Market Overview

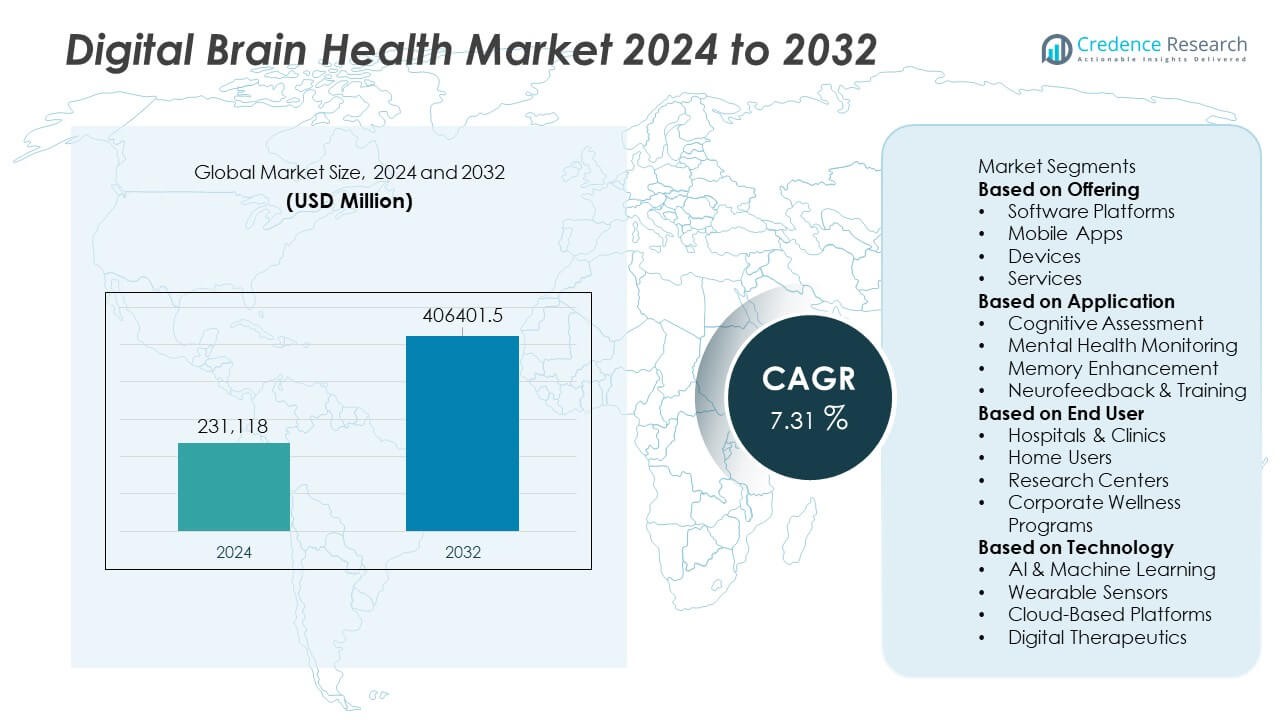

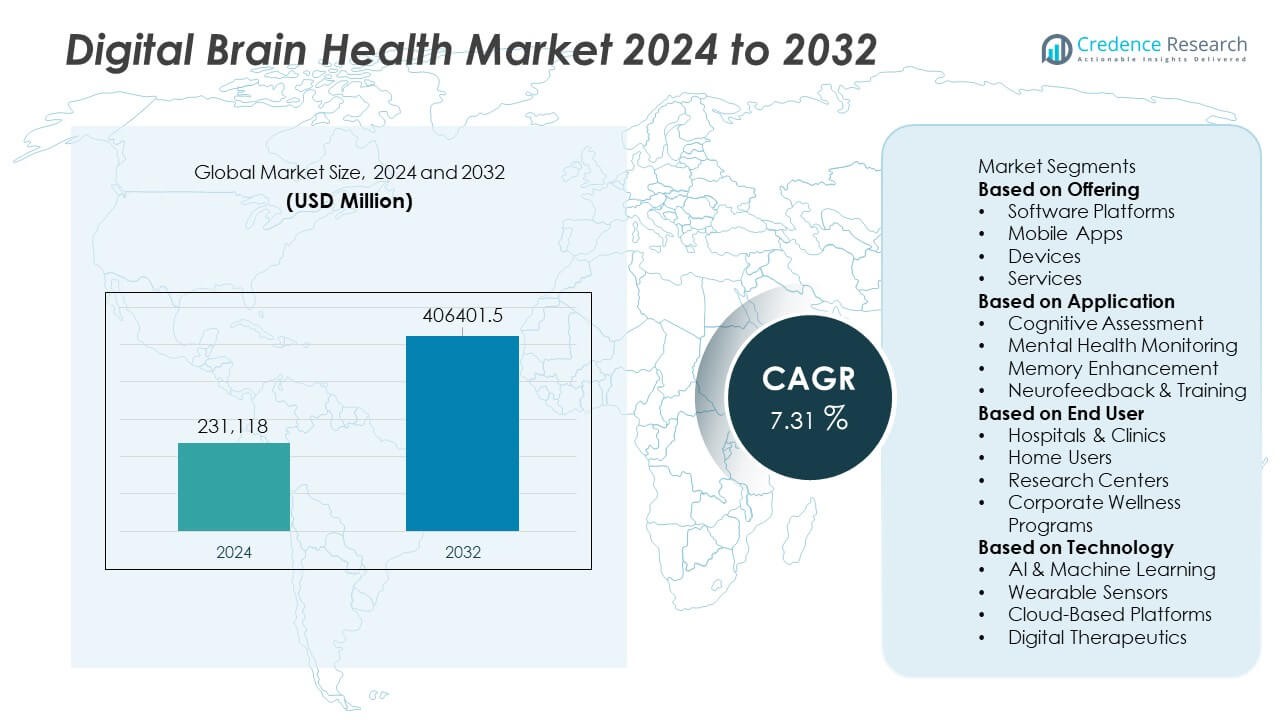

The Digital Brain Health Market was valued at USD 231,118 million in 2024 and is projected to reach USD 406,401.5 million by 2032, growing at a CAGR of 7.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Brain Health Market Size 2024 |

USD 231,118 Million |

| Digital Brain Health Market, CAGR |

7.31% |

| Digital Brain Health Market Size 2032 |

USD 406,401.5 Million |

The Digital Brain Health market is shaped by leading players such as Cogstate Ltd., Pear Therapeutics, Akili Interactive, Headspace Health, NeuroSky, BrainCheck, MindMaze, Lumosity, Altoida Inc., and Happify Health, each advancing AI-driven assessment tools, digital therapeutics, and cognitive-training platforms. These companies compete through clinical validation, real-time analytics, and strong integration with healthcare systems. North America leads the market with 38% share, supported by high digital adoption and strong investment in mental-health technologies. Europe follows with 29% share, driven by structured healthcare frameworks and early-screening initiatives, while Asia Pacific holds 25% share, reflecting rapid digitalization and rising consumer demand for brain-health solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Digital Brain Health market reached USD 231,118 million in 2024 and will grow at a CAGR of 7.31% through 2032.

- Demand rises as early cognitive assessment and remote monitoring support better detection and personalized care, boosting adoption across clinical and home settings.

- AI-driven analytics, wearable cognitive tracking, and digital therapeutics shape major trends, with software platforms leading the offering segment at 42% share.

- Competition intensifies as key players expand clinical validation, enhance user engagement, and form partnerships to strengthen technology capabilities and market reach.

- North America leads with 38% share, followed by Europe at 29% and Asia Pacific at 25%, supported by strong digital adoption and rising focus on mental-wellness solutions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Offering

Software platforms lead this segment with 42% share, supported by strong use in clinical and home settings. These platforms enable cognitive screening, symptom tracking, and structured therapy programs, which boosts demand for reliable digital tools. Mobile apps grow as users adopt easy self-guided mental-wellness features. Devices expand due to rising interest in wearable sensors that track stress, focus, and cognitive load. Services gain momentum as providers add coaching and therapy support. The leadership of software platforms continues as healthcare groups prefer integrated systems for scalable brain-health management.

- For instance, Cogstate expanded its digital testing suite when its FDA-cleared Cognigram tool reached deployment across clinical sites and in-home settings, enabling standardized cognitive screening with a test time of under a quarter of an hour.

By Application

Cognitive assessment holds the dominant 38% share, driven by rising focus on early detection and preventive care. These tools help clinicians identify decline patterns and track changes in memory, attention, and processing speed. Mental health monitoring grows as people adopt digital platforms for tracking mood, anxiety, and behavioral trends. Memory enhancement solutions gain traction due to an aging population and increased interest in cognitive training. Neurofeedback and training expand across rehabilitation and wellness programs. The dominance of cognitive assessment reflects strong clinical integration and wider screening adoption.

- For instance, Altoida validated its AI-powered cognitive assessment platform using a wide range of objective digital biomarkers, demonstrating a significant ability to identify individuals at risk of progression from mild cognitive impairment to Alzheimer’s disease in research studies.

By End User

Hospitals and clinics lead this segment with 44% share, supported by strong adoption of digital diagnostics and validated assessment tools. These settings use structured platforms for screening, monitoring, and treatment planning, which strengthens demand for reliable solutions. Home users rise as mobile apps and wearable devices enable self-tracking and guided exercises. Research centers rely on advanced tools for clinical trials and cognitive-function studies. Corporate wellness programs adopt brain-health modules to enhance productivity and reduce stress levels. Strong regulatory alignment and clinical credibility help hospitals and clinics maintain their lead.

Key Growth Drivers

Rising Demand for Early Cognitive Assessment

Growing focus on early detection of cognitive decline strengthens adoption of digital brain health tools. Providers use screening platforms to detect subtle changes in memory and attention before major symptoms appear. The aging population increases the need for routine cognitive checks, while families seek proactive monitoring. Digital tools offer quick and non-invasive tests that support large-scale use across clinics and homes. Automated scoring and real-time insights improve treatment planning and preventive strategies. This rising demand positions cognitive assessment as a core driver of market expansion.

- For instance, Akili Interactive validated its digital cognitive tool through a clinical study involving hundreds of participants, demonstrating measurable improvements in attention scores using a game-based assessment with standardized performance metrics.

Expansion of Remote and Personalized Care

Remote care grows as digital platforms support continuous tracking, virtual consultations, and custom therapy programs. Wearables and mobile apps offer real-time insights into stress, mood, and cognitive load, helping users manage daily wellness. Clinicians adjust treatment plans based on ongoing digital feedback, reducing the need for frequent in-person visits. Personalized training programs appeal to users seeking tailored care options. AI-driven recommendations enhance engagement and strengthen progress tracking. This shift toward accessible and individualized care boosts adoption across healthcare and consumer groups.

- For instance, Headspace Health enhanced its remote-care platform by integrating a clinical program that delivered therapist-guided sessions to users across its digital ecosystem, supported by a network of licensed providers.

Growing Integration of AI and Advanced Analytics

AI adoption accelerates as advanced analytics enhance diagnostic accuracy and predictive modeling. Machine learning tools evaluate cognitive patterns, behavioral signals, and physiological data to support early risk detection. Clinicians rely on AI insights to refine care plans and anticipate decline trends. Companies expand datasets to improve model precision and support new clinical applications. These smart capabilities help providers deliver more effective, data-driven treatments. Strong AI performance improves confidence and drives wider deployment across medical, research, and wellness environments.

Key Trends & Opportunities

Rising Adoption of Wearable Cognitive Monitoring

Wearable devices create major growth opportunities as users seek continuous brain-health tracking. These devices measure stress, sleep, attention, and cognitive load, providing daily performance insights. Employers integrate wearables into wellness programs to reduce burnout and support mental fitness. Healthcare providers apply sensor data to refine rehabilitation and improve therapy accuracy. Advances in sensor quality expand clinical and consumer use. As interest in proactive health management rises, wearable monitoring becomes a strong opportunity for companies offering integrated hardware and software solutions.

- For instance, NeuroSky advanced its wearable EEG technology with its TGAM biosensor module, capable of recording brainwave signals at a 512 Hz sampling rate and detecting attention and meditation indices with validated algorithmic accuracy used in more than 100 commercial devices.

Growth of Digital Therapeutics for Cognitive and Mental Health

Digital therapeutics gain traction as validated programs support management of anxiety, depression, memory loss, and cognitive impairment. Structured therapy modules delivered via apps improve scalability for clinics and home users. Regulatory approvals and growing reimbursement support enhance trust among providers. These tools offer strong value in regions with limited specialists, expanding accessible care options. AI-driven personalization improves treatment outcomes through adaptive modules. As adoption increases across global healthcare systems, digital therapeutics emerge as a major opportunity shaping the future of digital brain health.

- For instance, Pear Therapeutics demonstrated clinical impact with its reSET-O program, showing improved adherence outcomes when evaluated across 1,000 documented patient sessions and supported by FDA authorization as a software-based therapeutic for opioid-use disorder.

Key Challenges

Concerns Over Data Privacy and Security

Digital brain health platforms handle sensitive cognitive and behavioral data, raising serious privacy concerns. Users expect strong protection against breaches, unauthorized access, and unethical data use. Healthcare systems require strict compliance with data regulations, increasing operational demands for developers. Weak security practices reduce trust and limit adoption, especially in clinical settings. Providers prefer platforms with encryption, transparent data policies, and secure storage. Companies that fail to meet privacy standards risk losing market confidence and face significant adoption barriers.

Limited Clinical Validation and Standardization

Many digital brain health solutions lack consistent clinical validation, creating uncertainty about accuracy and diagnostic reliability. Differences in algorithms, testing methods, and scoring reduce confidence among healthcare providers. Limited standardization slows integration into formal treatment guidelines and reimbursement frameworks. Clinicians favor tools supported by strong clinical studies and regulatory approvals. Companies must invest in long-term research to prove therapeutic value. Without robust evidence, digital brain health tools struggle to achieve large-scale adoption in hospitals, insurance networks, and regulated care environments.

Regional Analysis

North America

North America leads the Digital Brain Health market with 38% share, driven by strong adoption of cognitive assessment platforms, digital therapeutics, and wearable mental-wellness devices. Healthcare systems integrate AI-enabled tools for early screening and personalized care, supported by favorable reimbursement and high digital literacy. The region benefits from strong investment in neuroscience research and rapid expansion of remote mental-health services. Rising prevalence of cognitive disorders and higher awareness of early intervention support continued growth. Technology companies and healthcare providers form partnerships to enhance data integration, improving clinical outcomes and strengthening market leadership.

Europe

Europe holds 29% share, supported by strong regulatory focus on mental-health improvement and early dementia detection. Countries adopt digital assessment tools and remote-care platforms to address increasing neurological and psychological health needs. Government initiatives encourage digital transformation across healthcare settings, improving access to validated cognitive-testing systems. The region benefits from aging demographics, which drive demand for long-term cognitive monitoring. Investments in AI-driven research and cross-border health programs enhance platform reliability and foster clinical adoption. Growing emphasis on patient data protection strengthens trust and supports sustainable expansion across major European markets.

Asia Pacific

Asia Pacific accounts for 25% share, driven by rising healthcare digitalization and growing consumer adoption of mobile mental-wellness tools. Expanding internet access and high smartphone usage support strong demand for affordable cognitive-tracking apps and AI-based assessment platforms. Governments invest in mental-health awareness programs and digital therapeutics to address growing stress and neurological health concerns. Aging populations in countries such as Japan and South Korea increase demand for memory-support and early-diagnosis solutions. Regional startups accelerate innovation through low-cost, scalable platforms. Strong economic growth and expanding healthcare infrastructure strengthen long-term market potential.

Latin America

Latin America holds 5% share, supported by improving access to digital healthcare services and rising interest in mental-wellness solutions. Countries adopt mobile-based cognitive assessment and stress-monitoring tools to address rising demand for accessible mental-health support. Growing smartphone penetration allows broader use of digital platforms across urban and semi-urban regions. Healthcare providers explore digital therapeutics to manage cognitive and behavioral disorders at lower cost. Limited specialist availability encourages adoption of remote-care tools. Despite infrastructure gaps, rising awareness and expanding insurance coverage strengthen the region’s emerging market presence.

Middle East & Africa

Middle East & Africa account for 3% share, driven by rising investments in digital health transformation and increasing interest in mental-wellness programs. Wealthier Gulf countries adopt AI-enabled cognitive assessment tools and wearable monitoring systems in hospitals and corporate wellness programs. Growing awareness of early cognitive screening supports adoption across private healthcare networks. Many regions benefit from expanding telehealth infrastructure aimed at improving access to neurological care. However, lower digital literacy and uneven healthcare availability restrict broader adoption. Gradual improvements in digital infrastructure and rising mental-health awareness support steady long-term growth.

Market Segmentations:

By Offering

- Software Platforms

- Mobile Apps

- Devices

- Services

By Application

- Cognitive Assessment

- Mental Health Monitoring

- Memory Enhancement

- Neurofeedback & Training

By End User

- Hospitals & Clinics

- Home Users

- Research Centers

- Corporate Wellness Programs

By Technology

- AI & Machine Learning

- Wearable Sensors

- Cloud-Based Platforms

- Digital Therapeutics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Digital Brain Health market features strong competition among key players such as Cogstate Ltd., Pear Therapeutics, Akili Interactive, Headspace Health, NeuroSky, BrainCheck, MindMaze, Lumosity, Altoida Inc., and Happify Health. Companies focus on developing AI-driven assessment tools, digital therapeutics, and wearable-based cognitive monitoring systems to meet increasing demand for early detection and personalized care. Many firms invest in clinical validation and regulatory approvals to strengthen credibility in healthcare settings. Strategic partnerships with hospitals, research institutions, and technology providers help expand platform capabilities and enhance data accuracy. Vendors also emphasize user engagement through behavioral analytics, gamified training modules, and mobile-based therapy programs. Growing interest in remote care and long-term cognitive monitoring fuels product innovation and competition. Firms that deliver robust data security, strong clinical outcomes, and high user retention gain a competitive edge in this expanding market.

Key Player Analysis

- Cogstate Ltd.

- Pear Therapeutics

- Akili Interactive

- Headspace Health

- NeuroSky

- BrainCheck

- MindMaze

- Lumosity (Lumos Labs)

- Altoida Inc.

- Happify Health

Recent Developments

- In October 2025, Cogstate announced at its Annual General Meeting that it is stepping up its efforts to optimize brain-health assessments for clinical trials and new medicines.

- In August 2025, Cogstate Ltd. welcomed Dr. Luka Lucić as Senior Director of Clinical Science in Psychiatry.

- In June 2025, Lumosity (Lumos Labs) received FDA 510(k) clearance for its adult ADHD digital therapeutic “Prismira.”

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Offering, Application, End User, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital brain health tools will gain wider clinical adoption as early screening becomes routine.

- AI models will improve diagnosis accuracy and support more precise treatment planning.

- Wearable devices will expand real-time cognitive and emotional monitoring capabilities.

- Digital therapeutics will strengthen their role in managing cognitive and mental-health conditions.

- Remote care platforms will grow as users seek flexible assessment and therapy options.

- Personalized cognitive-training programs will increase engagement and long-term adherence.

- Healthcare systems will integrate more validated digital tools into reimbursement pathways.

- Corporate wellness programs will adopt brain-health solutions to improve workforce performance.

- Privacy and security enhancements will boost user trust and platform reliability.

- Growth in emerging markets will accelerate as digital literacy and healthcare infrastructure improve.

Market Segmentation Analysis:

Market Segmentation Analysis: