Market Overview:

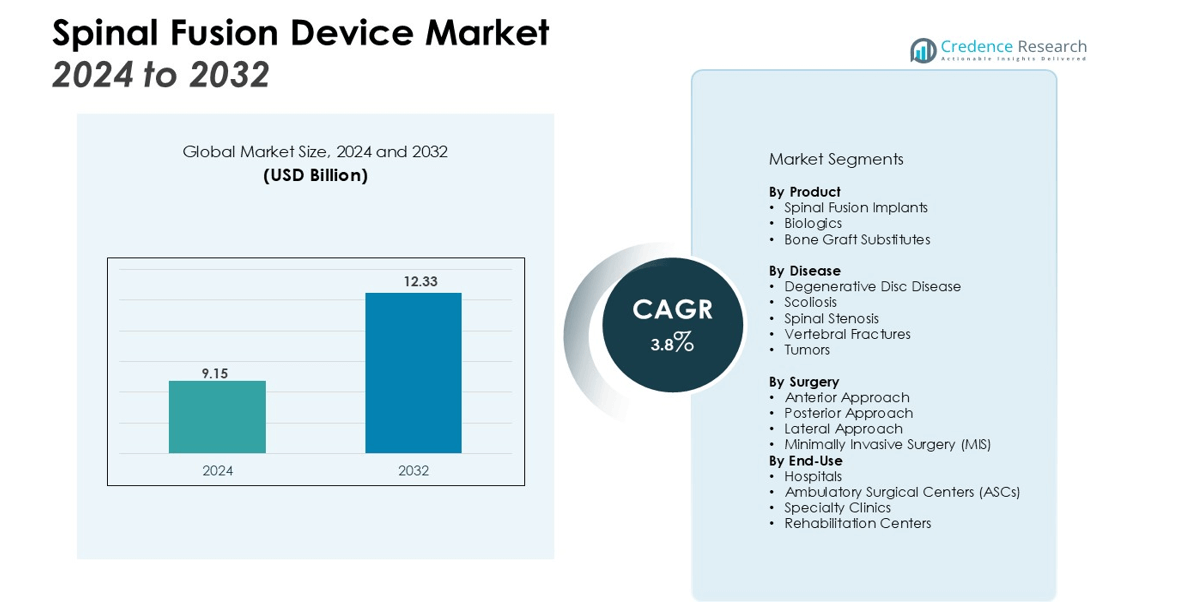

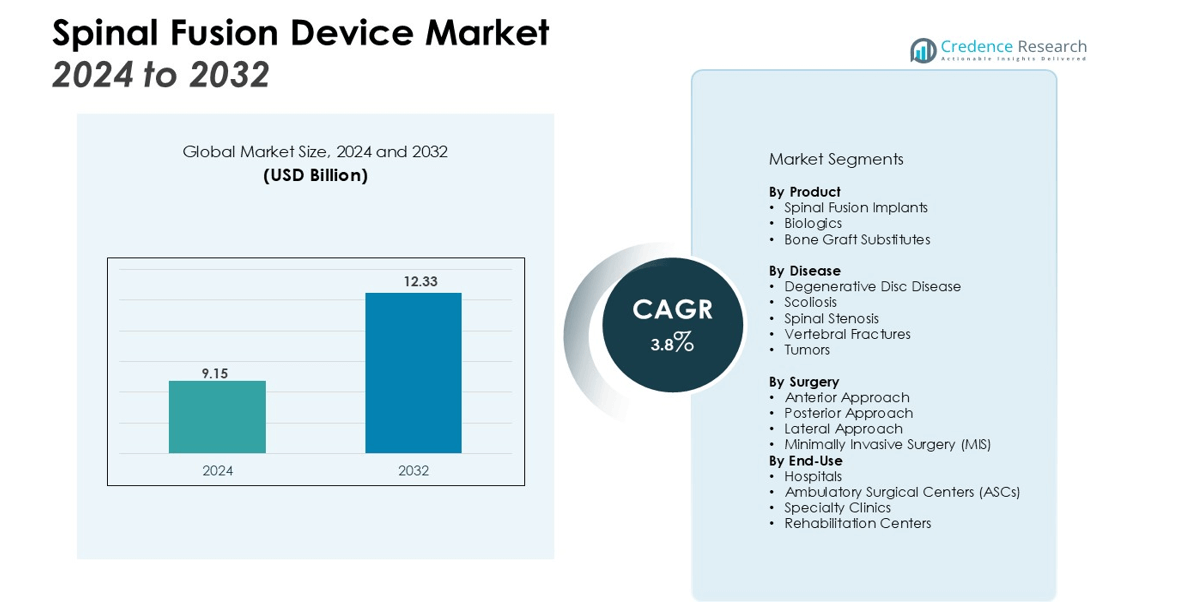

The Spinal Fusion Devices Market size was valued at USD 9.15 billion in 2024 and is anticipated to reach USD 12.33 billion by 2032, at a CAGR of 3.8% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spinal Fusion Devices Market Size 2025 |

USD 9.15 billion |

| Spinal Fusion Devices Market, CAGR |

3.8% |

| Spinal Fusion Devices Market Size 2032 |

USD 12.33 billion |

Key drivers for market expansion include the growing incidence of spinal deformities such as scoliosis, osteoarthritis, and degenerative disc disease, which lead to higher demand for spinal fusion surgeries. Additionally, advancements in spinal fusion devices, such as biologics, bone graft substitutes, and personalized implants, have significantly improved surgical outcomes. Increased healthcare spending and the adoption of new surgical techniques also fuel market growth.

Regionally, North America holds a dominant position in the spinal fusion device market due to advanced healthcare infrastructure, high treatment adoption rates, and the prevalence of spinal conditions. Europe follows closely with a strong demand driven by technological innovations and an aging population. The Asia Pacific region is expected to witness the highest growth, supported by improving healthcare infrastructure, rising awareness, and growing medical tourism in countries like India and China.

Market Insights:

- The Spinal Fusion Device Market was valued at USD 9.15 billion in 2024 and is expected to reach USD 12.33 billion by 2032, growing at a CAGR of 3.8%.

- Increasing spinal disorders like scoliosis and degenerative disc disease are driving higher demand for spinal fusion surgeries.

- Advancements in minimally invasive surgeries (MIS) and robotic-assisted procedures are improving surgical precision and reducing recovery times.

- Biologic implants and personalized implants are gaining popularity, enhancing fusion outcomes and reducing complications.

- Growing healthcare infrastructure in emerging markets, such as India and China, is contributing to rising demand for spinal fusion surgeries.

- High costs of spinal fusion procedures, particularly with advanced biologic implants, are limiting accessibility in certain regions.

- North America holds a 40% market share, Europe 30%, and Asia-Pacific 20%, with the highest growth expected in Asia-Pacific due to improving healthcare infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Prevalence of Spinal Disorders Driving Demand

The increasing prevalence of spinal disorders, including degenerative disc disease, scoliosis, and osteoarthritis, is a significant driver for the Spinal Fusion Device market. These conditions are becoming more common, especially in aging populations, leading to higher demand for surgical interventions. Spinal fusion surgeries, which offer relief from chronic pain and restore spinal stability, are essential for many patients suffering from these conditions. This growing patient pool is directly boosting the need for advanced spinal fusion devices.

- For instance, NuVasive’s less invasive XLIF (eXtreme Lateral Interbody Fusion) procedure has been used to treat hundreds of thousands of patients since its introduction, demonstrating the significant and ongoing demand for effective spinal fusion solutions.

Technological Advancements in Spinal Fusion Techniques

Continuous advancements in spinal fusion techniques, including minimally invasive surgery (MIS) and robotic-assisted procedures, are contributing to market growth. These innovations enhance the precision and effectiveness of spinal surgeries, minimizing patient recovery times and improving outcomes. Spinal fusion devices have evolved to accommodate these advancements, with new designs offering better compatibility with these cutting-edge surgical techniques. Such improvements attract more patients and surgeons to adopt spinal fusion procedures.

Increasing Adoption of Biologic and Personalized Implants

The growing use of biologic implants and bone graft substitutes is another key driver of the Spinal Fusion Device market. These implants promote better fusion outcomes by enhancing bone growth and healing, reducing the risk of complications. Personalized implants, tailored to individual patient needs, are gaining traction in the market. These innovations improve the effectiveness of spinal fusion surgeries, driving greater demand for these devices.

- For instance, Medtronic’s INFUSE™ Bone Graft, a widely adopted biologic implant, has been used in procedures for more than 1 million patients, showcasing the extensive clinical adoption of bone graft substitutes to enhance fusion outcomes.

Expansion of Healthcare Infrastructure and Access

The expansion of healthcare infrastructure, particularly in emerging markets, plays a crucial role in the growth of the Spinal Fusion Device market. Increased access to advanced medical technologies and improved healthcare facilities are making spinal fusion surgeries more widely available. As countries such as India and China invest in healthcare development, demand for spinal fusion devices continues to rise, further driving market growth.

Market Trends:

Increasing Shift Towards Minimally Invasive Spinal Fusion Surgeries

Minimally invasive spinal fusion surgery (MIS) is gaining traction in the healthcare industry due to its numerous benefits over traditional open surgery. These procedures involve smaller incisions, leading to reduced tissue damage, faster recovery times, and less postoperative pain for patients. Spinal fusion devices are evolving to support MIS techniques, with designs that allow for precision and easier implantation in confined spaces. This trend is particularly appealing to patients seeking quicker recovery and shorter hospital stays, driving the demand for spinal fusion devices tailored to MIS approaches. Surgeons also prefer these techniques, as they reduce the risk of complications, making MIS an increasingly popular choice for spinal fusion surgeries.

- For instance, Medtronic enhanced its offerings for MIS procedures with the FDA-cleared Adaptix Interbody System, this system features an implant manufactured from a specialized titanium alloy powder (Ti-6Al-4V ELI) that conforms to the ASTM F3001 standard, and its surface is treated with nano-scale features to improve bone fixation.

Growth of Biologic and Advanced Materials in Spinal Fusion Devices

The integration of biologic materials and advanced biomaterials in spinal fusion devices is a significant trend in the market. Biologic implants, such as bone graft substitutes and growth factors, enhance the fusion process and promote quicker recovery by stimulating natural bone growth. This trend is gaining momentum as patients and healthcare providers seek better long-term outcomes. Spinal fusion devices are incorporating these materials, along with novel biomaterials that offer improved strength and biocompatibility. The increasing focus on improving the success rate of spinal fusion surgeries and reducing complications is pushing manufacturers to invest in research and development of advanced materials. These innovations are expected to continue reshaping the market by enhancing the overall effectiveness and safety of spinal fusion procedures.

- For instance, a peer-reviewed preclinical study showed that Stryker’s 3D-printed Tritanium® cages demonstrated significantly greater total bone volume within the graft window at both 8 and 16 weeks, confirming the material’s ability to enhance bone in-growth for spinal fusion.

Market Challenges Analysis:

High Cost and Affordability Issues in Spinal Fusion Procedures

The high cost of spinal fusion surgeries and devices presents a significant challenge in the market. Advanced spinal fusion devices, especially those using biologic and customized implants, can be expensive, making the procedure less accessible to patients in certain regions. This cost burden is especially pronounced in emerging markets, where healthcare budgets are limited, and patients may not afford the necessary treatments. The need for more affordable alternatives is growing, but current advancements in spinal fusion devices often come with a premium price. This limits the widespread adoption of these technologies, posing a challenge for both healthcare providers and manufacturers.

Postoperative Complications and Long-Term Efficacy Concerns

Despite advances in spinal fusion technology, postoperative complications and long-term efficacy remain concerns in the market. Some patients experience delayed fusion, infections, or hardware-related issues after surgery, which can lead to further interventions. These complications can decrease the overall success rate of spinal fusion procedures and increase healthcare costs due to the need for additional treatments or revisions. These ongoing challenges highlight the need for continued innovation and improvements in spinal fusion devices to enhance their performance and reduce the risk of adverse outcomes for patients.

Market Opportunities:

Rising Demand for Minimally Invasive Procedures

The growing preference for minimally invasive spinal fusion surgeries presents a significant opportunity for the Spinal Fusion Device market. These procedures offer patients reduced recovery times, less pain, and shorter hospital stays, making them an attractive option for both patients and healthcare providers. As more surgeons adopt minimally invasive techniques, the demand for specialized spinal fusion devices designed for these surgeries increases. Companies that focus on developing devices that cater to this need can gain a competitive edge in the market by offering solutions that support faster recovery and improved surgical outcomes. This shift toward minimally invasive procedures provides an opportunity for growth in both developed and emerging markets.

Expansion in Emerging Markets Driven by Healthcare Infrastructure Improvements

The improvement of healthcare infrastructure in emerging markets presents another key opportunity for the Spinal Fusion Device market. As countries like India, China, and Brazil expand their healthcare systems and increase access to advanced surgical treatments, the demand for spinal fusion surgeries is expected to rise. This growth is further supported by increasing awareness about spinal health and the availability of advanced spinal fusion devices. Manufacturers can capitalize on these opportunities by offering cost-effective solutions tailored to the needs of these regions, fostering greater adoption and penetration of spinal fusion technologies in these growing markets.

Market Segmentation Analysis:

By Product

The Spinal Fusion Device market is segmented by product type, which includes spinal fusion implants, biologics, and bone graft substitutes. Spinal fusion implants dominate the market due to their widespread use in surgical procedures. These devices include screws, rods, and plates, designed to stabilize the spine during fusion. Biologics, which promote faster healing, and bone graft substitutes are growing segments, especially with advancements in regenerative medicine.

- For instance, Medtronic’s ARTiC-L implant, the first to be manufactured with its TiONIC 3D printing technology, is designed to help restore sagittal alignment by offering various lordotic angles up to 20 degrees.

By Disease

The market is also segmented by disease, with degenerative disc disease, scoliosis, and spinal stenosis leading the demand for spinal fusion surgeries. Degenerative disc disease is the primary cause, as it affects a large portion of the aging population. Scoliosis, particularly in adolescent patients, is another major contributor to spinal fusion surgeries. Spinal stenosis, which causes narrowing of the spinal canal, also drives the need for corrective surgeries, increasing the demand for spinal fusion devices.

- For instance, Globus Medical’s AERIAL is an expandable interspinous fixation system designed for treating spinal stenosis that features an expandable core allowing for up to 6mm of continuous distraction to help restore neuroforaminal area.

By Surgery

The market is further segmented by surgery type, including anterior, posterior, and lateral approaches. The posterior approach is the most commonly used in spinal fusion surgeries, where the surgeon accesses the spine from the back. Anterior and lateral approaches are gaining traction due to their benefits in specific cases, such as deformity correction and less tissue disruption. These surgical techniques require devices tailored to the specific approach, influencing the growth of spinal fusion device demand across different surgery types.

Segmentations:

By Product

- Spinal Fusion Implants

- Biologics

- Bone Graft Substitutes

By Disease

- Degenerative Disc Disease

- Scoliosis

- Spinal Stenosis

- Vertebral Fractures

- Tumors

By Surgery

- Anterior Approach

- Posterior Approach

- Lateral Approach

- Minimally Invasive Surgery (MIS)

By End-Use

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Rehabilitation Centers

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Market Dominance in Spinal Fusion Devices

North America holds a 40% share of the global Spinal Fusion Device market, with the United States representing the largest contributor. The region benefits from advanced healthcare infrastructure, a high incidence of spinal disorders, and strong demand for surgical interventions. The presence of leading manufacturers and constant innovations in spinal fusion technologies further supports growth. Favorable reimbursement policies and a robust healthcare system continue to drive the adoption of advanced spinal fusion devices in North America.

Europe: Strong Market Presence and Technological Advancements

Europe captures 30% of the global Spinal Fusion Device market share, with Germany, the United Kingdom, and France showing notable growth. The region’s aging population and rising spinal disorders are contributing to increased demand for spinal fusion surgeries. Technological advancements, including minimally invasive techniques and biologic solutions, are transforming the market. Government healthcare investments and a growing focus on improving surgical outcomes are expected to further boost market share in Europe.

Asia-Pacific: Rapid Growth and Emerging Market Potential

The Asia-Pacific region holds a 20% share in the global Spinal Fusion Device market, with strong growth projected in countries like China, India, and Japan. Improving healthcare infrastructure, increased adoption of medical technologies, and rising disposable incomes are driving demand for spinal fusion surgeries. The prevalence of spinal conditions and a growing focus on healthcare accessibility present significant opportunities for market expansion. As the region continues to modernize its healthcare system, demand for advanced spinal fusion devices is expected to rise.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- NuVasive, Inc.

- Zimmer Biomet.

- Medical Device Business Services, Inc.

- Stryker

- Spine Wave, Inc.

- XTANT MEDICAL

- Globus Medical

- ATEC Spine, Inc.

- Medtronic

- Orthofix Medical Inc.

- Captiva Spine, Inc.

- Institute for Spine & Scoliosis

- Braun SE

Competitive Analysis:

The Spinal Fusion Device market is highly competitive, with key players focusing on product innovation, strategic partnerships, and expanding their market reach. Major companies include Medtronic, Stryker Corporation, DePuy Synthes, and Zimmer Biomet. These companies lead in market share due to their extensive product portfolios and strong distribution networks. Medtronic, for example, offers a wide range of spinal fusion implants and biologic solutions, strengthening its position in the market. New entrants and smaller players are capitalizing on niche products, such as minimally invasive spinal fusion devices and biologic substitutes, which have gained popularity due to their faster recovery times. Competitive strategies also include mergers and acquisitions, allowing companies to expand their product offerings and access new markets. The growing demand for advanced spinal fusion technologies and increasing healthcare investments in emerging markets present opportunities for these players to strengthen their foothold globally.

Recent Developments:

- In July 2025, Johnson & Johnson MedTech announced its plan to introduce the next generation of its Stroke Solutions portfolio, the CEREGLIDE™ 42 and CEREGLIDE™ 57 catheters, at the SNIS 2025 Annual Meeting.

- In September 2025, Stryker launched its Incompass™ Total Ankle System.

- In July 2025, Zimmer Biomet and Getinge announced a strategic partnership for the distribution of Getinge’s Operating Room (OR) capital products to Ambulatory Surgery Centers (ASCs).

Report Coverage:

The research report offers an in-depth analysis based on Product, Disease, Surgery, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current maket trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for spinal fusion devices will continue to grow, driven by the rising prevalence of spinal disorders.

- Technological advancements in spinal fusion procedures, such as robotic surgery and minimally invasive techniques, will further enhance market growth.

- Biologic implants and personalized spinal fusion devices will see increased adoption, improving patient outcomes and recovery times.

- Emerging markets, particularly in Asia-Pacific, will witness rapid growth as healthcare infrastructure continues to improve.

- The aging population in developed regions will contribute to the rising need for spinal fusion surgeries.

- Increased awareness and early diagnosis of spinal conditions will drive more patients to opt for spinal fusion surgeries.

- New regulatory approvals for advanced spinal fusion devices will create opportunities for market players to introduce innovative products.

- The shift towards outpatient and minimally invasive spinal fusion procedures will reduce healthcare costs and drive demand for specialized devices.

- Strong competition among leading manufacturers will push for continuous product innovation and improvements in device design.

- Strategic mergers and acquisitions by key players will enhance market penetration and expand product portfolios to meet evolving consumer needs.