Market Overview

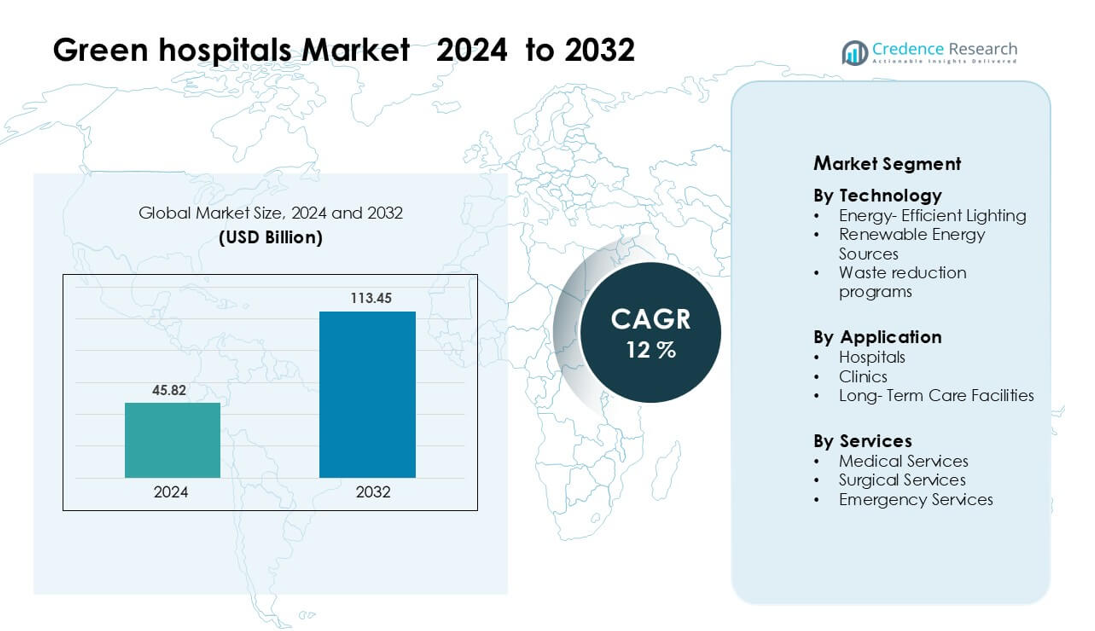

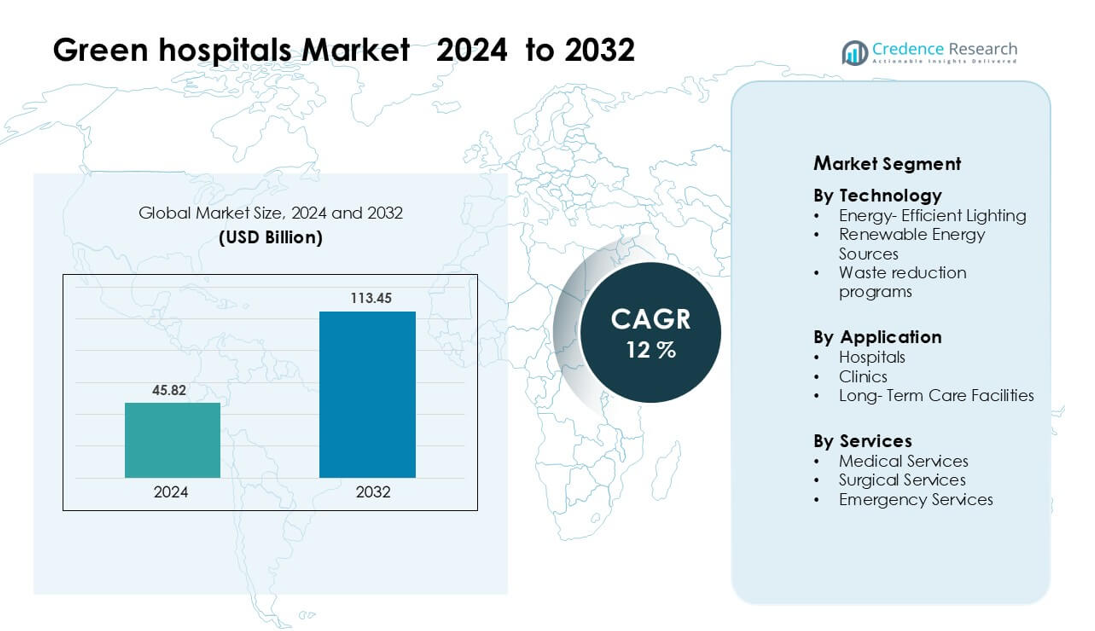

Green hospitals Market was valued at USD 45.82 billion in 2024 and is anticipated to reach USD 113.45 billion by 2032, growing at a CAGR of 12 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Green Hospitals Market Size 2024 |

USD 45.82 billion |

| Green Hospitals Market, CAGR |

12% |

| Green Hospitals Market Size 2032 |

USD 113.45 billion |

The Green Hospitals Market included major players such as Siemens Healthineers AG, Schneider Electric SE, Philips Healthcare, Johnson & Johnson, Hitachi, Medline Industries, Max Healthcare, Dignity Health, Gundersen Health Systems, and the HINDUJA Group. These companies advanced sustainability through energy-efficient building systems, renewable-power integration, low-waste solutions, and smart digital monitoring platforms. Their focus on reducing operational costs and lowering emissions strengthened competitive positioning across global healthcare networks. North America emerged as the leading region in 2024 with about 38% share, supported by strict environmental regulations, strong investment capacity, and rapid adoption of smart green hospital infrastructure.

Market Insights

- The Green Hospitals Market reached USD 82 billion in 2024 and is projected to grow at a CAGR of 12 % through 2032.

- Demand grew as hospitals adopted energy-efficient lighting, renewable systems, and waste-reduction programs, with energy-efficient lighting holding about 43% share.

- Smart building trends expanded as facilities used IoT controls, automated HVAC, and digital dashboards to lower power use and improve sustainability.

- Competition involved Siemens Healthineers AG, Schneider Electric SE, Philips Healthcare, Johnson & Johnson, and others focusing on low-carbon solutions and advanced retrofitting capabilities.

- North America led the market with 38% share, followed by Europe at 32%, while hospitals remained the dominant application segment with nearly 58% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Energy-efficient lighting led the Green Hospitals Market in 2024 with about 43% share. Hospitals preferred advanced LED systems due to strong power savings and lower maintenance needs. The segment grew as facilities upgraded old fixtures to meet new sustainability rules. Renewable energy solutions such as rooftop solar expanded fast with better storage options. Waste-reduction programs gained attention as providers targeted lower disposal costs. Rising focus on carbon-neutral operations continued to push hospitals toward long-term energy management plans.

- For instance, at AIIMS (All India Institute of Medical Sciences), Hitachi replaced 33,000 conventional lights with LED lights as part of a comprehensive ‘Green Hospital Demonstration Project’ that leveraged ICT and other energy-saving measures. The entire project, which also included installing a rooftop solar power system, upgrading HVAC, and deploying an energy management system, contributed to achieving a 30% reduction in the hospital’s overall energy consumption.

By Application

Hospitals dominated the Green Hospitals Market in 2024 with nearly 58% share. Large facilities adopted green designs faster due to higher energy loads and strict regulatory checks. Clinics expanded adoption as they aimed to cut running costs and improve indoor quality. Long-term care centers increased interest in sustainable systems to support better resident comfort. Growth stayed strong as healthcare networks invested in greener buildings to reduce pollution levels and strengthen operational efficiency across regions.

- For instance, Kohinoor Hospital, Mumbai, achieved LEED Platinum certification by using a 130 KLD sewage-treatment plant to recycle 100% of its wastewater, reducing its dependence on external water supplies.

By Services

Medical services held the leading position in 2024 with about 49% share. Providers upgraded equipment rooms and treatment spaces with efficient lighting, cleaner HVAC systems, and better water controls. Surgical services followed as operating theaters integrated low-waste protocols and optimized airflow systems. Emergency departments increased green adoption to handle high patient flow with stable energy use. The overall shift toward sustainable care continued as hospitals focused on reducing environmental risk while improving clinical performance.

Key Growth Drivers

Rising Focus on Energy Efficiency and Cost Reduction

Energy efficiency remained a major growth driver in the Green Hospitals Market, as hospitals aimed to reduce operating costs and comply with stricter sustainability rules. Administrators adopted LED lighting, advanced HVAC systems, and real-time energy management tools to cut electricity use without affecting care quality. Many facilities upgraded outdated systems through structured retrofitting programs that delivered measurable savings. Incentives, tax benefits, and national efficiency targets encouraged faster adoption across urban and regional hospitals. Large healthcare networks set internal carbon-reduction goals, which pushed investments in automated controls and smart building systems. Rising pressure to maintain reliable power during peak demand periods strengthened the shift toward efficient technologies. These efforts helped hospitals lower emissions, improve resilience, and operate more sustainably.

- For instance, a 350-bed hospital in Hyderabad worked with Energeia on an HVAC audit that revealed oversized chillers operating inefficiently; after retrofitting, they reduced HVC energy use from 1.14 million kWh to approximately 600,000 kWh annually, raising plant efficiency from 2.48 kW/TR to 1.05 kW/TR.

Growing Adoption of Renewable and Low-Emission Energy Sources

The rising preference for renewable power acted as a strong driver, as hospitals sought cleaner and more stable energy options. Solar photovoltaic systems, on-site batteries, and hybrid energy models gained rapid adoption because they lowered grid dependence and improved operational continuity. Facilities began integrating solar heating, geothermal pumps, and small wind systems to diversify energy supply. Healthcare groups also aligned their energy planning with national carbon-neutral commitments, fueling broader investment in low-emission infrastructure. Long-term savings on utility bills motivated hospital boards to approve large-scale renewable installations. These projects helped reduce environmental impact and supported community expectations for cleaner healthcare operations. The shift strengthened market demand for renewable-focused engineering, procurement, and construction providers.

- For instance, Max Super Speciality Hospital in Vaishali (Ghaziabad) installed a 392.4 kWp rooftop solar power plant, which, according to SunSource Energy, will supply almost 11 GWh of clean power over its technical lifetime.

Increased Emphasis on Waste Reduction and Sustainable Resource Management

Hospitals prioritized waste reduction due to rising disposal costs, stricter regulations, and higher volumes of medical waste. Green facilities implemented recycling systems, low-waste procurement rules, and sustainable materials to reduce environmental impact. Many organizations transitioned to reusable surgical supplies where safe and feasible, lowering landfill pressure. Digital record-keeping reduced paper waste and improved internal workflow efficiency. Water-efficient fixtures, smart irrigation, and wastewater treatment upgrades helped cut resource consumption. Regulators enforced tighter biomedical waste norms, prompting facilities to modernize treatment units. These changes helped hospitals strengthen compliance, improve community confidence, and reach long-term sustainability goals.

Key Trend & Opportunity:

Expansion of Smart and Connected Green Infrastructure

A key trend in the Green Hospitals Market involved the rapid growth of smart building technologies. Hospitals deployed IoT-enabled systems, automated lighting, and sensor-based HVAC solutions to monitor and control energy use with high accuracy. Real-time dashboards allowed administrators to view consumption patterns and optimize resource allocation. Predictive maintenance tools helped cut equipment downtime and extend asset life. Artificial intelligence applications improved airflow management, temperature control, and power distribution. These innovations enhanced patient comfort, strengthened operational reliability, and supported long-term sustainability targets. The shift toward connected green infrastructure continued to create strong demand for digital platforms and analytics providers.

- For instance, Humber River Hospital in Toronto, working with Cisco and BlackBerry QNX, operates with 5,400 networked smart devices, including automated HVAC controls, patient-monitoring integrations, and robotics. This digital infrastructure has enabled a 30% reduction in energy consumption compared to its legacy facility.

Growth in Green Construction and Retrofitting Projects

Sustainable construction and retrofitting offered major market opportunities as healthcare providers modernized infrastructure. New hospitals followed green certification frameworks such as LEED, IGBC, and BREEAM, expanding demand for eco-friendly materials and advanced design solutions. Existing hospitals invested in insulation upgrades, daylight-optimized layouts, and low-emission paints to meet evolving regulations. Retrofitting older buildings provided fast energy savings without major structural changes, creating steady growth for contractors and engineering firms. These upgrades improved indoor air quality, reduced staff fatigue, and enhanced patient recovery environments. The long-term focus on sustainable building performance supported strong expansion of this opportunity segment.

- For instance, Sir H.N. Reliance Foundation Hospital & Research Centre in Mumbai was retrofitted and awarded IGBC LEED India Gold, with its green upgrades (LEDs, VFD-driven AHUs & pumps, performance glazing) saving 8,665 kWh/day from lighting and 5,867 kWh/day via variable-frequency drives.

Key Challenge

High Initial Capital Costs and Long Payback Periods

High upfront investment remained a significant challenge as hospitals weighed green upgrades against competing clinical priorities. Solar systems, efficient HVAC units, and smart building controls required large capital budgets that smaller clinics often could not meet. Facilities hesitated when payback periods stretched over several years, especially in regions with limited incentives. Economic pressure on healthcare budgets made administrators cautious about large-scale sustainability spending. Financial barriers delayed implementation timelines and slowed adoption across low-income areas. These challenges restricted the market’s ability to reach full-scale transformation.

Complex Integration and Regulatory Compliance Requirements

Integrating green technologies into existing hospital structures posed operational difficulties. Older buildings required extensive planning to fit renewable systems, advanced controls, or waste-management upgrades without disrupting patient care. Compliance standards for healthcare infrastructure added another layer of complexity, as every system required detailed testing and approval. Staff training became essential because new technologies demanded skilled monitoring and proper operation. These constraints increased project costs and extended implementation timeframes. As a result, integration and compliance challenges continued to slow sustainable transformation, particularly in facilities with legacy infrastructure.

Regional Analysis

North America

North America led the Green Hospitals Market in 2024 with about 38% share. Hospitals in the U.S. and Canada adopted advanced energy-efficient systems, renewable power, and smart building controls to meet strict sustainability rules. Federal incentives and state programs supported upgrades in HVAC, solar installations, and waste-reduction systems. Large health networks invested in LEED-certified buildings to cut long-term operating costs. Growing pressure to reduce carbon emissions and improve disaster-ready infrastructure strengthened regional demand for green solutions. The presence of strong technology providers helped accelerate modernization across major cities and regional healthcare systems.

Europe

Europe captured nearly 32% share in 2024, driven by aggressive climate targets and strong regulatory frameworks for sustainable healthcare facilities. Countries such as Germany, the U.K., France, and the Nordics advanced green hospital programs that prioritized renewable energy, circular-waste systems, and smart resource-management platforms. Public health authorities supported investments through green financing and compliance requirements. Hospitals also embraced retrofitting programs to align with EU energy-efficiency guidelines. Adoption of low-carbon building materials and innovative design solutions accelerated growth. Strong focus on environmental protection and carbon neutrality kept Europe a major contributor to market expansion.

Asia Pacific

Asia Pacific held about 24% share and grew rapidly due to increasing healthcare infrastructure investment in China, India, Japan, and Southeast Asia. Governments encouraged green construction to address rising pollution levels and reduce energy loads in expanding hospital networks. New hospitals adopted solar systems, smart controls, and efficient water-management solutions in urban centers. Large private hospital chains invested in digital tools and renewable-energy integration to reduce operating expenses. Rapid population growth and expanding healthcare access strengthened demand for sustainable hospital models. Supportive policies and rising awareness positioned the region as a key future growth hub.

Latin America

Latin America accounted for nearly 4% share, supported by gradual adoption of energy-efficient technologies in Brazil, Mexico, Chile, and Colombia. Hospitals invested selectively in LED lighting, solar rooftops, and basic waste-reduction programs to manage rising electricity and disposal costs. Government sustainability initiatives encouraged early adoption, though budget limitations slowed large-scale transformation. Urban private hospitals led modernization efforts, while public facilities followed through small retrofitting projects. Growing environmental awareness and rising healthcare spending helped build steady momentum for green practices. Long-term potential remained strong as policies moved toward carbon-reduction goals.

Middle East & Africa

The Middle East & Africa region held around 2% share, with progress driven mainly by large hospitals in the UAE, Saudi Arabia, and South Africa. High energy consumption in climate-controlled facilities encouraged adoption of efficient HVAC, smart lighting, and solar-powered systems. National visions in GCC countries promoted sustainable infrastructure development, creating demand for green-certified hospital buildings. African hospitals adopted selective upgrades focused on solar power and water-efficient systems to manage resource shortages. Despite slower adoption in many areas, increasing investment in modern healthcare infrastructure provided long-term opportunities for green transformation.

Market Segmentations:

By Technology

- Energy- Efficient Lighting

- Renewable Energy Sources

- Waste reduction programs

By Application

- Hospitals

- Clinics

- Long- Term Care Facilities

By Services

- Medical Services

- Surgical Services

- Emergency Services

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Green Hospitals Market featured a mix of global technology providers, healthcare groups, and sustainability-focused organizations working to modernize hospital infrastructure. Leading participants such as Siemens Healthineers AG, Schneider Electric SE, Philips Healthcare, Johnson & Johnson, Medline Industries, Hitachi, Max Healthcare, Dignity Health, Gundersen Health Systems, and the HINDUJA Group advanced their positions through energy-efficient technologies, renewable power integration, and hospital-wide sustainability programs. Companies invested in smart building systems, low-carbon equipment, and waste-reduction platforms to help hospitals cut emissions and operating costs. Healthcare networks strengthened green commitments by adopting digital monitoring tools and certified construction standards. Partnerships between engineering firms, medical suppliers, and hospital groups expanded the availability of advanced retrofitting solutions. Continuous innovation in HVAC optimization, solar systems, lighting automation, and sustainable materials kept competition active and supported long-term growth in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Max Healthcare inaugurated a 300-bed greenfield hospital in Dwarka (Delhi, India) with sustainability features such as clean-energy solutions, zero-liquid-discharge, and EV-charging.

- In May 2024, Siemens Healthineers AG launched its Greener Clinical Lab Testing solutions: its Atellica analyzers achieved My Green Lab ACT Ecolabel certification, helping labs reduce water, energy and plastic waste

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, Services and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Green hospital investments will rise as administrators target lower emissions and stronger energy resilience.

- Smart building systems will expand with wider use of sensors, automation, and real-time monitoring tools.

- Renewable power integration will grow as hospitals adopt solar, storage, and hybrid energy systems.

- Retrofitting older facilities will accelerate to meet new sustainability rules and reduce long-term costs.

- Demand for low-waste clinical supplies and circular-design products will increase across large health networks.

- Green-certified construction will gain traction as new hospitals follow global sustainability frameworks.

- Digital twins and AI platforms will support predictive energy planning and resource optimization.

- Partnerships between healthcare groups and technology providers will strengthen sustainability adoption.

- Regions with rising healthcare investment will shift toward greener designs to improve operational efficiency.

- Environmental reporting requirements will push hospitals to adopt transparent carbon-reduction strategies.