Market Overview:

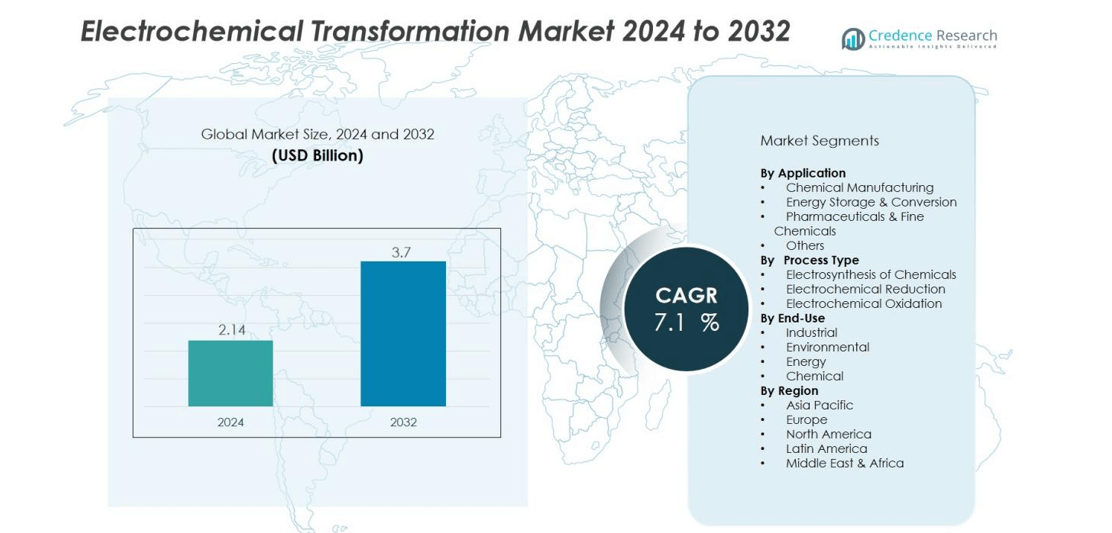

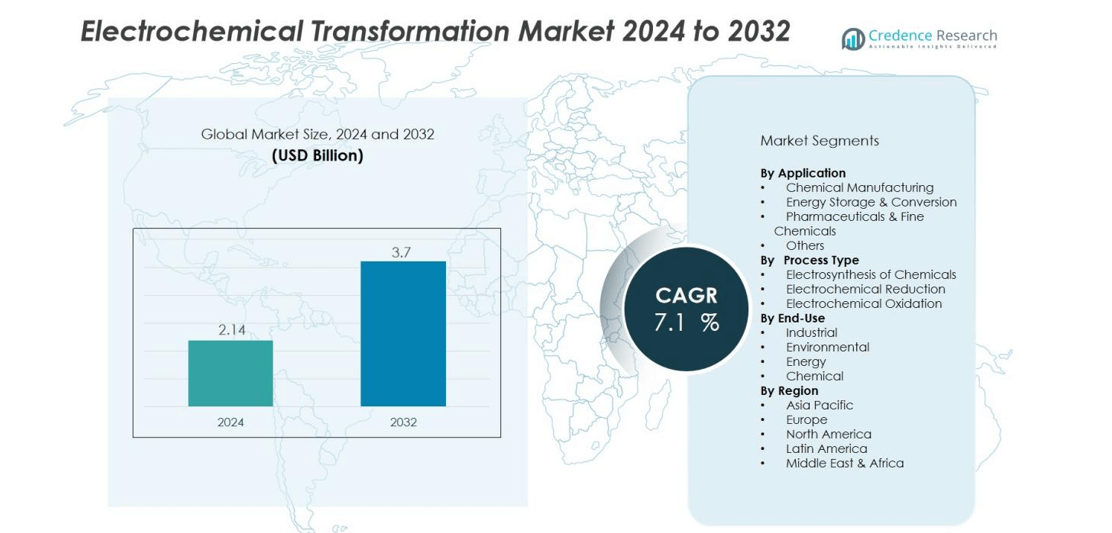

The Electrochemical Transformation Market size was valued at USD 2.14 billion in 2024 and is anticipated to reach USD 3.7 billion by 2032, at a CAGR of 7.1 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrochemical Transformation Market Size 2024 |

USD 2.14 billion |

| Electrochemical Transformation Market, CAGR |

7.1% |

| Electrochemical Transformation Market Size 2032 |

USD 3.7 billion |

Growth in this market is driven by increasing industrial demand for sustainable and energy-efficient chemical processes, tightening environmental regulations, and rising investments in decarbonisation technologies. Advances in material science—especially in electrodes, electrolytes, and catalysts—are enhancing performance and reducing energy consumption.

Regionally, North America is seeing steady adoption with the market in the region valued at about USD 572.3 million in 2023 and expected to grow at a CAGR of around 8.5% through 2032. Meanwhile, Europe and the Asia-Pacific region are expanding rapidly, with Asia-Pacific poised to outpace other regions due to strong manufacturing bases, supportive policies, and growing chemical and energy demand.

Market Insights:

- The Electrochemical Transformation Market was valued at USD 2.14 billion in 2024 and is anticipated to reach USD 3.7 billion by 2032, growing at a CAGR of 7.1% during the forecast period.

- North America holds a market share of 35%, Europe has a share of 30%, and Asia-Pacific commands 25%. North America’s strong infrastructure, research investment, and government incentives contribute to its leading position. Europe benefits from circular economy policies, while Asia-Pacific is expanding rapidly due to low-cost manufacturing and high demand for chemicals.

- Asia-Pacific is the fastest-growing region, with a significant increase in chemical processing, energy storage, and waste-stream valorization. Its share is expected to grow due to investments in battery materials and hydrogen infrastructure.

- The Electrochemical Transformation Market is dominated by the electrosynthesis of chemicals segment, while the electrochemical reduction segment is seeing strong demand for CO2 conversion and metal recovery.

- The market shows increasing adoption across energy storage and conversion applications, along with chemical manufacturing, where sustainability and energy efficiency drive adoption of electrochemical processes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Sustainable and Energy-Efficient Processes

The Electrochemical Transformation Market is driven by the increasing global emphasis on sustainability and energy efficiency in industrial processes. Manufacturers across sectors are seeking cleaner, more cost-effective alternatives to traditional chemical production methods. Electrochemical processes offer lower energy consumption, reduced greenhouse gas emissions, and minimal waste generation. This shift aligns with global efforts to meet stricter environmental regulations and achieve carbon neutrality targets.

- For instance, the advanced chlor-alkali technology project at the U.S. Department of Energy successfully developed “zero-gap” oxygen-depolarized cathode cells that achieved energy savings of 38% at standard industrial current densities of 0.31 amperes per square centimeter (A/cm²), compared to conventional membrane cells that consume approximately 2,500 kilowatt-hours per metric ton of chlorine.

Technological Advancements in Electrochemical Materials and Catalysts

Technological innovations in electrochemical materials and catalysts significantly boost market growth. Advancements in electrode materials, such as carbon-based and nanomaterials, enhance the efficiency and performance of electrochemical systems. Moreover, the development of new electrolytes and catalysts allows for more efficient reactions and expanded applications across industries. These innovations improve the overall cost-effectiveness and applicability of electrochemical transformation processes.

Government Policies and Regulatory Support

Government policies and regulations are vital drivers of the Electrochemical Transformation Market. Governments worldwide are increasingly focused on sustainability and clean energy, offering incentives and grants for adopting green technologies. These policies are driving the transition from conventional chemical processes to more sustainable electrochemical alternatives. Stringent environmental regulations further compel industries to adopt low-emission, energy-efficient solutions, benefiting the market.

- For Instance, BASF continued to invest in electrochemical research and, as part of Germany’s Hydrogen Strategy, completed the construction of a 54-megawatt proton exchange membrane (PEM) electrolyzer at its Ludwigshafen site, which went into operation in March 2025.

Expansion of the Renewable Energy and Chemical Industries

The expanding renewable energy and chemical industries contribute to the growth of the Electrochemical Transformation Market. Electrochemical technologies play a crucial role in the storage and conversion of renewable energy, such as in hydrogen production and energy storage systems. Additionally, the increasing demand for eco-friendly chemical products pushes industries to invest in electrochemical processes, further driving market expansion.

Market Trends:

Advanced Reactor Designs and Modular Production Models

he Electrochemical Transformation Market shows rising interest in modular reactor systems that simplify onsite installation and scale‑up. Firms deploy plug‑and‑play electrochemical units that reduce commissioning time and adapt to diverse chemical processes. Innovations in flow reactors, membrane‑based systems and compact electrolytic cells boost system flexibility and reduce footprint. These technical enhancements lower capital and operating expenses, thereby accelerating adoption. Industry participants integrate digital monitoring and process control to optimise performance across installations.

- For Instance, SIWA Optim app have demonstrated the ability to reduce energy consumption and costs by up to 15% in applications such as optimizing pump and valve schedules for water supply networks.

Integration with Circular Economy and Carbon‑Utilisation Pathways

The market embraces electrochemical pathways that convert CO₂, hydrogen and waste streams into value‑added chemicals and fuels. It leverages energy from renewable sources to perform chemical transformations at relatively low temperature and pressure. Stakeholders in petrochemicals, speciality chemicals and fuels increasingly adopt electrochemical conversion to reduce carbon intensity. Partnerships between energy companies and chemical producers foster deployment of such low‑carbon solutions. Rising corporate commitments to net‑zero targets further push investment into these circular economy models.

- For instance, Graphitic Energy (formerly C-Zero), which has received investment from entities including Shell Ventures, commissioned a pilot plant in San Antonio, Texas, in March 2025. The facility produces several hundred kilograms of clean hydrogen and up to 1,000 kg of solid graphitic carbon per day, with plans to operate through the end of 2025, virtually preventing direct CO₂ emissions during the process.

Market Challenges Analysis:

High Capital Expenditure and Energy‑Intensive Operation

The Electrochemical Transformation Market faces considerable upfront capital demands that limit early‐stage adoption. Setting up reactors, catalysts and control systems demands large investment. It requires continuous electricity input and skilled personnel, which increases operational expenditure. Efficiency of electrochemical conversion varies with feed quality, temperature and chemical composition, adding operational complexity. Industries in regions with high electricity tariffs may hesitate to deploy these technologies due to cost sensitivity.

Scalability and Commercialisation Barriers Across Sectors

This market struggles with the gap between laboratory innovations and full‐scale industrial deployment. Many electrochemical methods work at bench scale but require redesign for large reactors and continuous operation. Material durability, catalyst stability and system integration continue to pose hurdles when scaling. It demands rigorous process validation and regulatory approval in chemical manufacturing settings. Market players must coordinate among equipment makers, operators and suppliers to overcome these barriers.

Market Opportunities:

Emerging Application Horizons in Chemicals and Materials Sectors

The Electrochemical Transformation Market can capture opportunity through the expanding demand for speciality and fine chemicals produced via electrochemical routes. It offers manufacturers a pathway to create high‑value chemical intermediates with lower emissions and higher selectivity. Firms that adopt electrochemical methods for synthesising polymers, catalysts and battery‑grade materials gain competitive advantage. Growth in the battery sector and electronics supply chain supports uptake of electrochemical production technologies. Partnerships between chemical firms and equipment suppliers enable tailored reactor solutions and faster commercialisation. Access to such value‑added markets accelerates investment in this technology domain.

Decarbonisation and Circular Economy Driven Growth Models

The market benefits from industry decarbonisation initiatives and circular economy strategies that deploy electrochemical systems for CO₂ conversion, hydrogen generation and waste‑stream valorisation. It enables firms to turn carbon or waste feedstocks into useful products under electricity‑driven processes. Renewable power integration strengthens business cases for electrochemical units in green chemical plants. Public‑private funding for low‑carbon technologies opens door to pilot projects and scale‑ups. Companies that position themselves as eco‑friendly solution providers attract regulatory support and market differentiation. These developments underpin long‑term growth prospects in the electrochemical transformation space.

Market Segmentation Analysis:

By Process Type

The Electrochemical Transformation Market divides majorly into electrosynthesis of chemicals, electrochemical reduction, and electrochemical oxidation. The electrosynthesis of chemicals segment holds strong presence due to its broad utility in specialty chemical production. The electrochemical reduction segment gains traction through carbon dioxide conversion and metal recovery applications. The electrochemical oxidation segment sees demand in wastewater treatment and pollutant degradation contexts. Together these sub‑segments allow process providers to target tailored reactions and efficiency improvements.

- For Instance, pH7 Technologies has demonstrated advanced electrochemical metal recovery capabilities, processing over 250 tonnes of end-of-life spent catalyst materials and recovering more than 3,000 troy ounces of platinum group metals equivalent, with capacity expansion targeted to reach 25,000 tonnes per year by 2028.

By Application

Applications in this market cover chemical manufacturing, energy storage & conversion, pharmaceuticals & fine chemicals, and others. The chemical manufacturing segment attracts investment because firms pursue low‑waste production and green chemistry routes. The energy storage & conversion segment grows thanks to the push for hydrogen production, battery materials and grid integration. The pharmaceuticals & fine chemicals segment picks up demand from companies seeking high‑purity intermediates and selective reaction paths. Each application niche offers unique value‑chain opportunities for technology suppliers and end‑users.

- For instance, in 2023, Lonza completed several expansions at its Visp facility, including new bioconjugation suites and a mid-scale microbial manufacturing facility with two 4,000-liter fermenters, to support the development and manufacture of complex medicines.

By End‑Use

The end‑use segmentation of the Electrochemical Transformation Market includes industrial, environmental, energy and chemical sectors. The industrial sector stands largest as manufacturers adopt electrochemical technologies for production and resource recovery. The environmental sector expands with demand for water treatment, waste remediation and circular‑economy processes. The energy sector accelerates growth through clean fuel production, battery platforms and hydrogen pathways. The chemical sector focuses on fine chemicals, specialty materials and advanced intermediates that leverage electrochemical routes. End‑users across all sectors drive differentiated demand, creating multiple entry points for market participants.

Segmentations:

By Process Type

- Electrosynthesis of Chemicals

- Electrochemical Reduction

- Electrochemical Oxidation

By Application

- Chemical Manufacturing

- Energy Storage & Conversion

- Pharmaceuticals & Fine Chemicals

- Others

By End-Use

- Industrial

- Environmental

- Energy

- Chemical

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Regional Dynamics

North America holds a market share of approximately 35 % in the Electrochemical Transformation Market. The region benefits from strong infrastructure, leading chemical manufacturers, and significant research investment in electrochemical technologies. Corporations deploy innovative reactors and catalysts to reduce waste and energy usage in production. Government incentives for clean chemistry and decarbonisation further bolster growth. The United States leads in project count and capital deployment for industrial scale electrochemical solutions. High electrification of processes and emphasis on sustainable outputs reinforce regional demand.

Europe Regional Dynamics

Europe commands a market share of about 30 % in this market. Companies in Germany, France and the UK adopt electrochemical platforms for fine chemicals, hydrogen production and carbon‑utilisation pathways. Renewable electricity integration and circular economy policies create favourable conditions for uptake. Regional legislation mandates lower emissions, driving manufacturers toward electrochemical methods. The supply‑chain for advanced materials and catalysts strengthens competitive positioning. Collaborative initiatives between industry and academia accelerate commercialisation of new reactor designs.

Asia‑Pacific Regional Dynamics

Asia‑Pacific registers a market share near 25 % in the Electrochemical Transformation Market. Rapid industrialisation in China, India and Southeast Asia drives demand for chemical processing, energy storage and waste‑stream valorisation. Local governments support domestic manufacture of electrochemical systems to reduce import reliance. The region’s low‑cost manufacturing base and scaling capabilities provide an advantage for new plants. Investments in battery materials and hydrogen infrastructures open parallel growth paths for electrochemical processes. Rising regional consumption of speciality chemicals and fuels further augments demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Invista

- Solvay

- Kemira

- DuPont

- Eastman Chemical Company

- Lanxess

- Evonik Industries

- Wacker Chemie AG

- Olin Corporation

- TPC Group

- Toray Industries

- Arkema

- Clariant

- ICL

- The Dow Chemical Company

Competitive Analysis:

Major players such as Invista, Solvay, Kemira, DuPont and Eastman Chemical Company compete on technology innovation, global footprint and cost efficiency. Each firm holds strong expertise in materials science, catalysts and electrochemical process design, which drives differentiation.

It benefits companies that integrate proprietary electrode materials, efficient reactor designs and scale‑up capabilities. Some firms prioritise partnerships and acquisitions to accelerate access to new markets or technologies. Competitive pressure forces participants to continuously demonstrate lower energy use, higher conversion yields and regulatory compliance. Markets with high entry barriers—such as electrochemical conversion for CO₂ or specialty chemicals—offer advantage to established players. Firms that secure long‑term enterprise contracts or collaborate with renewable energy providers strengthen their market position.

Recent Developments:

- In September 2025, Invista formed a strategic partnership with Koch Technology Solutions to accelerate the deployment of Invista’s nitrous oxide (N2O) abatement technology in industrial facilities.

- In September 2025, DuPont announced its agreement to acquire Sinochem (Ningbo) RO Memtech Co., Ltd., expanding its reverse osmosis membrane manufacturing capacity in China.

Report Coverage:

The research report offers an in-depth analysis based on Process Type, Application, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Industry players will expand partnerships with renewable‑power providers to deploy electrochemical systems.

- Companies will integrate digital monitoring and process control platforms into reactor operations.

- Electrochemical technologies will enter new feedstock streams, including CO₂ and waste gases, for conversion to value‑added chemicals.

- Equipment manufacturers will offer modular electrochemical units for rapid scale‑up in manufacturing plants.

- Catalyst and membrane suppliers will reduce costs and enhance durability to support industrial adoption.

- Chemical producers will convert traditional thermal processes to electrochemical routes for lower emissions and lower energy consumption.

- Regions with large manufacturing bases and strong policy support will attract electrochemical manufacturing investments.

- Business models will shift toward service‑based offerings such as “electro‑chemistry as a service” for smaller firms.

- Regulatory mandates for decarbonisation will drive demand for electrochemical transformation solutions in industries such as chemicals, refining and energy.

- Academic and industrial research will refine paired electrolysis and hybrid systems to enable higher efficiencies and broaden application scope.