Market Overview

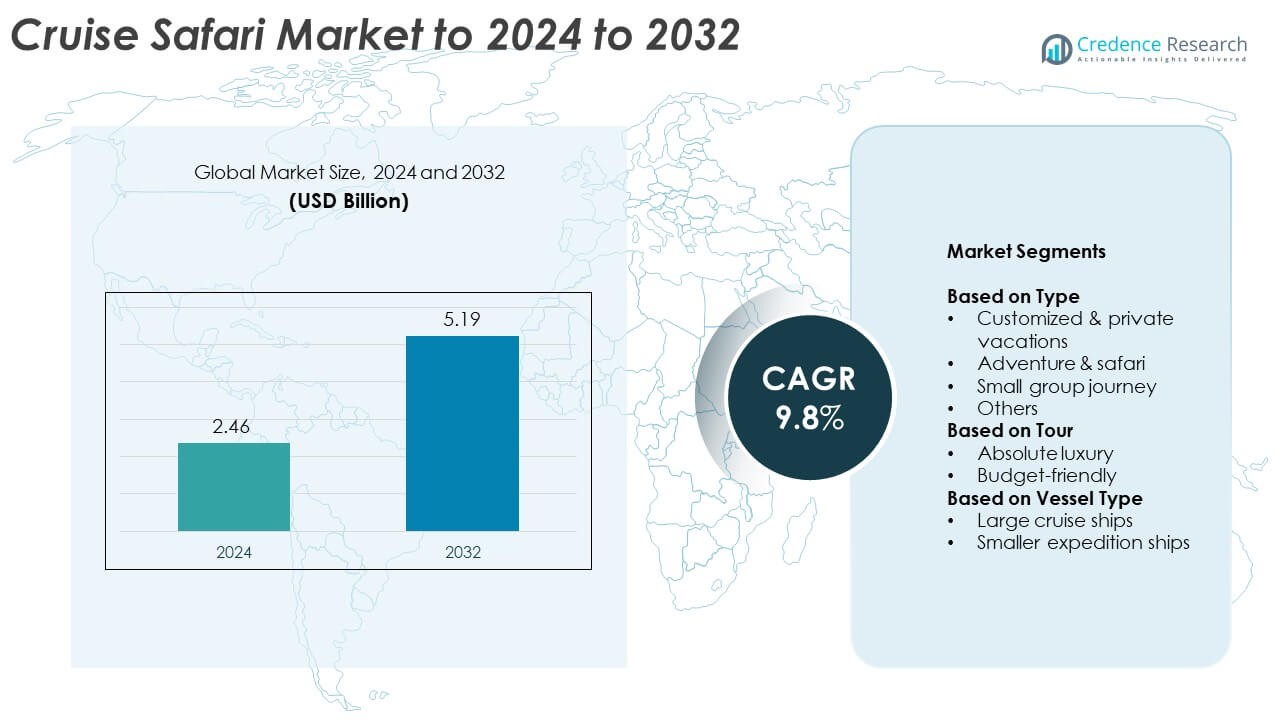

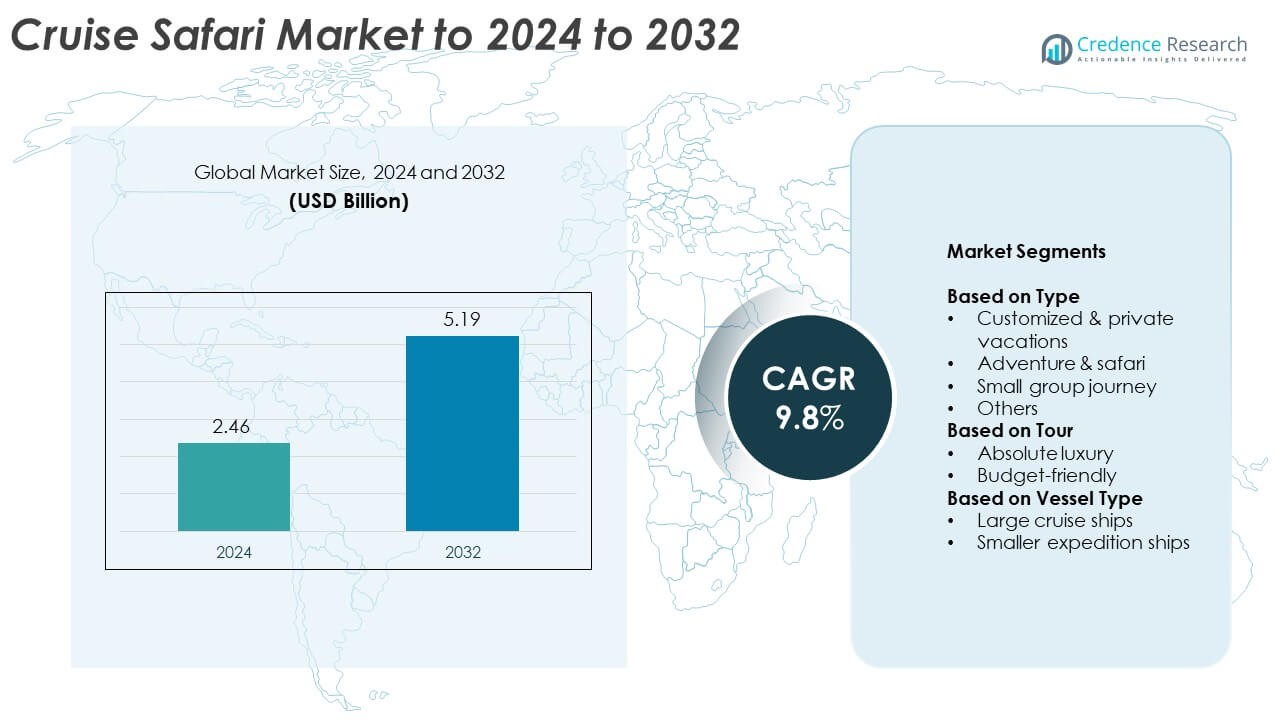

Cruise Safari Market size was valued at USD 2.46 Billion in 2024 and is anticipated to reach USD 5.19 Billion by 2032, at a CAGR of 9.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cruise Safari Market Size 2024 |

USD 2.46 Billion |

| Cruise Safari Market, CAGR |

9.8% |

| Cruise Safari Market Size 2032 |

USD 5.19 Billion |

The Cruise Safari Market is shaped by leading players such as Hurtigruten, Ponant Explorations Group, G Adventures, Aurora Expeditions, Lindblad Expeditions, National Geographic Expeditions, Celebrity Cruises (Celebrity Flora), Hapag-Lloyd Cruises (HANSEATIC Nature), Mangunda Safari Cruise, and Oceanwide Expeditions. These companies focus on eco-friendly operations, customized itineraries, and luxury expedition experiences to strengthen their global presence. North America led the market in 2024 with a 28% share, supported by growing demand for adventure-based travel and sustainable cruise experiences. Europe followed closely with a 25% share, driven by high outbound tourism and expanding expedition routes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cruise Safari Market was valued at USD 2.46 Billion in 2024 and is expected to reach USD 5.19 Billion by 2032, growing at a CAGR of 9.8%.

- Rising demand for experiential and eco-friendly travel experiences is driving market growth, supported by increasing interest in adventure-based cruises and luxury expeditions.

- Key trends include the adoption of hybrid-powered vessels, sustainable operations, and expansion into new destinations across Asia and South America.

- The market is moderately competitive, with companies focusing on route innovation, smaller expedition ships, and premium onboard services to attract high-value travelers.

- North America led the market with a 28% share in 2024, followed by Europe with 25%, while the adventure and safari segment dominated by type with around 42% market share.

Market Segmentation Analysis:

By Type

The adventure and safari segment dominated the cruise safari market in 2024 with a share of around 42%. This segment attracts travelers seeking immersive wildlife experiences, combining luxury amenities with nature-based exploration. The growing demand for sustainable and experiential travel drives this segment, as travelers prefer guided expeditions to remote destinations such as African coasts and Galápagos Islands. The customized and private vacation category also shows steady growth due to rising interest in tailor-made itineraries, privacy, and exclusive onboard services appealing to premium travelers and small groups.

- For instance, Quark Expeditions’ Ultramarine carries a maximum of 199 guests, features two twin-engine helicopters, and an internal hangar for 20 quick-launching Zodiacs, enabling remote landings and off-ship excursions for polar wildlife viewing.

By Tour

The absolute luxury tour segment held the largest share of about 58% in 2024. Luxury cruise safaris provide high-end accommodation, personalized services, and fine dining experiences, attracting affluent travelers seeking exclusivity and comfort. Companies are investing in bespoke onboard amenities and curated excursions to enhance customer satisfaction. Increasing preference for private charters, spa services, and sustainability-focused experiences supports this segment’s growth. The budget-friendly category is also expanding as cruise operators introduce affordable options to attract younger and first-time safari travelers.

- For instance, Silversea’s Silver Origin sails Galápagos with 100 guests and 90 crew, delivering high staff-to-guest service levels.

By Vessel Type

Smaller expedition ships dominated the market in 2024, accounting for nearly 61% of total revenue. These vessels offer greater accessibility to remote regions, personalized services, and low environmental impact, aligning with the trend toward sustainable and immersive travel. Their compact design allows navigation through shallow waters and secluded ports, creating unique wildlife-viewing opportunities. The large cruise ship segment continues to attract mainstream travelers due to superior onboard facilities and entertainment options, yet its share is slightly lower as travelers increasingly favor intimate and adventure-oriented voyages.

Key Growth Drivers

Rising Demand for Experiential Travel

The growing preference for immersive travel experiences is driving the cruise safari market. Tourists are seeking close encounters with wildlife, local cultures, and nature-based adventures, increasing bookings for safari cruises across Africa and Asia. Operators are expanding routes to remote destinations and offering tailored itineraries. This shift toward experiential tourism, supported by higher disposable incomes and post-pandemic travel recovery, remains a primary driver for market expansion.

- For instance, the expedition ship Seabourn Venture carries two custom-built, six-person submarines, up to 24 Zodiacs, and a 23- to 26-person expedition team, depending on the itinerary, enabling passengers to get close to wildlife and scenery in remote destinations.

Growth of Luxury Tourism

Luxury tourism continues to be a major growth catalyst in the cruise safari industry. High-net-worth travelers are increasingly opting for luxury cruise safaris that combine comfort with exclusivity. Operators are upgrading vessels with premium suites, wellness facilities, and gourmet dining to enhance onboard experiences. This focus on premium offerings strengthens brand reputation and attracts repeat customers. Rising investments in ultra-luxury expeditions and private charters are further fueling the market’s upscale growth.

- For instance, Celebrity Flora limits occupancy to 100, uses dynamic positioning to avoid anchoring, and adds solar panels for greener luxury.

Sustainability and Eco-Tourism Initiatives

The rising adoption of eco-friendly operations is boosting cruise safari growth. Travelers are prioritizing sustainability, encouraging companies to use hybrid propulsion systems and waste management technologies. Operators are also partnering with conservation projects to support wildlife protection and reduce environmental footprints. These initiatives enhance brand credibility and attract environmentally conscious tourists, positioning sustainable cruise safaris as a key growth pillar for the coming years.

Key Trends and Opportunities

Integration of Smart Technologies

Cruise safari operators are adopting smart technologies to improve customer experience and efficiency. Advanced booking systems, AI-based personalization, and real-time navigation tools enhance operational control and safety. Digital tools also enable better wildlife tracking and onboard entertainment. This trend allows companies to offer data-driven services, boosting customer loyalty and operational transparency.

- For instance, Albatros Expeditions’ Ocean Albatros, built in 2023, sails with a maximum capacity of 169 guests and a crew of 120. It features a stable X-BOW design and a hybrid diesel-electric propulsion system, resulting in significantly lower fuel consumption and emissions compared to traditional expedition vessels.

Expansion into Emerging Destinations

The growing interest in less-explored safari regions presents a strong opportunity. New routes across Southeast Asia, the Indian Ocean, and South America are gaining popularity among adventure travelers. Operators expanding into these regions benefit from lower competition and higher customer engagement. These destinations also appeal to eco-tourists seeking authentic, low-impact experiences, adding diversity to the global cruise safari portfolio.

- For instance, Aurora Expeditions’ Greg Mortimer is an X-BOW® designed expedition ship that accommodates a maximum of 130 passengers on polar voyages. The number of cabins is listed as 76 on the official website. The unique X-BOW® design offers increased stability and comfort in rough seas, making it particularly suitable for longer itineraries.

Growth in Multi-Generational Travel

The rise of multi-generational travel offers a new opportunity for cruise safari companies. Families now prefer safaris that cater to varied age groups with activities ranging from wildlife excursions to wellness programs. Operators are developing flexible itineraries and family-oriented amenities to attract this segment. This inclusivity widens the customer base and promotes repeat travel bookings.

Key Challenges

High Operational and Maintenance Costs

Cruise safari operations face significant costs related to fuel, maintenance, and crew management. Smaller expedition ships, while offering exclusivity, require specialized maintenance and logistical support. Fluctuating fuel prices and strict maritime regulations further add financial pressure. These expenses can limit profitability and hinder smaller operators from market expansion.

Environmental and Regulatory Constraints

Stringent environmental laws and regional restrictions pose ongoing challenges to cruise safari operators. Regulations aimed at protecting marine ecosystems limit navigation routes and anchorage points. Compliance with waste disposal, emission standards, and wildlife protection norms increases operational complexity. Adapting to these evolving frameworks demands consistent investment, which can restrain growth for emerging cruise safari brands.

Regional Analysis

North America

North America held a market share of 28% in 2024, driven by growing interest in adventure-based and luxury cruise safaris. The United States and Canada lead demand as travelers seek exclusive wildlife experiences in destinations such as Alaska and the Caribbean. Strong spending capacity and rising preference for eco-tourism continue to shape market expansion. Cruise companies in this region focus on integrating sustainable practices and premium services to attract environmentally conscious travelers. The region’s established cruise infrastructure and digital marketing reach also support strong customer engagement and repeat bookings.

Europe

Europe accounted for 25% of the cruise safari market in 2024, supported by the popularity of Mediterranean and Scandinavian expedition routes. Travelers from Germany, the United Kingdom, and France contribute significantly to luxury safari cruise demand. Increasing focus on sustainable travel and heritage tourism enhances market potential. European operators are investing in hybrid vessels and cultural immersion programs to meet evolving traveler expectations. The presence of major cruise lines and high outbound tourism rates further strengthen Europe’s position, making it a key source market for global cruise safari operations.

Asia Pacific

Asia Pacific captured 22% of the cruise safari market in 2024, driven by expanding tourism in coastal destinations such as Indonesia, Thailand, and Australia. The region benefits from growing middle-class incomes and improved maritime connectivity. Cruise operators are introducing new safari routes highlighting marine biodiversity and island ecosystems. Increasing awareness of wildlife conservation and the rise of domestic luxury travel are key regional growth factors. Partnerships between global operators and local tour agencies also enhance service quality, positioning Asia Pacific as a high-growth market for expedition-style cruises.

South America

South America represented 15% of the cruise safari market in 2024, fueled by increasing demand for nature-focused expeditions across the Galápagos Islands, Amazon Basin, and Patagonian routes. The region’s rich biodiversity and cultural heritage attract travelers seeking authentic eco-adventures. Operators emphasize sustainability and local community engagement to enhance destination appeal. Growing investment in small expedition vessels allows access to remote areas while minimizing environmental impact. Improved port infrastructure in Chile and Ecuador is also strengthening the regional cruise safari network, boosting South America’s role in global adventure tourism.

Middle East and Africa

The Middle East and Africa accounted for 10% of the global cruise safari market in 2024, with Africa serving as a prime destination for wildlife-focused expeditions. Coastal safaris along Tanzania, Kenya, and South Africa attract high-value tourists seeking exclusive nature encounters. The region’s untapped marine routes and government support for tourism infrastructure create growth opportunities. In the Middle East, luxury desert and Red Sea cruise safaris are gaining attention among affluent travelers. Increasing private investments and conservation-based tourism initiatives continue to enhance the region’s competitiveness in the global market.

Market Segmentations:

By Type

- Customized & private vacations

- Adventure & safari

- Small group journey

- Others

By Tour

- Absolute luxury

- Budget-friendly

By Vessel Type

- Large cruise ships

- Smaller expedition ships

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cruise Safari Market features prominent players such as Hurtigruten, Ponant Explorations Group, G Adventures, Aurora Expeditions, Lindblad Expeditions, National Geographic Expeditions, Celebrity Cruises (Celebrity Flora), Hapag-Lloyd Cruises (HANSEATIC Nature), Mangunda Safari Cruise, and Oceanwide Expeditions. These companies compete through differentiated offerings, focusing on sustainability, route diversity, and personalized services. Leading operators are investing in eco-friendly vessels, hybrid propulsion systems, and technology-driven experiences to attract environmentally conscious travelers. Strategic collaborations with tourism boards and conservation organizations enhance brand positioning and destination access. The market is also witnessing rising demand for smaller expedition ships that provide intimate and immersive experiences. Continuous innovation in onboard amenities, culinary services, and cultural programs supports customer retention and loyalty. As competition intensifies, companies are prioritizing unique itineraries and customized packages to appeal to diverse traveler segments, from luxury adventurers to eco-tourism enthusiasts, ensuring sustained growth in this niche travel sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hurtigruten

- Ponant Explorations Group

- G Adventures

- Aurora Expeditions

- Lindblad Expeditions

- National Geographic Expeditions

- Celebrity Cruises (Celebrity Flora)

- Hapag-Lloyd Cruises (HANSEATIC Nature)

- Mangunda Safari Cruise

- Oceanwide Expeditions

Recent Developments

- In 2025, Ponant Explorations Group, a small ship expedition cruise operator, acquires a majority stake in Aqua Expeditions, a specialist for river and ocean cruises

- In 2024, Lindblad Expeditions Introduced a series of new itineraries focusing on diverse wildlife habitats, including voyages to Baja California and the Gulf of California.

- In 2022, The Mangunda Safari Cruise embarked on its journey, providing an excellent experience along the Shire River in Liwonde National Park.

Report Coverage

The research report offers an in-depth analysis based on Type, Tour, Vessel Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for adventure-based and eco-friendly cruise safaris will continue to rise globally.

- Luxury expedition vessels with personalized services will gain higher customer preference.

- Operators will expand safari routes to lesser-known coastal and island destinations.

- Digital booking platforms and AI-driven personalization will enhance traveler experience.

- Partnerships with conservation projects will strengthen sustainable tourism efforts.

- Hybrid and electric-powered vessels will become more common in new fleet expansions.

- Younger travelers and family groups will drive multi-generational safari travel growth.

- Local community engagement will become central to destination development strategies.

- Emerging markets in Asia and South America will attract strong investment in cruise infrastructure.

- Enhanced onboard wellness, culture, and culinary offerings will improve overall traveler satisfaction.