Market Overview

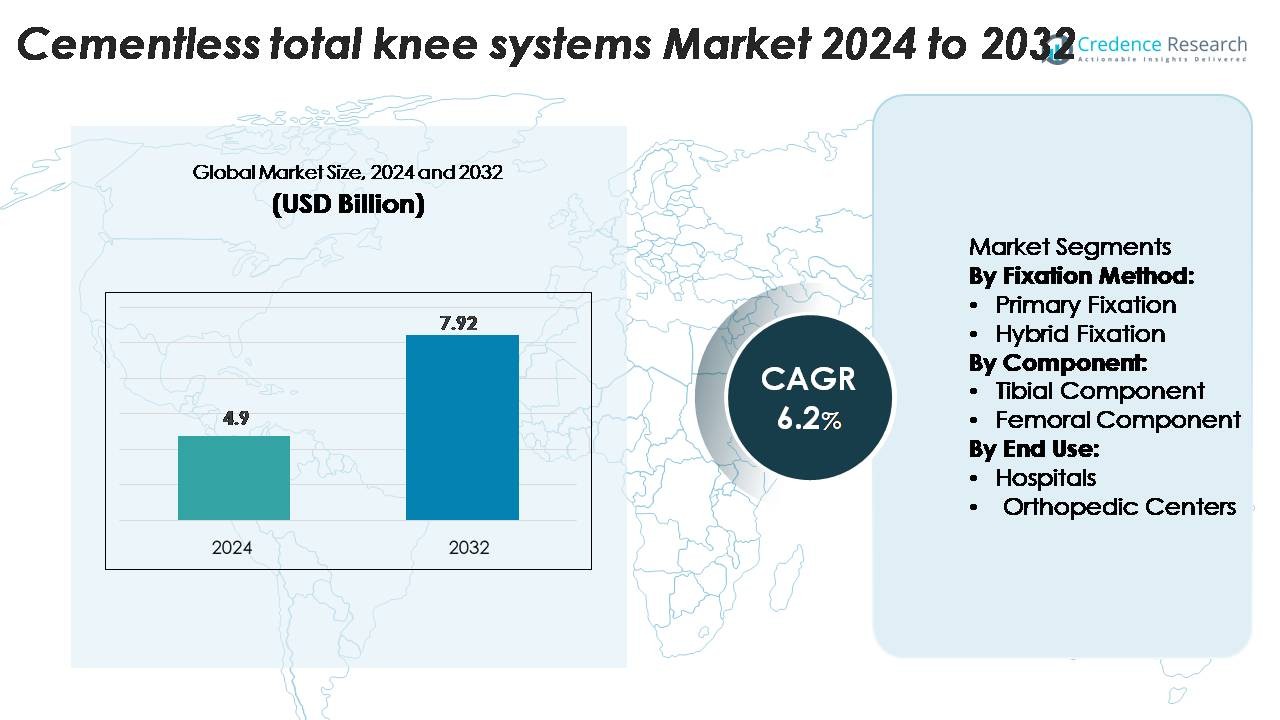

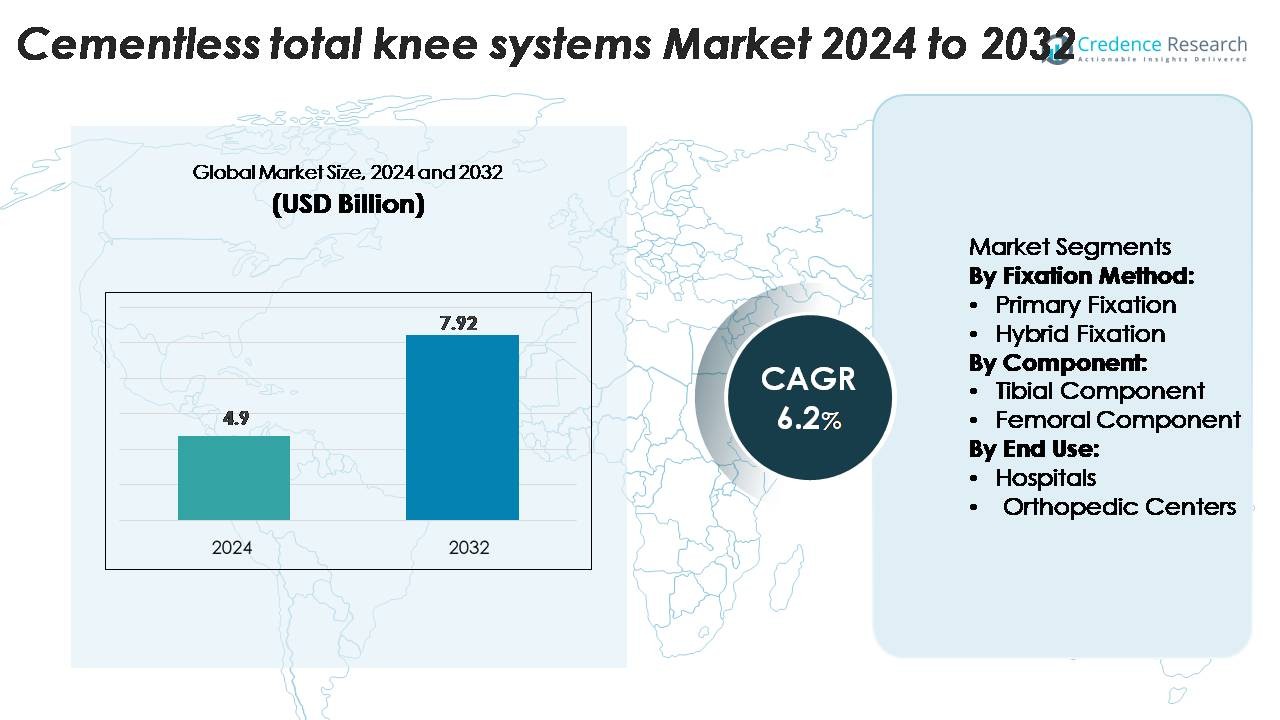

The global cementless total knee systems market was valued at USD 4.9 billion in 2024 and is projected to reach USD 7.92 billion by 2032, expanding at a CAGR of 6.2% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cementless Total Knee Systems Market Size 2024 |

USD 4.9 Billion |

| Cementless Total Knee Systems Market, CAGR |

6.2% |

| Cementless Total Knee Systems Market Size 2032 |

USD 7.92 Billion |

The cementless total knee systems market is driven by key players such as Stryker Corporation, Zimmer Biomet Holdings, DePuy Synthes (Johnson & Johnson), Smith+Nephew plc, and B. Braun Melsungen AG. These companies focus on developing advanced porous coatings, 3D-printed implants, and robotic-assisted surgical systems to enhance fixation and longevity. Stryker’s Mako SmartRobotics and Zimmer Biomet’s Persona OsseoTi series highlight technological leadership in precision surgery and osseointegration. North America leads the global market with a 39.6% share, supported by high procedural volumes, strong reimbursement frameworks, and widespread adoption of next-generation cementless knee replacement technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global cementless total knee systems market was valued at USD 4.9 billion in 2024 and is projected to reach USD 7.92 billion by 2032, growing at a CAGR of 6.2% during the forecast period.

- Rising prevalence of osteoarthritis and an aging population drive demand, supported by improved implant designs, bone ingrowth technology, and minimally invasive surgical techniques.

- Advancements in 3D printing, porous titanium coatings, and robotic-assisted knee replacement surgeries are shaping market innovation and improving long-term outcomes.

- Key players such as Stryker, Zimmer Biomet, DePuy Synthes, Smith+Nephew, and B. Braun Melsungen focus on product differentiation, strategic partnerships, and surgeon training programs to strengthen global presence.

- North America leads with a 39.6% share, followed by Europe at 28.4% and Asia-Pacific at 22.7%, while the primary fixation segment dominates with 62.4% share, reflecting its superior stability and osseointegration performance.

Market Segmentation Analysis:

By Fixation Method

The primary fixation segment dominates the cementless total knee systems market with a 62.4% share in 2024. Its dominance stems from enhanced bone ingrowth technology, improved implant stability, and long-term durability. Advancements in porous titanium coatings and 3D-printed lattice structures facilitate superior osseointegration, reducing revision rates. For instance, Zimmer Biomet’s Persona OsseoTi implants use a 3D-printed porous design that mimics cancellous bone architecture, ensuring better biological fixation. Growing preference for bone-preserving procedures and the expanding elderly population undergoing total knee replacement further drive the demand for primary fixation systems.

- For instance, Zimmer Biomet’s Persona OsseoTi implants feature a 3D-printed, porous titanium covering that mimics cancellous bone to enhance biological fixation, with the material having a typical porosity of approximately 70%

By Component

The tibial component segment holds a 54.7% market share in 2024, leading the component category. It plays a vital role in weight-bearing and load distribution during knee movement, making design innovation crucial. Manufacturers focus on lightweight materials and advanced geometries to enhance performance and implant longevity. For example, Smith+Nephew’s LEGION cementless tibial baseplate integrates a porous titanium structure and hydroxyapatite coating, improving initial stability and bone integration. Rising adoption of modular tibial components in revision surgeries and customized implant solutions supports the segment’s growth.

- For instance, Smith+Nephew’s LEGION® Cementless Tibial Baseplate features a porous titanium lattice using CONCELOC Advanced Porous Titanium technology, which has a porosity of 80%, enabling rapid osseointegration and enhanced initial stability.

By End Use

Hospitals accounted for a 67.3% share of the cementless total knee systems market in 2024, emerging as the leading end-use segment. The dominance is attributed to higher patient inflow, access to advanced orthopedic infrastructure, and the availability of skilled surgeons. Hospitals increasingly adopt robotic-assisted and navigation-guided systems to improve surgical precision and recovery outcomes. For instance, Stryker’s Mako SmartRobotics platform enables surgeons to perform personalized bone resections with sub-millimeter accuracy, enhancing implant fit. Rising reimbursement coverage for knee replacement surgeries further supports hospital-based procedures over outpatient orthopedic centers.

Key Growth Drivers

Advancements in Implant Materials and Design

The development of advanced biomaterials and porous surface technologies drives the growth of cementless total knee systems. Modern implants incorporate titanium alloys, trabecular metal, and 3D-printed porous coatings that enhance osseointegration and reduce micromotion. These innovations promote long-term fixation and minimize complications associated with cemented implants. For instance, DePuy Synthes’ ATTUNE Cementless Knee System uses a 3D-printed cellular titanium structure that mimics cancellous bone, improving biological fixation and load transfer. Manufacturers’ focus on custom-fit and lightweight implant geometries further enhances patient outcomes and surgical success, fueling market adoption.

- For instance, the DePuy Synthes ATTUNE® Cementless Knee System features a porous titanium structure (marketed as the CONCELIUM Porous Structure) covering a significant portion of the tibial baseplate. This structure is designed to mimic the architecture of cancellous bone to improve load transfer and encourage biological fixation (bone ongrowth).

Rising Incidence of Osteoarthritis and Aging Population

The increasing prevalence of osteoarthritis, coupled with an aging population, significantly boosts demand for total knee replacements. Aging leads to degenerative joint diseases, driving higher surgical volumes globally. Cementless systems offer improved long-term outcomes, making them ideal for active older patients seeking durable solutions. For instance, the World Health Organization estimates over 528 million people worldwide suffer from osteoarthritis, underscoring the growing need for joint reconstruction procedures. The trend toward early diagnosis and increased access to orthopedic care also supports market growth, particularly in developed healthcare systems.

- For instance, Zimmer Biomet has reported that the Persona OsseoTi Keel Tibia for cementless knee replacement is a key growth driver and an important product in their portfolio.

Growing Adoption of Robotic and Navigation-Assisted Surgery

The integration of robotic and computer-assisted systems enhances surgical accuracy and implant alignment in total knee arthroplasty. Surgeons increasingly prefer cementless implants due to their compatibility with robotic precision and reduced dependency on cement fixation. For example, Stryker’s Mako SmartRobotics technology enables precise bone preparation, improving fixation accuracy and reducing surgical errors. These systems help minimize revision rates, shorten hospital stays, and accelerate recovery times. The rising use of AI-driven preoperative planning and navigation-assisted procedures continues to strengthen confidence in cementless knee implant adoption across advanced orthopedic centers.

Key Trends & Opportunities

3D Printing and Patient-Specific Implants

The use of additive manufacturing in orthopedic implants has transformed knee replacement procedures. 3D printing allows for highly customized implants tailored to individual bone structures, ensuring superior fit and comfort. For example, Zimmer Biomet’s Persona OsseoTi Knee features a 3D-printed porous structure that closely mimics trabecular bone, enhancing biological fixation. This innovation also reduces inventory waste and production time for manufacturers. The trend toward personalized medicine and data-driven implant design creates opportunities for next-generation cementless systems offering optimized biomechanical performance and improved long-term outcomes.

- For instance, Zimmer Biomet’s Persona OsseoTi Knee features a 3D-printed porous lattice covering 90% of the tibial tray, closely mimicking trabecular bone to enhance biological fixation and load distribution.

Expanding Adoption in Emerging Markets

Emerging economies such as India, Brazil, and China present significant opportunities for cementless total knee systems. Rising healthcare expenditure, expanding insurance coverage, and improving hospital infrastructure drive greater access to orthopedic care. Local manufacturing partnerships and government initiatives supporting joint replacement programs accelerate adoption. For instance, Smith+Nephew expanded its production capacity in Malaysia to serve regional demand for advanced orthopedic implants. The growing focus on cost-effective, durable, and minimally invasive knee replacement options positions cementless systems as an attractive choice in these developing markets.

- For instance, Smith+Nephew opened a high‑technology manufacturing facility in Batu Kawan Industrial Park, Penang (Malaysia) covering 250,000 square feet, and projected creation of 800 local jobs over the following years.

Integration of Smart Implants and Digital Monitoring

Smart implant technology is gaining momentum in orthopedic surgery, offering real-time data on joint performance and recovery. Implantable sensors track parameters such as load distribution, alignment, and healing progression. Companies like Zimmer Biomet have introduced sensor-enabled solutions like Persona IQ, which uses embedded technology to transmit motion data securely. Such systems enable post-operative monitoring, early detection of complications, and personalized rehabilitation. The convergence of orthopedic implants with digital health platforms represents a key opportunity to improve clinical outcomes and patient engagement in knee arthroplasty.

Key Challenges

High Cost and Reimbursement Limitations

Cementless knee systems are often more expensive than traditional cemented implants due to advanced materials and complex manufacturing. Limited reimbursement in several regions restricts accessibility, particularly in middle-income markets. Hospitals and patients face higher upfront costs for robotic-assisted procedures and 3D-printed implants. For instance, healthcare systems in countries like India and Brazil have slower reimbursement adoption for cementless orthopedic technologies. The financial burden can limit patient adoption despite proven long-term benefits. Addressing cost disparities and developing favorable insurance frameworks remain critical to expanding global market penetration.

Surgical Learning Curve and Limited Expertise

Despite technological advantages, cementless total knee systems require specialized surgical skills and experience for optimal outcomes. Precise bone preparation, alignment, and fixation are critical to ensuring implant stability. A lack of training and familiarity among surgeons, particularly in developing regions, hampers widespread adoption. For example, many healthcare institutions still rely on cemented implants due to established procedural familiarity. Training programs and simulation-based learning modules are essential to enhance proficiency. Without standardization and continuous skill development, the risk of suboptimal outcomes may slow adoption of cementless systems.

Regional Analysis

North America

North America dominates the cementless total knee systems market, accounting for a 39.6% share in 2024. The region’s leadership is supported by advanced healthcare infrastructure, strong reimbursement frameworks, and early adoption of robotic-assisted knee replacement procedures. High prevalence of osteoarthritis, coupled with an aging population, fuels procedural demand. Manufacturers like Stryker and Zimmer Biomet continue to introduce innovative systems with enhanced osseointegration and precision alignment. Additionally, strong orthopedic surgeon expertise and rising patient preference for minimally invasive solutions sustain the region’s dominant position in the global market.

Europe

Europe holds a 28.4% market share in 2024, driven by strong clinical adoption across Germany, France, and the U.K. The region benefits from high healthcare spending, a well-established orthopedic ecosystem, and growing awareness of cementless implant benefits. Companies such as Smith+Nephew and DePuy Synthes actively promote 3D-printed and porous-coated implants designed for superior fixation. The increasing geriatric population and emphasis on reducing revision surgeries contribute to sustained growth. Furthermore, favorable government initiatives supporting joint replacement procedures strengthen Europe’s role as a key contributor to global market expansion.

Asia-Pacific

Asia-Pacific ranks as the fastest-growing region, capturing a 22.7% share of the cementless total knee systems market in 2024. Rapid urbanization, rising osteoarthritis incidence, and improving healthcare infrastructure across China, Japan, and India fuel regional demand. Increasing investment in advanced surgical technologies and localized manufacturing also reduce costs, enhancing accessibility. For example, regional production expansions by Zimmer Biomet and Smith+Nephew address growing patient volumes. The region’s expanding middle-class population, coupled with greater health insurance penetration, supports long-term adoption of cementless knee implants.

Latin America

Latin America accounts for a 5.6% market share in 2024, led by Brazil and Mexico. Expanding healthcare coverage, medical tourism, and growing awareness of advanced knee replacement techniques support regional growth. However, limited reimbursement frameworks and uneven access to specialized orthopedic care hinder wider adoption. International players like Stryker and DePuy Synthes collaborate with local distributors to improve market reach. Training initiatives and clinical education programs are expected to enhance surgeon proficiency and accelerate the transition from cemented to cementless implant techniques.

Middle East & Africa

The Middle East & Africa region holds a 3.7% share in the global cementless total knee systems market. Demand is primarily driven by the rising burden of osteoarthritis and growing healthcare investments in Gulf Cooperation Council (GCC) countries. Nations such as Saudi Arabia and the UAE are adopting advanced orthopedic technologies to expand surgical capacity. However, limited access to high-cost implants in parts of Africa constrains overall penetration. Strategic partnerships with local hospitals and government-funded orthopedic programs are likely to improve availability and promote gradual market growth.

Market Segmentations:

By Fixation Method:

- Primary Fixation

- Hybrid Fixation

By Component:

- Tibial Component

- Femoral Component

By End Use:

- Hospitals

- Orthopedic Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cementless total knee systems market is characterized by strong technological innovation and strategic collaboration among leading manufacturers. Key players such as Stryker Corporation, Zimmer Biomet Holdings, DePuy Synthes (Johnson & Johnson), Smith+Nephew plc, and B. Braun Melsungen AG dominate the market through continuous investment in research and development. These companies focus on enhancing implant stability, biocompatibility, and long-term performance using advanced materials like trabecular titanium and porous coatings. For instance, Stryker’s Mako SmartRobotics platform integrates precision-guided surgery with cementless implant design, improving clinical outcomes. Zimmer Biomet’s Persona OsseoTi Knee exemplifies 3D printing innovation for superior osseointegration. Strategic partnerships, product launches, and regional expansion remain core growth strategies. Moreover, increasing competition in emerging markets is prompting companies to localize production and training programs, fostering accessibility while maintaining quality standards. The market continues to evolve toward personalized and digitally integrated orthopedic solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Corin Group

- Dentsply Sirona

- Episurf Medical

- Conformis

- Medacta International

- Aesculap

- Exactech

- DePuy Synthes

- Enovis

- MicroPort Orthopedics

Recent Developments

- In Nov 2024, Corin Group announced the first clinical use of its Unity Knee™ Medial‑Constrained (MC) Tibial Insert.

- In March 2022, DePuy Synthes added the ATTUNE® Cementless Fixed Bearing Knee with AFFIXIUM™ 3DP Technology to its portfolio.

Report Coverage

The research report offers an in-depth analysis based on Fixation method, Component, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for cementless total knee systems will continue to rise with the aging global population.

- Technological advancements in porous coatings and biomaterials will improve implant longevity.

- 3D printing will enable more personalized and anatomically precise knee implant designs.

- Robotic-assisted and navigation-guided surgeries will become standard in orthopedic procedures.

- Manufacturers will expand in emerging markets with localized production and training programs.

- Smart implants with digital tracking capabilities will enhance post-surgery monitoring and outcomes.

- Strategic partnerships and mergers will increase to strengthen product portfolios and market presence.

- Hospitals and orthopedic centers will drive adoption through infrastructure upgrades and advanced surgical systems.

- Regulatory approvals for innovative designs will accelerate global commercialization.

- Focus on cost-effective, minimally invasive, and durable solutions will define the next phase of market evolution.