Market Overview:

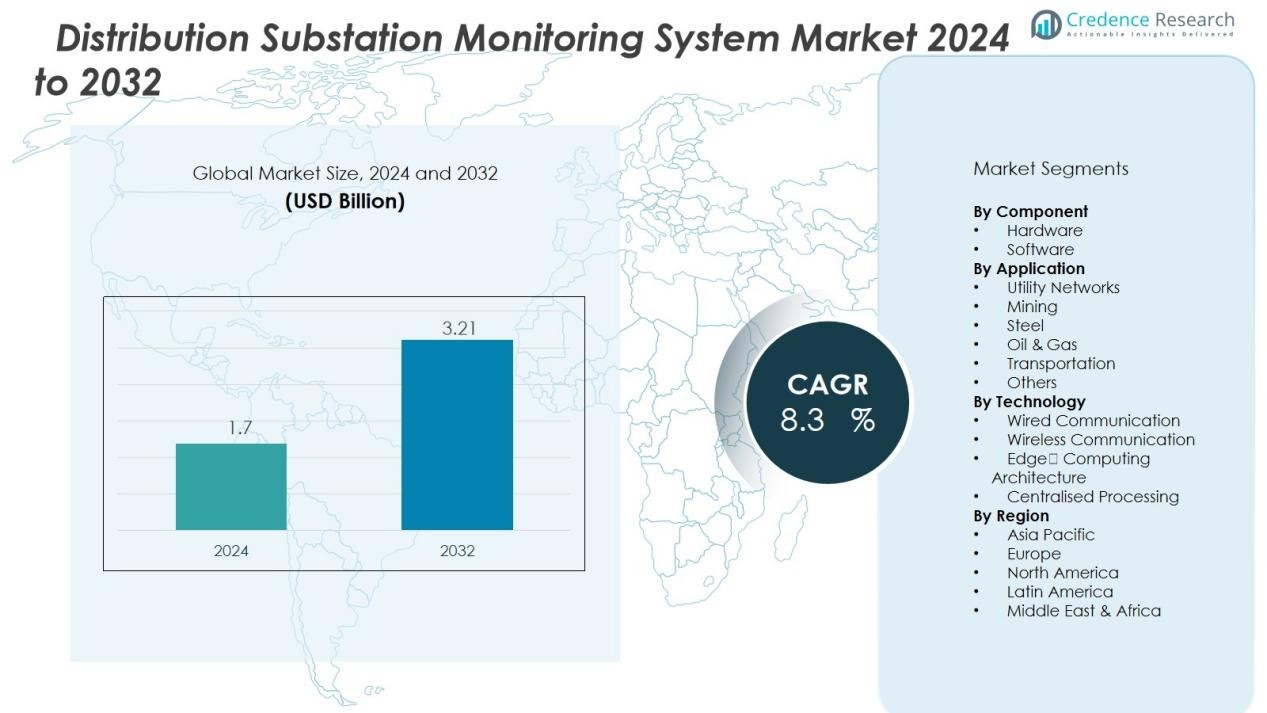

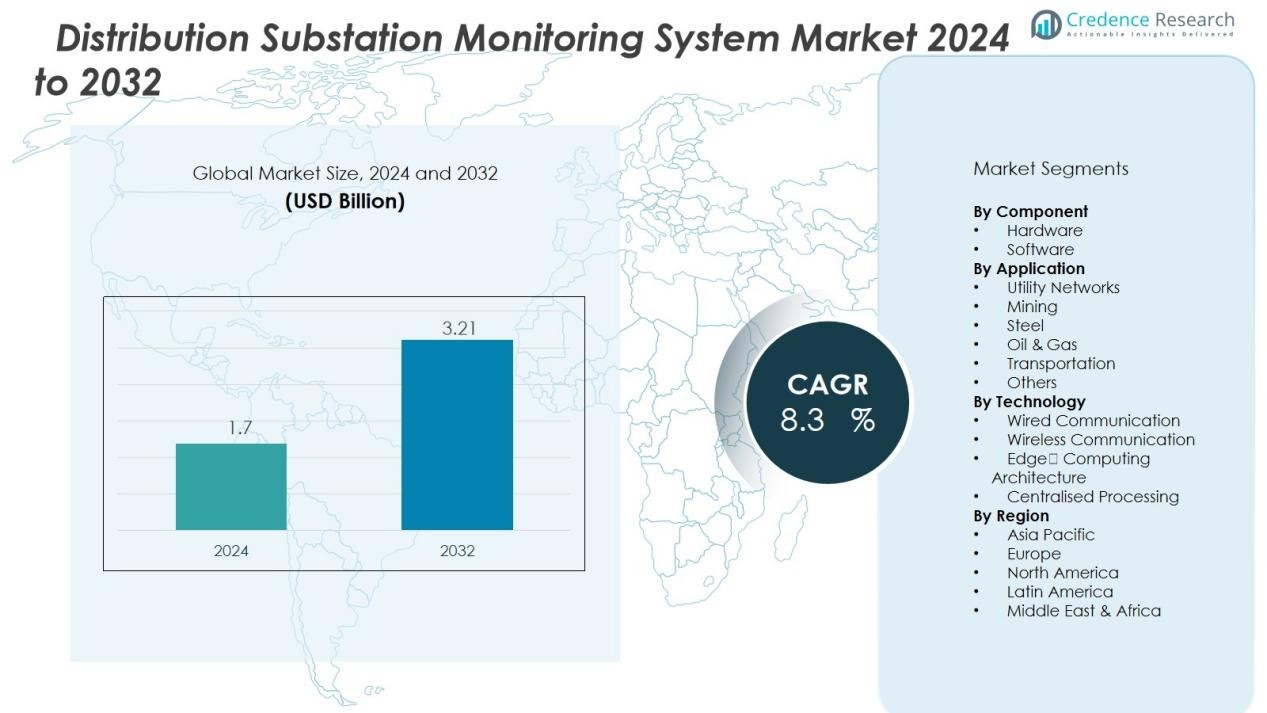

The Distribution Substation Monitoring System Market size was valued at USD 1.7 billion in 2024 and is anticipated to reach USD 3.21 billion by 2032, at a CAGR of 8.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Distribution Substation Monitoring System Market Size 2024 |

USD 1.7 Billion |

| Distribution Substation Monitoring System Market, CAGR |

8.3 % |

| Distribution Substation Monitoring System Market Size 2032 |

USD 3.21 Billion |

The growth of the distribution substation monitoring system market is primarily driven by several factors. The modernization of aging grid infrastructure and utility networks creates a strong need for systems that improve reliability, minimize outages, and optimize maintenance practices. Additionally, the growing integration of renewable energy sources and the rise of smart-grid technologies necessitate advanced monitoring and data analytics tools for substations. Furthermore, regulatory pressures focusing on energy efficiency, carbon reduction, and enhanced grid resilience are pushing utilities to invest in sophisticated monitoring solutions that offer actionable insights into system performance and uptime.

Regionally, North America holds the largest market share due to substantial investments in grid modernization, regulatory mandates, and widespread adoption of digital monitoring systems by utilities. The Asia-Pacific region is emerging as the fastest-growing market, driven by rapid urbanization, industrial growth, and government initiatives in countries like China and India. Europe is also experiencing steady growth, particularly due to infrastructure upgrades and the continued rollout of smart-grid systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Distribution Substation Monitoring System Market was valued at USD 1.7 billion in 2024 and is projected to reach USD 3.21 billion by 2032, growing at a CAGR of 8.3% during the forecast period.

- North America leads the market with a 38% share due to substantial investments in grid modernization, regulatory mandates, and the widespread adoption of digital monitoring systems by utilities.

- Europe holds a 30% share, driven by its focus on decarbonization, grid modernization, and strong regulatory frameworks that encourage the adoption of advanced substation monitoring solutions.

- Asia-Pacific, with a 25% share, is the fastest-growing region, driven by rapid urbanization, industrial expansion, and government initiatives in countries like China and India, pushing for smarter infrastructure and grid upgrades.

- The hardware segment dominates the market share, accounting for the majority of revenue, followed by the software segment, which is growing rapidly due to its role in analytics and real-time fault detection

Market Drivers:

Modernization of Aging Grid Infrastructure

The growing need to modernize aging electrical grid infrastructure significantly drives the distribution substation monitoring system market. Utilities worldwide are increasingly investing in digital solutions that enhance system reliability, reduce downtime, and extend the life cycle of existing assets. Aging infrastructure presents a challenge in terms of efficiency and resilience, making advanced monitoring systems crucial to proactively identify issues before they result in outages. Upgrading substations with real-time monitoring technologies helps utilities better manage power distribution and ensures consistent service to consumers.

- For instance, Siemens Energy’s digital twin applications enable preemptive fault prediction with tangible system visibility improvements, illustrating measurable progress in grid resilience.

Integration of Renewable Energy Sources

The widespread integration of renewable energy sources is a major catalyst for the growth of the distribution substation monitoring system market. Renewable energy introduces variability in power generation, requiring more advanced monitoring systems to manage fluctuations and ensure grid stability. Substation monitoring solutions provide the necessary data to support the seamless integration of renewable energy, such as solar and wind, into the grid. These systems ensure the efficient operation of substations, allowing grid operators to balance renewable energy input with conventional power sources.

- For Instance, ABB offers solutions like its Smart Substation Control and Protection SSC600, which centralizes substation analytics and protection for 24/7 visibility and managing transient voltage events.”

Government Regulations on Grid Resilience and Energy Efficiency

Stricter government regulations aimed at improving grid resilience and enhancing energy efficiency continue to drive the demand for advanced distribution substation monitoring systems. Policies focused on reducing carbon emissions, optimizing energy use, and enhancing grid reliability require utilities to implement real-time monitoring to meet compliance standards. These regulations also incentivize investments in technologies that provide greater visibility into grid performance, helping utilities identify inefficiencies and minimize environmental impact.

Growing Demand for Smart Grid Solutions

The rising adoption of smart grid solutions significantly contributes to the expansion of the distribution substation monitoring system market. Smart grids rely on advanced digital technologies to optimize power distribution, improve energy efficiency, and enhance system reliability. Monitoring systems play an integral role within smart grids by providing valuable data that helps utilities respond to demand fluctuations, detect faults, and improve decision-making processes. This trend toward intelligent grid management is pushing utilities to embrace substation monitoring technologies for enhanced operational efficiency.

Market Trends:

Rise of Advanced Analytics and Artificial Intelligence in Monitoring Systems

The adoption of machine‑learning tools and artificial‑intelligence‑enabled analytics marks a strong trend within the Distribution Substation Monitoring System Market. Utilities deploy these systems to interpret real‑time data streams from sensors and intelligent electronic devices, enabling predictive fault detection and proactive maintenance. It strengthens asset‑health management by identifying deterioration or abnormal operations before failures occur. The data‑driven insights enhance decision‑making and optimize resource allocation for maintenance crews and spare‑parts inventories. These capabilities increase operational resilience, reduce unplanned downtime, and contribute to improved grid reliability.

- For instance, Siemens implements edge analytics and smart grid software in substations, which enables autonomous reconfiguration during disturbances and helps utilities reduce average outage durations by significant margins, in some cases up to 30 percent.

Expansion of Wireless Communications and Edge‑Computing Architectures

Wireless communication technologies and edge‑computing architectures continue to shape the Distribution Substation Monitoring System Market. It becomes common for monitoring platforms to integrate wireless modules and distributed computing nodes at the substation edge rather than relying solely on centralised data centres. This shift permits lower latency, localised decision‑making and bandwidth‑efficient operations. Moreover, the architecture supports deployments in remote or hard‑to‑access areas where wired infrastructure proves expensive or impractical. Utilities therefore gain greater flexibility when expanding their monitoring footprint across distribution networks and integrating distributed energy resources.

- For Instance, Duke Energy is engaged in extensive grid modernization initiatives across its service territories, including in South Carolina. These efforts involve integrating advanced technologies such as smart meters, smart grid automation, and renewable energy sources (like solar and battery storage) to improve reliability and efficiency.

Market Challenges Analysis:

High Initial Capital Outlay and Infrastructure Integration Complexity

The Distribution Substation Monitoring System Market faces a significant challenge due to the large upfront investment required for hardware, software, and communications infrastructure. Many utilities must allocate substantial funds to install intelligent electronic devices, sensor networks, and communication links for real‑time monitoring. It complicates project approval in regions with constrained budgets or competing priorities. Integration of new monitoring systems with legacy distribution networks can introduce technical compatibility and operational disruption risks. These barriers may delay deployment schedules and reduce the pace of adoption by smaller utilities.

Cyber‑Security Risks and Skilled Workforce Shortages

The shift toward digital monitoring and data‑driven operations introduces heightened vulnerability to cyber threats and data breaches within monitoring systems. It demands robust cybersecurity frameworks, regular audits, and ongoing vigilance to protect critical infrastructure. The market also contends with a shortage of qualified engineers and technicians capable of configuring, maintaining and analysing sophisticated monitoring platforms. Utility companies may struggle to recruit and retain personnel who can handle both operational technology and advanced analytics. Without the right human resource foundation, utilities risk under‑utilising system capabilities and failing to achieve the full value from their monitoring investments.

Market Opportunities:

Emerging Adoption of Digital Twins and Predictive Maintenance Capabilities

The Distribution Substation Monitoring System Market presents a strong opportunity as utilities embrace digital‑twin technologies and predictive maintenance frameworks. It permits grid operators to create real‑time virtual models of distribution substations, enabling simulation of fault scenarios and optimization of asset lifecycles. Monitoring platforms equipped with advanced analytics help detect early signs of equipment stress, guiding maintenance schedules and reducing unplanned outages. Their deployment supports utilities striving to minimise operational expenditure and extend infrastructure longevity. With the proliferation of IoT sensors and cloud‑based platforms, vendors can offer scalable solutions to utilities seeking greater operational visibility across the grid.

Growing Role of Distributed Energy Resources and Electrification Trends

Rapid deployment of distributed energy resources (DERs), electric‑vehicle charging infrastructure and electrification of industrial loads creates new opportunities in the Distribution Substation Monitoring System Market. It drives demand for monitoring platforms capable of managing higher bidirectional power flows, variable loads and the geometric complexity of modern distribution networks. Utilities must monitor and control substations not only for traditional grid flow but also for reversals and dynamic interactions from DER integration. Monitoring systems offer value by enabling real‑time voltage control, load balancing and network reconfiguration in this evolving environment. Vendors that deliver monitoring solutions tailored to DER‑rich networks and electrified transport corridors will find expanding addressable markets.

Market Segmentation Analysis:

By Component

The Distribution Substation Monitoring System Market segments its components into hardware and software categories. The hardware segment dominates revenue in many regions because utilities invest heavily in sensors, intelligent electronic devices, communication modules and supporting infrastructure. Software has grown rapidly given its role in analytics, visualization and asset‑management platforms that convert raw data into actionable insights. It supports predictive maintenance and automated fault‑detection, which boosts the value of monitoring systems. Vendors that combine strong hardware capability with advanced software solutions stand to lead in this component space.

- For instance, a real-world example of hardware progress is Duke Energy’s deployment of nearly a million (966,000) smart meters in Ohio and the Carolinas, which are IoT-enabled devices that facilitate remote monitoring, improved billing accuracy, and faster outage detection.

By Application

Application segmentation divides the market by how utilities deploy the systems, notably across utility networks, mining, steel, oil & gas, transportation and other industries. Within distribution networks specifically, substations require monitoring solutions for load management, fault isolation and reliability. It becomes especially important in sectors with high regulatory pressure or mission‑critical operations such as transportation and industrial operations. Adoption in non‑utility segments offers incremental growth potential as those industries modernise their distribution assets and seek real‑time visibility.

- For instance, a steel plant’s distribution modernization involved replacing numerous legacy relays with a smaller number of compact digital relays, achieving significant space savings in the switchyard, consistent with the benefits of modern digital technology

By Technology

Under technology segmentation, the market breaks out by communication and processing technologies—wired versus wireless communications, edge‑computing versus centralised architectures, and integration of analytics/AI platforms. Wired solutions retain strong share given their established reliability in substation environments; however, wireless systems gain traction where wiring proves costly or impractical. It supports flexible deployments and remote monitoring in challenging locations. Edge‑computing further enhances real‑time responsiveness by processing data locally at the substation instead of relying solely on remote servers.

Segmentations:

By Component

By Application

- Utility Networks

- Mining

- Steel

- Oil & Gas

- Transportation

- Others

By Technology

- Wired Communication

- Wireless Communication

- Edge‑Computing Architecture

- Centralised Processing

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Region Overview

North America held around a 38% market share in the global Distribution Substation Monitoring System Market in 2025. The region benefits from mature power infrastructure, regulatory mandates on grid resilience, and high utility spending. It drives demand for monitoring systems that provide real‑time fault detection and asset visibility. The United States leads with significant investment into smart‑grid upgrades and digital substation initiatives, supporting the uptake of comprehensive monitoring solutions. It also features a strong presence of global vendors who apply advanced analytics and hardware innovation. The combination of ageing distribution assets and the rise of distributed energy resources (DERs) places pressure on utilities to adopt monitoring systems for operational efficiency and risk mitigation.

Europe Region Overview

Europe commanded about a 30% market share in the Distribution Substation Monitoring System Market in recent years. The region’s emphasis on decarbonisation, regulatory frameworks for energy efficiency, and widespread grid modernization push utilities toward substation monitoring deployments. Nations such as Germany, France, and the UK lead efforts to replace legacy assets and integrate renewables, creating demand for advanced systems. It also benefits from a high level of standardisation and interoperability across grid‑equipment manufacturers. The ecosystem encourages innovation in edge processing, communications technology, and software analytics tailored to substations. Utilities in Europe face pressure to reduce downtime, manage bidirectional flows from DERs, and deliver reliability—factors that favour monitoring system adoption.

Asia‑Pacific & Other Markets Overview

Asia‑Pacific held approximately 25% market share in the Distribution Substation Monitoring System Market, while Latin America, the Middle East, and Africa collectively represented the remaining share. Emerging economies in Asia‑Pacific, such as China and India, invest heavily in modernising distribution networks and installing smart infrastructure, which accelerates adoption of monitoring systems. It faces challenges such as remote network geography and scattered grid assets, which increase the value of wireless communications and edge‑computing technologies. In Latin America and the Middle East & Africa, growth stems from rising energy demand, government‑backed infrastructure programmes, and integration of renewable energy resources. These markets present potential for expansion, given that utilities increasingly recognise the importance of real‑time asset monitoring and grid intelligence.

Key Player Analysis:

- ABB Ltd.

- Cadillac Automation and Controls

- Cisco

- Eaton Corporation

- Emerson Electric

- GE Vernova

- Honeywell

- iGRID t&D

- Novatech

- Schneider Electric

- Schweitzer Engineering Laboratories, Inc.

- Sentient Energy

- Siemens

Competitive Analysis:

The competitive landscape of the Distribution Substation Monitoring System Market features prominent global players such as ABB Ltd., Cadillac Automation and Controls, Cisco, Eaton Corporation, Emerson Electric, GE Vernova and Honeywell. These companies develop and deliver monitoring hardware, software platforms, sensors, analytics and services to utilities and industrial users.

ABB stands out with its comprehensive digital‑substation portfolio, including hardware and software that conform to IEC 61850 standards and real‑time monitoring capabilities. Cisco contributes its networking and cybersecurity expertise to fortify substation communications and data infrastructures. Eaton and Emerson expand their offerings through integrated power‑management and automation solutions tailored for high‑reliability applications. GE Vernova and Honeywell differentiate through their global service networks, analytics capabilities and support for distributed energy resources. Cadillac Automation and Controls brings niche specialization in control systems and retrofit solutions. Collectively, these players intensify innovation, partnerships and project wins, driving competitive dynamics within the market.

Recent Developments:

- In October 2025, ABB Ltd. announced the divestiture of its Robotics division to SoftBank Group, with the sale valued at approximately $5.4 billion, supporting an expansion into AI-driven robotics.

- In September 2025, The Cadillac Formula 1 Team, a new entity formed by TWG Motorsports and General Motors under the Cadillac brand, entered a global partnership with Jim Beam as the official spirits partner for its upcoming 2026 F1 debut.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Component, Application, Technology and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Distribution Substation Monitoring System Market is poised for significant growth as utilities modernize their infrastructure and embrace digital transformation.

- Increasing adoption of smart grids and renewable energy integration will drive demand for advanced monitoring systems that ensure grid stability and efficiency.

- The rise of artificial intelligence (AI) and machine learning will enable predictive maintenance, helping utilities detect faults early and reduce downtime.

- Wireless communication technologies and edge computing will become more prevalent, offering greater flexibility and real-time decision-making capabilities for remote substations.

- Governments and regulatory bodies worldwide will continue to mandate stricter grid resilience and energy efficiency standards, propelling the adoption of monitoring solutions.

- Regional expansion, particularly in emerging markets like Asia-Pacific, will offer untapped growth opportunities as utilities invest in grid modernization and smart infrastructure.

- Advancements in cybersecurity will play a crucial role, ensuring that digital substation monitoring systems remain secure from potential threats and breaches.

- The increasing focus on data analytics will enable utilities to optimize operational performance and make informed decisions based on real-time insights.

- Utilities will focus on reducing operational costs and enhancing system reliability, further driving the need for advanced substation monitoring solutions.

- Collaboration between technology providers and utilities will intensify, fostering innovation in solutions that cater to the evolving needs of modern power distribution networks.