Market Overview

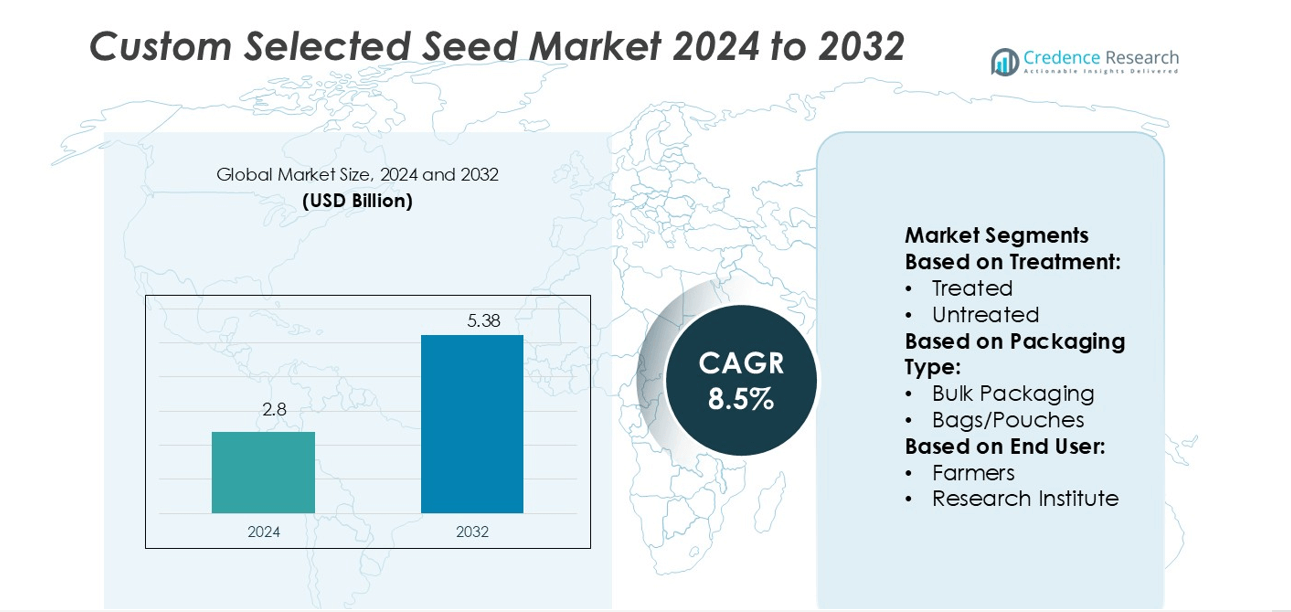

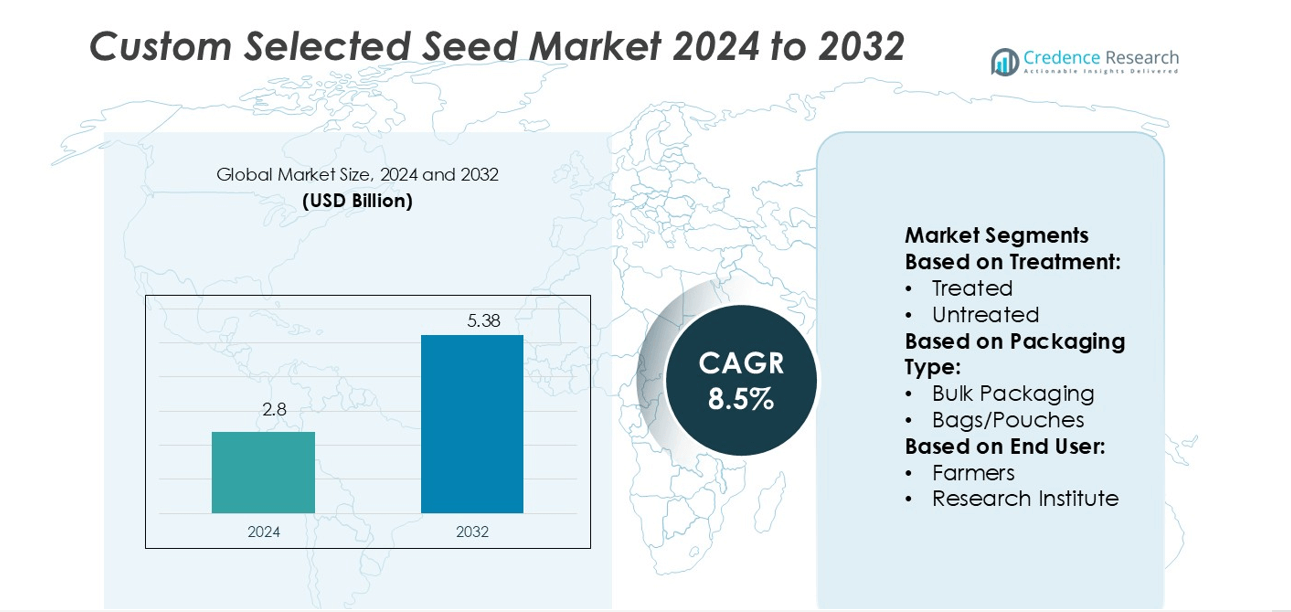

Custom Selected Seed Market size was valued USD 2.8 billion in 2024 and is anticipated to reach USD 5.38 billion by 2032, at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Custom Selected Seed Market Size 2024 |

USD 2.8 billion |

| Custom Selected Seed Market, CAGR |

8.5% |

| Custom Selected Seed Market Size 2032 |

USD 5.38 billion |

The Custom Selected Seed Market is shaped by major players including Johnny’s Selected Seeds, Dow AgroSciences LLC, Enza Zaden, DuPont Pioneer, Groupe Roullier (Phyterra), BASF SE, Bayer CropScience AG, Harris Seeds, Bejo Zaden BV, and Syngenta AG. These companies focus on advanced breeding programs, hybrid seed development, and sustainable farming solutions to strengthen their market positions. North America leads the global market with a 34.2% share, driven by large-scale farming operations, strong research capabilities, and early adoption of precision agriculture. Strategic investments in biotechnology, seed certification, and digital distribution enable market leaders to expand their reach, improve crop resilience, and meet growing food demand across key agricultural economies.

Market Insights

- The Custom Selected Seed Market was valued at USD 2.8 billion in 2024 and is projected to reach USD 5.38 billion by 2032, growing at a CAGR of 8.5%.

- Rising demand for high-yield and climate-resilient seed varieties is a key driver, supported by biotechnology and precision farming adoption.

- Growing use of sustainable farming practices and digital distribution platforms is shaping market trends and improving global reach.

- Intense competition among major players is increasing innovation and product differentiation, though high R&D costs and strict regulations may restrain growth.

- North America leads the market with a 34.2% share, supported by large-scale farming and strong research infrastructure, while the treated seed segment dominates due to higher crop protection and productivity benefits.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Treatment

Treated seeds dominate the Custom Selected Seed Market with a 62.4% share in 2024. This segment leads due to higher resistance to pests and diseases, ensuring better germination rates and uniform crop quality. Farmers prefer treated seeds because they reduce crop loss and lower the need for early pesticide application. Seed treatment technologies also extend storage life and improve stress tolerance. These advantages make treated seeds more reliable and cost-effective for large-scale farming, driving their strong adoption across major agricultural regions.

- For instance, DuPont Pioneer’s Premium Seed Treatment system is tested across over 400 locations and 65,000 plots annually, with treated soybean seeds showing an average yield gain of 4.5 bushels/acre in responsive environments versus untreated seed.

By Packaging Type

Bulk packaging holds a 48.7% market share, emerging as the leading packaging type in 2024. This format is widely used in commercial and cooperative farming, where large volumes are required. Bulk packaging simplifies logistics, reduces handling costs, and allows efficient seed distribution. Its cost-effectiveness attracts medium to large-scale farmers, particularly in high-production zones. Bags and pouches remain popular among smallholders, but bulk packaging dominates due to its strong alignment with modern mechanized farming practices and large-scale seed procurement programs.

- For instance, Groupe Roullier’s packaging division, Agriplas-Sotralentz, operates 3 production units in France, specializing in the design and manufacture of standard and customized plastic packaging for various industries.

By End-user

Farmers account for a 58.3% share of the end-user segment in 2024, making them the dominant customer group. Their preference for high-performance custom-selected seeds stems from the need for better yield, climate resilience, and shorter crop cycles. Farmers’ adoption is further supported by government subsidy programs, extension services, and precision farming tools. Research institutes and cooperative societies also contribute to demand, but the farmer segment drives the bulk of market expansion due to growing commercialization and large-scale agricultural production.

Key Growth Drivers

Rising Demand for High-Yield Seeds

Farmers are increasingly adopting high-performance custom selected seeds to boost crop yield. These seeds offer improved resistance to pests and diseases, reducing crop losses. Better yield performance lowers production costs and increases profit margins. The shift toward quality inputs is also supported by government incentives and awareness campaigns. Major seed producers focus on genetic enhancement to meet yield targets. This rising demand for high-yield seeds is a key driver of market growth, ensuring consistent agricultural output and higher farm profitability.

- For instance, BASF added 19 new Xitavo® soybean seed products, bringing its portfolio to 46 varieties with relative maturities from 0.0 to 4.8, emphasizing yield adaptation and genetic diversity.

Expanding Precision Agriculture Practices

The growth of precision agriculture strongly supports the adoption of custom selected seeds. Precision tools enable farmers to choose seeds suited to specific soil, weather, and pest conditions. This alignment improves crop quality and production efficiency. Farmers benefit from optimized resource use, including water and fertilizers. Precision farming also reduces environmental impact, aligning with sustainable agriculture goals. The increasing use of GPS mapping, drones, and smart irrigation systems drives steady seed demand in this segment.

- For instance, Bayer’s FieldView™ platform now supports Prescription Delivery its Drive 2.0 hardware enables farmers to send seed, fertilizer, or spray prescriptions directly to precision planters and sprayers in-field.

Growing Focus on Sustainable Farming

Sustainable agriculture is becoming a major priority for both producers and policymakers. Custom selected seeds offer climate resilience, improved soil health, and reduced chemical input. These traits support eco-friendly cultivation and comply with global sustainability goals. Governments and agri-tech companies promote the adoption of sustainable seed varieties. Rising consumer demand for organic and clean-label products accelerates this trend. The emphasis on long-term farm productivity and soil conservation positions custom seeds as a key enabler of sustainable growth.

Key Trends & Opportunities

Genetic Enhancement and Trait Innovation

The market is witnessing growing investment in advanced breeding technologies. Genetic enhancement focuses on traits like drought tolerance, disease resistance, and nutrient efficiency. Seed companies are integrating CRISPR and hybrid breeding to deliver superior varieties. These innovations offer strong opportunities for large-scale commercialization. Demand for climate-resilient crops further strengthens this trend, opening new avenues for R&D investment and licensing agreements.

- For instance, Syngenta’s Plant Stand Analyzer (PSA) travels at up to 10 mph (16 km/h), combining laser sensors and RTK-GPS to detect each plant and geo-reference it within 10 cm accuracy—covering what would take humans days in just hours.

Digital Platforms for Seed Distribution

Online platforms and digital marketplaces are transforming how farmers access custom selected seeds. E-commerce simplifies procurement, ensuring faster delivery and better transparency. Companies leverage mobile apps, AI tools, and blockchain for traceability and product authentication. This digital shift expands market reach to remote farming communities. Seed firms gain a competitive edge by building strong online networks and partnerships with agri-tech startups.

- For instance, Bourgault manufactures seeding equipment, including the 4420 Deep Knife Drill (DKD). This drill uses a deep knife to place fertilizer at depths of 120 to 165 mm, followed by a separate, shallower seed knife to precisely place legume seed, which enhances nitrogen fixation.

Government Support and Subsidy Programs

Governments are increasing funding to promote quality seed adoption through subsidies and training. These programs target small and medium farmers to improve crop output. Policy support enhances farmer access to certified seed varieties, boosting overall demand. This creates opportunities for seed companies to expand distribution networks and strengthen their rural presence. Subsidy-driven adoption is expected to significantly support market expansion.

Key Challenges

High Production and Development Costs

The development of custom selected seeds involves significant investment in breeding, testing, and regulatory approvals. These costs limit participation from small and mid-sized producers. High R&D expenditure also affects pricing strategies, making seeds less affordable for smallholder farmers. This cost barrier can slow market penetration in low-income regions, especially without adequate subsidies or financing support.

Limited Awareness Among Small Farmers

Many smallholder farmers remain unaware of the benefits of custom selected seeds. Traditional seed-saving practices dominate in rural areas, reducing the adoption rate. Limited access to technical knowledge, training, and financing adds to the problem. Without effective extension services and outreach programs, market growth may remain concentrated in developed agricultural zones. Overcoming this awareness gap is critical for broader market expansion.

Regional Analysis

North America

North America holds a 34.2% share of the Custom Selected Seed Market, leading the global landscape. The region benefits from advanced agricultural technologies, large-scale farming operations, and strong investments in hybrid and genetically enhanced seed varieties. The U.S. and Canada drive demand due to rising adoption of precision farming practices and favorable government programs. Companies focus on improving crop resilience and yields to meet food security goals. The region’s strong research infrastructure supports faster product development and commercialization, making it a key hub for innovation and market expansion.

Europe

Europe accounts for 28.6% of the Custom Selected Seed Market, supported by sustainable farming initiatives and regulatory frameworks promoting high-quality seed production. Germany, France, and the Netherlands are major contributors due to their advanced seed breeding technologies. Farmers in this region favor certified and disease-resistant seed varieties to boost productivity and align with environmental standards. Policies supporting organic farming and crop diversification further strengthen the market. Strong collaboration between private seed companies and research institutions fosters innovation and enhances regional competitiveness.

Asia Pacific

Asia Pacific represents 23.8% of the Custom Selected Seed Market, driven by rapid agricultural modernization and large-scale crop cultivation. China, India, and Japan are key markets, supported by government schemes promoting hybrid and improved seed adoption. The region’s high population density fuels demand for high-yield crop varieties. Expanding agritech startups and public-private partnerships accelerate product penetration. Farmers are increasingly shifting toward customized seed solutions to improve crop performance under varying climate conditions. Strong R&D initiatives are enhancing regional seed development capabilities.

Latin America

Latin America holds a 7.9% share of the Custom Selected Seed Market, with Brazil and Argentina being the primary contributors. The region is witnessing strong adoption of hybrid seeds, particularly for corn and soybean cultivation. Favorable climatic conditions, coupled with expanding agricultural exports, support consistent market growth. Government policies promoting modern farming techniques further boost demand for improved seed varieties. Key seed companies are expanding their distribution networks, offering tailored solutions to meet diverse crop requirements in the region.

Middle East & Africa

The Middle East & Africa region holds a 5.5% share of the Custom Selected Seed Market, supported by rising food security initiatives and agricultural transformation programs. Countries such as South Africa, Saudi Arabia, and the UAE are increasing investments in modern farming practices. The adoption of drought-tolerant and climate-resilient seed varieties is expanding rapidly due to challenging environmental conditions. Governments and international organizations are collaborating to improve seed accessibility and farmer training. This growing focus on productivity enhancement is fueling steady market expansion in the region.

Market Segmentations:

By Treatment:

By Packaging Type:

- Bulk Packaging

- Bags/Pouches

By End User:

- Farmers

- Research Institute

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Custom Selected Seed Market features key players such as Johnny’s Selected Seeds, Dow AgroSciences LLC, Enza Zaden, DuPont Pioneer, Groupe Roullier (Phyterra), BASF SE, Bayer CropScience AG, Harris Seeds, Bejo Zaden BV, and Syngenta AG. The Custom Selected Seed Market is defined by continuous innovation, strategic collaborations, and strong research investments. Companies are focusing on developing high-performance seed varieties with improved yield, pest resistance, and climate adaptability. Advanced biotechnology and precision agriculture techniques are widely used to enhance seed quality and production efficiency. Strategic partnerships with research institutes and government programs support faster product development and certification. Firms are also expanding their global footprint through mergers, acquisitions, and localized production facilities. A strong emphasis on sustainable farming solutions and tailored seed offerings further intensifies competition and strengthens market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2024, Corteva introduced a proprietary and novel non-GMO hybrid technology for wheat, which is expected to ensure substantial yield improvements to the crop. The new method boosts yield potential by 10% while utilizing the same quantity of land resources.

- In June 2023, Takii unveiled a new advanced seed production facility in Karacabey, Turkey. The plant, situated in the Bursa province, has been established to improve the company’s production process for both flower and vegetable seeds.

- In April 2023, Bayer said that it would begin investing 60 million euros in its maize seed production facility in Pochuiky, Ukraine, beginning in 2023. By taking this action, the life sciences company shows its commitment to Ukraine, expands its Crop Science business there, and contributes to the economic recovery of the country.

- In February 2023, Optimum GLY canola will be offered for commercial planting in Canada and the United States through Corteva Agriscience seed brands Pioneer and Brevant Pioneer and Brevant seeds, two Corteva Agriscience brands, will sell optimal GLY canola for commercial planting in the US and Canada

Report Coverage

The research report offers an in-depth analysis based on Treatment, Packaging Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as farmers adopt high-yield and climate-resilient seed varieties.

- Biotechnology advancements will drive the development of customized and hybrid seeds.

- Precision farming will increase the demand for seeds tailored to specific soil and crop needs.

- Sustainable farming practices will strengthen the market for eco-friendly seed solutions.

- Companies will invest more in R&D to speed up seed innovation and quality improvements.

- Strategic collaborations and partnerships will support faster market penetration.

- Emerging economies will witness strong growth due to rising agricultural modernization.

- Digital platforms will enhance seed distribution and farmer accessibility.

- Government initiatives will promote certified and high-quality seed adoption.

- Competition will intensify as global and regional players expand their market presence.