Market Overview:

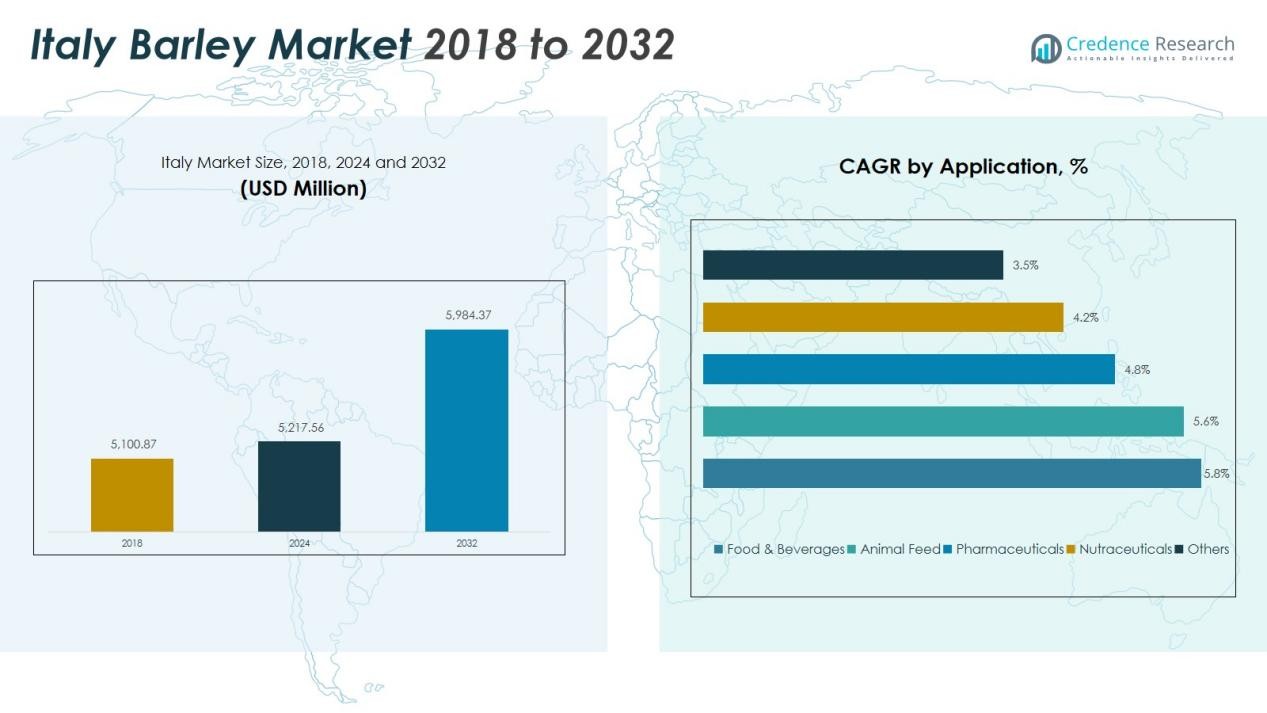

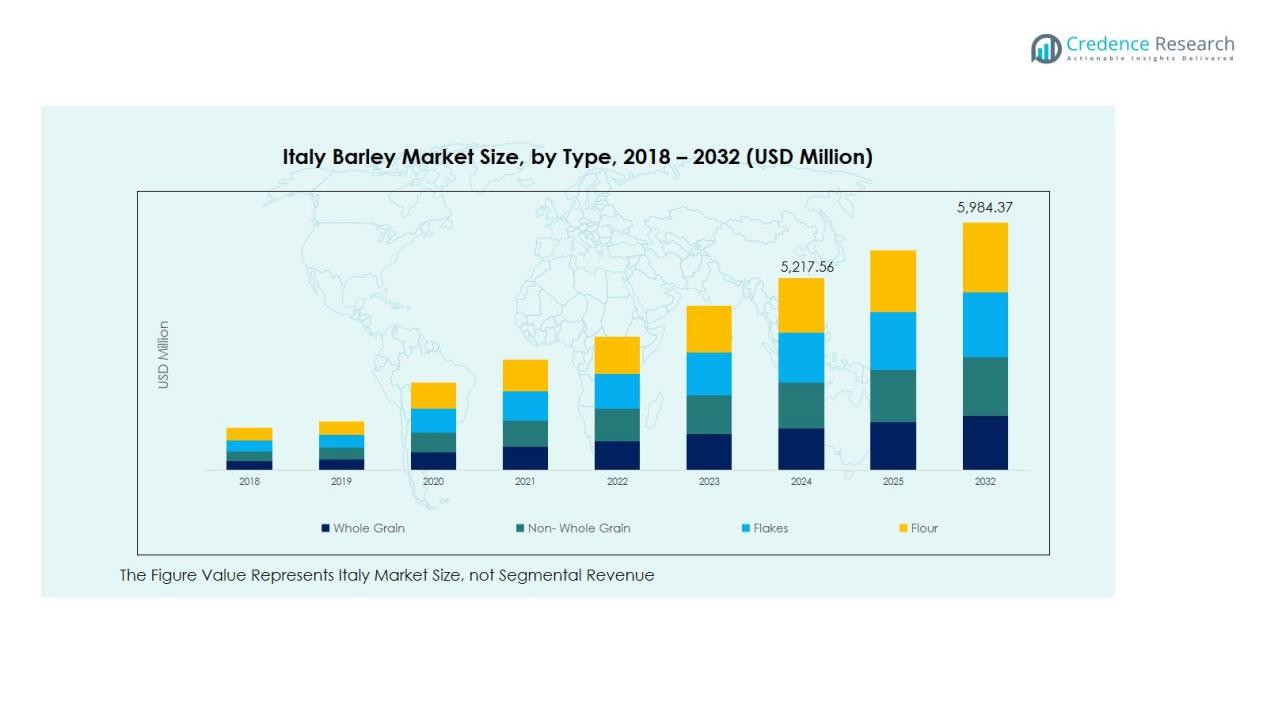

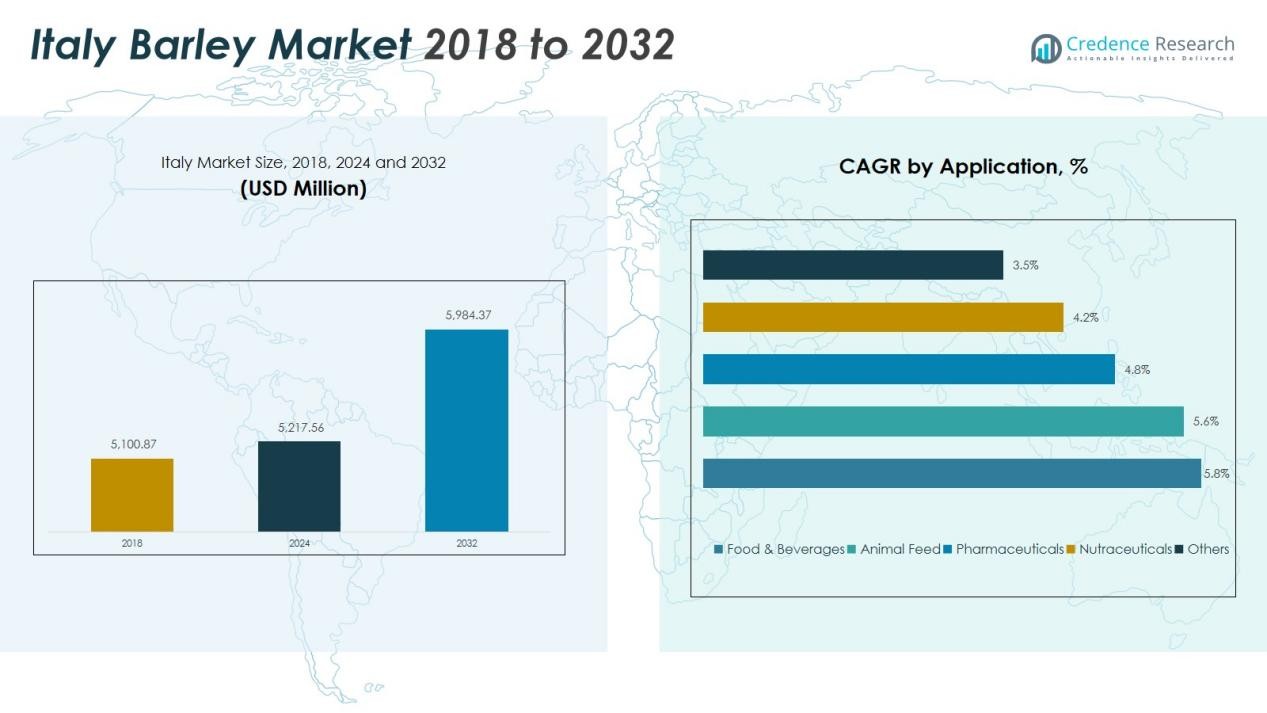

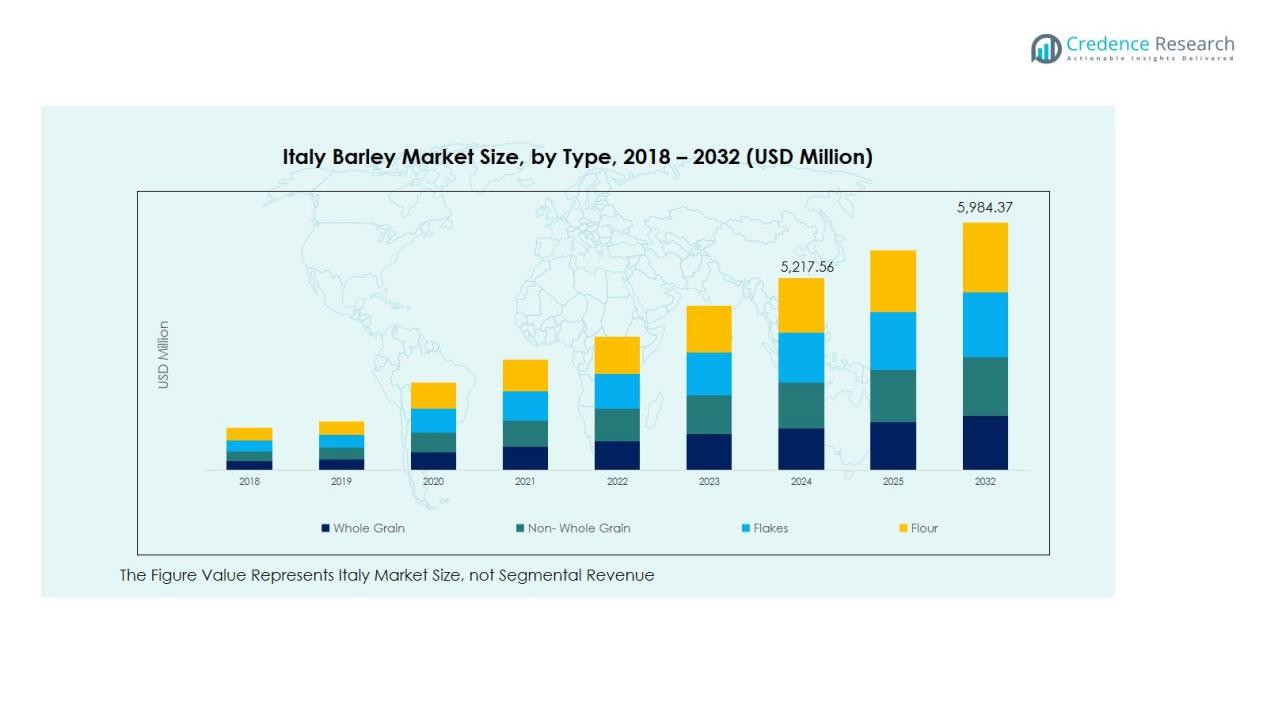

The Italy Barley Market size was valued at USD 5,100.87 million in 2018 to USD 5,217.56 million in 2024 and is anticipated to reach USD 5,984.37 million by 2032, at a CAGR of 1.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Barley Market Size 2024 |

USD 5,100.87 Million |

| Italy Barley Market, CAGR |

1.73% |

| Italy Barley Market Size 2032 |

USD 5,217.56 Million |

Strong market drivers support this growth trajectory. Italy’s well-developed brewing and distilling sector remains a primary consumer of premium malting barley, particularly for craft and specialty beer production. Rising consumer preference for whole-grain, fiber-rich foods further elevates barley usage in bakery, cereal, and functional food formulations. The livestock industry contributes additional demand, making feed barley a vital input for dairy and meat production. Advances in agronomy—such as improved seed varieties, optimized crop management techniques, and integrated pest-resistant practices—enhance yield reliability and overall product quality.

Regionally, barley cultivation is concentrated in northern and central Italy, including Emilia-Romagna, Veneto, Piedmont, and Tuscany. These areas benefit from favorable agro-climatic conditions, fertile soils, and efficient supply chain networks. Proximity to major maltsters, breweries, and export hubs strengthens regional productivity and supports Italy’s role within the broader European barley market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Italy Barley Market is valued at USD 5,217.56 million in 2024 and is projected to reach USD 5,984.37 million by 2032, growing at a CAGR of 73%, supported by strong demand from brewing, functional foods, and livestock feed sectors.

- Northern Italy holds the largest regional share at 48%, driven by fertile soils, advanced agronomy, and proximity to major maltsters; Central Italy follows with 32% due to its diversified food-processing demand; Southern Italy accounts for 14%, supported by feed-focused cultivation and improving agri-infrastructure.

- The fastest-growing region is Southern & Island Italy with a CAGR-aligned rising share of 14%, supported by adoption of climate-resilient varieties, irrigation investments, and expanding feed demand.

- Malting barley contributes 41% of total segment share, strengthened by Italy’s craft beer, specialty malt, and distilling industries that require premium, traceable grain quality.

- Feed barley holds 37% share, supported by continuous consumption from dairy and livestock producers seeking cost-efficient, energy-rich formulations.

Market Drivers:

Market Drivers:

Robust Demand from Brewing and Distilling Industries

The Italy Barley Market gains strong momentum from the country’s established brewing and distilling ecosystem. Premium malting barley remains essential for beer, craft brews, and spirits, which continue to expand their consumer base. Producers require consistent quality standards, which strengthens demand for high-grade barley varieties. Italian maltsters and breweries maintain steady procurement, reinforcing the crop’s strategic importance. The sector’s shift toward specialty beverages further increases the need for quality-driven barley supplies.

- For instance, Birra Baladin, a prominent Italian brewery, has developed a committed short supply chain by cultivating 300 hectares of spring two-row barley across regions like Basilicata and Marche, directly ensuring quality and consistency for their craft beers.

Rising Consumer Preference for Whole-Grain and Functional Foods

Health-conscious consumers support new demand channels within the Italy Barley Market. Barley’s high fiber and nutrient profile strengthens its use in bakery, breakfast cereals, and functional food formulations. Food manufacturers introduce barley-based products that target digestive health, weight management, and clean-label positioning. It encourages the adoption of innovative ingredients that align with modern dietary patterns. Barley’s versatility across traditional and contemporary foods strengthens market appeal.

- For instance, the company Molino Spadoni in Italy developed barley flour variants used in bakery products that retain over 5 grams of dietary fiber per 100 grams, enhancing satiety and digestive function in line with modern dietary preferences.

Expansion of Livestock and Dairy Feed Requirements

Feed demand remains a core driver for the Italy Barley Market. The livestock and dairy industries rely on barley for its digestibility, energy content, and cost efficiency. Italian producers maintain steady consumption due to the crop’s role in balanced feed formulations. It supports productivity improvements in meat and dairy operations. Broad feed usage stabilizes market volumes throughout the year.

Advancements in Agronomy and Sustainable Farming Practices

Enhanced cultivation methods reinforce long-term growth within the Italy Barley Market. Farmers benefit from improved seed varieties that offer better yield performance and resilience. Precision agriculture practices help optimize soil management, irrigation, and input application. It strengthens production reliability while supporting environmental goals. Sustainable farming initiatives improve traceability, quality consistency, and market competitiveness.

Market Trends:

Market Trends:

Growing Preference for Premium Malting and Specialty Barley Varieties

The Italy Barley Market reflects a clear shift toward premium malting grades driven by the rise of craft breweries and specialty distillers. Producers prioritize varieties that deliver higher extract potential, better protein balance, and improved flavor profiles. Breweries strengthen collaboration with farmers to secure traceable and consistent supplies. It supports long-term contracts that stabilize prices and improve quality control. Food processors also explore specialty barley types for clean-label and health-focused product lines. Technological improvements in sorting and quality assessment refine post-harvest handling standards. Sustainability criteria influence purchasing decisions and encourage farmers to adopt practices that enhance soil health and reduce input dependency.

- For Instance, Scoular utilizes a proprietary and patented process to concentrate protein from whole barley kernels, enabling high-quality and traceable products like its Emerge™ barley protein concentrate.

Expansion of Sustainable Farming Models and Digital Agronomy Adoption

The Italy Barley Market shows increasing alignment with sustainability-driven production models. Farmers adopt precision agronomy tools that support real-time monitoring of soil conditions, nutrient needs, and disease risks. It improves yield reliability and reduces resource waste across major cultivation regions. Demand for climate-resilient barley varieties rises due to weather variability and water management concerns. Supply chain stakeholders integrate digital platforms to strengthen traceability and quality verification. Breweries and food manufacturers prefer suppliers that demonstrate measurable sustainability commitments. Standardized certification frameworks gain traction and influence procurement patterns across the domestic market.

- For instance, Farmable, an Italian digital farm management platform, reported that in 2022, 82% of Italian farms used at least one digital solution for real-time monitoring of soil conditions and nutrient needs, leading to enhanced yield reliability and resource efficiency.

Market Challenges Analysis:

Exposure to Climate Variability and Yield Instability

The Italy Barley Market faces persistent challenges linked to unpredictable weather patterns and rising climate stress. Farmers experience yield variability due to irregular rainfall, heat episodes, and soil moisture deficits. It limits production stability and increases the risk associated with long-term planning. Crop resilience remains uneven across regions, which affects supply consistency for malting and feed sectors. Input costs rise when growers rely on irrigation or protective treatments to safeguard yields. Supply chain stakeholders monitor weather-related disruptions closely to maintain procurement balance.

Competitive Pressures and Quality Compliance Constraints

The Italy Barley Market must navigate competitive pressure from imported barley that often offers lower prices or higher malting performance. Domestic producers work under strict quality specifications required by breweries and food processors. It intensifies the need for better seed varieties and efficient post-harvest handling. Storage limitations and quality losses during transit create further constraints for producers. Smaller farms struggle to invest in technology that ensures consistent quality grades. Market participants continue to focus on efficiency and compliance to protect domestic competitiveness.

Market Opportunities:

Rising Demand for Premium Malting and Value-Added Food Applications

The Italy Barley Market presents strong opportunities through the expanding need for high-quality malting barley. Craft breweries and specialty distillers continue to diversify product portfolios, which increases demand for traceable and premium-grade varieties. It encourages farmers to adopt advanced cultivation methods that enhance grain quality. Food manufacturers explore barley for fiber-rich and clean-label product lines that target health-conscious consumers. Innovation in barley-based snacks, cereals, and functional foods strengthens market penetration. Collaborations between growers, maltsters, and processors support new value-added segments.

Growth Potential in Sustainable Farming and Export-Oriented Supply Chains

The Italy Barley Market gains new opportunities from rising interest in sustainability-focused production systems. Farmers who integrate precision tools and eco-friendly practices position themselves as preferred suppliers to domestic and international buyers. It supports access to high-value markets that emphasize certified and traceable crops. Expanding demand for environmentally responsible ingredients creates incentives for investment in better seed technologies. Export channels benefit from improved quality standards that meet European and Mediterranean market needs. Stronger integration across the supply chain helps unlock long-term commercial potential.

Market Segmentation Analysis:

By Power Source

The Italy Barley Market shows structured growth across power‐source–driven processing and handling systems used in milling, grading, and movement of barley across facilities. Manual systems remain common among smaller producers that prioritize low-cost operations and traditional workflows. It supports consistent handling efficiency but limits scalability. Electric-powered systems gain traction due to higher precision, stable output, and lower long-term operating costs. Pneumatic solutions also secure demand in large-scale processing units that require controlled movement, reduced contamination risk, and higher throughput. Technology upgrades across major barley-producing regions reinforce adoption of advanced equipment.

- For instance, Fava S.r.l., an Italian family-owned company, designs and manufactures highly automated, computer-controlled industrial pasta production lines that can handle capacities of up to several tons of product per hour, representing a global leader in advanced food processing technology.

By Application

The Italy Barley Market records strong application-based diversification supported by consistent demand from food, beverage, and feed sectors. Food and beverage processors continue to dominate consumption because barley plays a central role in malt production, bakery formulations, cereals, and health-oriented foods. It strengthens market relevance in premium malting and functional ingredient categories. Animal feed manufacturers rely on barley for its digestibility, cost efficiency, and balanced nutrient profile. Pharmaceuticals and nutraceuticals create niche opportunities through growing interest in beta-glucan–rich ingredients used in wellness products. The “Others” category includes industrial and specialty uses that expand steadily.

- For Instance, Barilla’s “White Fiber” pasta, for example, contains 6 grams of fiber per 56-gram serving using a blend of wheat flours and resistant corn starch.

By Shovel Type

The Italy Barley Market maintains operational efficiency through segment adoption of shovel types used for transport, loading, and on-farm handling. Standard shovels dominate small and medium farming operations due to their flexibility and ease of use. Grain-specific shovels gain demand in large production units that require reduced losses and improved handling speed. It supports higher hygiene standards and better material flow. Ergonomic and lightweight variants help reduce operator fatigue during repetitive handling tasks. Specialty shovels continue to expand presence in commercial storage and processing environments.

Segmentations:

Segmentations:

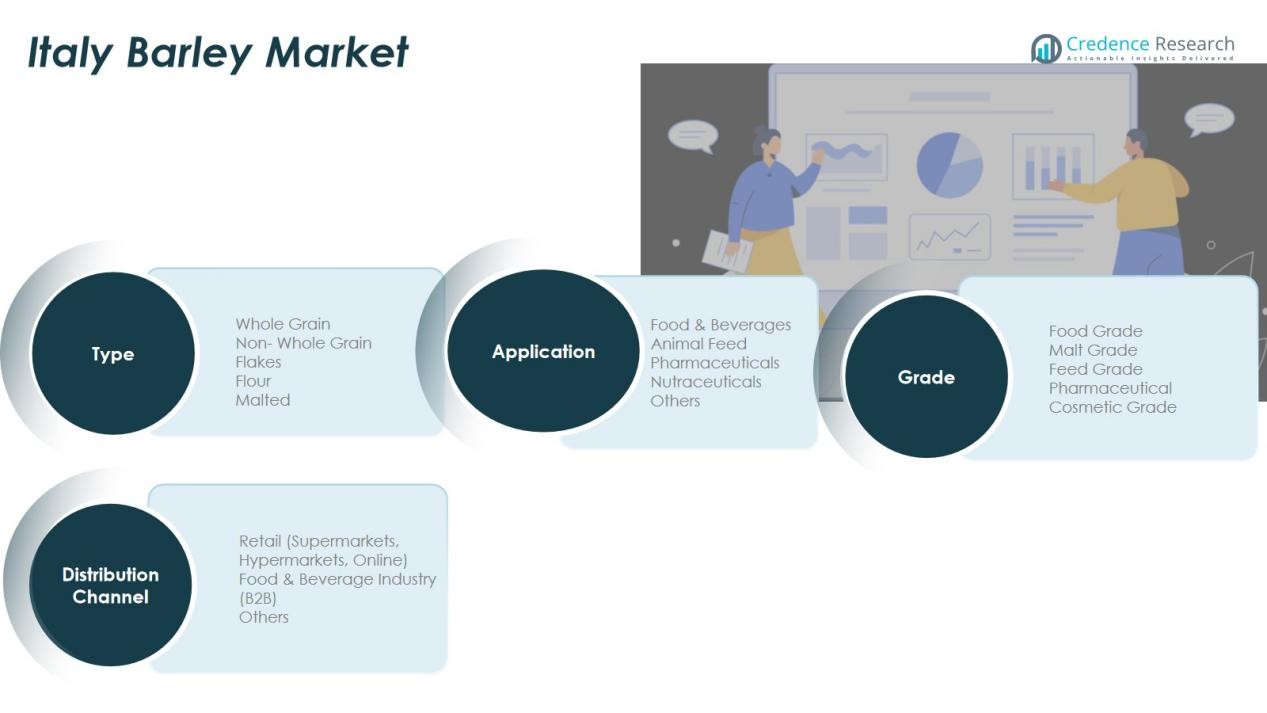

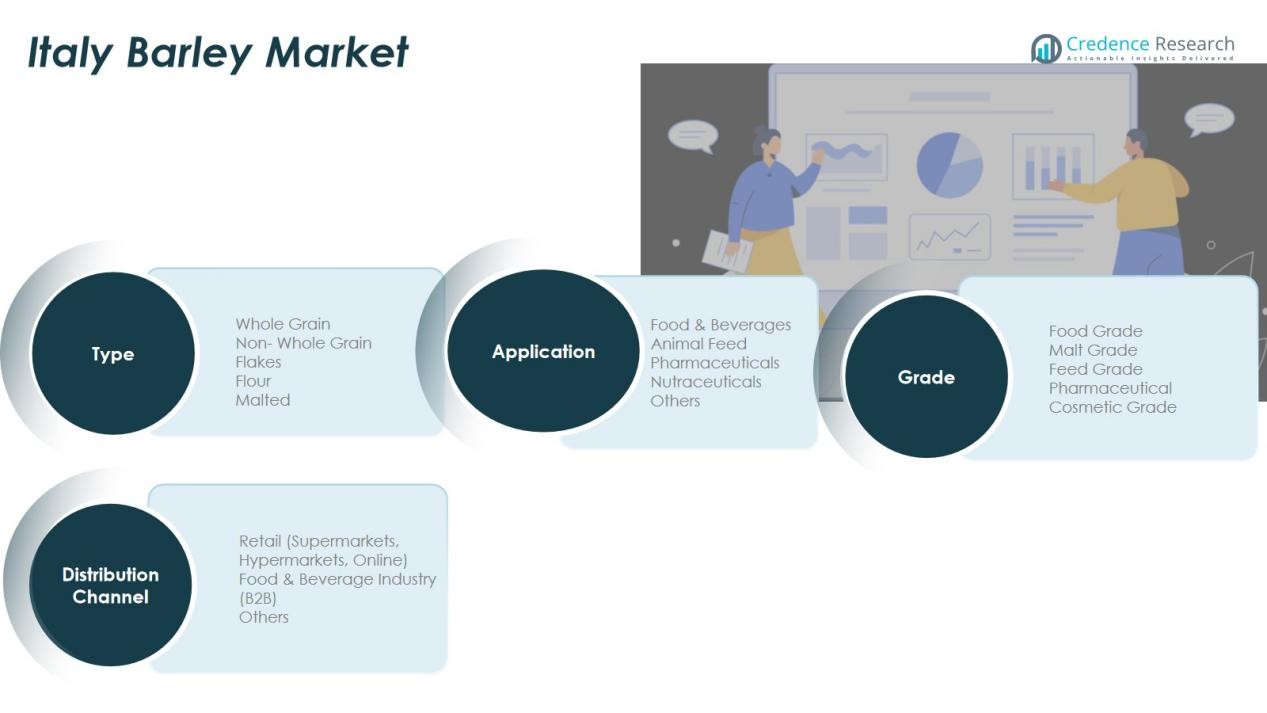

By Type

- Whole Grain

- Non-Whole Grain

- Flakes

- Flour

- Malted

By Application

- Food & Beverages

- Animal Feed

- Pharmaceuticals

- Nutraceuticals

- Others

By Grade

- Food Grade

- Malt Grade

- Feed Grade

- Pharmaceutical

- Cosmetic Grade

By Distribution Channel

- Retail (Supermarkets, Hypermarkets, Online)

- Food & Beverage Industry (B2B)

- Others

Regional Analysis:

Strong Production Concentration in Northern Italy

Northern Italy remains the core production zone of the Italy Barley Market due to its favorable climate, fertile soils, and well-developed agricultural infrastructure. Regions such as Emilia-Romagna, Veneto, Piedmont, and Lombardy support large-scale cultivation that meets the requirements of malting, feed, and food processors. Farmers in these areas benefit from advanced agronomy practices that improve yield stability and grain quality. It ensures consistent supply to breweries and maltsters that rely on premium barley varieties. Regional cooperatives strengthen collection, storage, and distribution efficiency, which supports long-term competitiveness.

Steady Expansion in Central Italy Supported by Diversified Demand

Central Italy contributes to market growth through a mix of mid-scale farming operations and rising demand from food manufacturers. Tuscany, Umbria, and Marche cultivate barley that aligns with both feed and specialty food applications. Processors in these regions focus on value-added uses such as whole-grain products, flours, and artisanal food items. It broadens demand beyond traditional malting channels and creates stable regional consumption patterns. Local initiatives that promote sustainable farming amplify adoption of improved varieties and better soil management practices.

Emerging Opportunities in Southern and Island Regions

Southern Italy and the island territories of Sardinia and Sicily show expanding interest in barley cultivation, supported by rising feed demand and resilience-focused crop planning. Warmer climates, shifting rainfall cycles, and soil limitations require varieties that tolerate heat and drought. It encourages experimentation with climate-adapted barley types that support livestock operations and niche food industries. Investment in irrigation, storage, and small-scale processing facilities helps improve economic viability. Regional diversification strengthens national supply security and broadens the geographic footprint of barley production.

Key Player Analysis:

- Malteurop Groupe S.A.

- Boortmalt (Axereal Group)

- Soufflet Group

- Birra Peroni (Asahi Group Holdings)

- Heineken Italia S.p.A.

- Carlsberg Italia S.p.A.

- Mosaico Agricolo S.r.l.

- Birrificio Angelo Poretti (Carlsberg Group)

- Agricola Peroni S.r.l.

Competitive Analysis:

The Italy Barley Market features a competitive landscape shaped by strong integration across malting, brewing, and agricultural value chains. Key participants such as Malteurop Groupe S.A., Boortmalt (Axereal Group), Soufflet Group, Birra Peroni (Asahi Group Holdings), and Heineken Italia S.p.A. strengthen their positions through vertical coordination and consistent demand for high-quality barley. It drives structured procurement networks that support farmers, maltsters, and processors across major producing regions. Market leaders focus on premium malting standards, sustainability commitments, and long-term supply agreements that stabilize quality and volume. Investments in processing capacity, traceability systems, and quality testing strengthen their competitive edge. Growing partnerships with domestic growers reinforce supply security and support Italy’s expanding craft and specialty beverage sectors.

Recent Developments:

- In May 2025, Malteurop inaugurated a new biomass power plant in Seville, Spain, representing a €40 million investment and targeting a 75% reduction in greenhouse gas emissions at their malting facility as part of a major decarbonisation strategy.

- In August 2024, Sanders, a subsidiary of Avril, completed the acquisition of Soufflet Agriculture’s animal nutrition activities, launching the new brand Nuoo and strengthening its position in France’s livestock nutrition market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Grade and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Italy Barley Market will strengthen its role in premium malting through steady demand from breweries and distillers.

- It will see higher adoption of improved barley varieties that support quality, resilience, and grain uniformity.

- Food manufacturers will expand the use of barley in clean-label, fiber-rich, and functional products that target health-focused consumers.

- Feed producers will maintain stable uptake due to barley’s balanced nutrient profile and cost efficiency.

- Sustainability programs will guide farm-level decisions, with greater emphasis on soil health, reduced inputs, and traceable supply chains.

- Digital agronomy tools will gain wider use and improve crop management, yield predictability, and risk mitigation.

- Regional expansion in southern and island areas will create new supply pockets supported by climate-adapted varieties.

- Processing infrastructure upgrades will improve storage stability, grain sorting accuracy, and overall value-chain efficiency.

- Strategic partnerships between farmers, maltsters, and beverage companies will strengthen long-term supply security.

- Export opportunities for specialty and sustainably produced barley will widen as global markets prioritize quality and responsible sourcing.

Market Drivers:

Market Drivers: Market Trends:

Market Trends: Segmentations:

Segmentations: