Market Overview

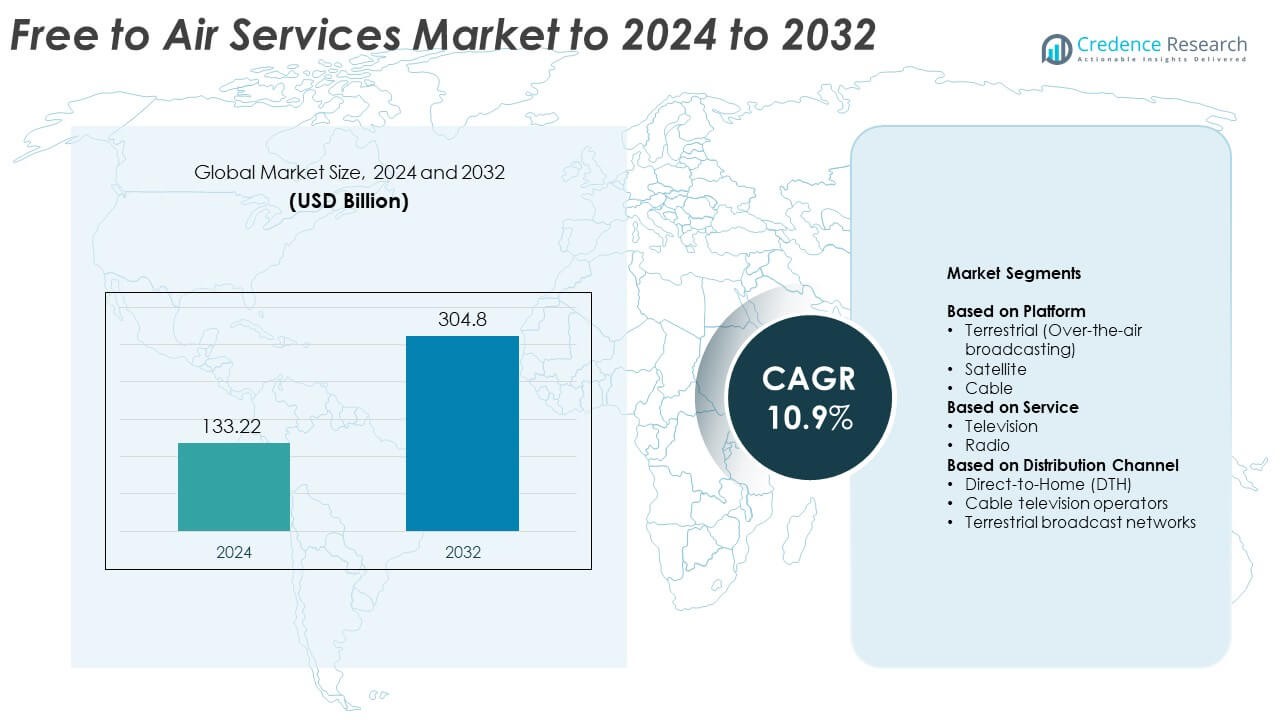

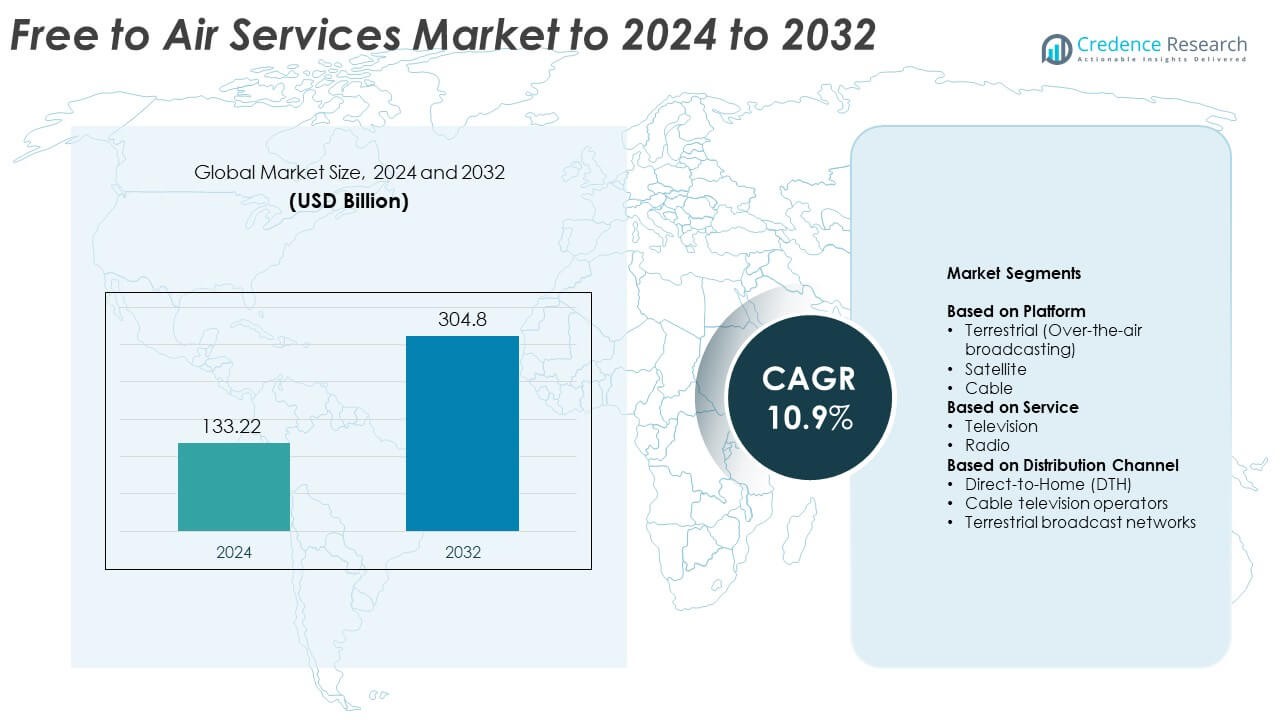

The Free to Air Services Market size was valued at USD 133.22 billion in 2024 and is anticipated to reach USD 304.8 billion by 2032, at a CAGR of 10.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Free to Air Services Market Size 2024 |

USD 133.22 Billion |

| Free to Air Services Market, CAGR |

10.9% |

| Free to Air Services Market Size 2032 |

USD 304.8 Billion |

The Free to Air Services Market is dominated by major broadcasters such as British Broadcasting Corporation, China Central Television, Australian Broadcasting Corporation, Columbia Broadcasting System, and Nippon Hoso Kyokai. These companies lead through strong regional presence, advanced transmission technologies, and diverse content portfolios that cater to global audiences. Strategic investment in digital broadcasting, high-definition channels, and hybrid broadcast-broadband platforms has strengthened their market positioning. North America emerged as the leading region in 2024, capturing a 32% market share, supported by robust infrastructure, technological adoption, and increasing consumer preference for free-to-access, high-quality television and radio content.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Free to Air Services Market was valued at USD 133.22 billion in 2024 and is expected to reach USD 304.8 billion by 2032, growing at a CAGR of 10.9%.

- Expanding digital broadcasting networks and government initiatives promoting free public access are key drivers boosting global adoption.

- The market is witnessing trends such as high-definition broadcasting, AI-based content analytics, and increasing regional language programming for audience engagement.

- Competition remains strong as major broadcasters focus on digital upgrades, advertising-based revenue models, and localized content strategies to retain market share.

- North America led the market with a 32% share in 2024, followed by Europe at 28% and Asia Pacific at 26%, while the satellite segment dominated with 46% share due to wide coverage and reliable transmission quality.

Market Segmentation Analysis:

By Platform

The satellite segment dominated the Free to Air Services Market in 2024, accounting for 46% of the total share. Satellite broadcasting offers broad coverage, making it the preferred choice in rural and remote regions. The segment benefits from high signal quality, minimal infrastructure needs, and growing adoption of high-definition and 4K channels. Continuous technological upgrades in transponder capacity and digital compression further enhance efficiency. Expanding global reach and increasing investments by service providers to improve satellite bandwidth and coverage are driving growth in this platform segment.

- For instance, Eutelsat says it broadcasts ~6,500 TV channels to over 1 billion viewers worldwide.

By Service

The television segment held the largest share of 68% in 2024, driven by the strong demand for free entertainment and news content across developing and developed economies. Broadcasters are leveraging advertising-supported models and digital upgrades to attract large audiences. The rise of digital terrestrial transmission and integration with smart TVs have boosted free-to-air television access. Public service broadcasting initiatives and government policies promoting information access also strengthen this segment. Continuous innovation in broadcasting formats and localized content offerings sustain television’s dominance in the service category.

- For instance, Prasar Bharati’s DD Free Dish carries 184 TV channel slots, and its reach has grown, with official estimates at 49 million households in 2024.

By Distribution Channel

The direct-to-home (DTH) segment led the Free to Air Services Market in 2024 with a 49% market share. DTH platforms deliver content directly to households without intermediary cable networks, offering better signal quality and wide channel choices. The segment’s growth is supported by rising consumer preference for subscription-free entertainment and the expansion of digital satellite services. Affordable set-top boxes and improved receiver technology further boost accessibility. The increasing popularity of regional content and government initiatives promoting free satellite broadcasting continue to enhance the adoption of DTH distribution globally.

Key Growth Drivers

Expanding Access to Digital Broadcasting Infrastructure

The expansion of digital broadcasting infrastructure is a major driver for the Free to Air Services Market. Governments are investing in digital switchover programs that enhance transmission quality and spectrum efficiency. This shift enables broadcasters to deliver more channels with improved picture and sound quality. Increasing digital penetration in emerging economies also boosts accessibility for rural audiences. The adoption of next-generation broadcasting standards like DVB-T2 and ISDB-T is further accelerating growth by enhancing spectrum utilization and expanding coverage areas.

- For instance, Arqiva manages 1,450 radio and TV broadcast sites and reports Digital Terrestrial Television (DTT) coverage of 98.5% of the UK population via Freeview.

Rising Demand for Cost-Free Entertainment Platforms

Growing consumer preference for cost-free media content fuels the adoption of Free to Air (FTA) services. Economic constraints and subscription fatigue from paid streaming platforms are pushing audiences toward free alternatives. FTA services provide accessible entertainment and information without recurring costs, making them attractive across low- and middle-income households. The combination of wide channel availability, diverse programming, and local language content continues to strengthen viewership. This affordability advantage positions FTA as a resilient platform against subscription-based streaming competitors.

- For instance, PBS reaches millions of U.S. TV households in a year via member stations, and a Nielsen study from 2016-2017 found that 80% of all U.S. TV households view PBS programs annually.

Government Policies Promoting Public Broadcasting

Government-led initiatives supporting public broadcasting significantly drive market expansion. Many countries mandate free access to educational, cultural, and news programs as part of their public service broadcasting mission. These policies ensure equitable access to information and encourage the development of state-funded channels. In regions like Europe and Asia-Pacific, policy support for free satellite and terrestrial broadcasting enhances network coverage. Such regulatory efforts strengthen content diversity while promoting national identity, contributing to stable growth in the Free to Air Services Market.

Key Trends & Opportunities

Integration of Advanced Transmission Technologies

Adoption of advanced transmission technologies presents significant opportunities for FTA broadcasters. The transition to digital and high-efficiency video coding (HEVC) standards enables improved picture quality and reduced bandwidth usage. Broadcasters are integrating hybrid broadcast-broadband (HbbTV) services, allowing interactive content delivery and on-demand access. The use of AI-based content recommendations further enhances viewer engagement. These technological advancements not only modernize traditional broadcasting but also open new revenue streams through targeted advertising and enhanced audience analytics.

- For instance, following the final phase of deployment around the Paris 2024 Olympic Games, TDF reported that French DTT UHD for France 2 and France 3 covers 75% of the population, enabling approximately 50 million people to receive the broadcasts.

Growing Local and Regional Content Demand

The rising demand for localized and regional content represents a strong trend in the FTA landscape. Viewers increasingly seek programming that reflects their cultural identity and language preferences. Broadcasters are responding by producing region-specific shows, community news, and educational content. This shift enhances audience loyalty and strengthens regional advertising opportunities. Partnerships between local producers and FTA networks also improve content diversity. As competition intensifies, the ability to deliver culturally relevant programming remains a key advantage for market participants.

- For instance, Everyone TV operates the platforms Freeview and Freesat, which have a combined reach of over 17 million UK households.

Key Challenges

Competition from Paid and On-Demand Streaming Platforms

Intense competition from paid and on-demand streaming services poses a significant challenge to FTA operators. Platforms like Netflix, Disney+, and Amazon Prime offer exclusive content and personalized viewing experiences, attracting younger audiences. As streaming services expand into low-cost subscription models, they erode the traditional FTA viewership base. Maintaining audience engagement requires continuous innovation in content delivery and quality. Broadcasters must adopt hybrid models or integrate digital platforms to remain competitive against evolving consumer preferences.

Declining Advertising Revenue Amid Changing Media Consumption

Shifts in advertising expenditure toward digital platforms are reducing revenue streams for FTA broadcasters. Advertisers are increasingly favoring online and social media channels due to their data-driven targeting capabilities. Traditional broadcasters struggle to compete with these precise analytics and audience segmentation tools. This trend pressures FTA networks to adapt and explore alternative monetization strategies. Investments in digital advertising technologies and cross-platform campaigns are essential to sustain profitability amid the evolving advertising ecosystem.

Regional Analysis

North America

North America held a 32% market share in the Free to Air Services Market in 2024, driven by strong digital broadcasting infrastructure and extensive adoption of satellite and terrestrial transmission systems. The United States leads the region due to the presence of public broadcasting networks and diverse entertainment content. Canada also contributes through advanced government-supported free broadcasting initiatives. Increasing consumer demand for cost-free high-definition content and growing reach of digital terrestrial services continue to support market expansion. The region’s focus on technology integration and ad-supported programming sustains its competitive edge.

Europe

Europe accounted for 28% of the global market share in 2024, supported by robust public broadcasting systems and a well-established regulatory framework promoting free access to media. The United Kingdom, Germany, and France dominate the regional landscape with strong terrestrial and satellite coverage. European consumers benefit from high-quality digital television and multilingual channels, enhancing viewer engagement. Public broadcasters such as BBC and ARD maintain leadership through diversified programming and cultural content. Continuous government support for free broadcasting and growing digital infrastructure investments further strengthen Europe’s market position.

Asia Pacific

Asia Pacific captured 26% of the Free to Air Services Market share in 2024, fueled by rapid digitalization and increasing television penetration across emerging economies. Countries such as India, China, and Indonesia are expanding terrestrial and satellite coverage to reach rural areas. The region benefits from government policies promoting educational and entertainment broadcasting at no cost. Rising middle-class populations and high demand for regional-language content drive steady viewership growth. Technological improvements, including the shift toward digital terrestrial broadcasting, are expected to further boost market development across Asia Pacific.

Latin America

Latin America held an 8% market share in 2024, driven by the increasing demand for affordable media access and improved signal transmission infrastructure. Countries such as Brazil, Mexico, and Argentina are enhancing free-to-air broadcasting coverage through digital switchover programs. The expansion of terrestrial and satellite networks has improved rural connectivity and boosted audience engagement. Public initiatives aimed at promoting cultural and educational programming also strengthen adoption. The region’s shift toward digital platforms and multilingual broadcasting supports future market growth despite economic and regulatory challenges.

Middle East and Africa

The Middle East and Africa accounted for a 6% share of the global Free to Air Services Market in 2024, supported by growing satellite broadcasting penetration and demand for regional content. Gulf countries such as the UAE and Saudi Arabia are investing in high-definition broadcasting networks. In Africa, initiatives promoting educational and community-oriented television channels enhance public engagement. The affordability of FTA services makes them a preferred entertainment option. Ongoing infrastructure improvements and regional partnerships with international broadcasters are expected to expand accessibility across underserved areas.

Market Segmentations:

By Platform

- Terrestrial (Over-the-air broadcasting)

- Satellite

- Cable

By Service

By Distribution Channel

- Direct-to-Home (DTH)

- Cable television operators

- Terrestrial broadcast networks

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Free to Air Services Market features key players such as British Broadcasting Corporation, China Central Television, Australian Broadcasting Corporation, Columbia Broadcasting System, Nippon Hoso Kyokai, Nine Entertainment Co. Holdings, Seven West Media, ProSiebenSat.1, Die ARD, TF1 Group, Fuji Television Network, Nexstar Media, Public Broadcasting Service, and PBS launched. These broadcasters compete through advanced transmission infrastructure, diverse regional programming, and strong advertising partnerships. Companies are investing in digital upgrades, high-definition formats, and hybrid broadcast-broadband platforms to enhance viewer engagement. Growing emphasis on localized content, cultural programming, and real-time news delivery strengthens audience loyalty. Strategic collaborations with telecom operators and streaming platforms further expand content accessibility. Market leaders also focus on sustainable broadcasting practices and AI-based analytics to optimize audience reach and advertisement placement. The industry remains highly competitive, with ongoing innovation, policy support, and content diversification shaping the future of global free-to-air broadcasting.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- British Broadcasting Corporation

- China Central Television

- Australian Broadcasting Corporation

- Columbia Broadcasting System

- Nippon Hoso Kyokai (Japan Broadcasting Corporation)

- Nine Entertainment Co. Holdings Limited

- Seven West Media Limited

- 1 (Germany)

- Die ARD

- TF1 Group

- Fuji Television Network, Inc.

- Nexstar Media

- Public Broadcasting Service

Recent Developments

- In 2025, Nexstar launched free live local news apps for its affiliate stations in 116 television markets.

- In 2024, ProSiebenSat.1 (Germany) Expanded its reach by launching the Joyn streaming app on Deutsche Telekom’s MagentaTV platform in Germany. In a further expansion, ProSiebenSat.1 launched a Swiss version of Joyn.

- In 2024, TF1 Group Launched its free streaming platform, TF1+, expanding its on-demand content and introducing exclusive news coverage and FAST channels.

Report Coverage

The research report offers an in-depth analysis based on Platform, Service, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital broadcasting upgrades will expand free-to-air coverage across developing and rural regions.

- Governments will continue supporting public broadcasting to ensure universal media access.

- Satellite-based services will gain momentum due to wider signal reach and improved transmission quality.

- Integration of hybrid broadcast-broadband systems will enhance interactivity and viewer engagement.

- Regional and local content production will rise to attract culturally diverse audiences.

- High-definition and 4K broadcasting will become standard in free-to-air platforms.

- Advertising models will shift toward data-driven and personalized campaigns.

- Strategic alliances between broadcasters and telecom providers will boost distribution efficiency.

- Technological innovations like AI-based content analytics will improve viewer targeting.

- Free-to-air services will remain vital for emergency communication and public awareness programs.