Market Overview

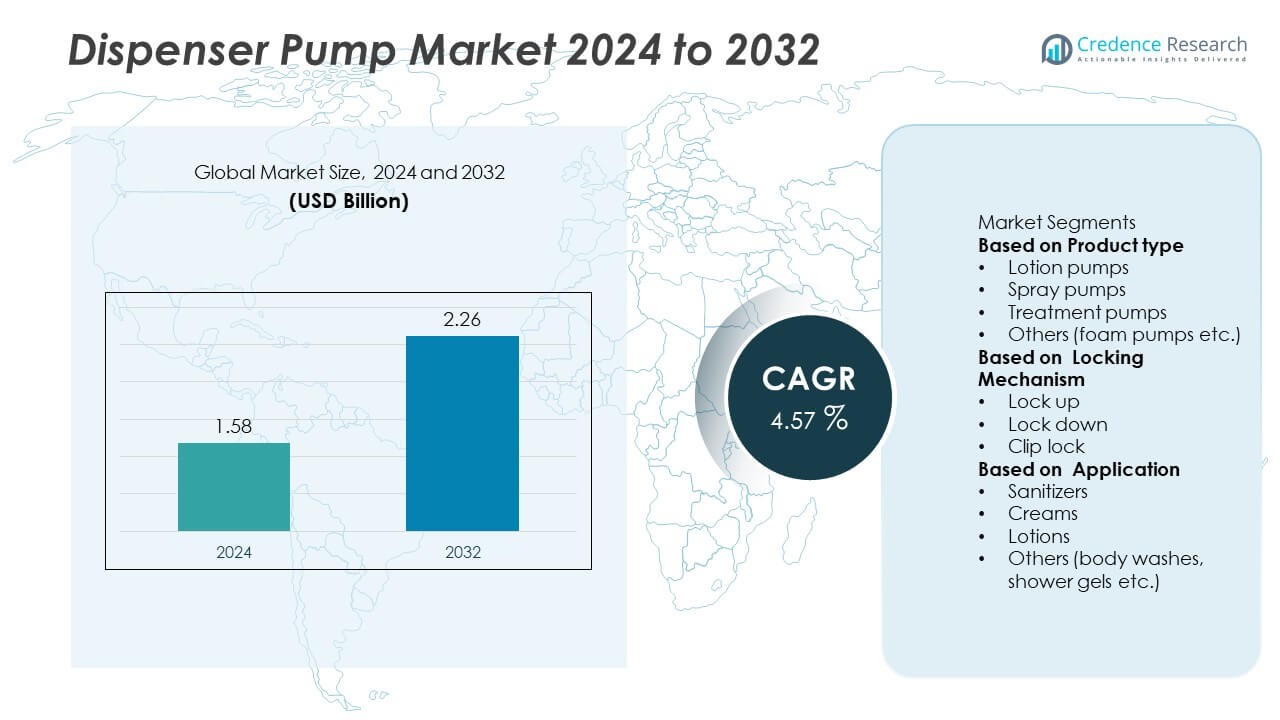

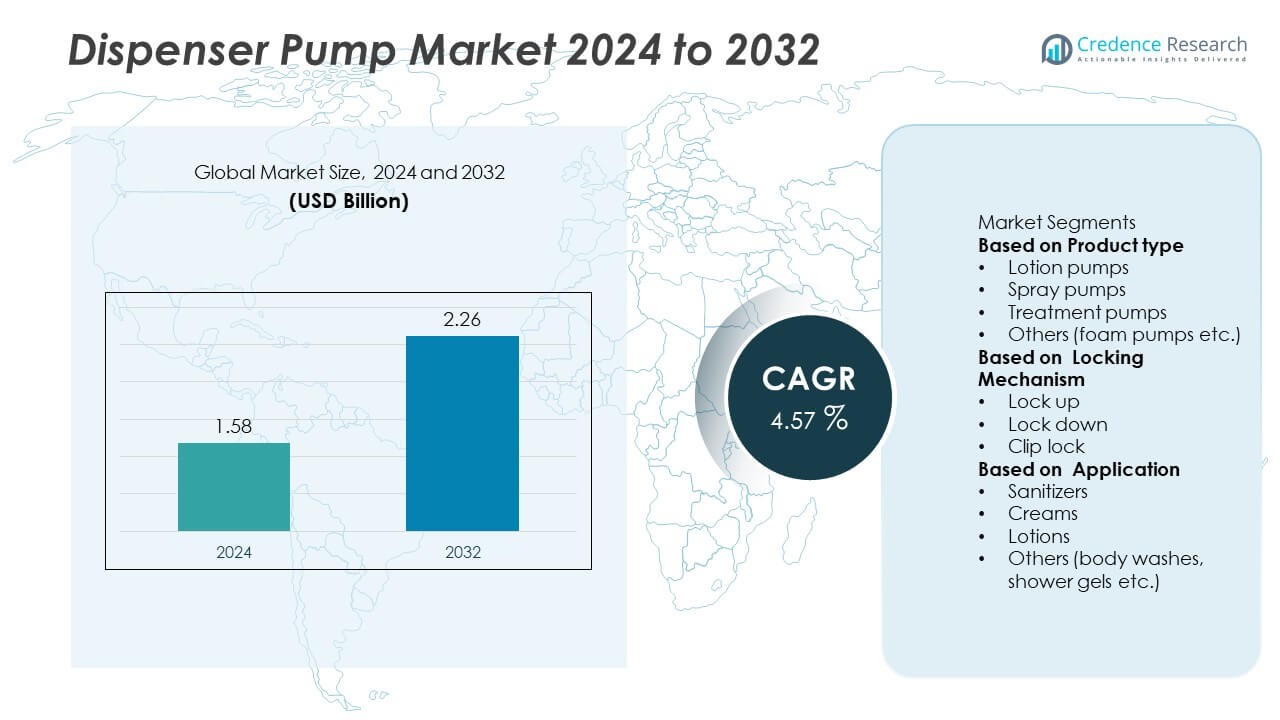

The Dispenser Pump market was valued at USD 1.58 billion in 2024 and is projected to grow to USD 2.26 billion by 2032, registering a CAGR of 4.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dispenser Pump Market Size 2024 |

USD 1.58 Billion |

| Dispenser Pump Market, CAGR |

4.57% |

| Dispenser Pump Market Size 2032 |

USD 2.26 Billion |

The top players in the dispenser pump market include Silgan Holdings, AptarGroup, Rieke, Richmond Containers CTP, and TAPLAST, which collectively hold a significant portion of the market share. These companies lead the market by focusing on innovation, quality, and global distribution networks. Their strong R&D investments and wide product offerings cater to various industries, including personal care, pharmaceuticals, and cleaning products. Silgan Holdings and AptarGroup, for instance, are recognized for their advanced dispensing solutions and eco-friendly materials. The leading region in the dispenser pump market is Asia-Pacific, commanding a market share of 38.45% in 2024, driven by rapidly growing consumer demand in countries like China and India. North America and Europe follow as key markets, accounting for substantial shares due to the high adoption of premium and sustainable dispensing systems. These regions continue to see growth due to evolving consumer preferences and increased demand for convenient, hygienic packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global market size reached USD 9.5 billion in 2024 and is forecast to grow at a CAGR of 4.8% through 2034.

- Rising hygiene awareness, growth in personal care products, and demand for controlled-dispensing packaging drive market expansion.

- Key trends include eco-friendly materials, touchless dispensing systems, and growth in e-commerce packaging channels.

- The market faces restraints from rising raw-material costs, supply chain volatility, and intense competitive pressure among global packaging suppliers.

- Regionally, Asia-Pacific led with about 38.45% share in 2024, followed by North America and Europe. The lotion-pump product type held roughly 43% of the product-type segment in that year.

Market Segmentation Analysis:

By Product Type:

The Dispenser Pump market is segmented by product type, with lotion pumps holding the largest share, 40%. Lotion pumps are highly popular due to their widespread use in personal care products such as lotions and creams. Spray pumps also capture a significant share, driven by their use in sanitizers, disinfectants, and cleaning products. Treatment pumps and other types like foam pumps are emerging sub-segments, contributing to market diversification. Lotion pumps dominate the segment, driven by their convenience and consumer demand for ease of use in daily skincare routines.

- For instance, Silgan Dispensing Systems provides foam formulation services and offers a wide variety of pumps to help customers achieve enhanced foam quality, consistent performance, and superior user experiences in the personal care sector.

By Locking Mechanism:

In the locking mechanism segment, the lock-up mechanism leads with the largest market share, around 45%. This type is favored for its secure closure, ensuring no product leakage during storage and transportation, which is crucial in consumer goods packaging. Lock-down mechanisms are gaining popularity for their simplicity and ease of use, particularly in personal care and healthcare products. Clip locks, though less common, hold a smaller share but are seeing growth in specialized applications. The lock-up mechanism continues to lead due to its reliability and demand for leak-proof dispensers.

- For instance, companies such as MeadWestvaco (now part of Smurfit Westrock) developed innovative packaging solutions like the child-resistant, senior-friendly Shellpak® Renew to improve medication adherence and the overall patient experience in the healthcare sector.

By Application:

The sanitizer application leads the dispenser pump market with a dominant share of 35%, driven by heightened hygiene awareness and ongoing demand for sanitizer products, especially post-pandemic. Creams and lotions follow closely in the market, contributing to strong growth due to their widespread use in personal care. Other applications, including body washes and shower gels, also show growth, driven by consumer preference for convenient, hygienic dispensing. Sanitizers continue to hold the largest share due to global health trends and the ongoing emphasis on hygiene.

Key Growth Drivers

Rising Demand for Hygienic Solutions

The growing global emphasis on hygiene, particularly post-pandemic, is a major driver for the Dispenser Pump market. Increased awareness of cleanliness has led to a surge in demand for hand sanitizers, disinfectants, and other hygiene products, which require dispenser pumps for convenient and hygienic usage. The need for safe, contactless dispensing systems is pushing innovation in the market, with consumers preferring products that minimize direct contact to prevent contamination. This shift is expected to continue fueling market growth over the forecast period.

- For instance, SC Johnson Professional, a company that provides the public with various hygiene solutions, manufactures touchless dispensers that eliminate common surface contact, which in general reduces the risk of cross-contamination compared to traditional manual pumps.

Expanding Personal Care Industry

The personal care and cosmetics industries are witnessing significant growth, contributing to the rising demand for dispenser pumps. Products such as lotions, creams, and shampoos require efficient, controlled dispensing, driving the adoption of various pump systems. The increasing consumption of skincare products globally, particularly in emerging markets, is propelling the demand for dispenser pumps. As more consumers seek convenience and precise product delivery, the market for dispenser pumps in personal care applications is expected to expand substantially.

- For instance, Silgan Dispensing Systems developed an airless pump for cosmetics, which helps to increase the shelf life of products by preventing exposure to air, oxidation, and contamination, ensuring a fresher and longer-lasting experience for consumers.

Technological Advancements in Pump Systems

Technological innovation plays a key role in the growth of the dispenser pump market. Manufacturers are focusing on improving pump efficiency, durability, and eco-friendliness through innovations such as eco-friendly materials, no-spill mechanisms, and ergonomic designs. The integration of smart technologies, including sensors for touchless operation, is enhancing user convenience, further driving the adoption of dispenser pumps across various sectors. As these technological advancements continue to evolve, they will likely open up new avenues for growth in both consumer and industrial applications.

Key Trends & Opportunities

Eco-friendly and Sustainable Packaging

Sustainability is becoming a significant trend in the dispenser pump market. Consumers and manufacturers alike are increasingly prioritizing eco-friendly solutions, including recyclable pumps and biodegradable materials. The push for sustainability is being driven by rising environmental concerns and regulations that encourage the reduction of plastic waste. Companies are innovating with pump systems made from recycled plastics or plant-based materials, catering to the growing demand for sustainable packaging. This trend aligns with the broader shift towards environmentally conscious consumption in the global market.

- For instance, AptarGroup introduced a dispenser pump made from 50% recycled plastic, reducing its carbon footprint by 20% compared to traditional pump systems. The push for sustainability is being driven by rising environmental concerns and regulations that encourage the reduction of plastic waste.

Increasing Adoption of Touchless Technology

There is a growing trend towards touchless dispensing solutions, particularly in public spaces and healthcare settings. Touchless dispenser pumps are becoming a preferred choice for hand sanitizers, soaps, and other hygiene products, reducing the risk of contamination. This trend is supported by technological advancements such as infrared sensors and motion detectors that allow for hands-free dispensing. The demand for these systems is expected to increase as hygiene standards become stricter, especially in high-traffic areas like airports, hospitals, and schools.

- For instance, Gojo Industries, the company behind PURELL hand sanitizer, pioneered electronic hand hygiene monitoring and touch-free dispensers. The PURELL SMARTLINK™ system uses IoT, sensors, and a cloud platform to automatically monitor dispenser usage and refill levels, providing data to improve hygiene compliance and efficiency in hospitals.

Growth in E-commerce and Online Retail

The rise of e-commerce is opening up new opportunities for the dispenser pump market. As more consumers shop online for personal care, hygiene, and cleaning products, the demand for dispenser pump packaging is increasing. E-commerce platforms are focusing on convenience, and products with user-friendly dispensing systems are in high demand. Additionally, online retailers are offering more customizable pump options to cater to individual preferences. This trend is expected to drive market growth, especially as consumers increasingly prioritize convenience in their online shopping experiences.

Key Challenges

Raw Material Costs and Supply Chain Issues

One of the key challenges faced by the dispenser pump market is the rising cost of raw materials and supply chain disruptions. The global supply chain has experienced significant challenges due to factors such as geopolitical tensions, the COVID-19 pandemic, and fluctuations in material prices. This has led to increased production costs for manufacturers of dispenser pumps. The volatility of plastic and metal prices, along with logistical issues, poses a significant challenge to maintaining competitive pricing and meeting growing demand in the market.

Intense Market Competition

The dispenser pump market is highly competitive, with numerous players offering similar products. This intense competition makes it difficult for companies to differentiate themselves and maintain market share. Price wars, product imitation, and innovation challenges put pressure on manufacturers to constantly improve their offerings. While innovation in design and functionality is one way to stand out, the overall competitive environment remains a challenge for companies seeking to secure a strong position in this market. Additionally, the dominance of established brands makes it hard for newer entrants to gain a foothold.

Regional Analysis

North America

North America accounted for roughly 32% market share in the global dispenser pump market in 2024. The region’s mature personal‑care industry and high adoption of sustainable packaging solutions support strong demand. Leading manufacturers benefit from advanced manufacturing infrastructure and consumer preference for premium dispensing systems. Regulations around hygiene and safety further stimulate uptake in hand sanitizers and lotions. Overall, North America remains a key growth contributor, with demand driven by innovation in dispenser pump technology and value‑added packaging solutions.

Europe

Europe held 28% market share in the dispenser pump market in 2024. Growth in this region is fuelled by the strong cosmetics sector in countries such as Germany, France and the UK, which drives demand for high‑quality dispenser pumps. Stringent environmental regulations push manufacturers towards eco‑friendly materials and refined designs. The region also benefits from widespread consumer awareness about personal care hygiene and convenience packaging. As a result, Europe remains a major region in terms of dispenser pump uptake and technology advancement.

Asia‑Pacific

Asia‑Pacific led the market with about 38% market share in 2024, the highest among all regions. Rapid industrialisation in China, India and Southeast Asia, combined with rising disposable incomes, increased demand for premium personal‑care and hygiene products available with dispenser pumps. The region also benefits from expanding e‑commerce channels and urbanisation which drive packaging innovations. Manufacturers are leveraging cost‑efficient local production and growing domestic consumption to secure strong market positions across the Asia‑Pacific region.

Latin America

Latin America captured around 7% of the global dispenser pump market share in 2024. Growth in this region is supported by rising middle‑class consumer spending on lotions, creams and sanitizers, especially in Brazil and Argentina. Packaged personal‑care and hygiene products increasingly rely on dispenser pumps for convenience and hygiene appeal. Challenges include economic volatility and supply‑chain constraints, but favourable demographics and increasing brand penetration suggest positive medium‑term prospects for the dispenser pump market in Latin America.

Middle East & Africa

The Middle East & Africa region held roughly 5% market share in 2024. Demand for dispenser pumps in this region is driven by expanding infrastructure, growing urban populations and increasing demand for premium personal‑care and hygiene products. Countries like Saudi Arabia and the UAE are investing in modern packaging and consumer goods markets that adopt advanced dispensing systems. However, the region faces challenges from economic instability and regulatory variability. Despite this, favourable demographic trends and rising health awareness present opportunities for growth in the dispenser pump market.

Market Segmentations:

By Product type

- Lotion pumps

- Spray pumps

- Treatment pumps

- Others (foam pumps etc.)

By Locking Mechanism

- Lock up

- Lock down

- Clip lock

By Application

- Sanitizers

- Creams

- Lotions

- Others (body washes, shower gels etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the dispenser pump market features key players such as Silgan Holdings Inc., AptarGroup, Inc., Rieke Corporation, Richmond Containers CTP Ltd and TAPLAST Srl among others. These firms lead the market through large-scale production capabilities, global distribution networks and strong brand recognition. They earn competitive advantage by investing heavily in R&D to develop sustainable materials and smart dispensing systems. Their broad product portfolios allow them to serve numerous end‑use applications across personal care, hygiene, and pharmaceuticals. Additionally, many firms actively pursue strategic acquisitions and partnerships to expand geographic reach and enhance technical capabilities. As such, new entrants face high barriers in terms of cost, innovation and supply‑chain integration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PKP Plastic Products

- DARIN

- Silgan Holdings

- Frapak Packaging

- Unicom International

- AptarGroup

- Richmond Containers CTP

- TYH Container Enterprise

- TAPLAST

- Rieke

Recent Developments

- In December 2024, Richmond Containers CTP Ltd launched the “Dawn Airless Range” of mono‑material PE (polyethylene) airless bottles and pumps, combining aesthetic packaging with recycling ease.

- In September 2024, Silgan Holdings Inc. (via its subsidiary Silgan Dispensing) introduced the “ReVive™ 1.4 cc” fully‑recyclable dispenser, an all‑plastic refill system built on its patented LifeCycle™ technology.

Report Coverage

The research report offers an in-depth analysis based on Product type, Locking Mechanism, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dispensers will shift strongly toward smart, connected systems with built‑in sensors and usage tracking.

- Refillable and reusable dispenser pump solutions will gain traction as brands push for sustainability and reduced waste.

- Premium applications in skincare and high‑end hygiene products will drive larger dispenser pump units and advanced materials.

- Growth in emerging markets, especially Asia‑Pacific, will boost dispenser pump uptake as disposable incomes and urbanisation increase.

- Formulations with higher viscosity will require specialised dispenser pumps, opening product innovation opportunities.

- Surge in online retail and direct‑to‑consumer sales will accelerate demand for compact, travel‑friendly dispenser pump formats.

- Regulatory pressure on single‑use plastics will compel manufacturers toward recyclable or bioplastic dispenser pump designs.

- Expansion in healthcare and pharmaceutical sectors will require sterile, lock‑down dispenser pumps with enhanced dosing control.

- Manufacturers will adopt advanced automation and production methods to control costs and adapt to raw‑material price volatility.

- Consolidation in the dispenser pump industry will increase as players pursue acquisitions to access new regions and technologies.