Market Overview

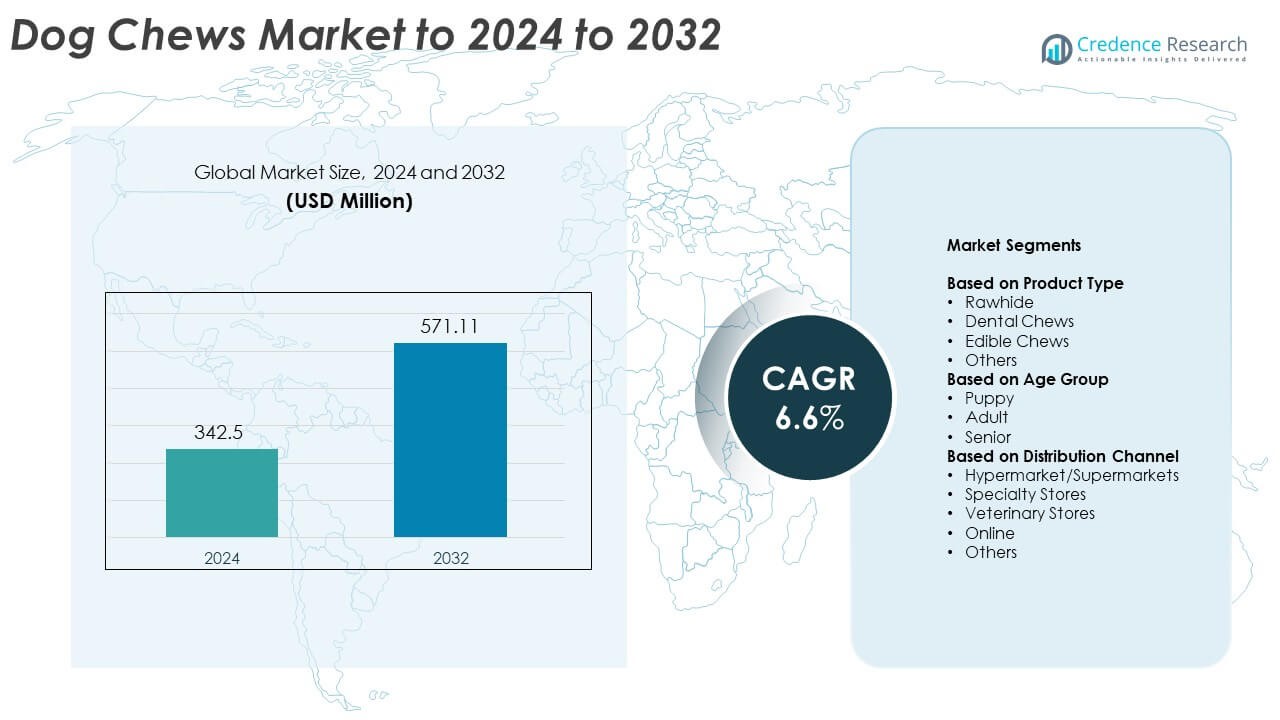

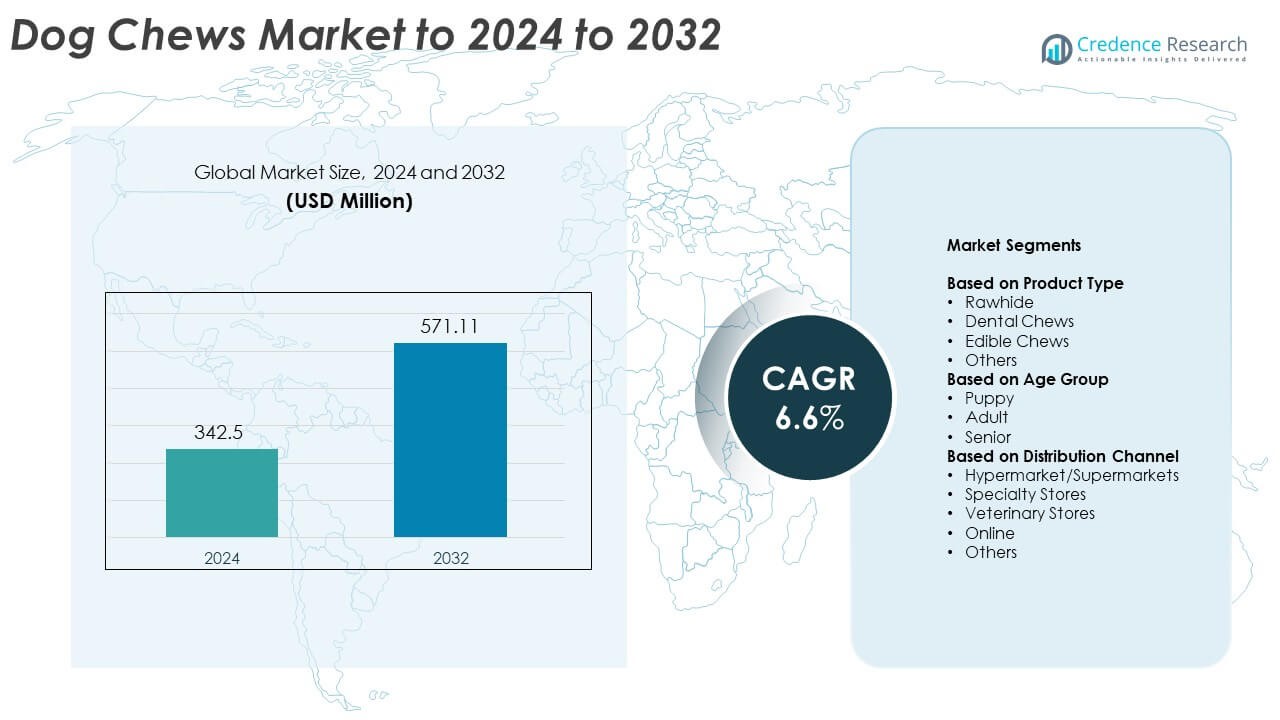

Dog Chews Market size was valued at USD 342.5 million in 2024 and is anticipated to reach USD 571.11 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dog Chews Market Size 2024 |

USD 342.5 Million |

| Dog Chews Market, CAGR |

6.6% |

| Dog Chews Market Size 2032 |

USD 571.11 Million |

The dog chews market includes major players such as Colgate-Palmolive Company, WellPet LLC, Mars, Inc., Nutri-Vet Wellness LLC, Blue Buffalo Co., Ltd., PetIQ, Merrick Pet Care, Inc., Arm & Hammer, Spectrum Brands Holdings, Inc., Nestlé Purina PetCare, and The J.M. Smucker Company, all competing through premium, natural, and functional chew offerings. These companies focus on dental health benefits, clean-label formulations, and strong retail and online distribution. North America emerged as the leading region in 2024 with 38% share, supported by high pet ownership, strong spending on premium pet nutrition, and rapid adoption of natural chew alternatives across major retail channels.

Market Insights

- Dog chews market size reached USD 342.5 million in 2024 and is projected to hit USD 571.11 million by 2032, registering a CAGR of 6.6%.

- Rising pet humanization and strong demand for dental and functional chew products continue to drive market expansion across all age groups, especially among adult dogs holding the largest segment share of 57% in 2024.

- Natural, grain-free, and highly digestible chew formats remain key trends as consumers shift toward clean-label and veterinarian-endorsed products with strong online subscription growth.

- The competitive landscape features global and regional brands expanding premium chew portfolios, improving sourcing transparency, and strengthening digital retail to gain wider consumer reach.

- North America led the market with 38% share in 2024, followed by Europe at 27% and Asia Pacific at 22%, while rawhide chews held the dominant product share of 38% supported by high adoption for long-lasting chewing needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Rawhide led the product type segment in 2024 with about 38% share due to strong demand for long-lasting chew formats that support jaw activity and reduce destructive behavior. Pet owners chose rawhide because the material offers extended chewing time and helps manage anxiety in active breeds. Dental chews grew steadily as brands promoted plaque-control benefits, while edible chews gained traction among owners seeking natural formulations. Other chew types, including plant-based and grain-free variants, expanded as manufacturers introduced cleaner labels and allergen-friendly recipes.

- For instance, Hill’s Pet Nutrition operates its Pet Nutrition Center, an 180-acre global campus where it cares for approximately 900 dogs and cats.

By Age Group

Adult dogs dominated the age group segment in 2024 with nearly 57% share, driven by the high global population of adult pets and stronger purchasing frequency from owners managing daily chewing habits. Adult dogs require more durable and functional chew options, which boosted demand for rawhide alternatives and dental chews. Puppy chews grew as breeders and new pet households focused on teething relief, while senior dog products advanced with softer, joint-supporting formulations aimed at pets with lower bite strength.

- For instance, Nestlé Purina manages a global R&D network employing over 500 researchers, including behaviorists who study chewing patterns across dog life stages.

By Distribution Channel

Hypermarkets and supermarkets led the distribution channel segment in 2024 with around 35% share, supported by strong retail penetration, wide assortment availability, and competitive pricing. Mass retail formats drew consistent foot traffic, enabling rapid turnover of dog chew products and higher visibility for new launches. Specialty pet stores advanced through premium chew sales and expert-driven recommendations. Online channels rose quickly as pet owners shifted to subscription models, wider brand choices, and doorstep convenience, while veterinary stores retained demand for medically approved dental chew products.

Key Growth Drivers

Rising Pet Humanization

Growing pet humanization remained the strongest growth driver as owners increasingly treated dogs as family members and prioritized premium nutrition and daily wellness. This shift boosted demand for high-quality chews that support dental health, anxiety relief, and behavioral enrichment. Brands offering natural, grain-free, and functional chew products gained rapid traction as consumers linked chew quality with long-term pet health. Higher spending capacity among urban households also strengthened the preference for safer and veterinarian-recommended chew formats.

- For instance, Mars Petcare employs more than 100,000 associates worldwide and runs nearly 3,000 veterinary clinics globally, enabling large-scale product development aligned with humanization trends.

Demand for Functional and Dental Health Chews

Rising awareness of canine oral health created steady demand for dental-focused chew products. Pet owners adopted dental chews to reduce plaque buildup and improve breath quality, supporting routine home-based oral care. Veterinary professionals increasingly recommended functional chews that support gum strength and lower periodontal risk, which further pushed category growth. As dental disease affects a large share of adult dogs, the segment gained strong repeat purchase rates and higher brand loyalty.

- For instance, Virbac validates its dental range through clinical programs that generate peer-reviewed oral-health data, with individual studies involving numerous companion animals (e.g., 125 dogs in one published study) to demonstrate effectiveness in reducing plaque and calculus formation.

Expansion of Premium and Natural Chew Formulations

The shift toward clean-label, natural, and minimally processed chews became a major growth driver as owners avoided artificial additives and low-grade rawhide. Premium chews made from single proteins, plant-based ingredients, or limited-allergen recipes attracted health-conscious consumers. This trend expanded the market for ethically sourced and sustainably produced chew products. Brands leveraging transparent sourcing, high digestibility, and nutritional certification gained wider acceptance across retail channels.

Key Trends & Opportunities

Growth of Online Subscription Models

E-commerce emerged as a leading trend, with subscription-based chew programs offering convenience, custom pack sizes, and delivery flexibility. Online platforms enabled personalized recommendations based on dog size, breed, and chewing intensity. Brands used digital analytics to launch targeted product bundles and loyalty plans that boosted retention. This shift presented strong opportunities for direct-to-consumer labels seeking higher margins and broader reach without relying solely on retail visibility.

- For instance, BarkBox (BARK Inc.) reported approximately 2.2 million active subscribers at the end of its fiscal year 2023, driving recurring monthly shipments of chews and toys.

Rising Preference for Veterinary-Endorsed Chews

Veterinary-endorsed chews gained momentum as owners trusted clinically validated claims around dental health, joint support, and digestibility. This trend created opportunities for brands to collaborate with veterinarians, invest in clinical testing, and position products within the premium functional category. Growth in senior dog populations further increased demand for softer, vet-approved chews designed for sensitive teeth. This segment opened room for innovation in therapeutic and condition-specific formulations.

- For instance, Royal Canin, operating in more than 100 markets, employs over 8,500 associates, including over 500 veterinarians and nutritionists, and runs 16 production sites/factories, 1 research and development center, 2 innovation centers, and 4 laboratories worldwide. These numbers are based on the company’s official information as of 2019/2020.

Innovation in Sustainable and Alternative Ingredients

Sustainability became a notable trend as consumers moved toward eco-friendly and responsibly sourced chew products. Opportunities grew for brands using plant-based proteins, upcycled materials, and low-impact manufacturing processes. The rise of environmental awareness encouraged companies to introduce biodegradable packaging and carbon-neutral production claims. This trend aligned with broader shifts in the pet food industry toward greener and cruelty-free solutions.

Key Challenges

Concerns Over Rawhide Safety and Digestibility

Safety concerns around rawhide chews posed a significant challenge, as many owners worried about choking risks, chemical residues, and poor digestibility. Regulatory scrutiny increased across major markets, pushing manufacturers to reformulate or introduce safer alternatives. This challenge affected the long-term growth of traditional rawhide categories while increasing pressure on brands to enhance quality control and transparency. Overcoming safety perceptions remained critical for sustaining consumer trust.

Price Sensitivity in Mass Market Chews

The dog chews market faced challenges from price-sensitive buyers who favored low-cost options over premium functional products. Inflation and rising ingredient costs intensified this issue, limiting the adoption of higher-priced natural chews among budget-conscious households. Competitive pressure in mass retail channels also drove frequent discounting, which reduced margins for manufacturers. Balancing affordability with quality and innovation remained a key restraint for sustained market expansion.

Regional Analysis

North America

North America held about 38% share in 2024 due to high pet ownership, strong spending on premium pet nutrition, and wide retail availability of functional chew formats. Consumers in the United States and Canada favored natural, dental, and rawhide-alternative chews, which supported steady category expansion. Large retail chains and online platforms strengthened product visibility and subscription-based demand. Continuous innovation in high-protein, single-ingredient, and veterinarian-endorsed chew products also pushed the region ahead of others, supported by rising adoption in multi-pet households.

Europe

Europe accounted for nearly 27% share in 2024, driven by rising demand for natural and grain-free chew formulations across Germany, the United Kingdom, France, and Italy. Strict quality regulations encouraged manufacturers to offer safer and more transparent chew options. Growth in online pet product adoption and higher spending among urban pet owners supported market expansion. Premium edible chews and dental care formats gained popularity as pet wellness awareness increased. Sustainability trends and plant-based chew introductions further strengthened the regional landscape.

Asia Pacific

Asia Pacific captured about 22% share in 2024 and recorded strong momentum from expanding pet adoption in China, India, Japan, and South Korea. Rising middle-class income and higher awareness of pet nutrition encouraged buyers to shift from low-cost treats to safer, branded chew products. The region saw rapid online channel growth, with digital marketplaces offering broad access to premium chews. Local and global brands invested in natural and high-digestibility formulations to address rising health concerns. Urbanization and nuclear households further increased spending on functional chew options.

Latin America

Latin America held close to 8% share in 2024, supported by increasing dog ownership in Brazil, Mexico, Argentina, and Chile. Consumers gradually shifted toward healthier edible chews as awareness of dental care and digestive safety grew. Retail expansion in supermarkets and specialty pet stores improved product accessibility. Economic limitations slowed premium adoption, but mid-range chew categories performed well. Growth in e-commerce and locally produced natural chew options helped strengthen regional demand, especially in markets with rising disposable income among young pet owners.

Middle East & Africa

Middle East & Africa represented around 5% share in 2024, with steady growth driven by increasing pet ownership in the UAE, Saudi Arabia, South Africa, and Egypt. Premium chew imports gained traction as affluent households prioritized safer and veterinarian-recommended products. Limited domestic manufacturing increased reliance on international brands, especially for dental and functional chews. Expansion of modern retail channels and online platforms improved access to diverse chew types. Despite slower overall adoption, rising awareness of pet wellness continued to support long-term market potential.

Market Segmentations:

By Product Type

- Rawhide

- Dental Chews

- Edible Chews

- Others

By Age Group

By Distribution Channel

- Hypermarket/Supermarkets

- Specialty Stores

- Veterinary Stores

- Online

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the dog chews market features key players such as Colgate-Palmolive Company, WellPet LLC, Mars, Inc., Nutri-Vet Wellness LLC, Blue Buffalo Co., Ltd., PetIQ, Merrick Pet Care, Inc., Arm & Hammer, Spectrum Brands Holdings, Inc., Nestlé Purina PetCare, and The J.M. Smucker Company, all competing through strong product portfolios and wide retail presence. Companies focused on expanding premium, natural, and functional chew lines to meet rising demand for safer and digestible alternatives. Innovation centered on dental health chews, grain-free options, and single-ingredient formulations that appeal to health-conscious pet owners. Digital channels and subscription programs strengthened consumer reach, while private-label products increased competition in cost-sensitive markets. Many brands invested in sustainable packaging, clean-label recipes, and enhanced sourcing transparency to build trust. Partnerships with veterinarians, retailers, and e-commerce platforms further helped companies improve visibility and capture growing demand across global markets.

Key Player Analysis

- Colgate-Palmolive Company

- WellPet LLC

- Mars, Inc.

- Nutri-Vet Wellness LLC

- Blue Buffalo Co., Ltd.

- PetIQ

- Merrick Pet Care, Inc.

- Arm & Hammer

- Spectrum Brands Holdings, Inc.

- Nestlé Purina PetCare

- The J.M. Smucker Company

Recent Developments

- In 2025, Mars, Inc. introduced the GREENIES™ Canine Dental Check, an AI-powered tool to help pet owners monitor their dog’s dental health via smartphone photos.

- In 2024, PetIQ launched Minties dental treats for large-sized dogs, expanding the brand’s offerings to now include products for large, medium, and small dogs.

- In 2023, Nestlé Purina PetCare acquired a single manufacturing factory in Miami, Oklahoma, from Red Collar Pet Foods to enhance its in-house manufacturing capacity for dog and cat treats, including dental chews.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Age Group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift further toward natural and highly digestible chew formulations.

- Demand for dental health chews will rise as owners focus on preventive oral care.

- Online subscriptions and personalized chew bundles will grow across major markets.

- Brands will increase investment in sustainable ingredients and eco-friendly packaging.

- Functional chews targeting anxiety, joint health, and immunity will gain wider adoption.

- Rawhide alternatives will expand as safety concerns encourage cleaner product choices.

- Veterinary-endorsed chew lines will grow with stronger clinical validation and testing.

- Premium chew products will see faster growth in urban and high-income households.

- Emerging markets in Asia Pacific and Latin America will experience stronger adoption.

- Innovation in plant-based and single-protein chew formats will shape future product development.