Market Overview

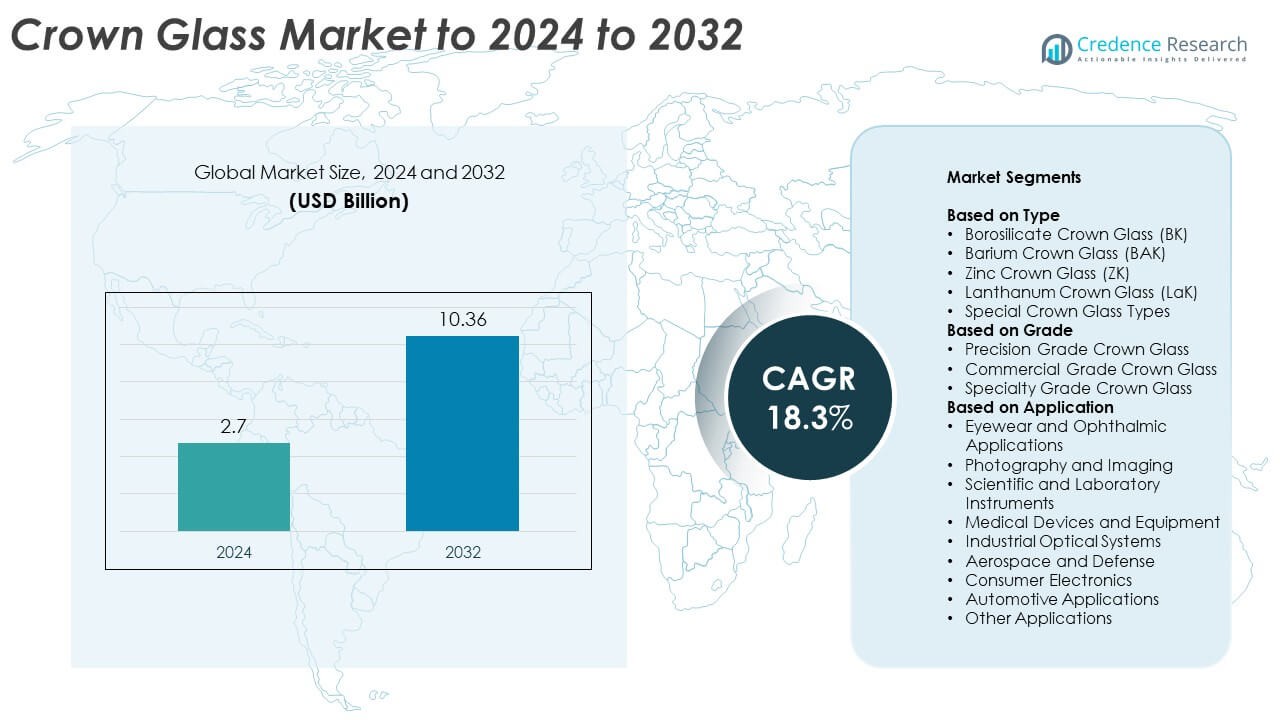

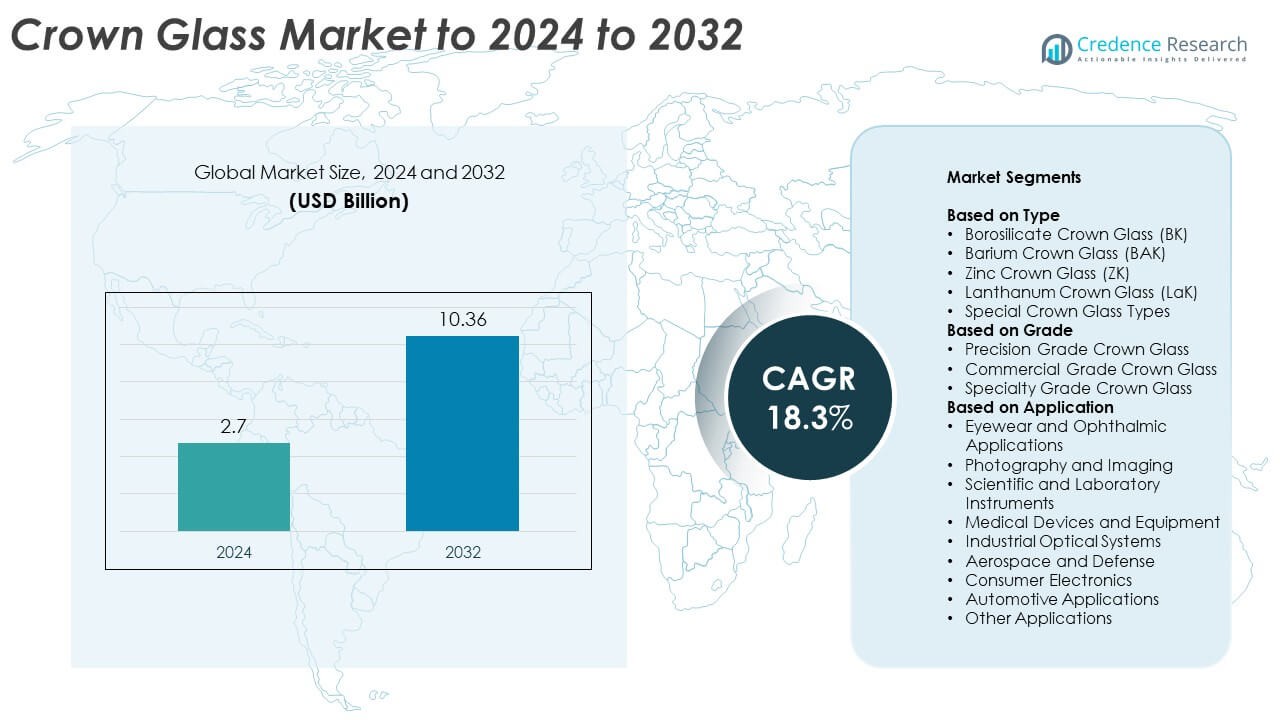

Crown Glass Market size was valued USD 2.7 Billion in 2024 and is anticipated to reach USD 10.36 Billion by 2032, at a CAGR of 18.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crown Glass Market Size 2024 |

USD 2.7 Billion |

| Crown Glass Market, CAGR |

18.3 % |

| Crown Glass Market Size 2032 |

USD 10.36 Billion |

The Crown Glass Market is led by major players such as Corning Inc., SCHOTT AG, Saint-Gobain, HOYA Corporation, Ohara Corporation, Nippon Electric Glass, and CDGM Glass Company. These companies focus on developing high-performance optical materials for applications in electronics, aerospace, and healthcare. Their strong emphasis on innovation, product precision, and global distribution enhances market competitiveness. North America emerged as the leading regional market in 2024, accounting for 31% of the total share, driven by advanced optical manufacturing, robust defense investments, and rising demand for precision lenses and scientific instruments across industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Insights

- The Crown Glass Market was valued at USD 2.7 Billion in 2024 and is expected to reach USD 10.36 Billion by 2032, growing at a CAGR of 18.3%.

- Rising demand for high-precision optical materials in eyewear, imaging, and aerospace applications is driving market growth.

- Manufacturers are focusing on advanced borosilicate and lanthanum-based crown glass to meet performance requirements in defense and healthcare sectors.

- The market is highly competitive, with major players emphasizing R&D, sustainability, and strategic partnerships to strengthen their global presence.

- North America led with 31% share in 2024, followed by Europe with 28% and Asia Pacific with 30%, while Borosilicate Crown Glass accounted for the largest segment share of 38%.

Market Segmentation Analysis:

By Type

Borosilicate Crown Glass (BK) dominated the Crown Glass Market in 2024, holding nearly 38% share. Its strong thermal resistance, optical clarity, and low dispersion make it ideal for lenses and optical components. Barium Crown Glass (BAK) followed closely, driven by higher refractive indices used in precision lenses and microscopy. Zinc and Lanthanum Crown Glass types are also gaining traction in high-end imaging and defense optics. The demand for BK glass continues to rise due to its superior performance in both scientific and consumer optical systems.

- For instance, the technical datasheet for SCHOTT N-BK7 optical glass lists a refractive index (\(n_{d}\)) of 1.51680 (at 587.6 nm) and an Abbe number (\(V_{d}\)) of 64.17.

By Grade

Precision Grade Crown Glass accounted for the largest market share of about 44% in 2024. This segment’s dominance is fueled by its use in high-accuracy optical lenses, scientific instruments, and advanced imaging devices. Commercial Grade Crown Glass caters to general optical applications, providing cost-effective solutions for consumer and industrial products. Specialty Grade Crown Glass, with tailored compositions, supports niche uses such as aerospace optics and laser systems. Growth in precision engineering and metrology has strengthened demand for Precision Grade glass globally.

- For instance, Thorlabs offers a range of optical components, and while its standard N-BK7 “High Precision Windows” typically achieve λ/2 flatness and a 40-20 scratch-dig surface quality, the company also provides components with more stringent specifications, such as a λ/10 flatness and a 20-10 scratch-dig, for custom or specialized applications.

By Application

Eyewear and Ophthalmic Applications represented the leading segment in 2024, with a 32% market share. The segment benefits from rising global demand for prescription lenses, contact lenses, and smart eyewear. Photography and Imaging also contribute significantly, driven by digital camera and telescope production. Scientific instruments and medical devices employ crown glass for its optical uniformity and chemical stability. Expanding use in automotive sensors and aerospace vision systems further supports market expansion, as manufacturers increasingly rely on lightweight, high-transparency optical materials.

Key Growth Drivers

Rising Demand for High-Precision Optical Components

The expanding use of high-precision optical instruments in industries such as healthcare, defense, and electronics is a major growth driver for the crown glass market. Manufacturers prefer crown glass due to its excellent optical clarity and minimal chromatic aberration. Growing adoption in scientific and laboratory applications further strengthens demand. Increasing investments in imaging technologies and laser optics continue to support the use of borosilicate and lanthanum-based crown glass types across advanced optical systems worldwide.

- For instance, OHARA’s S-LAL7 optical glass lists a refractive index (\(n_{d}\)) of 1.65160 and an Abbe number (\(V_{d}\)) of 58.55. S-LAL7Q is a newer version of the glass with improved chemical durability and processability, but it maintains the same refractive indices and Abbe number.

Expansion of Consumer Electronics and Eyewear Applications

The rapid growth of the consumer electronics sector, including smartphones, AR devices, and smart eyewear, drives the consumption of crown glass. Its lightweight properties and superior transparency make it ideal for camera lenses and augmented displays. Rising global demand for prescription lenses and advanced eyewear enhances production volumes. Companies are increasingly developing thinner and more durable crown glass materials to meet consumer preferences for compact and high-quality optical devices.

- For instance, HOYA offers a lineup of optical materials and wafers for AR/MR waveguides with options categorized by refractive index values, from approximately 1.7 to 2.0.

Advancements in Aerospace and Defense Optics

The aerospace and defense industries are adopting crown glass for precision targeting, navigation, and sensor systems. Its ability to withstand temperature fluctuations and radiation exposure makes it suitable for demanding environments. Increased investments in surveillance and satellite optics also stimulate market growth. Defense modernization programs across the U.S., Europe, and Asia-Pacific are accelerating the need for durable, high-transmission optical materials, positioning crown glass as a preferred choice in mission-critical applications.

Key Trends & Opportunities

Emergence of Specialty and Lanthanum-Based Crown Glass

The trend toward specialty crown glass formulations, such as lanthanum-based types, is gaining momentum. These variants offer high refractive indices and low dispersion, improving performance in optical imaging and laser systems. Growing demand from scientific and defense applications encourages research into new glass compositions. This shift toward high-performance materials creates strong opportunities for manufacturers focused on innovation and precision engineering in optical technologies.

- For instance, the optical glass SUMITA K-LaKn7 lists a refractive index (\(n_{d}\)) of 1.67000 and an Abbe number (\(V_{d}\)) of 51.7, as specified in product data from the manufacturer.

Integration of Crown Glass in Medical and Imaging Devices

Medical device manufacturers are increasingly adopting crown glass for diagnostic imaging and optical instruments. Its biocompatibility, clarity, and stability enhance accuracy in endoscopes and microscopes. The surge in healthcare infrastructure and diagnostic procedures boosts consumption. Market players are collaborating with healthcare OEMs to develop customized optical solutions, positioning crown glass as a key enabler for precision healthcare technologies and advanced medical imaging systems.

- For instance, ZEISS Plan-Apochromat 20x/0.8 lists 0.55 mm working distance. The objective specifies a 25 mm field of view. The numerical aperture is 0.8.

Key Challenges

High Production Costs and Complex

Manufacturing Processes

Crown glass production involves intricate refining and melting processes, leading to high costs and limited scalability. Maintaining uniform optical properties and low impurity levels requires advanced equipment and skilled labor. Smaller manufacturers face barriers in achieving precision standards demanded by high-end applications. These cost challenges often restrict market penetration in low-margin consumer segments, prompting companies to explore cost-efficient production technologies and material substitutes.

Competition from Alternative Optical Materials

The increasing use of alternative optical materials such as synthetic quartz, sapphire, and polymer-based lenses poses a major challenge. These substitutes often offer comparable optical performance with lower production costs or higher flexibility. Continuous improvements in plastic optics for consumer devices intensify competition. To remain competitive, crown glass manufacturers must focus on innovations that enhance durability, temperature resistance, and environmental sustainability while maintaining optical superiority.

Regional Analysis

North America

North America held a 31% share of the Crown Glass Market in 2024, driven by strong demand across aerospace, defense, and healthcare sectors. The United States leads regional consumption due to advanced optical manufacturing capabilities and growing investments in high-precision imaging systems. Expanding use of crown glass in ophthalmic applications and scientific instrumentation supports steady market growth. Rising adoption in medical diagnostics and research laboratories further strengthens regional revenue, while Canada’s increasing focus on optical component exports enhances overall North American competitiveness in the global market.

Europe

Europe accounted for 28% of the global Crown Glass Market in 2024, supported by its established optics and photonics industries. Germany, France, and the United Kingdom dominate production due to their expertise in precision glass manufacturing. Demand is concentrated in automotive sensors, defense optics, and scientific equipment. The region’s emphasis on sustainable materials and high-performance glass products fosters innovation. Investments in smart mobility, renewable energy systems, and industrial automation are expanding the use of optical glass, reinforcing Europe’s position as a key hub for technological development and export.

Asia Pacific

Asia Pacific captured a 30% share of the Crown Glass Market in 2024, emerging as the fastest-growing regional segment. China, Japan, and South Korea lead consumption due to rapid industrialization and the rise of consumer electronics manufacturing. Expanding production of smartphones, cameras, and smart eyewear supports strong regional demand. Local investments in optical research and defense applications further stimulate market expansion. India’s growing presence in precision engineering and low-cost manufacturing enhances supply capabilities, positioning Asia Pacific as a global leader in both production and technological advancement in crown glass materials.

Latin America

Latin America represented a 6% share of the Crown Glass Market in 2024, driven mainly by growing adoption in healthcare and automotive sectors. Brazil and Mexico lead the regional market due to increased industrial activity and expanding optical imports. Rising use of crown glass in diagnostic instruments, imaging systems, and educational equipment supports market development. The region benefits from partnerships with European and Asian manufacturers focused on distributing precision glass components. Although growth remains moderate, ongoing infrastructure modernization and healthcare investment are expected to create new opportunities in the forecast period.

Middle East and Africa

The Middle East and Africa accounted for 5% of the Crown Glass Market in 2024, with increasing applications in defense optics and medical equipment. The United Arab Emirates and Saudi Arabia are key contributors, emphasizing technological investments in scientific research and security systems. South Africa’s growing healthcare and education sectors also drive demand for optical instruments. Regional growth is supported by government-funded projects in research and renewable energy applications. Despite limited local manufacturing, the market is expanding steadily through imports and collaborative ventures with established global optical material producers.

Market Segmentations:

By Type

- Borosilicate Crown Glass (BK)

- Barium Crown Glass (BAK)

- Zinc Crown Glass (ZK)

- Lanthanum Crown Glass (LaK)

- Special Crown Glass Types

By Grade

- Precision Grade Crown Glass

- Commercial Grade Crown Glass

- Specialty Grade Crown Glass

By Application

- Eyewear and Ophthalmic Applications

- Photography and Imaging

- Scientific and Laboratory Instruments

- Medical Devices and Equipment

- Industrial Optical Systems

- Aerospace and Defense

- Consumer Electronics

- Automotive Applications

- Other Applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Crown Glass Market features several leading players such as Corning Inc., SCHOTT AG, Saint-Gobain, HOYA Corporation, Ohara Corporation, Nippon Electric Glass, and CDGM Glass Company. These companies focus on developing high-quality optical materials with superior thermal and refractive properties. Competitive strategies include continuous investment in R&D, advanced glass formulations, and automation in production. Firms are also expanding partnerships with optical device manufacturers to enhance product reach across consumer electronics, aerospace, and healthcare sectors. Emphasis on precision-grade and specialty glass for scientific instruments and imaging systems strengthens their market positions. Growing sustainability initiatives and integration of eco-efficient production processes further define the competitive dynamics within the global crown glass industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, SCHOTT introduced its new BOROFLOAT Crown Glass Series.

- In 2025, HOYA added new optical glass types, FD300 and MC-NBFD130L, to its portfolio. These additions further expanded the company’s precision crown glass offerings for high-end optical systems.

- In 2023, SCHOTT introduced a new Type I borosilicate glass tubing called FIOLAX® Pro. The innovation is designed to meet future demands for complex pharmaceuticals, sustainability, and digitalization.

Report Coverage

The research report offers an in-depth analysis based on Type, Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-precision optical materials will rise with advancements in imaging and laser technologies.

- The eyewear and ophthalmic industry will continue driving consistent consumption of crown glass globally.

- Asia Pacific will maintain strong growth due to expanding electronics and defense sectors.

- Innovation in lanthanum and specialty crown glass compositions will support performance-focused applications.

- Increased investment in aerospace optics will enhance demand for durable and temperature-resistant glass.

- Healthcare and medical imaging applications will create new opportunities for precision-grade materials.

- Manufacturers will focus on reducing production costs through automation and material optimization.

- Environmental regulations will encourage the use of eco-friendly and recyclable glass formulations.

- Collaborations between optical manufacturers and research institutions will accelerate product development.

- Global competition from alternative materials will push companies toward innovation and quality enhancement.