Market overview

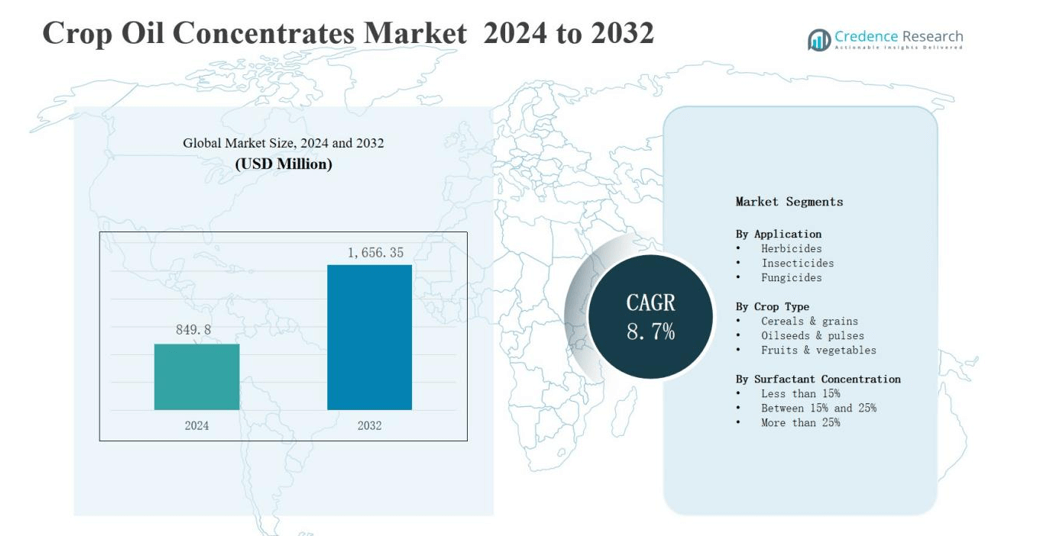

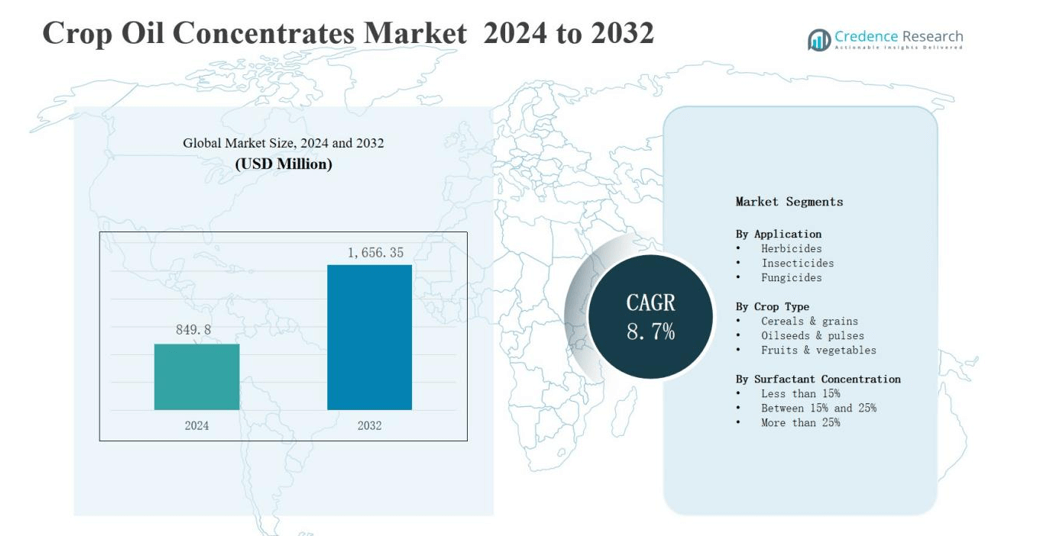

Crop Oil Concentrates Market size was valued at USD 849.8 million in 2024 and is anticipated to reach USD 1,656.35 million by 2032, at a CAGR of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crop Oil Concentrates Market Size 2024 |

USD 849.8 million |

| Crop Oil Concentrates Market, CAGR |

8.7% |

| Crop Oil Concentrates Market Size 2032 |

USD 1,656.35 million |

The Crop Oil Concentrates Market is led by prominent companies such as BASF SE, Croda International Plc, Wilbur-Ellis Holdings, Inc., CHS Inc., Brandt Consolidated, Inc., Helena Agri-Enterprises, LLC, KALO, Inc., Winfield Solutions, Precision Laboratories, LLC, and Innvictis Crop Care, LLC. These players focus on developing advanced, eco-friendly formulations that improve pesticide performance and compatibility across diverse crops. Strategic partnerships and expansions into emerging markets strengthen their global presence. North America dominates the market with a 37% share, driven by advanced farming technologies, precision agriculture adoption, and strong awareness of adjuvant benefits among large-scale farming operations.

Market Insights

- The Crop Oil Concentrates Market was valued at USD 849.8 million in 2024 and is projected to reach USD 1,656.35 million by 2032, growing at 8.7%.

- North America leads the market with a 37% share, driven by advanced farming technologies, precision agriculture, and strong adoption of adjuvants.

- The herbicides segment dominates with 58% of total revenue in 2024, supported by widespread use in large-scale weed management and precision spraying.

- The cereals and grains segment holds a 49% share, boosted by high global demand for wheat, corn, and rice, requiring effective crop protection solutions.

- Formulations with surfactant concentrations between 15% and 25% account for 52% share, offering balanced performance and cost efficiency across multiple applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Application

The herbicides segment dominates the Crop Oil Concentrates Market, accounting for 58% of total revenue in 2024. Its dominance stems from widespread use in weed management across large-scale farming operations. Herbicides require effective oil concentrates to improve spray coverage and penetration, ensuring better absorption by plant tissues. Increasing adoption of advanced crop protection chemicals and precision agriculture techniques further boosts demand for herbicide-compatible oil concentrates in both developed and emerging agricultural regions.

- For instance, BASF launched its upgraded Dash HC methylated seed oil adjuvant in Europe, specifically formulated to boost uptake of post-emergence herbicides in cereals and corn.

By Crop Type

The cereals and grains segment leads the market with a 49% share in 2024. This dominance is driven by high global production volumes of wheat, corn, and rice, which demand extensive pesticide and nutrient applications. Crop oil concentrates enhance the efficiency of chemical uptake and reduce drift loss during spraying. Rising food demand, expanding cultivation areas, and increasing adoption of high-yield varieties sustain strong demand for concentrates in cereals and grains cultivation worldwide.

By Surfactant Concentration

The segment with surfactant concentration between 15% and 25% holds the largest market share of 52% in 2024. These formulations offer a balanced mix of performance and cost efficiency, improving chemical dispersion and adhesion on plant surfaces. Farmers prefer this concentration range for diverse climatic and soil conditions. The growing focus on optimizing pesticide efficacy while reducing chemical waste has reinforced its adoption across herbicide, insecticide, and fungicide applications in modern crop management practices.

- For instance, BASF’s Break-Thru® S 240 is a silicone surfactant used in tank-mix applications; it gives “super spreading” behavior at low concentrations (e.g. ~0.1 % in spray solution) and supports cuticular uptake.

Key Growth Drivers

Rising Demand for Effective Pesticide Performance

The Crop Oil Concentrates Market is driven by the growing need for enhanced pesticide effectiveness. Farmers increasingly use crop oil concentrates to improve the penetration, spreading, and retention of herbicides, insecticides, and fungicides. This improves pest control efficiency and reduces chemical waste. Expanding agricultural activities and higher adoption of integrated pest management practices are fueling consistent demand. The trend toward maximizing yield through efficient agrochemical use continues to strengthen the market’s expansion globally.

- For instance, ExxonMobil’s patented Crop Oil Concentrates have demonstrated improved herbicidal activity by facilitating better pesticide penetration and spreading on crops, which enhances overall pest control outcomes.

Expansion of Commercial and Large-Scale Farming

The rise in commercial farming operations significantly boosts the use of crop oil concentrates. Large-scale farms rely on advanced spraying systems that require efficient adjuvants to optimize chemical delivery. The shift from traditional to mechanized farming practices increases product adoption in major agricultural regions such as North America, Brazil, and India. The need for consistent and cost-effective crop protection solutions drives the integration of these concentrates into farm management systems.

- For instance, in the U.S., Brazil, and Australia, large commercial farms primarily use crop oil concentrates in tank mixes with complex chemical formulations to enhance herbicide performance and weed control.

Increasing Awareness of Sustainable Crop Protection

Growing awareness of sustainable agriculture practices supports market growth. Farmers are adopting environmentally safe adjuvants like crop oil concentrates that reduce overall pesticide volume without compromising effectiveness. The movement toward eco-friendly formulations aligns with global initiatives for reduced chemical runoff and soil contamination. Government programs promoting sustainable inputs and precision spraying techniques further enhance demand for advanced crop oil concentrate formulations with biodegradable ingredients.

Key Trends & Opportunities

Shift Toward Bio-Based and Renewable Formulations

A major trend in the Crop Oil Concentrates Market is the transition toward bio-based formulations derived from vegetable oils. These eco-friendly alternatives offer comparable performance to petroleum-based variants while meeting regulatory requirements for low environmental impact. The growing consumer and government emphasis on sustainable agriculture creates strong opportunities for manufacturers. Companies investing in renewable raw materials and green chemistry innovations are gaining competitive advantages across key agricultural economies.

- For instance, BASF has developed bio-based adjuvants for crop oil concentrates that meet strict regulatory standards for eco-friendliness, utilizing vegetable oils such as sunflower and rapeseed oil as feedstock.

Rising Adoption of Precision Agriculture Technologies

The integration of precision agriculture systems presents significant growth opportunities for crop oil concentrates. GPS-guided sprayers and automated dosing technologies enhance the use efficiency of oil-based adjuvants. These systems ensure precise droplet formation, reducing drift and improving target coverage. As farmers adopt digital farming tools to optimize agrochemical inputs, demand for compatible and high-performance concentrates continues to grow. The trend supports better yield outcomes and sustainable farm management practices.

- For instance, AllyNav’s VS100 Spray Control System achieves 98% application accuracy by integrating GPS data with spray control to manage complex field operations, optimizing input use and minimizing drift.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of petroleum and vegetable oils used in concentrate production pose a challenge to manufacturers. Variations in feedstock availability and geopolitical factors directly affect production costs and pricing stability. This volatility limits profit margins and may lead to inconsistent supply in certain markets. Manufacturers must adopt strategic sourcing and consider alternative materials to manage cost pressures and maintain product affordability for end users.

Stringent Environmental and Safety Regulations

The Crop Oil Concentrates Market faces increasing regulatory scrutiny concerning environmental safety and chemical usage. Governments are enforcing stricter norms for formulation toxicity, residue levels, and application methods. Compliance with multiple international standards increases operational costs for producers. Small and medium manufacturers struggle to meet these evolving requirements, affecting competitiveness. The need for reformulation and certification delays market entry for new products in several regions.

Limited Awareness Among Small Farmers

Despite proven benefits, adoption remains low among small and resource-limited farmers due to lack of awareness. Many rely on conventional pesticides without adjuvants, reducing overall effectiveness. Limited access to technical guidance and training restricts market penetration in developing regions. Industry stakeholders need to increase farmer education programs, demonstration trials, and distribution support to enhance understanding and drive usage of crop oil concentrates in rural markets.

Regional Analysis

North America

North America dominates the global Crop Oil Concentrates Market with a 37% share in 2024. The region’s leadership is driven by extensive adoption of modern agricultural practices and advanced spraying systems. The U.S. and Canada have well-established commercial farming sectors focused on herbicide-based weed control. Strong awareness of adjuvant benefits and widespread use of precision agriculture enhance market penetration. Increasing focus on yield optimization and sustainable crop protection further supports steady growth. Leading manufacturers also operate major production and R&D facilities in the region.

Europe

Europe holds a 26% share of the Crop Oil Concentrates Market, supported by strict environmental regulations and sustainable farming initiatives. Farmers in countries such as France, Germany, and Spain prefer bio-based oil concentrates that align with EU green policies. The market benefits from steady investments in agricultural innovation and government programs promoting reduced pesticide use. Demand is high across cereal, vegetable, and fruit cultivation zones. The presence of leading agrochemical companies contributes to product advancement. It continues to gain traction through research on eco-friendly formulations and improved spray efficiency.

Asia Pacific

Asia Pacific accounts for 24% of the global market and is projected to register the fastest growth through 2032. Expanding agricultural areas in China, India, and Southeast Asia drive demand for efficient crop protection solutions. Farmers increasingly adopt oil concentrates to improve herbicide and insecticide performance. Government efforts to enhance food security and crop yield support large-scale usage. Rapid mechanization and growing exports of agricultural commodities strengthen market expansion. It remains a key region for both consumption and manufacturing due to abundant raw materials.

Latin America

Latin America captures a 9% market share, driven by the growing adoption of modern farming techniques in Brazil and Argentina. High soybean and corn cultivation creates consistent demand for crop oil concentrates. Strong agricultural export industries encourage the use of efficient adjuvants to maintain product quality and yield. Favorable climatic conditions and increased herbicide applications contribute to market growth. It benefits from expanding distribution networks and partnerships between local cooperatives and global agrochemical companies.

Middle East & Africa

The Middle East & Africa region holds a 4% share of the Crop Oil Concentrates Market. Rising focus on improving agricultural productivity in water-scarce regions fuels product adoption. Countries like South Africa, Egypt, and Saudi Arabia are investing in efficient crop management systems. Limited arable land drives the use of concentrates to maximize chemical effectiveness. Ongoing government support for sustainable agriculture and import dependence on advanced agrochemicals sustain steady market growth.

Market Segmentations:

By Application

- Herbicides

- Insecticides

- Fungicides

By Crop Type

- Cereals & grains

- Oilseeds & pulses

- Fruits & vegetables

By Surfactant Concentration

- Less than 15%

- Between 15% and 25%

- More than 25%

By Region

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Competitive Landscape

The Crop Oil Concentrates Market is moderately consolidated, with competition driven by product innovation, distribution reach, and strategic partnerships. Key players such as BASF SE, Croda International Plc, Wilbur-Ellis Holdings, Inc., CHS Inc., and Brandt Consolidated, Inc. focus on developing advanced formulations that enhance pesticide efficacy and reduce environmental impact. Companies are expanding their portfolios with bio-based and sustainable concentrates to align with global agricultural trends. Strategic alliances with agrochemical producers and distributors help strengthen regional market penetration. Firms like Helena Agri-Enterprises, LLC, Winfield Solutions, KALO, Inc., and Precision Laboratories, LLC emphasize improving formulation performance, spray uniformity, and compatibility across multiple crop types. Continuous investment in R&D and field trials enhances product differentiation and brand credibility. The growing focus on precision agriculture and eco-friendly farming practices is encouraging key market participants to expand their presence in emerging economies through collaborations and localized manufacturing initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- BASF SE

- Wilbur-Ellis Holdings, Inc.

- Croda International Plc

- CHS Inc.

- Brandt Consolidated, Inc.

- Helena Agri-Enterprises, LLC

- KALO, Inc.

- Precision Laboratories, LLC

- Winfield Solutions

- Plant Health Technologies

- Innvictis Crop Care, LLC

Recent Developments

- In August 2025, WinField United launched its SuperLock™ adjuvant, a high-surfactant crop oil concentrate offering advanced drift reduction technology in a single formulation.

- In September 2025, Loveland Products introduced Extract® XC, a concentrated residue-management formulation designed for compatibility with a wide range of herbicide mixes.

- In July 2023, Croda International Plc completed the acquisition of Solus Biotech, strengthening its biologically derived input technologies and adjuvant development capabilities.

Report Coverage

The research report offers an in-depth analysis based on Application, Crop Type, Surfactant Concentration and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow due to rising adoption of advanced crop protection methods.

- Farmers will increasingly prefer bio-based and sustainable oil concentrate formulations.

- Precision agriculture technologies will drive higher use efficiency of oil concentrates.

- Manufacturers will focus on developing multi-functional and eco-safe formulations.

- Expanding large-scale farming operations will boost product consumption globally.

- Partnerships between agrochemical companies and adjuvant producers will strengthen distribution networks.

- Increased awareness among small and mid-sized farmers will support market penetration.

- Regulatory support for environmentally safe adjuvants will promote new product approvals.

- Investments in R&D will lead to improved spray performance and product stability.

- Emerging markets in Asia and Latin America will become major growth centers.