Market Overview

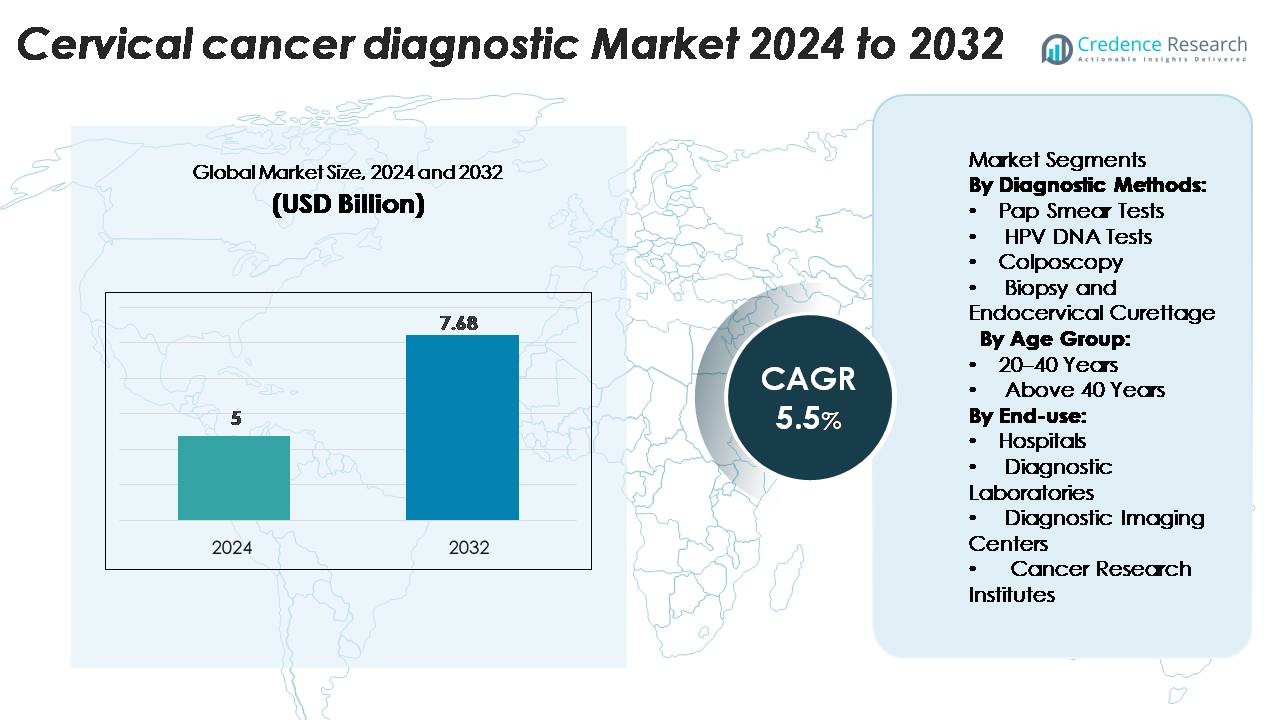

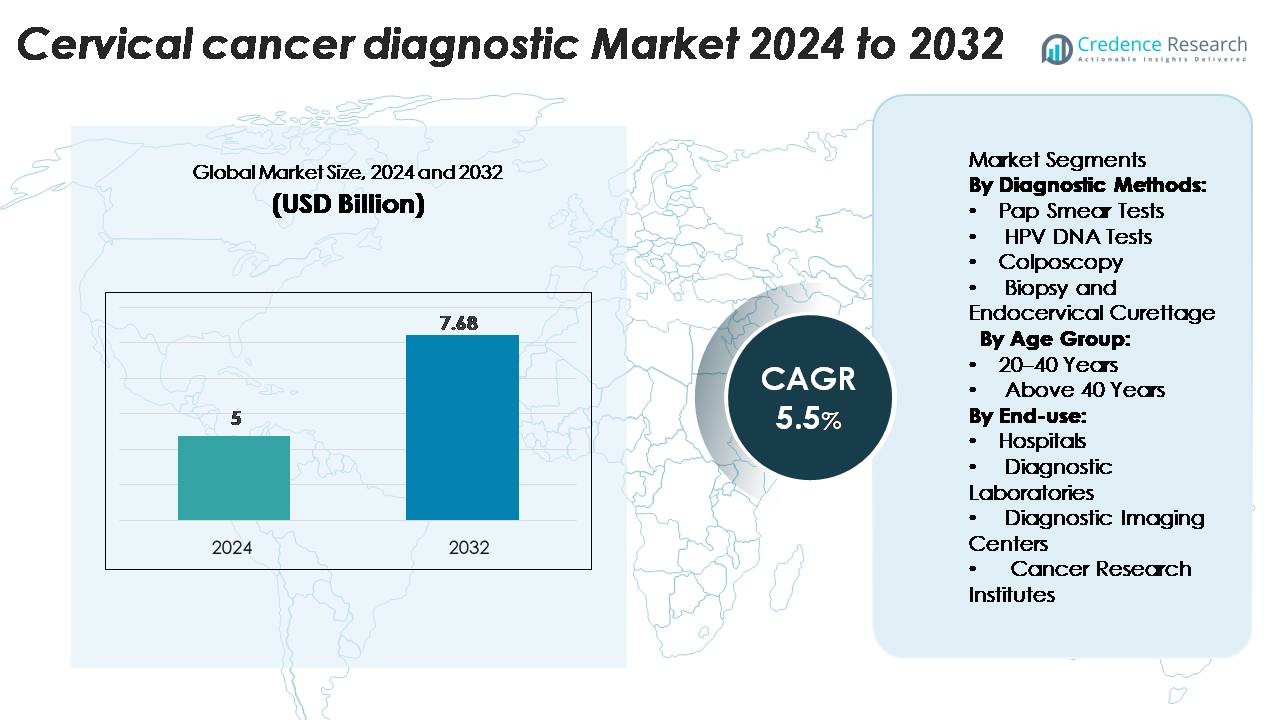

Cervical Cancer Diagnostic Market was valued at USD 5 billion in 2024 and is projected to reach USD 7.68 billion by 2032, growing at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cervical Cancer Diagnostic Market Size 2024 |

USD 7.68 Billion |

| Cervical Cancer Diagnostic Market, CAGR |

5.5% |

| Cervical Cancer Diagnostic Market Size 2032 |

USD 7.68 Billion |

Leading players such as Abbott Laboratories, QIAGEN N.V., Hologic, Inc., Becton, Dickinson and Company and Siemens Healthineers lead the cervical cancer diagnostics market through product innovation, strategic collaborations and global outreach. North America dominates the region with a market share of approximately 45.7% in 2022, driven by strong healthcare infrastructure, high screening rates and regulatory support.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cervical Cancer Diagnostic Market was valued at USD 5 billion in 2024 and is projected to reach USD 7.68 billion by 2032, expanding at a CAGR of 5.5% during the forecast period.

- Increasing awareness of cervical cancer prevention, along with national screening programs, drives market demand across hospitals and diagnostic centers.

- Technological advancements in molecular testing and AI-based cytology are improving detection accuracy and expanding product portfolios among major players such as Abbott, QIAGEN, and Hologic.

- High equipment costs and limited screening infrastructure in low-income regions restrain market expansion despite strong government initiatives.

- North America leads the market with a 45.7% share, followed by Europe and Asia-Pacific at 26.4% and 22.3% respectively, while Pap smear tests dominate diagnostic methods with a 41.2% segment share in 2024.

Market Segmentation Analysis:

By Diagnostic Methods

The Pap smear test segment dominates the cervical cancer diagnostic market with a 41.2% share in 2024, owing to its cost-effectiveness, simplicity, and widespread use in early detection programs. Regular screening through Pap tests enables early identification of precancerous lesions, significantly reducing disease progression. The HPV DNA test segment is expanding rapidly due to its higher sensitivity in detecting high-risk HPV strains. Continuous government awareness programs and WHO-endorsed screening initiatives further strengthen the adoption of molecular diagnostic methods, enhancing test reliability and preventive care outcomes.

- For instance, QIAGEN’s careHPV™ test can detect 14 high-risk HPV strains and process up to 90 samples in less than 3 hours, making it suitable for large-scale screening in low-resource settings.

By Age Group

The above 40 years segment holds a 58.6% market share, driven by a higher prevalence of cervical cancer among middle-aged and older women. Increased healthcare awareness, combined with national screening guidelines recommending regular testing after 40, contributes to the dominance of this age group. The risk of persistent HPV infection also increases with age, prompting more frequent diagnostic evaluations. Improved access to advanced screening technologies and targeted awareness campaigns among women in this demographic further enhance market growth across developed and emerging economies.

- For instance, Roche’s cobas® HPV Test is approved for women aged 30 years and above and detects 14 high-risk HPV genotypes in a single run, processing up to 384 samples per day.

By End-use

Hospitals lead the cervical cancer diagnostic market with a 49.3% share, supported by integrated facilities offering advanced diagnostic imaging, pathology, and biopsy services. Hospitals benefit from strong patient inflow, insurance coverage, and the presence of multidisciplinary oncology units. Diagnostic laboratories follow closely, driven by the expansion of specialized molecular testing and partnerships with hospitals for sample processing. The growing adoption of automated screening systems and digital cytology in hospital settings enhances diagnostic precision, reduces turnaround time, and supports early intervention, reinforcing hospitals’ leading role in cervical cancer diagnosis.

Key Growth Drivers

Rising Prevalence of HPV Infections and Cervical Cancer Cases

The increasing incidence of human papillomavirus (HPV) infections remains a primary growth driver for the cervical cancer diagnostic market. HPV is responsible for nearly all cervical cancer cases, with global studies reporting millions of new infections annually. This surge in cases has accelerated the adoption of HPV DNA testing and cytology-based screening programs. Governments and healthcare organizations are implementing large-scale awareness and vaccination campaigns, which indirectly fuel diagnostic demand. The combination of early detection initiatives, improved test accuracy, and inclusion of cervical screening in national health programs continues to enhance diagnostic volumes across both developed and emerging regions.

- For instance, Abbott Laboratories’ Alinity™ m HR HPV assay can detect 14 high-risk HPV genotypes and deliver results for 300 samples within eight hours, supporting large-scale population screening.

Expansion of Screening Programs and Preventive Healthcare Initiatives

Government-led cervical cancer screening programs are significantly boosting market growth. The World Health Organization’s global strategy aims to eliminate cervical cancer by promoting universal screening, vaccination, and treatment. Many countries have integrated Pap smear and HPV testing into public healthcare systems to ensure early detection. Preventive health check-ups are increasingly becoming mandatory in corporate and institutional healthcare settings. Furthermore, NGOs and international health agencies support rural screening drives in low- and middle-income countries, expanding diagnostic outreach. These structured screening frameworks are increasing test accessibility, improving patient outcomes, and generating consistent demand for advanced diagnostic solutions.

- For instance, World Health Organization guidelines now recommend screening women aged 30 and above every five years using high-risk HPV testing, which many nations are adopting.

Technological Advancements in Molecular and Imaging Diagnostics

Advances in molecular diagnostics and imaging technologies are revolutionizing cervical cancer detection. Automated cytology systems, AI-based image analysis, and next-generation sequencing (NGS) enhance accuracy and reduce false-negative results. Companies are developing high-throughput HPV DNA platforms and portable colposcopes for efficient, real-time diagnosis. Integration of digital pathology and telemedicine supports remote screening and data sharing between laboratories and specialists. For instance, AI-assisted Pap test analysis reduces evaluation time by nearly 40%, improving workflow efficiency. The rising adoption of precision diagnostics and point-of-care screening tools ensures faster results, supporting timely treatment decisions and expanding the market’s technological landscape.

Key Trends & Opportunities

Increasing Adoption of Self-Sampling and Point-of-Care Testing

The market is witnessing a growing shift toward self-sampling kits and point-of-care HPV testing. Self-collection methods empower women to perform HPV screening privately, improving participation in early detection programs. Rapid HPV DNA test kits with shorter turnaround times are gaining traction, especially in resource-limited settings. These innovations expand diagnostic reach, particularly in regions lacking clinical infrastructure. Healthcare organizations are piloting community-based self-sampling models, which reduce screening gaps and support preventive health strategies. The trend aligns with global efforts to make cervical screening more accessible, cost-effective, and patient-centered, creating new opportunities for diagnostic manufacturers.

- For instance, the Cepheid Xpert HPV assay, when paired with the GeneXpert Omni (or other GeneXpert) platform, delivers accurate HPV DNA results within approximately 60 minutes using a self-contained, single-use cartridge system.

Integration of Artificial Intelligence and Digital Pathology

Artificial intelligence and digital pathology are reshaping cervical cancer diagnostics. AI algorithms assist in analyzing cytology slides with greater precision, minimizing human error. Deep learning models enable automated image classification, helping identify abnormal cells faster. Digital pathology platforms allow remote consultations, supporting pathology services in underserved regions. Leading companies are investing in cloud-based AI tools integrated with laboratory information systems to optimize diagnostic workflows. This trend enhances test reproducibility and enables scalable screening programs. The fusion of AI and digital imaging offers immense opportunities for improving diagnostic accuracy, efficiency, and accessibility in both hospital and lab settings.

Key Challenges

Limited Access to Screening in Low-Income Regions

Despite advancements in diagnostic technologies, limited access to screening remains a major challenge in low- and middle-income countries. Inadequate healthcare infrastructure, lack of trained professionals, and insufficient awareness about cervical cancer hinder early diagnosis. Many women in rural regions remain unscreened due to logistical barriers and cultural stigma surrounding gynecological examinations. The high cost of advanced diagnostic equipment further restricts adoption in public health systems. Bridging these gaps requires government funding, mobile screening units, and subsidized test programs to ensure equitable access. Overcoming this challenge is vital for global efforts toward cervical cancer elimination.

High Cost and Limited Reimbursement for Advanced Tests

The cost of advanced diagnostic procedures, such as HPV genotyping and digital cytology, remains high, limiting affordability in several markets. Reimbursement policies for cervical cancer screening vary widely across countries, with many healthcare systems providing partial or no coverage for molecular tests. This creates disparities in screening rates and delays early detection. Diagnostic companies face challenges in reducing test costs without compromising quality. Establishing value-based reimbursement models and integrating screening into national insurance schemes could help improve affordability. Addressing financial barriers is essential to sustain market growth and expand access to early, reliable diagnosis.

Regional Analysis

America

The North American region led the cervical cancer diagnostics market, with a share of 45.7% in 2022. Growth in the United States and Canada stems from widespread screening initiatives, advanced healthcare infrastructure, and high awareness of early detection. The presence of major diagnostic companies and strong reimbursement frameworks further supports market dominance. Elevated investment in R&D and the adoption of cutting-edge diagnostic technologies reinforce North America’s leading position in the global market.

Asia-Pacific

The Asia-Pacific region captured about 22.3% of the global market in 2023, and projected the fastest growth in coming years. Expanded healthcare access, rising cervical cancer incidence, and increasing government support in countries such as India and China are key growth drivers. Many emerging markets in the region are enhancing screening programmes and infrastructure, paving the way for rapid market expansion. The combination of unmet screening needs and growing diagnostic awareness positions Asia-Pacific as a significant opportunity region.

Europe

Europe holds a strong but secondary share of the cervical cancer diagnostics market. Although specific share data is not disclosed, the region benefits from well-established reimbursement policies, organized screening programs, and high uptake of advanced diagnostic tests. Regulatory support and high healthcare spending drive market activity. The region also faces saturation in some mature markets, prompting moderate growth compared with high-growth regions.

Latin America

Latin America is gradually increasing its participation in the cervical cancer diagnostics market, supported by rising awareness and improving healthcare infrastructure. The region’s growth is moderate due to budget constraints and variable screening coverage. Efforts by governments and NGOs to broaden access to diagnostics remain critical. As screening rates and diagnostic access improve, Latin America represents a developing but promising market.

Middle East & Africa (MEA)

The MEA region registers the slowest growth among major regions but offers long-term potential. Challenges such as limited screening infrastructure, low awareness, and constrained reimbursement hinder expansion. However, increasing focus on women’s health, donor-funded programmes, and expanding diagnostic services in urban centres suggest incremental growth opportunities. With targeted investments, MEA could evolve into a meaningful market segment over time.

Market Segmentations:

By Diagnostic Methods:

- Pap Smear Tests

- HPV DNA Tests

- Colposcopy

- Biopsy and Endocervical Curettage

By Age Group:

- 20–40 Years

- Above 40 Years

By End-use:

- Hospitals

- Diagnostic Laboratories

- Diagnostic Imaging Centers

- Cancer Research Institutes

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the global cervical cancer diagnostics market remains moderately consolidated, with several major players driving innovation, market expansion, and service differentiation. Leading companies such as Abbott Laboratories, QIAGEN N.V., Hologic, Inc., Becton, Dickinson and Company, and Siemens Healthineers hold significant market share and compete through new product launches, mergers, and geographic expansion.Many of these firms have diversified across diagnostic methods—such as cytology, HPV-DNA testing, and biopsy systems—and extended service platforms to hospitals and laboratories. Competitive strategies focus on automated screening technologies, point-of‐care diagnostics, and strategic partnerships to penetrate emerging markets where screening awareness and infrastructure are growing. Given the increasing demand for accuracy, speed, and cost-efficiency in cervical cancer diagnostics, these dominant players are likely to maintain leadership while mid-sized and regional entrants pursue niche segments and underserved regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hologic, Inc.

- Seegene Inc.

- QIAGEN

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc.

- Becton, Dickinson and Company (BD)

- Danaher Corporation

- Fujirebio Diagnostics, Inc.

- Arbor Vita Corporation

Recent Developments

- In July 2024, researchers from the Waseda University, Kanazawa Medical University, and German Cancer Research Center developed a non-invasive alternative method to detect high-risk HPV16 E7 oncoproteins in urine using ELISA.

- In May 2024, Aptamer Group, plc announced a collaboration with Timser Group with a deal value of up to £465,000. The collaboration was made to develop the world’s first blood test for cervical cancer through Timser’s patented cervical cancer biomarker panel.

Report Coverage

The research report offers an in-depth analysis based on Diagnostic methods, Age group, End-Useand Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of molecular and HPV DNA testing will enhance early detection accuracy.

- Integration of AI and digital pathology will streamline cytology analysis and improve diagnostic precision.

- Expansion of national screening programs will increase testing volumes in emerging economies.

- Rising awareness of women’s health will drive regular screening participation across all age groups.

- Self-sampling and point-of-care testing will gain momentum, improving accessibility in remote regions.

- Collaborations between diagnostic firms and healthcare providers will strengthen global market reach.

- Continuous innovation in automation and imaging technologies will reduce diagnosis time.

- Supportive government policies and funding will promote large-scale screening initiatives.

- Growing private healthcare investments will expand diagnostic infrastructure in developing countries.

- Increasing emphasis on personalized medicine will boost demand for advanced biomarker-based tests.