Market Overview

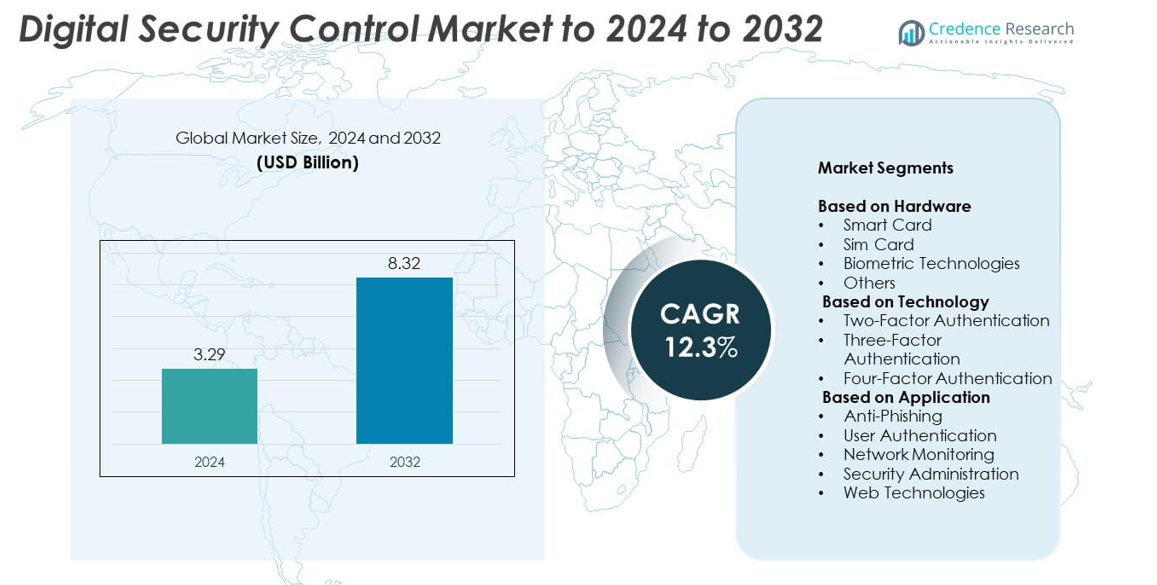

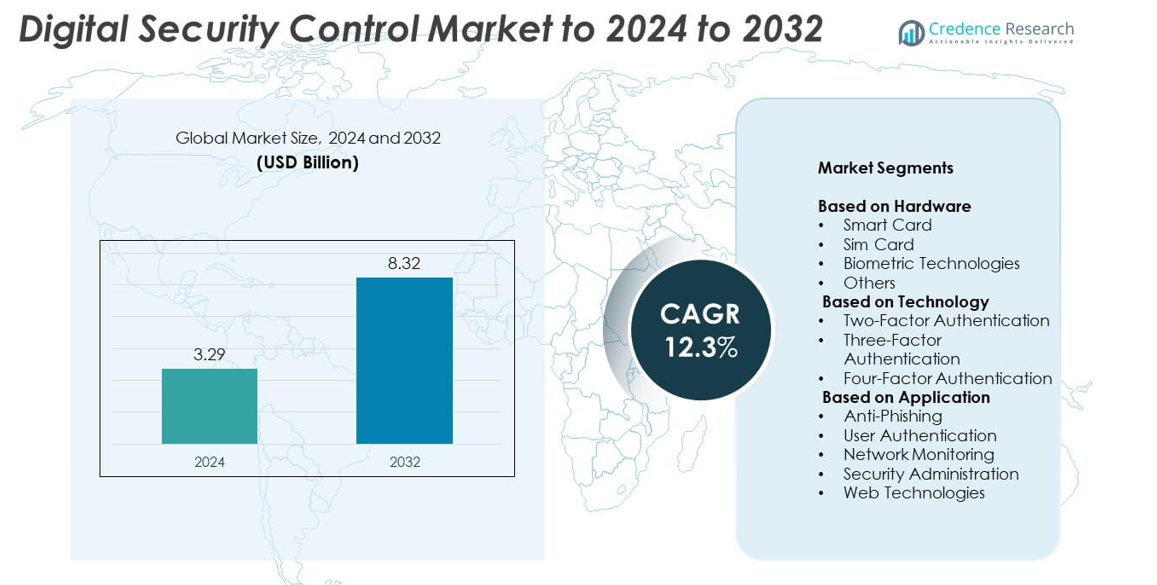

Digital Security Control market size was valued at USD 3.29 billion in 2024 and is anticipated to reach USD 8.32 billion by 2032, at a CAGR of 12.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Security Control Market Size 2024 |

UUSD 3.29 billion |

| Digital Security Control Market, CAGR |

12.3% |

| Digital Security Control Market Size 2032 |

SD 8.32 billion |

The Digital Security Control Market is highly competitive, with key players including Microsoft, Fortinet, RSA Security, Cisco Systems, McAfee, Palo Alto Networks, Linked Security NY, Orbit Security Systems, Digital Security Concepts, and Hadrian Security. These companies focus on enhancing multi-factor authentication, biometric verification, and AI-driven cybersecurity frameworks. Strategic partnerships, cloud integration, and continuous R&D investment strengthen their global presence. North America emerged as the leading region in 2024, holding a 36% market share, supported by strong digital infrastructure, advanced cybersecurity regulations, and early adoption of authentication technologies across industries such as finance, healthcare, and government.

Market Insights

- The Digital Security Control Market was valued at USD 3.29 billion in 2024 and is projected to reach USD 8.32 billion by 2032, growing at a CAGR of 12.3%.

- Rising cyber threats, increasing digital transformation, and expanding IoT ecosystems are driving the adoption of multi-layered authentication and encryption technologies.

- Key trends include AI-based threat detection, growing use of biometric authentication, and integration of cloud-based security platforms across enterprises.

- The market is moderately fragmented, with major players such as Microsoft, Fortinet, and Cisco Systems focusing on innovation, partnerships, and scalable subscription-based models to strengthen their market presence.

- North America led the market with a 36% share in 2024, followed by Europe at 28% and Asia Pacific at 24%, while the smart card segment dominated with a 42% share due to its wide use in identity verification and financial transactions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Hardware

Smart cards dominated the hardware segment in 2024, accounting for nearly 42% of the market share. Their extensive use in secure identity management, financial transactions, and government applications drives their dominance. The integration of embedded microprocessors and advanced encryption enhances data protection, boosting adoption in corporate and public sectors. Biometric technologies, including fingerprint and facial recognition systems, are rapidly gaining ground due to their contactless nature and improved accuracy. The rising focus on multi-layered authentication and compliance with security regulations further strengthens demand for smart card-based digital security solutions.

- For instance, Infineon has shipped over 10,000,000,000 security controllers with Integrity Guard.

By Technology

Two-factor authentication (2FA) held the largest share of around 48% in 2024. Its dominance stems from broad enterprise adoption across banking, IT, and e-commerce sectors to secure user identities. The method’s combination of passwords and one-time verification codes offers a balance between security and usability. Three-factor and four-factor authentication technologies are expanding, driven by the need for enhanced access control in high-risk environments. Growing data breaches and stricter cybersecurity mandates encourage organizations to integrate multi-factor authentication systems into their digital security frameworks.

- For instance, Okta blocked over 3,000,000,000 identity attacks per month in 2024.

By Application

User authentication led the application segment, capturing about 37% of the total market share in 2024. Its leadership is driven by the growing need for secure access management across corporate networks, financial institutions, and government databases. Increasing digital identity theft and phishing attacks accelerate demand for advanced authentication systems. Network monitoring and security administration applications are also gaining momentum as enterprises invest in continuous threat detection. The expansion of cloud-based platforms and remote work practices reinforces the importance of robust user authentication mechanisms in the digital security control market.

Key Growth Drivers

Rising Incidence of Cyber Threats

Increasing frequency of phishing, ransomware, and identity theft incidents drives strong demand for digital security control systems. Organizations are investing heavily in multi-layered protection to safeguard sensitive data and ensure business continuity. Governments and enterprises prioritize robust authentication and access management solutions to reduce vulnerabilities. This rising threat landscape makes cybersecurity spending a strategic necessity, positioning advanced digital security solutions as a critical safeguard across industries.

- For instance, Cloudflare blocked an average of 209,000,000,000 threats per day in early 2024.

Rapid Digital Transformation Across Industries

The accelerated adoption of digital platforms, cloud computing, and IoT devices fuels the demand for secure access systems. Businesses are deploying authentication technologies to protect large volumes of interconnected data. Financial services, healthcare, and e-commerce sectors are leading adopters of digital security solutions to ensure compliance and safeguard user information. This shift toward digital operations strengthens the adoption of security controls to prevent unauthorized access and ensure trust across networks.

- For instance, Amazon reported 175,000,000 customers enabling passkeys for their accounts.

Expansion of Smart Devices and Connected Ecosystems

The growing use of smartphones, smart cards, and wearable devices enhances the need for integrated digital security frameworks. These devices rely on secure authentication systems for transactions, identity management, and access control. As connected ecosystems expand globally, enterprises prioritize advanced encryption and biometric-based verification technologies. The proliferation of connected infrastructure in banking, logistics, and retail sectors drives long-term growth in the digital security control market.

Key Trends & Opportunities

Integration of Artificial Intelligence in Security Systems

AI-powered security analytics and behavioral biometrics are emerging as key trends in digital security control. Artificial intelligence enables predictive threat detection and real-time response capabilities, reducing manual monitoring efforts. Machine learning algorithms enhance authentication accuracy and adapt to evolving attack patterns. Companies investing in AI-driven security frameworks gain competitive advantages through improved efficiency, faster risk assessment, and reduced breach incidents.

- For instance, NEC’s face recognition was benchmarked on a 12,000,000-person NIST 1:N dataset.

Rising Demand for Biometric Authentication Solutions

The increasing need for contactless, accurate, and user-friendly verification fuels demand for biometric technologies. Fingerprint, facial recognition, and iris scanning are becoming mainstream across financial institutions, airports, and corporate environments. The convenience of seamless identity verification without passwords enhances user experience while improving security. Ongoing advancements in sensor technology and AI-powered image analysis create new opportunities for biometric authentication providers.

- For instance, IDEMIA supports India’s Aadhaar program serving over 1,200,000,000 people. IDEMIA has been a partner in India’s Aadhaar program, which has grown to issue over 1.42 billion Aadhaar numbers to residents of India as of September 2025.

Key Challenges

High Implementation Costs and Infrastructure Complexity

Deploying digital security control systems involves significant investment in hardware, software, and skilled personnel. Small and medium-sized enterprises often face budget constraints that limit adoption. Integrating advanced authentication frameworks with legacy systems adds to technical complexity. These cost and compatibility barriers slow down market penetration, particularly in developing economies where cybersecurity budgets remain limited.

Data Privacy and Regulatory Compliance Issues

Strict data protection regulations such as GDPR and CCPA increase pressure on organizations to maintain compliance. Managing cross-border data flow while ensuring privacy remains challenging. Non-compliance risks financial penalties and reputational damage, discouraging rapid deployment of new technologies. The evolving regulatory landscape requires continuous updates in security protocols, increasing operational and compliance burdens for enterprises.

Regional Analysis

North America

North America held the largest share of around 36% in 2024, driven by advanced digital infrastructure and strict cybersecurity regulations. The United States leads adoption, supported by strong enterprise investments in authentication and encryption technologies. High awareness of data breaches and government-led initiatives for critical infrastructure protection fuel growth. Canada’s expanding fintech and healthcare sectors also drive security solution uptake. Increasing implementation of biometric verification in corporate and defense sectors continues to strengthen regional dominance, with cloud-based security frameworks becoming central to digital transformation strategies across industries.

Europe

Europe accounted for nearly 28% of the market share in 2024, supported by strong regulatory frameworks such as GDPR and eIDAS. The United Kingdom, Germany, and France drive adoption through financial institutions and public sector digitalization projects. Enterprises emphasize compliance-based security investments, leading to widespread use of multi-factor authentication and encryption tools. The region’s growing digital banking and e-commerce ecosystem accelerates demand for secure identity management solutions. Rising cyberattack incidents and government support for advanced authentication technologies further sustain Europe’s position as a key market for digital security control systems.

Asia Pacific

Asia Pacific captured around 24% of the market share in 2024, emerging as the fastest-growing region. Rapid digitization, rising mobile connectivity, and government-backed smart city projects drive demand. China, Japan, South Korea, and India are leading adopters of biometric and cloud-based security solutions. Expanding digital payment ecosystems and growing e-governance programs further enhance market potential. Enterprises across IT, manufacturing, and telecom sectors are integrating advanced security controls to combat data breaches. Increasing awareness of cybersecurity and ongoing investment in secure digital infrastructure continue to strengthen the region’s growth trajectory.

Latin America

Latin America represented about 7% of the global market share in 2024, with Brazil and Mexico leading adoption. Rising cybercrime incidents and regulatory reforms encouraging data protection are key growth drivers. The banking and telecom sectors are adopting biometric authentication and encrypted communication systems to enhance consumer trust. Governments are promoting digital identity frameworks to improve public service delivery. Despite challenges from limited infrastructure and budget constraints, rising awareness and cloud adoption trends are gradually boosting investments in advanced digital security control technologies across regional enterprises.

Middle East & Africa

The Middle East & Africa region accounted for nearly 5% of the global market share in 2024. Increasing digital transformation initiatives, especially in the UAE, Saudi Arabia, and South Africa, support market growth. Governments and financial institutions are investing in multi-factor authentication and AI-based monitoring systems to secure sensitive data. Expansion of e-government services and national digital identity programs further strengthen regional adoption. However, limited cybersecurity expertise and inconsistent infrastructure remain barriers. Continued investments in cloud platforms and partnerships with global cybersecurity firms are expected to enhance regional capabilities.

Market Segmentations:

By Hardware

- Smart Card

- Sim Card

- Biometric Technologies

- Others

By Technology

- Two-Factor Authentication

- Three-Factor Authentication

- Four-Factor Authentication

By Application

- Anti-Phishing

- User Authentication

- Network Monitoring

- Security Administration

- Web Technologies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Digital Security Control market is characterized by intense competition among leading technology providers such as Microsoft, Fortinet, Inc., RSA Security LLC, Cisco Systems, Inc., McAfee, LLC, Palo Alto Networks, Linked Security NY, Orbit Security Systems, Digital Security Concepts, and Hadrian Security. These companies compete through advanced authentication frameworks, cloud-based protection platforms, and AI-driven threat detection solutions. The market is witnessing a strong focus on integrating multi-factor authentication, endpoint protection, and real-time monitoring tools. Firms are expanding through partnerships, acquisitions, and product innovations to strengthen their portfolios and global reach. Growing enterprise demand for unified security architectures and compliance-driven frameworks fuels ongoing investments in R&D. Vendors are also emphasizing scalable, subscription-based models to cater to evolving cybersecurity needs across industries. Continuous innovation and strategic collaborations remain central to maintaining a competitive edge and addressing the increasing sophistication of digital threats across enterprise networks worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Microsoft

- Fortinet, Inc.

- RSA Security LLC

- Cisco Systems, Inc.

- McAfee, LLC

- Palo Alto Networks

- Linked Security NY

- Orbit Security Systems

- Digital Security Concepts

- Hadrian Security

Recent Developments

- In 2025, Fortinet Launched its AI-powered FortiMail Workspace Security suite and enhanced FortiDLP (Data Loss Prevention) to protect users and sensitive data across email, browsers, and collaboration tools. It also addressed threats from insider risks and AI-driven cyberattacks.

- In 2024, Cisco Systems Introduced “HyperShield,” a new AI-powered security product designed to turn all IT assets, including cloud-based resources and virtual machines, into security enforcement points.

- In 2024, Palo Alto Networks Launched Prisma SASE 3.0 to expand Zero Trust protection to devices, providing a natively integrated enterprise browser with AI-powered security.

Report Coverage

The research report offers an in-depth analysis based on Hardware, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as cyber threats continue to evolve globally.

- Multi-factor authentication systems will become standard across industries.

- AI-driven threat detection will strengthen security efficiency and response speed.

- Biometric verification will gain wider use in finance, healthcare, and government sectors.

- Cloud-based security platforms will dominate due to scalability and remote accessibility.

- Integration of blockchain will enhance data integrity and identity verification.

- Growing smart city projects will drive adoption of digital identity solutions.

- SMEs will increasingly invest in cost-effective authentication and encryption tools.

- Regulatory compliance will continue to shape innovation and product development.

- Strategic collaborations between cybersecurity firms and tech providers will accelerate market maturity.