Market Overview

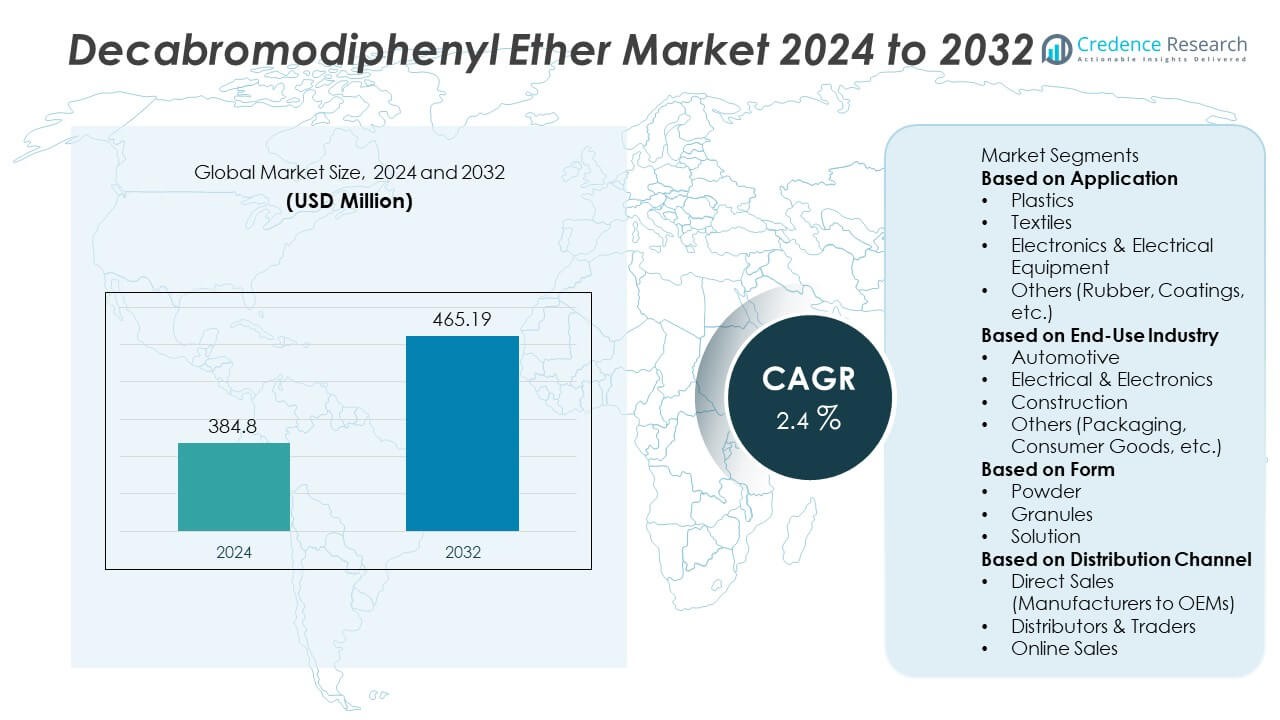

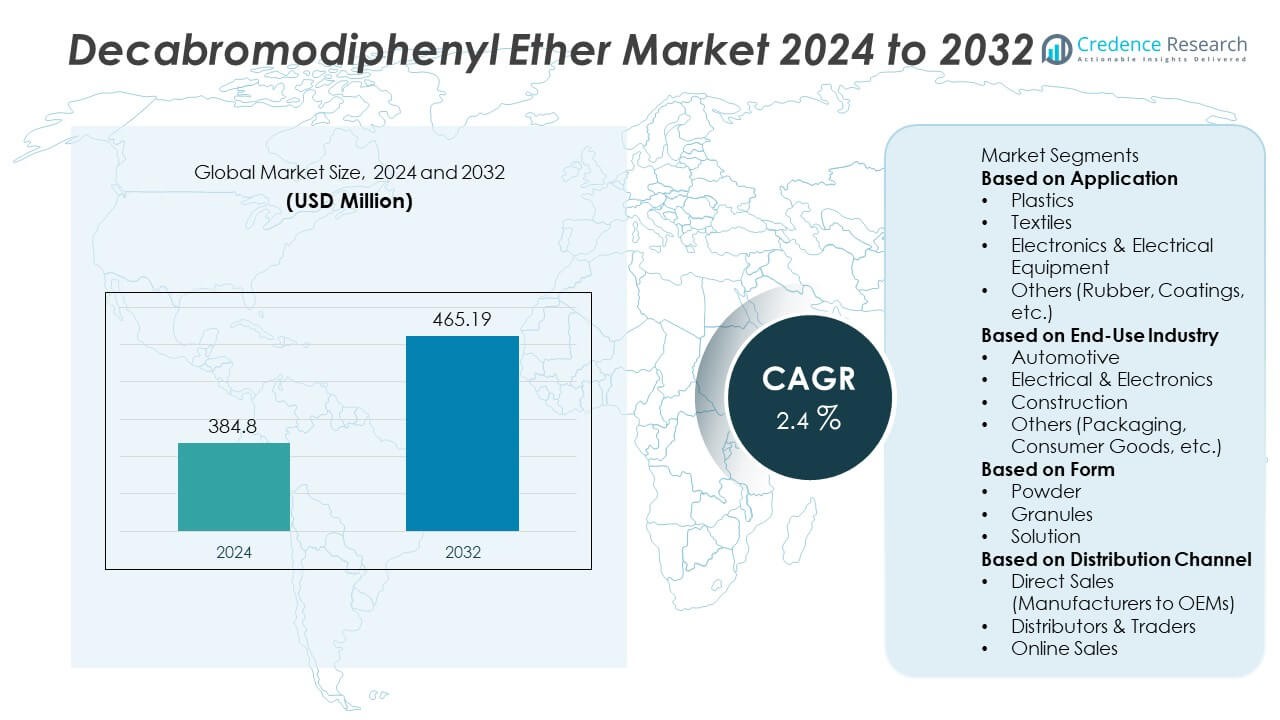

The Decabromodiphenyl Ether (DecaBDE) market was valued at USD 384.8 million in 2024 and is projected to reach USD 465.19 million by 2032, registering a CAGR of 2.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Decabromodiphenyl Ether (DecaBDE) Market Size 2024 |

USD 384.8 Million |

| Decabromodiphenyl Ether (DecaBDE) Market, CAGR |

2.4% |

| Decabromodiphenyl Ether (DecaBDE) Market Size 2032 |

USD 465.19 Million |

The Decabromodiphenyl Ether market is led by major companies including Shandong Haiwang Chemical, Acuro, Tosh Corporation, Toronto Research Chemicals, Suli, Albemarle Corporation, Lanxess AG, ICL Industrial Products, Chemtura Corporation, and Tosoh Corporation. These players dominate through large-scale production, strong export networks, and continuous formulation improvements for safer flame-retardant applications. Asia-Pacific leads the global market with a 41% share in 2024, driven by high manufacturing output and demand from electronics and automotive industries. North America follows with 27% share, supported by advanced technological integration and consistent industrial safety standards. Europe maintains a 22% share, emphasizing sustainable and regulatory-compliant alternatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Decabromodiphenyl Ether market was valued at USD 384.8 million in 2024 and is projected to reach USD 465.19 million by 2032, growing at a CAGR of 2.4%.

- Rising demand for flame-retardant materials in plastics and electrical components drives steady market growth, supported by increasing fire safety regulations across industrial sectors.

- Key trends include the transition toward eco-friendly brominated compounds and increased R&D investments to develop halogen-free alternatives with enhanced thermal stability.

- The market is moderately consolidated, with major players such as Shandong Haiwang Chemical, Albemarle Corporation, and Lanxess AG competing through product innovation and global expansion strategies.

- Asia-Pacific dominates with a 41% share, followed by North America at 27% and Europe at 22%; the plastics segment leads applications with 46% share, supported by extensive use in automotive, electronics, and construction industries across growing manufacturing economies.

Market Segmentation Analysis:

By Application

The plastics segment held the dominant 46% share of the Decabromodiphenyl Ether market in 2024. Its leadership stems from extensive use in thermoplastics and thermosetting polymers for electrical casings, cables, and automotive interiors. The compound’s high thermal stability and cost efficiency make it a preferred flame retardant in ABS and HIPS plastics. The electronics and electrical equipment segment follows, driven by demand for insulation materials and printed circuit boards. Rising fire safety standards across industrial manufacturing continue to strengthen the position of plastic-based applications globally.

- For instance, ICL Industrial Products operates a bromine and flame retardant complex in Neot Hovav, Israel, producing over 280,000 metric tons of bromine annually. The facility supplies brominated compounds for ABS and HIPS plastics used in electrical housings and cable insulation, supporting compliance with UL 94 V-0 standards.

By End-Use Industry

The electrical and electronics industry accounted for the largest 39% share in 2024. The dominance reflects increasing consumption in components such as connectors, enclosures, and circuit assemblies requiring high flame resistance. Growing use of consumer electronics and home appliances further boosts demand for DecaBDE-based retardants. The automotive sector also shows notable growth, supported by vehicle lightweighting trends and safety compliance. Construction and furniture industries use DecaBDE-treated polymers in insulation foams and composite boards to improve fire performance and extend product durability.

- For instance, Lanxess AG produces flame retardants and polymer additives for high-performance materials used in electronic connectors, vehicle interiors, and circuit components. Their products, which are both brominated and phosphorus-based, are designed to meet stringent flammability norms for the automotive and electronics industries, including standards like FMVSS 302 and those from Underwriters Laboratories (UL).

By Form

The powder form captured the leading 51% share of the DecaBDE market in 2024. Its fine particle structure enables uniform dispersion in polymer matrices, enhancing flame retardancy efficiency during compounding and molding. The granules segment also gained traction, favored for reduced dust generation and ease of handling in automated systems. The solution form remains niche, used mainly in coatings and textiles for precision applications. Manufacturers continue to favor powdered DecaBDE for consistent blending performance, higher stability, and compatibility with large-scale industrial polymer production.

Key Growth Drivers

Growth in Electrical and Electronics Manufacturing

Expanding electrical and electronics manufacturing drives strong demand for Decabromodiphenyl Ether as a flame retardant. Its use in printed circuit boards, enclosures, and wire insulation enhances fire resistance and product safety. Rapid growth in consumer electronics and smart devices, particularly in Asia-Pacific, amplifies material consumption. Rising industrialization and government safety mandates in China, India, and South Korea continue to reinforce DecaBDE’s application in electrical components, making the sector one of the primary revenue contributors within the global market.

- For instance, Tosoh Corporation operates its Nanyo complex in Shunan, Japan, which produces over 180,000 metric tons of specialty chemicals annually, including brominated intermediates used in flame-retardant formulations. The facility supplies compounds utilized in electronic casings and printed circuit board coatings that meet Japan’s Electrical Appliance and Material Safety Law (DENAN) standards.

Increased Automotive Safety Requirements

Stringent automotive safety regulations are boosting DecaBDE adoption in interior and under-hood components. The material’s superior heat resistance and flame-retardant properties make it suitable for dashboards, seat covers, and cable assemblies. Growing production of electric vehicles further supports usage due to higher thermal management needs in battery systems. Automakers increasingly incorporate DecaBDE-treated plastics to meet international flammability standards, particularly in Asia-Pacific and Europe, strengthening its long-term demand within the transportation and mobility segment.

- For instance, Albemarle Corporation operates bromine and derivatives facilities in Magnolia, Arkansas, producing brominated flame retardants used in polymer compounds for automotive interiors and wire harnesses, supporting compliance with flammability standards such as UL 94 V-0 and ISO 3795.

Rising Use in Building and Construction Materials

The building and construction sector is contributing significantly to market growth through use in insulation panels, coatings, and wire casings. Fire safety compliance in residential and commercial projects has intensified the adoption of flame-retardant additives. DecaBDE provides cost-effective performance compared with emerging substitutes, maintaining its position in legacy applications. Infrastructure expansion across developing economies, combined with increasing awareness about fire prevention standards, sustains its consumption within construction materials and industrial flooring applications worldwide.

Key Trends and Opportunities

Shift Toward Alternative Brominated Compounds

A major trend in the market is the shift toward next-generation brominated flame retardants with lower toxicity. Manufacturers are gradually replacing DecaBDE with environmentally safer compounds like decabromodiphenyl ethane (DBDPE). This transition aligns with evolving global regulations on persistent organic pollutants. Companies investing in R&D for halogen-free or low-emission alternatives gain strategic advantage, offering performance parity while reducing ecological impact. This trend supports sustainable growth and ensures compliance with strict safety and environmental frameworks.

- For instance, Shandong Haiwang Chemical operates a brominated flame retardant production base in Weifang, China, with an annual DBDPE output capacity of 16,000 metric tons. The plant integrates recovery systems to reduce bromine emissions and has obtained EU REACH certification, supporting compliance for exported products.

Expansion in Asia-Pacific Manufacturing Hubs

Asia-Pacific continues to present key opportunities for DecaBDE producers due to strong industrial activity. The region’s expanding electronics, automotive, and construction sectors sustain steady consumption levels. Government-driven infrastructure programs in China and India further increase demand for flame-retardant materials. Additionally, cost-efficient manufacturing bases and growing domestic polymer industries enhance the region’s role as both a consumer and exporter of DecaBDE-based products, providing consistent revenue opportunities for global suppliers.

- For instance, Suli Chemicals operates a bromine derivatives facility in Jiangsu that produces brominated flame retardants for use in plastics, building materials, and electronics.

Key Challenges

Stringent Environmental Regulations

Stringent environmental regulations remain a primary challenge for the DecaBDE market. The compound faces restrictions under the Stockholm Convention due to concerns over persistence and bioaccumulation. Regulatory agencies in the EU and North America are limiting its use in consumer products, compelling manufacturers to seek safer alternatives. Compliance costs, along with reformulation needs, are impacting profit margins. These restrictions pose long-term challenges to producers relying on traditional brominated flame retardants for revenue stability.

Growing Substitution by Eco-Friendly Alternatives

The increasing shift toward eco-friendly and halogen-free flame retardants is reducing DecaBDE’s market share. Manufacturers are investing in phosphorus- and nitrogen-based formulations to meet sustainable manufacturing goals. Consumer awareness and corporate sustainability commitments are accelerating this transition, particularly in developed economies. Although DecaBDE remains cost-effective and efficient, rising preference for greener products is pushing industry players to innovate or diversify product portfolios to maintain market relevance amid tightening environmental standards.

Regional Analysis

North America

North America held a 27% share of the Decabromodiphenyl Ether market in 2024. The region’s growth is driven by strong demand from the electrical and electronics industries, particularly in the United States. Extensive use of flame-retardant plastics in automotive interiors and construction materials also supports consumption. However, increasing regulatory scrutiny from the U.S. Environmental Protection Agency is prompting a gradual shift toward alternative brominated compounds. Manufacturers continue investing in safer formulations and recycling systems to maintain supply continuity while adhering to evolving environmental and product safety standards.

Europe

Europe accounted for 22% share of the global DecaBDE market in 2024. The region’s demand is shaped by stringent fire safety norms across construction and transportation sectors. However, restrictions under the European Chemicals Agency’s REACH regulation have curtailed usage in consumer products. Key countries such as Germany, France, and the United Kingdom are focusing on advanced, eco-friendly flame retardants. Industry players are transitioning toward decabromodiphenyl ethane and phosphorus-based alternatives, driven by the region’s sustainability agenda and ongoing product innovation in industrial plastics and coatings.

Asia-Pacific

Asia-Pacific dominated the DecaBDE market with a 41% share in 2024. Rapid industrialization and expansion in electronics, automotive, and building materials industries across China, India, and South Korea are major growth drivers. Low production costs, strong manufacturing capacity, and favorable government incentives for polymer production strengthen the region’s dominance. China remains the largest producer and exporter of DecaBDE compounds globally. Rising fire safety awareness and increasing adoption of electrical appliances continue to sustain market demand, even as gradual regulatory alignment toward safer alternatives gains momentum.

Latin America

Latin America captured an 6% share of the Decabromodiphenyl Ether market in 2024. The regional growth is supported by increasing applications in construction, automotive, and consumer goods manufacturing. Brazil and Mexico lead the market, driven by rising urbanization and safety regulations in building infrastructure. Limited domestic production capacity has led to high reliance on imports from Asia-Pacific suppliers. Ongoing industrial expansion and gradual implementation of safety compliance standards are expected to maintain steady market growth despite moderate regulatory constraints.

Middle East & Africa

The Middle East & Africa held a 4% share of the DecaBDE market in 2024. Demand is mainly driven by industrial growth in construction, electrical, and transportation sectors, particularly in Saudi Arabia, the UAE, and South Africa. The region’s expanding infrastructure projects and rising focus on fire safety in public facilities are key growth enablers. However, limited local manufacturing capabilities and increasing awareness of environmental risks are pushing industries toward alternative flame retardants. Continued investments in energy-efficient materials support gradual but steady market expansion.

Market Segmentations:

By Application

- Plastics

- Textiles

- Electronics & Electrical Equipment

- Others (Rubber, Coatings, etc.)

By End-Use Industry

- Automotive

- Electrical & Electronics

- Construction

- Others (Packaging, Consumer Goods, etc.)

By Form

By Distribution Channel

- Direct Sales (Manufacturers to OEMs)

- Distributors & Traders

- Online Sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Decabromodiphenyl Ether market features key players such as Shandong Haiwang Chemical, Acuro, Tosh Corporation, Toronto Research Chemicals, Suli, Albemarle Corporation, Lanxess AG, ICL Industrial Products, Chemtura Corporation, and Tosoh Corporation. These companies focus on expanding production capacity, optimizing formulations, and strengthening supply networks to meet global demand for flame-retardant additives. Many players invest in research to develop safer, environmentally compliant brominated compounds that align with global regulations. Strategic collaborations, mergers, and technology upgrades are enhancing their market reach and product performance. Asian manufacturers continue to dominate due to cost advantages and strong export capabilities, while North American and European firms emphasize innovation and regulatory compliance. The market remains moderately consolidated, with ongoing efforts to balance cost-efficiency, product safety, and environmental sustainability driving competition among leading producers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Shandong Haiwang Chemical

- Acuro

- Tosh Corporation

- Toronto Research Chemicals

- Suli

- Albemarle Corporation

- Lanxess AG

- ICL Industrial Products

- Chemtura Corporation

- Tosoh Corporation

Recent Developments

- In 2025, ICL Industrial Products expanded its flame retardant offerings by developing bromine-based specialty derivatives with improved thermal stability and lower environmental impact, aimed at global electrical and construction applications.

- In June 2023, Australia’s regulatory authority announced that amendments to the Industrial Chemicals (General) Rules 2019 will include DecaBDE in the list of chemicals requiring export/import authorisation.

Report Coverage

The research report offers an in-depth analysis based on Application, End-Use Industry, Form, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for flame-retardant additives will continue to rise in electronics and automotive sectors.

- Manufacturers will focus on developing safer and more sustainable brominated alternatives.

- Regulatory compliance will drive innovation in low-toxicity and halogen-free formulations.

- Asia-Pacific will maintain dominance due to strong production capacity and export growth.

- North America and Europe will prioritize eco-friendly replacements for DecaBDE in key industries.

- Construction and infrastructure expansion will sustain demand for flame-retardant plastics and coatings.

- Strategic collaborations and mergers will help companies expand market presence and technology capabilities.

- R&D investments will increase in performance-enhancing polymer applications.

- Consumer preference for sustainable and compliant materials will reshape product portfolios.

- The market will experience gradual but stable growth supported by safety-driven industrial regulations.