frequent fluctuations in global grain prices create uncertainty for farmers who must balance profitability with market demand. The Europe Barley Market is impacted by rising fertilizer, fuel, and labor costs that compress margins and influence planting decisions. It also competes with alternative crops such as wheat and corn that promise stronger returns in certain seasons. Malt processors face tighter cost structures when barley supply tightens or when quality standards are difficult to meet. Trade disruptions and regulatory shifts further complicate import and export flows. These challenges restrict market stability and demand strategic adjustments across the value chain.

Market Opportunities:

Expansion of Premium Malt, Health-Focused Foods, and High-Value Applications

The Europe Barley Market is positioned to benefit from rising demand for premium malt products supported by growth in craft beer, specialty beverages, and high-quality distilling. Food manufacturers increase barley use in nutritious, high-fiber, and clean-label products that align with consumer health trends. It offers opportunities for growers and processors to supply differentiated grain varieties that command premium pricing. New applications in plant-based foods, functional ingredients, and natural sweeteners strengthen barley’s relevance in emerging segments. Feed producers also explore enhanced barley formulations that improve livestock performance and sustainability outcomes. These developments create pathways for value-added diversification across the industry.

Advancements in Agritech, Sustainability Programs, and Climate-Ready Varieties

Strong investment in precision agriculture, digital monitoring, and advanced breeding supports long-term productivity gains. The Europe Barley Market can leverage climate-resilient seed varieties that improve yield stability under heat and drought stress. It enables farmers to reduce input dependency and achieve higher consistency in grain quality. Sustainability certifications, carbon-reduction programs, and traceability solutions open new market channels for producers meeting environmental standards. Collaboration between growers, malt processors, and food companies strengthens innovation and accelerates adoption of efficient farming systems. These opportunities support a more competitive and resilient barley ecosystem across Europe.

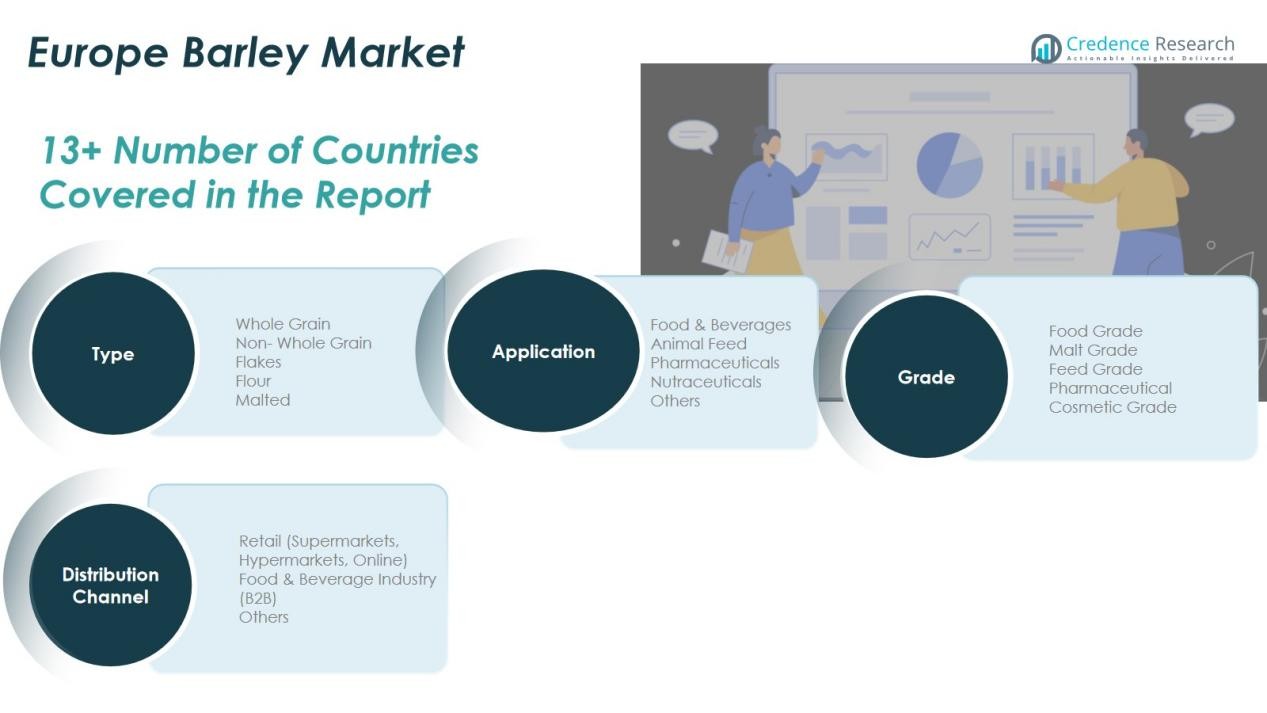

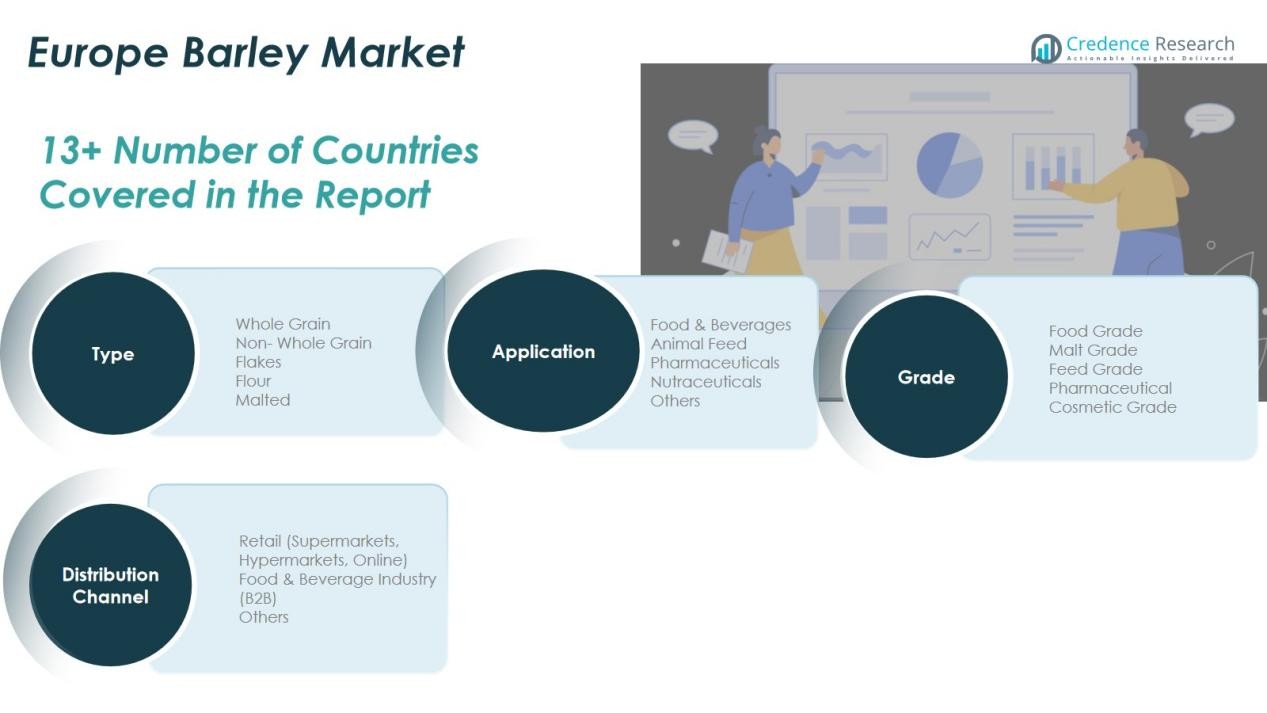

Market Segmentation Analysis:

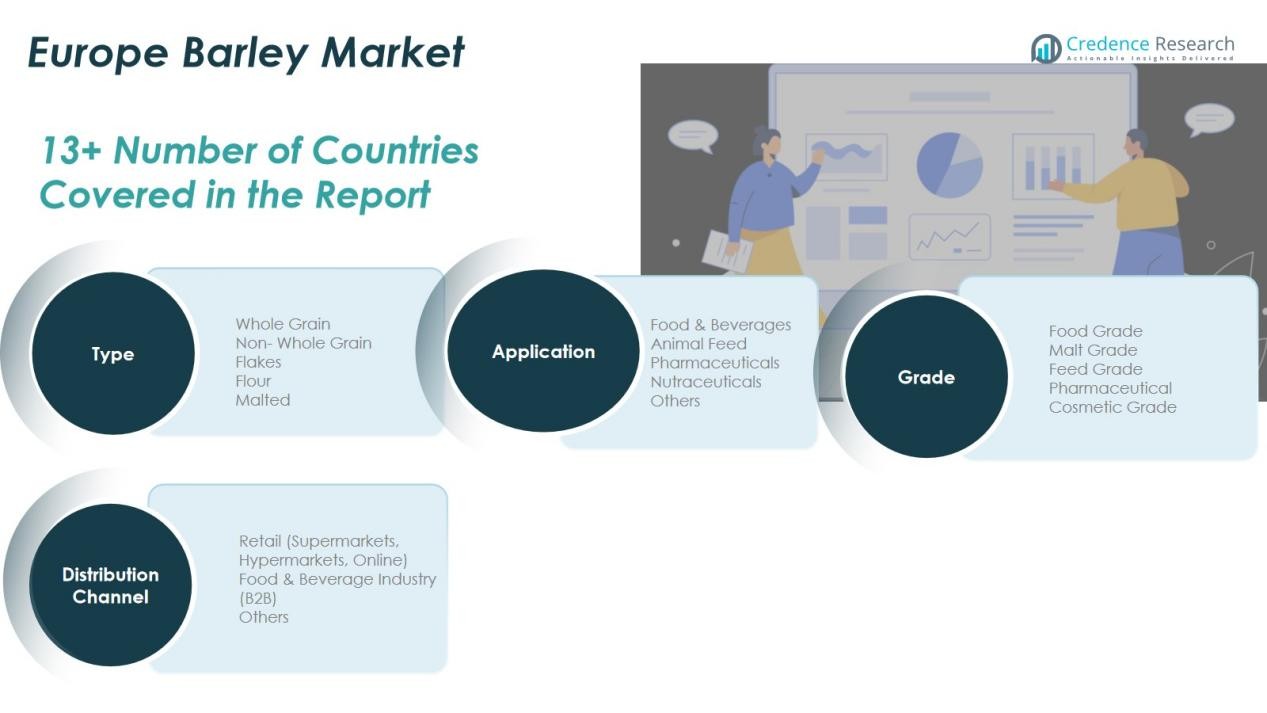

By Type

The Type segment shows strong demand for whole grain and malted barley due to their essential role in brewing, distilling, and health-focused food products. Flakes and flour secure growing interest from bakery and cereal manufacturers that prioritize fiber-rich and clean-label ingredients. Non-whole grain products maintain steady usage in processed food applications that require versatile grain formats. It supports broader market penetration by offering diverse functional and nutritional profiles.

- For instance, Anheuser-Busch InBev, the world’s largest brewer, utilizes millions of metric tons of whole grain and malted barley annually in its global brewing operations, optimizing fermentation efficiency and product consistenc

By Application

The Application segment is driven primarily by the food and beverages category, supported by Europe’s established brewing industry and rising consumer interest in nutritious grain-based foods. Barley’s role in animal feed remains critical due to its favorable energy profile and cost advantages compared to alternative cereals. Pharmaceuticals and nutraceuticals expand their use of barley-derived compounds, benefiting from growing interest in natural ingredients and digestive health solutions. Other industrial applications contribute to niche but steady revenue streams within the broader ecosystem.

- For instance, Rahr Malting Co.’s Shakopee facility in Minnesota processes 460,000 metric tons of malted barley annually across six malthouses, producing enough malt to brew approximately 12 billion 12-ounce cans of light beer or 6 billion bottles of craft beer per year.

By Distribution Channel

The Distribution Channel segment, retail platforms strengthen accessibility through supermarkets, hypermarkets, and online channels that cater to household consumption. The food and beverage industry remains a dominant B2B customer group due to large-scale procurement by brewers, distillers, and food processors. It helps stabilize demand through long-term supply contracts and quality-driven sourcing practices. Other distribution routes support regional trade networks and specialized industrial applications across Europe.

Segmentations:

By Type

- Whole Grain

- Non-Whole Grain

- Flakes

- Flour

- Malted

By Application

- Food & Beverages

- Animal Feed

- Pharmaceuticals

- Nutraceuticals

- Others

By Grade

- Food Grade

- Malt Grade

- Feed Grade

- Pharmaceutical Grade

- Cosmetic Grade

By Distribution Channel

- Retail (Supermarkets, Hypermarkets, Online)

- Food & Beverage Industry (B2B)

- Others

By Country

- Europe (Regional Overview)

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe: Strong Production Base and High-Value Processing Demand

Western Europe holds the leading position in the Europe Barley Market, supported by advanced agricultural systems and strong industrial processing capabilities. France, Germany, and the UK dominate production due to favorable climates, large farming areas, and long-established grain supply chains. Breweries and maltsters in this region maintain consistent demand for premium barley varieties that meet strict quality standards. It strengthens integration between farmers, cooperatives, and processing industries. Export activity remains robust, especially for malt and processed barley destined for global beverage markets.

Southern Europe: Climate-Driven Variability and Growing Demand for Malted Products

Southern Europe shows steady market participation despite higher climate sensitivity that affects yield stability in countries such as Spain and Italy. Producers in these regions focus on varieties adapted to warmer conditions and water-efficient farming practices. Demand for malted barley remains strong, reflecting the region’s expanding craft beer sector and specialty beverage production. It supports investments in localized malting facilities and more resilient crop development programs. Imports often supplement domestic supply during low-yield seasons, ensuring continuity for food, feed, and brewing applications.

Central and Eastern Europe: Expanding Production Capacity and Strengthening Export Role

Central and Eastern Europe continue to increase their influence through growing cultivation areas and modernization of agricultural infrastructure. Poland, Russia, and other emerging markets enhance production with improved technologies, seed varieties, and mechanized farming. The Europe Barley Market benefits from this region’s expanding export capacity, which supports both intra-European and international supply chains. It enables maltsters and feed producers in Western Europe to secure a stable and cost-efficient raw material base. Rising investments in local processing further elevate the region’s strategic importance within Europe’s barley ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Malteurop Groupe S.A.

- Soufflet Group

- Boortmalt (Axereal Group)

- GrainCorp Europe

- Cargill, Incorporated

- Muntons plc

- Simpsons Malt Ltd.

- Crisp Malting Group

- Heineken N.V.

- Carlsberg Group

- AB InBev

- Irish Distillers Ltd. (Pernod Ricard)

- Diageo plc

- United Malt Group

Competitive Analysis:

The Europe Barley Market features a highly competitive landscape shaped by global maltsters, agribusiness leaders, and integrated supply chain participants. Major companies such as Malteurop Groupe S.A., Soufflet Group, Boortmalt (Axereal Group), GrainCorp Europe, Cargill, Incorporated, and Muntons plc anchor market structure through extensive processing capacities and long-term farmer partnerships. These players focus on securing high-quality barley varieties that support brewing, distilling, and food production requirements. It strengthens competition around sourcing efficiency, product consistency, and traceability.

Leading companies invest in advanced malting technologies, sustainability programs, and regional expansion to enhance supply resilience and meet rising demand for premium malt. Strategic initiatives include capacity upgrades, acquisition-driven growth, and tighter integration with barley growers. Firms also prioritize environmental compliance and carbon-reduction commitments to align with Europe’s evolving regulatory landscape. Competitive intensity remains high as companies pursue differentiated capabilities in quality assurance, supply reliability, and value-added product portfolios.

Recent Developments:

- In November 2024, Boortmalt announced the expansion of its Minch Malt plant to increase production capacity and meet rising industry demand, continuing its partnership with Axereal Group.

- In June 2024, Boortmalt entered a carbon-reduced malting barley supply agreement with Cefetra Ecosystem Services as part of its commitment to regenerative agriculture practices

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Grade, Distribution Channel and Country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Europe Barley Market is set to benefit from rising demand for premium malt driven by craft breweries, specialty distillers, and high-quality beverage producers.

- Consumer interest in clean-label, high-fiber, and nutrient-rich foods will elevate barley’s role in bakery, cereals, and functional food applications.

- Expansion of climate-resilient seed varieties will support stable yields and improve grain consistency across diverse climatic zones.

- Adoption of precision agriculture and digital monitoring tools will increase production efficiency and optimize resource use.

- Sustainability initiatives will push supply chain stakeholders to adopt low-carbon farming and traceability systems.

- Stronger collaboration among growers, maltsters, and food manufacturers will enhance supply stability and quality control.

- Export opportunities for malt and processed barley will grow due to Europe’s reputation for high-quality grain.

- Diversification into nutraceutical and health-focused ingredients will create new revenue pathways for processors.

- Modernization of Eastern and Central European agricultural systems will expand Europe’s overall production capacity.

- Regulatory support for sustainable farming and soil health improvement will reinforce long-term market resilience.