Market Overview

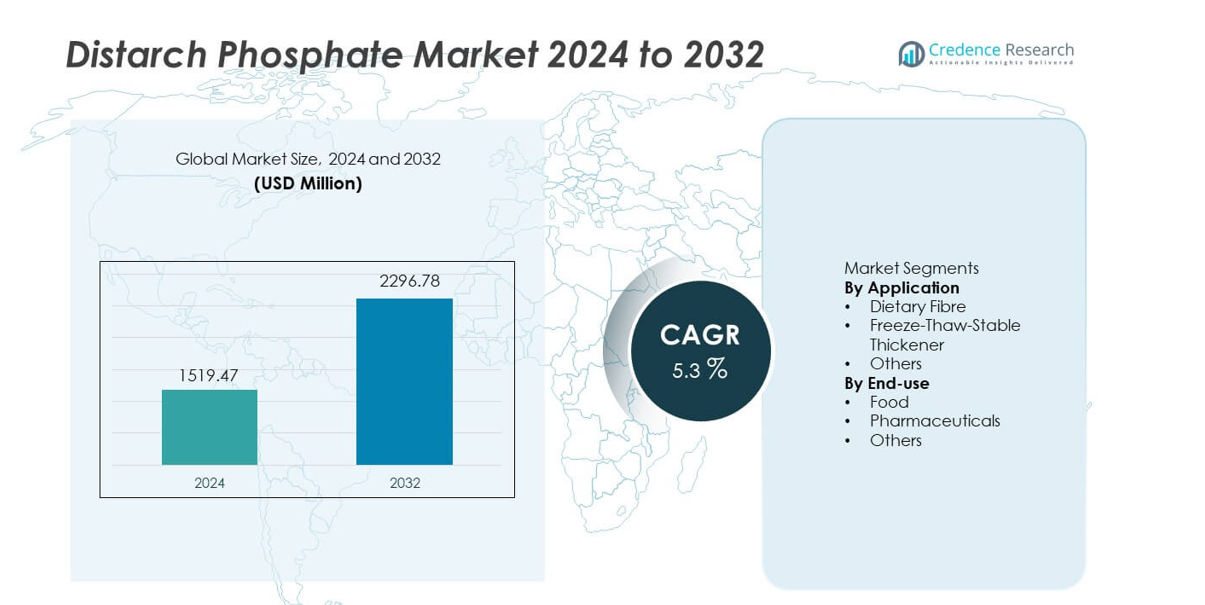

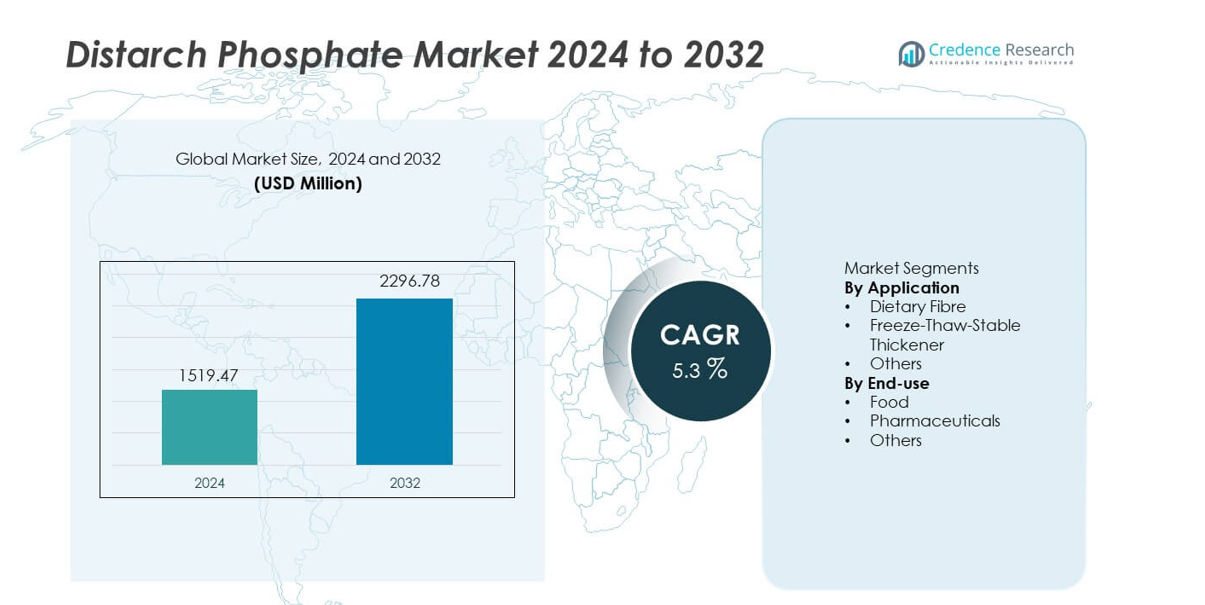

The Distarch Phosphate Market reached USD 1,519.47 million in 2024 and is projected to grow to USD 2,296.78 million by 2032, registering a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Distarch Phosphate Market Size 2024 |

USD 1,519.47 million |

| Distarch Phosphate Market, CAGR |

5.3% |

| Distarch Phosphate Market Size 2032 |

USD 2,296.78 million |

Top players in the Distarch Phosphate market include Cargill, Incorporated, Tate & Lyle PLC, Ingredion Incorporated, Archer Daniels Midland Company (ADM), Roquette Frères, Avebe, Agrana Beteiligungs-AG, Emsland Group, Global Bio-Chem Technology Group, and Fooding Group Limited, all of which focus on advanced starch modification technologies, clean-label solutions, and improved freeze–thaw stability to meet rising demand across food and pharmaceutical sectors. These companies strengthen competitiveness through capacity expansion, sustainable sourcing, and collaboration with processed food manufacturers. Asia Pacific leads the global market with a 34% share, supported by large-scale starch production, rapid urbanization, and growing consumption of processed and convenience foods, while North America and Europe follow due to strong demand for functional and high-performance starch ingredients.

Market Insights

- The Distarch Phosphate market reached USD 1,519.47 million in 2024 and will grow at a CAGR of 5.3% through 2032.

- Strong market drivers include rising demand for texture stability and freeze–thaw performance, with freeze-thaw-stable thickener holding a 54% share due to its essential role in frozen and processed foods.

- Key trends highlight clean-label adoption and broader use in nutritional formulations, while Asia Pacific leads with a 34% regional share, supported by large-scale food production and growing urban consumption.

- Competitive activity intensifies as major players invest in advanced starch processing, sustainable sourcing, and capacity expansions to strengthen market presence.

- Market restraints include regulatory limitations on modified starch usage and competition from natural thickeners, while the food industry remains dominant with a 72% share, driven by rising demand for processed, frozen, and convenience products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Freeze-thaw-stable thickener dominates the application segment with a 54% share, driven by strong demand from food processors requiring ingredients that maintain texture and viscosity during storage, freezing, and reheating. Distarch phosphate performs well under shear stress and temperature fluctuations, making it essential in ready-to-eat meals, sauces, bakery fillings, and frozen desserts. Dietary fibre applications hold a smaller but rising share as consumers seek clean-label products with functional health benefits. The “Others” category grows steadily due to broader use in industrial formulations. Increasing focus on product stability and extended shelf life continues to reinforce segment leadership.

- For instance, Cargill runs starch modification plants in multiple countries and reports many proprietary modified starch grades that support freeze-thaw use in ready meal production, confirmed through its ingredient portfolio disclosures.

By End-use

The food industry leads the end-use segment with a 72% share, supported by widespread use of distarch phosphate in processed foods, convenience products, bakery items, and dairy applications. Manufacturers rely on its enhanced stability, viscosity control, and resistance to acidic and high-temperature environments. Pharmaceuticals hold a moderate share as the ingredient is used in tablet binding and controlled-release formulations due to its structural integrity. The “Others” category expands gradually through adoption in personal care and industrial products. Rising consumption of packaged and frozen foods continues to strengthen demand in the dominant food segment.

- For instance, Ingredion lists over 40 clean-label starch solutions and operates manufacturing sites across 44 locations, enabling validated application in bakery, dairy, and processed food lines based on company technical documentation.

Key Growth Driver

Rising Demand for Processed and Convenience Foods

Global consumption of ready-to-eat meals, bakery products, sauces, and frozen foods continues to increase, driving strong demand for distarch phosphate due to its superior thickening stability and freeze–thaw resistance. Manufacturers use this ingredient to maintain product texture, extend shelf life, and improve heat tolerance during processing. The shift toward fast meal solutions in urban populations further supports adoption. As food producers invest in texture-enhancing and clean-label ingredients, distarch phosphate becomes essential for achieving consistent quality in large-scale production environments.

- For instance, Tate & Lyle operates production sites and supplies specialty food ingredients, including modified starch technologies used in frozen bakery and ready-meal applications, stated in the company’s global ingredient portfolio information.

Expanding Applications in Pharmaceuticals

Pharmaceutical manufacturers increasingly adopt distarch phosphate as a binder, disintegrant, and stabilizer in tablets and controlled-release formulations. Its structural integrity under compression, moisture resistance, and ability to improve drug delivery make it valuable in modern drug manufacturing. Growth in generic drug production and rising consumption of oral solid dosage forms strengthen adoption. As companies seek consistent, safe, and cost-effective excipients, distarch phosphate gains traction across global pharmaceutical supply chains, supporting long-term market expansion.

- For instance, Archer Daniels Midland (ADM) runs over 270 processing facilities and 420 crop procurement locations, and its functional starch derivatives include excipients listed for tablet stability and drug formulation performance in ADM ingredient technical references.

Shift Toward Clean-Label and Functional Ingredients

Consumer preference for natural, plant-derived, and minimally processed ingredients boosts demand for modified starches with clear functionality. Distarch phosphate aligns with clean-label expectations by offering improved stability with limited chemical modification compared to synthetic additives. Food companies use it to enhance viscosity, improve texture, and reduce reliance on artificial thickeners. As brands reformulate products to meet transparency standards, demand grows for functional ingredients that balance performance and consumer acceptance. This shift supports steady growth across packaged food categories.

Key Trend and Opportunity

Adoption of Freeze–Thaw-Stable Ingredients in Frozen Products

Growth in frozen desserts, bakery fillings, and ready-to-heat meals creates opportunities for distarch phosphate due to its superior freeze–thaw stability and resistance to syneresis. Manufacturers seek ingredients that maintain texture and viscosity throughout cold-chain distribution. As the frozen food sector expands globally, companies explore modified starches that support product quality while meeting clean-label trends. This demand opens new opportunities for suppliers offering high-performance variants tailored to cold-temperature applications and large-scale production needs.

- For instance, Roquette operates numerous industrial sites and offers various modified starch solutions designed for cold-temperature stability according to its food applications portfolio, including use in frozen bakery and dessert categories recorded in Roquette technical data sheets.

Rising Use in Nutritional and Dietary Fibre Products

The global push for fiber-enriched foods provides new growth avenues for distarch phosphate, particularly in fortified bakery, cereals, and functional nutrition products. Its ability to enhance fibre content without compromising texture or mouthfeel supports expanding use in health-focused formulations. As consumers prioritize gut health and balanced diets, manufacturers invest in ingredients that deliver both functional and nutritional benefits. Growing interest in low-fat and low-calorie products further strengthens the opportunity for distarch phosphate in fibre-enhanced applications.

- For instance, Agrana runs numerous production facilities in various countries across the globe and lists dietary and functional starch derivatives used in high-fibre bakery and cereal applications, supported by Agrana ingredient documentation and product specification reports.

Key Challenge

Regulatory Restrictions on Modified Starches

Evolving food safety and labeling regulations create challenges for manufacturers using modified starches such as distarch phosphate. Different regions enforce varying limits on chemical modification and usage levels, requiring strict compliance and frequent reformulation. These requirements increase production costs and slow innovation for global suppliers. Clean-label pressures also push brands toward simpler ingredient lists, which may limit use in certain product categories. Navigating these regulatory complexities remains a key challenge for market participants.

Availability of Substitute Thickening Agents

Competition from alternative thickeners—such as native starches, guar gum, xanthan gum, and other hydrocolloids—poses a challenge to distarch phosphate adoption. These substitutes offer different functional benefits and align well with natural and clean-label preferences. Price fluctuations and regional availability of raw materials also influence buyer choice. In applications where extreme stability is not required, manufacturers may opt for lower-cost or more label-friendly alternatives. This competition reduces switching costs and increases pressure on distarch phosphate suppliers to differentiate through performance and quality.

Regional Analysis

North America

North America holds a market share of 27%, driven by strong demand for processed foods, bakery items, and convenience meals that rely on distarch phosphate for texture stability and freeze–thaw performance. Food manufacturers adopt the ingredient to enhance product consistency and extend shelf life across frozen and refrigerated categories. The presence of a well-established pharmaceutical industry further supports usage in tablet-binding and controlled-release applications. Rising consumer preference for clean-label and functional ingredients encourages product reformulation, while technological advancements in starch modification sustain steady market growth across the region.

Europe

Europe accounts for a market share of 25%, supported by strict food-quality regulations and high adoption of texture-stabilizing ingredients in bakery, dairy, and ready-meal segments. Distarch phosphate demand rises as manufacturers meet labeling standards and maintain product performance in processed foods. The region’s strong pharmaceutical sector also contributes to steady uptake in excipient applications. Growing interest in plant-based and high-fibre foods drives additional usage. Sustainability-focused innovations in starch sourcing and processing further influence market expansion, reinforcing Europe’s position as a mature but steadily evolving market.

Asia Pacific

Asia Pacific leads the global market with a market share of 34%, driven by rapid growth in processed food consumption, frozen products, and expanding pharmaceutical manufacturing. Countries such as China, India, Japan, and South Korea show rising use of distarch phosphate in noodles, sauces, bakery items, and packaged foods. Increasing urbanization and changing dietary habits accelerate demand for stable, heat-resistant, and cost-efficient thickeners. Large-scale starch production and growing industrial capacity lower manufacturing costs. Government support for food-processing modernization and export-oriented production further strengthens regional market leadership.

Latin America

Latin America holds an 8% market share, with rising demand for distarch phosphate driven by growth in processed foods, bakery products, and dairy applications. Manufacturers in Brazil, Mexico, and Argentina increasingly adopt the ingredient to enhance product stability under varying temperature and storage conditions. Expanding pharmaceutical production also contributes to adoption. While growth remains gradual, rising consumption of convenience foods and improving local processing capabilities strengthen market opportunities. Economic development and investment in food manufacturing infrastructure support broader utilization across the region.

Middle East & Africa

The Middle East & Africa region represents a 6% market share, supported by expanding food-processing industries and growing demand for shelf-stable products suited to hot climates. Distarch phosphate is widely used to maintain texture and prevent syneresis in sauces, dairy products, and frozen foods. Increasing urbanization and reliance on packaged meals enhance demand. Adoption in pharmaceuticals rises as regional drug manufacturing expands. Although market maturity remains lower, rising investments in food technology and improved supply-chain access contribute to steady growth across both the Middle East and Africa.

Market Segmentations:

By Application

- Dietary Fibre

- Freeze-Thaw-Stable Thickener

- Others

By End-use

- Food

- Pharmaceuticals

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes Cargill, Incorporated, Tate & Lyle PLC, Ingredion Incorporated, Archer Daniels Midland Company (ADM), Roquette Frères, Avebe, Agrana Beteiligungs-AG, Emsland Group, Global Bio-Chem Technology Group, and Fooding Group Limited. These companies compete by expanding their portfolios of modified starches, improving functional performance, and enhancing production efficiency to meet rising food and pharmaceutical demand. Leading players invest in advanced starch-processing technologies to deliver superior freeze–thaw stability, viscosity control, and clean-label compatibility. Strategic partnerships with food manufacturers, along with capacity expansions in high-growth regions, strengthen market presence. Sustainability-driven sourcing initiatives and innovation in plant-based ingredients help differentiate offerings as consumers shift toward healthier and more transparent food products. As competition intensifies, companies focus on quality consistency, regulatory compliance, and customized solutions tailored to diverse industrial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cargill, Incorporated

- Tate & Lyle PLC

- Ingredion Incorporated

- Archer Daniels Midland Company (ADM)

- Roquette Frères

- Avebe

- Agrana Beteiligungs-AG

- Emsland Group

- Global Bio-Chem Technology Group

- Fooding Group Limited

Recent Developments

- In August 2024, Roquette Frères launched CLEARAM TR tapioca cook-up starches. The range targets sauces, dairy desserts, and bakery fillings.

- In February 2024, Ingredion Incorporated launched NOVATION Indulge 2940. This label-friendly native starch targets gelling and mouthfeel.

Report Coverage

The research report offers an in-depth analysis based on Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for distarch phosphate will grow as processed and convenience food consumption increases worldwide.

- Freeze–thaw-stable formulations will gain stronger adoption in frozen meals, bakery fillings, and dairy products.

- Clean-label reformulations will drive interest in modified starches with minimal chemical processing.

- Pharmaceutical applications will expand as manufacturers seek stable, safe, and cost-effective excipients.

- Asia Pacific will continue to lead market growth due to rising food production and industrial capacity.

- Investment in advanced starch modification technologies will accelerate product innovation and performance.

- Sustainability initiatives will push companies toward environmentally responsible sourcing and processing.

- Competition from natural thickeners will increase, encouraging performance improvements in modified starches.

- Rising demand for fibre-enriched and functional nutrition products will expand usage in health-focused foods.

- Global food manufacturers will adopt more specialized starch solutions to enhance texture stability and shelf life.