Market Overview

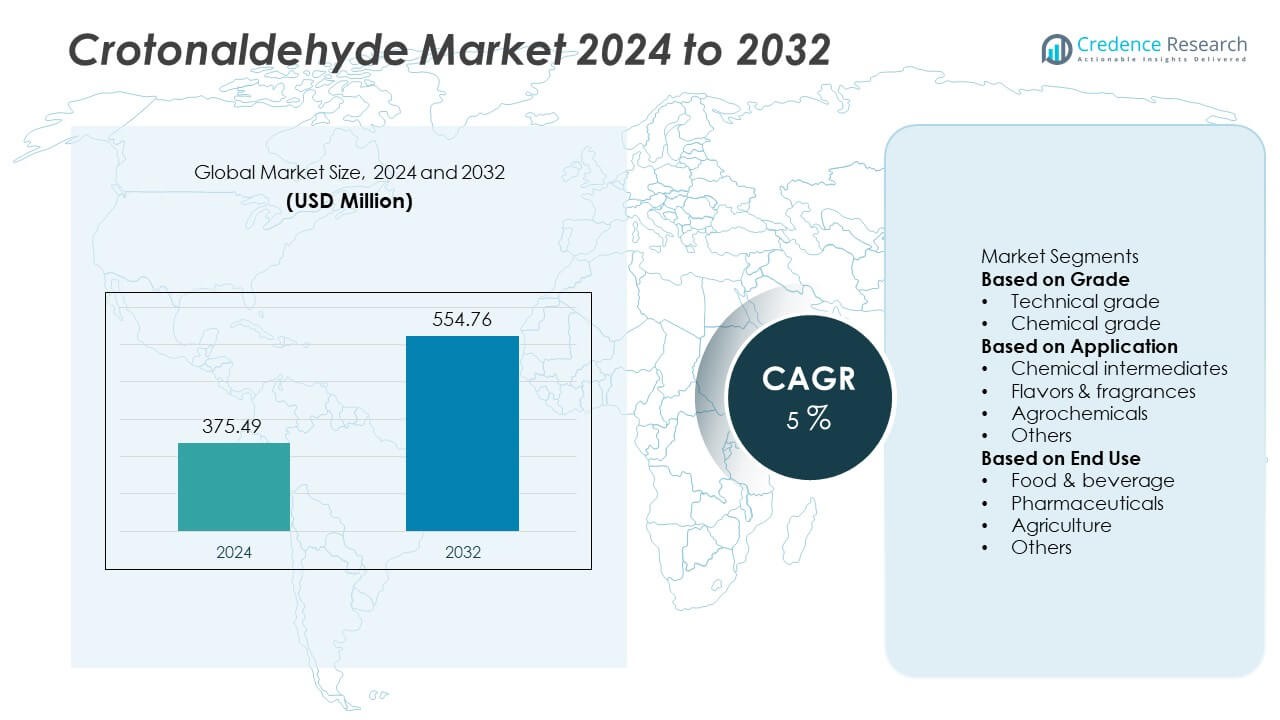

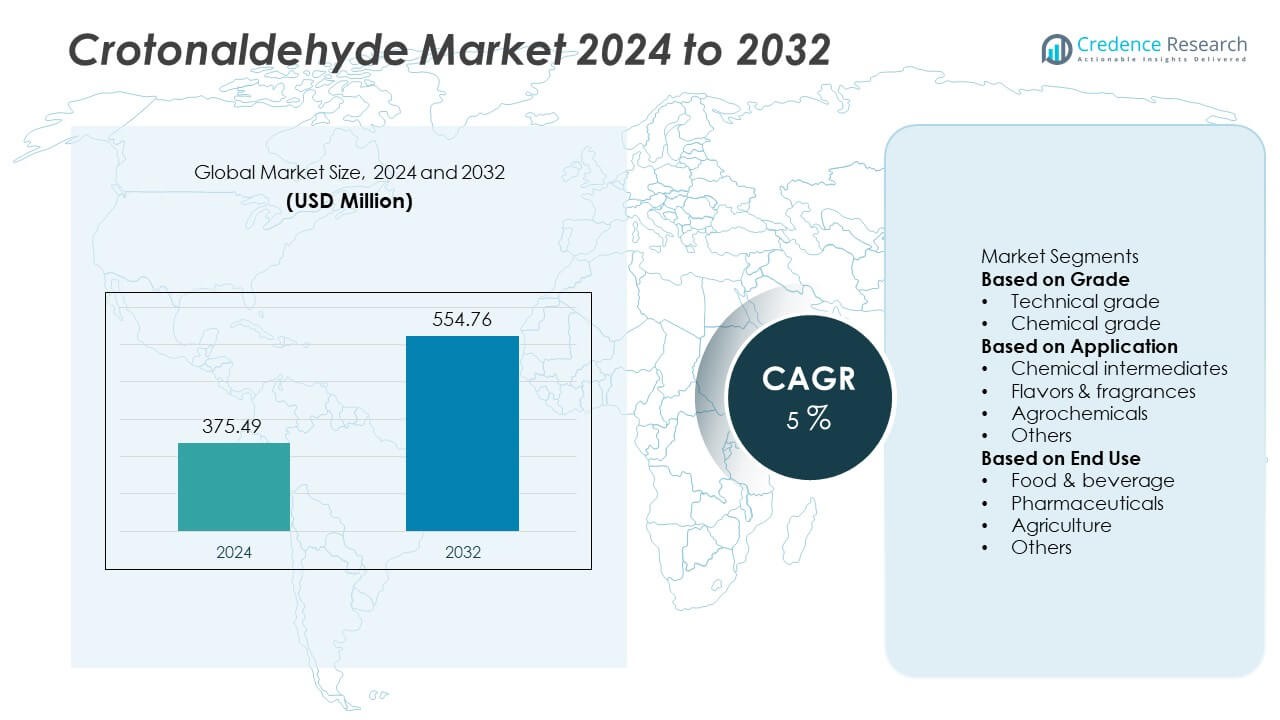

The Crotonaldehyde market was valued at USD 375.49 million in 2024 and is expected to reach USD 554.76 million by 2032, growing at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crotonaldehyde Market Size 2024 |

USD 375.49 Million |

| Crotonaldehyde Market, CAGR |

5% |

| Crotonaldehyde Market Size 2032 |

USD 554.76 Million |

The Crotonaldehyde market is led by major companies including BASF SE, Celanese Corporation, Merck KGaA, Shandong Kunda Biotechnology Co., Transpek-Silox Industry Pvt. Ltd, Tokyo Chemical Industry, Nantong Acetic Acid Chemical, Alfa Aesar, Eastman Chemical Company, and Haihang Industry Co., Ltd. These players maintain strong positions through advanced production technologies, global distribution networks, and diversified product portfolios. Asia-Pacific dominates the market with a 38% share, supported by large-scale manufacturing in China and India. North America follows with 27%, driven by demand from food and pharmaceutical sectors, while Europe holds 25% due to sustainable chemical initiatives and strong industrial infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Crotonaldehyde market was valued at USD 375.49 million in 2024 and is projected to reach USD 554.76 million by 2032, growing at a CAGR of 5%.

- Rising demand for chemical intermediates and preservatives drives market growth, supported by increasing use in food, pharmaceutical, and agrochemical industries.

- Key trends include the shift toward bio-based production methods, technological advancements in catalytic processes, and growing applications in specialty chemicals.

- Major players such as BASF SE, Celanese Corporation, and Merck KGaA lead the market through capacity expansion, process innovation, and strategic partnerships.

- Asia-Pacific dominates with a 38% share, followed by North America at 27% and Europe at 25%, while the technical grade segment leads with 62% share, supported by its extensive use in industrial and chemical manufacturing.

Market Segmentation Analysis:

By Grade

The technical grade segment held the dominant 62% share of the Crotonaldehyde market in 2024. Its leadership stems from widespread use in producing sorbic acid, crotonic acid, and other industrial intermediates. Technical grade crotonaldehyde offers high purity suitable for polymer synthesis, coatings, and specialty chemicals. Demand is reinforced by its application in adhesives, resins, and rubber processing agents. The chemical grade segment follows, used in laboratory research and fine chemical production. Rising industrialization and growing chemical manufacturing in Asia-Pacific continue to strengthen technical grade consumption across global markets.

- For instance, BASF SE operates a large-scale chemical production facility in Ludwigshafen, which manufactures a wide array of intermediate chemicals used in downstream processes, such as for the creation of plastics, solvents, and adhesives.

By Application

The chemical intermediates segment dominated the market with a 58% share in 2024. Crotonaldehyde’s use as a key feedstock in producing sorbic acid, butanol, and crotonic acid drives this dominance. Its reactivity and compatibility with multiple chemical reactions support large-scale industrial synthesis. Agrochemicals and flavors & fragrances segments are growing steadily, supported by applications in pesticide formulation and aroma compounds. Increasing demand for preservatives and polymer stabilizers enhances market growth, while expanding downstream chemical industries sustain demand for crotonaldehyde-based intermediates globally.

- For instance, Shandong Kunda Biotechnology expanded its potassium sorbate and sorbic acid production capacity to 30,000 tons per year. The company produces these food-grade preservatives for use in food, pharmaceuticals, and other industries.

By End Use

The food and beverage segment accounted for the largest 41% market share in 2024. Growth is fueled by its use in producing sorbic acid and preservatives that extend product shelf life. Crotonaldehyde’s role in flavor synthesis and stabilizer manufacturing supports consistent demand. The pharmaceuticals and agriculture segments follow, using crotonaldehyde-derived chemicals in drug intermediates and crop protection agents. Expanding processed food consumption, stricter food safety regulations, and increased agricultural productivity needs continue to drive adoption across end-use industries.

Key Growth Drivers

Rising Demand for Chemical Intermediates

The increasing use of crotonaldehyde as a precursor for sorbic acid, n-butanol, and crotonic acid is a major growth driver. Its reactivity and versatility make it essential in producing a wide range of industrial chemicals. Expanding manufacturing capacities in chemical and polymer industries enhance product demand. Growing adoption across coatings, resins, and stabilizers segments strengthens market expansion. Rising industrial output in China, India, and Southeast Asia further supports consistent consumption of crotonaldehyde-based intermediates.

- For instance, Celanese Corporation expanded its Clear Lake, Texas acetyl intermediates facility with a new 1.3 million metric tons per annum acetic acid unit that started up in March 2024. This expansion coincided with the facility’s carbon capture and utilization (CCU) project, which produces 130,000 metric tons of low-carbon methanol from captured industrial CO2.

Growing Applications in Food and Beverage Industry

Crotonaldehyde plays a crucial role in producing sorbic acid and related preservatives used in food processing. The rising consumption of packaged and processed foods globally is driving strong demand for food-grade derivatives. Manufacturers are focusing on improving production efficiency to meet the growing need for safe and stable preservatives. Enhanced food safety standards and stricter quality regulations are further stimulating the use of crotonaldehyde-derived additives. This trend reinforces its importance across global food supply chains.

- For instance, Shandong Kunda Biotechnology Co. is a leading manufacturer of sorbic acid, which is produced using crotonaldehyde and ketene as raw materials.

Expansion of Agrochemical and Pharmaceutical Applications

The agrochemical and pharmaceutical industries are adopting crotonaldehyde as a feedstock for synthesizing key intermediates. Its use in pesticide, herbicide, and vitamin formulations has expanded, driven by increasing agricultural productivity and healthcare needs. Continuous R&D in fine chemicals and bio-based synthesis supports market penetration. The compound’s chemical stability and compatibility enable cost-effective large-scale production. This diversification into high-value applications provides long-term growth opportunities for market participants across developing regions.

Key Trends and Opportunities

Shift Toward Sustainable and Bio-Based Production

Manufacturers are shifting toward eco-friendly production routes using renewable raw materials such as bio-based acetaldehyde. This transition reduces environmental impact and supports compliance with global sustainability standards. Green chemistry initiatives and government incentives for low-emission manufacturing drive adoption of sustainable processes. The trend aligns with industry efforts to reduce carbon footprints while maintaining product performance. Companies investing in advanced catalytic technologies and bio-derived feedstocks are expected to gain competitive advantages in the long term.

- For instance, Eastman Chemical Company operates a large-scale molecular recycling facility at its Kingsport site, which became operational in early 2024. This polyester renewal technology uses methanolysis to recycle hard-to-recycle plastic waste, converting it back into its molecular building blocks to produce new, virgin-quality materials.

Technological Advancements in Process Efficiency

Ongoing technological developments in catalyst design and reactor systems are improving crotonaldehyde production efficiency. Continuous-flow and low-energy synthesis techniques enhance yield and reduce waste. These innovations lower production costs while ensuring product consistency. Automation and process optimization also contribute to higher throughput and reduced operational risks. Companies adopting digital monitoring and AI-driven process control benefit from improved resource management. These advancements support scalability and strengthen competitiveness among global producers.

- For instance, Merck KGaA is currently investing heavily in its Darmstadt headquarters, including a €10 million modular production line using advanced automation technology that can be applied to various chemical processes. The company has also invested in a new Life Science Research Center and a new quality control building at the site.

Growing Opportunities in Emerging Economies

Rising industrialization and demand for chemical intermediates in emerging markets such as India, Indonesia, and Vietnam create new opportunities. Government investments in manufacturing infrastructure and favorable trade policies are supporting local production expansion. Increasing consumption of packaged foods, fertilizers, and pharmaceuticals enhances market potential. Local producers are focusing on backward integration to secure raw materials. This trend is expected to drive regional supply chain efficiency and long-term growth across Asia-Pacific.

Key Challenges

Toxicity and Environmental Concerns

Crotonaldehyde poses significant health and environmental hazards due to its high reactivity and toxicity. Exposure risks during manufacturing and handling require strict safety measures and regulatory compliance. Stringent environmental standards in Europe and North America limit its large-scale use in certain applications. Disposal and emission control challenges increase operational costs for producers. Growing preference for safer substitutes may restrain demand, compelling companies to develop cleaner, less hazardous production routes.

Fluctuating Raw Material Prices

The crotonaldehyde production process depends heavily on acetaldehyde and other petrochemical feedstocks. Price volatility in these inputs directly affects manufacturing costs and profitability. Supply chain disruptions and crude oil fluctuations further intensify pricing instability. Producers face challenges in maintaining consistent margins amid changing global economic conditions. The market’s reliance on petroleum-based raw materials also raises sustainability concerns. Diversifying feedstock sources and enhancing supply chain resilience remain critical to addressing this issue.

Regional Analysis

North America

North America held a 27% share of the Crotonaldehyde market in 2024, driven by strong demand from the food processing and pharmaceutical sectors. The United States leads regional consumption due to the presence of major chemical manufacturers and advanced production facilities. Increasing adoption of crotonaldehyde-derived preservatives and intermediates in packaged foods supports steady growth. Regulatory initiatives promoting safer industrial chemicals have encouraged innovation in synthesis methods. Continuous R&D investments and demand for high-purity grades in specialty chemical applications further strengthen regional market performance.

Europe

Europe accounted for a 25% share of the Crotonaldehyde market in 2024, supported by growing use in food additives, fragrances, and industrial intermediates. Germany, France, and the Netherlands serve as key production hubs owing to their established chemical industries. The region’s stringent environmental regulations are pushing producers to adopt cleaner, low-emission manufacturing processes. Rising demand from the cosmetics and pharmaceutical industries also contributes to growth. Sustainability-focused initiatives and technological advancements in production efficiency are expected to sustain Europe’s strong position in the global market during the forecast period.

Asia-Pacific

Asia-Pacific dominated the Crotonaldehyde market with a 38% share in 2024, led by rapid industrial expansion in China, India, and Japan. High demand from food processing, agrochemicals, and polymer manufacturing sectors fuels regional growth. The availability of low-cost raw materials and large-scale production facilities enhances competitiveness. Increasing investments in chemical manufacturing and favorable government policies further boost domestic production. Growing demand for sorbic acid, butanol, and other downstream chemicals continues to strengthen Asia-Pacific’s leadership. The region remains a primary driver of global supply, supported by a strong manufacturing ecosystem and export capacity.

Latin America

Latin America captured a 6% share of the Crotonaldehyde market in 2024, supported by rising industrial activity and agricultural expansion. Brazil and Mexico represent the largest markets due to the growth of agrochemical and food processing industries. The region’s increasing adoption of crotonaldehyde derivatives in preservatives and crop protection chemicals supports steady demand. Economic recovery and industrial diversification initiatives have encouraged regional chemical production. Investments in modernizing manufacturing facilities and expanding exports to North America and Europe are expected to enhance Latin America’s market contribution over the forecast period.

Middle East & Africa

The Middle East & Africa held a 4% share of the Crotonaldehyde market in 2024. Market growth is driven by expanding construction, packaging, and agricultural sectors that utilize crotonaldehyde-based intermediates. The United Arab Emirates and Saudi Arabia are emerging as regional trade centers for chemical distribution. Increasing government support for industrial diversification and downstream chemical manufacturing is fostering local production capabilities. Rising demand for agrochemicals and specialty chemicals contributes to gradual market development. Continued investments in industrial infrastructure and partnerships with Asian suppliers are expected to improve regional supply stability.

Market Segmentations:

By Grade

- Technical grade

- Chemical grade

By Application

- Chemical intermediates

- Flavors & fragrances

- Agrochemicals

- Others

By End Use

- Food & beverage

- Pharmaceuticals

- Agriculture

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Crotonaldehyde market features key players such as BASF SE, Celanese Corporation, Shandong Kunda Biotechnology Co., Transpek-Silox Industry Pvt. Ltd, Tokyo Chemical Industry, Merck KGaA, Nantong Acetic Acid Chemical, Alfa Aesar, Eastman Chemical Company, and Haihang Industry Co., Ltd. These companies focus on expanding production capacities, improving catalytic efficiency, and developing sustainable manufacturing technologies. BASF SE and Celanese lead through integrated supply chains and strong global distribution networks. Asian manufacturers, particularly in China and India, are increasing output to meet regional demand and export needs. Strategic collaborations, capacity expansions, and investments in eco-friendly synthesis methods remain core strategies. Continuous innovation in high-purity grades, coupled with customized formulations for food, pharmaceutical, and agrochemical applications, is strengthening market competitiveness. Growing emphasis on environmental compliance and raw material optimization further differentiates leading producers in the global Crotonaldehyde market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Shandong Kunda Biotechnology Co.

- Celanese Corporation

- Transpek-Silox Industry Pvt. Ltd

- Tokyo Chemical Industry

- Merck KGaA

- Nantong Acetic Acid Chemical

- Alfa Aesar

- Eastman Chemical Company

- Haihang Industry Co., Ltd.

Recent Developments

- In April 2025, Tokyo Chemical Industry introduced new crotonaldehyde-based reagents to its synthetic chemistry product lineup, targeting research institutions and specialty chemical manufacturers requiring high-grade, low-impurity aldehydes.

- In 2025, Silox Industry Pvt. Ltd began plant upgrades at its Gujarat site in India, focusing on modernized aldehyde production units and streamlined logistics to serve growing agrochemical and specialty chemical market demand.

- In 2024, Celanese Corporation was recognized for a key expansion in crotonaldehyde application, following its ongoing collaborations to develop high-purity aldehyde derivatives for use in adhesives, sealants, and acetate tow production for industrial clients.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for crotonaldehyde will rise with expanding chemical and polymer manufacturing sectors.

- Food and beverage applications will grow due to increased use of sorbic acid preservatives.

- Technological improvements in catalytic efficiency will enhance production yield and purity.

- Bio-based production routes will gain traction to meet sustainability targets.

- Agrochemical applications will expand with rising global crop protection needs.

- Pharmaceutical synthesis will drive steady demand for high-purity crotonaldehyde derivatives.

- Asia-Pacific will continue leading global production and consumption growth.

- Strategic partnerships among chemical producers will strengthen global supply networks.

- Environmental regulations will encourage cleaner and safer manufacturing methods.

- Innovation in downstream applications will open new opportunities in specialty chemicals.