Market Overview

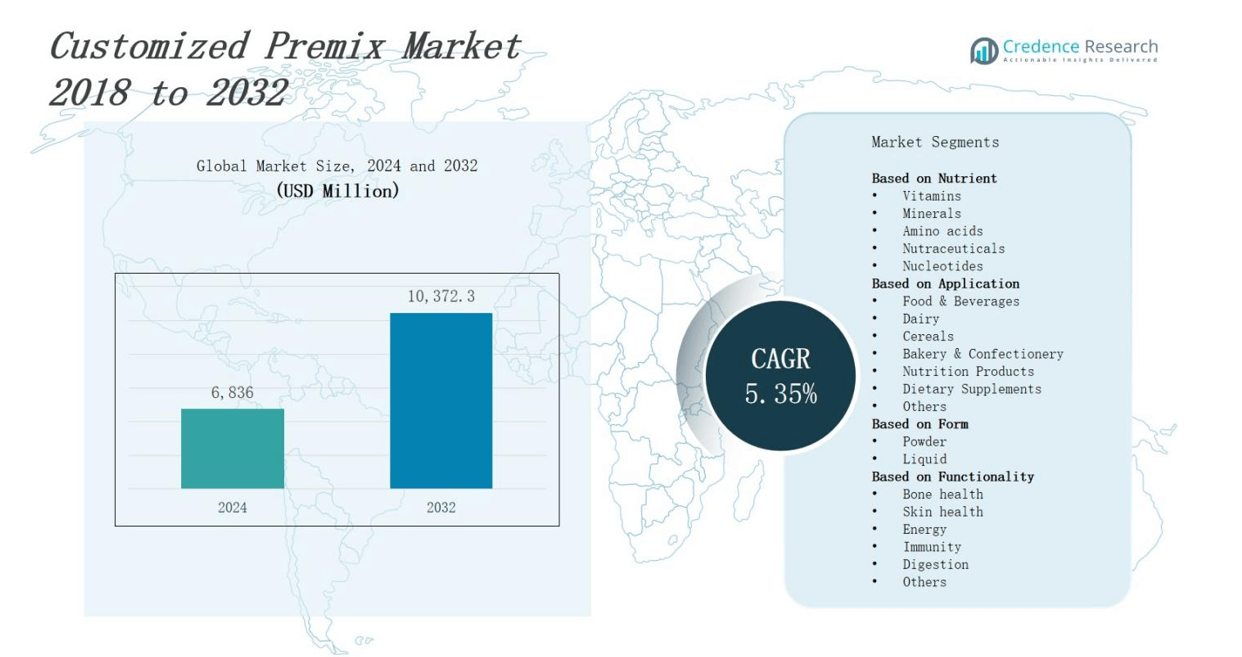

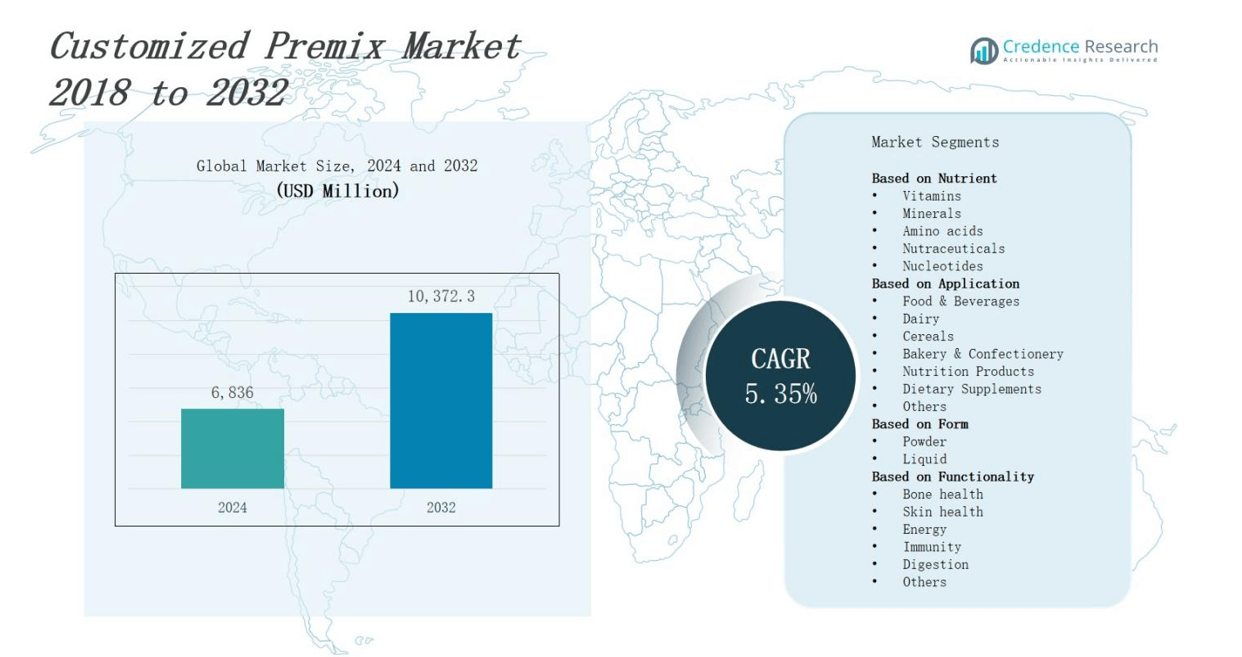

The customized premix market is projected to grow from USD 6,836 million in 2024 to USD 10,372.3 million by 2032, at a CAGR of 5.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Customized Premix Market Size 2024 |

USD 6,836 million |

| Customized Premix Market, CAGR |

5.35% |

| Customized Premix Market Size 2032 |

USD 10,372.3 million |

The customized premix market is driven by the rising demand for fortified foods and beverages, growing health consciousness, and the increasing prevalence of micronutrient deficiencies. Food manufacturers seek tailored nutritional solutions to enhance product appeal and meet regulatory requirements, supporting market growth. The shift toward personalized nutrition, clean-label ingredients, and plant-based formulations further fuels innovation. Trends include the integration of functional ingredients like probiotics, omega-3s, and botanical extracts, along with advancements in microencapsulation technologies. The market also benefits from the expansion of preventive healthcare and growing demand in emerging economies, where nutrition-focused initiatives continue to shape consumer preferences.

The customized premix market spans North America, Europe, Asia Pacific, and other regions globally. North America leads with 34% market share, followed by Europe at 27% and Asia Pacific at 24%, each driven by distinct consumer demands and regulatory frameworks. Key players operating across these regions include Vitablend Netherlands B.V, Glanbia PLC, Corbion N.V, Royal DSM N.V, The Wright Group, Stern Vitamin GmbH & Co. Kg, Watson Inc, DPO International Sdn. Bhd, Chemische Fabrik Budenheim Kg, and Farbest Brands, all focusing on innovation, compliance, and tailored nutrition solutions.

Market Insights

- The customized premix market is projected to grow from USD 6,836 million in 2024 to USD 10,372.3 million by 2032, registering a CAGR of 5.35%.

- Rising demand for fortified foods and beverages, coupled with growing health awareness, drives strong adoption across multiple sectors.

- Personalized nutrition, clean-label trends, and plant-based ingredient preferences are reshaping product development strategies.

- Technological advancements such as microencapsulation and bioavailability enhancement support innovation in nutrient delivery systems.

- North America leads the market with 34% share, followed by Europe at 27% and Asia Pacific at 24%.

- Applications expand across functional foods, supplements, and clinical nutrition, creating new revenue streams for manufacturers.

- Key players include Vitablend Netherlands B.V, Glanbia PLC, Corbion N.V, Royal DSM N.V, The Wright Group, and others focusing on innovation and regulatory compliance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Fortified Food and Beverages

The customized premix market benefits significantly from the increasing consumer demand for fortified food and beverage products. Consumers actively seek nutritional options that support immunity, energy, and overall well-being. Food manufacturers rely on premix solutions to meet specific nutrient profiles and health claims. Governments and health organizations promote food fortification to address micronutrient deficiencies. This drives investment and innovation in formulation development. The customized premix market enables precise nutrient integration and efficient product differentiation.

- For instance, Nestlé fortified its Maggi noodles with iron and iodine to combat micronutrient deficiency in India.

Increasing Health Awareness and Preventive Nutrition Focus

Consumers are prioritizing health and wellness, shifting toward proactive and preventive nutritional choices. The customized premix market supports this shift by enabling targeted nutrient delivery across various food categories. It allows brands to cater to dietary preferences such as gluten-free, low-sodium, or keto-friendly options. The global rise in lifestyle-related diseases reinforces the demand for functional ingredients. Tailored premixes align with wellness goals and dietary management. Market players expand offerings to match consumer health priorities.

- For instance, DSM created customized vitamin and mineral premixes used in Abbott’s Ensure products, which are formulated to support immunity and muscle health in older adults.

R&D Advancements in Nutritional Science and Ingredient Technology

Continuous advancements in ingredient science and nutritional research fuel the growth of the customized premix market. Manufacturers use microencapsulation, nanotechnology, and bioavailability enhancement techniques to improve ingredient performance. These developments allow stable, effective, and scalable formulations. The market evolves with new ingredient combinations, including probiotics, amino acids, and herbal extracts. It enables customized solutions for age-specific, gender-specific, and condition-specific formulations. Demand for precision nutrition creates opportunities for high-margin customized offerings.

Expansion in Functional Food, Beverage, and Supplement Industries

The rise of functional foods, beverages, and dietary supplements creates strong growth avenues for the customized premix market. Manufacturers require precise and efficient nutrient delivery systems to enhance product benefits. Custom premixes simplify production processes while maintaining quality and compliance. The surge in clean-label and natural product demand pushes innovation in premix formulation. It helps brands offer differentiated products with verified health claims. Growth in global health-conscious populations sustains long-term market potential.

Market Trends

Growing Adoption of Personalized and Targeted Nutrition Solutions

The customized premix market is witnessing a strong shift toward personalized nutrition, driven by rising consumer expectations for targeted health benefits. Brands are developing premixes tailored to individual needs such as age, gender, health condition, and activity level. Consumers prefer products that align with their unique wellness goals. The market supports this trend with customizable blends featuring vitamins, minerals, amino acids, and botanical extracts. It enables manufacturers to differentiate products and improve consumer engagement. Demand for precise nutrition continues to grow across multiple demographic groups.

- For instance, BirdieAI offers an AI nutrition coach that delivers prenatal, postpartum, and pediatric personalized meal plans based on users’ diet goals and preferences.

Integration of Clean-Label and Plant-Based Ingredients in Formulations

The clean-label movement significantly influences ingredient selection and product development across the customized premix market. Consumers increasingly seek transparency in sourcing, formulation, and nutritional value. Plant-based components such as pea protein, rice bran, and algae-derived nutrients are becoming popular in premix design. It aligns with rising demand for vegan, non-GMO, and allergen-free products. Manufacturers are responding with sustainable ingredient sourcing and natural processing methods. This trend expands applications across functional foods, beverages, and supplements.

- For instance, ADM has introduced algae-based nutrient premixes combining natural protein, fiber, and essential micronutrients to support clean-label plant-based functional foods and supplements, addressing consumer preferences for sustainable and transparent ingredients.

Technological Advancements in Nutrient Delivery and Formulation Stability

Advancements in processing and encapsulation technologies are shaping the evolution of the customized premix market. Techniques like microencapsulation, liposomal delivery, and nanotechnology improve ingredient stability and bioavailability. These innovations ensure the effectiveness of active nutrients in complex food matrices. It allows longer shelf life and greater flexibility in application formats. The market benefits from better nutrient release mechanisms that cater to evolving dietary needs. Improved R&D capabilities support the integration of advanced functional components.

Increased Collaboration Between Manufacturers and End-Use Industries

Manufacturers are forming strategic partnerships with food, beverage, and pharmaceutical brands to co-develop customized premix solutions. The customized premix market thrives on collaboration, allowing faster product launches and better alignment with consumer trends. It enables streamlined supply chains and agile product development. Co-creation drives innovation in formulations that meet regulatory and market requirements. The trend supports scale, speed, and tailored functionality. Customized solutions enhance competitive positioning across both premium and mass-market segments.

Market Challenges Analysis

Regulatory Complexity and Compliance Across Global Markets

The customized premix market faces challenges due to varying regulatory frameworks across regions. Compliance with food safety, health claims, and ingredient labeling laws differs by country, complicating global distribution. It increases the burden on manufacturers to conduct region-specific formulation and documentation. Frequent changes in policies or nutrient fortification guidelines can disrupt supply chains and delay product launches. The cost and time required for certifications and approvals also impact market entry strategies. Companies must invest in regulatory expertise and localized R&D to ensure continued growth.

Formulation Complexity and Ingredient Compatibility Issues

Developing stable and effective customized premixes requires addressing ingredient compatibility and formulation challenges. Some nutrients interact negatively when combined, affecting shelf life, taste, or bioavailability. It demands precise formulation strategies and advanced processing technologies, which may increase production costs. Ensuring consistent quality across large batches remains difficult, especially in multi-component blends. The need for specialized equipment and skilled personnel can also limit scalability. These formulation constraints pose barriers to innovation and broader application across food, beverage, and pharmaceutical sectors.

Market Opportunities

Rising Demand in Emerging Economies and Underserved Regions

The customized premix market holds strong growth potential in emerging economies where malnutrition and micronutrient deficiencies remain prevalent. Governments and health agencies are implementing national fortification programs, creating opportunities for premix manufacturers. Local food producers seek cost-effective, easy-to-integrate solutions that meet both health goals and regulatory standards. It allows companies to expand distribution through strategic partnerships and localized production. Increasing urbanization and dietary shifts in these regions support long-term demand. Brands that offer affordable, tailored solutions can gain early market advantage.

Expansion in Sports Nutrition, Geriatric, and Infant Health Segments

The customized premix market is well-positioned to serve specialized segments such as sports nutrition, elderly care, and infant health. These categories require precise nutrient combinations tailored to unique physiological needs. It enables targeted formulations that support energy, cognitive function, immunity, and bone health. Rising awareness of life-stage nutrition creates a growing customer base for condition-specific blends. Manufacturers can introduce high-margin products by aligning with clinical research and evolving consumer health priorities. Market players that invest in R&D and product diversification can capture these premium opportunities.

Market Segmentation Analysis:

By Type

The customized premix market includes vitamin premix, mineral premix, amino acid premix, nucleotide premix, and others. Vitamin and mineral premixes dominate due to their wide application in food, beverage, and pharmaceutical products. Manufacturers rely on these blends to meet fortification standards and health claims. It supports product functionality while simplifying formulation. Amino acid and nucleotide premixes are gaining traction in clinical and sports nutrition segments. Market demand reflects growing interest in performance-focused and therapeutic applications.

- For instance, Glanbia Nutritionals incorporates vitamin and mineral premixes into functional beverages to enhance immunity and energy levels in consumers.

By Technology

Dry blending and encapsulation technologies lead in the customized premix market. Dry blending remains preferred for its cost-effectiveness and compatibility with various formulations. Encapsulation is gaining market share due to its ability to protect sensitive ingredients and enhance nutrient stability. It ensures controlled release, extended shelf life, and improved bioavailability. Microencapsulation is especially relevant for heat-sensitive or reactive compounds. Advanced processing techniques help manufacturers develop tailored blends that perform well across diverse food matrices.

- For instance, Prinova offers customized dry premixes that effectively blend high-quality ingredients, ensuring uniform nutrient distribution and ease of use in diverse food applications.

By End User

Food and beverage manufacturers represent the largest end-user segment in the customized premix market. They integrate premixes into dairy, bakery, cereals, beverages, and snacks to meet consumer demand for fortified products. The pharmaceutical sector uses premixes in dietary supplements and therapeutic formulations. The market also serves animal nutrition, personal care, and infant nutrition. It enables end users to launch differentiated products quickly while ensuring consistency, quality, and regulatory compliance. Each sector drives demand based on specific nutritional goals.

Segments:

Based on Nutrient

- Vitamins

- Minerals

- Amino acids

- Nutraceuticals

- Nucleotides

Based on Application

- Food & Beverages

- Dairy

- Cereals

- Bakery & Confectionery

- Nutrition Products

- Dietary Supplements

- Others

Based on Form

Based on Functionality

- Bone health

- Skin health

- Energy

- Immunity

- Digestion

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share of the customized premix market, accounting for 34% of global revenue. Strong demand for fortified foods, supplements, and clinical nutrition drives consistent growth. Major food and pharmaceutical companies in the U.S. and Canada adopt custom blends to meet evolving consumer expectations. It benefits from advanced R&D infrastructure and strict regulatory compliance that ensures high-quality formulations. Increasing awareness of preventive healthcare and functional nutrition supports market expansion. Companies leverage innovation and personalized solutions to maintain competitiveness in this region.

Europe

Europe accounts for 27% of the customized premix market, supported by rising health consciousness and regulatory mandates for nutrient fortification. Countries like Germany, France, and the UK lead in demand for clean-label and plant-based fortified products. It sees increasing adoption of premixes in dairy, bakery, and nutraceutical applications. Manufacturers emphasize traceability, sustainability, and transparent sourcing to align with consumer expectations. The market reflects growing investments in age-specific and lifestyle-based nutritional products. Functional food launches in Europe continue to drive demand for tailored premix solutions.

Asia Pacific

Asia Pacific holds 24% of the global customized premix market and exhibits the fastest growth due to rising disposable income, urbanization, and malnutrition concerns. China, India, and Japan represent key contributors with expanding health and wellness industries. It sees strong government support for food fortification programs and preventive health initiatives. Local manufacturers adopt premix solutions to meet diverse regional dietary needs. The market supports applications across infant nutrition, functional beverages, and dietary supplements. Rapid product innovation and regulatory developments will shape future regional dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Vitablend Netherlands B.V

- The Wright Group

- Glanbia PLC

- DPO International Sdn. Bhd

- Corbion N.V

- Stern Vitamin GmbH & Co. Kg

- Farbest Brands

- Chemische Fabrik Budenheim Kg

- Watson Inc

- Royal DSM N.V

Competitive Analysis

The customized premix market is highly competitive, with key players focusing on innovation, regional expansion, and tailored solutions. Companies such as Vitablend Netherlands B.V, Glanbia PLC, and Corbion N.V offer advanced nutrient blends designed to meet specific health and regulatory requirements. It favors players with strong formulation expertise and flexible manufacturing capabilities. Firms like The Wright Group and Stern Vitamin GmbH & Co. Kg emphasize product quality, shelf-life stability, and application diversity. Strategic partnerships and acquisitions help companies enter new markets and broaden product portfolios. Investments in clean-label, plant-based, and bioavailable formulations strengthen competitive positioning. Leading players also invest in R&D to develop precision-targeted nutritional solutions. Customer-centric services, rapid delivery, and regulatory compliance drive brand loyalty. Competition intensifies with emerging regional firms offering cost-effective and localized premix options.

Recent Developments

- In April 2025, CCPA Group acquired Uruguay-based Nutrisur through its joint venture Euro-Nutec Premix, expanding its presence in the Latin American premix sector.

- In September 2024, DSM-Firmenich opened a new premix facility in Sadat City, Egypt, to strengthen its regional capabilities in animal nutrition and health.

- In June 2025, Premix Group partnered with LyondellBasell and Maillefer to launch PRE-ELEC® PP18220, a recyclable polypropylene compound designed for high-voltage cable applications, showcasing innovation in cross-industry material solutions.

- In December 2023, Archer Daniels Midland (ADM) acquired PT Trouw Nutrition Indonesia for USD 485 million, enhancing its premix capabilities and distribution network across Southeast Asia.

Market Concentration & Characteristics

The customized premix market shows moderate to high concentration, with a few key players dominating global supply through extensive manufacturing capabilities and strong distribution networks. It features a mix of multinational corporations and specialized regional firms, each offering tailored nutrient solutions across food, beverage, pharmaceutical, and nutraceutical sectors. The market values product customization, rapid formulation support, and regulatory compliance. It rewards companies that invest in R&D, technical expertise, and innovation in nutrient delivery technologies. Customer loyalty depends on quality, reliability, and the ability to deliver precise blends aligned with client-specific goals. Market leaders focus on strategic partnerships, expansion into emerging economies, and product diversification to strengthen their competitive position. Standardization in production and traceability in sourcing have become core differentiators. The customized premix market relies on long-term contracts, collaborative development, and private-label offerings to secure recurring demand from major food and healthcare brands. Competitive advantage lies in flexibility, speed, and science-backed formulations.

Report Coverage

The research report offers an in-depth analysis based on Nutrient, Application, Form, Functionality and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for personalized nutrition will continue to drive the development of targeted premix formulations.

- Food and beverage companies will increasingly rely on custom blends to meet evolving consumer health preferences.

- Clean-label and plant-based ingredients will dominate future premix compositions across applications.

- Technological advancements in nutrient encapsulation will improve product stability and performance.

- Regulatory alignment across regions will influence product design and global expansion strategies.

- Manufacturers will expand their presence in emerging markets through local partnerships and production facilities.

- Precision nutrition for age-specific and condition-specific needs will gain wider adoption.

- Growth in e-commerce and private-label brands will create new distribution opportunities for premix suppliers.

- Companies will invest more in R&D to enhance bioavailability and compatibility of multifunctional blends.

- Strategic collaborations between ingredient suppliers and end-use industries will accelerate product innovation.