Market Overview:

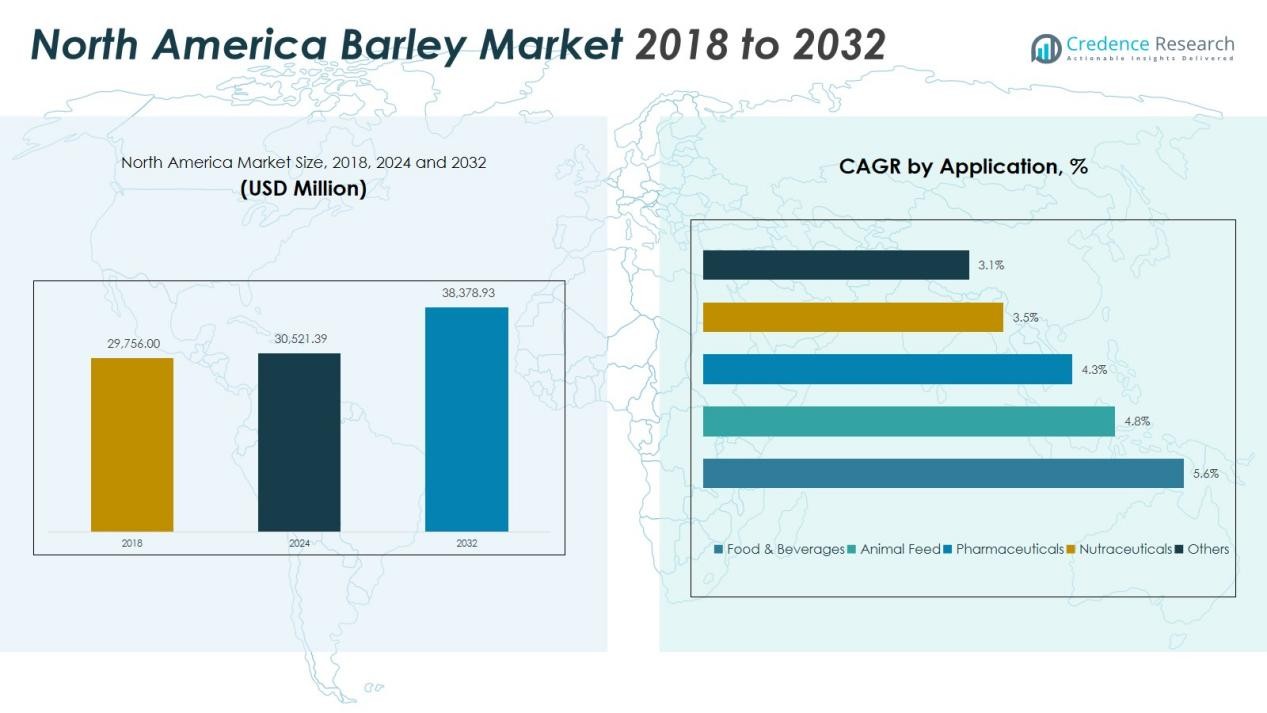

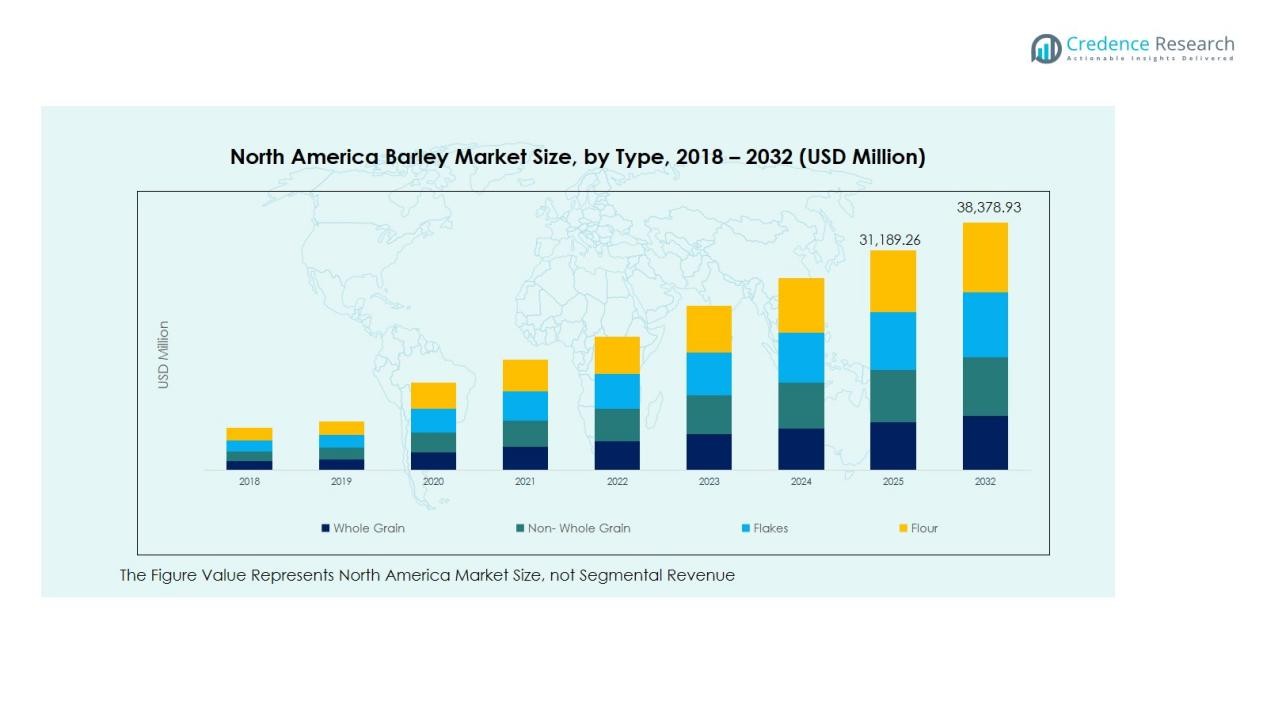

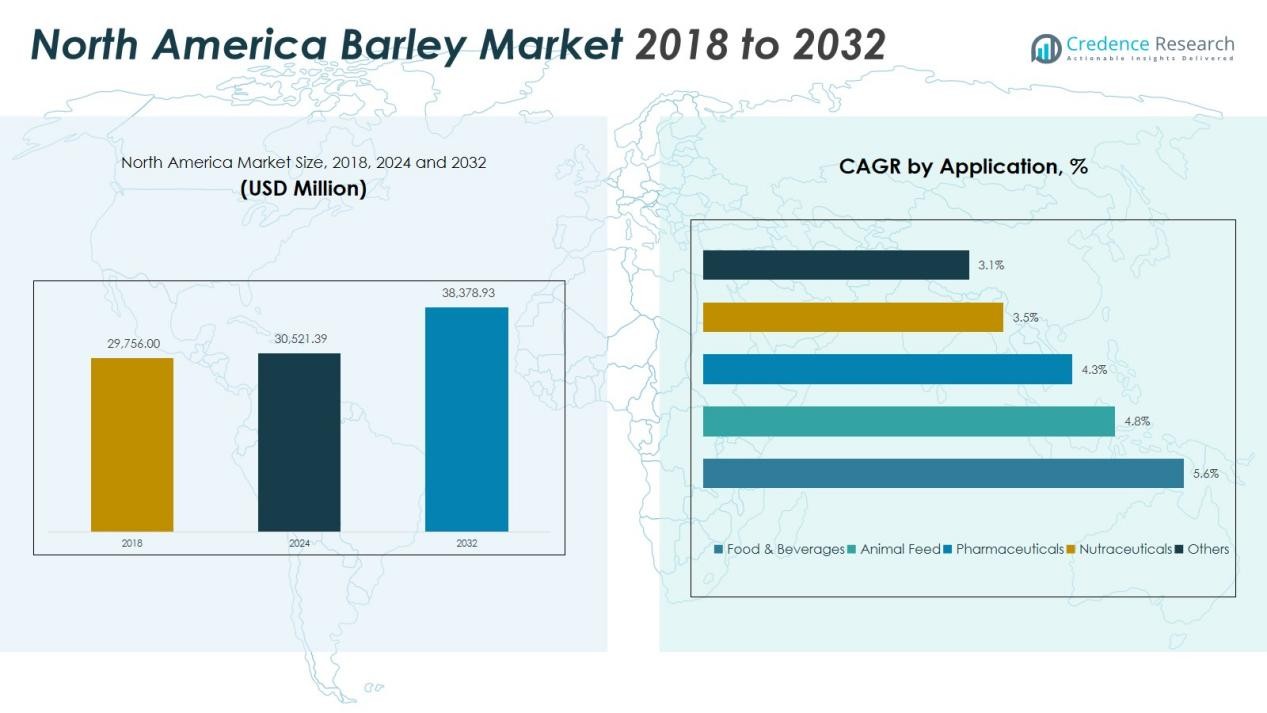

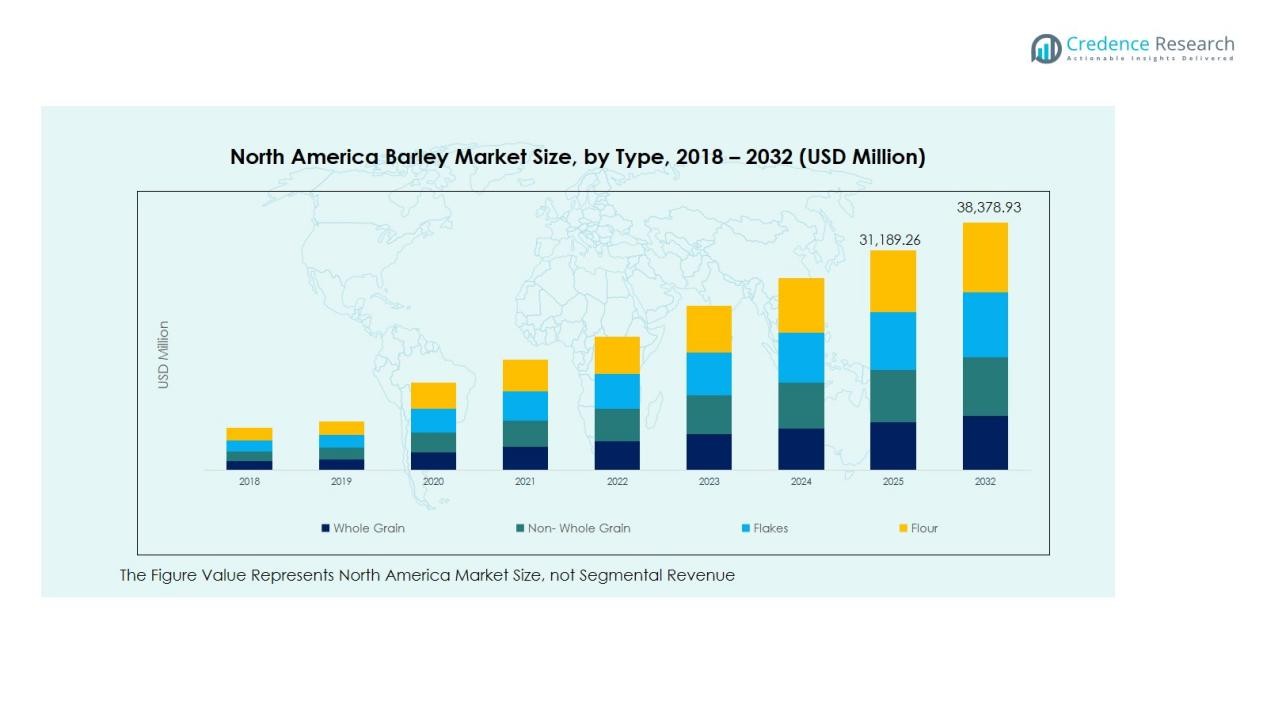

The North America Barley Market size was valued at USD 29,756.00 million in 2018 to USD 30,521.39 million in 2024 and is anticipated to reach USD 38,378.93 million by 2032, at a CAGR of 2.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Barley Market Size 2024 |

USD 30,521.39 Million |

| North America Barley Market, CAGR |

5.24 % |

| North America Barley Market Size 2032 |

USD 38,378.93 Million |

Key market drivers include the rising preference for craft beer and premium alcoholic beverages, which significantly boosts malt barley demand. The growing shift toward high-fiber and nutrient-enriched grains in the food industry further accelerates consumption. Barley’s role as a sustainable crop, requiring relatively lower inputs compared to other cereals, also supports its adoption in animal feed and environmentally conscious farming practices. Increasing investments in R&D, coupled with expanding applications in health foods and industrial uses, continue to enhance market potential.

Regionally, the United States dominates the market, driven by robust malting operations, strong craft brewing presence, and large-scale feed demand. Canada follows with substantial production capacities and high-quality barley varieties favored in global malt markets. Mexico shows gradual growth, supported by expanding beverage production and increased imports for brewing and feed industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- North America Barley Market size stands at USD 30,521.39 million in 2024 and is projected to reach USD 38,378.93 million by 2032, expanding at a CAGR of 2.90%, supported by strong malting demand, expanding health-grain applications, and resilient feed consumption.

- The United States leads with ~72% share, driven by its large malting capacity, strong craft-beer production, and extensive barley acreage, while Canada follows with ~23%, supported by premium barley varieties and export strength; Mexico accounts for ~5%, expanding steadily on rising brewing and feed imports.

- The fastest-growing region is Mexico, holding ~5% share, lifted by increasing beverage manufacturing, higher feed demand, and growing reliance on high-quality imports from the U.S. and Canada.

- Malting barley accounts for ~58% of total segment share, supported by high use in brewing, distilling, and specialty beverage production across North America.

- Feed barley holds ~42% share, driven by stable demand from cattle, dairy, and poultry producers seeking digestible and cost-efficient grain inputs.

Market Drivers:

Market Drivers:

Rising Demand for Malt in the Brewing and Distilling Sectors

The North America Barley Market benefits from the sustained expansion of craft breweries and premium alcoholic beverage producers. The growing preference for distinct flavor profiles strengthens malt barley consumption across the region. Producers rely on high-quality malting barley to meet strict industry specifications. It creates steady demand for specific barley varieties that support product differentiation.

- For instance, North America is home to over 9,000 craft breweries, heavily driving the demand for high-quality malted barley to create unique flavor profiles.

Growth in Functional and Nutrient-Rich Food Applications

Barley’s high fiber, beta-glucan content, and versatile nutritional profile elevate its importance in health-focused food categories. Manufacturers use barley in cereals, bakery products, and plant-based formulations to meet rising consumer interest in wholesome ingredients. It aligns with the shift toward cleaner labels and natural grain alternatives. Demand grows stronger as consumers prioritize digestive health and nutrient density.

- For instance, research articles show barley contains dietary fiber ranging from 11% to 34%, predominantly beta-glucan, which provides proven functional benefits such as postprandial glucose stabilization and increased satiety, helping brands address nutritional quality effectively.

Expansion of the Livestock and Feed Industries

Barley retains a strong position in regional feed markets due to its digestibility and balanced nutrient composition. Feed producers use barley to enhance livestock performance and support diversified feed formulations. It helps stabilize demand across fluctuating grain markets. Rising meat and dairy consumption in the region reinforces the need for reliable feed sources.

Advancements in Crop Breeding and Sustainable Farming Practices

Modern breeding programs improve barley yield, resilience, and malting characteristics, strengthening grower confidence. The crop’s adaptability to varied climates positions it well in sustainable farming systems. It requires fewer inputs compared to other cereals, supporting environmentally mindful production strategies. Increased investment in agronomic research encourages wider adoption of enhanced barley varieties.

Market Trends:

Market Trends:

Growing Shift Toward Premium Malting Varieties and High-Quality Grain Standards

The North America Barley Market observes a clear shift toward specialized malting varieties that support premium beer and spirits production. Brewers and distillers demand consistent grain quality, which encourages producers to adopt advanced cultivation practices. It strengthens collaboration between growers and maltsters who aim to meet strict quality specifications. Rising interest in flavor-forward craft beverages fuels the need for varieties with superior enzyme activity and stable performance. Consumers prefer products with transparency in grain sourcing, which motivates supply chains to prioritize traceability. The trend expands investment in research that targets improved malting characteristics and climate resilience.

- For instance, new malting barley varieties like AAC Connect have improved agronomic traits such as better yields and lodging resistance, enabling consistent protein content between 10-12.5%, preferred by maltsters. It strengthens collaboration between growers and maltsters who aim to meet strict quality specifications.

Expansion of Barley in Functional Foods and Sustainable Feed Formulations

Demand for fiber-rich and nutrient-dense grains elevates barley’s visibility in health-focused food categories across the region. The North America Barley Market benefits from growing interest in whole grains that support metabolic wellness and digestive health. It motivates food manufacturers to incorporate barley into snacks, cereals, and plant-forward formulations. Sustainability goals in agriculture also push feed producers to explore barley-based alternatives that reduce dependency on resource-intensive crops. The trend encourages development of regionally adapted varieties that perform well under environmental stress. Rising interest in regenerative practices further strengthens barley’s position in diversified crop rotations.

- For instance, in North Dakota, feed producers often incorporate several pounds of dry-rolled barley as part of cattle rations, which helps improve feed efficiencies and can reduce reliance on corn-based feeds.

Market Challenges Analysis:

Volatility in Production and Vulnerability to Climate Variations

The North America Barley Market faces persistent challenges linked to fluctuating weather patterns and climate-related stress. Producers experience inconsistent yields due to drought, excess moisture, and temperature extremes across key growing regions. It increases the difficulty of maintaining stable supply for malting and feed applications. Limited irrigation access in some areas further reduces resilience during adverse seasons. Buyers encounter uncertainty in quality and volume, which complicates procurement planning. These conditions prompt ongoing pressure on growers to adopt climate-adaptive practices and invest in more resilient varieties.

Rising Competition from Alternative Grains and Shifting Crop Economics

The North America Barley Market competes with higher-value crops such as wheat, corn, and oilseeds that often offer better returns per acre. Producers face difficult planting decisions when market prices favor alternative grains. It reduces barley acreage and constrains long-term supply stability. Feed manufacturers also substitute other grains when barley prices rise, which weakens demand in certain cycles. Trade disruptions and variable import needs further complicate market balance. These challenges reinforce the need for stronger pricing incentives and expanded end-use diversification.

Market Opportunities:

Expansion of High-Value Malting and Specialty Barley Segments

The North America Barley Market holds strong opportunities in premium malting varieties that support craft beer, distilled spirits, and specialty beverage production. Rising consumer interest in unique flavor profiles encourages brewers to source differentiated grain types. It motivates growers to invest in specialty varieties with enhanced enzyme activity and stable malting performance. Demand for traceable and region-specific barley also strengthens supply-chain partnerships. Producers gain opportunities in contract farming models that secure predictable pricing and long-term demand. The trend supports value creation across both small-scale and large-scale malt operations.

Growth in Functional Foods and Sustainable Feed Applications

Barley’s nutritional strengths create opportunities in health-focused food categories that emphasize fiber, beta-glucans, and whole-grain benefits. The North America Barley Market benefits from stronger interest in wellness-oriented cereals, snacks, and plant-forward formulations. It encourages manufacturers to expand product lines that use barley as a clean-label ingredient. Sustainability priorities in livestock production also boost opportunities for barley-based feed blends that support reduced input requirements. Demand rises for varieties adapted to low-water systems and regenerative farming practices. These opportunities strengthen barley’s role in food, feed, and environmentally aligned production models.

Market Segmentation Analysis:

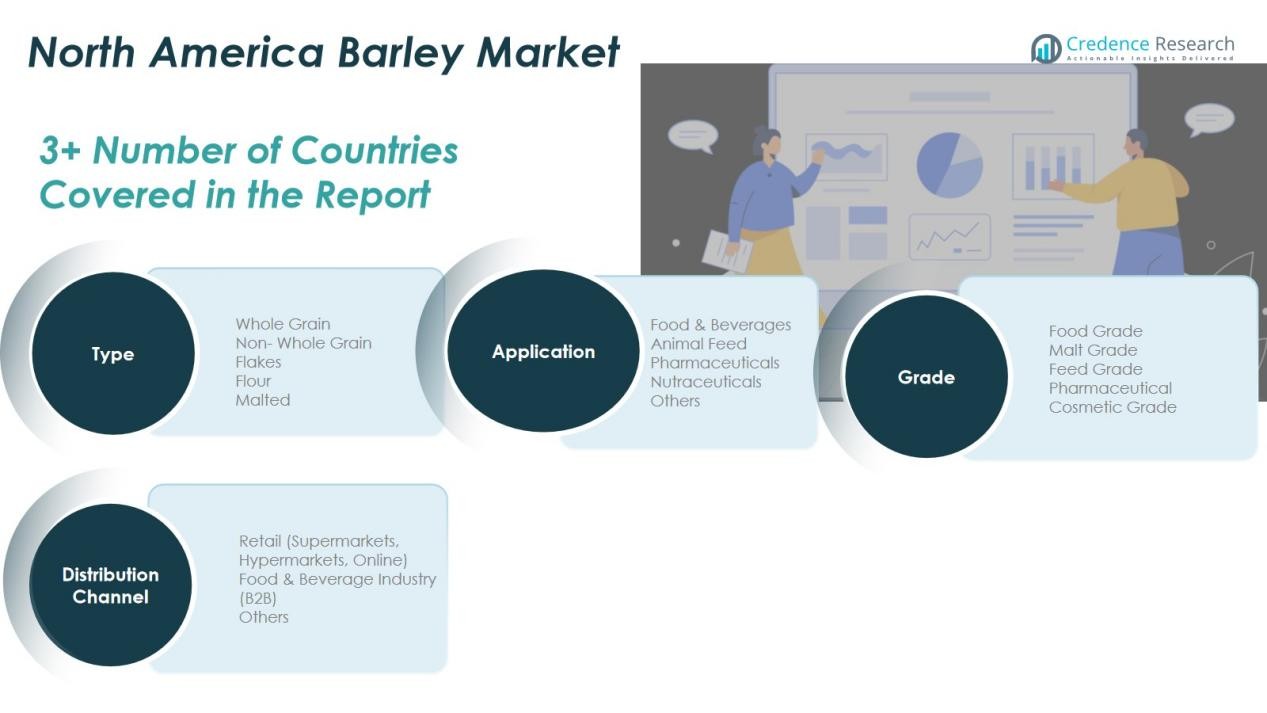

By Type

The North America Barley Market shows balanced demand across whole grain, non-whole grain, flakes, flour, and malted variants. Malted barley holds a dominant share due to strong consumption in brewing and distilling industries. Whole grain and flour gain traction in health-focused food categories that prioritize fiber and nutrient density. It supports expanding product lines in cereals, bakery items, and clean-label formulations. Flakes and non-whole grain types maintain steady growth through diversified use in packaged foods and specialty blends.

- For Instance, Anheuser-Busch InBev (AB InBev) reported a decline in total beer volumes in 2024. The overall U.S. beer market, including the craft segment, experienced a downturn, leading to a glut in the barley supply and a reduction in some barley contracts with farmers, challenging the narrative of a universal ‘growing preference for high-quality malt in brewing’ across the entire market

By Application

Food and beverages lead market consumption, driven by expanding malt requirements and rising interest in whole-grain ingredients. The animal feed segment maintains consistent demand supported by barley’s digestibility and strong nutritional profile. Pharmaceuticals and nutraceuticals grow steadily as research highlights barley’s beta-glucan benefits for heart health and metabolic wellness. It encourages manufacturers to incorporate barley into functional supplements and therapeutic formulations. Other applications emerge from industrial, specialty ingredient, and fermentation-related uses.

- For instance, Beneo has developed a barley beta-glucan ingredient, Orafti® β-fit, which is a whole grain barley flour with a natural beta-glucan content of typically 20%. This ingredient has been clinically shown in numerous human studies to help manage postprandial (after-meal) blood glucose levels by delaying glucose absorption in the small intestine.

By Grade

Food-grade and malt-grade segments account for a significant share due to high-quality standards required for food processing and brewing. Malt grade remains essential for craft and commercial beverage producers who seek consistent enzyme activity and grain performance. Feed grade maintains reliable demand from livestock and dairy operations across the region. Pharmaceutical and cosmetic grades expand gradually with rising interest in natural, grain-derived compounds. It supports innovation in wellness, skincare, and therapeutic product development.

Segmentations:

Segmentations:

By Type

- Whole Grain

- Non-Whole Grain

- Flakes

- Flour

- Malted

By Application

- Food & Beverages

- Animal Feed

- Pharmaceuticals

- Nutraceuticals

- Others

By Grade

- Food Grade

- Malt Grade

- Feed Grade

- Pharmaceutical

- Cosmetic Grade

By Distribution Channel

- Retail (Supermarkets, Hypermarkets, Online)

- Food & Beverage Industry (B2B)

- Others

- By Country

- U.S.

- Canada

- Mexico

Regional Analysis:

Strong Market Leadership in the United States

The North America Barley Market remains heavily influenced by the United States, which leads regional production, processing, and consumption. The country benefits from extensive malting infrastructure that supports both large breweries and the expanding craft beer industry. It strengthens demand for high-quality malting barley with consistent performance characteristics. Feed applications also contribute to steady uptake, supported by a strong livestock sector. Ongoing investment in crop research and sustainability initiatives enhances the competitiveness of U.S. barley across global markets.

Canada’s High-Quality Production and Export Strength

Canada holds a prominent position due to its reputation for producing premium barley varieties that meet strict malting and brewing standards. The country supplies both domestic maltsters and international buyers, supported by well-established grading systems and advanced agronomic practices. It benefits from favorable climatic conditions that support stable yields and reliable grain quality. Canadian barley gains strong traction in the premium beer segment, where consistency and purity remain critical. Regional strategies focus on improved varietal development and expanded export channels.

Mexico’s Growing Demand in Food, Feed, and Beverage Applications

Mexico demonstrates steady growth driven by rising demand for barley in brewing, food processing, and livestock feed. The country relies on imports from the United States and Canada to meet domestic requirements due to limited local production capacity. It supports strong trade flows and sustained market integration within North America. Expanding beverage manufacturing and investment in modern milling and malting facilities strengthen Mexico’s long-term consumption outlook. Growth in packaged foods and evolving dietary trends further enhance future demand potential.

Key Player Analysis:

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Bunge / Viterra Inc.

- CHS Inc.

- The Scoular Company

- Rahr Corporation

- Briess Malt & Ingredients Co.

- Malt Products Corporation (MPC)

- GrainCorp Limited

- Muntons plc

- The Andersons, Inc.

- CGB Enterprises, Inc.

- Malteurop North America

- Boortmalt (Axereal Group)

- Soufflet Group

Competitive Analysis:

The North America Barley Market features a competitive landscape shaped by large agribusinesses, specialized maltsters, and integrated supply-chain operators. Key participants include Cargill, Incorporated; Archer Daniels Midland Company (ADM); Bunge / Viterra Inc.; CHS Inc.; The Scoular Company; Rahr Corporation; Briess Malt & Ingredients Co.; and Malt Products Corporation (MPC). Competition centers on securing high-quality barley, strengthening malting capacity, and expanding regional sourcing networks. Leading players invest in breeding programs, contract farming, and advanced grain-handling systems to maintain consistent supply for food, feed, and beverage industries. It reinforces vertical integration strategies that improve efficiency and reduce exposure to commodity price fluctuations. Maltsters focus on specialty malts and premium product lines to support growing demand from craft breweries and distilleries. Market participants also prioritize sustainability commitments and traceability programs to align with evolving buyer expectations across North America.

Recent Developments:

- In July 2025, Cargill announced an agreement to acquire Mig-Plus, a Brazilian animal nutrition company, to expand its animal feed business in Brazil, subject to regulatory approval.

- In May 2025, Malteurop inaugurated a new biomass power plant in Seville, Spain, representing a €40 million investment and targeting a 75% reduction in greenhouse gas emissions at their malting facility as part of a major decarbonisation strategy.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Grade and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North America Barley Market is expected to experience steady demand growth supported by expanding applications in food, beverages, and feed.

- Innovation in malting and specialty barley varieties will strengthen opportunities in craft brewing and premium beverage segments.

- Rising consumer interest in high-fiber and whole-grain ingredients will support wider use of barley in health-focused food products.

- Sustainability priorities across agriculture will elevate barley’s role due to its lower input requirements and strong adaptability.

- Investments in climate-resilient varieties will improve yield stability and reduce supply risk across key producing regions.

- Expanding nutraceutical and functional food sectors will create new avenues for beta-glucan-rich barley ingredients.

- Feed manufacturers will continue to adopt barley as a reliable alternative to corn and wheat during periods of price volatility.

- Strengthening trade relationships within North America will support efficient movement of grain between the U.S., Canada, and Mexico.

- Digital tools in crop monitoring and grain traceability will improve transparency across supply chains and enhance buyer confidence.

- Strategic partnerships between growers, maltsters, and food producers will encourage long-term contracts and higher-value production models.

Market Drivers:

Market Drivers: Market Trends:

Market Trends: Segmentations:

Segmentations: