Market Overview

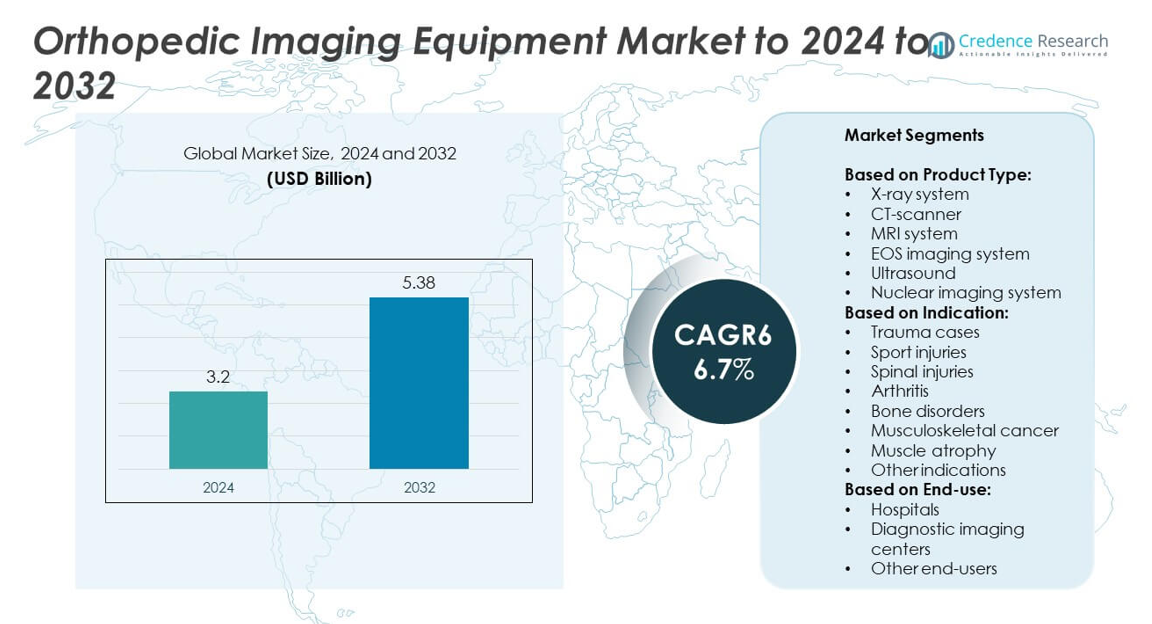

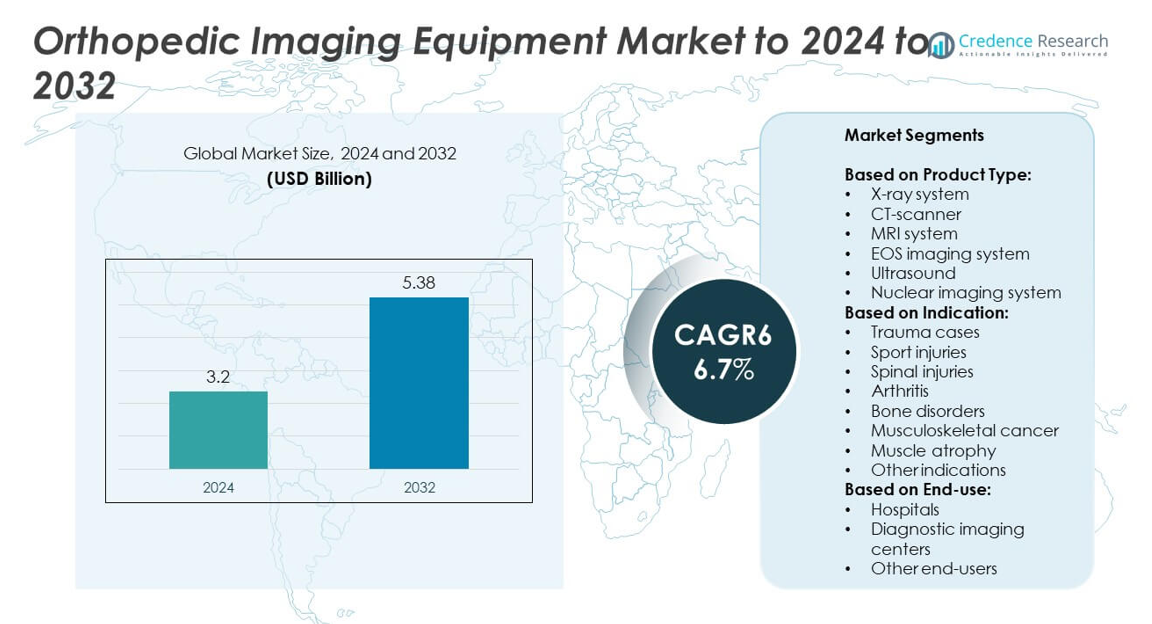

Orthopedic Imaging Equipment Market size was valued USD 3.2 Billion in 2024 and is anticipated to reach USD 5.38 Billion by 2032, at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Orthopedic Imaging Equipment Market Size 2024 |

USD 3.2 Billion |

| Orthopedic Imaging Equipment Market, CAGR |

6.7% |

| Orthopedic Imaging Equipment Market Size 2032 |

USD 5.38 Billion |

The orthopedic imaging equipment market is shaped by leading players such as Siemens Healthineers AG, GE HealthCare Technologies Inc., Canon Inc., FUJIFILM Holdings Corporation, Koninklijke Philips NV, Hologic, Inc., Carestream Health, Shimadzu Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., EOS imaging, and Esaote SPA. These companies focus on advancing technologies like AI-based diagnostics, low-dose radiation imaging, and portable systems to strengthen their market positions. Regionally, North America led the market with over 35% share in 2024, supported by robust healthcare infrastructure, high patient inflow, and favorable reimbursement policies, while Europe and Asia Pacific followed as significant contributors.

Market Insights

- The orthopedic imaging equipment market was valued at USD 3.2 Billion in 2024 and is projected to reach USD 5.38 Billion by 2032, growing at a CAGR of 6.7%.

- Growth is driven by rising cases of musculoskeletal disorders, sports injuries, and trauma, along with the adoption of advanced imaging technologies in hospitals and diagnostic centers.

- Key trends include increasing integration of AI for faster diagnostics, rising demand for portable imaging systems, and growing preference for low-dose radiation solutions to enhance patient safety.

- The competitive landscape is marked by strong global players focusing on innovation, partnerships, and expansion into emerging markets, with strategies centered on advanced MRI, CT, and digital X-ray solutions.

- North America led the market with over 35% share in 2024, followed by Europe at 28% and Asia Pacific at 22%, while Latin America and the Middle East & Africa accounted for 8% and 7% respectively.

cr_cta type=”download_free_sample”]

Market Segmentation Analysis:

By Product Type

X-ray systems dominated the orthopedic imaging equipment market in 2024 with more than 35% share. Their leadership stems from affordability, wide availability, and ability to deliver fast diagnostic results for trauma and fracture assessment. Continuous technological upgrades, such as digital radiography and 3D imaging integration, are boosting adoption across hospitals and clinics. MRI systems follow closely, driven by high accuracy in detecting soft tissue injuries and spinal disorders. EOS imaging is expanding gradually, supported by low-dose radiation benefits in pediatric and scoliosis cases.

- For instance, In its fiscal year 2024 Sustainability Report, Siemens Healthineers announced that it had achieved 2.6 billion patient touchpoints worldwide during that fiscal year. In the same report, the company also set a target of reaching 3.3 billion patient touchpoints by 2030.

By Indication

Trauma cases accounted for the largest share of over 30% in 2024. Rising road accidents and workplace injuries significantly drive demand for rapid diagnostic imaging, particularly X-ray and CT scanners, which deliver instant results. Sports injuries are another fast-growing sub-segment, fueled by increasing athletic activities and advanced imaging adoption for ligament and joint evaluations. Arthritis imaging is expanding with the aging population, while musculoskeletal cancer diagnosis relies on MRI and nuclear imaging advancements. The demand across indications reflects the broad scope of orthopedic imaging applications.

- For instance, Philips Healthcare manufactures the Ingenia Elition X MRI system, which is a high-performance 3.0T MRI.

By End-use

Hospitals held the leading position with a market share exceeding 45% in 2024. Their dominance is driven by high patient inflow, advanced infrastructure, and availability of multiple imaging modalities under one roof. Large hospitals increasingly invest in MRI and CT scanners to support trauma, arthritis, and cancer diagnostics. Diagnostic imaging centers are expanding steadily due to rising outpatient demand and preference for cost-effective, specialized imaging services. Other end-users, such as specialty orthopedic clinics and research institutions, contribute smaller but consistent growth supported by targeted imaging needs.

Key Growth Drivers

Rising Prevalence of Musculoskeletal Disorders

The growing burden of musculoskeletal conditions, including arthritis, osteoporosis, and spinal disorders, is a primary driver for orthopedic imaging equipment. An aging global population, coupled with lifestyle-related issues such as obesity and reduced physical activity, increases demand for accurate diagnostic imaging. Hospitals and diagnostic centers rely heavily on X-ray and MRI systems to provide early detection and effective treatment planning. This consistent rise in patient volume continues to strengthen the adoption of advanced imaging solutions, establishing it as a key growth driver for the market.

- For instance, Mayo Clinic operates advanced MRI systems, including 3T and 7T scanners, across its U.S. facilities. The clinic is a leader in the clinical use of 7T MRI technology for neurological conditions, and has a research partnership with Siemens Healthineers, including the installation of advanced systems like a 7T scanner at its Arizona campus in 2024.

Technological Advancements in Imaging Systems

The orthopedic imaging equipment market benefits significantly from continuous advancements in technology. Innovations such as low-dose EOS imaging, high-resolution MRI, and AI-enabled diagnostic tools are improving efficiency and diagnostic precision. These developments reduce patient exposure to radiation, enhance workflow efficiency, and support early-stage disease identification. The integration of artificial intelligence in image analysis is especially transformative, aiding physicians in detecting subtle abnormalities. Such advancements are driving increased adoption across hospitals and imaging centers, making this a major key growth driver shaping future market demand.

- For instance, Philips’ SmartSpeed Precise AI MRI software received FDA 510(k) clearance in July 2025.

Expanding Sports and Trauma Cases

The rising number of sports-related injuries and trauma cases from accidents strongly contributes to demand for orthopedic imaging. X-ray and CT systems remain the first choice for emergency diagnostics due to their speed and reliability. Growing investments in sports infrastructure, combined with increasing participation in professional and recreational sports, are also fueling demand for high-performance imaging systems. In trauma care, fast and accurate imaging is vital for timely interventions, further strengthening the role of advanced modalities. This makes expanding sports and trauma cases a vital growth driver in the market.

Key Trends & Opportunities

Integration of Artificial Intelligence and Machine Learning

Artificial intelligence and machine learning integration are transforming orthopedic imaging by improving accuracy, reducing reporting time, and enhancing workflow efficiency. AI algorithms enable precise image reconstruction and automate fracture detection, reducing diagnostic errors. This trend is gaining momentum across hospitals and diagnostic imaging centers as healthcare providers seek faster, more reliable solutions. Opportunities are strong for companies investing in AI-driven platforms, as they help improve patient outcomes and reduce overall healthcare costs. This growing adoption positions AI integration as a key trend and opportunity in the market.

- For instance, In molecular imaging, Siemens integrates AI tools on its Biograph PET/CT scanners, enabling lung segmentation in ~45 seconds.

Rising Demand for Outpatient and Ambulatory Imaging

The shift toward outpatient care and ambulatory surgical centers is creating opportunities for compact, cost-effective imaging equipment. Patients increasingly prefer diagnostic imaging outside hospital settings due to convenience and lower costs. Portable X-ray and ultrasound devices are particularly in demand, supporting point-of-care diagnostics. This transition is fostering growth for manufacturers focusing on flexible, mobile imaging solutions. The expansion of outpatient imaging services, particularly in developed and emerging economies, highlights a key trend and opportunity driving market expansion beyond traditional hospital environments.

- For instance, Canon Medical’s INSTINX workflow automation uses Anatomical Landmark Detection (ALD) on 240 landmark scans (40 head + 200 body) and achieves 97% accuracy within ±1 cm of target positions.

Key Challenges

High Equipment and Maintenance Costs

One of the major challenges in the orthopedic imaging equipment market is the high cost of advanced systems. MRI and CT scanners require significant upfront investment, along with ongoing maintenance and upgrades, limiting adoption among smaller healthcare providers. Budget constraints in developing regions further restrict access to cutting-edge imaging solutions. Additionally, the cost burden often falls on patients in markets with limited reimbursement policies. These financial barriers hinder wider penetration of advanced systems, making high equipment and maintenance costs a critical challenge in market growth.

Shortage of Skilled Radiology Professionals

The effective use of advanced orthopedic imaging equipment requires trained radiologists and technicians. However, many regions face a shortage of skilled professionals capable of operating sophisticated imaging modalities and interpreting complex results. This shortage leads to delayed diagnosis, underutilization of high-end equipment, and increased workload on existing staff. Training and retaining radiology professionals remain difficult, especially in emerging markets. The lack of skilled human resources poses a key challenge for expanding the adoption and effective utilization of orthopedic imaging technologies across healthcare settings.

Regional Analysis

North America

North America accounted for over 35% share of the orthopedic imaging equipment market in 2024. The region’s dominance is supported by strong healthcare infrastructure, high adoption of advanced imaging technologies, and a large patient base with musculoskeletal disorders. The U.S. leads the regional market due to significant investments in diagnostic imaging centers and hospitals. Rising sports-related injuries and trauma cases further strengthen demand for X-ray and MRI systems. Favorable reimbursement policies and continuous innovation by key players also drive market growth, ensuring North America maintains a leading position throughout the forecast period.

Europe

Europe held around 28% share of the orthopedic imaging equipment market in 2024. The region benefits from advanced healthcare systems, strong focus on research, and increasing prevalence of arthritis and osteoporosis. Germany, the U.K., and France are major contributors, with hospitals investing heavily in MRI and CT scanners. Growing emphasis on radiation-free imaging such as EOS technology is also gaining traction across European healthcare facilities. Supportive government initiatives and rising demand for early diagnostic tools continue to drive adoption. The increasing geriatric population across the region further boosts imaging demand, consolidating Europe’s strong market position.

Asia Pacific

Asia Pacific captured nearly 22% of the orthopedic imaging equipment market in 2024. The region’s growth is fueled by rising healthcare expenditure, expanding medical infrastructure, and increasing trauma and sports injuries. China, Japan, and India remain key contributors due to high patient volumes and growing adoption of advanced imaging solutions. Multinational manufacturers are also expanding operations in the region to meet rising demand for affordable systems. The growing burden of arthritis and bone disorders among aging populations further supports adoption. Asia Pacific is expected to record the fastest growth, narrowing the gap with developed regions during the forecast period.

Latin America

Latin America represented approximately 8% share of the orthopedic imaging equipment market in 2024. Brazil and Mexico drive the regional demand due to improving hospital infrastructure and growing patient awareness. Rising incidence of musculoskeletal injuries and increasing access to diagnostic imaging centers are boosting adoption of X-ray and CT systems. However, limited reimbursement frameworks and high costs of advanced modalities pose challenges. Investments by global companies in localized distribution networks are improving equipment availability. With growing demand for affordable imaging and rising government focus on healthcare modernization, the region is gradually expanding its market presence.

Middle East and Africa

The Middle East and Africa accounted for about 7% share of the orthopedic imaging equipment market in 2024. Growth in this region is supported by expanding healthcare facilities, particularly in the Gulf Cooperation Council countries, where investments in advanced diagnostic imaging are rising. South Africa also shows steady demand due to increasing cases of bone disorders and trauma-related injuries. However, limited access to high-end imaging systems in several African nations restricts overall growth. Global companies are focusing on partnerships and low-cost solutions to improve access, ensuring gradual adoption of orthopedic imaging technologies across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product Type:

- X-ray system

- CT-scanner

- MRI system

- EOS imaging system

- Ultrasound

- Nuclear imaging system

By Indication:

- Trauma cases

- Sport injuries

- Spinal injuries

- Arthritis

- Bone disorders

- Musculoskeletal cancer

- Muscle atrophy

- Other indications

By End-use:

- Hospitals

- Diagnostic imaging centers

- Other end-users

By Geography:

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

Siemens Healthineers AG, Carestream Health, Shimadzu Corporation, FUJIFILM Holdings Corporation, Hologic, Inc., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Canon Inc., Koninklijke Philips NV, EOS imaging, Esaote SPA, and GE HealthCare Technologies Inc. are the leading players shaping the orthopedic imaging equipment market. The competitive landscape is defined by continuous innovation, strategic partnerships, and expansion into emerging markets. Companies are focusing on advanced imaging technologies such as low-dose radiation systems, high-resolution MRI, and AI-integrated diagnostic platforms to enhance accuracy and efficiency. Growing demand for portable and digital solutions is encouraging manufacturers to invest in product diversification and cost-effective systems. In addition, expanding global distribution networks and increasing collaborations with hospitals and diagnostic centers are strengthening market presence. With rising musculoskeletal cases and growing emphasis on early diagnosis, competition remains intense, pushing players to differentiate through technological advancements, customer-focused service models, and expanded healthcare accessibility.

Key Player Analysis

Recent Developments

- In 2023, GE HealthCare reached an agreement to acquire Caption Health, an AI healthcare provider developing applications to aid ultrasound scans.

- In 2023, Siemens Healthineers introduced a new production facility in India for manufacturing MRI machines, strengthening its global reach for advanced imaging technologies.

- In 2023, Carestream launched its DRX-Rise Mobile X-ray System, a cost-effective solution designed to help healthcare facilities transition to digital imaging for orthopedic applications.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Indication, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising prevalence of musculoskeletal disorders worldwide.

- Adoption of AI-driven imaging solutions will improve diagnostic accuracy and workflow efficiency.

- Hospitals will remain the primary end-use segment due to strong infrastructure and patient inflow.

- Diagnostic imaging centers will expand as outpatient demand for cost-effective services increases.

- X-ray systems will maintain dominance, while MRI and CT scanners gain momentum in advanced diagnostics.

- Portable and point-of-care imaging equipment will see rising demand in outpatient and emergency care.

- Aging populations will drive consistent demand for arthritis and osteoporosis imaging solutions.

- Asia Pacific will record the fastest growth with expanding healthcare investments and infrastructure.

- High equipment and maintenance costs will continue to challenge adoption in emerging markets.

- Integration of low-dose imaging technologies will enhance patient safety and regulatory compliance.