Market Overview

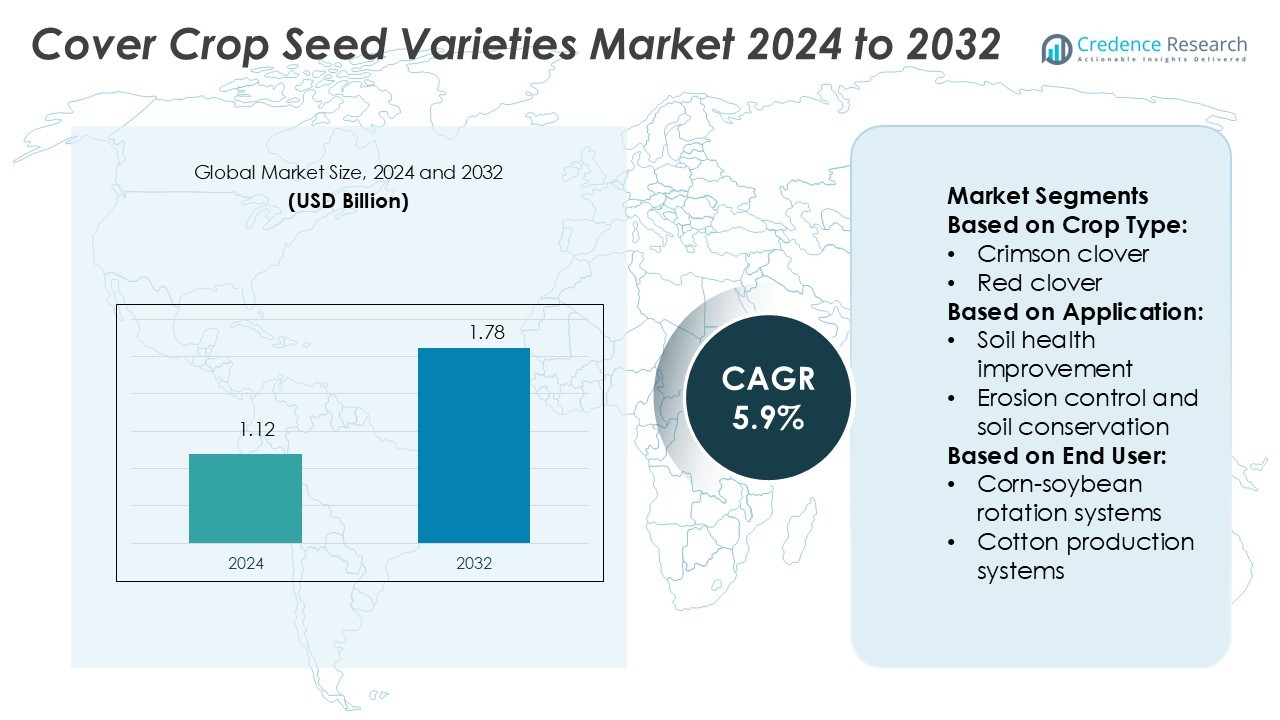

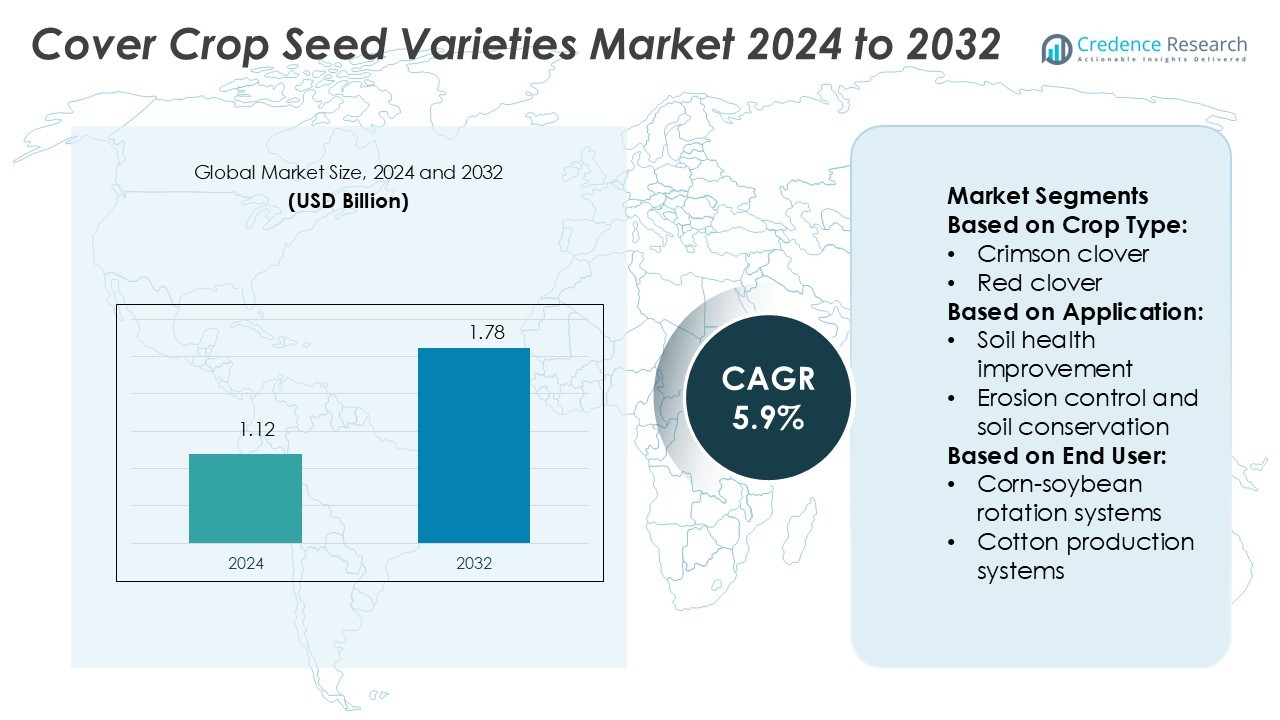

Cover Crop Seed Varieties Market size was valued USD 1.12 billion in 2024 and is anticipated to reach USD 1.78 billion by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cover Crop Seed Varieties Market Size 2024 |

USD 1.12 Billion |

| Cover Crop Seed Varieties Market, CAGR |

5.9% |

| Cover Crop Seed Varieties Market Size 2032 |

USD 1.78 Billion |

The Cover Crop Seed Varieties Market is driven by strong competition among top players including Corteva, TAKII & CO., LTD., KWS SAAT SE & Co. KGaA, Syngenta Global AG, Advanta Seeds, Bayer Group, SAKATA SEED AMERICA, Vilmorin-Mikado, Rijk Zwaan Zaadteelt en Zaadhandel B.V., and Dow. These companies focus on developing high-yielding, climate-resilient seed varieties that support soil enrichment and sustainable farming practices. North America leads the global market with a 36% share, supported by advanced agricultural infrastructure, large-scale adoption of regenerative practices, and strong policy support for soil conservation. The presence of well-established seed producers, investment in R&D, and wide distribution networks further strengthen the region’s leadership. Increasing demand for sustainable crop rotation systems continues to enhance market competitiveness and innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cover Crop Seed Varieties Market was valued at USD 1.12 billion in 2024 and is expected to reach USD 1.78 billion by 2032, growing at a CAGR of 5.9%.

- Strong market growth is driven by increasing adoption of regenerative farming practices, rising demand for sustainable soil management, and government support programs.

- Key trends include advanced seed breeding, bio-based seed treatments, and integration of precision agriculture tools to improve efficiency and yield.

- Intense competition among leading players encourages continuous R&D investment and product innovation, while high initial costs and limited awareness in developing regions act as restraints.

- North America leads with a 36% share, supported by strong infrastructure and large-scale adoption, while legume seed varieties hold the dominant segment share due to their nitrogen-fixing capabilities and contribution to soil health.

Market Segmentation Analysis:

By Crop Type

Legumes dominate the cover crop seed varieties market with the largest market share. Within legumes, crimson clover holds the leading position due to its adaptability and nitrogen-fixing capabilities. Crimson clover improves soil fertility, supports early spring biomass production, and suits a wide range of climatic conditions. Hairy vetch and Austrian winter pea also contribute significantly to nitrogen enrichment and weed suppression. Farmers prefer legumes because they reduce fertilizer dependence and improve overall soil structure, making them a cost-effective and sustainable option in crop rotation systems.

- For instance, academic and government trials with crimson clover have shown that it can achieve a biomass yield of over 5,500 lb/acre and fix over 130 lb of nitrogen per acre by mid-May in trials conducted in states like Mississippi.

By Application

Soil health improvement represents the dominant application segment, driven by rising adoption of regenerative farming practices. Cover crops increase organic matter, enhance soil microbial activity, and improve water retention. Farmers use these crops to prevent soil degradation and boost long-term fertility. Other key applications, such as erosion control, nutrient management, and weed suppression, also gain traction due to their role in reducing input costs and improving resilience against climate impacts. These benefits make cover crop seed varieties an essential part of sustainable agriculture programs globally.

- For instance, Takii’s Tagetes patula variety “Ground Control” has generated up to 120 tonnes fresh biomass per hectare in field trials, contributing that much organic matter to soil structure.

By End User

Corn-soybean rotation systems account for the highest market share in end-use segments. This dominance is linked to widespread adoption in North America and parts of Europe, where cover crops fit seamlessly into rotational schedules. Legumes like crimson clover and hairy vetch support nitrogen fixation, improving corn yield and soil quality. Organic farms and livestock integration systems also show strong growth potential, driven by soil conservation goals and sustainable production incentives. The increasing support from conservation programs further encourages adoption across multiple cropping systems.

Key Growth Drivers

Rising Focus on Soil Health and Regenerative Agriculture

Farmers are increasingly adopting cover crops to boost soil fertility and structure. Legume varieties like crimson clover and hairy vetch help fix nitrogen naturally, reducing chemical fertilizer use. This supports sustainable agriculture and enhances crop yields over time. Governments and NGOs also offer incentives for regenerative farming, encouraging wider adoption. These practices improve soil moisture retention, reduce erosion, and increase long-term productivity, making cover crop seeds a key input in sustainable farming strategies.

- For instance, Sakata recently opened its Woodland Innovation Center on a 219-acre site in Yolo County, California, consolidating R&D, seed processing, testing, and biotech operations. The facility includes a 9,000 ft² lab building, an 18,000 ft² LEED-certified office, a 32,000 ft² warehouse with a proprietary seed mill design, and a full solar energy plant supplying site electricity.

Government Subsidies and Incentive Programs

Many countries offer financial support for cover crop adoption through conservation and climate-smart agriculture programs. Subsidies lower initial seed costs and promote large-scale integration in corn-soybean rotations and cotton systems. Incentive schemes also help farmers manage nutrient runoff, meeting environmental compliance goals. This policy backing encourages both large and small farms to adopt cover crops. As a result, seed producers experience stable demand, driving market expansion globally.

- For instance, in its Innovation and Research disclosures, Vilmorin-Mikado states it invests 17% of its turnover into R&D, sustaining 50 experimental stations globally to support new seed varieties.

Growing Demand for Climate Resilience and Carbon Sequestration

Farmers are turning to cover crops to reduce climate risks and build resilient cropping systems. Species like red clover and Austrian winter pea help sequester carbon and protect topsoil during extreme weather. These crops enhance biodiversity and create stable agroecosystems that withstand droughts and floods. Carbon credit programs further encourage their use by offering economic returns. This climate-focused shift strengthens long-term market growth for cover crop seed varieties.

Key Trends & Opportunities

Rising Integration of Precision Agriculture and Digital Tools

Digital farming platforms are helping farmers optimize cover crop selection and management. Tools like remote sensing and AI-driven field mapping guide precise planting and termination strategies. Seed companies are developing crop-specific recommendations to enhance yield benefits. This integration lowers operational costs, improves crop performance, and creates opportunities for customized seed solutions. As precision farming adoption grows, cover crop seed demand is expected to rise significantly.

- For instance, Rijk Zwaan uses drones with images at under 0.1 cm to 0.5 cm per pixel and flights at 3–20 m altitude to phenotype breeding trials. The company also deploys wireless IoT sensors in seed production fields to monitor soil moisture and microclimate variables.

Expansion of Organic and Specialty Crop Farming

Organic farming relies heavily on cover crops for weed suppression and soil health. Crimson clover and hairy vetch are increasingly used to reduce synthetic inputs. Demand is rising among specialty crop growers seeking sustainable methods. This shift opens opportunities for seed companies to offer certified organic and non-GMO varieties. The growing premium market for organic produce directly supports cover crop seed market expansion.

- For instance, Takii deploys intensive breeding and trial networks across 15+ countries. They maintain over 5,500 distinct varieties in their global catalog.

Strategic Collaborations and New Product Development

Seed producers are investing in R&D and partnerships to release high-performance varieties. Collaborations with universities and ag-tech firms focus on traits like rapid biomass growth and better pest resistance. Companies are also tailoring seed blends for different climatic zones and crop rotations. These strategic moves create competitive advantages and widen product portfolios. The trend strengthens global market positioning and accelerates innovation.

Key Challenges

High Initial Costs and Limited Farmer Awareness

Despite long-term benefits, many farmers face high upfront costs for seeds, planting, and termination. Awareness of cover crop advantages remains low among small and medium-scale farmers in developing regions. Lack of technical knowledge often results in poor crop management and reduced returns. This cost and knowledge gap slows adoption rates, limiting market penetration, especially in low-income agricultural economies.

Climatic Variability and Regional Suitability Issues

Cover crop performance varies widely across regions due to temperature, rainfall, and soil type differences. Not all varieties adapt well to harsh or unpredictable climates, leading to inconsistent yields. Farmers may face challenges with timing and integration into existing crop rotations. These issues create uncertainty around return on investment, making some growers hesitant. This climatic sensitivity remains a significant barrier to broader market adoption.

Regional Analysis

North America

North America leads the Cover Crop Seed Varieties Market with a 36% share. High adoption of sustainable farming practices in the U.S. and Canada drives growth. Farmers use legumes and grasses extensively for soil enrichment, nitrogen fixation, and erosion control. Federal programs like EQIP and CSP encourage cover crop adoption. Leading seed companies focus on developing climate-resilient seed varieties suited to diverse climatic zones. Robust agricultural infrastructure and widespread knowledge of regenerative agriculture strengthen the regional market position, supporting increased adoption across row crop farming and organic production systems.

Europe

Europe holds a 31% share of the Cover Crop Seed Varieties Market. Countries such as Germany, France, and the Netherlands promote cover cropping through CAP greening measures and agroecological policies. Farmers integrate clover, vetch, and ryegrass to enhance soil carbon levels and improve biodiversity. EU targets for climate neutrality accelerate the adoption of climate-smart farming techniques. Major seed producers and research institutions drive innovation in seed breeding and disease resistance. High environmental awareness and strong policy support help maintain Europe’s leading role in sustainable agricultural practices.

Asia Pacific

Asia Pacific accounts for a 21% share of the market. The region shows fast growth due to expanding regenerative farming in India, China, Australia, and Japan. Government initiatives and rising awareness about soil health improve adoption rates among smallholder and commercial farmers. Legume-based cover crops gain traction in diversified cropping systems. Seed companies expand their distribution networks and partner with agricultural cooperatives to increase accessibility. Sustainable farming models, combined with climate adaptation goals, position Asia Pacific as a high-growth region in the forecast period.

Latin America

Latin America represents a 7% share of the Cover Crop Seed Varieties Market. Brazil and Argentina lead adoption, driven by large-scale soybean and corn production systems. Cover crops like vetch and clover help manage soil erosion and nutrient loss, supporting no-till farming methods. National conservation programs encourage the use of cover crops for long-term soil fertility. Seed suppliers expand offerings to match tropical and subtropical climate conditions. Growing demand for sustainable agricultural exports further supports regional market development and adoption.

Middle East & Africa

The Middle East & Africa region holds a 5% share of the market. Adoption remains modest but is rising in South Africa, Kenya, and parts of the Gulf region. Water conservation and soil fertility restoration are key drivers. Legume and grass seed varieties support climate adaptation in arid and semi-arid conditions. International development programs and agricultural NGOs introduce training on cover crop benefits. Limited infrastructure and funding remain challenges, but pilot projects and technology transfer initiatives indicate strong future potential for market expansion.

Market Segmentations:

By Crop Type:

- Crimson clover

- Red clover

By Application:

- Soil health improvement

- Erosion control and soil conservation

By End User:

- Corn-soybean rotation systems

- Cotton production systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cover Crop Seed Varieties Market features strong competition among leading players such as Corteva, TAKII & CO., LTD., KWS SAAT SE & Co. KGaA, Syngenta Global AG, Advanta Seeds, Bayer Group, SAKATA SEED AMERICA, Vilmorin-Mikado, Rijk Zwaan Zaadteelt en Zaadhandel B.V., and Dow. The Cover Crop Seed Varieties Market is characterized by rising innovation, strategic partnerships, and a strong focus on sustainability. Companies are investing in advanced breeding programs to develop climate-resilient seeds that enhance soil fertility, support nitrogen fixation, and improve water retention. Precision agriculture tools and bio-based seed treatments are gaining traction to increase germination rates and disease resistance. Expanding distribution networks and collaborations with research institutions strengthen market penetration and accelerate technology transfer to farmers. The growing emphasis on regenerative agriculture and supportive government initiatives is intensifying competition, driving continuous product differentiation and technological advancement across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Corteva

- TAKII & CO., LTD.

- KWS SAAT SE & Co. KGaA

- Syngenta Global AG

- Advanta Seeds

- Bayer Group

- SAKATA SEED AMERICA

- Vilmorin-Mikado

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- Dow

Recent Developments

- In November 2024, Corteva introduced a proprietary and novel non-GMO hybrid technology for wheat, which is expected to ensure substantial yield improvements to the crop. The new method boosts yield potential by 10% while utilizing the same quantity of land resources.

- In May 2024, Nuseed Carinata and Omega-3 Canola Production System contract programs for 2024 was recently announced by Nuseed. Now available throughout the Southern United States, the Nuseed Carinata program assists farmers in improving agronomic conditions and soil health, supporting sustainable farming practices and raising productivity.

- In July 2023, Syngenta, one of the prominent players in the agriculture inputs industry, announced the acquisition of Feltrin Sementes, a vegetable seed company based in Brazil. The move would help expand the range of products that the company can offer across the globe.

- In June 2023, Takii unveiled a new advanced seed production facility in Karacabey, Turkey. The plant, situated in the Bursa province, has been established to improve the company’s production process for both flower and vegetable seeds.

Report Coverage

The research report offers an in-depth analysis based on Crop Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of regenerative farming practices will continue to accelerate worldwide.

- Seed innovation will focus on improving climate resilience and soil health benefits.

- Digital farming tools will support better crop planning and seed selection.

- Governments will increase incentives to encourage sustainable farming systems.

- Bio-based seed treatments will gain stronger traction among farmers.

- Strategic partnerships will expand to enhance distribution and research capabilities.

- High-performing legume and grass seed varieties will dominate future demand.

- Private sector investments in R&D will strengthen competitive positioning.

- Awareness of carbon sequestration benefits will boost cover crop adoption.

- Market expansion will intensify in emerging economies with growing agricultural activity.