Market Overview

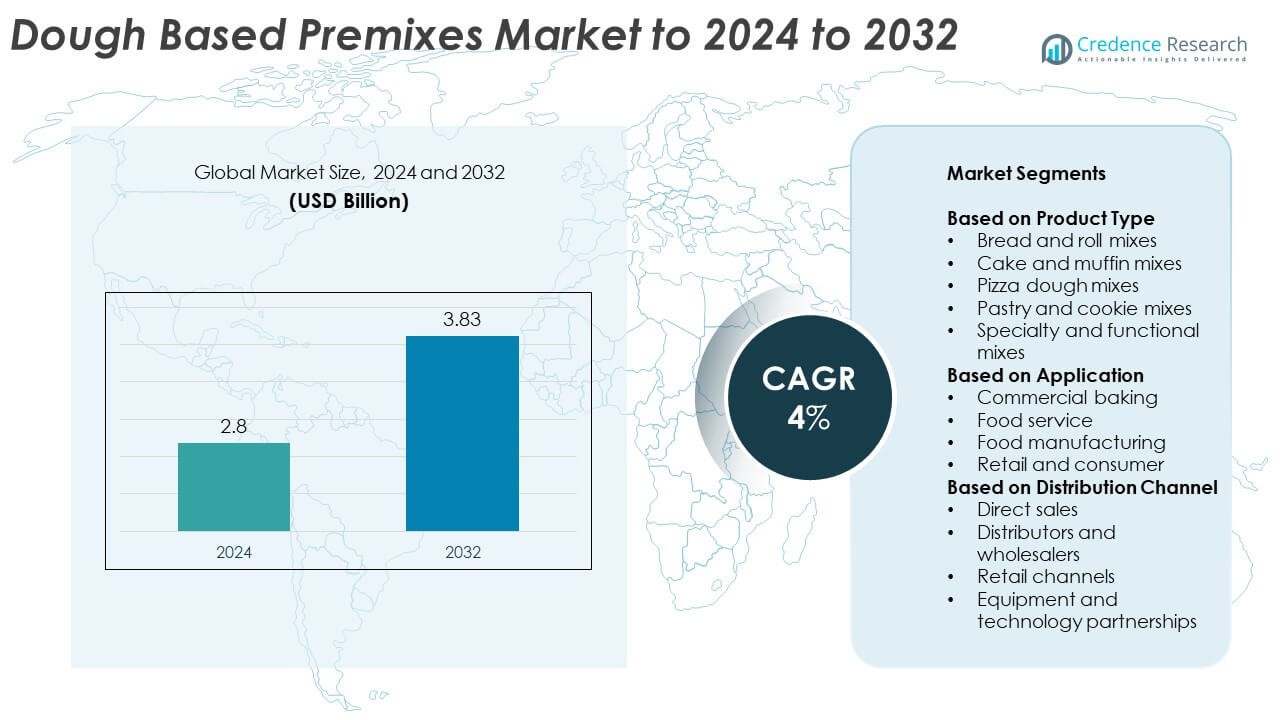

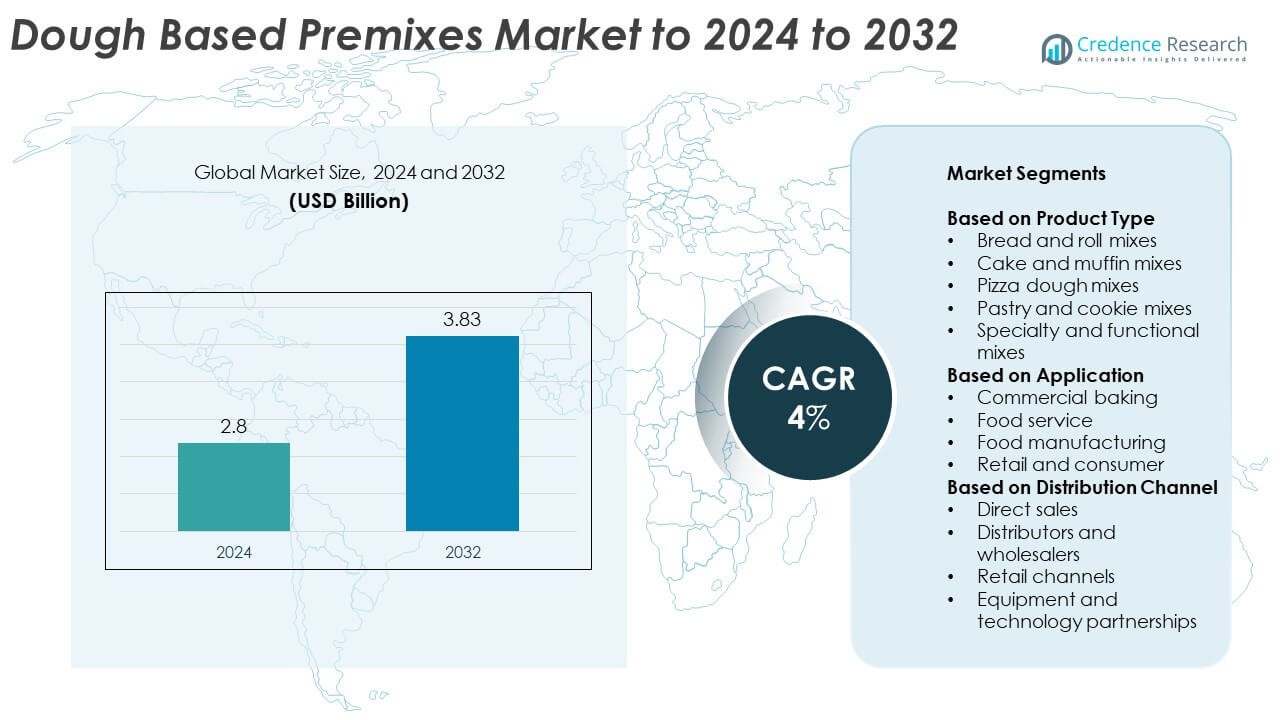

Dough Based Premixes Market size was valued USD 2.8 Billion in 2024 and is anticipated to reach USD 3.83 Billion by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dough Based Premixes Market Size 2024 |

USD 2.8 Billion |

| Dough Based Premixes Market, CAGR |

4% |

| Dough Based Premixes Market Size 2032 |

USD 3.83 Billion |

The dough-based premixes market is driven by key players such as Puratos Group, General Mills, Cargill Inc., Kerry Group, Lesaffre, Bakels Group, Archer Daniels Midland Company (ADM), and Millbio. These companies focus on expanding their product portfolios with clean-label, fortified, and functional premixes to meet the rising demand for convenient and health-oriented bakery solutions. Strategic partnerships with commercial bakeries and investments in sustainable ingredient sourcing strengthen their global presence. Regionally, North America leads the market with a 34% share in 2024, supported by a strong industrial bakery network and growing consumer preference for ready-to-bake products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dough Based Premixes Market was valued at USD 2.8 Billion in 2024 and is projected to reach USD 3.83 Billion by 2032, growing at a CAGR of 4%.

- Growing demand for convenient, ready-to-bake, and health-focused bakery solutions is driving market expansion across both commercial and retail sectors.

- Clean-label, gluten-free, and high-fiber formulations are emerging as key trends as consumers prioritize healthier baking ingredients.

- The market is competitive, with major players investing in innovation, automation, and sustainable ingredient sourcing to maintain leadership.

- North America leads with a 34% share, followed by Europe at 29% and Asia Pacific at 23%, while the bread and roll mixes segment dominates with a 38% market share in 2024.

Market Segmentation Analysis:

By Product Type

The bread and roll mixes segment dominated the dough-based premixes market in 2024 with a 38 percent share. Its dominance is driven by widespread use in commercial and household baking due to convenience and consistent quality. Rising demand for ready-to-bake and time-saving bakery ingredients supports this segment’s growth. Innovations in multigrain and high-fiber formulations enhance nutritional value, aligning with the growing consumer preference for healthier options. Continuous product development by major bakery ingredient manufacturers has strengthened adoption across both industrial and retail applications.

- For instance, AB Mauri’s Aromaferm Efficiency recommends 4% dosage on flour weight and ships in 10 × 1 kg vacuum bags, supporting consistent sourdough-style rolls at scale.

By Application

The commercial baking segment led the market in 2024, accounting for 42 percent of the total share. This leadership stems from the large-scale use of dough-based premixes in industrial bakeries and food production units to maintain uniform quality. The sector benefits from the demand for standardized dough preparation in mass bakery production. Automation in baking processes and the shift toward cost-efficient ingredient sourcing further boost adoption. Expanding bakery chains and café outlets worldwide continue to reinforce this segment’s strong position in the market.

- For instance, General Mills (Pillsbury Foodservice) supplies puff pastry dough in cases of 20 sheets, each sheet 10″×15″ and 12 oz, standardizing throughput in commissary lines.

By Distribution Channel

Distributors and wholesalers held the largest market share of 46 percent in 2024 in the dough-based premixes market. Their extensive supply networks and partnerships with commercial bakeries and food manufacturers drive this dominance. Distributors ensure product availability across regions and offer bulk purchase benefits to industrial clients. The segment also benefits from growing collaborations between premix producers and logistics firms to streamline cold chain and packaging operations. Increasing demand for customized formulations in large-scale baking operations further supports the continued leadership of distributors and wholesalers.

Key Growth Drivers

Rising Demand for Convenience Baking Solutions

The growing preference for ready-to-use bakery ingredients is a major growth driver in the dough-based premixes market. Consumers and commercial bakers seek time-efficient, consistent-quality products that reduce preparation time and labor costs. The rise in home baking culture and expansion of bakery cafés have accelerated adoption. Manufacturers are developing versatile premixes compatible with multiple baking methods, enhancing efficiency across applications. This shift toward convenience-driven baking continues to propel overall market growth globally.

- For instance, King Arthur Baking notes a 1-lb brick of SAF Red instant yeast yields about 96 loaves, enabling predictable batch planning for fast-turn dough lines.

Expansion of Industrial and Commercial Bakeries

Industrial bakeries are increasingly using dough-based premixes to maintain uniform product quality at scale. The segment’s growth is supported by automation in baking operations and demand for standardized recipes. Large bakery chains and quick-service restaurants rely on premixes to ensure consistency across outlets. The growing demand for frozen dough and ready-to-bake bakery lines also drives market adoption. This expanding commercial infrastructure enhances production efficiency and supports sustainable long-term market growth.

- For instance, Lallemand opened its Passau specialties yeast site with 1,100 tons per year drying capacity for wine active dry yeast, while its baking division operates different production facilities that supply the high-volume bakery market.

Innovation in Functional and Health-Based Premixes

Rising consumer focus on wellness has encouraged manufacturers to create fortified and functional dough premixes. These include formulations enriched with fiber, whole grains, and plant-based proteins. Clean-label and gluten-free variants are gaining traction among health-conscious consumers. The introduction of low-sugar and trans-fat-free products aligns with regulatory shifts promoting healthy eating habits. This innovation trend enables companies to differentiate their offerings and capture premium segments, boosting profitability and market reach.

Key Trends and Opportunities

Growth of Artisanal and Specialty Bakery Products

The market is witnessing increasing demand for artisanal and specialty bakery products using premium premixes. Consumers value unique textures, flavors, and natural ingredients. Producers are introducing customized blends for artisanal bread, cookies, and pastries, catering to niche consumer bases. The premiumization trend, combined with rising disposable incomes, is creating strong opportunities in both developed and emerging markets. Growth in craft bakery chains further expands this demand.

- For instance, Kerry backs specialty and artisanal bakery development through a network of 124+ manufacturing locations and dedicated bakery centres of excellence.

Adoption of Sustainable and Clean-Label Ingredients

Sustainability is becoming a critical trend influencing product innovation in dough premixes. Manufacturers are reformulating products with clean-label ingredients free from artificial additives. The use of locally sourced grains and eco-friendly packaging enhances brand image among environmentally aware consumers. This trend also aligns with global regulations encouraging transparency and traceability in the food industry. Companies adopting sustainable practices gain a competitive edge through increased consumer trust.

- For instance, Ingredion’s NOVATION® platform includes over 35 clean-label native starches derived from waxy maize, waxy rice, tapioca, and potato.

Expansion in E-commerce and Retail Baking Solutions

E-commerce platforms are transforming the accessibility of dough-based premixes for consumers and small-scale bakers. Online channels enable manufacturers to reach wider markets with direct-to-consumer offerings. Retail packaging innovations and smaller pack sizes encourage trial purchases. The growing number of home bakers and baking enthusiasts has further increased demand for online baking kits and digital brand engagement, opening new opportunities for market growth.

Key Challenges

Fluctuations in Raw Material Costs

Volatile prices of key raw materials such as flour, oils, and additives present a challenge for premix producers. Supply chain disruptions and weather-related impacts on crop yields often raise costs. This volatility affects pricing strategies and profit margins, particularly for small and mid-sized manufacturers. Ensuring stable sourcing through regional diversification and supplier partnerships remains crucial for market stability and long-term sustainability.

Limited Awareness in Developing Regions

In several developing economies, limited consumer awareness about dough-based premixes restricts market expansion. Traditional baking practices and preference for fresh ingredients reduce adoption among small bakeries. High initial costs and lack of product education further hinder penetration in rural and semi-urban areas. Targeted marketing campaigns, product demonstrations, and local partnerships are needed to overcome this barrier and drive growth in emerging markets.

Regional Analysis

North America

North America held a 34 % share of the dough-based premixes market in 2024, driven by strong demand from industrial bakeries and foodservice chains. The region benefits from advanced baking technology and widespread consumer adoption of convenient bakery products. Increasing health awareness has led to higher demand for gluten-free and whole-grain premixes. The United States leads regional growth with its expanding network of café-style bakeries and packaged bakery goods. Continuous product innovations and strong retail presence further enhance North America’s position as a key contributor to global market revenues.

Europe

Europe accounted for a 29 % share of the global dough-based premixes market in 2024. The region’s growth is fueled by the popularity of artisanal baking and traditional bread varieties in countries such as Germany, France, and Italy. Rising focus on clean-label and organic ingredients supports market expansion. European bakeries prioritize high-quality, customizable premixes to meet evolving consumer tastes. Strong industrial infrastructure, along with increasing adoption of frozen dough in foodservice, drives production efficiency. Sustainability initiatives in ingredient sourcing and packaging further reinforce Europe’s steady contribution to market growth.

Asia Pacific

Asia Pacific captured a 23 % share of the dough-based premixes market in 2024, supported by rapid urbanization and the growing influence of Western bakery culture. Expanding middle-class populations in China, India, and Southeast Asia are driving demand for convenient baking solutions. Rising investments in food processing and retail bakery chains enhance product accessibility. The region’s growing preference for ready-mix baking products is also fueled by online sales and home baking trends. Strong growth in industrial bakery expansion continues to make Asia Pacific a high-potential region for global manufacturers.

Latin America

Latin America represented an 8 % share of the dough-based premixes market in 2024. Market growth is led by rising demand for bakery products in Brazil, Mexico, and Argentina. Increasing popularity of packaged breads, pastries, and cookies among urban consumers supports regional expansion. Local bakeries are adopting cost-effective premix solutions to improve consistency and quality. Economic recovery and retail modernization contribute to steady demand. However, fluctuations in raw material prices and import dependency remain moderate challenges to long-term growth in this region’s bakery sector.

Middle East and Africa

The Middle East and Africa accounted for a 6 % share of the dough-based premixes market in 2024. Demand is increasing due to growing café culture and quick-service restaurants in Gulf countries and South Africa. Urban consumers are showing a stronger preference for ready-to-bake and frozen bakery products. Investment in food manufacturing infrastructure and retail modernization is expanding product reach. The region’s warm climate favors longer shelf-life solutions, further boosting premix adoption. Strategic partnerships with distributors and rising bakery franchising activity support gradual yet consistent market growth.

Market Segmentations:

By Product Type

- Bread and roll mixes

- Cake and muffin mixes

- Pizza dough mixes

- Pastry and cookie mixes

- Specialty and functional mixes

By Application

- Commercial baking

- Food service

- Food manufacturing

- Retail and consumer

By Distribution Channel

- Direct sales

- Distributors and wholesalers

- Retail channels

- Equipment and technology partnerships

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dough-based premixes market is highly competitive, featuring key players such as Puratos Group, General Mills, Cargill Inc., Kerry Group, Lesaffre, Bakels Group, Archer Daniels Midland Company (ADM), and Millbio. These companies emphasize product innovation, expanding their portfolios with health-focused and clean-label formulations to meet evolving consumer preferences. Strategic collaborations with bakeries and foodservice operators enhance distribution and market reach. Manufacturers invest in automation, quality consistency, and ingredient transparency to strengthen brand trust. Emerging technologies in dough processing and functional ingredient blending are shaping competitive differentiation. Global firms focus on sustainable sourcing, eco-friendly packaging, and regional production capabilities to reduce supply chain risks and improve responsiveness. Continuous R&D efforts aimed at improving texture, nutrition, and shelf life are further intensifying competition. The market’s competitive environment is expected to remain dynamic as producers pursue regional expansion and digital retail strategies to capture both industrial and retail consumers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Cargill announced it would showcase its innovative solutions for snacks, bakery, and confectionery at the AAHAAR food trade fair in India.

- In 2024, Millbio launched a new sourdough premix, PANVIVO SOURDOUGH SENSATION, in collaboration with an Italian chef.

- In 2023, Puratos Group the global bakery ingredient leader expanded its presence in the Kosovo market through a joint venture with local supplier Korabi Corporation.

- In September 2023, Puratos India introduced its “Easy Curry Masala Bread Mix” to offer a spicy, savory alternative for various baked goods.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for gluten-free and clean-label dough premixes will continue to grow globally.

- Manufacturers will focus on high-protein and fiber-enriched formulations to attract health-conscious consumers.

- Automation in commercial bakeries will drive higher adoption of standardized dough premixes.

- Online retail channels will expand, improving accessibility for home bakers and small bakeries.

- Sustainable ingredient sourcing and eco-friendly packaging will become industry priorities.

- Asia Pacific will emerge as the fastest-growing region due to urbanization and bakery expansion.

- Collaboration between ingredient suppliers and foodservice brands will increase innovation.

- Functional and fortified dough premixes will gain traction in premium product segments.

- Investment in cold chain and logistics will strengthen distribution efficiency across regions.

- Rising global interest in artisanal and specialty baked products will sustain long-term market growth.