Market Overview:

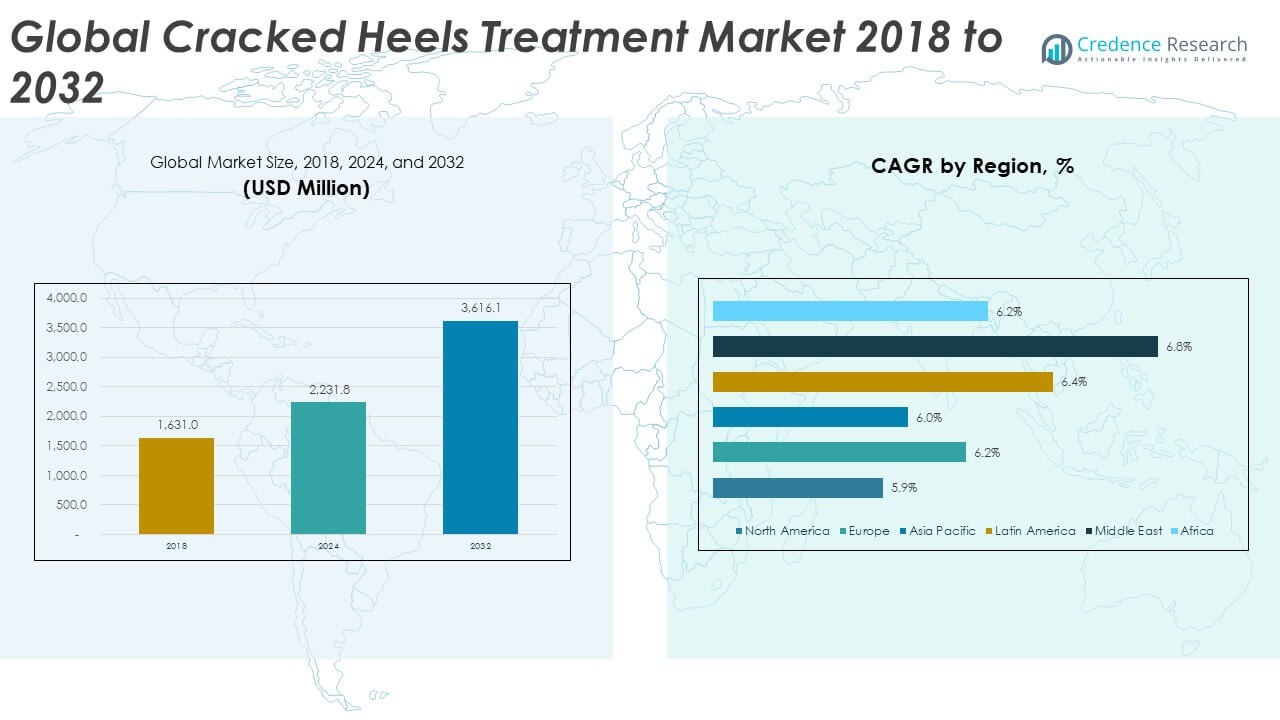

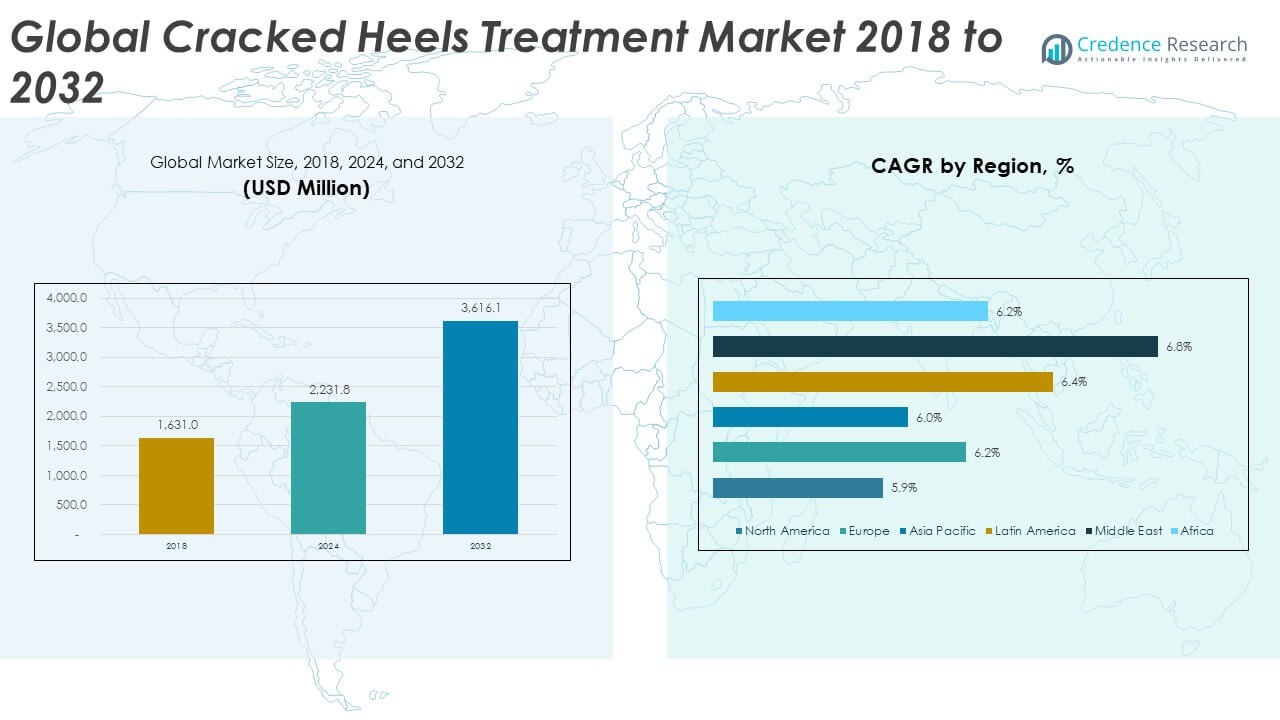

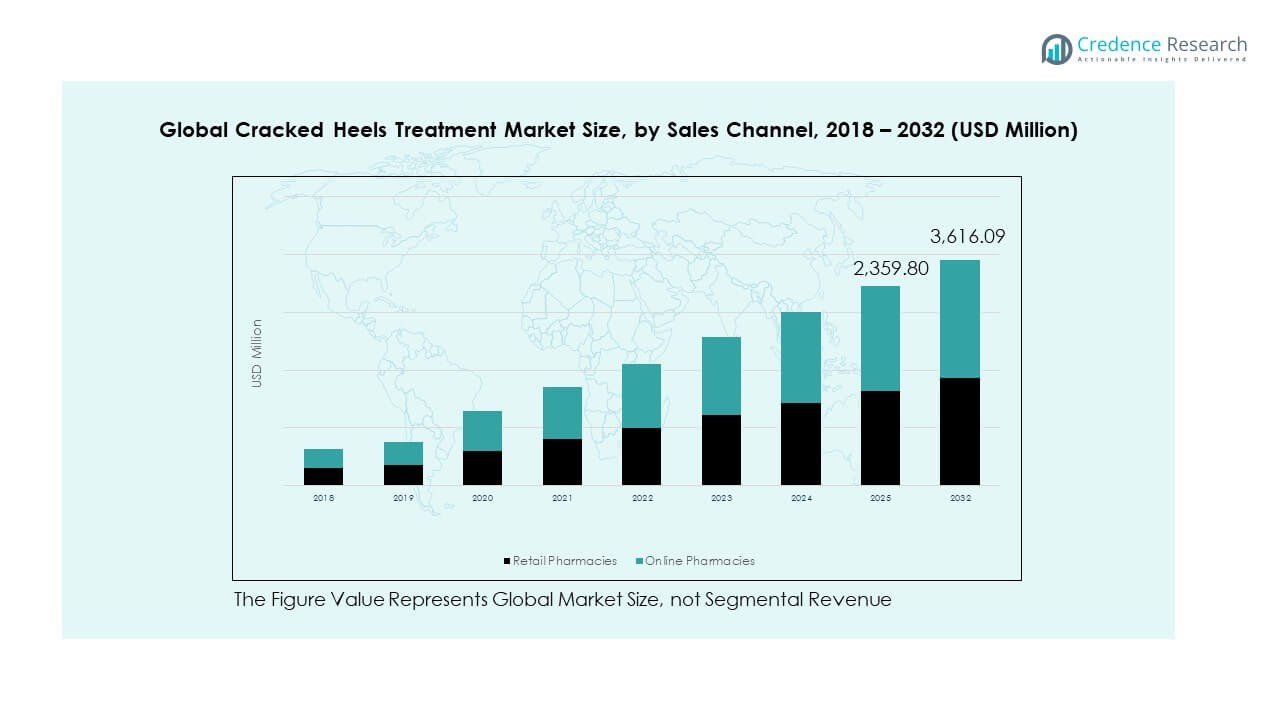

The Global Cracked Heels Treatment Market size was valued at USD 1,631.00 million in 2018 to USD 2,231.80 million in 2024 and is anticipated to reach USD 3,616.10 million by 2032, at a CAGR of 6.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cracked Heels Treatment Market Size 2024 |

USD 2,231.80 Million |

| Cracked Heels Treatment Market, CAGR |

6.29% |

| Cracked Heels Treatment Market Size 2032 |

USD 3,616.10 Million |

Demand rises due to growing awareness of foot-care needs among adults. Many people seek fast relief from dryness, pain, and skin damage caused by lifestyle habits. Brands expand product ranges with stronger moisturizers and advanced healing formulas. Clinics report higher cases linked to diabetes and age-related skin thinning. Rising self-care trends help drive wider use of creams, balms, and exfoliation solutions.

North America leads due to strong consumer spending on personal care and wide retail access. Europe follows with a mature skincare culture and high demand for dermatology-approved products. Asia Pacific emerges as a fast-growing region driven by large populations and rising grooming awareness. Urban areas in China and India show stronger adoption as self-care habits improve. The Middle East and Latin America expand steadily with broader product availability and a growing focus on foot health.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Cracked Heels Treatment Market grew from USD 1,631.00 million in 2018 to USD 2,231.80 million in 2024 and is projected to reach USD 3,616.10 million by 2032, driven by a 6.29% CAGR, supported by rising foot-care awareness and stronger adoption of repair solutions across demographics.

- Asia Pacific leads the global landscape with 36.6% share, driven by large populations and improving grooming habits. Europe follows with 22.8%, supported by a mature skincare culture, while North America holds 17.3%, backed by strong personal-care spending and wide retail access.

- The Middle East stands as the fastest-growing region with a 6.8% CAGR and a 7.0% global share, boosted by hot climates that intensify heel dryness and increasing demand for premium hydration products.

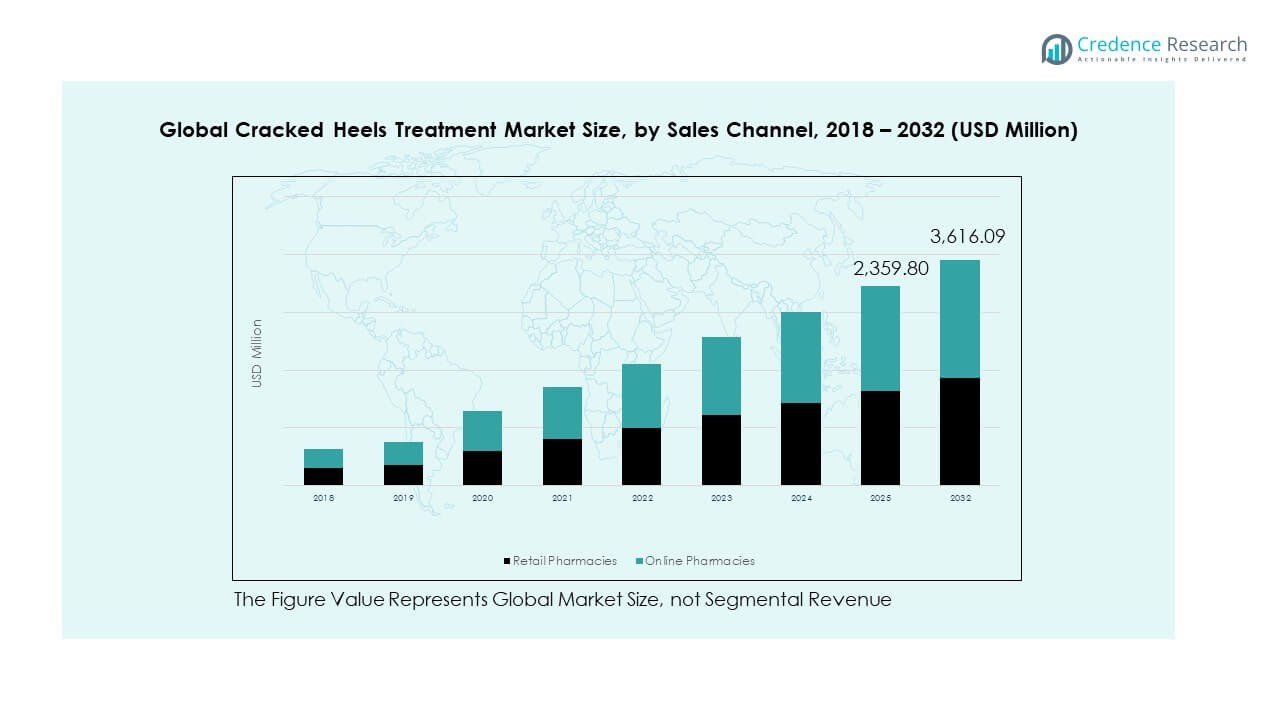

- Retail pharmacies account for roughly 40% of total sales based on visual distribution from the chart, supported by strong in-store demand for immediate treatment products and pharmacist-guided purchases.

- Online pharmacies represent about 60% of the distribution, gaining momentum through convenience, strong digital influence, wider product variety, and broader reach across emerging and remote markets.

Market Drivers:

Rising Foot-Care Awareness and Growing Demand for Targeted Heel Repair Solutions

Growing public concern over dry and damaged heels strengthens daily foot-care habits. Consumers seek relief from pain, cracks, and rough skin that affect mobility. The Global Cracked Heels Treatment Market expands with wider use of balms, creams, and exfoliation aids. It benefits from higher interest in dermatology-backed solutions that promise faster recovery. Diabetic users need stronger heel-care support due to high risk of fissures. Working adults face long hours on hard surfaces, which create deeper heel cracks. Many people adopt preventive routines to stop recurring dryness. Retail channels display more specialized products to meet rising needs.

- For instance, O’Keeffe’s Healthy Feet Cream is clinically proven to instantly boost moisture levels and help create a protective barrier on the skin’s surface, with most users feeling a difference within days of use. This is based on the brand’s verified performance testing.

Increasing Influence of Preventive Healthcare and Dermatology Guidance

Preventive care gains momentum as professionals highlight foot health in routine checkups. Dermatologists guide users toward hydration-focused formulas that restore the skin barrier. Growing acceptance of science-based skincare pushes more people to treat cracked heels early. The Global Cracked Heels Treatment Market benefits from higher trust in regulated formulations. It gains traction as brands use pH-balanced blends to stop moisture loss. Clinics report more visits linked to seasonal dryness and lifestyle habits. Working groups with long outdoor exposure adopt stronger heel-repair regimens. Rising interest in long-term skin protection supports wider adoption.

- For instance, Eucerin’s UreaRepair Plus line uses 10% urea, a concentration clinically validated to improve skin barrier function and reduce dryness in controlled dermatology studies.

Growing Impact of Lifestyle Patterns and Urban Work Routines on Heel Damage

Changing lifestyles raise stress on feet through long standing hours and improper footwear. Professionals in retail, healthcare, and hospitality experience higher heel dryness. The Global Cracked Heels Treatment Market gains value as users look for faster healing options. It supports people dealing with calluses linked to heavy foot pressure. Urban climates create exposure to dust and low humidity that worsen cracks. Many people prefer intensive overnight formulas to repair deeper fissures. Outdoor workers turn to protective balms to reduce skin breakdown. Household consumers also use foot masks and scrubs for routine care.

Expansion of Product Innovation Across Natural, Therapeutic, and Dermatology-Grade Formulations

Brands create blends with natural butters, ceramides, and skin-repair actives for broader appeal. New formulas focus on deep hydration and stronger barrier restoration. The Global Cracked Heels Treatment Market advances with products designed for faster absorption. It attracts users who need non-greasy textures that suit daily movement. Dermatology-grade options offer relief for severe heel dryness tied to medical concerns. Natural-focused consumers choose botanical formulas with fewer irritants. Growing trust in clinical claims improves brand positioning. Retailers expand assortments to cover all severity levels.

Market Trends:

Shift Toward Multi-Benefit Heel-Care Products With Hydration, Repair, and Protection Claims

Consumers now prefer heel-care products that offer hydration and faster repair. Multi-benefit formulas combine exfoliation, moisturization, and skin protection in one application. The Global Cracked Heels Treatment Market sees greater interest in products that reduce routine steps. It grows due to users seeking long-lasting softness without heavy textures. Natural blends remain popular due to rising clean-label preferences. Many brands highlight gentler ingredients to attract sensitive-skin users. Stronger repair claims increase confidence among frequent buyers. Retail shelves show clear movement toward multi-action solutions.

- For instance, Burt’s Bees Coconut Foot Cream contains 99% natural-origin ingredients, a figure confirmed by the company’s official formulation disclosures.

Growing Popularity of At-Home Foot-Care Tools and DIY Repair Kits

More users adopt home-based care kits to manage cracked heels without clinic visits. Electric files, foot masks, and deep-moisture socks gain steady traction. The Global Cracked Heels Treatment Market shifts toward convenience-focused formats. It benefits from users choosing self-care routines during busy schedules. Home kits help people control dryness before it becomes severe. Online platforms promote complete kits that combine tools with creams. Seasonal changes drive higher sales of exfoliation devices. Many consumers pair tools with repair balms for better results.

- For instance, the Amope Pedi Perfect Electronic Foot Filetypically operates at a high speed of approximately 2000 rotations per minute (RPM) and a low speed of around 1500 RPM, performance metrics published by the manufacturer.

Rising Use of Social Media, Dermatology Content, and Digital Beauty Education

Social platforms boost awareness through foot-care demonstrations and expert advice. Influencers show repair routines that encourage early treatment. The Global Cracked Heels Treatment Market strengthens due to rising visibility of effective solutions. It gains support from dermatologists sharing tips on hydration and barrier care. Digital tutorials guide people to adopt targeted products. Younger users follow quick routines shared online. Skincare communities highlight repair formulas with proven comfort. Digital content plays a major role in shaping product choices.

Increase in Specialized Products for High-Risk Groups Including Diabetic and Senior Users

Brands now create solutions for people with fragile skin or chronic dryness. Diabetic users need stronger and safer formulas for daily heel repair. The Global Cracked Heels Treatment Market grows as companies target high-risk groups. It supports seniors who face age-related moisture loss. Clinics recommend deeper hydration blends for severe fissures. Product labels now highlight safe-use guidance for sensitive conditions. Many households buy separate products for different family members. Higher awareness of medical-grade heel care supports market growth.

Market Challenges Analysis:

Growing Competition From Low-Cost Products and Limited Consumer Awareness in Some Regions

Market growth faces pressure from low-cost alternatives that promise quick results. Many users choose budget options without proper knowledge of long-term care. The Global Cracked Heels Treatment Market struggles in areas where foot health receives low attention. It faces slower progress where people treat heel cracks only during severe pain. Limited dermatology access reduces early diagnosis of skin damage. Retail shelves remain crowded, creating difficulty for new brands. Awareness gaps lead to inconsistent product use among buyers. Seasonal care patterns also restrict steady adoption.

Difficulty in Treating Severe Cracks and Low Compliance With Routine Care Regimens

Deep heel fissures need consistent treatment, which many consumers fail to maintain. Severe dryness demands prolonged hydration, yet many stop using products too early. The Global Cracked Heels Treatment Market deals with low compliance that weakens results. It faces hurdles in regions with harsh climates that speed skin breakdown. Some users delay treatment until cracks worsen. Improper footwear continues to trigger recurrent dryness. Lack of clinical follow-up slows healing of chronic fissures. Limited access to specialized care adds further challenges.

Market Opportunities:

Increasing Demand for Premium Dermatology-Approved Heel Repair Products and Advanced Formulations

Premium heel-repair products gain appeal among consumers seeking fast relief. Dermatology-backed formulas with deeper hydration create strong demand. The Global Cracked Heels Treatment Market benefits from rising trust in medically guided care. It gains traction as brands use strong barrier-repair ingredients. eCommerce platforms help premium items reach wider buyers. Growing interest in long-term foot health supports higher spending. Many companies expand into medicated and clinical-grade lines. Product innovation opens space for stronger brand loyalty.

Expansion of Foot-Care Adoption Across Emerging Regions Through Retail Growth and Digital Reach

Emerging regions show higher interest in structured foot-care routines. Retail expansion increases access to specialized heel-repair products. The Global Cracked Heels Treatment Market gains momentum through rising digital influence. It reaches new consumers through mobile shopping and social content. Warmer climates create stronger need for daily hydration. More brands enter price-sensitive markets with tailored formulas. Urban users adopt repair solutions as grooming habits evolve. Wider availability supports broader household adoption.

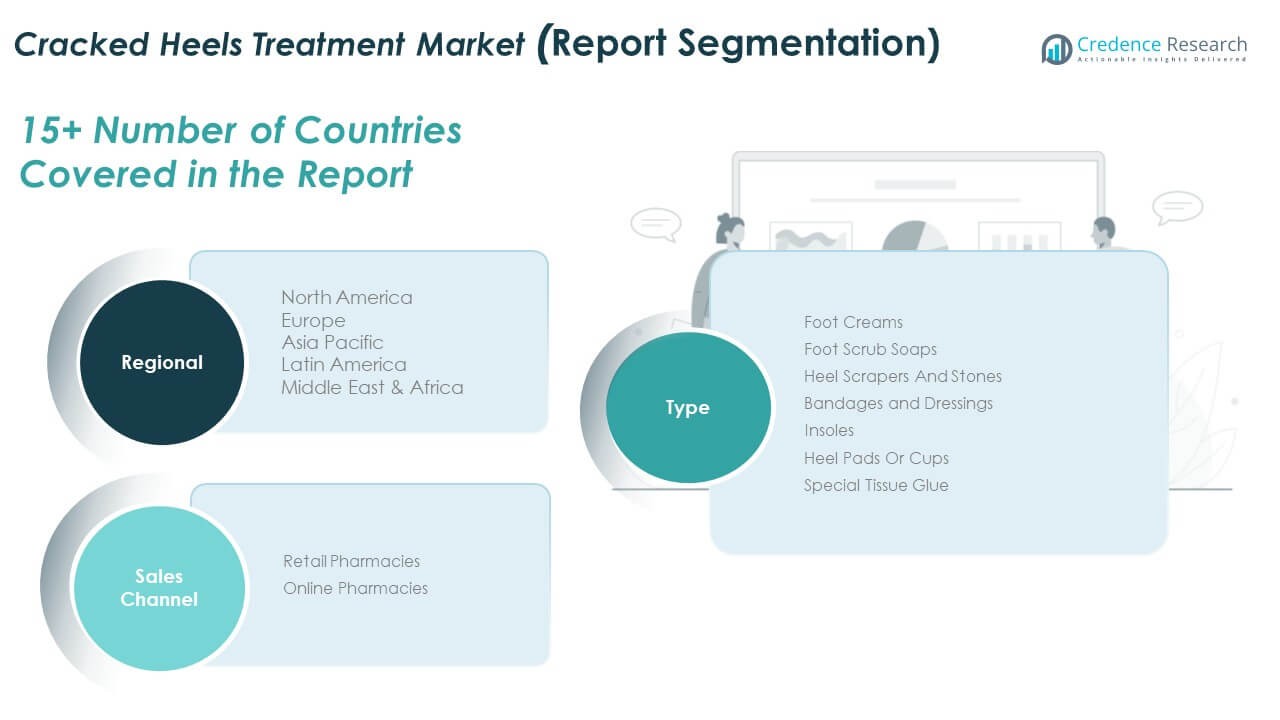

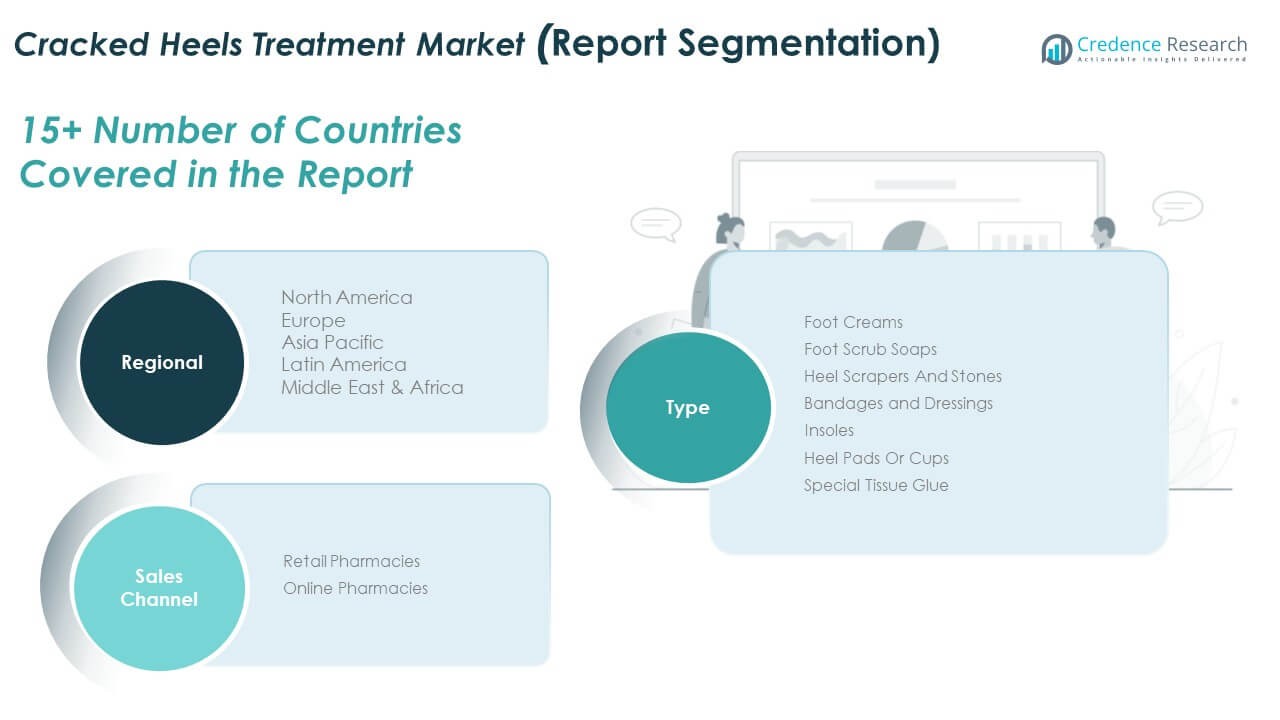

Market Segmentation Analysis:

By Type

The Global Cracked Heels Treatment Market expands across diverse product categories that target different severity levels and user preferences. Foot creams hold strong appeal due to their hydration focus and daily-use convenience. Many consumers rely on foot scrub soaps to remove dead skin and improve absorption of repair formulas. Heel scrapers and stones support users dealing with thicker calluses that need manual exfoliation. Bandages and dressings help protect deeper cracks and support healing during routine movement. Insoles reduce pressure on damaged heels for people with long standing hours. Heel pads or cups offer cushioning that prevents recurring fissures. Special tissue glue serves users with severe cracks who need fast closure and reinforced skin bonding.

- For instance, Dermabond medical adhesive, produced by Ethicon, has tensile strength levels comparable to fine traditional sutures (such as size 5-0 or smaller), and is indicated for use on low-tension, easily approximated wounds, based on FDA-published clinical evaluation data.

By Sales Channel

The market moves through retail pharmacies and online pharmacies, each influencing buyer behavior. Retail pharmacies attract walk-in users seeking immediate relief or professional guidance. Many buyers trust pharmacist recommendations for products that suit different skin conditions. Online pharmacies grow due to wide product access and strong convenience benefits. It provides options for price comparisons and discreet purchasing. Digital platforms influence buying patterns through education-driven content and customer reviews. Users in remote areas prefer online channels for reliable delivery. Expanding e-commerce improves product reach across varied demographics.

- For instance, Amazon’s personal-care category features numerous foot-care products, some of which individually have tens of thousands of reviews, easily leading to millions in aggregate across the category, reflecting significant online traction for heel-repair solutions.

Segmentation:

by Type

- Foot Creams

- Foot Scrub Soaps

- Heel Scrapers and Stones

- Bandages and Dressings

- Insoles

- Heel Pads or Cups

- Special Tissue Glue

by Sales Channel

- Retail Pharmacies

- Online Pharmacies

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Country-Level

- North America: U.S., Canada, Mexico

- Europe: UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific: China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

- Latin America: Brazil, Argentina, Rest of Latin America

- Middle East: GCC Countries, Israel, Turkey, Rest of Middle East

- Africa: South Africa, Egypt, Rest of Africa

Regional Analysis:

North America

The North America Global Cracked Heels Treatment Market size was valued at USD 308.26 million in 2018 to USD 413.38 million in 2024 and is anticipated to reach USD 651.62 million by 2032, at a CAGR of 5.9% during the forecast period. North America holds a strong share of the Global Cracked Heels Treatment Market due to high personal-care awareness and strong retail pharmacy penetration. The region benefits from wide access to dermatology products and a mature consumer base that adopts heel-repair solutions driven by active lifestyles and climate changes affecting hydration. Innovation across creams and protective dressings supports product interest, while digital platforms boost online sales across both urban and rural zones. Clinics play a key role in guiding high-risk groups, and advanced formulas designed for sensitive skin enhance market engagement. Regional Market Share: ~17.3%.

Europe

The Europe Global Cracked Heels Treatment Market size was valued at USD 393.40 million in 2018 to USD 535.05 million in 2024 and is anticipated to reach USD 859.91 million by 2032, at a CAGR of 6.2% during the forecast period. Europe maintains strong demand supported by a mature skincare culture and established dermatology networks. The region benefits from wide acceptance of medicated and natural heel-care options, with consumers prioritizing barrier-restoring formulas suited for chronic dryness. The Global Cracked Heels Treatment Market shows consistent traction across Western and Central Europe, driven by rising self-care habits supported by pharmacies and wellness retailers. Northern areas adopt heel-repair solutions at higher rates due to harsh winter conditions, while digital platforms attract younger consumers who prefer at-home foot-care routines. Regional Market Share: ~22.8%.

Asia Pacific

The Asia Pacific Global Cracked Heels Treatment Market size was valued at USD 612.44 million in 2018 to USD 843.28 million in 2024 and is anticipated to reach USD 1,377.73 million by 2032, at a CAGR of 6.0% during the forecast period. Asia Pacific leads the global market with the largest consumer base and rising personal-care spending. Growth is driven by urbanization, lifestyle changes, and climates that intensify dryness and cracked heels. The Global Cracked Heels Treatment Market benefits significantly from fast-growing online pharmacies that expand access across developing economies. Demand is strong in China and India due to heightened awareness campaigns, while Japan and South Korea influence premium innovation trends. Retail chains continue to boost product availability across major cities. Regional Market Share: ~36.6%.

Latin America

The Latin America Global Cracked Heels Treatment Market size was valued at USD 175.82 million in 2018 to USD 242.78 million in 2024 and is anticipated to reach USD 398.13 million by 2032, at a CAGR of 6.4% during the forecast period. Latin America shows steady market progress driven by rising awareness of hygiene and grooming habits. Expanding retail networks improve access to heel-care products, while the Global Cracked Heels Treatment Market gains traction in Brazil and Mexico with support from growing middle-income consumers. Regional climates often increase dryness, pushing adoption of hydrating formulas. Social media shapes consumer choices, especially for natural products, and online channels support growth among younger users. Dermatology clinics help encourage early treatment for severe conditions. Regional Market Share: ~10.5%.

Middle East

The Middle East Global Cracked Heels Treatment Market size was valued at USD 110.58 million in 2018 to USD 155.62 million in 2024 and is anticipated to reach USD 261.44 million by 2032, at a CAGR of 6.8% during the forecast period. The Middle East experiences strong demand driven by hot, arid climates that intensify heel cracking and dryness. Growing wellness spending across Gulf countries boosts adoption of premium repair creams and protective pads. The Global Cracked Heels Treatment Market benefits from improved retail and pharmacy infrastructure in urban hubs, while online platforms expand access in areas with limited physical stores. Migrant workers with long working hours show higher usage of protective heel-care solutions, and regional brands develop hydrating formulas suited for extreme weather. Regional Market Share: ~7.0%.

Africa

The Africa Global Cracked Heels Treatment Market size was valued at USD 30.50 million in 2018 to USD 41.64 million in 2024 and is anticipated to reach USD 67.26 million by 2032, at a CAGR of 6.2% during the forecast period. Africa shows moderate but increasing adoption of heel-care products influenced by growing urban populations and rising awareness of basic foot-health practices. The Global Cracked Heels Treatment Market expands as retail pharmacies strengthen their presence in major urban centers, while e-commerce enhances access in underserved regions. Climate conditions often drive recurring dryness, increasing demand for hydrating and protective blends. Price-sensitive groups support the growth of affordable product formats, while awareness campaigns encourage early treatment of cracked heels. Regional Market Share: ~1.8%.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bo International

- Bayer AG

- Beiersdorf

- Ego Pharmaceuticals Pty. Ltd.

- Galderma S.A.

- Orchid Lifescience

- Brinton Pharmaceuticals Ltd.

- Reckitt Benckiser

- Moberg Pharma

Competitive Analysis:

The Global Cracked Heels Treatment Market features strong competition driven by product innovation and diverse price ranges. It includes multinational leaders and specialized skincare brands that target hydration, exfoliation, and advanced repair. Companies focus on dermatology-tested formulas that address mild to severe heel dryness. It evolves with new blends using ceramides, natural butters, and safe medicated actives. Firms invest in wider retail and digital distribution to reach varied consumer groups. Strong R&D pipelines support superior barrier-repair solutions. Many brands leverage clinical endorsements to build trust. Competitive intensity stays high due to rising demand across personal-care categories.

Recent Developments:

- In November 2025, Moberg Pharma reinforced its specialty in topical treatments for nail and skin disorders by signing an exclusive licensing agreement with Karo Healthcare to commercialize its novel topical terbinafine product MOB‑015 (Terclara) for nail fungus across 19 European markets, with launches planned under the established Lamisil antifungal umbrella; while MOB‑015 specifically targets onychomycosis rather than cracked heels, the deal deepens Moberg’s footprint in foot‑related dermatology alongside its existing Kerasal foot‑care brand, which includes products for very dry and cracked skin, thereby indirectly supporting innovation and market presence in the broader cracked‑heels treatment category.

- In September 2025, Galderma advanced its position in intensive dry‑skin care with the launch of the Cetaphil Skin Activator Hydrating & Firming line, an “advanced hydration and firming” body and facial range built on encapsulated CICA and microdosed mandelic acid technology to improve crepey, dry and fragile skin; this new segment sits alongside Cetaphil’s Cracked Skin Repair Balm, a dimethicone‑based protectant balm designed to repair deeper cracks and soften rough skin on drier areas like hands and feet, marketed explicitly as suitable for cracked heel repair, thereby reinforcing Galderma’s role in treating severely dry and cracked skin, including heels.

- In July 2025, Ego Pharmaceuticals announced a major AUD 156 million, decade‑long investment in Australian manufacturing, officially opening its Zorzi Innovation Centre, new cream‑filling line and expanded warehouse operations at Braeside and Dandenong South; this capacity expansion, which doubles annual production for Ego’s science‑backed skincare portfolio, directly underpins global supply of QV Feet Heel Balm, a heel‑care product that uses alpha hydroxy acids and rich moisturisers to treat dry and cracked heels and is increasingly distributed through pharmacies and modern retail across markets such as Australia, the Middle East and online channels.

Report Coverage:

The research report offers an in-depth analysis based on Type and Sales Channel segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for targeted heel-repair products will rise as self-care routines strengthen worldwide.

- Premium dermatology-approved formulas will gain higher adoption across sensitive-skin users.

- E-commerce platforms will widen product access in developing and remote markets.

- Natural and clean-label ingredients will influence product design and brand positioning.

- At-home foot-care tools will grow in popularity among consumers seeking convenience.

- Clinical-grade solutions will expand among diabetic and senior populations with chronic dryness.

- Retail pharmacies will remain key channels while online pharmacies accelerate faster growth.

- Innovation will focus on deeper hydration and long-lasting skin barrier repair.

- Marketing strategies will rely strongly on social media, digital education, and expert endorsements.

- Global expansion will continue as companies enter new high-potential regions with tailored offerings.