| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental X-ray Systems Market Size 2024 |

USD 2,323.87 million |

| Dental X-ray Systems Market, CAGR |

8.13% |

| Dental X-ray Systems Market Size 2032 |

USD 4,324.01 million |

Market Overview:

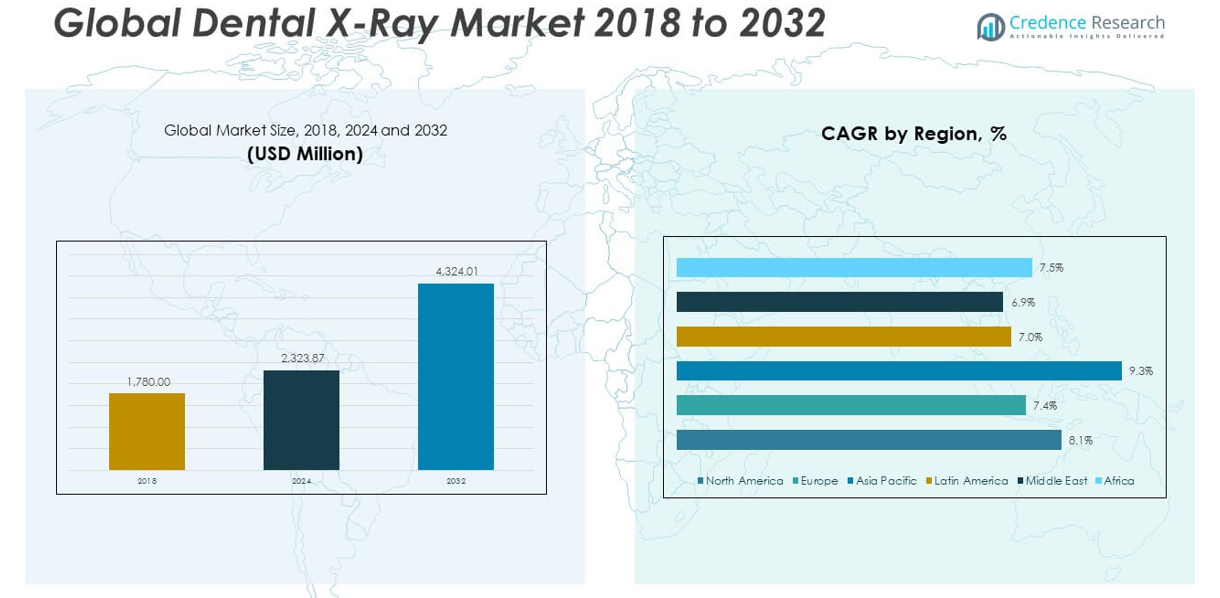

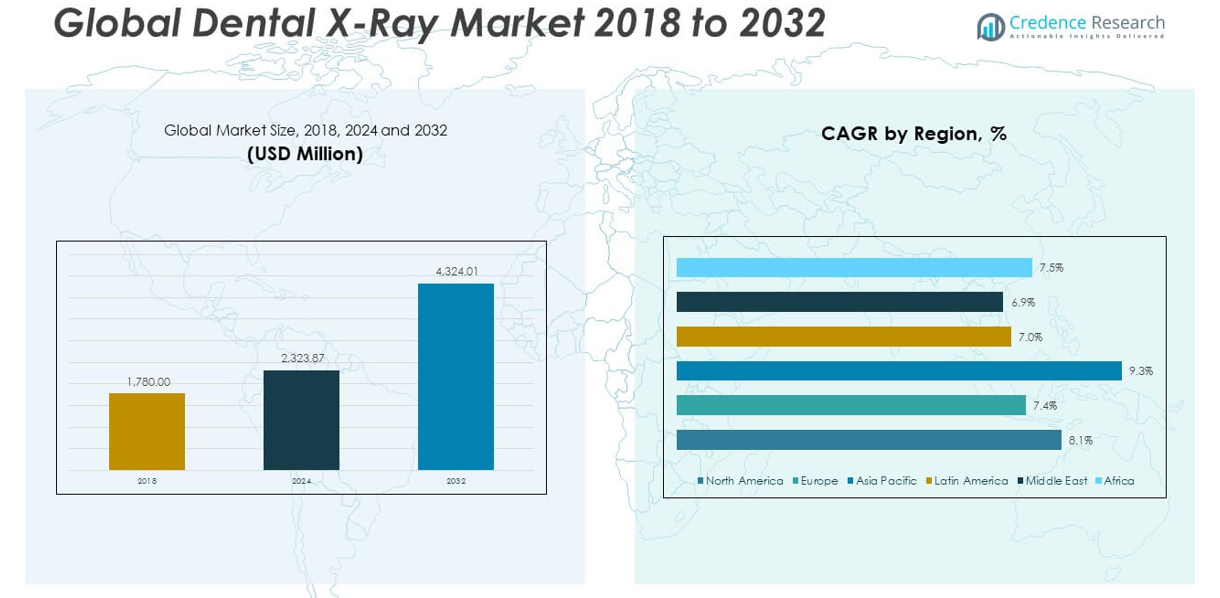

The Dental X-ray Systems Market size was valued at USD 1,780.00 million in 2018 to USD 2,323.87 million in 2024 and is anticipated to reach USD 4,324.01 million by 2032, at a CAGR of 8.13% during the forecast period.

The dental X-ray market is primarily driven by the increasing prevalence of oral health issues and the rising awareness of preventive dental care. Growing incidences of dental caries, periodontal diseases, and oral infections are compelling individuals to seek early diagnosis, thereby fueling the demand for dental imaging. Technological advancements have significantly enhanced the efficiency and accuracy of diagnostic tools, with digital X-rays and cone-beam computed tomography (CBCT) gaining traction among dental professionals. These innovations offer reduced radiation exposure, faster processing times, and improved image clarity, making them favorable for both practitioners and patients. Additionally, the surge in cosmetic dentistry and the aging global population further support the growing need for dental diagnostics. Government initiatives promoting oral health, improved insurance coverage, and expanding dental service accessibility also play a crucial role. Together, these factors create a favorable environment for the steady growth of the dental X-ray market across both developed and emerging economies.

North America dominates the dental X-ray market due to its well-established healthcare infrastructure, high adoption of advanced technologies, and favorable reimbursement policies. The region’s dental clinics and hospitals are well-equipped with state-of-the-art diagnostic tools, enabling faster integration of digital imaging systems. Europe follows closely, benefiting from strong government healthcare programs, increasing geriatric population, and a growing preference for minimally invasive dental procedures. The Asia-Pacific region is witnessing rapid growth, driven by urbanization, rising disposable incomes, and growing awareness of oral hygiene. Countries such as China, India, and South Korea are investing in healthcare infrastructure, which is boosting demand for modern dental equipment. Latin America and the Middle East & Africa are gradually emerging as potential markets due to improvements in healthcare access and increased private investments in dental services. Across all regions, the demand for accurate, efficient, and early-stage dental diagnostics is pushing the adoption of innovative X-ray technologies.

Market Insights:

- The Dental X-ray Market is projected to grow from USD 2,323.87 million in 2024 to USD 4,324.01 million by 2032, expanding at a CAGR of 8.13% due to rising dental disorders and increased preventive care awareness.

- Advancements in digital X-ray systems, including CBCT and intraoral imaging, are enhancing diagnostic speed, image precision, and workflow efficiency across dental practices.

- AI and machine learning are revolutionizing image analysis and patient data management, enabling faster clinical decisions and reducing manual errors in diagnostics.

- Portable and handheld dental X-ray devices are gaining popularity for their mobility, ease of use, and suitability in low-resource and remote environments.

- Integration of 3D printing with imaging data is enabling personalized dental restorations and implants, improving surgical accuracy and reducing patient wait times.

- High equipment costs and ongoing maintenance remain major hurdles for small clinics, limiting equitable access to modern diagnostic technology.

- North America leads the market with advanced infrastructure and adoption rates, while Asia Pacific shows the fastest growth driven by urbanization, healthcare investments, and growing oral health awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Use of AI and Machine Learning in Dental Imaging Interpretation and Workflow Enhancement

Artificial intelligence (AI) and machine learning are transforming diagnostic accuracy and workflow efficiency in dental radiology. These technologies enable real-time detection of cavities, bone loss, and abnormalities through automated image analysis. AI algorithms can highlight areas of concern on X-rays, helping dentists make quicker and more informed decisions. It also streamlines administrative functions, such as patient data management and image archiving, improving operational productivity. Integration with practice management software is expanding, allowing seamless connectivity between diagnostic tools and electronic health records. The Dental X-ray Market is seeing rising investments in AI-powered solutions that support clinical efficiency, reduce manual errors, and enhance patient care delivery.

Transition Toward Portable and Handheld X-ray Devices for Increased Accessibility and Efficiency

The demand for compact, mobile imaging devices is rising due to the need for point-of-care diagnostics in both urban and remote settings. Portable and handheld X-ray units are gaining popularity in dental camps, mobile clinics, and home-based care environments. These devices reduce patient movement and allow practitioners to perform quick scans without complex setups. It supports time-sensitive procedures and improves accessibility in low-resource settings. The growing adoption of wireless technology and battery-operated systems further fuels the use of mobile units. It also supports the shift toward decentralized care models, where diagnostic capabilities are available beyond conventional dental offices.

- For example, Planmeca’s ProX™ GO handheld intraoral X-ray devicefeatures a 3 mm focal spot, 70 kV/3 mA tube, and integrated radiation shielding, optimizing image quality and operator safety for mobile dental clinics and emergency use.

Integration of 3D Printing with X-ray Imaging Data for Precision Dental Restoration and Implants

The convergence of 3D printing and dental X-ray imaging is creating new pathways for customized dental solutions. High-resolution digital X-ray data feeds directly into 3D modeling software to design precise restorations, crowns, and surgical guides. It enhances the accuracy of dental prosthetics and reduces the margin for error during implant placement. This integration improves case planning and patient-specific treatment, especially in complex oral surgeries. The Dental X-ray Market benefits from the synergy between advanced imaging and additive manufacturing, allowing clinics to offer same-day solutions. It also strengthens the role of digital dentistry in reducing chair time and improving patient satisfaction.

- For implantology, CBCT (cone-beam computed tomography)provides 3D images with high resolution and precision for example, Vatech’s Green X system offers an endo mode with a 50-micron voxel size and multi-field-of-view (FOV) selection for detailed anatomical assessment and surgical guide fabrication.

Increasing Preference for Eco-Friendly and Sustainable Imaging Systems to Reduce Environmental Impact

Environmental sustainability is gaining importance in equipment selection and procurement within dental practices. Dentists and clinics are shifting toward digital X-ray systems that eliminate the need for chemical film processing. This move reduces hazardous waste, lowers energy consumption, and supports regulatory compliance. Manufacturers are designing systems with recyclable components, low radiation emission, and energy-efficient features. The market is witnessing a gradual decline in analog equipment purchases due to their environmental burden. It reflects a broader industry trend favoring green practices and sustainable healthcare technologies, driving the transition to eco-conscious solutions in diagnostic imaging.

Market Trends:

Rising Integration of Cloud-Based Imaging Platforms to Streamline Data Access and Collaboration

Dental practices are increasingly adopting cloud-based imaging platforms to manage and store diagnostic data. These platforms enable real-time access to patient radiographs across multiple locations, improving communication between dental professionals and specialists. It supports collaborative treatment planning and second-opinion consultations without physical data transfer. Cloud systems offer enhanced data security, automatic backups, and compliance with healthcare regulations. The shift to cloud storage reduces the need for on-site servers and lowers maintenance costs. The Dental X-ray Market is witnessing steady investment in cloud-enabled solutions to modernize imaging workflows and improve operational flexibility.

- For example, SOTA Cloudprovides true in-browser imaging, supporting integration with over 20 practice management systems and compatibility with all major sensors and cameras, allowing practices to convert and access existing imaging data without hardware barriers.

Growing Popularity of Teledentistry Boosts Remote Diagnostic Capabilities

The rise of teledentistry is transforming how patients receive preliminary consultations and follow-up care. Digital dental X-rays can now be captured in local clinics or through portable systems and reviewed remotely by specialists. It bridges the gap between underserved areas and professional expertise, enabling earlier detection of oral conditions. The integration of digital imaging into telehealth platforms is becoming more seamless, supported by secure data transmission protocols. Dentists are leveraging these tools to reduce in-office visits while maintaining care quality. The trend reflects the evolving landscape of dental care delivery and strengthens the position of imaging technologies in virtual care models.

Emergence of Hybrid Imaging Systems for Multifunctional Diagnostic Use

Hybrid imaging systems that combine intraoral, panoramic, and cone-beam CT capabilities are gaining traction in modern dental clinics. These multifunctional devices reduce the need for separate machines, saving space and cost while delivering comprehensive diagnostic coverage. It allows clinicians to switch between modes without repositioning the patient, increasing workflow efficiency. Hybrid systems support various dental applications including orthodontics, implant planning, and endodontic evaluation. Their ability to provide layered and contextual imaging strengthens clinical decision-making. The Dental X-ray Market is evolving with the demand for such integrated platforms that enhance patient throughput and diagnostic accuracy.

Advancements in Sensor Technology Drive Improved Image Quality and Lower Radiation Dose

Sensor innovation continues to shape the future of digital dental imaging. New-generation sensors offer higher resolution, faster processing, and improved sensitivity, enabling clearer images with minimal exposure. These advancements support precise diagnosis while adhering to safety standards and radiation guidelines. Manufacturers are focusing on ergonomic designs that enhance patient comfort and adaptability across age groups. It fosters better compliance during procedures and reduces retake rates. As dental clinics upgrade from legacy systems, the preference for advanced sensor-equipped devices is accelerating, reinforcing their value in improving diagnostic reliability across diverse clinical scenarios.

- Overjet’s FDA-cleared platform, for instance, analyzes over 500 million X-rays annually and is trusted by more than 50,000 clinicians across 50+ leading DSOs, demonstrating both scale and clinical impact.

Market Challenges Analysis:

High Capital Investment and Maintenance Costs Limit Accessibility for Smaller Clinics

The significant upfront cost of digital dental X-ray equipment presents a major barrier for small and mid-sized dental practices. Advanced systems such as cone-beam computed tomography (CBCT) and hybrid imaging units require substantial financial investment, often beyond the reach of independent practitioners. It becomes challenging for these clinics to stay competitive without access to the latest diagnostic technologies. Maintenance expenses, periodic calibration, and the need for specialized technicians further increase operational costs. Many clinics struggle to justify these expenditures without guaranteed returns, especially in regions with low insurance coverage or out-of-pocket patient payments. The Dental X-ray Market continues to see a disparity in technology adoption between large institutional settings and smaller private practices.

Complex Regulatory Approvals and Data Compliance Hinder Technology Deployment

Dental X-ray systems must comply with stringent regulations concerning radiation safety, equipment calibration, and patient data protection. Navigating these complex frameworks often delays product approvals and market entry for manufacturers. It also imposes added responsibilities on dental providers to ensure compliance with local and international guidelines. Evolving data protection laws, such as GDPR and HIPAA, place further emphasis on secure data storage and transmission in digital imaging workflows. Clinics adopting cloud-based or AI-driven systems must implement strict cybersecurity protocols, which can be technically and financially demanding. Regulatory variations across countries complicate global expansion strategies, slowing the adoption of newer technologies in certain regions.

Market Opportunities:

Expansion of Dental Infrastructure in Emerging Economies Presents Growth Potential

Rapid improvements in dental infrastructure across emerging economies create a strong foundation for market expansion. Government healthcare reforms, increased public funding, and private investments are accelerating the development of dental clinics and training centers. It opens new avenues for manufacturers to introduce cost-effective digital X-ray solutions tailored to local needs. Rising disposable incomes and awareness of oral health are encouraging more people to seek preventive dental care. The Dental X-ray Market stands to benefit from this shift, with local demand driving adoption of portable and easy-to-use diagnostic devices. Expansion into Tier 2 and Tier 3 cities offers untapped growth potential for industry players.

Growing Demand for Cosmetic Dentistry Drives Adoption of Advanced Imaging

The increasing global interest in cosmetic dental procedures fuels demand for precision imaging tools. Patients undergoing veneers, orthodontic treatments, or implants require detailed pre-treatment planning supported by high-resolution radiographs. It encourages dental professionals to upgrade to advanced systems like cone-beam CT and panoramic digital units. The trend also drives interest in 3D imaging that enhances visualization and treatment outcomes. The Dental X-ray Market can leverage this demand by offering integrated, user-friendly technologies that improve clinical accuracy and patient satisfaction. Expanding service offerings to include aesthetic procedures boosts equipment utilization rates and long-term revenue opportunities.

Market Segmentation Analysis:

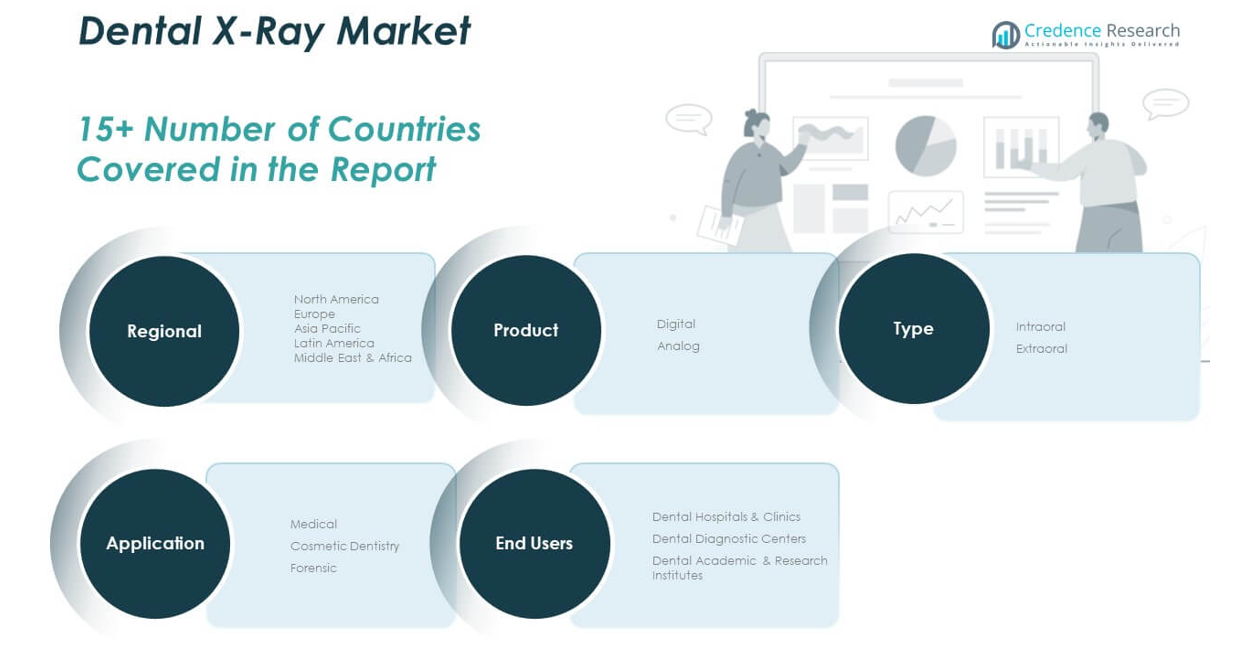

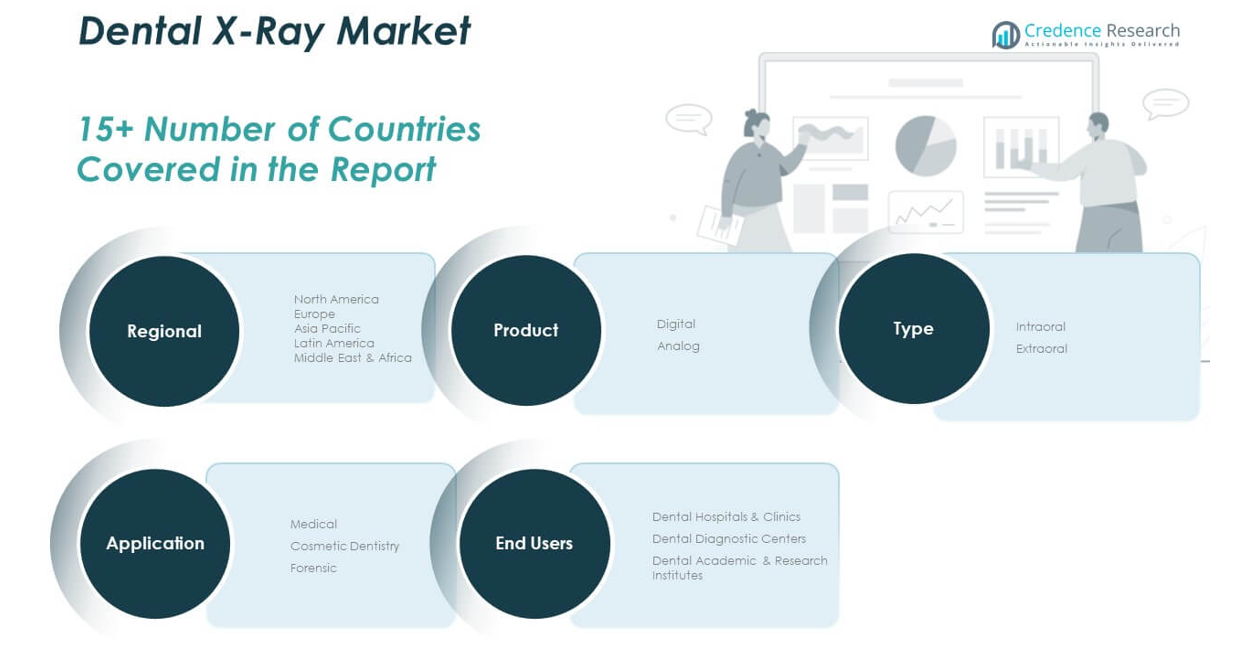

The Dental X-ray Market is segmented by product, type, application, and end-user, each playing a vital role in shaping demand and innovation.

By product, the market is dominated by digital systems due to their superior image quality, lower radiation exposure, and integration with electronic health records. Analog systems still exist in some cost-sensitive regions but are steadily declining in adoption.

- For example, Planmeca ProMax® 3D Classicis a leading digital dental X-ray system renowned for its superior image quality and integration capabilities. The ProMax® 3D Classic offers a maximum resolution of 96 μm, supports DICOM connectivity for seamless integration with electronic health records (EHR), and features ultra-low dose imaging that reduces patient radiation exposure by up to 77% compared to conventional digital imaging.

By type, intraoral X-rays hold the largest share due to their routine use in detecting cavities, monitoring dental health, and evaluating restorative treatments. Extraoral X-rays, including panoramic and cone-beam CT systems, are gaining traction for surgical planning and orthodontic assessments.

- For example, DEXIS Platinum Intraoral Sensoris one of the most widely adopted intraoral digital X-ray solutions. According to DEXIS, the sensor delivers 7 million shades of gray (14-bit ADC) and a theoretical resolution of 27 lp/mm, enabling precise detection of caries, bone loss, and assessment of restorative treatments.

By application, the medical segment leads, driven by the rising prevalence of oral diseases and the need for early detection. Cosmetic dentistry is expanding rapidly, supported by growing demand for aesthetic procedures that require precise imaging. Forensic applications remain niche but essential in legal and investigative domains.

By end-user, dental hospitals and clinics form the largest customer base due to their high patient volume and frequent imaging needs. Dental diagnostic centers are growing steadily, offering specialized radiographic services, while academic and research institutes contribute to innovation and clinical validation of emerging technologies.

Segmentation:

By Product

By Type

By Application

- Medical

- Cosmetic Dentistry

- Forensic

By End-User

- Dental Hospitals & Clinics

- Dental Diagnostic Centers

- Dental Academic & Research Institutes

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Dental X-ray Market size was valued at USD 689.75 million in 2018 to USD 890.26 million in 2024 and is anticipated to reach USD 1,651.30 million by 2032, at a CAGR of 8.1% during the forecast period. North America holds the largest share in the global dental X-ray market, accounting for nearly 32% of the overall revenue. It benefits from a highly developed healthcare infrastructure, widespread insurance coverage, and high patient awareness regarding oral hygiene. The region has seen early adoption of digital radiography, with a strong shift toward cone-beam computed tomography and AI-powered diagnostic tools. Dental professionals in the U.S. and Canada are increasingly investing in advanced imaging technologies to improve treatment outcomes and workflow efficiency. Favorable reimbursement policies and regulatory clarity also support faster integration of modern imaging systems. The Dental X-ray Market in North America is expected to maintain its leadership through continued innovation and upgrade cycles.

Europe

The Europe Dental X-ray Market size was valued at USD 457.46 million in 2018 to USD 573.47 million in 2024 and is anticipated to reach USD 1,006.43 million by 2032, at a CAGR of 7.4% during the forecast period. Europe contributes approximately 21% of the global dental X-ray market share, driven by a strong focus on preventive care and dental education. Public healthcare programs across countries like Germany, France, and the UK promote regular dental screenings supported by advanced diagnostic tools. The adoption of digital imaging and 3D radiography is steadily increasing across both public and private clinics. Rising demand for cosmetic dentistry and orthodontic services is creating new opportunities for equipment upgrades. Regulatory frameworks in Europe emphasize patient safety and image quality, encouraging investment in low-radiation systems. The Dental X-ray Market in Europe remains competitive and technology-driven, with a strong emphasis on efficiency and compliance.

Asia Pacific

The Asia Pacific Dental X-ray Market size was valued at USD 421.86 million in 2018 to USD 575.96 million in 2024 and is anticipated to reach USD 1,175.75 million by 2032, at a CAGR of 9.3% during the forecast period. Asia Pacific holds nearly 24% of the global dental X-ray market and is the fastest-growing regional segment. Urbanization, growing disposable income, and rising awareness of dental care are fueling rapid adoption of digital imaging solutions in countries like China, India, and South Korea. Governments are expanding healthcare access through infrastructure development and public health initiatives. Local clinics are increasingly investing in cost-effective and portable diagnostic equipment to cater to growing patient volumes. Dental tourism hubs such as Thailand and Malaysia further contribute to imaging equipment demand. The Dental X-ray Market in Asia Pacific is set to expand aggressively with strong manufacturer interest and strategic partnerships.

Latin America

The Latin America Dental X-ray Market size was valued at USD 102.35 million in 2018 to USD 132.20 million in 2024 and is anticipated to reach USD 226.45 million by 2032, at a CAGR of 7.0% during the forecast period. Latin America accounts for roughly 5% of the global dental X-ray market share, with steady demand supported by improvements in private dental services. Brazil and Mexico are leading markets due to their expanding middle-class populations and investments in dental tourism. Clinics are shifting from analog to digital imaging to reduce operating costs and improve diagnostic speed. While access to advanced technologies remains limited in rural regions, urban centers are adopting panoramic and intraoral imaging systems. Educational initiatives and professional training programs are also supporting market growth. The Dental X-ray Market in Latin America presents moderate growth opportunities with room for broader technology penetration.

Middle East

The Middle East Dental X-ray Market size was valued at USD 72.98 million in 2018 to USD 89.69 million in 2024 and is anticipated to reach USD 151.80 million by 2032, at a CAGR of 6.9% during the forecast period. The Middle East holds a 3% share of the global dental X-ray market, with growth centered around urban health facilities and specialty dental clinics. Wealthy populations in the UAE and Saudi Arabia are driving demand for high-end imaging equipment, including CBCT and 3D panoramic systems. Governments are investing in digital healthcare transformation, which includes upgrading diagnostic capabilities. Clinics in major cities are adopting cloud-connected devices to improve workflow and patient records management. Access to affordable equipment remains a challenge in less developed areas of the region. The Dental X-ray Market in the Middle East is advancing gradually through public-private healthcare partnerships.

Africa

The Africa Dental X-ray Market size was valued at USD 35.60 million in 2018 to USD 62.29 million in 2024 and is anticipated to reach USD 112.30 million by 2032, at a CAGR of 7.5% during the forecast period. Africa represents nearly 2% of the global dental X-ray market share, but its growth potential is gaining attention. Rising demand for accessible oral healthcare and increasing dental disease burden are prompting the need for basic diagnostic infrastructure. Several countries are receiving international aid and support from NGOs to improve dental care delivery. Portable and battery-operated imaging devices are becoming viable solutions for rural and remote settings. Private clinics in urban regions are slowly integrating digital X-ray systems to improve care standards. The Dental X-ray Market in Africa remains nascent but is poised for expansion with the right investments and training initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Planmeca OY

- Dentsply Sirona

- Danaher Corporation

- Institute Straumann

- Zimmer Biomet Holdings

- 3M Company

- Align Technology Inc.

- A-Dec

- Biolase Inc.

Competitive Analysis:

The Dental X-ray Market features a competitive landscape led by global players focused on innovation, product differentiation, and strategic partnerships. Companies such as Dentsply Sirona, Planmeca Oy, Carestream Dental, Vatech Co., Ltd., and Envista Holdings dominate the market through extensive product portfolios and strong distribution networks. It continues to evolve with advancements in digital imaging, artificial intelligence, and 3D technology integration. Key players invest in R&D to enhance image clarity, reduce radiation exposure, and streamline workflows. Emerging companies are gaining traction by offering cost-effective and portable solutions tailored for small and mid-sized dental practices. Strategic mergers, acquisitions, and regional expansions play a crucial role in strengthening market position and global footprint. It remains highly dynamic, with ongoing efforts to align product innovation with evolving clinical needs, regulatory standards, and digital transformation trends. Competitive intensity is expected to increase as more companies enter the space with advanced, cloud-based, and AI-supported diagnostic systems.

Recent Developments:

- In April 2025, Planmeca Oyintroduced its first handheld intraoral X-ray device, the Planmeca ProX™ GO, at the International Dental Show (IDS) in Cologne. This new device is designed for both stationary and mobile dental environments, offering high image quality, ease of use, and portability. With a lightweight build and long battery life, it is particularly suited for clinics with limited space or mobile dental services. The sales launch is planned to begin in the U.S. market following its debut.

- In March 2025, Dentsply Sironashowcased its advancements in digital and connected dentistry at IDS 2025. The company highlighted the integration of cloud-based and AI-powered tools through its DS Core platform, which centralizes imaging, diagnostics, and treatment planning. New products and features include enhanced 3D imaging solutions like Orthophos SL and Axeos, the cloud-native Primescan 2 intraoral scanner, and DS Core Diagnose, a cloud-based diagnostic viewer.

Market Concentration & Characteristics:

The Dental X-ray Market is moderately concentrated, with a few dominant players holding a significant share while several regional and niche companies compete for specific segments. It features strong brand loyalty, driven by product reliability, technical support, and integration capabilities. The market emphasizes innovation, with digital imaging, AI-based diagnostics, and cloud compatibility shaping purchasing decisions. High entry barriers exist due to regulatory compliance, capital requirements, and the need for specialized technology. Buyers in this market prioritize image quality, radiation safety, and interoperability with existing dental systems. It exhibits a strong demand for customization across various clinical applications, ranging from routine check-ups to complex surgical planning. Market characteristics include long product lifecycles, periodic upgrade cycles, and a growing preference for multifunctional imaging platforms.

Report Coverage:

The research report offers an in-depth analysis based on product, type, application, and end-user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- AI integration will enhance diagnostic accuracy and streamline dental imaging workflows.

- Demand for portable and handheld X-ray devices will increase in remote and mobile care settings.

- Cloud-based platforms will drive real-time image sharing and multi-location collaboration.

- Cosmetic dentistry growth will boost the adoption of advanced 3D imaging systems.

- Sensor innovations will reduce radiation exposure while improving image resolution.

- Expansion of dental infrastructure in emerging markets will create new sales channels.

- Hybrid imaging systems will gain popularity for their multifunctional diagnostic capabilities.

- Regulatory focus on data privacy and safety will shape product design and compliance.

- Teledentistry adoption will support remote diagnostics using integrated imaging tools.

- Sustainability efforts will lead to wider use of eco-friendly digital imaging solutions.