Market Overview

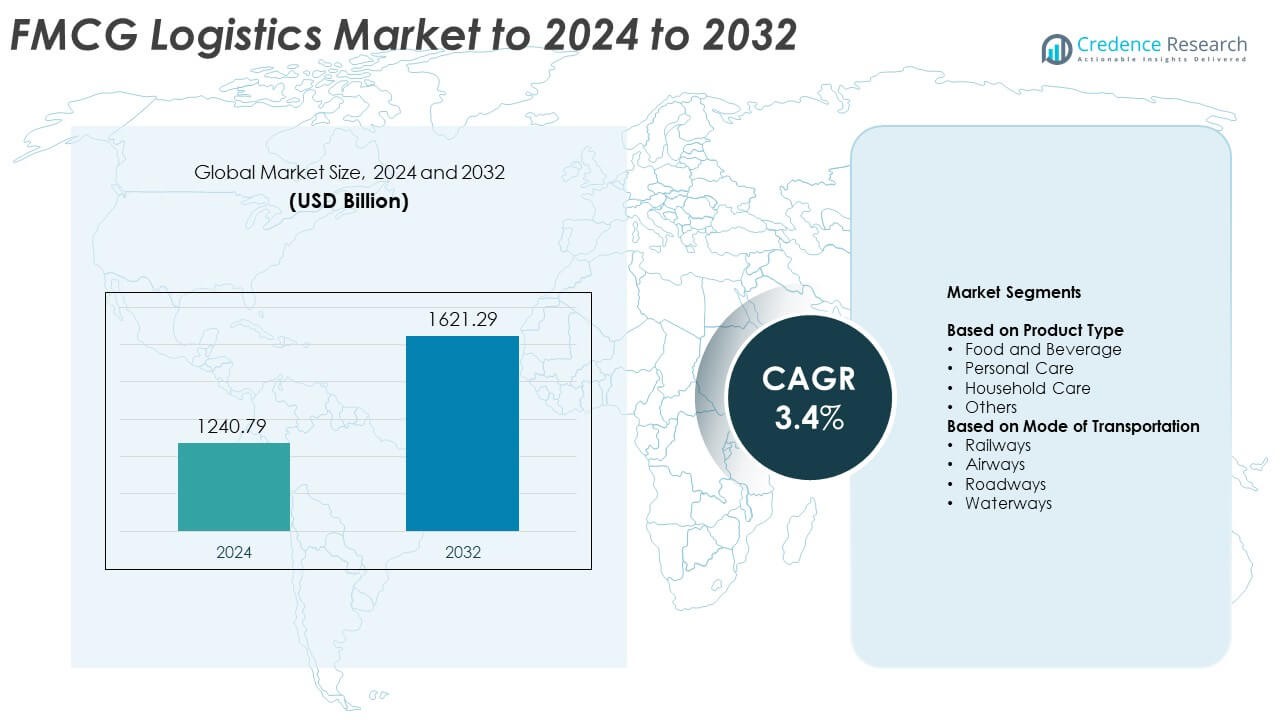

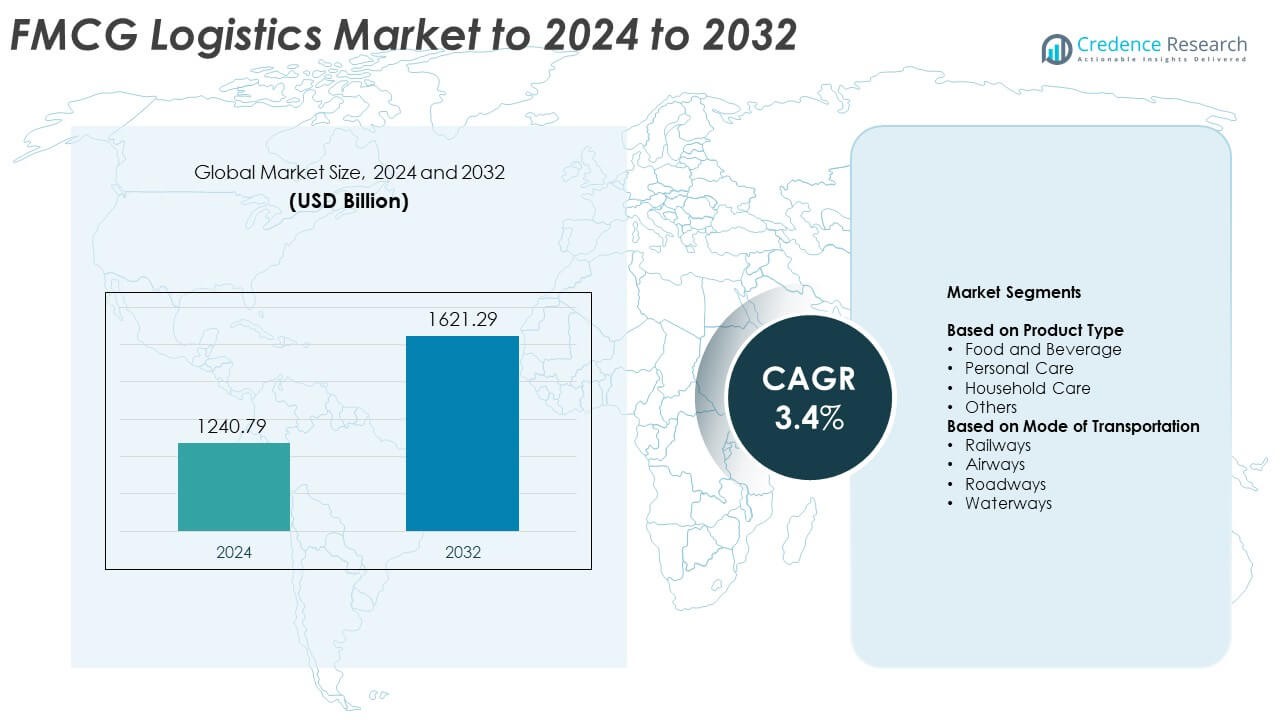

The FMCG Logistics Market size was valued at USD 1240.79 billion in 2024 and is anticipated to reach USD 1621.29 billion by 2032, at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| FMCG Logistics Market Size 2024 |

USD 1240.79 Billion |

| FMCG Logistics Market, CAGR |

3.4% |

| FMCG Logistics Market Size 2032 |

USD 1621.29 Billion |

The FMCG logistics market is led by major companies such as DHL Supply Chain, FedEx, C.H. Robinson, Kuehne + Nagel, CEVA Logistics, Maersk, DB Schenker, UPS, DSV, Geodis, XPO Logistics, Rhenus Warehousing Solutions UK, Cainiao, and Swiggy. These players focus on automation, sustainability, and technology integration to enhance global logistics performance. North America emerged as the leading region in 2024, holding a 35% share, supported by advanced infrastructure and high e-commerce penetration. Europe followed with 29%, driven by strong cross-border trade networks and sustainable transport practices, while Asia Pacific accounted for 25%, fueled by rapid urbanization and growing digital retail ecosystems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The FMCG logistics market was valued at USD 1240.79 billion in 2024 and is expected to reach USD 1621.29 billion by 2032, growing at a CAGR of 3.4%.

- Growing e-commerce demand, improved cold chain infrastructure, and automation in warehousing are driving logistics efficiency and service speed.

- The market is witnessing trends like digital supply chain integration, green logistics adoption, and AI-based route optimization for faster delivery.

- The competitive landscape features global logistics providers focusing on sustainability, automation, and regional expansion to strengthen their network capabilities.

- North America led the market with a 35% share, followed by Europe at 29% and Asia Pacific at 25%, while the food and beverage segment held the largest share of 46% in 2024.

Market Segmentation Analysis:

By Product Type

The food and beverage segment held the largest share of approximately 46% of the FMCG logistics market in 2024. This dominance is driven by the continuous demand for perishable goods, requiring advanced cold chain solutions and rapid delivery systems. Growth in e-commerce grocery platforms and global trade of packaged foods has further increased logistics efficiency. The segment benefits from innovations such as temperature-controlled warehouses and smart tracking systems that reduce spoilage and improve delivery accuracy.

- For instance, PepsiCo installed a Dematic automated storage and retrieval system with 16,520 pallet locations at its Thailand distribution center, enabling fully automated movement from production lines to outbound docks.

By Mode of Transportation

The roadways segment accounted for the dominant share of around 61% of the FMCG logistics market in 2024, owing to its flexibility, cost-effectiveness, and last-mile connectivity. Trucks and delivery vans are widely used for intra-city and intercity transport of FMCG products. The adoption of GPS-enabled fleet management systems and electric delivery vehicles has enhanced operational reliability. Expanding road infrastructure and express delivery services further strengthen this mode’s preference among FMCG manufacturers and distributors.

- For instance, DHL Group operated a global fleet of more than 42,000 electric delivery vehicles as of September 2025.

Key Growth Drivers

Rising Demand for E-commerce Fulfillment

The rapid expansion of online retail has created strong demand for efficient FMCG logistics networks. Consumers now expect faster delivery times and flexible return options, pushing companies to optimize warehousing and distribution. Advanced automation, AI-driven route planning, and real-time tracking systems are helping brands streamline last-mile delivery operations. The integration of digital platforms and smart inventory systems enhances supply chain visibility, enabling FMCG players to meet rising consumer expectations while maintaining cost efficiency.

- For instance, Lineage Logistics operates over 485 temperature-controlled facilities totaling about 3.1 billion cubic feet of capacity worldwide, supporting major FMCG distribution networks.

Expansion of Cold Chain Infrastructure

Growth in perishable and temperature-sensitive product categories, including dairy, frozen foods, and pharmaceuticals, has strengthened the need for cold chain logistics. Companies are investing in advanced refrigerated vehicles and temperature-controlled storage facilities to maintain product quality. The use of IoT-based monitoring ensures real-time tracking of temperature deviations. This infrastructure expansion supports safe and efficient transport of perishable goods across domestic and international routes, helping FMCG manufacturers maintain product integrity and reduce wastage.

- For instance, Walmart partnered with Symbotic to deploy automation systems in over 400 Accelerated Pickup and Delivery (APD) centers.

Technological Integration and Automation

Automation and digital transformation are driving major efficiency gains in FMCG logistics. Technologies like robotics, AI, and IoT enable real-time visibility, predictive maintenance, and automated warehouse operations. Smart sensors and data analytics optimize fleet performance and energy consumption. The adoption of automated sorting systems and robotic picking improves accuracy and speed, reducing manual labor costs. As digitalization accelerates, logistics networks are becoming more agile, resilient, and responsive to fluctuating consumer demand.

Key Trends and Opportunities

Sustainability and Green Logistics

Environmental concerns are prompting FMCG companies to adopt eco-friendly logistics solutions. Firms are deploying electric delivery vehicles, optimizing routes to cut fuel use, and investing in recyclable packaging. Green warehouses powered by renewable energy are becoming more common. These sustainable practices not only reduce carbon emissions but also improve brand reputation among environmentally conscious consumers. Regulatory support and incentives for green supply chains further encourage sustainable logistics investments.

- For instance, Geopost (DPD Group) expanded its low-emission fleet to more than 10,000 electric vans and cargo bikes for urban deliveries in 2024.

Rising Cross-Border Trade and Global Distribution

Expanding international trade in FMCG products offers strong growth opportunities for logistics providers. Companies are developing regional hubs and bonded warehouses to improve delivery efficiency in key markets. Digital trade platforms and customs automation simplify cross-border operations, reducing clearance delays. The demand for reliable and cost-effective international freight solutions is pushing logistics firms to expand global partnerships and enhance multimodal capabilities for faster and safer deliveries.

- For instance, Cainiao averaged over 5,000,000 cross-border packages daily in FY2024. Cainiao also launched a Xi’an–Liège charter operating 2 flights per week from September 2024.

Key Challenges

Rising Transportation Costs

Increasing fuel prices and vehicle maintenance expenses are significantly impacting FMCG logistics profitability. As companies strive to offer competitive pricing, high transportation costs put pressure on operating margins. Fluctuating energy costs and labor shortages further add to the challenge. Logistics providers are countering these issues by adopting energy-efficient fleets, optimizing load capacity, and using predictive analytics to manage expenses. However, balancing service quality with cost control remains a critical challenge.

Supply Chain Disruptions and Labor Shortages

Frequent supply chain disruptions caused by global conflicts, natural disasters, and labor constraints continue to affect FMCG logistics operations. Shortages of skilled drivers, warehouse workers, and technicians delay order fulfillment and increase delivery times. Automation and digital tools mitigate some of these risks, but dependency on human resources remains high in several regions. Strengthening supply chain resilience and workforce retention strategies is essential to sustain reliability and business continuity.

Regional Analysis

North America

North America held the largest share of about 35% of the FMCG logistics market in 2024. The region’s dominance is supported by advanced logistics infrastructure, high consumer spending, and the presence of major retail chains. Strong e-commerce penetration in the United States and Canada has increased demand for faster fulfillment and last-mile delivery services. Investments in automation, AI-enabled tracking, and sustainable delivery fleets continue to enhance operational efficiency. The focus on temperature-controlled logistics for food and beverage distribution further supports regional market growth.

Europe

Europe accounted for around 29% of the FMCG logistics market share in 2024, driven by well-established transport networks and strong regulatory standards. The region benefits from cross-border trade within the European Union, enabling streamlined movement of FMCG goods. Demand for sustainable logistics and green transport is rising as companies shift to low-emission vehicles. The expansion of cold chain capacity and adoption of digital supply chain systems are improving efficiency. Markets like Germany, France, and the United Kingdom remain key hubs for FMCG distribution and warehousing operations.

Asia Pacific

Asia Pacific captured about 25% of the FMCG logistics market in 2024, fueled by rapid urbanization, expanding retail networks, and rising disposable incomes. Countries such as China, India, and Japan are experiencing strong growth in e-commerce and consumer goods production. The region’s logistics players are investing heavily in smart warehouses and AI-driven route optimization. Increasing demand for cold chain solutions to handle perishable goods is accelerating market development. Government initiatives to enhance port connectivity and regional trade routes further strengthen Asia Pacific’s logistics capabilities.

Latin America

Latin America represented roughly 7% of the FMCG logistics market in 2024. Growth is supported by expanding retail infrastructure and increased adoption of digital logistics systems in Brazil, Mexico, and Argentina. The region’s improving road networks and growing cross-border trade within Mercosur contribute to logistics efficiency. However, challenges such as inconsistent regulatory frameworks and infrastructure gaps persist. Rising consumer demand for fast-moving products and the shift toward e-commerce distribution are expected to attract further investment in regional logistics operations.

Middle East & Africa

The Middle East and Africa accounted for nearly 4% of the FMCG logistics market share in 2024. The region’s growth is driven by expanding retail modernization, increasing urban populations, and rising demand for packaged goods. Gulf countries such as the UAE and Saudi Arabia are investing in advanced logistics hubs and free trade zones. Africa is witnessing gradual progress in transport infrastructure and cold chain development. While challenges in connectivity and customs processes remain, increasing investments in warehousing and digital supply chains are enhancing efficiency across the region.

Market Segmentations:

By Product Type

- Food and Beverage

- Personal Care

- Household Care

- Others

By Mode of Transportation

- Railways

- Airways

- Roadways

- Waterways

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The FMCG logistics market is shaped by global players such as DHL Supply Chain, FedEx, C.H. Robinson, Kuehne + Nagel, CEVA Logistics, Maersk, DB Schenker, UPS, DSV, Geodis, XPO Logistics, Rhenus Warehousing Solutions UK, Cainiao, and Swiggy. These companies focus on expanding warehousing capacity, digital automation, and sustainable logistics networks to enhance supply chain efficiency. The industry is witnessing major investments in AI-based route optimization, real-time tracking, and temperature-controlled storage for perishable goods. Strategic collaborations with e-commerce and FMCG brands are driving innovation in last-mile delivery and cold chain logistics. Firms are also integrating electric vehicle fleets and renewable-powered warehouses to reduce emissions and operational costs. The competitive environment emphasizes service diversification, regional expansion, and digital transformation to strengthen market presence and customer satisfaction across both developed and emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DHL Supply Chain

- FedEx

- H. Robinson

- Kuehne + Nagel

- CEVA Logistics

- Maersk

- DB Schenker

- UPS

- DSV

- Geodis

- XPO Logistics

- Rhenus Warehousing Solutions UK

- Cainiao

- Swiggy

Recent Developments

- In 2025, XPO earned the 2025 EcoVadis Gold Medal for its sustainability efforts, placing it in the top 1% of logistics companies worldwide.

- In 2024, Kuehne+Nagel opened a highly automated distribution center in Mantua, Italy, for Adidas, capable of handling a high volume of shipments for Southern and Eastern Europe.

- In 2023, Maersk initiated a green shipping program by bunkering its first methanol-enabled vessel, the Laura Maersk, demonstrating a commitment to more sustainable logistics.

- In 2023, DHL launched its “GoGreen Plus” service, offering a green logistics solution for shippers by powering freight with Sustainable Aviation Fuels.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Mode of Transportation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The FMCG logistics market will see increased automation, with robotics improving warehouse efficiency.

- Green logistics practices will gain momentum as companies invest in low-emission fleets and packaging.

- E-commerce growth will continue to drive demand for faster and more reliable last-mile delivery.

- Digital twins and IoT systems will enhance visibility and predictive maintenance across supply chains.

- Cold chain logistics will expand rapidly due to rising demand for perishable food and pharmaceuticals.

- Cross-border trade integration will strengthen, supported by digital customs and smart port networks.

- Artificial intelligence will optimize route planning, load management, and fuel efficiency for carriers.

- Urban logistics hubs will emerge to manage same-day delivery and reduce congestion in cities.

- Strategic partnerships between FMCG producers and logistics providers will improve scalability and service reach.

- Data-driven analytics will become vital for demand forecasting, risk assessment, and inventory optimization.