Market Overview

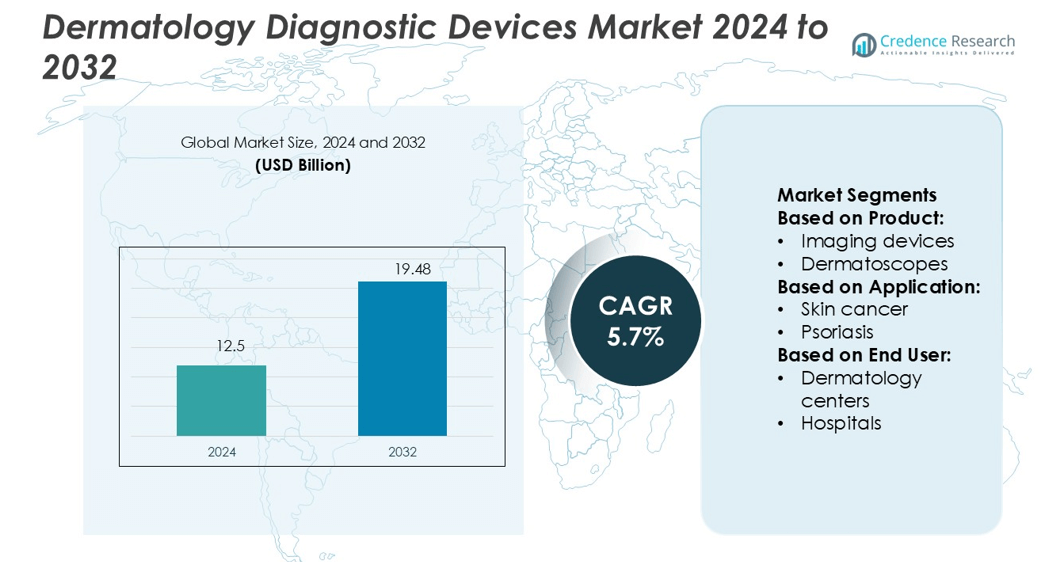

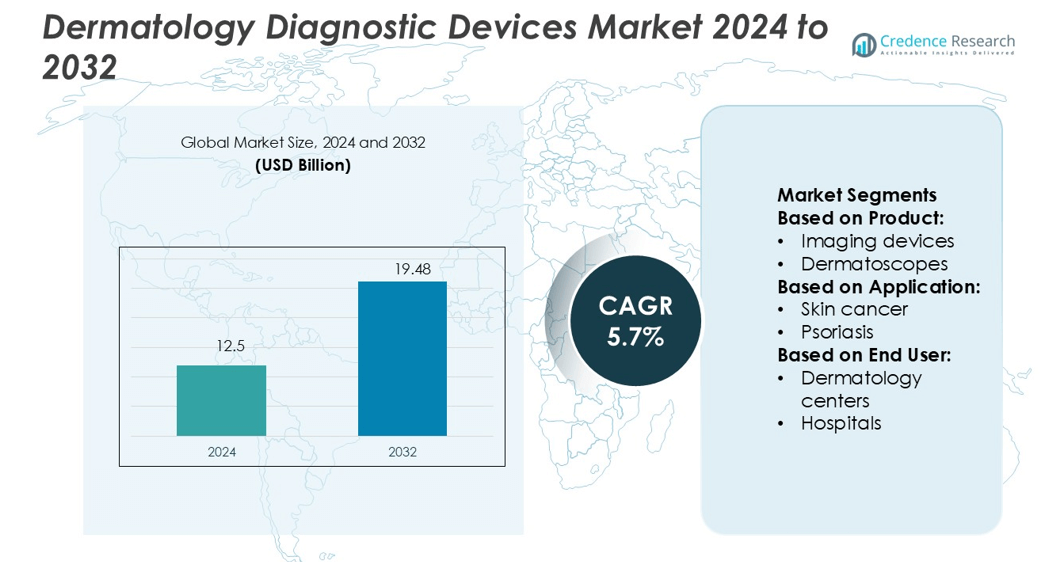

Dermatology Diagnostic Devices Market size was valued USD 12.5 billion in 2024 and is anticipated to reach USD 19.48 billion by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dermatology Diagnostic Devices Market Size 2024 |

USD 12.5 billion |

| Dermatology Diagnostic Devices Market, CAGR |

5.7% |

| Dermatology Diagnostic Devices Market Size 2032 |

USD 19.48 billion |

The dermatology diagnostic devices market is shaped by major players including DermoScan GmbH, Caliber I.D Inc, ILLUCO Corporation Ltd, Abbott Diagnostics, STRATA Skin Sciences (MELA Sciences, Inc), Michelson Diagnostics Limited, Nikon Corporation, BOMTECH ELECTRONICS CO, Canfield Imaging Systems, and Carl Zeiss Meditec AG. These companies lead through product innovation, AI integration, and strategic collaborations that enhance diagnostic precision and accessibility. North America dominates the global market with a 34% share, supported by advanced healthcare infrastructure, high adoption of imaging technologies, and strong reimbursement frameworks. The region’s emphasis on early disease detection and widespread teledermatology adoption further strengthens its leadership position, attracting continuous investment and accelerating technological advancements in dermatology diagnostics.

Market Insights

- The dermatology diagnostic devices market size was valued at USD 12.5 billion in 2024 and is projected to reach USD 19.48 billion by 2032, growing at a CAGR of 5.7%.

- Rising skin disease prevalence, growing patient awareness, and demand for non-invasive diagnostics are driving market expansion globally.

- AI integration and advanced imaging technologies are shaping market trends, improving accuracy and supporting early detection across multiple applications.

- High equipment cost and shortage of trained dermatologists remain key restraints, particularly in developing regions with limited infrastructure.

- North America leads with a 34% market share, supported by advanced healthcare systems and strong teledermatology adoption, while imaging devices hold the dominant segment share due to their precision and growing clinical use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Imaging devices dominate the dermatology diagnostic devices market with the largest share. High-resolution imaging systems allow early detection and accurate assessment of skin conditions. Their ability to deliver non-invasive, detailed visualization of lesions drives demand in hospitals and specialty clinics. Growing adoption of AI-powered imaging systems further enhances diagnostic accuracy and workflow efficiency. Continuous product innovations, such as multispectral and 3D imaging solutions, support better clinical outcomes and boost market penetration. Dermatoscopes and microscopes also show steady growth due to their rising use in routine skin examinations.

- For instance, DermoScan GmbH’s DermoGenius Ultra imaging system uses a 5-megapixel camera and offers AI-assisted lesion analysis via optional software (e.g., MoleExpertMicro). The system integrates with software that supports automated follow-up tracking by comparing images over time.

By Application

Skin cancer accounts for the largest share in the application segment, supported by rising melanoma and non-melanoma cases globally. Dermatology centers and hospitals increasingly use advanced imaging and dermatoscopic tools for early detection and treatment planning. The demand is further driven by public health initiatives and awareness campaigns promoting regular skin checks. High sensitivity and specificity of modern devices help dermatologists detect even early-stage lesions. Other applications such as psoriasis, acne, and hair disorders are expanding as diagnostic technologies become more accessible and affordable.

- For instance, Caliber’s VivaScope 1500 system can image a mapped field of 8 × 8 mm with single-frame fields of view of 500 µm × 500 µm, outputting 1024 × 1024 pixel images, with a lateral optical resolution < 1.25 µm and vertical optical resolution < 5.0 µm.

By End User

Hospitals lead the market among end users due to their advanced diagnostic infrastructure and access to skilled dermatologists. These facilities invest in imaging systems, dermatoscopes, and integrated diagnostic platforms to offer comprehensive skin care services. Increasing patient inflow for skin cancer screening and complex dermatological procedures strengthens their position. Dermatology centers follow closely, focusing on specialized diagnostics and targeted therapies. Clinics and other settings are witnessing growing adoption as compact and portable devices make advanced diagnostics feasible in smaller practices and remote locations.

Key Growth Drivers

Rising Prevalence of Skin Disorders

The increasing global incidence of skin cancer, psoriasis, acne, and dermatitis is driving demand for dermatology diagnostic devices. Early detection has become a priority, leading to higher adoption of imaging and dermatoscopic systems in clinical settings. Advanced diagnostic solutions enable faster, more accurate assessments, improving patient outcomes. Expanding healthcare coverage and screening programs further support market growth. Hospitals and dermatology centers are upgrading diagnostic infrastructure to address the rising patient pool, especially in urban areas with higher pollution and UV exposure risks.

- For instance, ILLUCO’s dermatoscope portfolio—such as IDS-1100—delivers 10× optical magnification via a 25 mm lens, backed by 32 white LEDs and cross + parallel polarization modes.

Technological Advancements in Imaging and AI Integration

Continuous innovation in imaging technologies and artificial intelligence is transforming dermatological diagnostics. High-resolution imaging, multispectral analysis, and AI-driven lesion detection enable more precise and early diagnosis. These tools reduce human error and enhance clinical efficiency. Integration of AI in dermatoscopes and imaging platforms supports automated risk assessment and better treatment planning. The adoption of smart diagnostic devices in hospitals and clinics is expanding, driven by their accuracy, speed, and ability to support remote consultations and teledermatology.

- For instance, Abbott claims its diagnostic platforms (over 10,000 systems globally) collect more than 1 billion anonymized test results per year into a central database to refine algorithms and support predictive decisioning.

Growing Demand for Non-Invasive Diagnostic Procedures

Patients and healthcare providers increasingly prefer non-invasive diagnostic tools that offer comfort and faster results. Devices such as dermatoscopes and advanced imaging systems enable real-time visualization without surgical intervention. This reduces patient discomfort and improves the efficiency of dermatological assessments. Non-invasive diagnostics also lower risks of infection and support routine screening programs. Their rising use in outpatient settings and dermatology centers accelerates market penetration, particularly in early-stage skin cancer detection and chronic disease monitoring.

Key Trends & Opportunities

Expansion of Teledermatology and Remote Diagnostics

Teledermatology is gaining traction as healthcare systems adopt digital tools to improve accessibility. Portable imaging devices and connected dermatoscopes support virtual consultations, enabling early diagnosis in remote areas. AI-powered diagnostic platforms allow dermatologists to analyze images in real time and provide faster assessments. This trend enhances patient reach and supports preventive care programs. Growing broadband penetration and digital health investments further accelerate the integration of remote diagnostics into mainstream dermatology practices.

- For instance, STRATA’s legacy system MelaFind used 3D multispectral imaging to noninvasively capture data to depths of 2.5 mm beneath the skin surface, applying proprietary algorithms to assess structural disorganization in pigmented lesions.

Integration of AI and Machine Learning in Clinical Workflows

AI and machine learning are increasingly embedded into dermatology diagnostics, enabling automated lesion detection, classification, and risk scoring. These technologies reduce workload, improve diagnostic accuracy, and support personalized treatment plans. Hospitals and clinics benefit from faster decision-making and standardized diagnostic processes. Regulatory approvals for AI-based solutions are expanding, encouraging wider adoption. As AI tools continue to advance, they create strong opportunities for manufacturers to introduce innovative, clinically validated diagnostic systems.

- For instance, Michelson’s VivoSight Dx OCT platform operates at 1305 nm wavelength with a swept-source frequency-domain architecture. It achieves 7.5 µm lateral and 5 µm axial optical resolution, imaging a 6 mm × 6 mm skin patch to depths > 1 mm, producing up to 500 cross-sectional (B-scan) frames per scan.

Rising Investments in R&D and Product Innovation

Leading device manufacturers are increasing R&D investments to develop next-generation dermatology diagnostic solutions. Innovations focus on high-resolution imaging, compact designs, and integrated cloud platforms for real-time data sharing. Companies are introducing AI-enabled dermatoscopes and advanced digital platforms to support early detection of skin conditions. These developments open new opportunities in developed and emerging markets. The growing emphasis on cost-efficient, user-friendly solutions enhances market competitiveness and drives adoption across hospitals, clinics, and dermatology centers.

Key Challenges

High Cost of Advanced Diagnostic Devices

The high upfront cost of advanced dermatology diagnostic systems remains a major barrier to widespread adoption. Many hospitals and smaller clinics face budget constraints, limiting their ability to invest in AI-integrated imaging platforms. Maintenance and software upgrade expenses add to the overall cost burden. This challenge is more pronounced in low- and middle-income countries where healthcare funding is limited. As a result, market penetration of advanced systems slows down, restricting access to early diagnosis and advanced screening programs.

Shortage of Trained Dermatology Professionals

A limited number of trained dermatologists and skilled technicians creates operational challenges for diagnostic device deployment. Accurate interpretation of imaging and dermatoscopic results requires specialized expertise, which is often scarce in rural and underserved areas. This shortage delays patient diagnosis and reduces the effectiveness of advanced technologies. Although AI tools can support decision-making, human expertise remains essential for final clinical assessment. Bridging this skill gap through training and education programs is critical for sustained market expansion.

Regional Analysis

North America

North America holds 34% share of the dermatology diagnostic devices market, driven by advanced healthcare infrastructure and high disease awareness. The U.S. leads regional growth due to widespread use of imaging systems and AI-powered diagnostic tools. Rising cases of skin cancer and supportive insurance coverage boost device adoption in hospitals and dermatology centers. Continuous product launches and FDA approvals accelerate technological integration in clinical workflows. The strong presence of key market players, extensive screening programs, and well-established teledermatology services further strengthen North America’s leading position in global market expansion.

Europe

Europe accounts for 28% share of the dermatology diagnostic devices market, supported by robust healthcare systems and increasing investment in early disease detection. Germany, France, and the UK are leading contributors due to high skin cancer incidence and strong adoption of AI-integrated imaging technologies. Government initiatives to promote preventive healthcare enhance screening coverage. Dermatology centers and hospitals invest heavily in digital dermatoscopy and imaging solutions. Technological innovation, aging populations, and favorable reimbursement policies sustain regional market growth, while regulatory frameworks ensure strong product quality standards and patient safety.

Asia Pacific

Asia Pacific holds 23% share of the dermatology diagnostic devices market and shows the fastest growth. Rising disposable income, expanding healthcare infrastructure, and increasing awareness of skin health drive adoption. China, Japan, and India lead the region with growing demand for non-invasive diagnostic tools. Urbanization and rising UV exposure contribute to higher incidence of skin disorders, supporting device uptake in hospitals and clinics. Government screening programs and telehealth expansion increase accessibility. Local manufacturing initiatives and international partnerships help bridge technology gaps, further strengthening the region’s position in the global market.

Latin America

Latin America represents 9% share of the dermatology diagnostic devices market, driven by improving healthcare systems and growing disease awareness. Brazil and Mexico are key contributors, supported by urbanization and increasing investments in diagnostic infrastructure. Rising incidence of skin conditions due to sun exposure and lifestyle factors fuels demand for dermatoscopes and imaging devices. The expansion of private healthcare and teledermatology services enhances accessibility. However, uneven healthcare access and limited specialist availability in rural areas remain constraints, slowing adoption compared to developed markets.

Middle East & Africa

The Middle East & Africa hold 6% share of the dermatology diagnostic devices market, supported by rising healthcare investments and expanding private clinic networks. Gulf countries lead with growing adoption of advanced diagnostic technologies in urban centers. Increasing prevalence of dermatological conditions due to climatic factors and lifestyle changes drives demand. Governments are investing in early detection programs to improve patient outcomes. However, limited specialist availability and high equipment costs restrict widespread access in parts of Africa. Ongoing partnerships with global manufacturers are expected to strengthen market presence across the region.

Market Segmentations:

By Product:

- Imaging devices

- Dermatoscopes

By Application:

By End User:

- Dermatology centers

- Hospitals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the dermatology diagnostic devices market features key players such as DermoScan GmbH, Caliber I.D Inc, ILLUCO Corporation Ltd, Abbott Diagnostics, STRATA Skin Sciences (MELA Sciences, Inc), Michelson Diagnostics Limited, Nikon Corporation, BOMTECH ELECTRONICS CO, Canfield Imaging Systems, and Carl Zeiss Meditec AG. The dermatology diagnostic devices market is characterized by rapid technological innovation, strong R&D investment, and strategic partnerships. Companies are focusing on enhancing diagnostic accuracy through advanced imaging, AI integration, and portable device development. Many players are expanding their global presence through mergers, acquisitions, and collaborations with healthcare providers. Regulatory approvals and product launches support market penetration, particularly in developed regions with established healthcare systems. Competitive strategies also emphasize cost efficiency, ease of use, and clinical reliability to appeal to hospitals, dermatology centers, and clinics. This intense competition is accelerating technological advancement and driving market growth worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DermoScan GmbH

- Caliber I.D Inc

- ILLUCO Corporation Ltd

- Abbott Diagnostics

- STRATA Skin Sciences (MELA Sciences, Inc)

- Michelson Diagnostics Limited

- Nikon Corporation

- BOMTECH ELECTRONICS CO

- Canfield Imaging Systems

- Carl Zeiss Meditec AG

Recent Developments

- In July 2025, Boehringer Ingelheim and LEO Pharma entered an exclusive global agreement to commercialize and further develop SPEVIGO (spesolimab) for generalized pustular psoriasis (GPP). The collaboration enhanced LEO Pharma’s and Boehringer’s impact in rare skin disease treatment.

- In January 2025, Gilead Sciences and LEO Pharma partnered to advance the development of oral STAT6 inhibitors for inflammatory diseases. The collaboration expanded Gilead’s inflammation pipeline and strengthened LEO Pharma’s dermatology innovation strategy.

- In October 2024, Organon acquired Dermavant Sciences, including its FDA-approved non-steroidal topical therapy VTAMA (tapinarof) cream, 1% for plaque psoriasis. This move extended Organon’s dermatology capabilities into the U.S. market and strengthened its presence in immuno-dermatology.

- In May 2024, Johnson & Johnson acquired Proteologix, gaining access to bispecific antibody candidates targeting IL-13, TSLP, and IL-22 for atopic dermatitis and asthma. The acquisition strengthened Johnson & Johnson’s dermatology pipeline aimed at immune-mediated skin conditions

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption of AI-integrated imaging systems for early diagnosis.

- Portable and wireless diagnostic devices will become more common in clinics and remote areas.

- Teledermatology will expand, improving access to dermatological care globally.

- Non-invasive diagnostic solutions will gain more preference over traditional methods.

- Product innovation will focus on faster, more accurate lesion detection.

- Regulatory support and reimbursement policies will strengthen device adoption rates.

- R&D investments will increase to enhance device functionality and user experience.

- Collaborations between technology firms and healthcare providers will accelerate market expansion.

- Demand will rise in emerging economies due to improved healthcare infrastructure.

- Integration of cloud platforms will enable real-time data sharing and remote analysis.