Market Overview

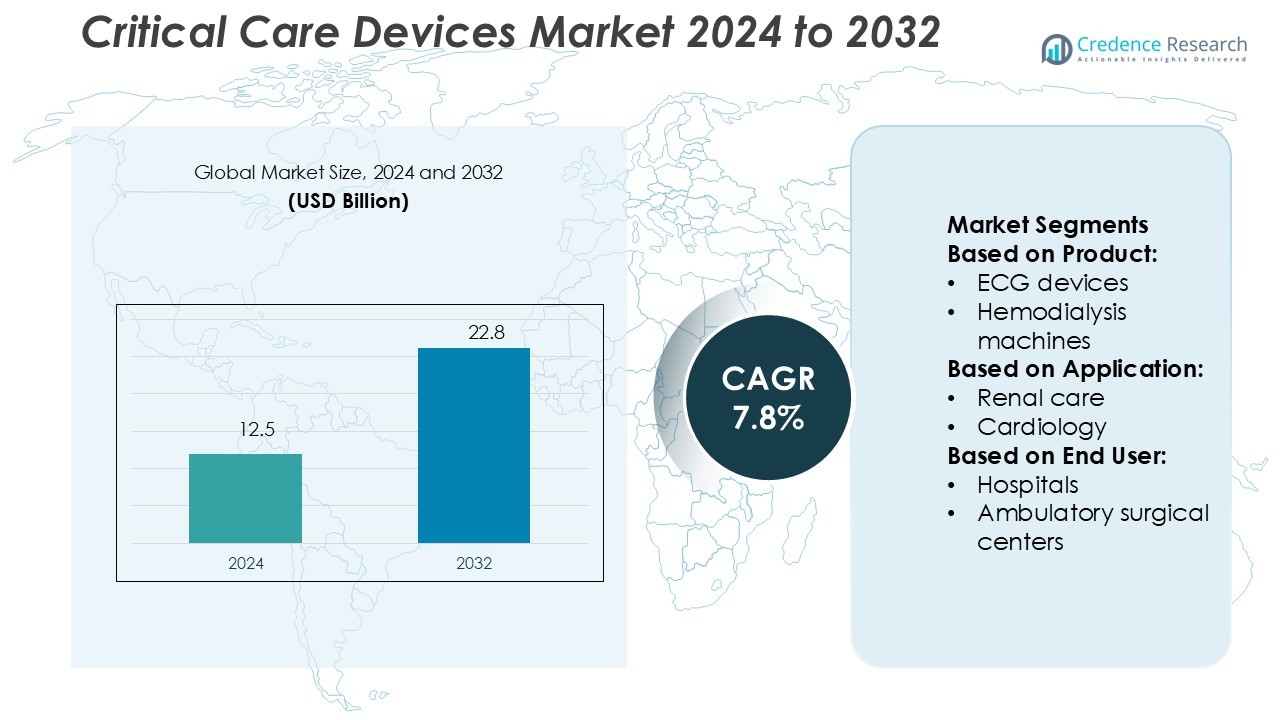

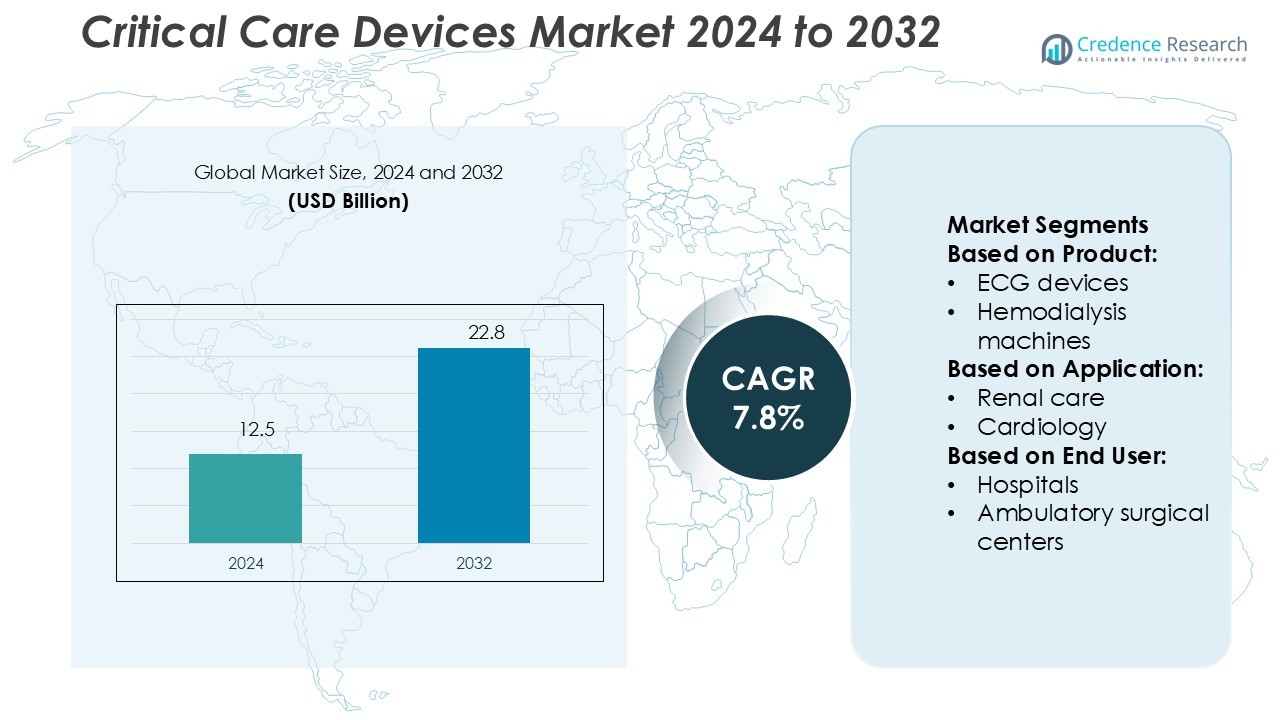

Critical Care Devices Market size was valued USD 12.5 billion in 2024 and is anticipated to reach USD 22.8 billion by 2032, at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Critical Care Devices Market Size 2024 |

USD 12.5 Billion |

| Critical Care Devices Market, CAGR |

7.8% |

| Critical Care Devices Market Size 2032 |

USD 22.8 Billion |

The Critical Care Devices Market is driven by major players such as GE Healthcare, Becton, Dickinson and Company, Fresenius Medical Care, Boston Scientific Corporation, Cardinal Health, B. Braun Melsungen, Getinge, Baxter, Drägerwerk, and Asahi Kasei Corporation. These companies lead through advanced product innovation, global distribution networks, and strategic collaborations with healthcare providers. Their portfolios span ventilators, monitoring systems, infusion technologies, and life-support devices, addressing growing demand in intensive care settings. North America holds the largest market share at 34%, supported by advanced healthcare infrastructure, high ICU capacity, and rapid adoption of connected technologies. This strong regional presence enables market leaders to maintain competitive advantages and accelerate product penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Critical Care Devices Market was valued at USD 12.5 billion in 2024 and is projected to reach USD 22.8 billion by 2032, growing at a CAGR of 7.8%.

- Increasing ICU admissions, aging populations, and rising prevalence of chronic diseases are driving strong demand for ventilators, monitoring systems, and infusion technologies.

- AI integration, remote monitoring, and tele-ICU adoption are shaping market trends, enhancing patient outcomes and operational efficiency.

- Intense competition among key players and regulatory compliance requirements act as major restraints, impacting pricing strategies and market entry.

- North America leads with 34% market share, followed by Europe with 29% and Asia Pacific with 24%, while the ventilators segment holds the largest share among critical care device categories.

Market Segmentation Analysis:

By Product

Defibrillators hold the dominant position in the critical care devices market, accounting for 21% share. Their high demand comes from their critical role in managing cardiac emergencies. Modern defibrillators integrate real-time monitoring and automated external shock delivery, improving survival rates in critical care units. Multiparameter monitoring devices and ventilators also show steady growth due to rising ICU admissions and the need for continuous patient monitoring. Expanding critical care infrastructure and growing awareness of advanced life support drive product adoption in hospitals and emergency care settings.

- For instance, GE HealthCare’s automated external defibrillators (AEDs) use Rescue Ready® technology to perform regular self-tests to ensure functionality. Its CARESCAPE R860 ventilator delivers precise lung-protective ventilation and includes advanced tools to enhance patient outcomes in intensive care settings. The R860 can deliver tidal volumes as low as 2 mL for neonatal patients, but the minimum volume varies by patient population.

By Application

Cardiology represents the largest application segment with a 37% share. The rising burden of cardiovascular diseases and the need for rapid response interventions strengthen the demand for defibrillators, ECG devices, and ventilators. Advanced monitoring technologies support early diagnosis and better outcomes for cardiac patients. Renal care follows due to increasing dialysis needs and demand for CRRT machines in critical care. Growing adoption of advanced clinical protocols and rising investments in specialized care units also support market expansion across these applications.

- For instance, Becton, Dickinson & Company’s Swan-Ganz IQ™ Pulmonary Artery Catheter, when used with a compatible monitor (such as the HemoSphere Alta™), delivers continuous cardiac output readings that update every 10 seconds.

By End User

Hospitals dominate the market with a 68% share, driven by advanced critical care units and high patient volumes. Hospitals rely on multiparameter monitoring devices, infusion pumps, ventilators, and defibrillators for emergency and intensive care. High infrastructure investments, skilled medical staff, and 24/7 operational capabilities support wider adoption of advanced technologies. Ambulatory surgical centers and specialty clinics show rising demand, focusing on portable and efficient devices to support patient stabilization and rapid interventions outside traditional hospital settings.

Key Growth Drivers

Rising Burden of Chronic and Critical Illnesses

The rising prevalence of cardiac, respiratory, and renal diseases is driving demand for critical care devices. Hospitals rely on advanced ventilators, multiparameter monitors, and defibrillators to support patients with life-threatening conditions. Rapid disease progression requires real-time monitoring and emergency interventions. The growing aging population increases the number of patients in intensive care units. Hospitals are expanding critical care capacity to address these needs. The rise in chronic conditions accelerates the adoption of connected monitoring systems to improve patient outcomes and reduce mortality.

- For instance, Fresenius Medical Care’s Xenios 2.0 ECLS/ECMO platform supports both veno-venous and veno-arterial modes across patient sizes (neonate to adult) on a single system, enabling up to 5 L/min blood flow in adult circuits.

Technological Advancements in Monitoring and Therapeutics

Continuous innovation in patient monitoring and life support technologies strengthens market growth. Advanced infusion pumps, high-precision ventilators, and AI-powered monitoring systems enable early detection of complications. These devices enhance workflow efficiency and help clinicians provide timely interventions. The integration of wireless and cloud-based systems improves data accuracy and patient management. Smart alarms and predictive analytics reduce clinical errors. Increasing investment in R&D by medical device manufacturers fuels faster product upgrades and regulatory approvals.

- For instance, Cardinal Health markets the Kangaroo OMNI™ enteral feeding pump, capable of delivering intermittent/bolus infusions of up to 400 mL/hour (with a standard feeding set).

Growing Hospital Infrastructure and ICU Capacity Expansion

Expanding hospital infrastructure is creating strong demand for critical care equipment. Governments and private providers are increasing ICU bed capacity to meet rising patient volumes. Healthcare investments focus on equipping ICUs with modern defibrillators, dialysis units, and ventilators. Emerging economies are prioritizing critical care modernization through large-scale procurement and funding programs. Better access to emergency care boosts the need for continuous monitoring systems. This expansion also supports adoption of tele-ICU solutions that optimize workforce deployment and enhance patient management.

Key Trends & Opportunities

Integration of AI and Digital Health Technologies

AI is increasingly being integrated into critical care devices to support faster decision-making. Machine learning algorithms predict patient deterioration and automate alarm systems. AI-enabled ventilators and monitoring systems reduce clinical workload and improve patient safety. Digital health platforms allow real-time data sharing between specialists and ICUs. This integration improves care coordination and reduces complications. Investments in AI-driven solutions create new opportunities for device manufacturers to offer smarter and more adaptive technologies.

- For instance, B. Braun’s use of MuleSoft APIs accelerated creation of new digital healthcare integrations 50 % faster by unifying data from back-end systems, enabling interoperability between ICU devices and hospital records.

Shift Toward Non-Invasive and Portable Devices

Non-invasive monitoring and portable life-support devices are gaining traction. Portable ventilators and compact infusion pumps support emergency and remote care settings. This shift addresses the need for flexibility in hospitals, ambulatory centers, and homecare. Miniaturization and battery-efficient systems enable continuous monitoring outside ICUs. Portable solutions reduce hospitalization costs and enhance mobility for patients. Rising demand for home-based critical care is driving manufacturers to design lightweight and efficient systems.

- For instance, Getinge’s Servo-air® ventilator is validated to run continuously for 50,000 hours (≈10 years) on its turbine design, and supports both invasive and non-invasive ventilation with two hot-swappable batteries.

Tele-ICU and Remote Monitoring Expansion

Tele-ICU solutions are transforming critical care delivery. Hospitals use remote monitoring platforms to manage ICU patients in real time. These systems allow centralized oversight of multiple facilities. Remote intensivists can guide treatment decisions using high-quality data from connected devices. This reduces ICU strain and supports better outcomes in rural or resource-limited settings. Tele-ICU adoption also aligns with workforce optimization strategies in healthcare systems facing critical care staff shortages.

Key Challenges

High Device Costs and Budget Constraints

Critical care devices are expensive to procure and maintain. High costs limit adoption in low- and middle-income countries, where ICU budgets are often tight. Advanced ventilators, dialysis units, and multiparameter monitors involve substantial capital investment. Maintenance, calibration, and software updates further add to operational expenses. Smaller hospitals may delay equipment upgrades due to financial pressures. This cost barrier restricts access to advanced care, affecting patient outcomes in resource-constrained settings.

Shortage of Trained Critical Care Personnel

The growing demand for advanced devices is outpacing the availability of skilled critical care staff. Operating complex ventilators, infusion systems, and monitoring platforms requires specialized training. Many hospitals, especially in developing regions, face staffing shortages and skill gaps. Improper device handling can increase the risk of complications or equipment failure. Workforce shortages also limit tele-ICU adoption and technology optimization. Addressing this challenge requires structured training programs and better clinical support systems.

Regional Analysis

North America

North America leads the Critical Care Devices Market with a 34% share. Strong healthcare infrastructure, high adoption of advanced technologies, and favorable reimbursement policies drive growth. The U.S. dominates the region due to a high volume of ICU admissions and strong demand for life-support systems. Increasing investment in connected monitoring devices enhances patient outcomes and operational efficiency. Canada contributes through strategic healthcare reforms that boost device utilization in critical care units. Strong regulatory approvals and early product launches by key manufacturers further strengthen the region’s leadership position in the market.

Europe

Europe holds 29% share in the Critical Care Devices Market. The region benefits from well-established healthcare systems, increasing ICU capacity, and strict patient safety regulations. Countries such as Germany, France, and the UK are leading adopters of advanced ventilators, infusion pumps, and monitoring systems. Strong government support for hospital modernization improves device penetration. European manufacturers also focus on product innovation and CE-mark approvals, enhancing patient care standards. The region’s aging population and rising chronic disease burden further increase demand for critical care devices across acute care settings.

Asia Pacific

Asia Pacific accounts for 24% of the Critical Care Devices Market. Rapid healthcare infrastructure expansion, increasing patient volumes, and government-led ICU capacity development drive market growth. China, Japan, and India dominate demand, supported by investments in advanced life-support technologies. Rising medical tourism and increasing awareness of critical care standards strengthen adoption. Favorable regulatory reforms and local manufacturing initiatives lower device costs and improve accessibility. Growing public-private partnerships also boost hospital upgrades and intensive care capacity, making the region a key emerging market for critical care solutions.

Latin America

Latin America represents 7% of the Critical Care Devices Market. Market growth is supported by healthcare modernization programs, increasing public investments, and the growing burden of chronic diseases. Brazil and Mexico lead demand with expanding ICU capacity in public and private hospitals. The region is adopting more cost-efficient and portable critical care devices to address resource limitations. Strategic collaborations with global manufacturers help accelerate technology transfer and enhance local production. Improving access to advanced monitoring systems and ventilators supports better patient management and clinical outcomes.

Middle East & Africa

The Middle East & Africa region holds 6% share of the Critical Care Devices Market. Rising investments in hospital infrastructure and the growing prevalence of respiratory and cardiovascular diseases drive demand. Gulf countries lead adoption due to large-scale government healthcare spending and modernization of critical care facilities. African countries are steadily improving access to essential life-support equipment through donor programs and private sector partnerships. Portable and mobile critical care solutions are gaining traction to address infrastructure gaps. Gradual regulatory alignment supports better access to global technologies.

Market Segmentations:

By Product:

- ECG devices

- Hemodialysis machines

By Application:

By End User:

- Hospitals

- Ambulatory surgical centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Critical Care Devices Market is shaped by key players including GE Healthcare, Becton, Dickinson and Company, Fresenius Medical Care, Boston Scientific Corporation, Cardinal Health, B. Braun Melsungen, Getinge, Baxter, Drägerwerk, and Asahi Kasei Corporation. The Critical Care Devices Market is defined by rapid technological advancement, strategic partnerships, and continuous product innovation. Manufacturers are focusing on expanding their product portfolios to address rising demand for advanced monitoring systems, ventilators, and infusion technologies. Companies are investing in AI-driven solutions and connected platforms to improve clinical efficiency and patient outcomes. Strategic mergers and acquisitions strengthen market reach, allowing broader access to critical care infrastructure across developed and emerging regions. R&D investments focus on enhancing device accuracy, interoperability, and ease of use. Strong regulatory compliance and product quality certifications remain key differentiators among competitors. This ongoing innovation race intensifies market competition, driving the development of safer, more reliable, and cost-effective critical care solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GE Healthcare

- Becton, Dickinson and Company

- Fresenius Medical Care

- Boston Scientific Corporation

- Cardinal Health

- Braun Melsungen

- Getinge

- Baxter

- Drägerwerk

- Asahi Kasei Corporation

Recent Developments

- In November 2024, Huyabio International announced new patient data for an antiarrhythmic drug, HBI-300. The drug candidate has a unique profile for the treatment of one of the most serious heart conditions, atrial fibrillation.

- In September 2024, Medtronic launched the VitalFlow, an all-in-one extracorporeal membrane oxygenation (ECMO) system, designed to offer a user-friendly experience. The company aimed to create a simple and intuitive device that would assist clinicians by streamlining the ECMO process, making it easier to operate.

- In May 2024, Milestone Pharmaceuticals Inc. announced a partnership with Arrhythmia Alliance to raise awareness about supraventricular tachycardia (SVT). Milestone, a biopharmaceutical company specializing in innovative cardiovascular medicines, aims to enhance education and understanding of this condition through this collaboration.

- In July 2023, Medanta, in collaboration with GE HealthCare, launched the Medanta e-ICU Command Centre, offering round-the-clock remote care for ICU patients.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced patient monitoring systems will increase due to rising ICU admissions.

- AI integration in critical care devices will enhance real-time decision-making.

- Portable and connected devices will gain traction in emergency and remote care.

- Hospitals will adopt more interoperable systems to improve workflow efficiency.

- Regulatory approvals for next-generation devices will accelerate product launches.

- Companies will invest in R&D to develop minimally invasive critical care solutions.

- Tele-ICU and remote monitoring will expand access to specialized care.

- Strategic partnerships will strengthen supply chains and global market reach.

- Sustainability and energy-efficient technologies will shape future product designs.

- Emerging markets will drive significant growth through infrastructure expansion.