Market Overview

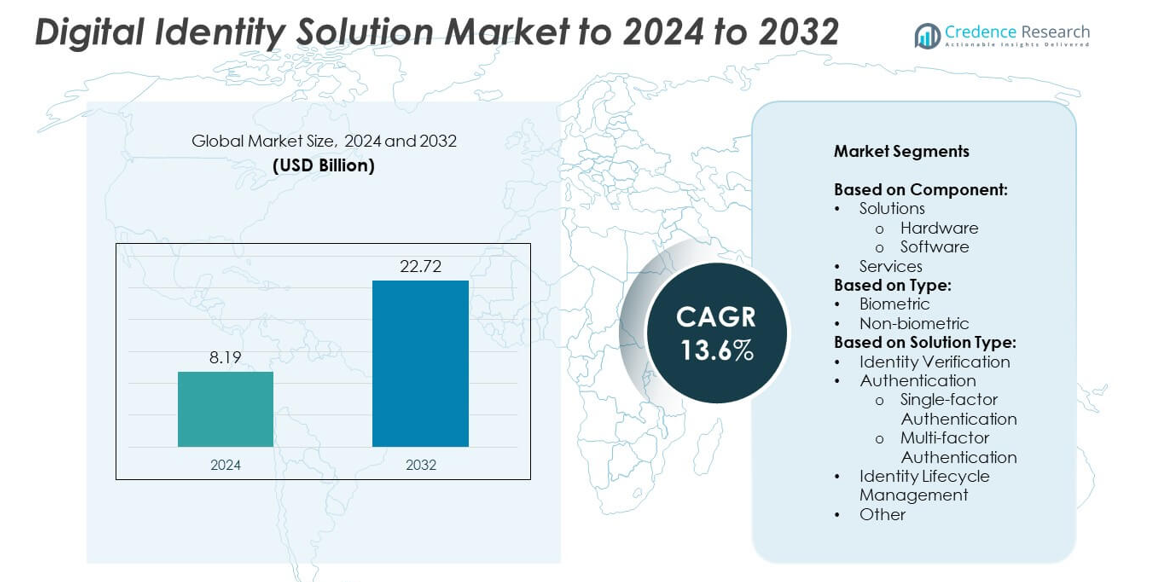

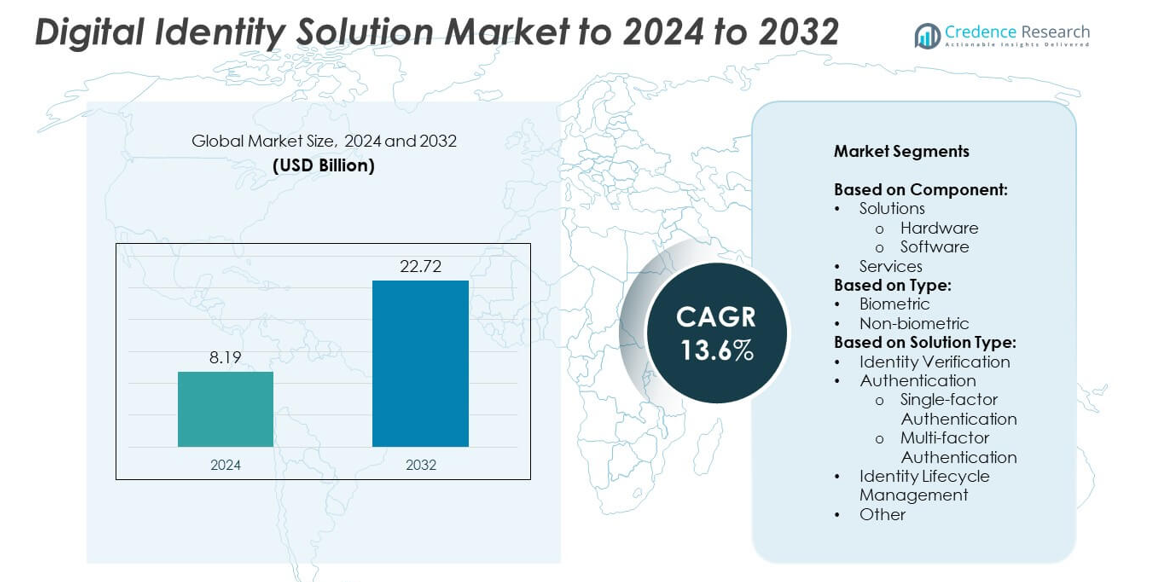

Digital Identity Solution market size was valued at USD 8.19 billion in 2024 and is anticipated to reach USD 22.72 billion by 2032, at a CAGR of 13.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Identity Solution Market Size 2024 |

USD 8.19 billion |

| Digital Identity Solution Market, CAGR |

13.6% |

| Digital Identity Solution Market Size 2032 |

USD 22.72 billion |

The digital identity solution market is led by major players including Microsoft, IDEMIA, Thales, Daon, ForgeRock, TELUS, GB Group plc, Okta, NEC Corporation, Jumio, Tessi, and IMAGEWARE. These companies focus on enhancing security, authentication accuracy, and compliance through AI-driven verification, biometrics, and cloud-based identity management. Continuous innovation in multi-factor authentication and zero-trust frameworks strengthens their competitive edge. Regionally, North America leads the market with a 36% share in 2024, supported by advanced digital infrastructure and strict data protection regulations, followed by Europe with 28% and Asia Pacific with 24%, reflecting rapid digital transformation and expanding e-governance initiatives.

Market Insights

- The digital identity solution market was valued at USD 8.19 billion in 2024 and is projected to reach USD 22.72 billion by 2032, growing at a CAGR of 13.6%.

- Market growth is driven by rising cybersecurity threats, growing digital transformation, and government-backed identity programs across sectors such as banking and telecom.

- Key trends include the integration of AI, machine learning, and blockchain for enhanced verification, and increasing adoption of cloud-based and multi-factor authentication solutions.

- The market is highly competitive, with companies focusing on partnerships, technology upgrades, and compliance-driven identity platforms to strengthen their global footprint.

- North America holds 36% of the market share, followed by Europe with 28% and Asia Pacific with 24%, while the solutions segment leads by component, supported by growing demand for biometric authentication and cloud identity management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The solutions segment dominates the digital identity solution market, accounting for over 70% share in 2024. This dominance is driven by widespread adoption of hardware and software tools for secure authentication and identity verification. Hardware components such as biometric scanners and smart cards enable accurate user identification, while software platforms provide scalability and cloud integration. Companies are investing in AI-driven and blockchain-based software solutions to strengthen identity protection and ensure compliance with KYC and GDPR regulations, boosting demand across financial institutions and government services.

- For instance, Yubico reports 35+ million YubiKeys sold worldwide to date.

By Type

The biometric segment holds the dominant market share of around 65% in 2024, reflecting the rising use of fingerprint, facial, and iris recognition technologies. The surge in biometric adoption is fueled by enhanced security needs and reduced dependency on passwords. Governments and enterprises are deploying biometric-based systems for access control and eKYC verification to prevent identity fraud. Growing smartphone integration with biometric sensors and the rise of digital onboarding processes further accelerate this segment’s growth across banking, healthcare, and border control applications.

- For instance, Jumio reports that its products have processed over 1 billion transactions for identity verification and compliance solutions globally, as confirmed in 2024. This includes supporting over 5,000 ID types from more than 200 countries and territories.

By Solution Type

Identity verification leads the market, capturing over 40% share in 2024 due to its critical role in preventing fraudulent digital transactions. This segment’s expansion is driven by the growing use of AI-based verification tools for remote onboarding and compliance. Multi-factor authentication solutions also gain traction as organizations strengthen cybersecurity frameworks. Cloud-enabled lifecycle management platforms are being adopted for centralized access control and credential updates. Increased regulatory emphasis on zero-trust frameworks and secure digital onboarding drives innovation across identity verification and authentication subsegments.

Key Growth Drivers

Rising Need for Secure Authentication Systems

The growing number of cyberattacks and identity theft cases is driving the adoption of secure digital identity systems. Organizations in banking, healthcare, and government sectors are implementing advanced authentication technologies such as biometrics and multi-factor verification to safeguard sensitive data. The shift toward passwordless authentication further enhances user convenience and system resilience. Increasing compliance requirements, including GDPR and KYC norms, continue to push enterprises toward robust identity protection frameworks.

- For instance, Microsoft blocked about 7,000 password attacks per second in 2024.

Rapid Digital Transformation Across Industries

Widespread digitalization across sectors like finance, retail, and telecommunications is a major growth catalyst. Businesses are adopting digital identity platforms to streamline customer onboarding and enable secure online services. Cloud-based identity management tools are gaining popularity due to scalability and cost efficiency. The integration of AI and blockchain technologies ensures faster verification, real-time monitoring, and higher transparency. Growing reliance on remote work and digital transactions reinforces the need for automated and secure identity verification solutions.

- For instance, UIDAI logged 2,356 crore e-KYC transactions cumulatively by Mar 31, 2025

Government Initiatives Promoting Digital Identity Programs

Global governments are investing heavily in national digital identity programs to improve service delivery and transparency. Initiatives such as Aadhaar in India and eID in Europe have accelerated market adoption. These programs aim to provide citizens with verifiable digital credentials for secure online access. Public-private partnerships are also emerging to develop interoperable identity frameworks. Such efforts enhance data security, promote financial inclusion, and drive large-scale deployment of digital identity solutions across multiple sectors.

Key Trends & Opportunities

Integration of Artificial Intelligence and Machine Learning

AI and ML are transforming the digital identity landscape by improving fraud detection and verification accuracy. Intelligent systems can analyze large datasets to identify suspicious patterns in real time. AI-based face recognition and behavioral analytics help verify users seamlessly while reducing manual verification delays. Vendors are leveraging predictive algorithms to strengthen authentication workflows, enhance user experience, and reduce operational costs. This integration presents major opportunities for innovation and competitive differentiation.

- For instance, Onfido, now part of Entrust, reported a 3,000% surge in deepfake attempts between 2022 and 2023, as documented in its 2024 Identity Fraud Report.

Expansion of Cloud-Based Identity Platforms

Cloud-based identity management systems are gaining traction due to their scalability and flexibility. Enterprises are shifting from on-premise solutions to SaaS-based models for improved accessibility and lower maintenance costs. These platforms support real-time data processing, enabling faster identity verification and policy enforcement. The demand for cloud-native architectures is growing among SMEs and large corporations alike. Integration with cybersecurity tools and compliance modules creates opportunities for secure, unified identity ecosystems.

- For instance, Okta found the average apps per customer topped 100 in 2025.

Key Challenges

High Implementation and Integration Costs

The initial investment required for digital identity solutions remains a major challenge, especially for small enterprises. Hardware deployment, software licensing, and integration with legacy systems increase project costs. Continuous maintenance and upgrades add to the financial burden. Many organizations face budget constraints that limit the adoption of advanced biometric and AI-driven identity systems. Vendors must offer cost-efficient, modular solutions to enhance accessibility and adoption rates across emerging markets.

Data Privacy and Regulatory Compliance Risks

Strict data protection regulations and privacy concerns create hurdles for digital identity adoption. Organizations must comply with laws such as GDPR, CCPA, and PSD2, which demand transparent data handling and user consent. Any breach or misuse of personal data can damage reputation and lead to severe penalties. Balancing convenience with compliance remains complex as identity systems process sensitive biometric and behavioral data. Ensuring encryption, anonymization, and secure storage is crucial to address these regulatory challenges.

Regional Analysis

North America

North America held the largest market share of around 36% in 2024, driven by high adoption of advanced identity verification technologies across banking, IT, and government sectors. The U.S. leads the region due to strong investments in AI-based authentication and cybersecurity frameworks. Regulatory initiatives such as the NIST digital identity guidelines further support growth. Increasing reliance on digital payments and remote work systems accelerates demand for secure identity platforms. Major vendors are expanding partnerships with enterprises to enhance cloud-based and biometric authentication capabilities.

Europe

Europe accounted for approximately 28% of the market share in 2024, supported by stringent data protection laws such as GDPR and eIDAS. Countries like Germany, France, and the U.K. are at the forefront of digital identity adoption. Public sector initiatives promoting secure online access and digital identity wallets are strengthening market penetration. Banks and telecom companies are focusing on compliance-driven identity management systems. The increasing use of blockchain-based identity solutions and cross-border verification tools enhances digital trust and interoperability across European economies.

Asia Pacific

Asia Pacific captured about 24% of the global market in 2024, fueled by rapid digitalization and government-led identity programs. Countries including India, China, and Japan are driving large-scale adoption through initiatives like Aadhaar, My Number, and national ID frameworks. Expanding fintech ecosystems and e-commerce platforms demand strong verification systems to combat fraud. The rise of mobile-based biometrics and AI-enabled authentication tools supports market expansion. Growing investments from technology firms and public agencies strengthen regional innovation in scalable, low-cost digital identity solutions.

Latin America

Latin America represented nearly 7% of the market share in 2024, led by Brazil and Mexico. The region is witnessing increasing adoption of digital banking and online government services, driving the need for secure identity frameworks. Regulatory developments focused on data privacy and anti-fraud measures are promoting the implementation of multi-factor authentication and cloud-based verification systems. Local fintech growth is encouraging partnerships with global digital identity providers. However, infrastructure limitations and uneven digital literacy remain barriers to widespread market penetration.

Middle East and Africa

The Middle East and Africa held a 5% share of the global market in 2024, supported by rising investments in national ID and e-governance programs. Countries such as the UAE, Saudi Arabia, and South Africa are deploying biometric systems to enhance digital trust and service accessibility. Financial institutions and telecom operators are adopting secure authentication platforms to meet regulatory requirements. The growing emphasis on smart city projects and digital transformation initiatives is expected to boost future adoption of digital identity solutions across this region.

Market Segmentations:

By Component:

By Type:

By Solution Type:

- Identity Verification

- Authentication

- Single-factor Authentication

- Multi-factor Authentication

- Identity Lifecycle Management

- Other

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The digital identity solution market features prominent players such as Microsoft, IDEMIA, Thales, Daon, Inc., ForgeRock, Inc., TELUS, GB Group plc (‘GBG’), Okta, NEC Corporation, Jumio, Tessi, and IMAGEWARE. These companies focus on developing advanced authentication, verification, and identity management platforms using biometrics, AI, and cloud technology. The competitive environment is characterized by continuous innovation in multi-factor authentication, behavioral analytics, and blockchain-based verification systems. Vendors are expanding their global presence through partnerships with financial institutions, government agencies, and telecom providers. The shift toward cloud-based and zero-trust security frameworks drives intense competition in product differentiation. Companies are investing in scalable, interoperable solutions to comply with regulatory frameworks like GDPR and KYC mandates. Strategic mergers, acquisitions, and technology integrations are enhancing product portfolios and strengthening global footprints. Increasing demand for secure, frictionless digital access across industries is compelling market leaders to prioritize innovation and cybersecurity resilience.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Microsoft

- IDEMIA

- Thales

- Daon, Inc.

- ForgeRock, Inc.

- TELUS

- GB Group plc (‘GBG’)

- Okta

- NEC Corporation

- Jumio

- Tessi

- IMAGEWARE

Recent Developments

- In 2025, Okta acquired Axiom Security to expand its capabilities in Privileged Access Management (PAM). The Axiom Security product helps organizations eliminate standing privileges and secure access to critical infrastructure.

- In 2023, Microsoft continued to expand its Entra product family, consolidating its digital identity and access management solutions.

- In 2023, IDEMIA launched a hardware solution called OneLook Gen2, which combines face and iris capture and biometric matching from a distance in a single device.

Report Coverage

The research report offers an in-depth analysis based on Component, Type, Solution Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding due to growing demand for secure digital authentication systems.

- Biometric technologies such as facial and fingerprint recognition will dominate future deployments.

- AI and machine learning will enhance fraud detection and identity verification accuracy.

- Cloud-based platforms will gain wider adoption for scalability and cost efficiency.

- Governments will strengthen digital identity programs to improve public service access.

- Integration with blockchain will increase transparency and data security in identity management.

- Multi-factor authentication will become a standard across financial and enterprise sectors.

- Expansion of remote work and digital payments will accelerate identity solution adoption.

- Partnerships between public and private sectors will promote interoperability and compliance.

- Emerging economies will witness strong adoption driven by fintech and e-governance growth.