Market Overview

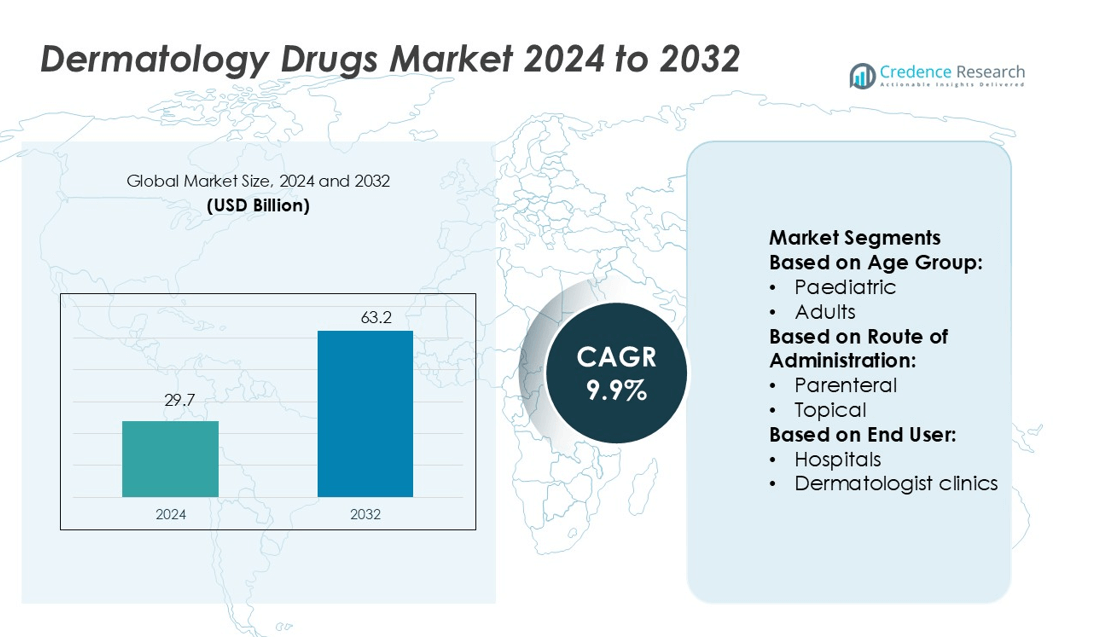

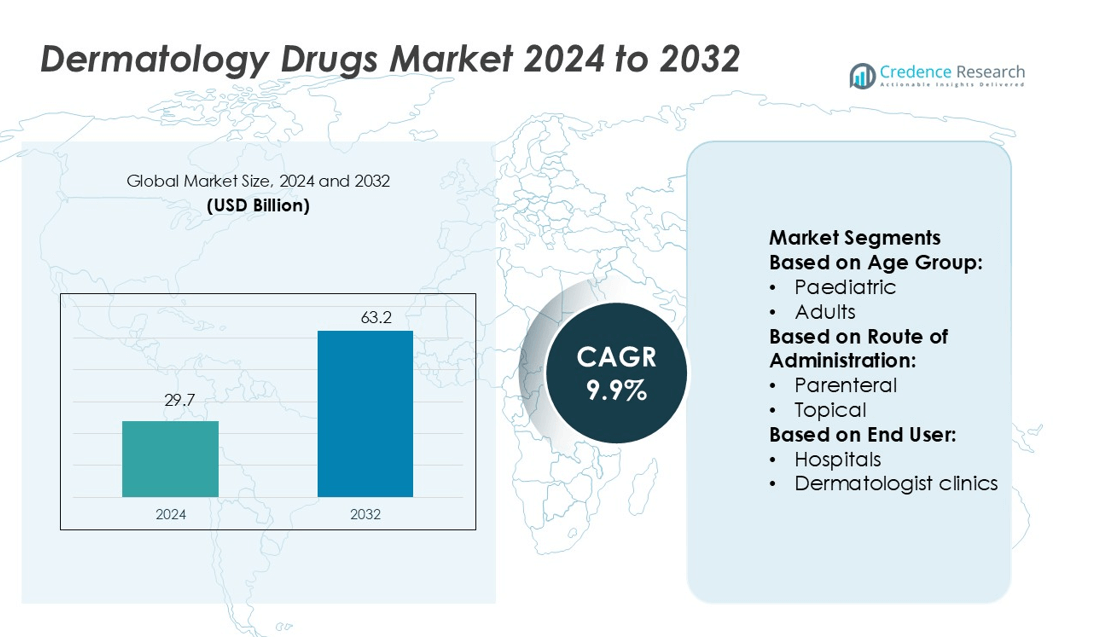

Dermatology Drugs Market size was valued USD 29.7 billion in 2024 and is anticipated to reach USD 63.2 billion by 2032, at a CAGR of 9.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dermatology Drugs Market Size 2024 |

USD 29.7 billion |

| Dermatology Drugs Market, CAGR |

9.9% |

| Dermatology Drugs Market Size 2032 |

USD 63.2 billion |

The Dermatology Drugs Market is shaped by major players such as AstraZeneca, Dermavant Sciences, F. Hoffmann La Roche, AbbVie, Galderma, Bausch Health, Eli Lilly and Company, Amgen, Almirall, and GlaxoSmithKline. These companies focus on expanding biologics, targeted therapies, and advanced topical solutions to address chronic skin disorders. Strategic R&D investments, product launches, and partnerships strengthen their competitive positions. North America leads the global market with a 35.2% share, supported by strong healthcare infrastructure, high treatment adoption rates, and continuous regulatory approvals. This leadership is further reinforced by a well-established distribution network and rapid uptake of innovative dermatology drugs.

Market Insights

- The Dermatology Drugs Market was valued at USD 29.7 billion in 2024 and is expected to reach USD 63.2 billion by 2032, growing at a CAGR of 9.9%.

- Rising prevalence of chronic skin disorders such as psoriasis and eczema drives demand for advanced biologics and topical therapies.

- Increasing R&D investments, strategic collaborations, and new product launches strengthen competition among leading global companies.

- High treatment costs and strict regulatory requirements restrain market growth in price-sensitive regions.

- North America leads with a 35.2% share, followed by Europe and Asia Pacific, while the biologics segment dominates with strong adoption in both hospital and clinic settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Age Group

Adults hold the dominant share in the dermatology drugs market. High prevalence of acne, psoriasis, eczema, and skin cancer among the adult population drives this segment. Adults often seek faster relief and long-term treatment options, supporting strong demand for biologics and targeted therapies. Rising awareness, frequent dermatologist visits, and increased use of prescription-based products strengthen the market presence of this group. Pharmaceutical companies focus on adult-specific formulations with improved efficacy and minimal side effects, further supporting growth.

- For instance, AstraZeneca conducted a completed Phase 2 trial (FRONTIER-2; NCT04212169) of MEDI3506 (tozorakimab) in 148 adults (aged 18–65) with moderate-to-severe atopic dermatitis.

By Route of Administration

Topical administration leads the market with the largest share. Ease of use, direct action on the affected area, and fewer systemic side effects make it the preferred choice. Topical creams, gels, and ointments are widely used for conditions like acne, dermatitis, and fungal infections. Over-the-counter availability boosts adoption rates, especially in early-stage or mild cases. Continuous advancements in drug delivery systems, including nanoemulsions and transdermal patches, further enhance treatment effectiveness and patient compliance.

- For instance, Dermavant’s VTAMA cream 1% is supplied in 60-gram tubes, with 10 mg tapinarof per gram, and its ADORING-3 LTE enrolled 728 patients, showing an average 80-day treatment-free interval after clearance.

By End User

Hospitals dominate the dermatology drugs market by end user. Hospitals handle severe or chronic skin conditions that require advanced treatment and specialized care. Strong clinical infrastructure, access to skilled dermatologists, and better availability of biologics and immunotherapies support this leadership. Hospitals also manage large patient volumes and facilitate early diagnosis through advanced diagnostic tools. Expanding healthcare access and rising skin disorder prevalence strengthen hospital-based treatment demand, making this segment a key revenue driver.

Key Growth Drivers

Rising Prevalence of Skin Disorders

The increasing incidence of chronic skin conditions such as acne, psoriasis, eczema, and dermatitis is driving demand for dermatology drugs. Urbanization, pollution, and changing lifestyle patterns are worsening skin health. Growing awareness of early treatment is pushing patients to seek medical care more often. Pharmaceutical companies are expanding product portfolios to target multiple skin concerns with advanced therapies. Expedited regulatory approvals for new dermatological drugs also support market growth. These factors are creating a steady rise in prescription rates and sales of dermatology drugs globally.

- For instance, Roche’s Erivedge (vismodegib) targets basal cell carcinoma by inhibiting the Hedgehog pathway. In clinical trials of 96 patients, 30 % partial response in metastatic cases and 43 % response in locally advanced cases were observed.

Advancements in Drug Formulations and Delivery Systems

Innovative drug formulations and targeted delivery systems are enhancing treatment effectiveness. Topical formulations with improved skin penetration and reduced side effects are gaining strong adoption. Biologics and small-molecule drugs are expanding the treatment scope for severe conditions like psoriasis and atopic dermatitis. Nanotechnology and transdermal patches offer better absorption and controlled drug release. These developments improve patient compliance and therapeutic outcomes. Pharmaceutical companies are investing in R&D to bring more personalized dermatological solutions to the market, boosting overall industry growth.

- For instance, AbbVie’s RINVOQ® (upadacitinib) was approved by the U.S. FDA in 2022 for moderate to severe atopic dermatitis for patients aged 12 and older.

Expanding Cosmetic Dermatology and Aesthetic Treatments

Growing interest in skincare and aesthetic procedures is boosting demand for dermatology drugs. Aesthetic dermatology focuses on anti-aging, pigmentation correction, and scar reduction. The rising popularity of minimally invasive procedures supports the use of topical and injectable formulations. Consumers are increasingly investing in preventive and maintenance skincare, not just treatment. Clinics and hospitals are adopting combination therapies that pair drugs with procedures for faster results. This shift toward aesthetic and preventive care is creating new revenue streams for drug manufacturers and service providers.

Key Trends & Opportunities

Biologics and Targeted Therapies Gaining Momentum

Biologics are transforming the treatment landscape for chronic skin diseases. These drugs target specific immune pathways, delivering higher efficacy with fewer systemic side effects. Their strong adoption in psoriasis and eczema treatment is shaping new clinical standards. Pharmaceutical companies are expanding pipelines with monoclonal antibodies and immune modulators. This trend creates opportunities for firms to develop niche products addressing unmet clinical needs, strengthening market competition and patient outcomes.

- For instance, OLYMPIA 1 and 2 trials in prurigo nodularis (n > 500), 56 % and 49 % of Nemluvio-treated patients achieved ≥ 4-point itch reduction at week 16, versus 16 % in placebo.

Grwing Teledermatology and Digital Health Integration

eledermatology platforms are improving patient access to skin care, especially in underserved regions. Digital tools enable remote diagnosis, prescription management, and treatment monitoring. This approach enhances patient convenience and physician efficiency. Integration of AI-driven image analysis supports early detection and personalized treatment recommendations. The increasing adoption of telehealth is creating new distribution and engagement channels for dermatology drugs, boosting their reach and adoption rates.

- For instance, Bausch’s Ortho Dermatologics announced adding four new products (Solodyn ER, Renova 0.02%, Loprox shampoo, BenzEFoam) to bring total product count to 15 on the telemedicine site.

Strong Demand in Emerging Markets

Rising healthcare spending in emerging economies is fueling dermatology drug market expansion. Greater insurance coverage, government healthcare initiatives, and increasing dermatology clinic numbers are improving treatment access. Growing middle-class populations are more aware of skincare and willing to spend on quality treatments. Local and global pharmaceutical firms are entering these markets through strategic partnerships and product launches, creating significant growth opportunities.

Key Challenges

High Cost of Advanced Treatments

Biologics and targeted therapies offer strong efficacy but remain expensive. High treatment costs limit patient access, especially in low- and middle-income countries. Many health systems lack reimbursement coverage for premium dermatology drugs. Price sensitivity affects adoption rates, forcing companies to balance innovation with affordability. The challenge of cost containment continues to hinder widespread use of advanced therapies.

Regulatory Hurdles and Patent Barriers

Stringent regulatory requirements for dermatology drugs slow product approvals and market entry. Long clinical trial timelines increase development costs and delay innovation. Patent protection restricts the entry of generic and biosimilar products, limiting competition. Smaller companies face greater difficulty navigating complex compliance frameworks. These regulatory and IP challenges create market entry barriers and can slow overall market expansion.

Regional Analysis

North America

North America holds a 35.2% share of the Dermatology Drugs Market, leading globally due to strong healthcare infrastructure and rapid drug innovation. The region benefits from high awareness of skin health, advanced dermatology research, and a large base of dermatologists. The U.S. drives most of the demand, supported by FDA approvals and increased access to biologics. Canada’s growth is fueled by better insurance coverage and expanding dermatology clinics. Rising cases of chronic skin conditions such as psoriasis and acne also strengthen market penetration and sustain long-term demand for prescription and OTC drugs.

Europe

Europe accounts for 28.4% of the global market share, supported by a strong regulatory framework and expanding clinical research programs. Germany, France, and the U.K. lead demand due to advanced healthcare systems and rising use of targeted dermatology drugs. Government reimbursement policies for chronic skin conditions and early adoption of biologics drive growth. The region also focuses on personalized treatment approaches and advanced formulations. Growing consumer preference for topical drugs and strong collaborations between pharmaceutical companies and research institutions support sustained market expansion.

Asia Pacific

Asia Pacific holds 24.6% of the market share, driven by rising disposable incomes and expanding healthcare access. China, Japan, India, and South Korea lead regional demand due to increasing prevalence of skin conditions, improved dermatology services, and growing cosmetic awareness. Strong investments in healthcare infrastructure and local manufacturing accelerate drug availability. Governments also support affordable dermatology treatments, increasing patient access. A growing aging population and higher incidence of eczema and acne further push market growth across both urban and semi-urban regions in the region.

Latin America

Latin America captures 6.8% of the Dermatology Drugs Market, with Brazil and Mexico driving regional growth. Expanding healthcare coverage, urbanization, and growing awareness of skincare support demand. The region is witnessing higher adoption of generics and affordable branded drugs, making treatments more accessible. Dermatology clinics and telemedicine platforms are expanding in major cities, improving patient reach. Rising sun exposure–related conditions, including melanoma and other skin disorders, increase the need for effective therapies, creating opportunities for both multinational and regional drug manufacturers.

Middle East & Africa

The Middle East & Africa region holds 5.0% of the global market share, with steady growth supported by expanding healthcare investments. Gulf Cooperation Council countries lead adoption due to higher spending on dermatology services and modern healthcare facilities. Increased awareness of skin diseases, growing cosmetic dermatology demand, and rising medical tourism strengthen the market outlook. In Africa, growth is emerging through donor-funded healthcare programs and improved access to basic dermatology drugs. The region is expected to see stronger pharmaceutical collaborations and distribution network expansions.

Market Segmentations:

By Age Group:

By Route of Administration:

By End User:

- Hospitals

- Dermatologist clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Dermatology Drugs Market is highly competitive, with leading players including AstraZeneca, Dermavant Sciences, F. Hoffmann La Roche, AbbVie, Galderma, Bausch Health, Eli Lilly and Company, Amgen, Almirall, and GlaxoSmithKline. The Dermatology Drugs Market is defined by strong innovation, strategic expansion, and increasing competition. Companies focus on developing advanced biologics, targeted therapies, and novel topical formulations to address chronic skin conditions such as psoriasis, eczema, acne, and skin cancers. Strategic R&D investments drive the introduction of next-generation drugs with improved efficacy and safety profiles. Many players are adopting digital platforms to enhance patient engagement and treatment adherence. Mergers, acquisitions, and partnerships strengthen distribution networks and support entry into emerging markets. Biologics and immunomodulators remain central to market growth, supported by strong regulatory approvals and expanding clinical pipelines.Top of Form

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AstraZeneca

- Dermavant Sciences

- Hoffmann La Roche

- AbbVie

- Galderma

- Bausch Health

- Eli Lilly and Company

- Amgen

- Almirall

- GlaxoSmithKline

Recent Developments

- In August 2025, Zenara Pharma Private Limited, were approved by the FDA in the United States, as the first FDA-approved generic equivalent of Almatica Pharma’s product. It was granted Competitive Generic Therapy (CGT) designation, which provided 180 days of U.S. marketing exclusivity.

- In June 2025, Advent International announced that it has signed a definitive agreement to invest through primary and secondary transactions to acquire a significant minority stake in Felix Pharmaceuticals.

- In August 2024, Sun Pharmaceutical Industries Ltd. launched STARIZO, an antibacterial treatment to combat Acute Bacterial Skin and Skin Structure Infections caused by drug-resistant bacteria such as MRSA in India. The medication offers the convenience of once-a-day dosing for six days, making it easier for patients than traditional treatments requiring more frequent dosing over longer periods.

- In January 2024, Pfizer Inc. partnered with Glenmark Pharmaceuticals to introduce abrocitinib, also known as CIBINQO, an oral treatment for atopic dermatitis in India. This treatment provides rapid itch relief and sustained disease control for patients suffering from this chronic skin condition

Report Coverage

The research report offers an in-depth analysis based on Age Group, Route of Administration, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with increasing demand for biologics and targeted therapies.

- Companies will focus on personalized dermatology treatments for better patient outcomes.

- Digital health platforms will enhance treatment adherence and monitoring.

- R&D investments will rise to support the launch of advanced drug formulations.

- Regulatory approvals for innovative therapies will accelerate market penetration.

- Expansion into emerging markets will boost global access to dermatology drugs.

- Combination therapies will gain traction for managing complex skin conditions.

- Biologics and immunomodulators will remain key drivers of competitive growth.

- Strategic collaborations will strengthen clinical pipelines and global reach.

- Patient awareness and early diagnosis will drive higher treatment adoption.