Market Overview

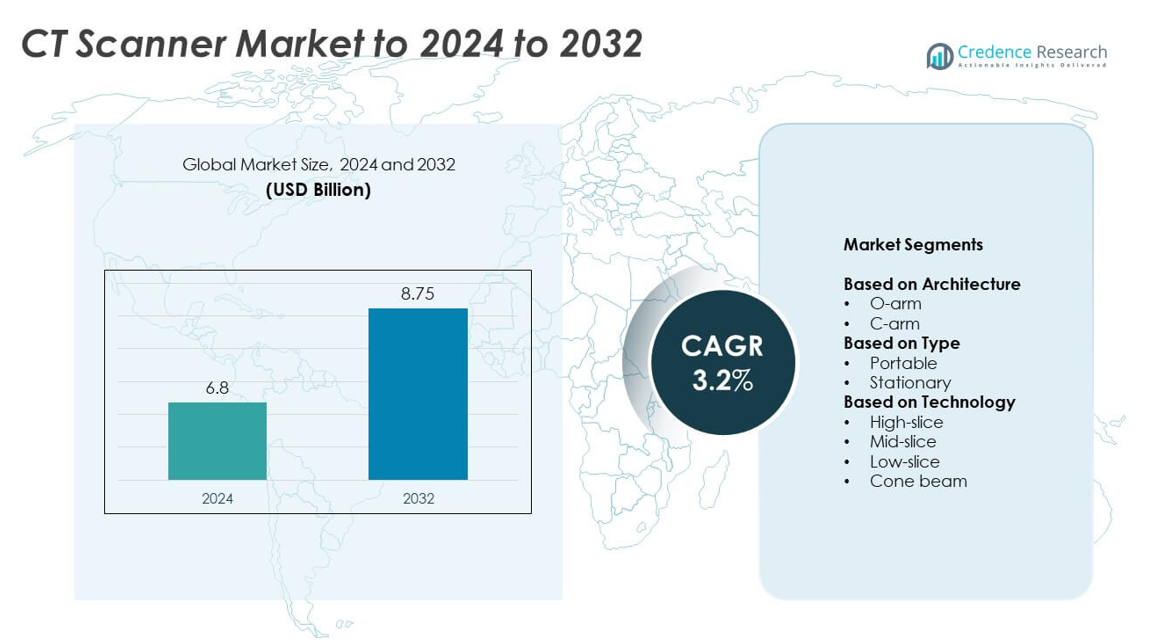

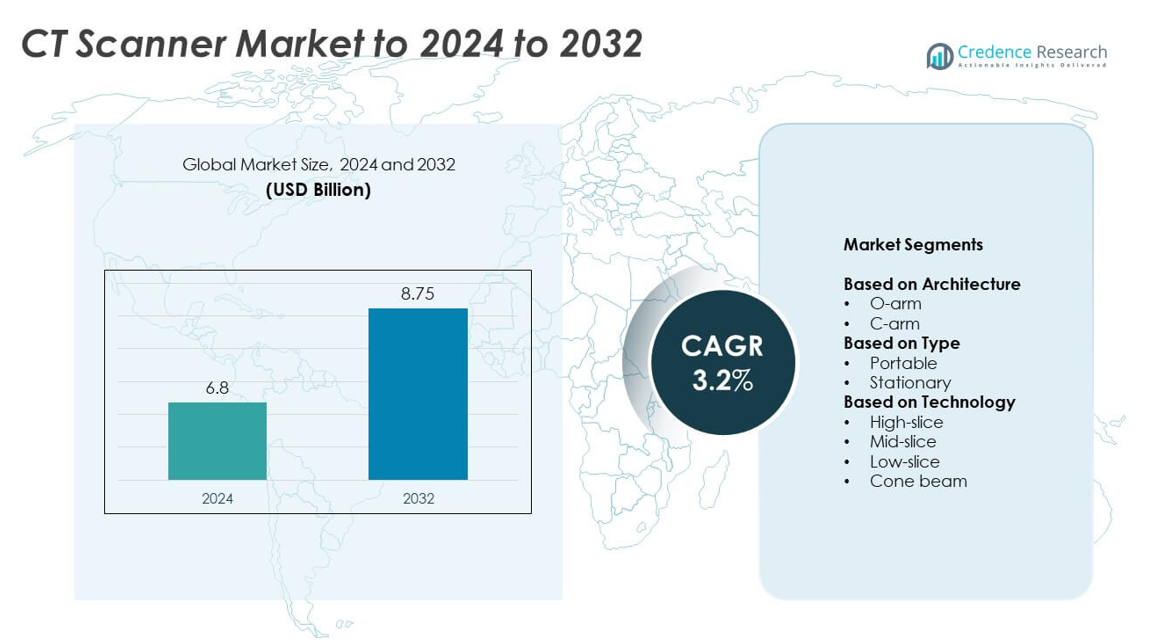

CT Scanner Market size was valued at USD 6.8 billion in 2024 and is anticipated to reach USD 8.75 billion by 2032, at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| CT Scanner Market Size 2024 |

USD 6.8 billion |

| CT Scanner Market, CAGR |

3,.2% |

| CT Scanner Market Size 2032 |

USD 8.75 billion |

The CT Scanner Market is dominated by major global players including Siemens Healthineers, Canon, GE HealthCare Technologies, FUJIFILM Holdings Corporation, and Philips. These companies lead through continuous technological innovation, AI integration, and expansion of advanced diagnostic solutions. Their focus on developing low-dose and high-slice CT systems enhances diagnostic precision and patient safety. North America remained the leading region in 2024, capturing 34.6% of the global market share due to strong healthcare infrastructure, high imaging procedure volumes, and early adoption of digital imaging technologies. Europe and Asia-Pacific followed, driven by growing investments in healthcare modernization and diagnostic advancements.

Market Insights

- The CT Scanner Market was valued at USD 6.8 billion in 2024 and is projected to reach USD 8.75 billion by 2032, growing at a CAGR of 3.2%.

- Market growth is driven by rising demand for advanced diagnostic imaging, increasing chronic disease cases, and technological advancements in AI-based CT systems.

- Key trends include the adoption of low-dose and spectral CT scanners, along with the growing use of portable units for emergency and remote diagnostics.

- The market is highly competitive, with leading players focusing on innovation, partnerships, and product upgrades to enhance performance and expand global reach.

- North America led with a 34.6% share in 2024, followed by Europe at 28.3% and Asia-Pacific at 24.9%; the C-arm segment dominated with 62.4% share, supported by its broad applications in hospitals and diagnostic centers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Architecture

The C-arm segment held the dominant share of 62.4% in 2024, driven by its broad use in hospitals and diagnostic centers for real-time imaging. C-arm systems offer high flexibility, superior image quality, and ease of positioning during surgical procedures. The demand for C-arm scanners continues to rise due to increased minimally invasive surgeries and orthopedic procedures. O-arm systems are gaining traction in neurosurgery and spinal applications, but their higher cost and specialized use limit widespread adoption compared to the more versatile C-arm segment.

- For instance, Medtronic O-arm O2 offers a 3D field of view of 20 cm in diameter by 15 cm in length, though it can acquire a 2D fluoroscopy field of view of 40 cm x 30 cm. It has two 3D image acquisition modes using a 512 x 512 x 192 reconstruction matrix. One is a standard definition mode that performs a 360° scan by acquiring approximately 391 images in 13 seconds. The high-definition (HD3D) mode acquires approximately 750 images over 360° during a 26-second scan.

By Type

The stationary segment accounted for the largest market share of 71.6% in 2024, driven by high imaging precision and integration within advanced diagnostic facilities. Stationary CT scanners deliver consistent image quality and higher power output, supporting detailed imaging of soft tissues and organs. The growing demand for accurate diagnostic solutions in oncology and cardiology enhances adoption across hospitals and imaging centers. Portable CT scanners are gaining popularity in emergency care and mobile diagnostics, but they currently serve as a complementary technology rather than a mainstream solution.

- For instance, Samsung NeuroLogica OmniTom Elite is a 16-slice bedside CT with 0.625 mm detectors, 40 cm gantry, and battery operation.

By Technology

The high-slice segment dominated the market with a 53.8% share in 2024, supported by the growing need for fast, detailed imaging in complex diagnostics. High-slice scanners, typically 64-slice and above, enable rapid acquisition and 3D reconstruction, improving workflow efficiency and patient throughput. These systems are widely adopted in cardiac, trauma, and oncology imaging. Mid-slice and low-slice scanners remain prevalent in smaller clinics for routine diagnostics, while cone-beam CT is expanding in dental and orthopedic imaging for localized, high-resolution scans.

Key Growth Drivers

Rising Demand for Advanced Diagnostic Imaging

The increasing prevalence of chronic diseases such as cancer and cardiovascular disorders is boosting demand for advanced CT scanners. Hospitals and diagnostic centers are investing in high-resolution, multi-slice systems to improve diagnostic accuracy and reduce scanning time. Enhanced imaging capabilities support early detection and treatment planning, driving adoption across developed and emerging markets. The shift toward precision medicine further strengthens the need for detailed anatomical imaging, making high-performance CT systems a critical component of modern healthcare infrastructure.

- For instance, Philips Spectral CT 7500 lists 0.27 s rotation, 80 mm coverage, and an 80 cm bore for rapid, broad-use imaging.

Technological Advancements in Imaging Systems

Continuous innovation in detector technology, AI integration, and iterative reconstruction techniques is improving image quality while reducing radiation exposure. AI-driven automation streamlines workflow and enhances diagnostic efficiency, allowing faster image interpretation. Leading manufacturers are introducing low-dose and spectral CT technologies to meet safety and efficiency standards. These advancements expand clinical applications in cardiology, oncology, and neurology, contributing to the overall market growth. The integration of digital connectivity and real-time data sharing also supports better clinical decision-making.

- For instance, Neusoft NeuViz 128 features Quad-Sampling (up to 400% sampling density) and 0.375 s rotation with an 80 kW generator.

Growing Healthcare Infrastructure in Emerging Economies

Expanding healthcare infrastructure in Asia-Pacific, Latin America, and the Middle East is fueling demand for CT scanners. Governments are investing in diagnostic imaging facilities to improve access to healthcare and early disease detection. Rising healthcare expenditure, along with public-private partnerships, accelerates CT system installations in regional hospitals. Portable and mid-range CT scanners are witnessing increased adoption due to their cost-effectiveness and flexibility in resource-limited settings. The expansion of diagnostic networks across rural regions presents major growth potential for manufacturers.

Key Trends and Opportunities

Integration of Artificial Intelligence and Automation

AI-based image analysis and automated reconstruction tools are transforming CT imaging workflows. These technologies help radiologists detect abnormalities faster, reduce interpretation errors, and optimize scan protocols. Automated dose control systems ensure patient safety while maintaining image precision. The integration of AI also enables predictive maintenance and remote system management, improving equipment uptime. As healthcare providers prioritize efficiency and diagnostic accuracy, AI-driven CT solutions are becoming central to clinical operations, creating opportunities for innovation and software development.

- For instance, Fujifilm SCENARIA View (Cardio StillShot) achieves ~28 ms effective temporal resolution, a ~6× improvement over conventional methods.

Expansion of Low-Dose and Spectral CT Scanners

The global shift toward radiation dose reduction is encouraging the adoption of low-dose and spectral CT systems. These scanners use advanced photon-counting detectors and dual-energy imaging to improve tissue differentiation while minimizing exposure. Healthcare facilities are increasingly choosing such systems for pediatric and chronic disease imaging. This trend aligns with regulatory standards emphasizing patient safety and precision imaging. Manufacturers focusing on energy-efficient, low-radiation designs are expected to gain a competitive edge in the evolving CT scanner market.

- For instance, Siemens NAEOTOM Alpha enables 0.2 mm slice thickness with 66 ms temporal resolution, and has recent FDA 510(k) clearances for the expanded class.

Key Challenges

High Cost of Equipment and Maintenance

The high initial investment and recurring maintenance costs of CT scanners remain a major barrier to adoption, especially for smaller hospitals and diagnostic centers. Advanced models with multi-slice and AI features demand substantial capital expenditure and technical expertise. Additionally, service contracts and software updates add to long-term ownership costs. These financial challenges restrict market penetration in developing regions, where healthcare budgets are limited. Affordable financing models and refurbished equipment offerings are essential to improve accessibility and sustain market growth.

Regulatory and Radiation Safety Concerns

Stringent regulatory approvals and radiation safety standards pose significant challenges for CT scanner manufacturers. Compliance with evolving global and regional norms increases product development timelines and costs. Radiation exposure concerns among patients and healthcare workers further limit frequent usage, especially in non-critical cases. Manufacturers must continually innovate to lower dose levels while maintaining image quality. Balancing technological advancement with safety compliance is critical for sustaining trust and expanding the use of CT imaging across medical disciplines.

Regional Analysis

North America

North America held the largest share of 34.6% in the CT scanner market in 2024, driven by high healthcare expenditure, advanced hospital infrastructure, and early adoption of AI-integrated imaging systems. The United States leads regional demand due to growing diagnostic imaging procedures for oncology and cardiovascular diseases. Continuous product launches, favorable reimbursement policies, and strong presence of global manufacturers further strengthen market growth. Canada also contributes significantly, with investments in digital healthcare modernization and AI-driven radiology systems supporting diagnostic accuracy and operational efficiency across public and private healthcare facilities.

Europe

Europe accounted for a 28.3% share of the global CT scanner market in 2024, supported by expanding healthcare digitization and growing focus on low-dose radiation technologies. Countries such as Germany, the U.K., and France lead adoption through national health initiatives and radiology equipment upgrades. Demand for high-slice CT scanners is increasing in tertiary hospitals for advanced cardiovascular and oncology imaging. EU regulations promoting radiation safety and quality assurance continue to drive innovation. Collaborations between medical device firms and research institutions are enhancing clinical imaging standards across the European market.

Asia-Pacific

Asia-Pacific represented 24.9% of the global CT scanner market share in 2024, fueled by rapid healthcare infrastructure expansion and rising diagnostic imaging demand. China, Japan, and India are key contributors due to growing investments in hospitals and diagnostic centers. Government-backed healthcare programs and increasing public awareness of early disease detection boost market penetration. Domestic manufacturers are introducing affordable CT systems to meet regional demand. Technological advancements, including portable and low-dose models, are improving accessibility in rural areas, while urban hospitals increasingly adopt AI-based CT scanners for advanced imaging applications.

Latin America

Latin America captured an 8.7% share of the CT scanner market in 2024, driven by improving healthcare infrastructure and rising adoption of digital imaging technologies. Brazil and Mexico lead regional growth due to expanding hospital networks and modernization of diagnostic facilities. Public healthcare initiatives supporting early disease detection further increase demand. However, high equipment costs and limited reimbursement frameworks pose challenges. International manufacturers are partnering with local distributors to enhance market presence. The growing use of portable CT scanners in remote healthcare centers supports broader accessibility across Latin American countries.

Middle East and Africa

The Middle East and Africa accounted for 3.5% of the global CT scanner market in 2024, supported by rising healthcare investments and an increasing number of diagnostic imaging centers. The United Arab Emirates and Saudi Arabia are leading markets, driven by hospital modernization and digital transformation initiatives. In Africa, South Africa and Egypt are expanding their diagnostic capacities with government-led health projects. Although the region faces budget constraints and equipment shortages, growing private healthcare investment and public health reforms continue to create new opportunities for CT system installations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Architecture

By Type

By Technology

- High-slice

- Mid-slice

- Low-slice

- Cone beam

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The CT scanner market features strong competition among major global manufacturers such as Siemens Healthineers, Canon, FUJIFILM Holdings Corporation, GE HealthCare Technologies, Philips, Medtronic, Samsung Electronics, Shimadzu Corporation, Neusoft Medical Systems, Accuray, CurveBeam AI, PLANMED, Koning Health, Shenzhen Anke High-tech, Xoran Technologies, and Koninklijke Philips. These companies focus on product innovation, advanced imaging technologies, and AI-driven diagnostic solutions to strengthen their market positions. The competition centers around developing low-dose, high-slice, and portable CT systems with improved image clarity and faster scan times. Continuous investment in R&D enables manufacturers to expand clinical applications across oncology, cardiology, and neurology. Strategic partnerships with hospitals and imaging centers enhance equipment adoption, while mergers and acquisitions foster technological integration. Market players are also emphasizing after-sales services, remote diagnostics, and digital platforms to improve customer experience. The growing demand for precise and efficient imaging solutions continues to shape competitive dynamics globally.

Key Player Analysis

- Siemens Healthineers

- Canon

- FUJIFILM Holdings Corporation

- GE HealthCare Technologies

- Philips

- Medtronic

- Samsung Electronics

- Shimadzu Corporation

- Neusoft Medical Systems

- Accuray

- CurveBeam AI

- PLANMED

- Koning Health

- Shenzhen Anke High-tech

- Xoran Technologies

- Koninklijke Philips

Recent Developments

- In 2025, GE HealthCare launched CleaRecon DL, a deep learning algorithm for cone-beam CT (CBCT) images, improving quality by reducing artifacts in interventional procedures.

- In 2023, GE HealthCare showcased its Revolution Ascend scanner, equipped with deep learning-based reconstruction (True Enhance DL) for better image contrast, particularly in oncology cases, at the RSNA 2023 conference.

- In 2023, Siemens Healthineers received FDA clearance for its dual-source Somatom Pro.Pulse CT system.

- In 2023, Philips launched the AI-powered CT 3500 system to accelerate routine radiology and high-volume screening programs.

Report Coverage

The research report offers an in-depth analysis based on Architecture, Type, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing adoption of AI-powered CT scanners will enhance diagnostic speed and accuracy.

- Demand for low-dose radiation systems will rise due to growing patient safety concerns.

- Portable and mobile CT scanners will gain traction in emergency and remote healthcare services.

- Integration of cloud-based imaging platforms will support data sharing and remote diagnostics.

- Spectral and photon-counting CT technologies will expand precision imaging applications.

- Emerging economies will invest more in advanced diagnostic imaging infrastructure.

- Hybrid imaging combining CT with MRI and PET will see wider clinical use.

- Automation in CT workflow will reduce scan time and improve radiologist productivity.

- Growing focus on preventive healthcare will increase routine CT scan volumes.

- Strategic collaborations between hospitals and manufacturers will accelerate technological innovation.