Market Overview

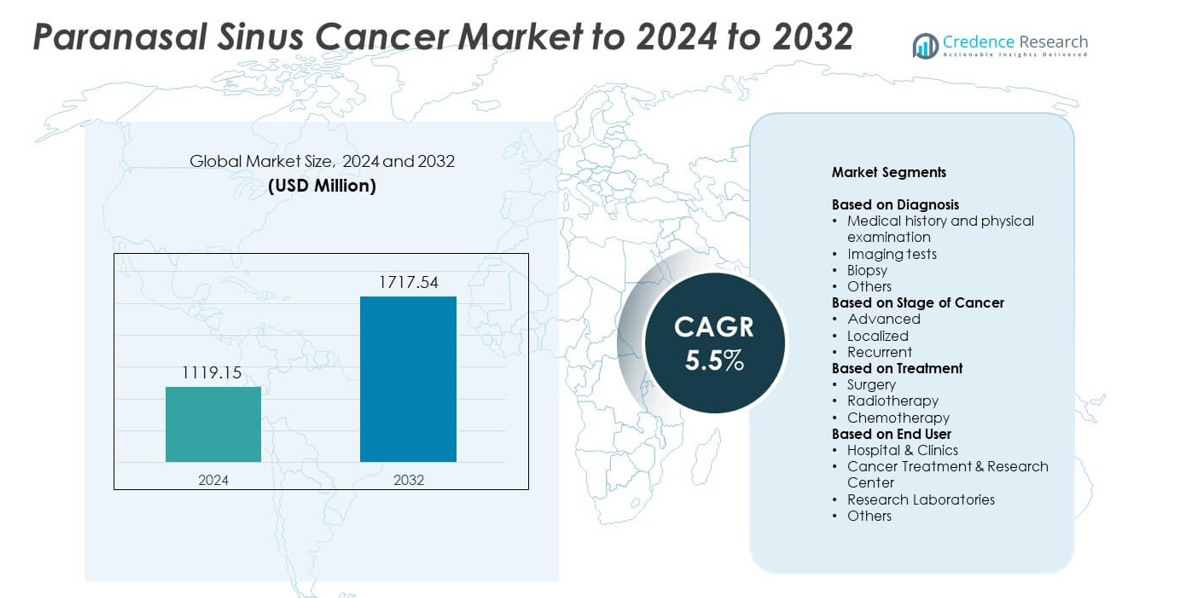

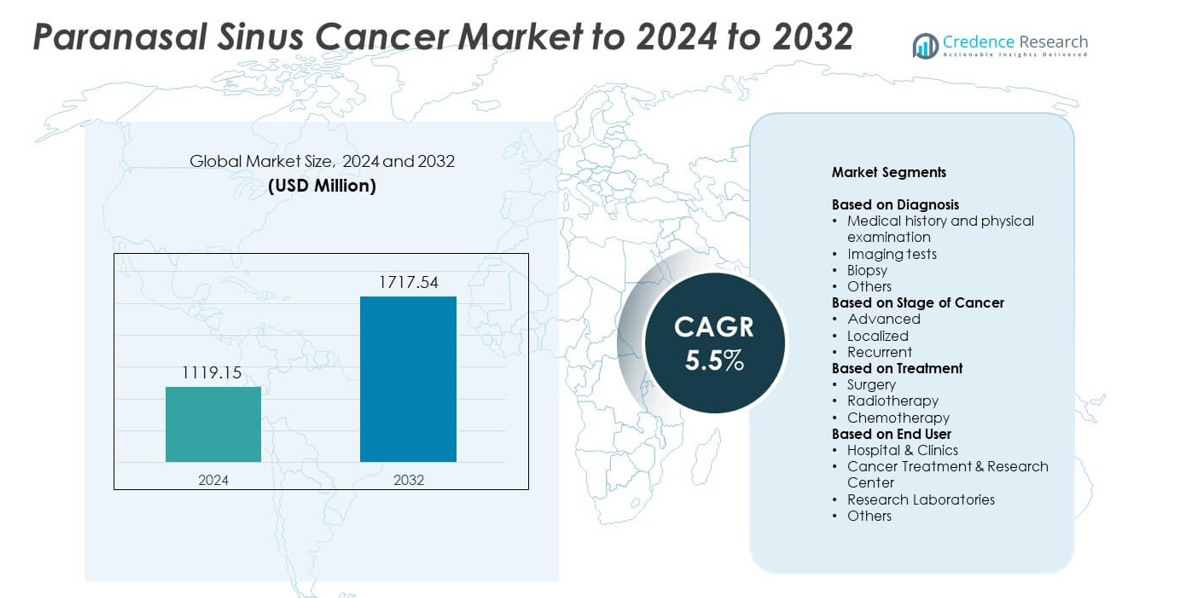

Paranasal Sinus Cancer Market size was valued at USD 1119.15 million in 2024 and is anticipated to reach USD 1717.54 million by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Paranasal Sinus Cancer Market Size 2024 |

USD 1119.15 million |

| Paranasal Sinus Cancer Market, CAGR |

5.5% |

| Paranasal Sinus Cancer Market Size 2032 |

USD 1717.54 million |

The Paranasal Sinus Cancer Market features major players such as AstraZeneca plc, Johnson & Johnson, Novartis AG, Pfizer Inc., Sanofi S.A., Merck & Co., Inc., Eli Lilly and Company, Bristol Myers Squibb, and F. Hoffmann-La Roche AG. These companies strengthened their positions through advanced oncology portfolios, targeted therapies, and investments in research for rare head and neck cancers. They also expanded access to precision diagnostics and improved treatment technologies across hospitals. North America led the market with about 41% share due to strong healthcare infrastructure, high diagnostic adoption, and wide availability of multidisciplinary cancer care centers.

Market Insights

- Paranasal Sinus Cancer Market was valued at USD 1119.15 million in 2024 and is projected to reach USD 1717.54 million by 2032, growing at a CAGR of 5.5%.

- Rising late-stage diagnosis and strong demand for surgery, which held about 47% share in 2024, continued to drive treatment expansion across cancer centers.

- Trends include wider use of endoscopic surgery and increasing adoption of precision oncology, supporting improved outcomes and stronger demand for imaging and biopsy tools, with medical history and physical examination holding 38% share.

- Competition grew as global oncology companies expanded targeted therapies, advanced radiotherapy platforms, and molecular diagnostic partnerships across major markets.

- North America led with about 41% share in 2024, followed by Europe at 29% and Asia Pacific at 22%, while advanced-stage cases accounted for nearly 52% of the market, shaping regional demand for multidisciplinary care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Diagnosis

Medical history and physical examination led the Paranasal Sinus Cancer Market in 2024 with about 38% share. This method remained the first diagnostic step due to its low cost, wide accessibility, and ability to identify early symptoms linked to nasal obstruction and facial swelling. Imaging tests such as CT and MRI grew steadily as providers relied on detailed anatomical views to assess tumor extent. Biopsy maintained vital use for confirmation, while other advanced diagnostic tools supported complex cases that required precise staging.

- For instance, Siemens Healthineers is a major manufacturer in the medical technology industry, known for its Somatom portfolio of CT scanners, including the NAEOTOM Alpha, which is the world’s first photon-counting CT system. As a large global corporation, it employs approximately 72,000 people worldwide (as of September 2024).

By Stage of Cancer

Advanced-stage cancer dominated the Paranasal Sinus Cancer Market in 2024 with nearly 52% share. Many patients presented late due to vague early symptoms, which increased the share of advanced-stage diagnosis. Treatment needs rose because larger tumors required multimodal care involving surgery, radiotherapy, and systemic therapy. Localized cases showed moderate growth as awareness programs improved early detection. Recurrent cases also contributed to market expansion due to long-term follow-up and repeat therapeutic interventions.

- For instance, Varian Medical Systems, now part of Siemens Healthineers, reported that orders for its TrueBeam radiotherapy platform reached 1,000 units by January 2015, 2,000 by February 2018, and 3,000 by August 2019.

By Treatment

Surgery held the largest share in 2024 with about 47% of the Paranasal Sinus Cancer Market. Surgeons preferred resection for localized and operable tumors because it offered strong control and improved survival in many patients. Radiotherapy followed as a key option for patients with advanced tumors or those unsuitable for surgery. Chemotherapy played a supporting role in combined treatment plans, helping manage aggressive or late-stage disease and expanding its use across multiple hospital settings.

Key Growth Drivers

Rising incidence and late-stage diagnosis

Growing cases of paranasal sinus cancer and frequent late-stage detection increased treatment demand. Many patients reached hospitals with advanced symptoms such as facial pressure or persistent nasal blockage, which raised the need for intensive care. Hospitals expanded diagnostic units to handle higher patient loads. This shift encouraged adoption of advanced imaging and biopsy tools along with multimodal therapies, driving steady market growth across major regions.

- For instance, Apollo Hospitals Group ordered 12 advanced medical linear accelerators and 5 brachytherapy systems for its Indian network in 2016 to expand capacity for treating rising cancer caseloads, including late-presenting head and neck tumors.

Advances in diagnostic imaging and pathology

Improved CT, MRI, and endoscopic tools enhanced tumor visualization and staging accuracy. Providers used high-resolution imaging to plan precise surgical approaches and evaluate treatment response. Modern pathology methods also strengthened molecular assessment, allowing specialists to tailor therapies based on tumor behavior. These upgrades supported early detection and reduced diagnostic errors. Better accuracy increased treatment success rates and boosted demand for comprehensive cancer care services.

- For instance, Philips reports having helped over 300 pathology customers implement digital pathology solutions in their laboratories since 2013, and specifically over 20 hospital pathology laboratories achieve fully digital operations since 2019.

Expansion of multidisciplinary cancer treatment centers

Integrated cancer centers offering surgery, radiotherapy, and chemotherapy in one setting strengthened patient access to complete care. Hospitals invested in skilled surgeons and modern radiotherapy platforms to manage complex head and neck cancers. Coordinated medical teams improved outcomes through shared decision-making and personalized treatment plans. This model reduced delays between diagnosis and therapy, improving overall survival and contributing to sustained market expansion.

Key Trends & Opportunities

Growth of minimally invasive surgical techniques

Endoscopic procedures gained wider use due to reduced recovery time, lower complication rates, and better cosmetic outcomes. Surgeons preferred these methods for localized tumors because they preserved surrounding structures while ensuring effective removal. Advancements in surgical navigation and high-definition optics improved accuracy during tumor excision. These benefits encouraged more hospitals to adopt such approaches, creating opportunities for companies offering endoscopic tools and navigation systems.

- For instance, Karl Storz reports offering around 10,000 different medical products, including rigid and flexible endoscopes widely used in endoscopic sinus and skull-base surgery for minimally invasive removal of paranasal lesions.

Rising adoption of precision oncology

Precision-based treatment grew as genetic profiling helped specialists identify tumor mutations linked to treatment response. Providers used targeted therapies and personalized radiotherapy planning to manage complex cases. This shift supported the use of biomarker-based selection for systemic therapies. The trend opened opportunities for diagnostic companies and oncology centers to expand molecular testing services and integrate advanced treatment platforms into routine practice.

- For instance, Illumina’s NovaSeq 6000 system can generate up to 20,000,000,000 single reads in one high-throughput run, enabling comprehensive genomic profiling that underpins targeted therapy selection in precision oncology.

Increasing investment in head and neck cancer research

Government bodies and private groups raised funding for clinical studies focused on rare cancers. Research programs explored new drug combinations, enhanced radiotherapy methods, and improved early detection tools. This investment encouraged collaboration between hospitals and academic institutions. The growing research focus created new commercial opportunities for therapy developers and diagnostic innovators targeting paranasal sinus cancer.

Key Challenges

Complex anatomy leading to surgical difficulty

Tumors growing near the eyes, brain, and major blood vessels increased surgical risks and required highly skilled teams. Surgeons faced challenges achieving full tumor removal without damaging vital structures. These limitations reduced the number of eligible candidates for complete resection. Hospitals needed advanced equipment and experienced staff to manage such cases, which raised treatment costs and limited access for patients in smaller centers.

Low awareness and delayed diagnosis

Early symptoms often resembled common sinus issues, leading many individuals to postpone medical evaluation. This delay caused higher advanced-stage presentations, reducing treatment success rates. Limited awareness among primary care providers also slowed referral to specialists. The pattern increased the need for complex treatment plans and added financial burdens on patients. Addressing this challenge required stronger awareness programs and improved screening practices.

Regional Analysis

North America

North America held about 41% share of the Paranasal Sinus Cancer Market in 2024, supported by strong diagnostic infrastructure and wide access to oncology specialists. Hospitals used advanced imaging tools and endoscopic systems, which improved early detection and surgical outcomes. High awareness among providers increased referrals to cancer centers for complex head and neck cases. Ongoing research programs and favorable reimbursement policies also encouraged adoption of multidisciplinary treatment. The region continued to grow as investments in radiotherapy upgrades and molecular testing expanded treatment precision across major healthcare networks.

Europe

Europe accounted for nearly 29% share of the Paranasal Sinus Cancer Market in 2024, driven by established cancer care systems and rising emphasis on precision diagnostics. Countries in Western Europe offered strong access to imaging, biopsy tools, and specialized oncology centers, improving patient evaluation and treatment planning. National healthcare programs supported early diagnosis initiatives to reduce late-stage presentation. Research collaboration between academic hospitals strengthened clinical trials for combined therapies. Growing awareness of minimally invasive surgery and wider use of endoscopic approaches also supported market expansion across the region.

Asia Pacific

Asia Pacific captured about 22% share of the Paranasal Sinus Cancer Market in 2024, with growth supported by rising patient cases and expanding hospital capacity. Many countries increased investments in oncology units and advanced imaging systems to manage higher cancer burdens. Urban centers improved access to endoscopic surgery and radiotherapy technology, while rural areas continued to face limited diagnostic reach. Growing training programs for head and neck surgeons and rising adoption of precision testing also boosted regional demand. Economic growth encouraged private hospitals to introduce modern treatment platforms.

Latin America

Latin America held around 5% share of the Paranasal Sinus Cancer Market in 2024, shaped by uneven healthcare access and rising focus on early detection. Major urban hospitals offered CT, MRI, and biopsy services, but smaller regions faced delays in diagnosis and specialist availability. Investments in cancer programs improved treatment capacity in countries such as Brazil and Mexico. Adoption of endoscopic surgery and radiotherapy upgrades increased gradually as hospitals modernized equipment. Public awareness campaigns supported earlier symptom reporting, helping reduce late-stage presentation across the region.

Middle East and Africa

The Middle East and Africa accounted for nearly 3% share of the Paranasal Sinus Cancer Market in 2024, with growth influenced by expanding oncology centers in Gulf countries. Advanced hospitals invested in surgical navigation systems and modern radiotherapy platforms to manage complex tumors. Many countries in Africa faced limited diagnostic capacity, resulting in late-stage detection and higher treatment needs. International partnerships and government initiatives improved training for specialists. Gradual adoption of imaging upgrades and increased patient referral to tertiary centers supported steady but slow market development.

Market Segmentations:

By Diagnosis

- Medical history and physical examination

- Imaging tests

- Biopsy

- Others

By Stage of Cancer

- Advanced

- Localized

- Recurrent

By Treatment

- Surgery

- Radiotherapy

- Chemotherapy

By End User

- Hospital & Clinics

- Cancer Treatment & Research Center

- Research Laboratories

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Paranasal Sinus Cancer Market is shaped by leading companies such as AstraZeneca plc (United Kingdom), Johnson & Johnson (United States), Novartis AG (Switzerland), Pfizer Inc. (United States), Sanofi S.A. (France), Merck & Co., Inc. (United States), Eli Lilly and Company (United States), Bristol Myers Squibb (United States), and F. Hoffmann-La Roche AG (Switzerland). Global manufacturers focused on expanding oncology portfolios through advanced immunotherapies, targeted drugs, and precision-based treatment solutions. Many firms strengthened their clinical pipelines by investing in trials related to rare head and neck cancers. Companies adopted strategies such as enhancing molecular diagnostic partnerships, improving radiotherapy platforms, and integrating support services across cancer care pathways. Rising emphasis on personalized medicine encouraged firms to refine biomarker-driven treatment models. Market leaders also expanded collaborations with research institutions to accelerate new therapy development and improve access to effective treatment options across developed and emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Johnson & Johnson, through its Janssen pharmaceutical company, presented positive results from the Phase 1b/2 OrigAMI-4 study at the ESMO Congress.

- In October 2024, Merck reported positive Phase 3 KEYNOTE-689 trial results for pembrolizumab as a perioperative treatment for resected locally advanced head and neck squamous cell carcinoma from the oropharynx, oral cavity, larynx, or hypopharynx.

- In 2023, Bristol Myers Squibb (BMS) collaborated with Paradigm to create a new clinical trial model aimed at improving patient access, accelerating trial completion, and easing the burden on healthcare providers.

Report Coverage

The research report offers an in-depth analysis based on Diagnosis, Stage of Cancer, Treatment, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as early detection programs expand across major regions.

- Hospitals will increase adoption of advanced imaging tools for precise tumor evaluation.

- Minimally invasive endoscopic surgery will gain wider use in specialized centers.

- Precision oncology will shape treatment planning through greater use of molecular testing.

- Integrated cancer care centers will strengthen multidisciplinary management of complex cases.

- Research investment will rise to develop improved radiotherapy and targeted therapy options.

- Awareness campaigns will help reduce late-stage diagnosis and improve treatment outcomes.

- Emerging markets will upgrade oncology infrastructure and expand access to skilled specialists.

- Digital tools such as AI-assisted diagnostics will support faster and more accurate evaluations.

- Collaborations between hospitals and research institutions will drive innovation in treatment pathways.