Market Overview

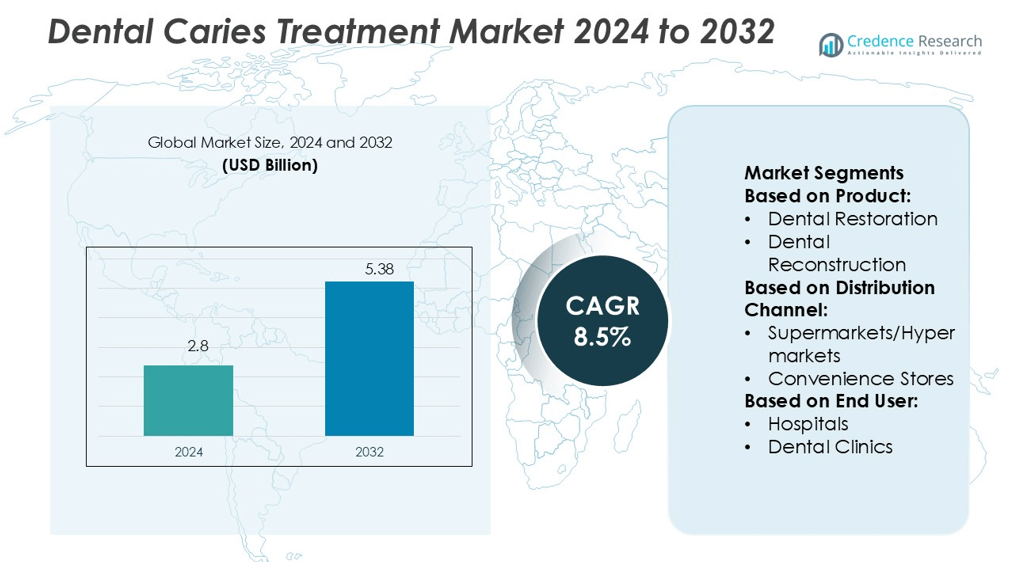

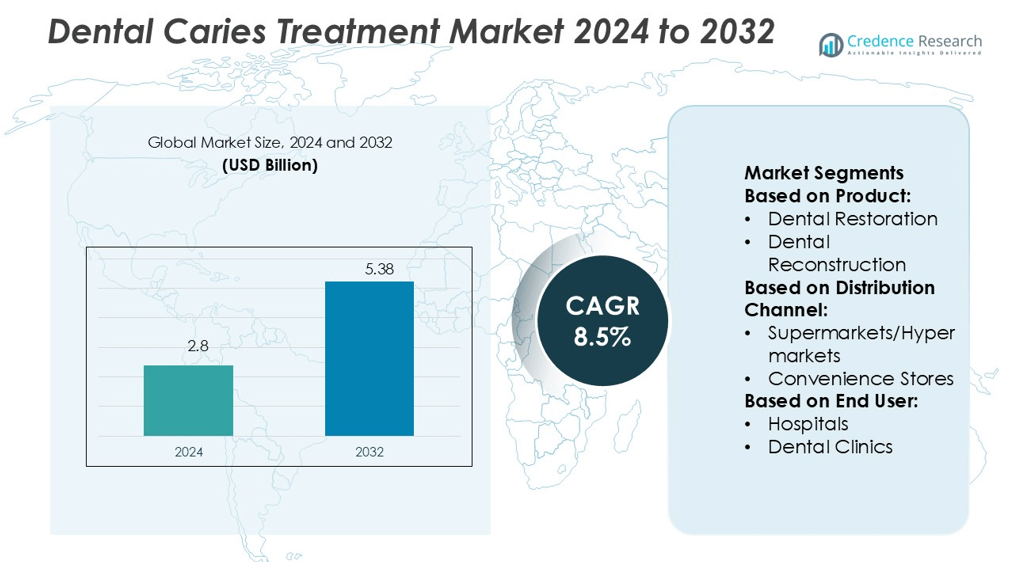

Dental Caries Treatment Market size was valued USD 2.8 billion in 2024 and is anticipated to reach USD 5.38 billion by 2032, at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental Caries Treatment Market Size 2024 |

USD 2.8 billion |

| Dental Caries Treatment Market, CAGR |

8.5% |

| Dental Caries Treatment Market Size 2032 |

USD 5.38 billion |

The dental caries treatment market is driven by major players including Dentsply Sirona, AdDent, Inc., Ross Video LTD., DentLight Inc., Quantum Dental Technologies, Hu-Friedy Mfg. Co., LLC., Air Techniques, Inc., Kuraray Europe GmbH, Centrix, Inc., and Acteon. These companies focus on digital dentistry, advanced restorative materials, and diagnostic innovation to strengthen their global presence. Their strategies include expanding product portfolios, enhancing clinical efficiency, and improving accessibility in emerging markets. North America leads the global market with a 34.2% share, supported by advanced healthcare infrastructure, high patient awareness, and strong adoption of minimally invasive dental treatments. The region’s technological leadership and favorable reimbursement policies give it a competitive advantage.

Market Insights

- The Dental Caries Treatment Market size was valued at USD 2.8 billion in 2024 and is expected to reach USD 5.38 billion by 2032, growing at a CAGR of 8.5%.

- Rising awareness of preventive oral care, increasing adoption of digital dentistry, and growth in minimally invasive procedures drive the market.

- Key players focus on innovation, product expansion, and strategic collaborations to enhance global presence and improve treatment accessibility.

- North America leads with a 34.2% market share, followed by Europe with 28.7% and Asia Pacific with 23.4%, reflecting strong regional adoption.

- Dental restoration dominates the product segment with the highest share, supported by technological advancements and growing patient demand for durable and aesthetic treatment solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Dental restoration dominates the dental caries treatment market with the largest market share. This dominance comes from the widespread use of fillings, crowns, and bridges to restore damaged teeth. These products offer long-lasting solutions and support functional recovery. Crowns and bridges hold a strong position as they provide durability and aesthetic appeal, especially for severe cases. Continuous advancements in dental materials and digital scanning technologies support this growth. Demand also rises with increasing cases of untreated dental caries and patient preference for minimally invasive procedures.

- For instance, Dentsply Sirona introduced the CEREC Primemill system, which enables chairside production of full-contour zirconia crowns in around 5 minutes and can also mill bridges using its “Super Fast” mode, backed by validated clinical performance data.

By Distribution Channel

Pharmacies and drug stores lead the distribution channel segment with the highest market share. Their dominance stems from accessibility, trusted service, and wide product availability. These outlets serve both patients and dental professionals, ensuring quick access to pain relief, sealants, and preventive solutions. Supermarkets and online channels are growing but remain secondary. The rise of over-the-counter oral care products and improved retail networks strengthens this segment’s market position. Expansion of pharmacy chains further drives product reach in urban and rural areas.

- For instance, Ross Video’s Carbonite HyperMax platform supports up to 8 M/E (Mix/Effect) layers and 4K video processing, winning multiple industry awards in 2025, including a ProductionHUB Award of Excellence at the NAB Show.

By End User

Dental clinics hold the dominant share in the end-user segment. Clinics are the primary points for restorative and preventive dental care, including fillings, crowns, and implants. They benefit from specialized equipment and personalized treatment, which supports high patient footfall. Rising awareness about preventive dental care and insurance coverage boosts clinic visits. Hospitals remain relevant for complex or surgical cases but have a smaller share. The growing number of private dental practices globally strengthens the segment’s leadership in treatment adoption.

Key Growth Drivers

Rising Prevalence of Dental Caries

The growing prevalence of dental caries among children and adults drives market expansion. Urban lifestyles, high sugar intake, and poor oral hygiene contribute to this increase. The demand for restorative and preventive dental procedures grows with rising awareness and regular dental visits. Public health programs focused on early diagnosis further support market penetration. Developed and emerging countries are investing in preventive care to reduce the burden of untreated caries, creating sustained demand for restoration, reconstruction, and endodontic products.

- For instance, DentLight’s wireless diode laser operates at a nominal wavelength of 810 nm (often also cited as 808 nm, offering 3W constant and 5W pulsed infrared power, with a unique green aiming beam for visual clarity.

Advancements in Dental Restoration Technologies

Continuous innovation in restorative technologies boosts the adoption of modern treatment methods. CAD/CAM systems, 3D printing, and advanced biomaterials improve treatment precision and aesthetics. These technologies enable faster chairside procedures, enhancing patient experience and clinical efficiency. Manufacturers are focusing on durable, biocompatible materials with better functional outcomes. Digital dentistry adoption also reduces treatment time and costs, increasing acceptance among clinics and hospitals. This technological shift strengthens the value proposition of dental caries treatment and supports market growth.

- For instance, Quantum’s Canary System uses a low-power pulsating laser combining photothermal radiometry and luminescence to detect carious lesions as deep as 5 mm below the tooth surface and as small as 50 µm in size.

Increasing Access to Dental Care Services

Expanding dental infrastructure in urban and rural areas enhances service accessibility. Governments and private players are investing in affordable and specialized care facilities. Awareness campaigns and insurance coverage are encouraging early diagnosis and treatment. This growing access improves patient flow to clinics and hospitals, supporting demand for restoration, sealants, and reconstruction solutions. The availability of trained professionals and advanced dental equipment also supports better treatment outcomes. These developments collectively create a favorable environment for market expansion.

Key Trends & Opportunities

Shift Toward Minimally Invasive Procedures

Minimally invasive dental procedures are gaining traction due to faster recovery and improved patient comfort. Modern sealants, bioactive restorative materials, and laser-assisted techniques allow preservation of healthy tooth structure. This trend aligns with patient preference for less invasive and aesthetic treatments. Dental clinics are adopting these technologies to improve service quality and efficiency. The growing use of advanced imaging and diagnostic tools further enhances treatment accuracy, creating opportunities for product innovation and market differentiation.

- For instance, Hu-Friedy markets EverEdge® scalers made with a proprietary stainless steel alloy that are 30% sharper when new compared to a leading coated competitor, based on independent CATRA testing.

Rising Adoption of Digital Dentistry

Digital dentistry adoption is accelerating across developed and emerging markets. 3D scanning, chairside milling, and computer-aided restoration improve accuracy and reduce treatment time. Clinics and hospitals are investing in integrated digital systems to enhance patient experience and workflow. These technologies also enable customized solutions, improving outcomes for crowns, bridges, and fillings. Vendors are expanding product portfolios with digital-compatible materials and systems. This digital transformation offers strong growth potential for both equipment and consumables in the dental caries treatment market.

- For instance, Air Techniques, Inc. introduced the ScanX Duo Touch digital radiography scanner that reads phosphor plates in all intraoral sizes (0-4) via dual input slots and features Wi-Fi transfer and a large touchscreen interface, speeding scan-to-diagnosis workflows.

Growing Preventive Dental Care Awareness

Preventive dentistry is gaining importance as patients prioritize early intervention. Public health initiatives and educational campaigns are increasing awareness of fluoride use, dental sealants, and routine check-ups. Preventive solutions reduce treatment complexity and costs, encouraging adoption among patients. Manufacturers are focusing on fluoride-based and antibacterial products to support early-stage caries management. The shift toward preventive strategies creates new opportunities for product expansion in both clinical and retail channels.

Key Challenges

High Cost of Advanced Dental Procedures

Advanced restorative and digital dental procedures involve high treatment and equipment costs. Many patients in developing economies lack access to affordable dental care. Clinics face heavy investment requirements for adopting CAD/CAM systems and high-performance materials. These costs limit technology penetration in low-income regions. Although insurance coverage is improving, it remains insufficient in several countries. This cost barrier slows market expansion and restricts advanced treatment adoption among broader patient groups.

Limited Skilled Workforce in Developing Regions

The shortage of trained dental professionals remains a significant challenge. Many rural and low-income regions lack qualified dentists and advanced facilities. This gap leads to delayed diagnosis and treatment, increasing the risk of complications. Training programs and infrastructure investments are limited in several emerging markets. The uneven distribution of skilled professionals restricts service availability and market penetration. Addressing this workforce gap is critical to meeting rising demand for effective dental caries treatment.

Regional Analysis

North America

North America holds the largest share in the dental caries treatment market with 34.2%. High awareness, strong insurance coverage, and well-established dental infrastructure support market growth. The U.S. dominates the region, driven by advanced restorative technologies, growing adoption of minimally invasive procedures, and a large patient base. The presence of major dental manufacturers and strong R&D investment further boost product availability. Favorable reimbursement policies and preventive dental programs increase access to care. Rising demand for digital dentistry and cosmetic dental procedures continues to strengthen the region’s leadership position in the global market.

Europe

Europe accounts for 28.7% of the global dental caries treatment market. The region benefits from advanced healthcare systems, early disease diagnosis, and high patient awareness. Germany, France, and the U.K. lead due to robust dental service networks and technological adoption. Widespread preventive programs, along with supportive reimbursement policies, increase treatment penetration. The rising elderly population and demand for prosthetic and restorative procedures contribute to market growth. The region’s strong regulatory framework and public health funding create a stable environment for innovation and adoption of advanced dental care solutions.

Asia Pacific

Asia Pacific holds a 23.4% share of the dental caries treatment market and is the fastest-growing region. Rapid urbanization, changing dietary habits, and increasing sugar consumption contribute to rising dental caries prevalence. Countries such as China, Japan, and India drive growth through expanding dental infrastructure and growing disposable income. The adoption of advanced dental technologies is increasing in urban centers. Government initiatives to improve preventive oral healthcare and growing insurance coverage support further market expansion. Rising investment in dental clinics and training programs strengthens the region’s future market potential.

Latin America

Latin America represents 8.1% of the global dental caries treatment market. Brazil and Mexico lead due to their growing dental care infrastructure and increasing awareness. Rising disposable income, urbanization, and public oral health programs support demand for restorative and preventive treatments. However, uneven healthcare access and limited insurance coverage remain challenges. International manufacturers are expanding their distribution networks in the region. Investment in affordable dental solutions and government-led prevention programs are expected to drive steady growth, particularly in urban areas with improving healthcare facilities.

Middle East & Africa

The Middle East & Africa hold a 5.6% share of the dental caries treatment market. Market growth is driven by improving healthcare infrastructure and rising awareness about oral health. The Gulf Cooperation Council (GCC) countries lead the region, supported by higher healthcare spending and adoption of modern dental technologies. However, large rural populations in Africa face limited access to dental services. Increasing investments in private dental clinics and preventive health initiatives are improving treatment reach. Ongoing infrastructure development and training programs are expected to enhance the region’s future market performance.

Market Segmentations:

By Product:

- Dental Restoration

- Dental Reconstruction

By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dental caries treatment market features leading players such as Dentsply Sirona, AdDent, Inc., Ross Video LTD., DentLight Inc., Quantum Dental Technologies, Hu-Friedy Mfg. Co., LLC., Air Techniques, Inc., Kuraray Europe GmbH, Centrix, Inc., and Acteon. The dental caries treatment market is defined by rapid technological advancement, strategic partnerships, and expanding global reach. Companies are focusing on developing innovative restorative materials, advanced imaging systems, and minimally invasive treatment solutions. Digital dentistry, including CAD/CAM integration and 3D printing, plays a major role in improving accuracy and reducing chairside time. Manufacturers are expanding distribution networks in emerging markets to strengthen their market presence. Strategic collaborations with dental clinics, academic institutions, and technology firms enhance innovation pipelines. Regulatory compliance, quality assurance, and patient safety remain central to competitive positioning, driving continuous product development and differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dentsply Sirona

- AdDent, Inc.

- Ross Video LTD.

- DentLight Inc.

- Quantum Dental Technologies

- Hu-Friedy Mfg. Co., LLC.

- Air Techniques, Inc.

- Kuraray Europe GmbH

- Centrix, Inc.

- Acteon

Recent Developments

- In October 2024, Dentsply Sirona collaborated with the McGuire Institute (iMc) and introduced the PrimeTaper EV Implant Registry to assess its performance in various real-world clinical environments. With over 300 clinicians nationwide contributing data on nearly 2,000 implants, the registry has reported an outstanding 99% survival rate for the PrimeTaper EV Implant so far.

- In March 2024, Overjet, the global leader in dental artificial intelligence, announced the launch of Overjet to provide dental care to kids. It is a technology that was cleared by the Food and Drug Administration (FDA) of the United States and can detect, outline, and quantify tooth decay in children ages four and above to avoid future problems at a later stage.

- In May 2023, Straumann announced the acquisition of GalvoSurge, a manufacturer of dental medical devices based in Switzerland. The company specializes in implant care as well as maintenance solutions, with its concept for supporting peri-implantitis treatment – the GalvoSurge Dental Implant Cleaning System GS 1000 – holding a CE mark and has been in the market since 2020.

- In January 2023, Nobel Biocare announced a partnership with Mimetis Biomaterials S.L., launching the ‘creos syntogain’ biomimetic bone graft substitute. This has helped Nobel Biocare to expand its regenerative solutions portfolio under the Creos brand, adding to its creos xenoprotect, creos xenogain, creos syntoprotect, and creos mucogain offerings.

Report Coverage

The research report offers an in-depth analysis based on Product, Distribution Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing awareness of preventive oral healthcare.

- Digital dentistry adoption will increase treatment speed and precision.

- Demand for minimally invasive procedures will rise among younger patients.

- Advanced restorative materials will enhance durability and patient comfort.

- Public health initiatives will support early diagnosis and treatment.

- AI-powered diagnostic tools will improve detection accuracy.

- Emerging markets will drive strong growth through expanding dental infrastructure.

- Insurance coverage and reimbursement will support wider treatment access.

- Strategic collaborations will accelerate innovation in restorative solutions.

- Global players will invest more in R&D and digital integration.