Market Overview

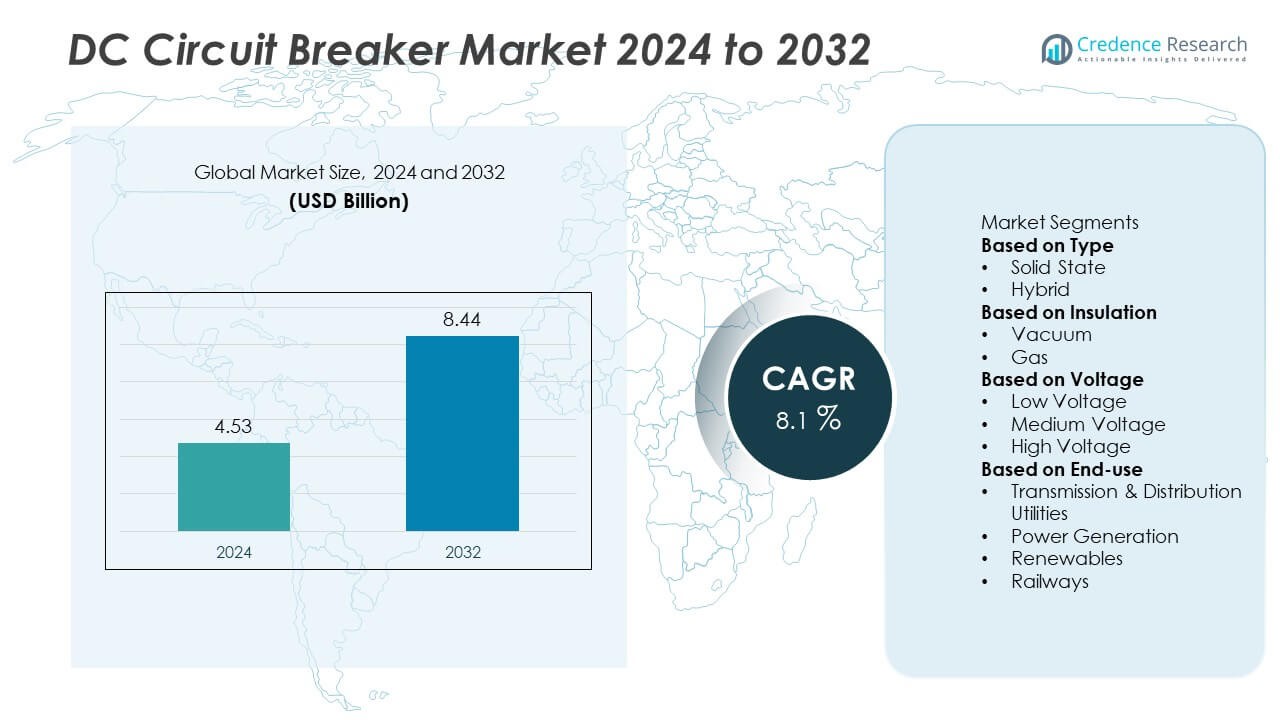

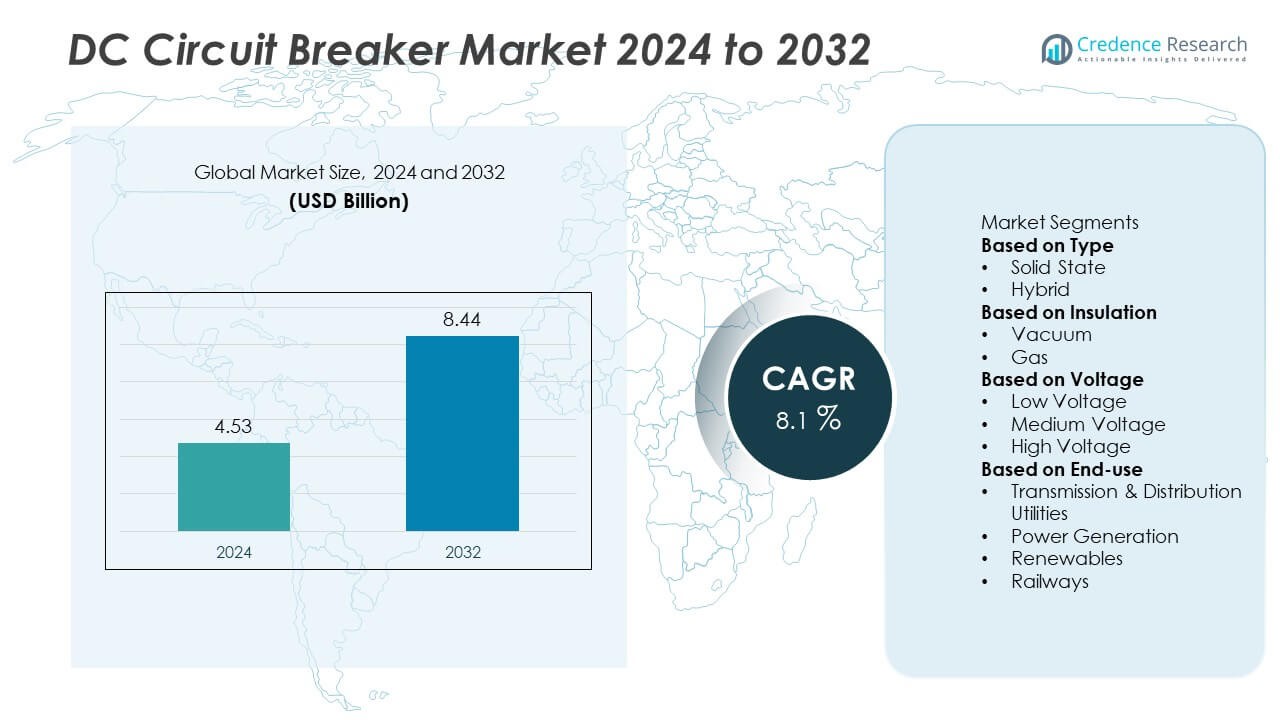

The DC Circuit Breaker market was valued at USD 4.53 billion in 2024 and is projected to reach USD 8.44 billion by 2032, growing at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DC Circuit Breaker market Size 2024 |

USD 4.53 Billion |

| DC Circuit Breaker market, CAGR |

8.1% |

| DC Circuit Breaker market Size 2032 |

USD 8.44 Billion |

The DC circuit breaker market is led by major players such as Nader Electrical, Mitsubishi Electric Corporation, Eaton Corporation PLC, Entec Electric & Electronic Co Ltd, Rockwell Automation, Hyundai Electric & Energy Systems Company, Larsen & Toubro Limited, ABB Ltd, GEYA Electrical Co., and Siemens AG. These companies dominate through advanced product portfolios, technological innovation, and strong global distribution networks. They focus on hybrid and solid-state DC breakers to enhance reliability and safety in renewable and industrial systems. Asia Pacific led the market with a 34% share in 2024, driven by expanding HVDC and solar infrastructure. Europe followed with a 32% share, supported by grid modernization and offshore wind projects, while North America accounted for 29%, driven by renewable integration and electrification of transport systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global DC circuit breaker market was valued at USD 4.53 billion in 2024 and is projected to reach USD 8.44 billion by 2032, growing at a CAGR of 8.1% during the forecast period.

- Market growth is driven by increasing renewable energy adoption, HVDC transmission expansion, and rising investments in electric mobility and smart grid infrastructure.

- Key trends include advancements in hybrid and solid-state DC breakers, digital monitoring integration, and compact designs for high-speed fault protection.

- The market is competitive, with major players such as ABB Ltd, Siemens AG, Eaton Corporation PLC, Mitsubishi Electric Corporation, and Larsen & Toubro Limited focusing on efficiency, safety, and technological innovation.

- Asia Pacific led with a 34% share, followed by Europe at 32% and North America at 29%, while the hybrid segment dominated with a 57% share, driven by its reliability in renewable and industrial applications.

Market Segmentation Analysis:

By Type

The hybrid segment dominated the DC circuit breaker market with a 57% share in 2024, driven by its efficiency and reliability in handling high-voltage direct current (HVDC) applications. Hybrid breakers combine mechanical and semiconductor technologies, offering fast fault isolation and reduced arc energy. They are increasingly deployed in renewable energy integration, electric railways, and DC grids for enhanced safety. The solid-state segment is gaining traction due to its ultra-fast response and low maintenance needs, but higher costs limit its widespread adoption across large-scale power systems.

- For instance, Mitsubishi Electric developed and successfully tested a prototype 160 kV mechanical DC circuit breaker for HVDC applications. The device interrupted a 16kA fault current within 7 milliseconds during a 2019 test. The successful demonstration was part of the EU-funded PROMOTioN project to advance HVDC networks.

By Insulation

The vacuum insulation segment held a 52% share in 2024, emerging as the dominant category due to superior arc-quenching performance and long operational life. Vacuum-insulated DC circuit breakers are widely used in renewable and industrial power networks where reliability and minimal maintenance are essential. Their compact design and high dielectric strength make them ideal for medium-voltage applications. Gas-insulated breakers, while offering excellent cooling and insulation, are primarily preferred in high-voltage networks and offshore installations where environmental and space constraints demand sealed systems.

- For instance, Eaton introduced a vacuum-interrupting DC breaker rated at 40 kA breaking capacity for rail and industrial grids, ensuring over 20,000 mechanical operations before maintenance.

By Voltage

The high-voltage segment led the DC circuit breaker market with a 46% share in 2024, driven by rising demand for HVDC transmission and large renewable integration projects. These breakers are critical for ensuring grid stability and preventing equipment damage during power fluctuations. The medium-voltage segment is also expanding due to its use in urban power distribution, electric mobility, and industrial automation. Low-voltage DC breakers serve residential and commercial solar installations, where compact protection systems are required to handle increasing distributed energy generation.

Key Growth Drivers

Expansion of Renewable and Electric Power Infrastructure

The increasing adoption of renewable energy and electric mobility is driving strong demand for DC circuit breakers. These breakers ensure safe and efficient current interruption in solar farms, EV charging stations, and battery storage systems. Global grid modernization projects are integrating more DC networks to reduce transmission losses. The growing focus on electrification of transport and industrial systems further boosts installations, particularly in Asia Pacific and Europe, where renewable generation and smart grid investments continue to expand rapidly.

- For instance, ABB has produced a Gerapid DC high-speed circuit breaker with ratings up to 8,000A. These single-pole breakers are specifically designed for high-energy DC power distribution in various applications. They are used in fields such as railway traction substations and heavy industry.

Rising Demand for HVDC Transmission Systems

The surge in high-voltage direct current (HVDC) transmission networks is a major growth driver for the DC circuit breaker market. HVDC systems offer improved efficiency in long-distance power transfer, particularly for offshore wind and interregional grid connections. DC circuit breakers provide critical protection against short circuits and fault currents in these networks. Increasing cross-border energy exchange in Europe, North America, and Asia is accelerating deployment, while ongoing investments in power reliability and flexible grid interconnections enhance market expansion.

- For instance, Hyundai Electric & Energy Systems developed a 120 kV DC circuit breaker prototype capable of isolating fault currents within 6 ms during Korea Electric Power Corporation’s HVDC pilot project, improving grid stability across the national transmission network.

Technological Advancements in Switching and Protection Systems

Rapid advancements in power electronics and semiconductor technology are improving DC circuit breaker performance. Innovations such as hybrid and solid-state designs enable faster fault isolation, minimal arcing, and longer operational lifespans. Integration of intelligent monitoring systems enhances fault detection and predictive maintenance, improving grid reliability. Manufacturers are focusing on compact, modular, and high-speed designs for next-generation renewable and transportation applications. These technological improvements are crucial to meeting safety and performance standards in evolving DC-based infrastructure.

Key Trends & Opportunities

Integration with Smart Grids and Energy Storage Systems

Smart grid expansion and the rise of distributed energy resources are creating new opportunities for DC circuit breakers. Their ability to provide high-speed protection and remote monitoring makes them ideal for advanced grid applications. Integration with battery energy storage systems enhances grid flexibility and energy management. The trend toward digitalization in power networks, driven by IoT-enabled control systems, supports real-time monitoring and automation, further driving adoption across renewable and industrial sectors.

- For instance, Schneider Electric’s MasterPact MTZ breaker supports IoT connectivity and predictive analytics, which improves power uptime and enhances reliability in smart grid networks.

Growing Adoption in Electric Mobility and Transportation

The rapid growth of electric vehicles (EVs), high-speed trains, and electric ships is boosting demand for DC circuit breakers. These breakers provide reliable protection for DC charging infrastructure and onboard power systems. Governments worldwide are investing in EV charging networks, which require robust DC protection solutions to ensure operational safety and power efficiency. As electrified transportation expands globally, manufacturers are developing compact, high-speed DC breakers suited for mobile and stationary charging environments.

- For instance, Toshiba offers its SCiB™ lithium-ion rechargeable battery, known for its rapid charging capabilities and long life, for use in electric buses. The SCiB™ battery minimizes downtime through fast charging and provides reliability due to its long cycle life and thermal stability.

Key Challenges

High Cost of Advanced DC Circuit Breakers

High manufacturing and installation costs remain a major challenge for widespread adoption. Hybrid and solid-state DC breakers require advanced materials and semiconductor components, increasing production costs. Their integration into existing AC-based systems also involves complex retrofitting and additional protection equipment. These cost constraints particularly affect small renewable developers and emerging markets. Efforts to scale production and optimize designs will be critical to reducing prices and enabling broader market penetration.

Complex Fault Detection and Maintenance Requirements

DC systems pose unique challenges in fault detection due to the absence of natural current zero-crossing, making interruption more complex than in AC systems. Maintaining DC breakers requires advanced diagnostic tools and skilled technicians, increasing operational costs. Delays in fault clearance can cause equipment damage or grid instability. The need for advanced control systems and continuous monitoring adds technical complexity. Manufacturers must develop more adaptive and self-diagnostic protection technologies to overcome these maintenance challenges.

Regional Analysis

North America

North America held a 29% share of the DC circuit breaker market in 2024, driven by rising investments in renewable energy, electric mobility, and grid modernization. The United States and Canada are expanding HVDC transmission networks to enhance grid stability and reduce losses. The growing deployment of EV charging infrastructure and energy storage systems further strengthens product demand. Major manufacturers are focusing on developing hybrid and solid-state breakers to meet stringent safety and efficiency standards. Continuous technological upgrades and supportive government incentives sustain market growth across industrial and utility applications.

Europe

Europe accounted for a 32% share of the DC circuit breaker market in 2024, supported by strong regulatory focus on decarbonization and renewable integration. Countries such as Germany, the United Kingdom, and France are expanding offshore wind and HVDC grid projects that require advanced DC protection systems. EU initiatives promoting smart grid infrastructure and low-emission transport drive product adoption. Increasing investments in electric railways and energy storage applications further accelerate demand. Europe’s emphasis on energy efficiency and electrical safety standards continues to position the region as a key innovator in DC circuit breaker technologies.

Asia Pacific

Asia Pacific dominated the DC circuit breaker market with a 34% share in 2024, emerging as the fastest-growing region globally. Strong government initiatives to expand renewable power capacity in China, India, Japan, and South Korea drive large-scale installations of HVDC and solar networks. Rapid industrialization, urban electrification, and growing EV adoption further boost regional demand. Local manufacturers are investing in cost-effective, high-performance breakers to support expanding transmission infrastructure. The focus on reliable, high-speed protection systems aligns with regional goals for energy security and sustainable power distribution, ensuring continued market leadership for Asia Pacific.

Latin America

Latin America captured a 3% share of the DC circuit breaker market in 2024, driven by ongoing renewable power projects in Brazil, Mexico, and Chile. Governments are promoting grid modernization and clean energy integration to reduce dependence on fossil fuels. The adoption of DC protection systems is rising in solar farms and industrial automation. International partnerships and investments are improving technology access and product availability across the region. However, high equipment costs and limited technical expertise continue to slow adoption rates, although gradual policy support is strengthening long-term market potential.

Middle East & Africa

The Middle East & Africa region accounted for a 2% share of the DC circuit breaker market in 2024, reflecting early but growing adoption. Countries such as Saudi Arabia, the UAE, and South Africa are investing in renewable energy projects and HVDC transmission lines to diversify energy sources. Expansion of smart grid initiatives and electric transportation networks supports rising demand for DC protection systems. However, infrastructure gaps and high capital requirements limit large-scale deployment. Strategic collaborations with global manufacturers and supportive clean energy policies are expected to stimulate gradual growth in the coming years.

Market Segmentations:

By Type

By Insulation

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

By End-use

- Transmission & Distribution Utilities

- Power Generation

- Renewables

- Railways

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The DC circuit breaker market is highly competitive, featuring key players such as Nader Electrical, Mitsubishi Electric Corporation, Eaton Corporation PLC, Entec Electric & Electronic Co Ltd, Rockwell Automation, Hyundai Electric & Energy Systems Company, Larsen & Toubro Limited, ABB Ltd, GEYA Electrical Co., and Siemens AG. These companies compete through innovation in high-speed switching technologies, hybrid designs, and advanced fault protection systems. Leading manufacturers focus on developing compact, energy-efficient, and digitally monitored breakers suitable for renewable, industrial, and transportation applications. Continuous R&D investments aim to improve response times, arc suppression, and system reliability. Strategic collaborations with utilities and renewable developers expand market reach, while regional manufacturing capabilities ensure cost competitiveness. Additionally, integration of IoT-enabled diagnostics and smart grid compatibility is becoming a key differentiator, helping top players strengthen their market positions and meet the growing demand for efficient, high-performance DC circuit protection solutions worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2024, Mitsubishi Electric signed an agreement with Siemens Energy Global GmbH & Co. KG on August 28 to co-develop DC switching stations and DC circuit breaker requirement specifications for multi-terminal HVDC systems.

- In June 2024, Eaton Corporation PLC announced its participation in the Shift2DC project on June 26, to develop and test low-voltage DC technologies including interoperable control and protection systems for DC grids.

- In February 2023, Mitsubishi Electric Corporation entered into a share transfer agreement on February 16 to fully acquire Scibreak AB, a Swedish company developing direct-current circuit breakers (DCCBs).

Report Coverage

The research report offers an in-depth analysis based on Type, Insulation, Voltage, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for DC circuit breakers will rise with growing renewable energy and HVDC transmission projects.

- Hybrid and solid-state breakers will gain wider adoption due to faster switching and improved efficiency.

- Manufacturers will focus on compact and modular designs to meet space and performance needs.

- Integration of IoT and smart monitoring systems will enhance fault detection and predictive maintenance.

- Expansion of EV charging infrastructure will drive demand for reliable DC protection systems.

- Asia Pacific will remain the leading region due to rapid industrialization and renewable expansion.

- Europe will strengthen its position through offshore wind projects and energy transition goals.

- North America will grow with grid modernization and electrification of transportation networks.

- Rising investments in smart grids and battery storage will support steady market growth.

- Partnerships and technological innovation will shape competitive strategies among major manufacturers.