Market Overview

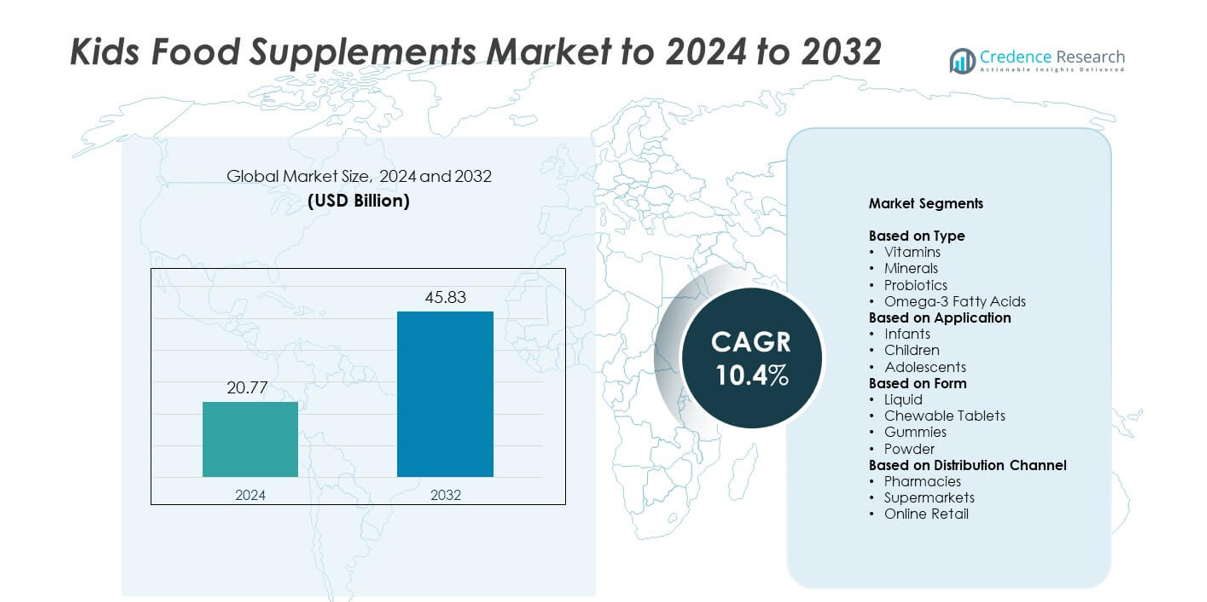

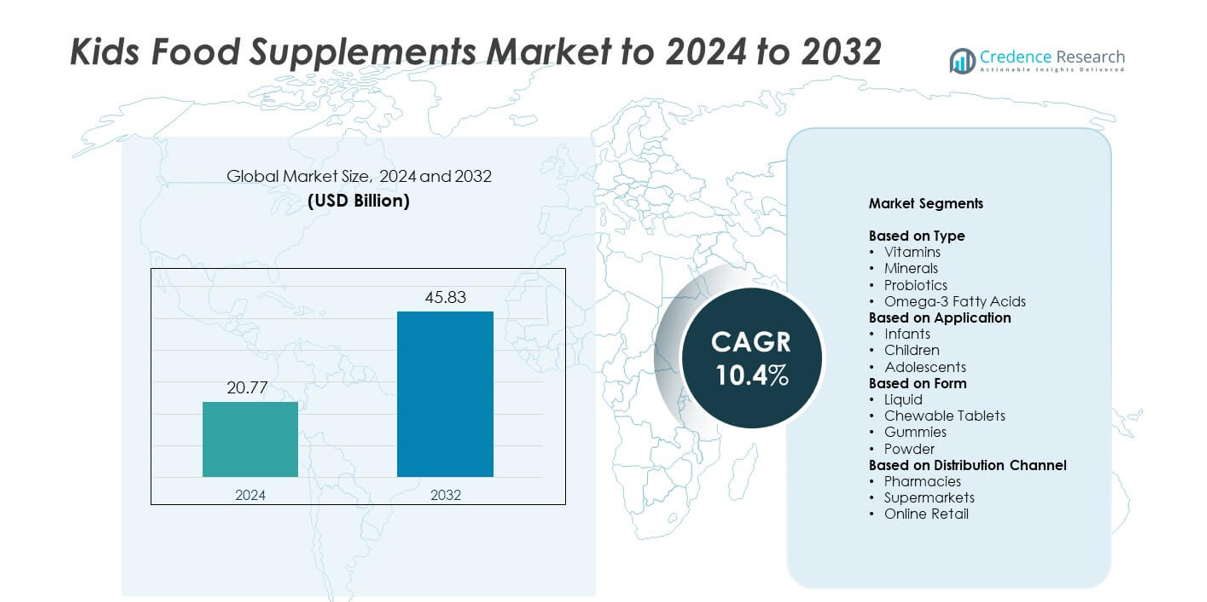

Kids Food Supplements Market size was valued at USD 20.77 billion in 2024 and is anticipated to reach USD 45.83 billion by 2032, at a CAGR of 10.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Kids Food Supplements Market Size 2024 |

USD 20.77 billion |

| Kids Food Supplements Market, CAGR |

10.4% |

| Kids Food Supplements Market Size 2032 |

USD 45.83 billion |

The Kids Food Supplements Market is shaped by leading companies such as Abbott, Danone, Perrigo Company plc, Nestlé, Herbalife, Goodwolf Feeding Co., Nutribud Foods, Mead Johnson & Company, LLC, My Lunchbuddy, Else Nutrition, and Yamo AG. These players compete through clean-label formulas, functional blends, and child-friendly formats like gummies and liquids. Innovation in immunity, cognition, and gut-health products helps strengthen their market positions. Regionally, North America leads the global market with about 34% share due to high awareness, strong retail presence, and premium product adoption. Asia Pacific follows with nearly 29% share, supported by rising incomes and fast-growing online channels.

Market Insights

- Kids Food Supplements Market was valued at USD 20.77 billion in 2024 and is projected to reach USD 45.83 billion by 2032, growing at a CAGR of 10.4%.

- Rising focus on child immunity and nutrient-gap awareness drives strong demand for vitamins, probiotics, and omega-3 supplements across all major demographics.

- Gummies remain the leading form with about 46% share, supported by high acceptance among children and ongoing product innovation in clean-label and low-sugar options.

- Competition intensifies as global and regional brands expand portfolios with plant-based, allergen-free, and science-backed formulations tailored to specific age groups.

- North America leads the market with nearly 34% share, followed by Asia Pacific at around 29% and Europe at about 27%, driven by strong retail networks, digital adoption, and rising focus on preventive nutrition.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Vitamins held the dominant share of about 42% in 2024. Parents choose vitamin supplements to support growth, immunity, and overall wellness in young consumers. Rising awareness about micronutrient deficiencies increases demand for vitamin drops, syrups, and gummies. Minerals, probiotics, and omega-3 products grow at a steady pace as families focus on digestive health and cognitive development. Strong marketing by major brands and wider retail availability further support the vitamin category.

- For instance, the Flintstones Sugar Free Multivitamin Gummies provide 11 essential nutrients (including vitamins A, C, E, B6, B12, niacin, and zinc) in each daily serving. The serving size varies by age: one gummy daily for children aged 2-3 years, and two gummies daily for children aged 4 years and older.

By Application

Children led the segment in 2024 with nearly 51% share. This group shows strong use of supplements due to higher nutrient requirements during early development. Parents prefer balanced products that support immunity, focus, and physical activity. Infants and adolescents record steady expansion as healthcare providers recommend targeted blends. Growth across all age groups continues due to better awareness, product innovation, and improved distribution through pharmacies, online platforms, and supermarkets.

- For instance, the Centrum Kids multivitamin and mineral gummies in the Indian market are designed for children aged 5–15 years and formulated with 12 vital nutrients (including vitamins A, C, D2, E, B1, B3, B5, B6, B12, biotin, folic acid, iodine, and zinc), along with a probiotic (Bacillus coagulans) to support growth, development, and healthy digestion.

By Form

Gummies dominated the form segment in 2024 with about 46% share. Kids prefer gummies due to easy use, appealing flavors, and better compliance. Brands invest in sugar-controlled and natural-ingredient gummy formulas, which attracts more parents. Liquid, chewable tablets, and powder formats expand with specialized blends for digestion, bone strength, and brain health. Broader retail placement and active product innovation help sustain interest across all delivery formats.

Key Growth Drivers

Rising Focus on Child Immunity

Families invest more in products that support strong immunity due to frequent infections and seasonal illnesses among young consumers. Brands introduce vitamin-rich and probiotic blends that appeal to parents seeking daily support for their children. Wider availability in pharmacies and online stores also expands access. Growing awareness campaigns by healthcare groups further strengthen demand for immunity-focused supplements across all age groups.

- For instance, The Nature’s Nutrition Kids Immune Support gummies can indeed provide 60 mg of vitamin C and 5 mg of zinc per serving. However, the serving size to achieve this for children aged 4 and up is typically three gummies daily

Growing Awareness of Nutrient Deficiencies

Many children face gaps in essential nutrients due to changing food habits and reduced intake of balanced meals. Healthcare professionals highlight the need for vitamins, minerals, and omega-3 fatty acids during early development, which drives category growth. Schools and pediatric clinics promote awareness about healthy nutrition, encouraging parents to consider supplements. Rising sales of fortified gummies and liquids also reflect a shift toward convenient options.

- For instance, ChildLife Essentials Multi Vitamin & Mineral recommends 1 teaspoon daily for infants 6–12 months and 2–3 teaspoons daily for children 4–12 years to help cover nutrient gaps.

Product Innovation and Attractive Formats

Manufacturers develop gummies, flavored liquids, and chewable tablets that engage younger consumers and improve compliance. Clean-label formulas with natural colors and low sugar win trust among parents. Companies also expand specialized blends for bone strength, cognition, and digestion. These innovations help brands differentiate products and attract new buyers in a competitive market.

Key Trends and Opportunities

Premium and Clean-Label Formulations

Parents prefer products made with natural ingredients, minimal additives, and transparent labeling. This shift boosts demand for organic, plant-based, and allergen-free supplements. Brands use this trend to move into premium positioning with functional blends that support growth and long-term wellness. Clean-label innovation also opens opportunities in retail and online channels where buyers compare quality standards.

- For instance, the current SmartyPants Kids Formula (Cherry Berry Punch flavor) provides 16 essential nutrients in each daily serving (two gummies for ages 4 and up), including omega-3 EPA and DHA, vitamins D3, C, B12, B6, A, K, and zinc.

Expansion of Personalized Nutrition for Kids

Digital health tools and simple at-home assessments increase interest in personalized supplement plans. Parents seek age-specific and need-specific formulas designed around immunity, cognition, and gut health. Brands respond with customizable dosage packs and subscription models that improve long-term engagement. This trend creates a strong pathway for premium pricing and higher brand loyalty.

- For instance, prior to its closure in June 2024, the personalized vitamin service Care/of built each supplement plan using a short online quiz that assessed lifestyle, diet, and health goals, which generally took customers about 5 minutes to complete.

Growth of Online and DTC Channels

Online platforms offer a wide range of products, clear ingredient details, and convenient delivery. Parents trust digital reviews and expert guidance, which supports rapid adoption of emerging brands. Direct-to-consumer models help companies maintain stronger customer relationships and offer subscription-based packages. This shift broadens market reach and supports higher product visibility.

Key Challenges

Stringent Regulatory and Safety Requirements

Kids supplements must meet strict safety, labeling, and formulation rules. Companies face delays and higher testing costs to ensure compliance with regional standards. Any quality concerns can quickly reduce consumer trust, making risk management essential. These strict rules slow product launches and raise barriers for smaller brands.

High Risk of Misuse and Overconsumption

Parents may unintentionally exceed safe dosage levels, especially with flavored gummies and liquids. This concern forces companies to provide clear instructions and safety warnings. Healthcare professionals emphasize proper guidance to avoid nutrient imbalance. Misuse cases also prompt tighter oversight, which increases operating challenges for manufacturers.

Regional Analysis

North America

North America held about 34% of the Kids Food Supplements Market in 2024. The region benefits from strong awareness of child nutrition, high purchasing power, and wide access to premium products across retail and online channels. Parents show strong preference for vitamins, probiotics, and clean-label gummies, which supports steady category expansion. Major brands also invest in targeted formulations for immunity and cognition, further driving uptake. Supportive recommendations from pediatric groups and strong digital marketing help maintain high consumer engagement and reinforce the region’s leadership.

Europe

Europe accounted for nearly 27% of the market share in 2024. Demand grows due to rising focus on preventive health and strong regulatory oversight that enhances product trust. Families adopt supplements to support balanced nutrition, especially in countries where pediatricians encourage monitored use. The region sees increasing interest in organic and allergen-free formulations, strengthening premium product sales. Broad distribution through pharmacies and supermarket chains ensures steady growth across diverse consumer groups and supports wider adoption in both western and eastern markets.

Asia Pacific

Asia Pacific captured around 29% of the market share in 2024, showing one of the fastest growth rates. Rising disposable incomes and growing attention to children’s immunity and cognitive development drive strong demand. Urban families adopt gummies, liquids, and probiotic blends due to busy lifestyles and evolving dietary patterns. Expanding e-commerce access strengthens product visibility and improves affordability across developing markets. Local and global brands introduce affordable formats tailored to regional tastes, which helps expand penetration across emerging economies.

Latin America

Latin America represented roughly 6% of the market share in 2024. Awareness about nutrient deficiencies grows as healthcare groups highlight the benefits of vitamins and minerals for child development. Retail pharmacies and online platforms expand their supplement offerings, helping families access a wider range of products. Economic constraints slow premium adoption, yet steady demand for basic vitamins and immunity blends drives moderate growth. Brands also focus on flavored gummies and liquids to build appeal among younger consumers across key countries.

Middle East and Africa

Middle East and Africa held around 4% of the market share in 2024. Urban populations adopt supplements at a faster pace due to rising focus on child health and growing access to international brands. Demand centers on vitamins and immune-support blends, particularly in countries with higher disposable incomes. Limited awareness in rural areas slows broader uptake, yet improving distribution networks support gradual expansion. Governments and healthcare providers promote nutritional education, helping increase acceptance of safe and regulated supplement products.

Market Segmentations:

By Type

- Vitamins

- Minerals

- Probiotics

- Omega-3 Fatty Acids

By Application

- Infants

- Children

- Adolescents

By Form

- Liquid

- Chewable Tablets

- Gummies

- Powder

By Distribution Channel

- Pharmacies

- Supermarkets

- Online Retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Kids Food Supplements Market features key players such as Abbott, Danone, Perrigo Company plc, Nestlé, Herbalife, Goodwolf Feeding Co., Nutribud Foods, Mead Johnson & Company, LLC, My Lunchbuddy, Else Nutrition, and Yamo AG. Competition strengthens as brands expand portfolios with clean-label, allergen-free, and plant-based formulations designed for immunity, growth, and cognitive support. Companies focus on appealing delivery formats, including gummies and flavored liquids, to improve compliance among young consumers. Many brands invest in clinical backing, transparent labeling, and fortified blends to increase credibility with parents and healthcare providers. Digital marketing, subscription models, and omni-channel distribution further shape competitive positioning. Global and regional players seek stronger market reach by entering emerging economies through affordable SKUs and localized flavors, while premium brands target urban families seeking high-quality nutritional solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Abbott

- Danone

- Perrigo Company plc

- Nestlé

- Herbalife

- Goodwolf Feeding Co.

- Nutribud Foods

- Mead Johnson & Company, LLC

- My Lunchbuddy

- Else Nutrition

- Yamo AG

Recent Developments

- In 2025, Mead Johnson & Company, a global leader in pediatric nutrition, celebrated its 120th anniversary and reinforced its long-standing commitment to science-backed innovation, highlighting its historical pioneering work in introducing DHA-enriched products to the U.S. market in 2002.

- In 2025, Nestlé Unveiled a new CEREGROW variant without refined sugar.

- In March 2025, Herbalife announced it had entered into agreements to acquire Pro2col Health and Pruvit Ventures, along with a 51% controlling interest in Link BioSciences, as part of a strategic move to expand its supplement portfolio and enhance its personalized wellness platform

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Form, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for clean-label and natural formulations will grow across all age groups.

- Gummies and flavored liquids will remain the most preferred formats for kids.

- Personalized nutrition for children will expand through digital health tools.

- Online and direct-to-consumer channels will gain stronger influence on buying habits.

- Probiotic and gut-health focused supplements will see higher adoption among parents.

- Brands will invest more in science-backed formulations to build trust and credibility.

- Pediatric recommendations will shape product innovation and targeted nutrient blends.

- Emerging markets will record fast growth due to rising awareness and wider access.

- Premium products with organic and allergen-free claims will capture expanding demand.

- Stronger regulations will improve product quality and safety across global markets