Market Overview:

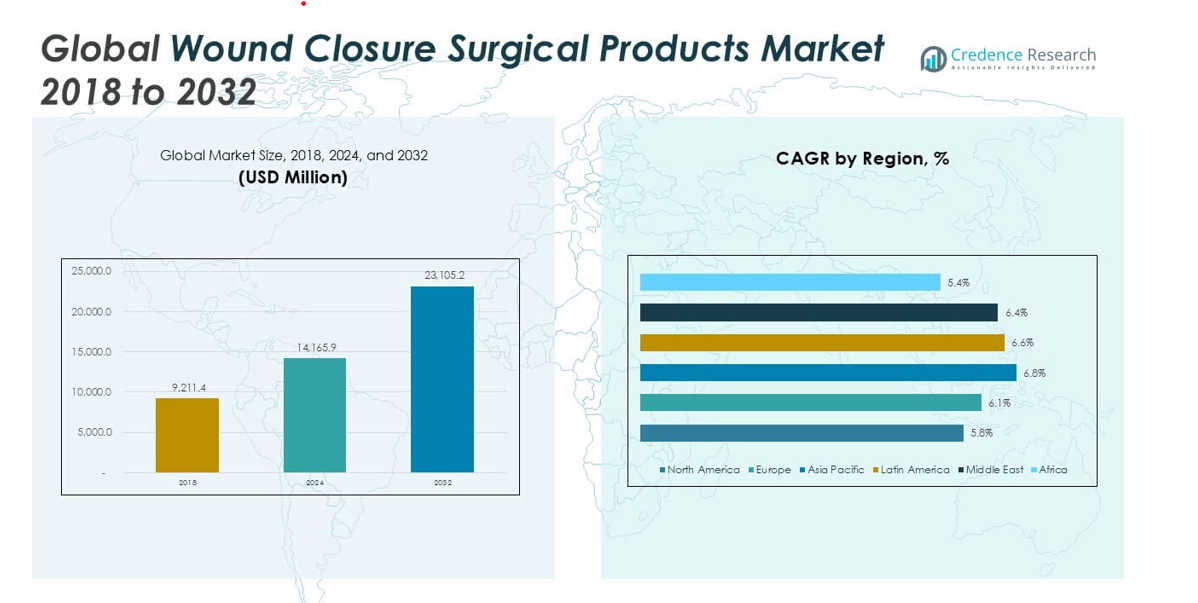

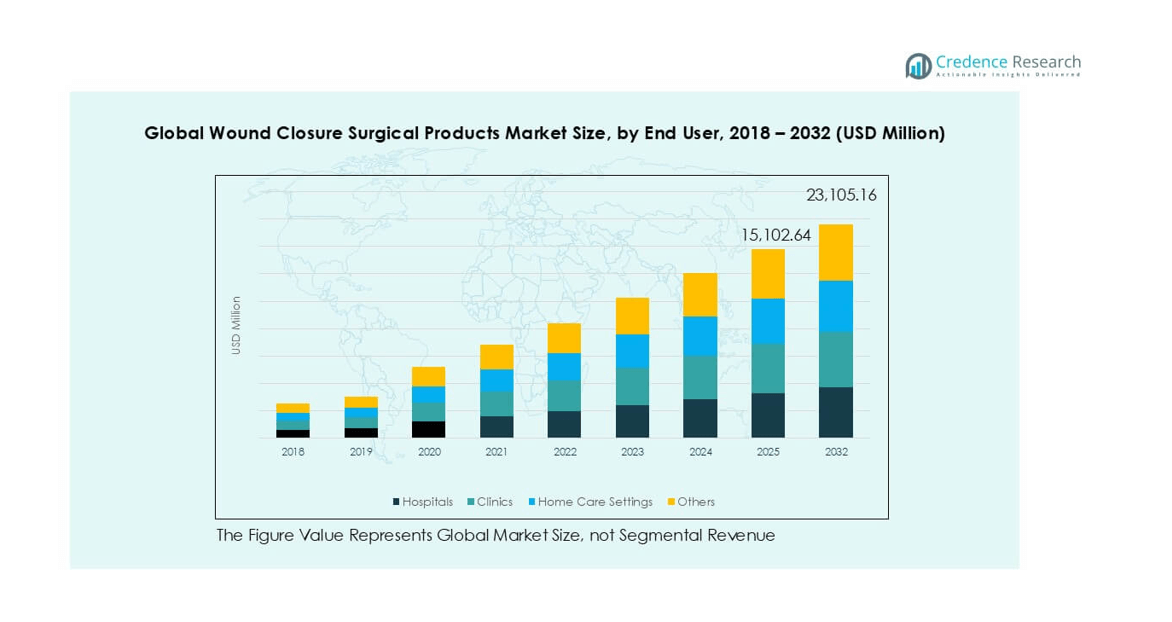

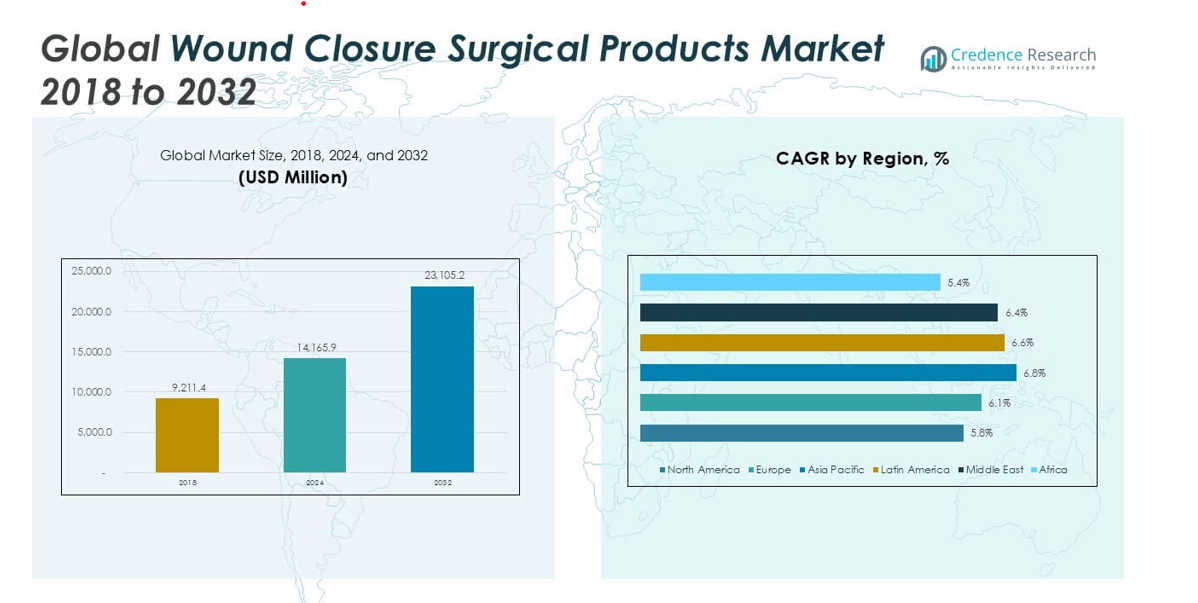

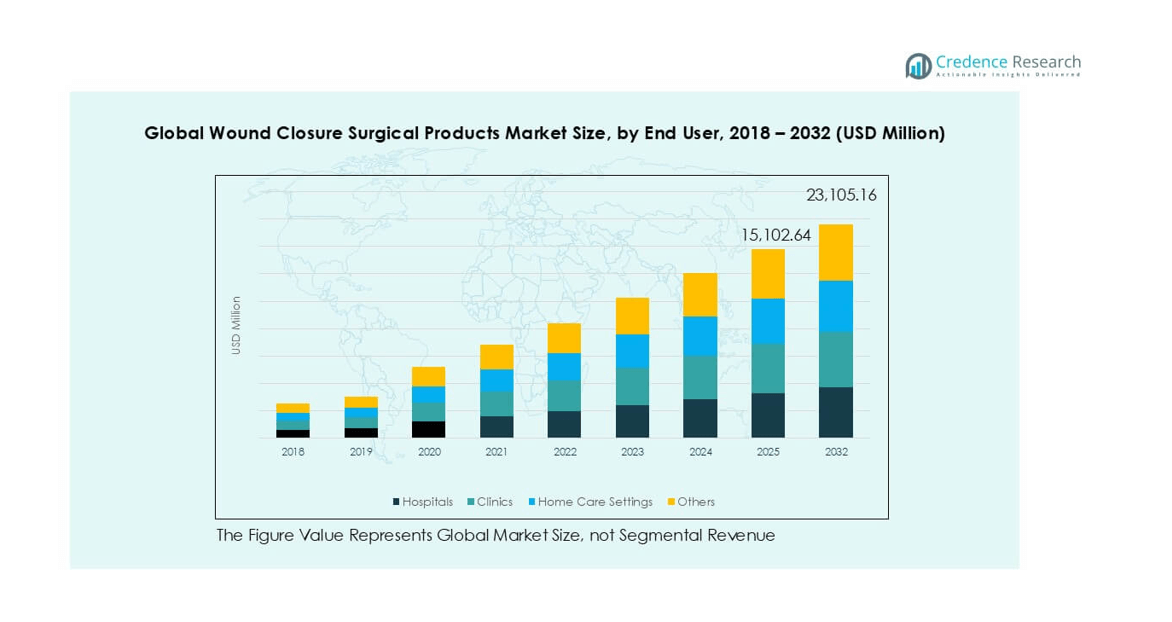

The Global Wound Closure Surgical Products market size was valued at USD 9,211.4 million in 2018 and reached USD 14,165.9 million in 2024. It is anticipated to reach USD 23,105.2 million by 2032, growing at a CAGR of 6.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wound Closure Surgical Products Market Size 2024 |

USD 14,165.9 million |

| Wound Closure Surgical Products Market, CAGR |

6.26% |

| Wound Closure Surgical Products Market Size 2032 |

USD 23,105.2 million |

The global wound closure surgical products market is led by major players such as Johnson & Johnson Services, Inc., Baxter, Medtronic, Stryker, and Solventum, alongside Smith+Nephew, B. Braun SE, and Boston Scientific Corporation. These companies dominate through extensive product portfolios, advanced technologies, and strong global networks. Regional firms including Frankenman International Ltd. in China and MANI, INC. in Japan strengthen competition by offering cost-effective solutions, while niche players like Artivion, CP Medical, CONMED Corporation, CooperSurgical, Intuitive Surgical, and Genesis Medtech drive growth in specialized applications. North America accounted for the largest share of 33.1% in 2024, supported by advanced healthcare systems, high surgical volumes, and early adoption of innovative closure products, making it the leading region in the global market.

Market Insights

- The global wound closure surgical products market was valued at USD 14,165.9 million in 2024 and is projected to reach USD 23,105.2 million by 2032, growing at a CAGR of 6.26%.

- Rising surgical volumes driven by trauma cases, chronic diseases, and an aging population are fueling demand for sutures, staplers, and hemostatic agents across hospitals and ambulatory surgical centers.

- Minimally invasive surgeries and infection-prevention technologies such as absorbable sutures, powered staplers, and antimicrobial products are shaping key market trends.

- The market is highly competitive, with Johnson & Johnson, Medtronic, Baxter, Stryker, Smith+Nephew, and B. Braun SE leading through innovation and strong global presence, while regional players expand with cost-effective alternatives.

- North America held the largest share at 33.1% in 2024, followed by Europe at 22.0% and Asia Pacific at 26.9%; among product types, sutures dominated with over 40% share, supported by strong adoption of absorbable variants.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

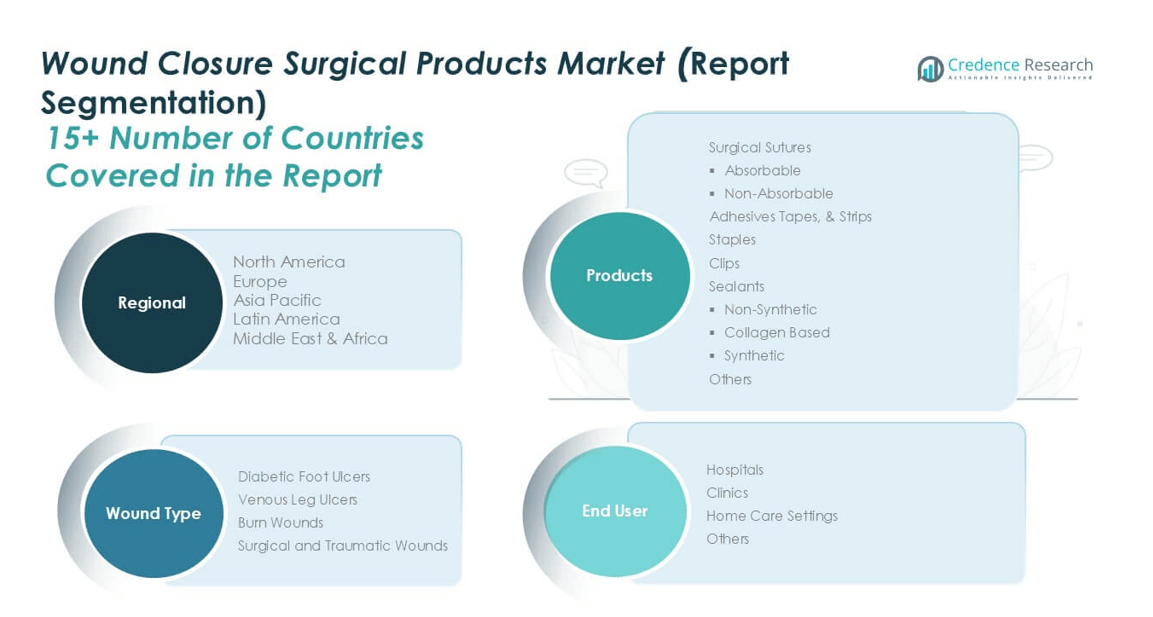

By Product Type

Sutures held the dominant share in the global wound closure surgical products market in 2024, accounting for over 40% of total revenue. Within this category, absorbable sutures led adoption due to their ability to naturally degrade in the body, reducing the need for removal and lowering infection risks. Non-absorbable sutures continue to support long-term wound security in cardiovascular and orthopedic procedures. Hemostatic agents are growing steadily, with active hemostats gaining traction for complex bleeding control. Staplers, especially powered variants, show rising demand in minimally invasive surgeries for improved precision and efficiency.

- For instance, Ethicon Inc., a Johnson & Johnson MedTech company, is a major global manufacturer of absorbable sutures, including popular brands like Monocryl and Vicryl. The company’s surgical sutures are used in countries around the world.

By Application

General surgery emerged as the leading application segment, contributing more than 35% of the global market share in 2024. High procedure volumes in hernia repair, gastrointestinal surgeries, and trauma care drive this dominance. Orthopedics follows closely, supported by the increasing incidence of fractures, joint replacements, and sports injuries requiring wound closure products. Gynecology and obstetrics also represent a growing segment, benefiting from rising caesarean deliveries and gynecological surgeries. Ophthalmology and cardiology applications, though smaller in volume, continue to expand with the adoption of advanced closure products in delicate surgical settings.

- For instance, B. Braun Melsungen AG is a major supplier of wound closure systems, including absorbable suture lines like Monosyn®. However, the number of procedures using B. Braun products annually is likely much lower than 10 million, as the market is highly competitive and dominated by other key players.

By End-user

Hospitals and ambulatory surgical centers (ASCs) dominated the end-user segment with over 60% share in 2024. The large share reflects their high patient inflow, advanced infrastructure, and preference for comprehensive surgical procedures requiring sutures, staplers, and hemostatic agents. Hospitals benefit from strong reimbursement frameworks and rising demand for complex surgeries. Specialty clinics represent a fast-growing sub-segment, supported by increasing outpatient surgeries and a shift toward cost-effective, minimally invasive procedures. Other end-users, including research institutions and smaller care facilities, contribute modestly but are expected to grow as accessibility to advanced wound closure products improves.

Key Growth Drivers

Rising Volume of Surgical Procedures

The growing number of surgical interventions worldwide remains a primary driver for the wound closure surgical products market. Increasing incidences of chronic diseases, trauma, and accidents have significantly elevated the demand for surgeries across specialties, including general surgery, orthopedics, and cardiology. The rising geriatric population, prone to age-related conditions, further fuels surgical volumes. In addition, lifestyle-related disorders such as obesity and diabetes have heightened the number of procedures like bariatric and cardiovascular surgeries. This continuous rise in global surgical cases creates consistent demand for sutures, staplers, and hemostatic agents, ensuring stable revenue growth for market players.

- For instance, Mayo Clinic cared for 1.3 million patients in 2023, according to a March 2025 news report. The following year, the organization cared for 155,000 surgical patients, an increase of more than 3% from 2023, reflecting higher utilization of closure products across general and orthopedic surgeries.

Advancements in Wound Closure Technologies

Technological innovation in wound closure solutions is another major growth factor. The shift from traditional sutures to advanced absorbable sutures and powered staplers has improved procedural efficiency and reduced post-operative complications. The introduction of active hemostats and combination products has provided surgeons with more reliable options for bleeding control, especially in complex surgeries. These innovations are increasingly aligned with minimally invasive surgical practices, offering faster wound healing and reduced hospital stays. Companies are also investing in bioengineered closure products, such as tissue adhesives and antimicrobial sutures, which enhance safety while addressing infection risks. Such advancements are widening adoption across developed and emerging markets.

- For instance, Ethicon Inc. (Johnson & Johnson MedTech) developed Plus Antibacterial Sutures, which have been shown in meta-analyses of clinical trials to lower the risk of surgical site infections by up to 28%.

Growing Demand from Emerging Markets

Emerging economies present strong growth potential due to expanding healthcare infrastructure, rising surgical capabilities, and increasing patient awareness. Governments across Asia-Pacific, Latin America, and the Middle East are investing heavily in improving surgical care, driving higher adoption of wound closure products in hospitals and ambulatory surgical centers. Rising disposable incomes and healthcare spending have made advanced closure products more accessible to larger patient pools in these regions. Additionally, medical tourism is expanding rapidly in countries like India, Thailand, and Mexico, where cost-effective surgical care boosts the need for reliable wound closure products. This trend positions emerging markets as key revenue contributors in the coming years.

Key Trends & Opportunities

Shift Toward Minimally Invasive Surgeries

The global shift toward minimally invasive surgeries (MIS) is creating new opportunities for wound closure product manufacturers. These procedures require smaller incisions, leading to lower infection risks and faster recovery times. As a result, demand for precision-driven closure solutions such as powered staplers, absorbable sutures, and advanced hemostatic agents is increasing. With MIS becoming a standard in gynecology, orthopedics, and cardiology, companies are focusing on developing closure products tailored for small incisions and complex anatomical procedures. This trend is also driving higher investments in R&D to create products that ensure efficiency and safety in minimally invasive settings.

- For instance, Medtronic plc’s Signia™ Stapling System supports laparoscopic and thoracic MIS procedures. Through its Adaptive Firing™ technology, which uses real-time feedback to adjust firing speed, the system has demonstrated a 99% hemostatic rate in certain clinical studies on thoracic surgery, leading to more consistent staple lines.

Rising Focus on Infection Prevention and Biocompatible Products

Another notable trend is the growing emphasis on infection control and biocompatibility in surgical products. Hospital-acquired infections remain a major concern, prompting greater adoption of antimicrobial sutures and bio-based hemostatic agents. These products reduce post-surgical complications, shorten hospital stays, and improve overall patient outcomes. Furthermore, the rising regulatory focus on patient safety and product biocompatibility is encouraging manufacturers to innovate eco-friendly and bioengineered wound closure solutions. The increasing adoption of these advanced, infection-resistant products is expected to open significant opportunities for market expansion, particularly in markets with stringent healthcare standards.

Key Challenges

High Cost of Advanced Closure Products

The elevated cost of advanced wound closure solutions, including powered staplers and bioengineered hemostats, poses a major challenge for widespread adoption. In many developing regions, cost constraints limit access to these products, restricting their use to premium healthcare facilities. Hospitals and clinics with limited budgets often continue to rely on conventional sutures and manual staplers, slowing the penetration of advanced technologies. Additionally, reimbursement gaps in several countries further limit adoption. Manufacturers must address pricing barriers through cost-optimized production, partnerships, and tiered pricing strategies to ensure broader accessibility across different healthcare systems.

Regulatory Hurdles and Product Approval Delays

Strict regulatory requirements for wound closure products often result in prolonged approval timelines, delaying market entry for innovative solutions. Each product must meet rigorous safety, efficacy, and biocompatibility standards, which can be resource-intensive for manufacturers. Smaller players, in particular, face challenges in navigating diverse regulations across regions, impacting global commercialization strategies. Additionally, product recalls due to compliance failures or safety concerns can harm brand credibility. These regulatory complexities slow innovation and increase costs for manufacturers. Developing strong regulatory expertise and ensuring early compliance remain critical to overcoming these challenges and sustaining growth in the global market.

Regional Analysis

North America

North America held the largest share of the wound closure surgical products market in 2024, valued at USD 4,686.09 million, up from USD 3,121.74 million in 2018. The region is projected to reach USD 7,393.65 million by 2032, advancing at a CAGR of 5.8%. Strong demand stems from high surgical volumes, advanced healthcare infrastructure, and early adoption of powered staplers and absorbable sutures. Favorable reimbursement frameworks and increasing cases of chronic diseases further strengthen regional dominance, positioning North America as the leading revenue contributor with a market share of over 33% in 2024.

Europe

Europe represented a significant share of the global wound closure market, with revenues growing from USD 2,036.64 million in 2018 to USD 3,112.05 million in 2024. By 2032, the market is projected to reach USD 5,032.30 million at a CAGR of 6.1%. Europe’s growth is driven by a large geriatric population, expanding minimally invasive surgeries, and the rising adoption of absorbable sutures and advanced hemostats. Strong regulatory emphasis on patient safety and product quality supports consistent uptake. The region accounted for nearly 23% of the global market share in 2024, reinforcing its role as a key growth hub.

Asia Pacific

Asia Pacific emerged as the fastest-growing region, expanding from USD 2,405.10 million in 2018 to USD 3,813.47 million in 2024. The market is expected to reach USD 6,469.44 million by 2032, recording the highest CAGR of 6.8%. Growth is supported by rising surgical procedures, expanding healthcare access, and strong demand in China, India, and Japan. Medical tourism and increasing adoption of advanced closure solutions such as powered staplers are additional growth enablers. Asia Pacific held around 27% market share in 2024, with rapid infrastructure development and government healthcare investments ensuring sustained momentum.

Latin America

Latin America’s wound closure surgical products market rose from USD 992.99 million in 2018 to USD 1,554.41 million in 2024. It is forecasted to reach USD 2,594.71 million by 2032, growing at a CAGR of 6.6%. Rising surgical procedures, particularly in Brazil and Mexico, along with expanding medical tourism, are driving demand. The adoption of cost-effective sutures and gradual penetration of advanced staplers support regional growth. Latin America contributed nearly 11% of the global market share in 2024, with improving healthcare infrastructure and increasing awareness creating favorable conditions for future expansion.

Middle East

The Middle East market expanded from USD 440.30 million in 2018 to USD 684.42 million in 2024 and is expected to reach USD 1,132.15 million by 2032, at a CAGR of 6.4%. Growth is supported by expanding hospital infrastructure, rising chronic disease burden, and increasing surgical volumes in Gulf Cooperation Council (GCC) countries. Medical tourism, particularly in the UAE and Saudi Arabia, is further boosting demand for advanced sutures and staplers. The Middle East accounted for about 5% of the global market share in 2024, with investments in healthcare modernization continuing to drive growth.

Africa

Africa showed steady growth in the wound closure products market, increasing from USD 214.63 million in 2018 to USD 315.50 million in 2024. The market is anticipated to reach USD 482.90 million by 2032, advancing at a CAGR of 5.4%. Growth is supported by gradual improvements in surgical care, international healthcare investments, and rising awareness about wound management. However, limited access to advanced closure solutions and cost barriers restrict widespread adoption. Africa accounted for nearly 2% of the global market share in 2024, but ongoing infrastructure development and foreign collaborations indicate steady long-term opportunities.

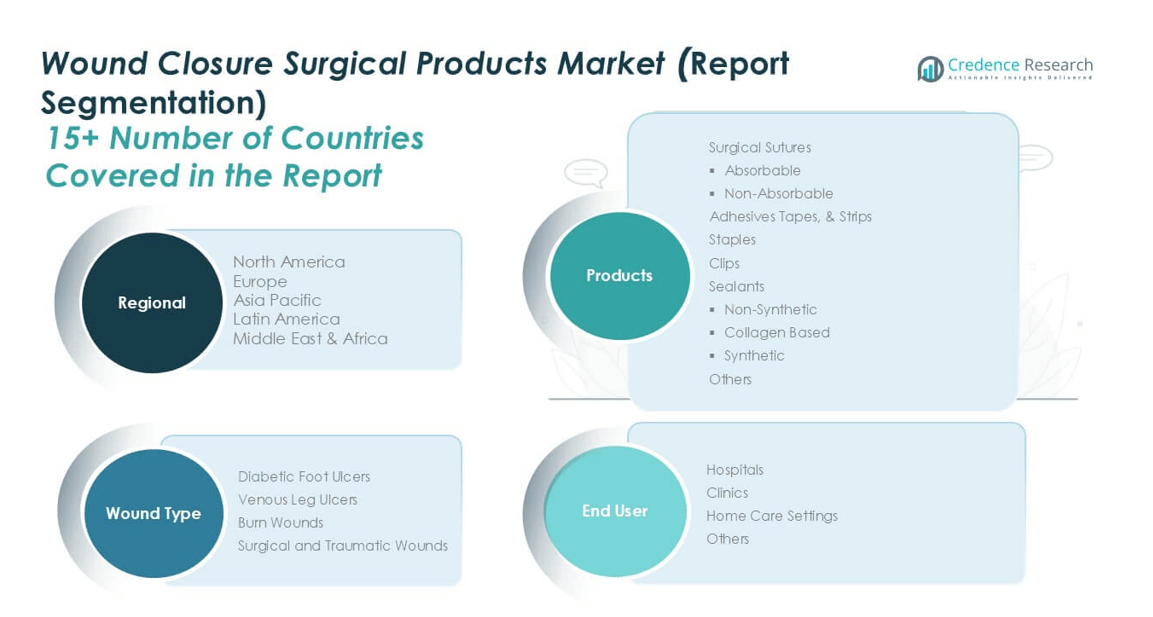

Market Segmentations:

By Product Type

- Sutures

- Absorbable

- Non-Absorbable

- Hemostatic Agents

- Active Hemostats

- Passive Hemostats

- Combination Hemostats

- Others

- Staplers

By Application

- Orthopedics

- Gynecology and Obstetrics

- General Surgery

- Ophthalmology

- Cardiology

- Others

By End-user

- Hospitals & ASCs

- Specialty Clinics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global wound closure surgical products market is highly competitive, with leading players focusing on innovation, product portfolio expansion, and strategic collaborations to strengthen their positions. Johnson & Johnson Services, Inc., Medtronic, Baxter, and Stryker dominate the market through advanced sutures, staplers, and hemostatic technologies supported by global distribution networks. Companies such as Smith+Nephew, B. Braun SE, and Boston Scientific Corporation emphasize research-driven solutions, particularly in infection-resistant and minimally invasive closure systems. Regional players, including Frankenman International Ltd. and MANI, INC., are expanding their presence through cost-effective alternatives and localized manufacturing. Additionally, niche firms like Artivion, CP Medical, and Genesis Medtech are focusing on specialized surgical applications and emerging markets. Strategic mergers, acquisitions, and partnerships remain common, enabling firms to expand surgical portfolios and access new geographic markets. Intense competition drives continuous R&D investment, ensuring technological advancements that improve patient safety, surgical efficiency, and clinical outcomes in wound closure procedures.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Johnson & Johnson Services, Inc. (U.S.)

- Baxter (U.S.)

- Medtronic (Ireland)

- Stryker (U.S.)

- Solventum (U.S.)

- Smith+Nephew (U.K.)

- Braun SE (Germany)

- Boston Scientific Corporation (U.S.)

- Frankenman International Ltd. (China)

- CooperSurgical Inc. (U.S.)

- Intuitive Surgical (U.S.)

- MANI, INC. (Japan)

- Artivion, Inc. (U.S.)

- CP Medical (Riverpoint Medical) (U.S.)

- CONMED Corporation (U.S.)

- Genesis Medtech (U.S.)

Recent Developments

- In March 2024, Intuitive Surgical received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for da Vinci 5, the next-generation multiport robotic system.

- In February 2024, Boston Scientific Corporation announced positive results from the National Institute for Health and Clinical Excellence review on the safety and efficacy of endoscopic sleeve gastroplasty (ESG) with the OverStitch endoscopic suturing system. The results stated that the minimally invasive weight loss procedure is safe for bariatric surgery.

- In August 2023, Healthium Medtech Limited launched TRUMASTM, a range of synthetic absorbable sutures designed to address challenges faced during suturing in minimal access surgeries in the Indian market.

- In May 2023, Artivion, Inc., announced that its PERCLOT Absorbable Hemostatic System (PerClot) secured premarket application (PMA) approval from the U.S. Food and Drug Administration (FDA). The approval has been granted for product usage to control bleeding in certain open and laparoscopic surgical procedures.

- In May 2023, Baxter received the U.S. Food and Drug Administration (FDA) premarket application (PMA) approval for the PERCLOT absorbable hemostatic system

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand steadily driven by increasing global surgical volumes.

- Adoption of absorbable sutures will rise due to reduced infection risks and faster healing.

- Powered staplers will gain momentum with the growth of minimally invasive surgeries.

- Active and combination hemostats will see strong demand in complex surgical procedures.

- Hospitals and ambulatory surgical centers will remain the dominant end-users.

- Specialty clinics will grow rapidly with rising outpatient surgical procedures.

- Emerging markets in Asia Pacific and Latin America will drive significant future opportunities.

- Infection-prevention products like antimicrobial sutures will gain wider adoption.

- Competitive intensity will increase with innovation and strategic acquisitions.

- North America will retain leadership, while Asia Pacific will record the fastest growth rate.