Market Overview:

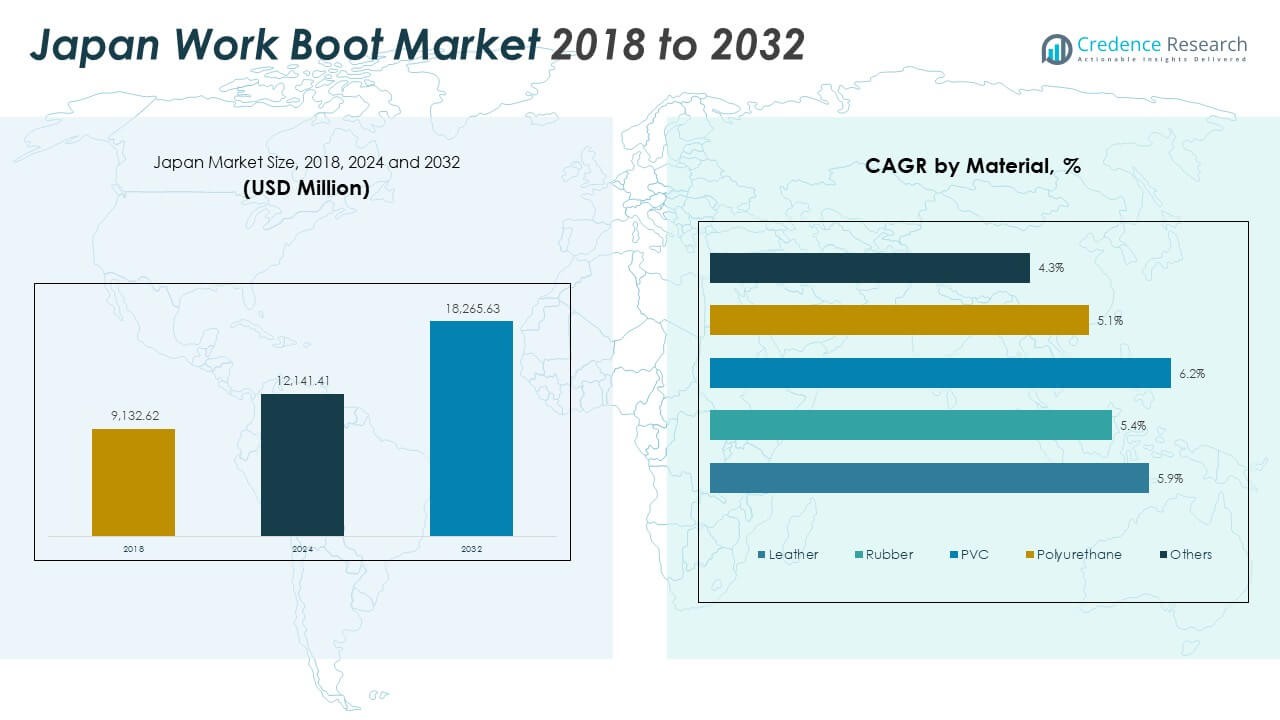

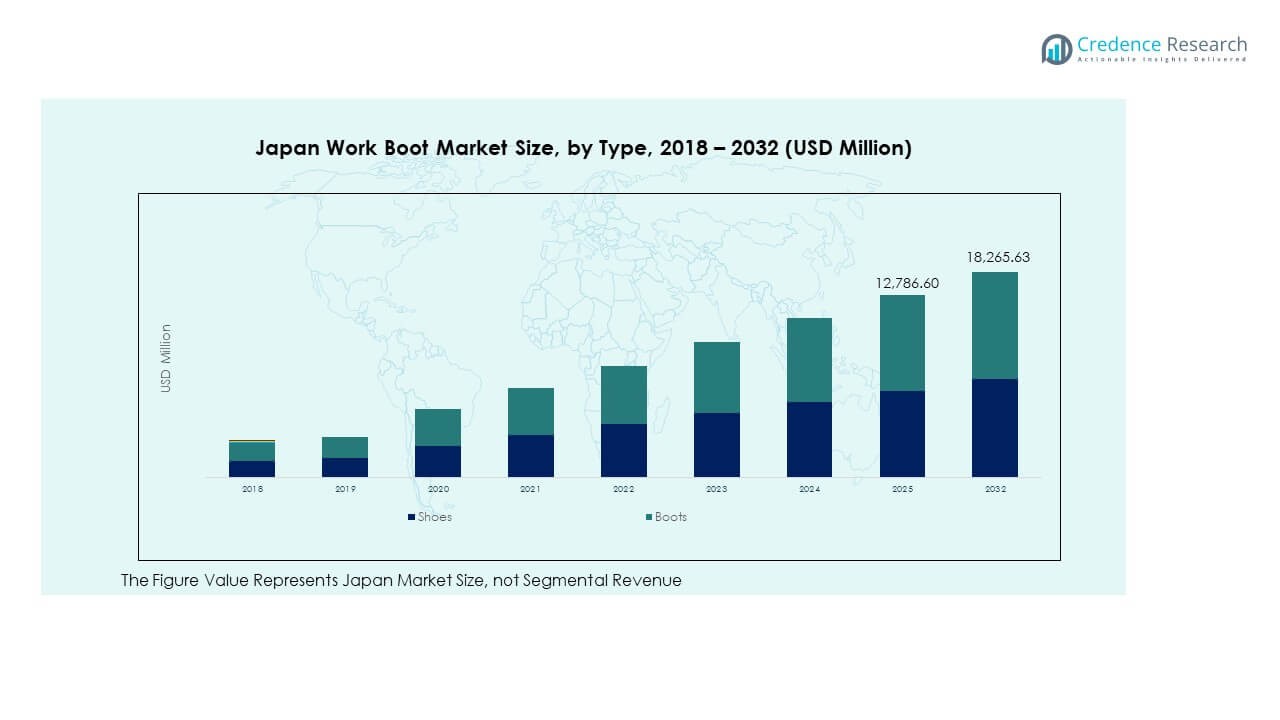

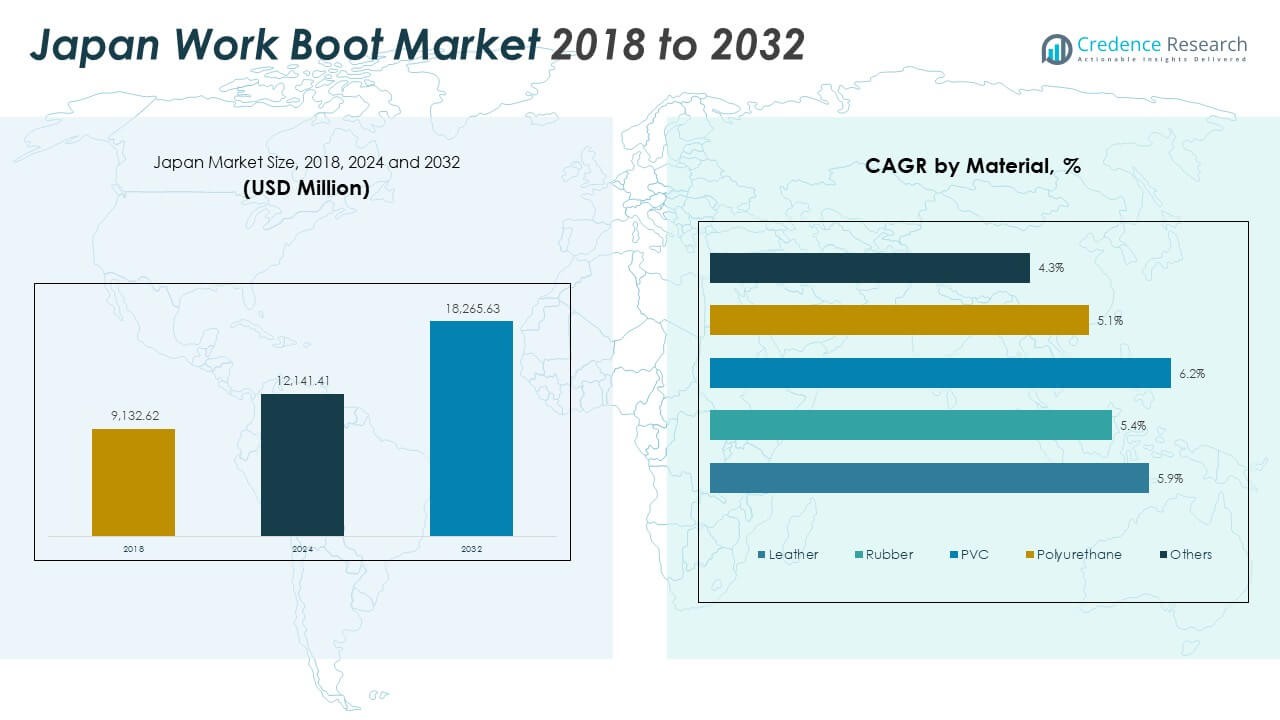

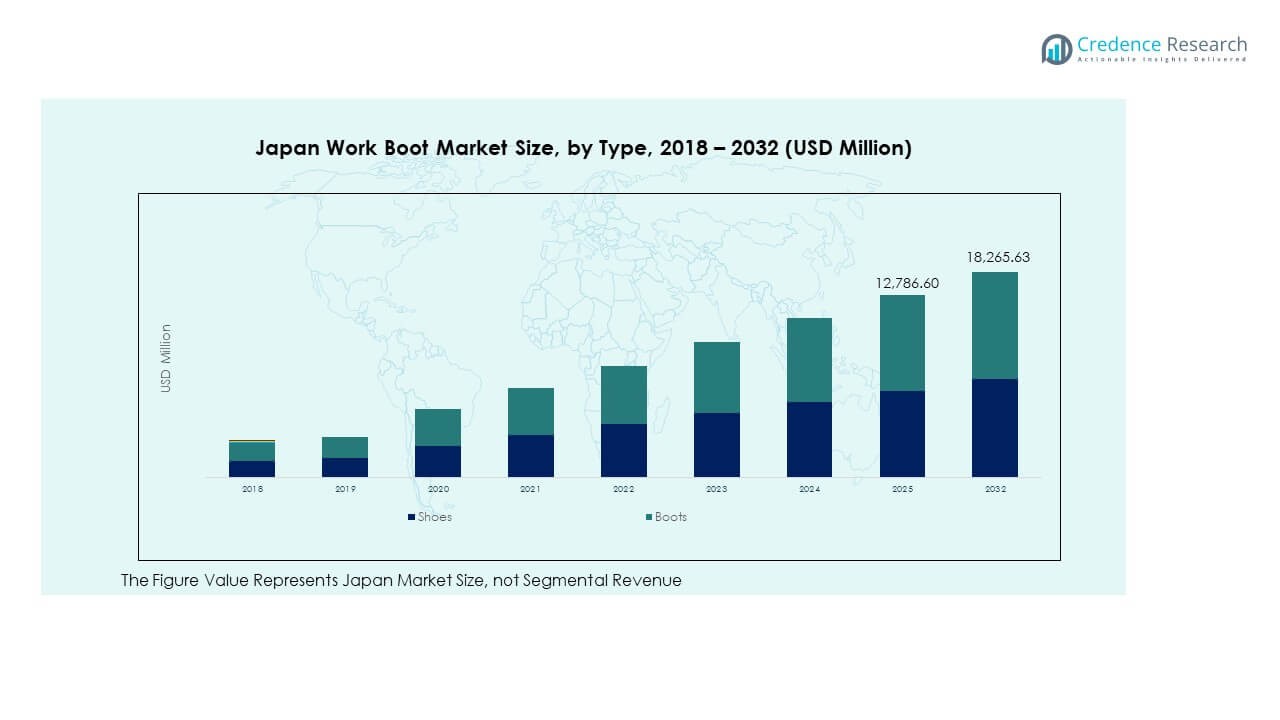

The Japan Work Boot Market size was valued at USD 9,132.62 million in 2018, grew to USD 12,141.41 million in 2024, and is anticipated to reach USD 18,265.63 million by 2032, expanding at a CAGR of 5.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Work Boot Market Size 2024 |

USD 12,141.41 Million |

| Japan Work Boot Market, CAGR |

5.23% |

| Japan Work Boot Market Size 2032 |

USD 18,265.63 Million |

The market growth is driven by increasing demand for safety footwear across manufacturing, construction, and mining sectors. Rising workplace safety regulations and employer emphasis on reducing injuries have accelerated adoption. Companies are investing in ergonomic designs and lightweight materials that enhance comfort without compromising protection. Technological innovations such as slip-resistant soles, puncture-proof midsoles, and breathable linings are also influencing consumer preference for durable and high-performance boots.

Regionally, Japan’s market reflects strong concentration in industrial and urban manufacturing zones. The Kanto and Kansai regions lead due to dense industrial clusters and growing infrastructure projects. Emerging demand from logistics and warehousing hubs is also notable, supported by the country’s expanding e-commerce sector. Northern regions show gradual adoption, driven by mining and construction activities. Overall, the market demonstrates steady regional diversification supported by consistent industrial modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan Work Boot Market was valued at USD 9,132.62 million in 2018, reached USD 12,141.41 million in 2024, and is projected to hit USD 18,265.63 million by 2032, expanding at a CAGR of 5.23% during the forecast period.

- The Kanto region dominates with a 36% share, driven by dense industrial zones and major construction projects, followed by Kansai (27%) and Chubu (25%), supported by strong manufacturing and automotive clusters.

- Kyushu, with an 8% share, is the fastest-growing region, driven by energy infrastructure expansion and industrial modernization across southern Japan.

- By type, boots accounted for approximately 62% of the total market share in 2024, supported by high adoption in construction and manufacturing sectors requiring durable and protective footwear.

- Shoes represented around 38% of the market in 2024, with increasing demand from logistics and service industries favoring lightweight, comfortable, and ergonomic designs.

Market Drivers:

Rising Workplace Safety Regulations and Industrial Expansion Driving Boot Adoption

Growing awareness of occupational safety standards in Japan has increased the use of protective footwear. The expansion of construction, logistics, and manufacturing industries supports this growth. Government-led initiatives to enforce worker protection regulations have encouraged companies to invest in certified safety gear. The Japan Work Boot Market benefits from these policies, particularly in high-risk environments. Employers prefer premium-grade boots that offer durability and ergonomic support. Manufacturers respond by improving materials and compliance features. The combination of safety mandates and expanding infrastructure projects drives steady market demand.

- For instance, Asics Corporation’s CP302 and CP307 protective sneaker series are JSAA A-Class certified footwear, featuring anti-slip soles and composite fiber toe caps verified to meet normal industrial protection levels across Japanese workplaces.

Increasing Technological Advancements in Footwear Design and Materials

Innovation in footwear design is enhancing both comfort and protection levels. Advanced materials such as thermoplastic polyurethane and microfiber leather improve durability and resistance to harsh environments. Many brands integrate breathable linings, anti-fatigue insoles, and shock-absorbing midsoles. These features appeal to industrial and service sectors where workers spend long hours on-site. The integration of composite toe caps reduces boot weight without compromising safety. Such innovations position domestic manufacturers competitively against imported products. Continuous design improvements create consumer trust and sustain market expansion.

- For instance, Mizuno Corporation utilizes recycled polyester and plant-derived components in its footwear line, achieving a documented 17% reduction in CO₂ emissions and integrating chemically recycled materials in uniforms and industrial shoes used across Japanese facilities.

Growing Demand from Construction and Manufacturing Sectors

Japan’s construction boom, driven by urban redevelopment and public infrastructure upgrades, boosts boot sales. Large-scale projects, including transport and industrial parks, require robust safety footwear. Manufacturing hubs in Tokyo, Osaka, and Nagoya demand heavy-duty boots for plant operations. The Japan Work Boot Market responds with reinforced designs suited to high-stress environments. Steel-toe and anti-slip variants are gaining preference among industrial workers. Strong domestic production capacity ensures timely supply to local distributors. Sustained growth in these core industries maintains consistent demand momentum.

Shift Toward Comfort-Oriented and Ergonomic Work Boots

Workers increasingly value comfort features alongside protection standards. Ergonomic soles, moisture control technology, and arch-support designs have become key differentiators. The focus on long-wear comfort enhances productivity and reduces fatigue-related injuries. Brands emphasize lighter construction to appeal to diverse work environments. The Japan Work Boot Market shows rising interest in hybrid models suitable for both field and indoor use. User preference for energy-absorbing and flexible designs guides product innovation. Enhanced wearability contributes to repeat purchases and stronger brand loyalty.

Market Trends:

Growing Penetration of Smart and Sensor-Integrated Safety Boots

Smart technologies are gradually entering industrial footwear design. Sensor-embedded soles monitor worker posture, temperature, and fatigue levels in real time. These innovations help employers prevent workplace accidents and improve compliance. The Japan Work Boot Market observes increased R&D investments in IoT-based protective footwear. Collaborations between tech startups and safety gear manufacturers are expanding. Data-driven performance tracking supports predictive maintenance of safety gear. Such advancements signal the early transition toward connected industrial wearables.

- For instance, Mizuno Corporation utilizes recycled polyester and plant-derived components in its footwear line, achieving a documented reduction in CO₂ emissions and integrating chemically recycled materials in uniforms and industrial shoes used across Japanese facilities.

Rising Popularity of Eco-Friendly and Sustainable Materials in Production

Environmental awareness among Japanese consumers influences footwear manufacturing practices. Companies adopt recycled rubber, water-based adhesives, and biodegradable soles. Sustainable sourcing aligns with corporate environmental goals and consumer expectations. The shift toward eco-friendly production supports brand reputation and regulatory compliance. The Japan Work Boot Market experiences a gradual move toward greener alternatives. Local firms prioritize low-carbon manufacturing processes to meet ESG standards. Eco-conscious designs strengthen competitiveness in both domestic and export markets.

- For instance, Japanese industrial manufacturers have significantly expanded the use of water-based adhesives and low-VOC production technologies between 2024 and 2025, as confirmed by sectoral reports highlighting reduced VOC emissions through substitution of solvent-based glues with sustainable alternatives.

Expanding E-Commerce and Omni-Channel Distribution Strategies

Digital retail platforms are reshaping product accessibility and sales strategies. Work boot brands use online marketplaces to target both industrial clients and individuals. E-commerce allows easy product customization and quick comparison across models. The Japan Work Boot Market benefits from integrated logistics and real-time inventory systems. Omni-channel strategies combine physical stores with digital convenience for a seamless experience. Subscription models and direct-to-consumer sales improve profitability. The digital shift enhances brand reach and boosts repeat purchases.

Customization and Personalization in Industrial Footwear Demand

End users now seek personalized fits and specialized protection levels. Manufacturers offer modular designs with adjustable features for comfort and safety. Custom options based on work environment improve compliance and user satisfaction. The Japan Work Boot Market adopts digital sizing and 3D scanning for better precision. This customization trend appeals to both SMEs and large enterprises. Tailored safety solutions reduce replacement costs and enhance user experience. The trend highlights a growing convergence of functionality and personalization.

Market Challenges Analysis:

High Product Costs and Competition from Low-Cost Imports

Premium-quality safety boots require advanced materials and high production standards, raising costs. Domestic manufacturers face challenges balancing quality with affordability. Imported products from cost-efficient regions exert price pressure across retail channels. The Japan Work Boot Market struggles to maintain margins without compromising compliance standards. Distribution and raw material expenses further raise production costs. Some small manufacturers find it difficult to compete against global brands offering lower-priced alternatives. Consumer sensitivity to pricing limits the growth of premium categories.

Limited Awareness and Adoption Among Small and Medium Enterprises

Smaller firms often underestimate the importance of certified protective footwear. This low awareness restricts market penetration in non-regulated sectors. The Japan Work Boot Market experiences uneven demand across enterprise sizes. SMEs prioritize short-term savings over long-term safety investments. Lack of structured safety training programs delays adoption. Manufacturers face the challenge of demonstrating return on investment for safety gear. Increasing outreach and education may bridge this awareness gap and promote consistent demand.

Market Opportunities:

Rising Automation and Industrial Modernization Creating New Safety Needs

The adoption of robotics and automated systems in factories increases exposure to new operational risks. This evolution fuels demand for advanced safety footwear with higher electrical resistance and impact protection. The Japan Work Boot Market gains from industries upgrading to meet automation standards. Opportunities arise in sectors like logistics, semiconductor production, and heavy machinery. Smart safety footwear can complement modern manufacturing environments. Investments in worker protection remain essential as technology integration deepens.

Expanding Female Workforce and Demand for Gender-Specific Work Boots

The rising participation of women in industrial and technical fields creates new market segments. Footwear manufacturers develop smaller, ergonomically fitted models designed for female workers. The Japan Work Boot Market recognizes this demographic shift as a growth opportunity. Inclusive design strategies enhance brand appeal and workforce satisfaction. Lightweight and flexible options for women expand product diversity. This trend also strengthens sustainability goals through broader consumer inclusion.

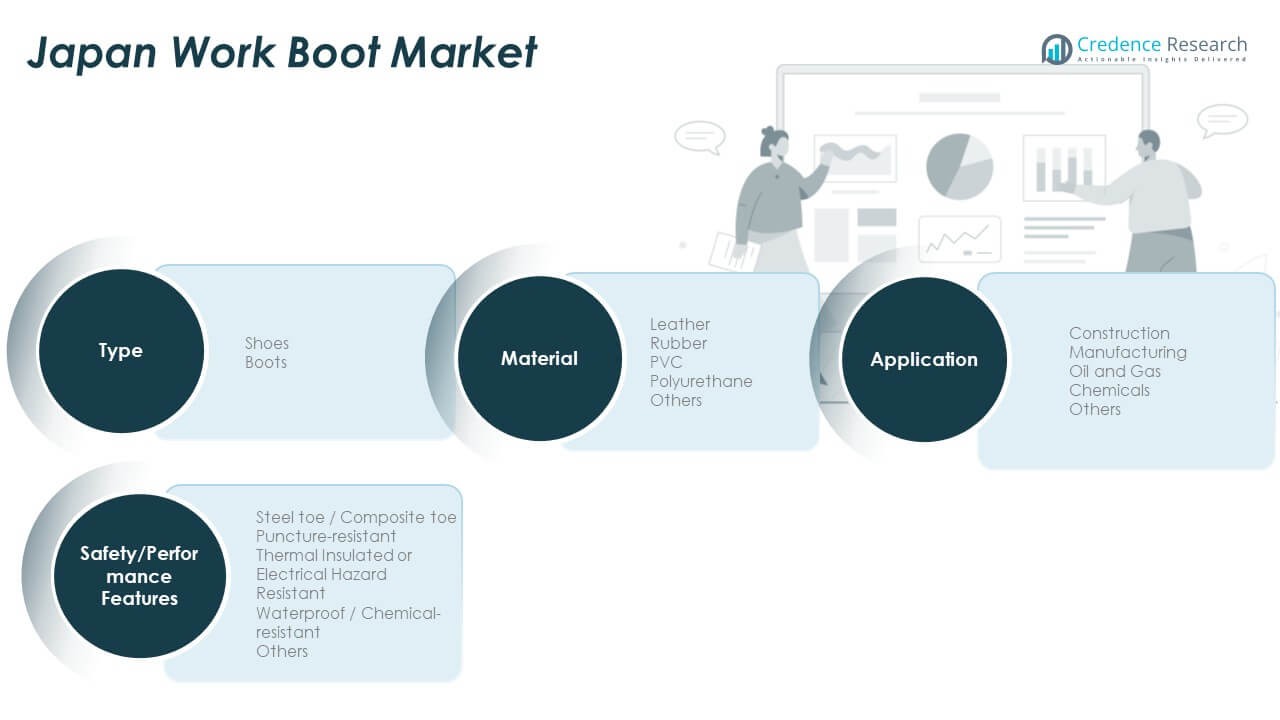

Market Segmentation Analysis:

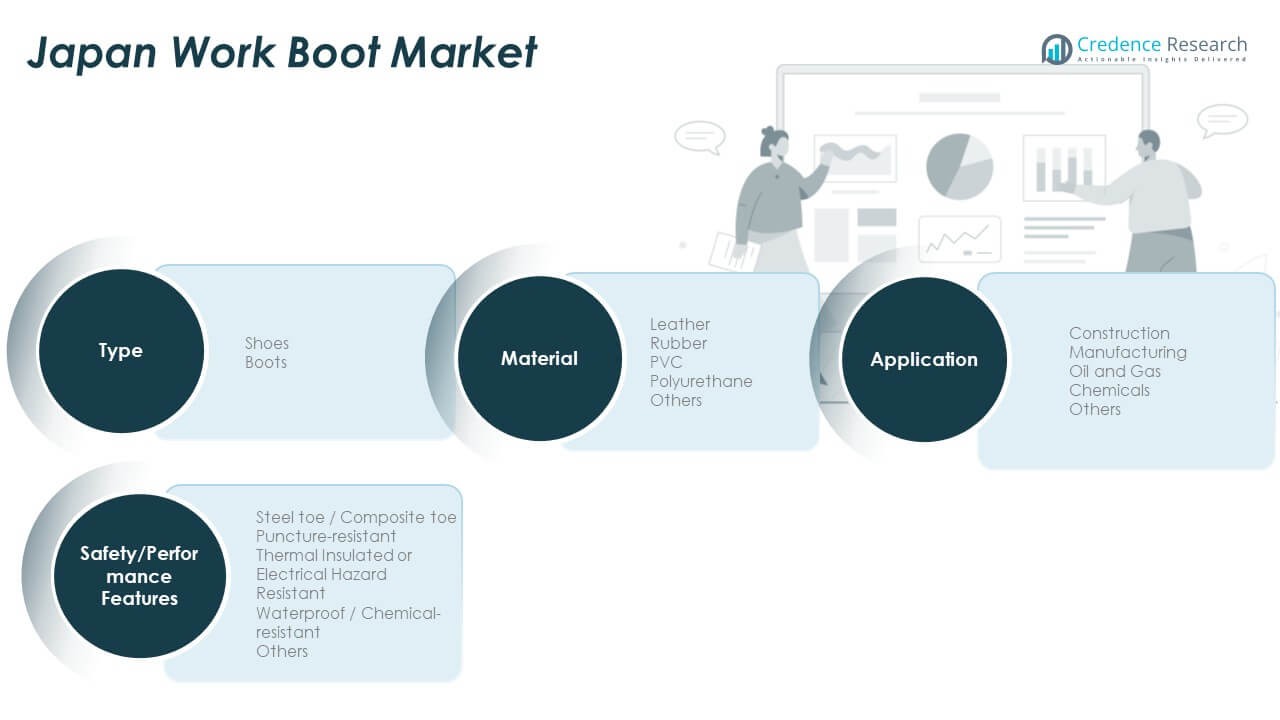

By Type

The Japan Work Boot Market is segmented into shoes and boots, with boots dominating demand due to their superior protection and durability. Industrial sectors prefer high-ankle boots for heavy-duty applications, while low-cut shoes gain traction in light manufacturing and logistics. The growing shift toward lightweight and comfortable footwear is driving hybrid product innovation. It continues to expand as manufacturers combine style, comfort, and safety for broader workforce appeal.

- For instance, Asics’ CP6 S3 G-TX BOA Mid-Cut work boot, certified under EN ISO 20345 and AS 2210.3:2019 safety standards, features a GORE‑TEX waterproof upper and anti-static composite toe cap rated for 200 joule impact resistance—making it highly preferred across logistics and construction sectors in Japan.

By Application

Construction and manufacturing remain the leading application segments, driven by strict occupational safety standards and extensive infrastructure projects. The oil and gas sector demands specialized, heat- and slip-resistant boots. The chemicals industry focuses on boots resisting corrosive substances. Other sectors, including logistics and warehousing, prefer ergonomic footwear for extended use. This broad industrial adoption supports steady demand growth across applications.

- For instance, Japanese construction and foundry facilities have adopted heat‑resistant work shoes with reinforced leather and high‑temperature rubber soles capable of withstanding exposure exceeding 300°C, helping companies comply with Japan’s labor safety standards under MHLW guidelines.

By Material

Leather dominates the market due to its durability, breathability, and resistance to wear. Rubber holds a strong position for waterproof and chemical-resistant boots. PVC and polyurethane are favored for their lightweight structure and affordability. The use of synthetic materials is increasing to improve flexibility and reduce costs. Each material type contributes distinct advantages aligned with specific industrial requirements.

By Safety/Performance Features

Steel toe and composite toe boots lead the safety feature segment, ensuring impact and compression protection. Puncture-resistant soles and insulated linings enhance workplace safety. Thermal and electrical hazard resistance cater to specialized environments. Waterproof and chemical-resistant boots are preferred for harsh outdoor and chemical exposure. The growing demand for multi-functional designs drives technological innovation across this segment.

Segmentation:

By Type

By Application

- Construction

- Manufacturing

- Oil and Gas

- Chemicals

- Others

By Material

- Leather

- Rubber

- PVC

- Polyurethane

- Others

By Safety/Performance Features

- Steel Toe / Composite Toe

- Puncture-Resistant

- Thermal Insulated or Electrical Hazard Resistant

- Waterproof / Chemical-Resistant

- Others

Regional Analysis:

Kanto Region – Industrial and Construction Core

The Kanto region holds the largest share of the Japan Work Boot Market, accounting for 36% of total revenue in 2024. Tokyo and surrounding prefectures serve as industrial and commercial hubs, driving strong demand from construction, logistics, and manufacturing sectors. Continuous redevelopment projects and rising safety compliance in urban worksites strengthen sales of premium-grade boots. The concentration of corporate headquarters and industrial zones encourages procurement of advanced, ergonomic footwear. It benefits from robust distribution networks and high consumer purchasing power. Strong domestic manufacturing and presence of leading brands further reinforce Kanto’s dominance in the national market.

Kansai Region – Expanding Manufacturing and Export Hub

The Kansai region contributes 27% of the Japan Work Boot Market in 2024, led by Osaka, Kyoto, and Hyogo prefectures. This region’s growing manufacturing and export-oriented industries create a sustained demand for durable safety footwear. Expansion in shipbuilding, automotive, and heavy machinery sectors reinforces product uptake. It experiences an increasing preference for rubber and polyurethane boots that combine toughness with flexibility. Regional initiatives promoting workplace safety and industrial modernization support continuous market penetration. The presence of regional footwear producers enhances competitive pricing and product variety.

Chubu, Kyushu, and Tohoku Regions – Emerging Growth Territories

Together, Chubu, Kyushu, and Tohoku regions account for 25%, 8%, and 4% shares respectively, showing rising industrial diversification. Chubu’s automotive and electronics clusters drive consistent consumption of high-performance safety boots. Kyushu’s infrastructure and energy projects promote demand for chemical- and heat-resistant models. The Japan Work Boot Market gains momentum in Tohoku due to public reconstruction projects and growing awareness of occupational safety. These regions present high potential for mid-range and specialized product segments. Strengthening regional distribution and local partnerships are expected to enhance market accessibility and long-term expansion across emerging zones.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mizuno Safety

- Asahi Safety Shoes

- Shoe Corporation (MoonStar)

- Sumitomo Rubber Industries

- Marugo Shoji

- North Star

- Red Wing Shoes

- Yamaha Safety Footwear

Competitive Analysis:

The Japan Work Boot Market features a moderately consolidated landscape led by domestic and international players. Mizuno Safety, Asahi Safety Shoes, MoonStar, and Sumitomo Rubber Industries dominate through extensive product portfolios and strong retail networks. It demonstrates competitive differentiation through innovation, durability, and design excellence. Global brands such as Red Wing Shoes and North Star enhance competition by introducing premium products tailored to Japanese standards. Local manufacturers maintain an edge with cost-efficient production and regional market understanding. Strategic investments in R&D and ergonomic designs support sustained brand loyalty and market leadership.

Recent Developments:

- In August 2025, Sumitomo Rubber Industries made a significant acquisition by purchasing Viaduct, Inc., a U.S.-based AI solutions company, for approximately USD 104 million. The acquisition is intended to accelerate the global rollout of predictive maintenance services for fleet vehicles, leveraging Sumitomo’s SENSING CORE tire technology with Viaduct’s advanced AI. This step marks a strategic expansion into digital fleet management and maintenance services both in North America and globally, directly benefiting segments relevant to industrial and work boot applications.

- In March 2025, Mizuno Safety made headlines by entering a new partnership with the Dorna WorldSBK Organization, becoming the Official Footwear Partner for the WorldSBK series starting in 2025. This collaboration allows Mizuno to supply high-performance footwear for WorldSBK staff and will include various co-marketing initiatives throughout the season to underscore innovation and quality in work and safety footwear.

- In March 2025, Asahi Safety Shoes’ parent company, Asahi Group Foods, announced a definitive agreement to acquire 100% of Leiber GmbH, an innovative brewer’s yeast-related products manufacturer based in Germany. Scheduled for completion by the end of April 2025, this move will significantly expand Asahi’s international presence, especially in biotechnology and food application sectors. The acquisition is intended to enhance Asahi’s footprint and product range, although it primarily influences the broader Asahi Group portfolio.

Report Coverage:

The research report offers an in-depth analysis based on type, application, material, and safety/performance features segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising workplace safety mandates will continue to boost demand across industrial sectors.

- Growth in construction and logistics will sustain steady consumption of heavy-duty boots.

- Eco-friendly production will gain traction through increased use of recycled materials.

- Technological integration, including smart sensors, will enhance product innovation.

- Expansion of e-commerce channels will widen market access and consumer reach.

- Customized and ergonomic designs will strengthen end-user satisfaction and retention.

- Growing female workforce participation will drive development of gender-specific models.

- Local manufacturing expansion will reduce reliance on imported raw materials.

- Collaborations between safety and tech firms will shape the next generation of products.

- Ongoing industrial modernization will sustain consistent revenue growth over the forecast period.