Market Overview

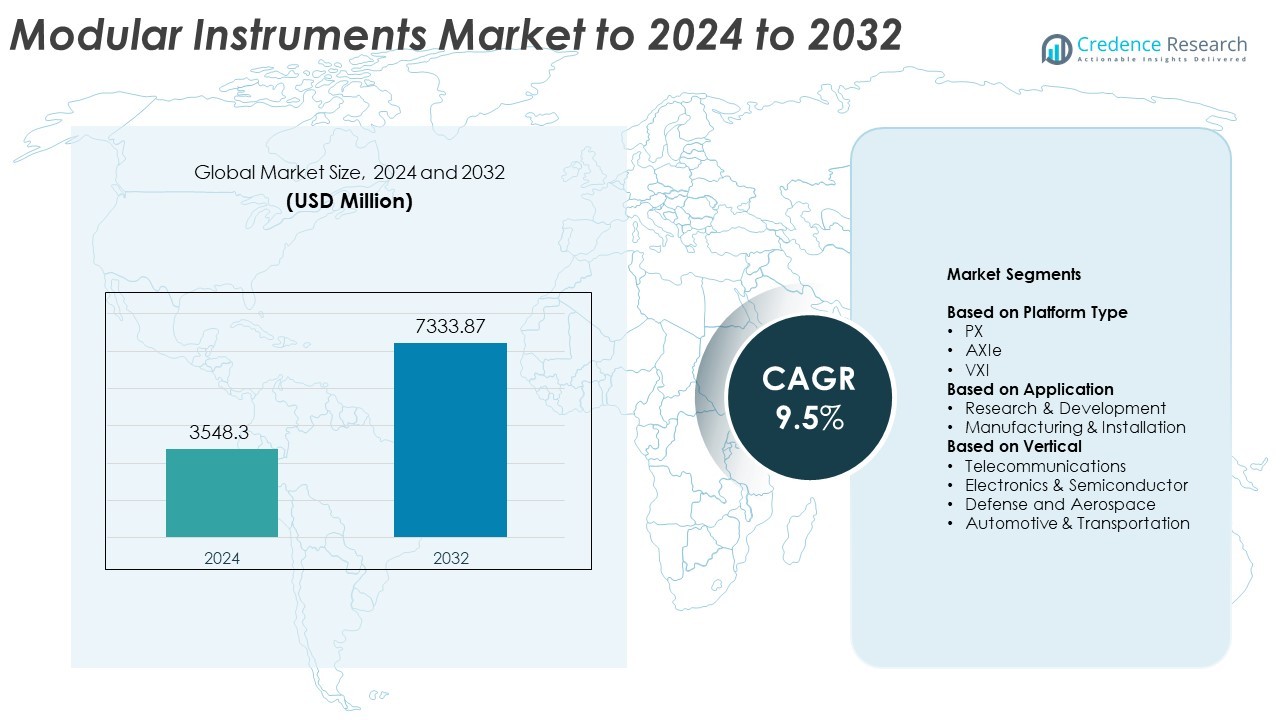

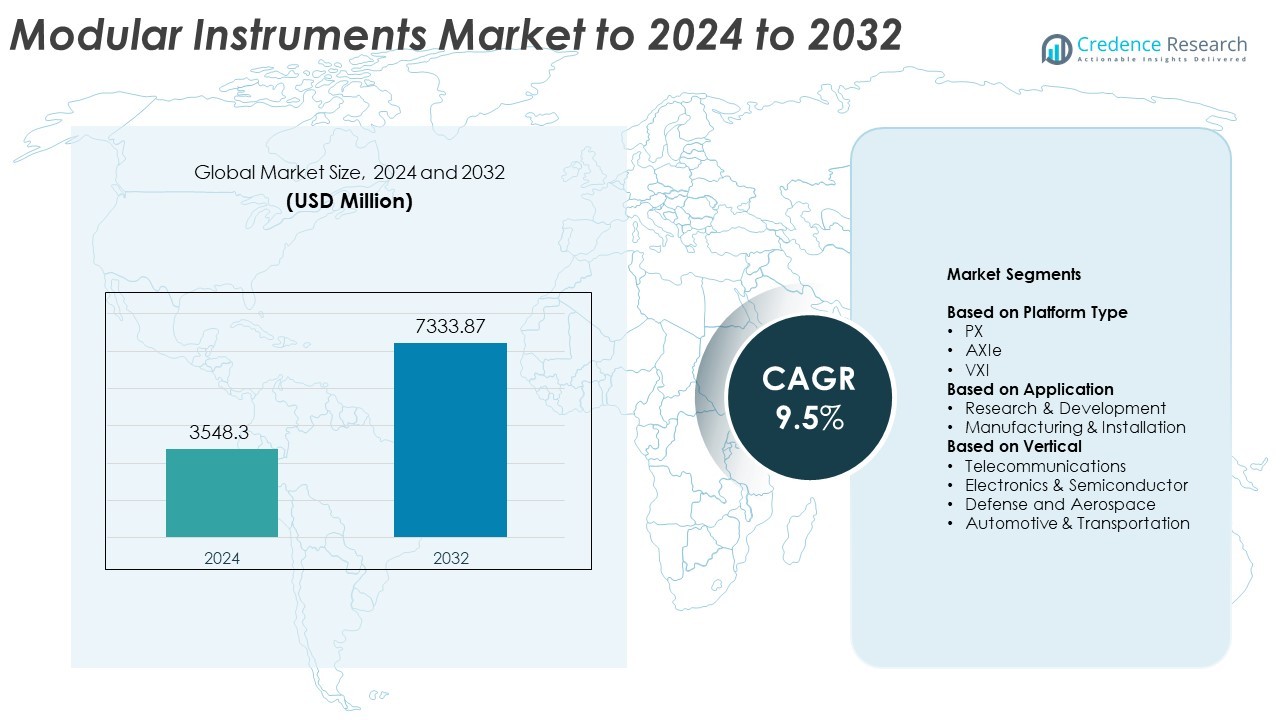

Modular Instruments Market size was valued USD 3548.3 million in 2024 and is anticipated to reach USD 7333.87 million by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Modular Instruments Market Size 2024 |

USD 3548.3 Million |

| Modular Instruments Market, CAGR |

9.5% |

| Modular Instruments Market Size 2032 |

USD 7333.87 Million |

The Modular Instruments Market includes major players such as Pickering, Delta Electronics, Inc., AMETEK, Inc., Picotest Corp, Keysight Technologies, Astronics Corporation, Advantest Corporation, Rohde & Schwarz, Fortive Corporation, and Agilent Technologies, each contributing to technological advancement and broader adoption. These companies compete by improving measurement speed, software control, and scalability for use in electronics, telecommunications, automotive, and aerospace testing. North America leads the global market with about 36.0 % share in 2024, supported by strong R&D activity and advanced manufacturing. Asia Pacific and Europe follow as significant contributors due to rapid industrialisation, semiconductor growth, and expanding 5G infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Modular Instruments Market was valued at USD 3548.3 million in 2024 and is projected to reach USD 7333.87 million by 2032, growing at a CAGR of 9.5 %.

• Growth is driven by rising demand for high-speed electronic testing, strong adoption in 5G and IoT development, and increased use of automated testing in R&D environments where the segment holds about 58 % share.

• Key trends include rapid expansion of software-defined testing, higher use of modular RF platforms, and strong uptake of PX-based systems, which lead the platform segment with nearly 63 % share.

• Market competition intensifies as global vendors invest in AI-enabled diagnostics, high-density modules, and cloud-integrated testing to reduce test cycles and enhance measurement accuracy across advanced applications.

• North America leads the market with around 36 % share, followed by Europe at about 26.5 % and Asia Pacific at roughly 26.6 %, driven by semiconductor growth, 5G rollout, and rising electronics manufacturing.

Market Segmentation Analysis:

By Platform Type

PX leads this segment with about 63% share in 2024. PX systems dominate due to strong scalability, high channel density, and broad vendor support for automated test setups. Industries prefer PX because the platform reduces system footprint, supports faster data throughput, and offers wide compatibility with RF, modular DAQ, and mixed-signal testing. AXIe gains traction in high-performance computing and radar testing, while VXI maintains use in legacy defense and aerospace programs that still rely on established instrument architectures.

- For instance, the NI PXIe-1092 chassis is a high-performance PXI Express chassis that features a total of 10 slots, comprising one system slot, eight PXI Express peripheral slots, and one PXI Express peripheral expansion slot.

By Application

Research and Development dominates this segment with nearly 58% share in 2024. Demand increases as laboratories and design teams use modular instruments for faster prototyping, validation, and mixed-signal analysis. R&D teams choose modular systems because these platforms support flexible configuration, real-time data acquisition, and rapid upgrades during product development cycles. Manufacturing and installation applications grow as factories automate quality testing, improve calibration precision, and meet rising production standards for electronics and communication devices.

- For instance, the Keysight M9410A PXIe vector transceiver (VXT) integrates a vector signal generator (VSG) and a vector signal analyzer (VSA) in a 2-slot module, It offers analysis bandwidth options of 300 MHz, 600 MHz, and a maximum of 1.2 GHz

By Vertical

Electronics and Semiconductor holds the largest share in this segment with about 46% in 2024. Adoption rises as chipmakers and electronics firms rely on modular instruments for precise RF testing, high-speed signal analysis, and automated validation of integrated circuits. The vertical favors modular platforms because they reduce test time, enhance measurement accuracy, and support parallel testing needed for high-volume production. Telecommunications grows with 5G rollouts, while defense and aerospace and automotive and transportation expand due to rising demand for advanced radar, EV electronics, and safety system testing.

Key Growth Drivers

Rising Demand for High-Performance Electronic Testing

The need for faster, accurate, and flexible testing solutions drives strong demand for modular instruments across electronics, semiconductor, and telecom industries. Companies adopt these systems to support advanced RF testing, high-speed data analysis, and automated validation. Modular platforms help reduce test time, enhance measurement precision, and support rapid upgrades, which aligns well with shrinking product cycles. Growth accelerates as manufacturers integrate complex chipsets, high-frequency components, and mixed-signal designs that require scalable and software-driven testing architectures.

- For instance, Rohde & Schwarz offers the high-performance RTP family of oscilloscopes. The lower-end models, such as those with bandwidths up to 8 GHz, have a maximum sampling rate of 40 Gsample/s, but this rate is available on only two channels simultaneously, dropping to 20 Gsample/s per channel across all four channels.

Expansion of 5G, IoT, and Advanced Communication Networks

The deployment of 5G networks and rapid growth in IoT devices push organizations to adopt next-generation testing setups. Modular instruments support wide bandwidths, multi-channel analysis, and dynamic signal environments required in modern telecom ecosystems. Operators and equipment providers rely on modular platforms to evaluate network reliability, validate RF modules, and optimize latency-sensitive applications. Demand grows further as industries integrate mmWave technologies, low-power IoT chips, and advanced antenna systems that require adaptable and high-throughput testing tools.

- For instance, Anritsu’s MS2850A signal analyzer supports a 1 GHz modulation bandwidth and frequency coverage up to 44.5 GHz.

Rising Automation in Manufacturing and Quality Control

Factories increasingly shift to automated test environments to improve efficiency, maintain consistency, and reduce operational errors. Modular instruments play a central role in automated workflows by enabling parallel testing, remote configuration, and seamless integration with production lines. Their compact form factor and plug-and-play scalability help manufacturers adapt to varied product requirements. Growth strengthens as more industries adopt Industry 4.0 practices, implement predictive maintenance, and introduce high-precision inspection systems that depend on modular test equipment.

Key Trends and Opportunities

Growing Adoption of Software-Defined and AI-Driven Testing

Software-defined measurement systems and AI-enabled analytics reshape the future of modular testing. Companies deploy adaptive test platforms that automatically adjust parameters, improve detection accuracy, and shorten validation cycles. AI models analyze large volumes of measurement data to optimize performance and predict failures early. This shift creates strong opportunities for vendors offering advanced algorithms, cloud-based test management, and machine-learning-enhanced diagnostics. Demand grows as testing environments become more complex and data-centric.

- For instance, The Viavi Solutions TM500 test platform is an industry-standard solution utilized by the majority of wireless equipment manufacturers to validate the performance of base stations (gNB) and O-RAN components. This system is highly scalable and used globally by network operators and manufacturers to test 3GPP and O-RAN features across the entire protocol stack.

Increasing Use of Modular Platforms in Semiconductor Fabrication

Semiconductor production requires precise, repeatable, and high-speed testing, creating a strong opportunity for modular instruments. These systems handle mixed-signal verification, RF measurement, wafer-level testing, and reliability assessments across advanced nodes. As chip designs become more compact and heterogeneous, manufacturers seek modular setups that support rapid configuration and multi-site testing. The trend strengthens with rising demand for AI chips, EV electronics, and high-performance computing processors that depend on robust validation environments.

- For instance, The Tokyo Electron CELLESTA™ SCD system is a single-wafer cleaning system introduced for advanced semiconductor manufacturing to prevent pattern collapse using a supercritical fluid drying method. The throughput for the CELLESTA™-i MD model, which uses a different (New IPA/SMD) drying method, is typically around 650 wafers per hour (wph)”.

Key Challenges

High Initial Investment and Integration Complexity

Modular instruments offer long-term benefits but often require significant upfront investment, especially for small and mid-scale facilities. Integrating these systems with legacy equipment and custom test setups can add complexity and cost. Organizations may need specialized software, skilled technicians, and tailored calibration processes. These factors create barriers for firms with limited technical expertise or tight capital budgets, slowing adoption in emerging markets and cost-sensitive industries.

Growing Cybersecurity and Data Management Concerns

As modular instrument platforms become more connected and software-driven, cybersecurity risks increase. Test environments generate large volumes of sensitive performance and design data that must be protected. Unauthorized access or system breaches can disrupt testing workflows, compromise IP, and damage product integrity. Managing secure communication, data storage, and real-time analytics adds extra pressure on organizations with limited IT infrastructure. These challenges intensify as cloud-based and remote testing environments expand.

Regional Analysis

North America

The North America region held approximately 36.0 % share of the global modular instruments market in 2024. Strong R&D investments, leading electronics and defence industries, and early adoption of Industry 4.0 technologies drive growth. The presence of established test-and-measurement vendors and steady roll-out of 5G infrastructure further support the region’s dominance. Manufacturers prioritize modular platforms to rapidly validate high-complexity devices in aerospace, telecom and semiconductors, reinforcing North America’s position as the largest regional market.

Europe

Europe accounted for around 26.5 % share of the modular instruments market in 2024. The region’s advanced manufacturing base in automotive, aerospace and electronics sectors fuels demand for precision test systems. Stringent regulatory standards and sustainability mandates compel companies to adopt modular instruments for compliance, quality assurance and automation. Growth is further supported by government initiatives toward smart factories and digital transformation. Europe thus offers a mature yet steadily expanding market environment.

Asia Pacific

Asia Pacific captured about 26.6 % share of the global modular instruments market in 2024. Rapid industrialisation in China, India, Japan and South Korea drives demand for modular testing platforms in electronics, telecommunications and automotive sectors. Significant investments in semiconductor fabrication, 5G deployment and smart manufacturing underpin regional growth. While the base is smaller than North America, the region offers the fastest growth trajectory and rising contribution to global market value.

Latin America

Latin America held an estimated share of approximately 6 % of the modular instruments market in 2024. The region’s growth stems from increasing telecommunications upgrades, manufacturing automation and infrastructure development. However, adoption remains constrained by lower R&D intensity, limited local manufacturing scale and budgetary constraints. Suppliers view Latin America as an emerging opportunity for modular instrument expansion, particularly as OEMs seek cost-effective test solutions.

Middle East & Africa

The Middle East & Africa region represented approximately 6 % share of the global modular instruments market in 2024. Growth is driven by rising defence modernisation, smart infrastructure projects and telecommunications expansion in Gulf-Cooperation Council (GCC) countries. Nonetheless, slower industrial penetration, lower technology adoption and fewer test-equipment investments temper momentum. Vendors are increasingly targeting this region for future deployments as digitalisation and automation agendas accelerate.

Market Segmentations:

By Platform Type

By Application

- Research & Development

- Manufacturing & Installation

By Vertical

- Telecommunications

- Electronics & Semiconductor

- Defense and Aerospace

- Automotive & Transportation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Modular Instruments Market features leading companies such as Pickering, Delta Electronics, Inc., AMETEK, Inc., Picotest Corp, Keysight Technologies, Astronics Corporation, Advantest Corporation, Rohde & Schwarz, Fortive Corporation, and Agilent Technologies. Competition intensifies as vendors focus on expanding product portfolios, enhancing measurement accuracy, and strengthening software integration to support advanced testing environments. Manufacturers invest in high-density modules, faster data acquisition systems, and flexible architectures to meet rising demand across electronics, telecommunications, automotive, and aerospace sectors. Companies also emphasize partnerships, technology upgrades, and platform interoperability to improve user adoption. Increased attention toward AI-enabled testing, remote diagnostics, and cloud-based management further shapes competitive strategies. As industries embrace automation and digital transformation, market players differentiate through performance, scalability, and reduced test cycle times, driving sustained innovation across modular platforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pickering

- Delta Electronics, Inc.

- AMETEK, Inc.

- Picotest Corp

- Keysight Technologies

- Astronics Corporation

- Advantest Corporation

- Rohde & Schwarz

- Fortive Corporation

- Agilent Technologies

Recent Developments

- In 2025, Advantest launched new machine learning-driven solutions for semiconductor testing, combining NVIDIA’s AI infrastructure with the Advantest Cloud Solutions Real-Time Data Infrastructure (ACS RTDI™).

- In 2024, Agilent Technologies acquired Sigsense Technologies, an AI-powered startup based in San Francisco. This technology is designed to enhance lab operations by monitoring modular instruments’ utilization and performance, integrating with Agilent’s CrossLab Connect to optimize scientific asset efficiency and improve lab productivity.

- In 2024, AMETEK, Inc. acquired Virtek Vision International, a company specializing in advanced laser-based projection and inspection. This expanded AMETEK’s modular instruments portfolio, particularly for automated 3D scanning, inspection, and quality control in aerospace, defense, and industrial sectors.

Report Coverage

The research report offers an in-depth analysis based on Platform Type, Application, Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as industries adopt faster and more flexible automated testing systems.

- Demand will rise due to growing complexity in semiconductors, electronics and communication devices.

- 5G, IoT and advanced connectivity deployments will accelerate investments in modular platforms.

- AI-driven analytics will enhance accuracy, speed and adaptability in test environments.

- Software-defined instruments will gain traction as companies shift toward scalable digital architectures.

- Manufacturers will increase adoption to support Industry 4.0 upgrades and smart factory integration.

- R&D laboratories will continue to prioritise modular systems for rapid prototyping and validation.

- Compact, high-density and multi-channel modules will see greater demand across high-performance sectors.

- Cloud-enabled test solutions will grow as remote monitoring and data management become essential.

- Emerging markets will offer new opportunities as industrial automation and telecom expansion accelerate.