Market Overview

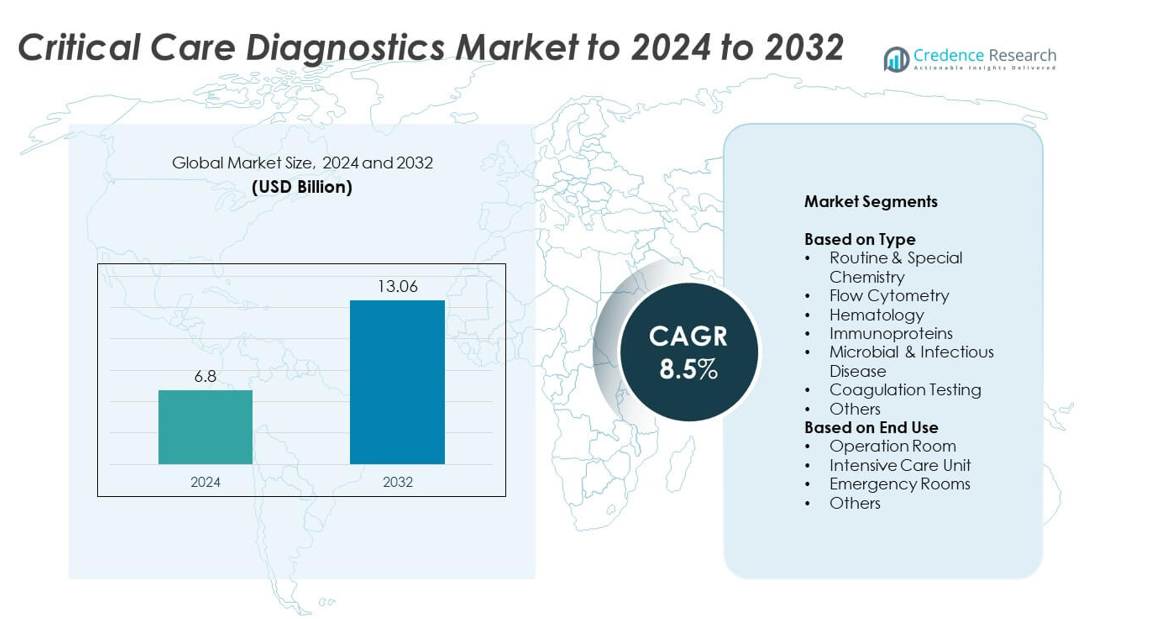

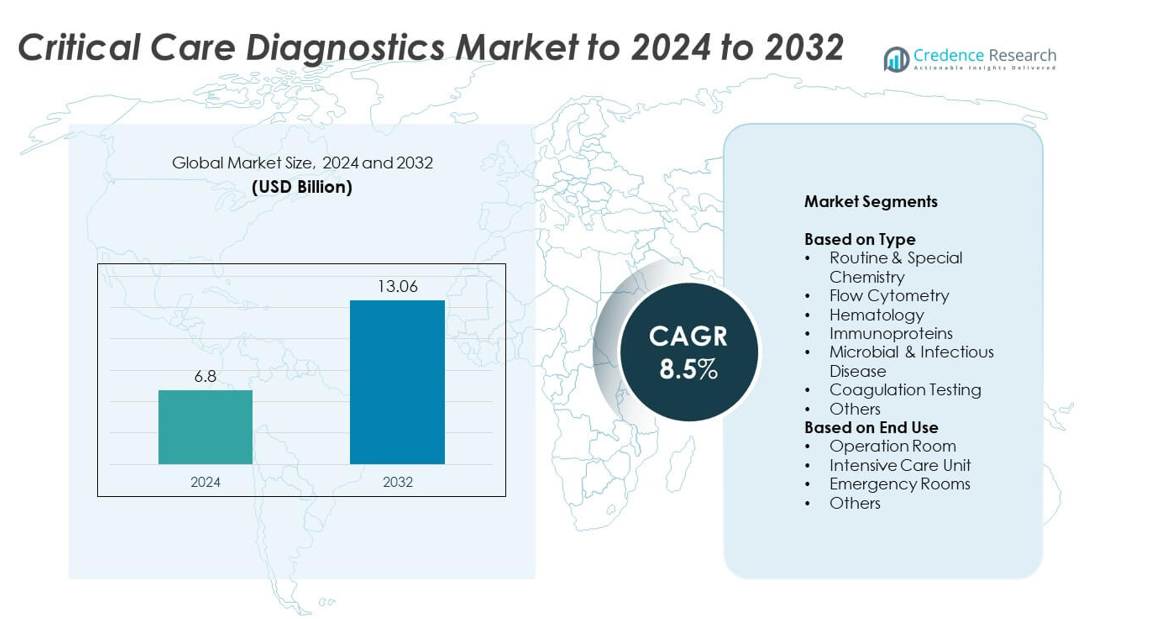

Critical Care Diagnostics Market size was valued at USD 6.8 Billion in 2024 and is anticipated to reach USD 13.06 Billion by 2032, at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Critical Care Diagnostics Market Size 2024 |

USD 6.8 Billion |

| Critical Care Diagnostics Market, CAGR |

8.5% |

| Critical Care Diagnostics Market Size 2032 |

USD 13.06 Billion |

The critical care diagnostics market is led by prominent players such as Siemens Healthcare Private Limited, BD, Bayer AG, EKF Diagnostics, Abbott, F. Hoffmann-La Roche Ltd, Danaher, bioMérieux, Chembio Diagnostics, and Roche. These companies focus on advancing diagnostic technologies, expanding point-of-care testing, and integrating AI-driven systems to enhance patient outcomes. The competitive landscape is shaped by continuous innovation, regulatory compliance, and strategic collaborations with healthcare providers. Regionally, North America dominates the global market with a 38% share in 2024, supported by advanced healthcare infrastructure, strong R&D capabilities, and high adoption of real-time diagnostic systems across intensive and emergency care units.

Market Insights

- The critical care diagnostics market was valued at USD 6.8 Billion in 2024 and is projected to reach USD 13.06 Billion by 2032, growing at a CAGR of 8.5%.

- Growth is driven by rising cases of sepsis, cardiac, and respiratory disorders, alongside expanding ICU facilities and adoption of point-of-care testing.

- Key trends include integration of AI-based diagnostic tools, automation, and the shift toward molecular and personalized testing to enhance speed and accuracy.

- The market is highly competitive, with global players focusing on innovation, partnerships, and portfolio expansion to strengthen their presence.

- North America leads with a 38% market share, followed by Europe at 27% and Asia Pacific at 22%, while the routine and special chemistry segment dominates by type, accounting for the largest share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The routine and special chemistry segment held the dominant share in the critical care diagnostics market in 2024. This segment accounted for nearly 28% of the total market due to its vital role in assessing patient metabolic profiles and organ functions. The demand for rapid biochemical testing has increased across ICUs and emergency departments for real-time decision-making. Growth is driven by advancements in automated analyzers, integration of point-of-care systems, and increased adoption of multiparameter testing panels that enhance diagnostic speed and accuracy in critical settings.

- For instance, Beckman Coulter’s AU5800 processes up to 2,000 tests/hour per module.

By End Use

Intensive care units represented the largest share of the critical care diagnostics market in 2024, contributing about 40% of total revenue. These units rely heavily on real-time diagnostic data to guide treatment in life-threatening conditions such as sepsis, cardiac arrest, and respiratory failure. The segment’s growth is fueled by the rising number of critically ill patients, expansion of advanced ICU facilities, and integration of bedside testing technologies that reduce turnaround times and improve clinical outcomes for patients under intensive monitoring.

- For instance, Radiometer’s ABL90 FLEX PLUS reports results in 35 seconds on up to 19 parameters, including blood gases, metabolites like creatinine and urea, electrolytes, and oximetry measurements.

Key Growth Drivers

Rising Prevalence of Chronic and Critical Illnesses

The growing incidence of sepsis, cardiovascular diseases, and respiratory disorders is fueling demand for advanced critical care diagnostics. Hospitals and ICUs are increasingly investing in real-time testing systems to support rapid intervention and improved patient outcomes. Early detection tools, such as high-sensitivity troponin assays and multiplex molecular diagnostics, are becoming essential in managing complex cases. The expanding elderly population further intensifies the need for accurate and quick diagnostic evaluations in intensive and emergency care settings.

- For instance, Siemens’ Atellica VTLi delivers hs-cTnI results in 8 minutes.

Technological Advancements in Diagnostic Systems

Continuous innovation in point-of-care devices, biosensors, and molecular testing platforms is transforming the critical care diagnostics market. Automated systems now deliver faster results with improved accuracy, enabling immediate treatment decisions in life-threatening conditions. Integration of AI-based analytics supports predictive diagnostics and helps clinicians interpret complex data efficiently. These technological improvements enhance workflow efficiency, reduce diagnostic errors, and strengthen overall patient management in high-pressure critical environments.

- For instance, Cepheid’s GeneXpert system returns PCR results in a variable amount of time depending on the assay; the Xpert Xpress SARS-CoV-2 assay, can produce positive results in as little as 25 minutes or negative results in around 45 minutes, while other tests like the Xpert MTB/RIF assay for tuberculosis take approximately 90 minutes to under two hours.

Rising Adoption of Point-of-Care Testing (POCT)

The increasing implementation of POCT in intensive care and emergency departments is a key growth driver. Portable diagnostic instruments reduce turnaround times and improve clinical response for patients requiring immediate care. Healthcare facilities are adopting POCT for tests like arterial blood gases, cardiac biomarkers, and coagulation due to its convenience and reliability. The trend aligns with the growing emphasis on decentralized diagnostics that minimize laboratory dependency while maintaining high accuracy levels.

Key Trends & Opportunities

Integration of Artificial Intelligence and Data Analytics

Artificial intelligence is reshaping critical care diagnostics through predictive modeling and automated analysis. AI-enabled systems assist clinicians in detecting abnormalities and predicting patient deterioration before visible symptoms appear. Integration with cloud-based diagnostic platforms allows seamless data sharing across departments, supporting precision medicine and reducing errors. This trend presents opportunities for healthcare providers to enhance efficiency and clinical decision-making in critical settings.

- For instance, Philips’ eICU hub can manage 50–500 remote ICU beds.

Growing Demand for Personalized and Molecular Diagnostics

Advances in genomics and molecular assays are creating opportunities for precision-based critical care testing. Personalized diagnostics enable targeted treatment approaches for patients with severe infections or immune responses. The shift toward molecular-based testing supports early pathogen identification, optimizing antibiotic use and reducing resistance risks. These developments are fostering a new era of tailored diagnostics for critically ill patients across hospitals and specialized care units.

- For instance, bioMérieux’s BioFire BCID2 detects 43 targets in ~1 hour from positive cultures.

Expansion of Critical Care Infrastructure

The expansion of hospitals and ICU facilities, particularly in emerging economies, is opening new growth opportunities. Governments and private investors are focusing on strengthening healthcare infrastructure to manage rising critical illness cases. Increased healthcare spending and strategic collaborations between medical device firms and hospitals are accelerating diagnostic system adoption. This expansion supports wider availability of advanced testing systems across both developed and developing regions.

Key Challenges

High Cost of Advanced Diagnostic Equipment

The high cost of sophisticated diagnostic analyzers and consumables poses a major challenge for healthcare providers. Smaller hospitals and facilities in developing regions struggle with budget limitations, restricting access to advanced testing systems. Additionally, the maintenance and calibration costs of these instruments increase operational expenses. These financial barriers slow the adoption of next-generation diagnostic technologies in low-resource settings, impacting market penetration.

Lack of Skilled Professionals and Integration Barriers

A shortage of trained laboratory and critical care staff limits the effective use of advanced diagnostic systems. Complex equipment requires specialized handling and accurate interpretation to ensure reliable outcomes. Integration challenges between diagnostic devices and hospital information systems also create workflow inefficiencies. Addressing these gaps through targeted training programs and interoperability standards is essential to enhance diagnostic reliability and clinical efficiency in critical environments.

Regional Analysis

North America

North America held the largest share of around 38% in the critical care diagnostics market in 2024. The region benefits from advanced healthcare infrastructure, high adoption of point-of-care testing, and strong presence of major diagnostic companies. Growing prevalence of chronic illnesses such as sepsis, cardiac disorders, and respiratory failures continues to drive market growth. The United States dominates the regional landscape due to significant investments in ICU modernization and AI-driven diagnostic systems, while Canada focuses on improving access to rapid testing solutions in emergency and intensive care facilities.

Europe

Europe accounted for nearly 27% of the global critical care diagnostics market in 2024, supported by a well-established hospital network and favorable regulatory environment. Countries such as Germany, France, and the United Kingdom lead in adopting advanced diagnostic technologies for intensive and emergency care. The region’s emphasis on patient safety, coupled with increased funding for early disease detection programs, strengthens market expansion. Moreover, the integration of molecular diagnostics and automation in hospital laboratories continues to enhance testing efficiency and clinical decision-making in European healthcare systems.

Asia Pacific

Asia Pacific captured about 22% of the critical care diagnostics market in 2024, driven by rapid healthcare infrastructure development and rising investments in hospital expansion. Countries like China, India, and Japan are experiencing growing demand for point-of-care and molecular testing solutions. The increasing burden of infectious diseases and chronic health conditions has accelerated diagnostic equipment adoption. Government initiatives promoting healthcare digitization and intensive care upgrades are fostering market growth, while partnerships between global diagnostic firms and local providers enhance regional access to advanced testing technologies.

Latin America

Latin America represented nearly 8% of the global critical care diagnostics market in 2024, with Brazil and Mexico serving as key growth centers. Expanding healthcare budgets and improved hospital infrastructure are encouraging the deployment of automated diagnostic systems. The region is witnessing gradual adoption of point-of-care technologies to address emergency care needs. Public health programs targeting infection control and early disease diagnosis are also supporting market progress. However, economic disparities and limited access to advanced testing in rural areas continue to restrain overall market potential across Latin America.

Middle East and Africa

The Middle East and Africa region accounted for about 5% of the critical care diagnostics market in 2024. Growth is primarily driven by rising investments in hospital infrastructure and intensive care facilities in Gulf Cooperation Council countries. Increased awareness of early diagnostic interventions for critical conditions such as sepsis and cardiac disorders is boosting demand. South Africa and Saudi Arabia are emerging as key markets with expanding healthcare modernization programs. Despite these advances, limited diagnostic capabilities in lower-income nations remain a challenge for wider adoption across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

- Routine & Special Chemistry

- Flow Cytometry

- Hematology

- Immunoproteins

- Microbial & Infectious Disease

- Coagulation Testing

- Others

By End Use

- Operation Room

- Intensive Care Unit

- Emergency Rooms

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The critical care diagnostics market is highly competitive, with major players such as Siemens Healthcare Private Limited, BD, Bayer AG, EKF Diagnostics, Abbott, F. Hoffmann-La Roche Ltd, Danaher, bioMérieux, Chembio Diagnostics, and Roche leading innovation and expansion. The market is characterized by continuous advancements in diagnostic technologies, automation, and integration of point-of-care testing systems to enhance speed and accuracy. Companies are focusing on strategic collaborations with hospitals and research institutions to strengthen their clinical presence. Product differentiation through AI-enabled platforms and molecular testing solutions is becoming a key competitive factor. Manufacturers are also expanding their global distribution networks to cater to rising demand in developing regions. Continuous R&D investments, coupled with efforts to gain regulatory approvals for new diagnostic assays, are driving portfolio diversification. The competitive environment is shifting toward smart, connected, and patient-centric diagnostic solutions that improve critical care outcomes and operational efficiency in healthcare facilities.

Key Player Analysis

Recent Developments

- In 2025, Siemens Healthineers unveiled several innovations for critical care at the Asian Oceanian Congress of Radiology (AOCR), including the MAGNETOM Flow MRI.

- In 2025, Roche unveiled its “sequencing by expansion” (SBX) technology, offering enhanced speed, throughput, and flexibility for next-generation sequencing.

- In 2023, Abbott launched its “Vertigo Coach” app in India, a digital health solution to help patients manage their condition

Report Coverage

The research report offers an in-depth analysis based on Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for rapid and accurate diagnostic testing will continue to rise in intensive care settings.

- Integration of artificial intelligence will enhance early disease detection and clinical decision-making.

- Point-of-care testing adoption will expand across hospitals and emergency departments for faster results.

- Molecular diagnostics and genomic testing will gain importance in infection and sepsis management.

- Hospitals will increasingly invest in connected diagnostic platforms for real-time data sharing.

- Emerging economies will witness strong growth due to healthcare infrastructure expansion.

- Automation and miniaturization of diagnostic devices will improve testing accuracy and efficiency.

- Partnerships between healthcare providers and diagnostic firms will accelerate technology integration.

- Rising focus on personalized medicine will drive demand for patient-specific diagnostic tools.

- Continued government support and funding for critical care research will strengthen market development.