Market Overview:

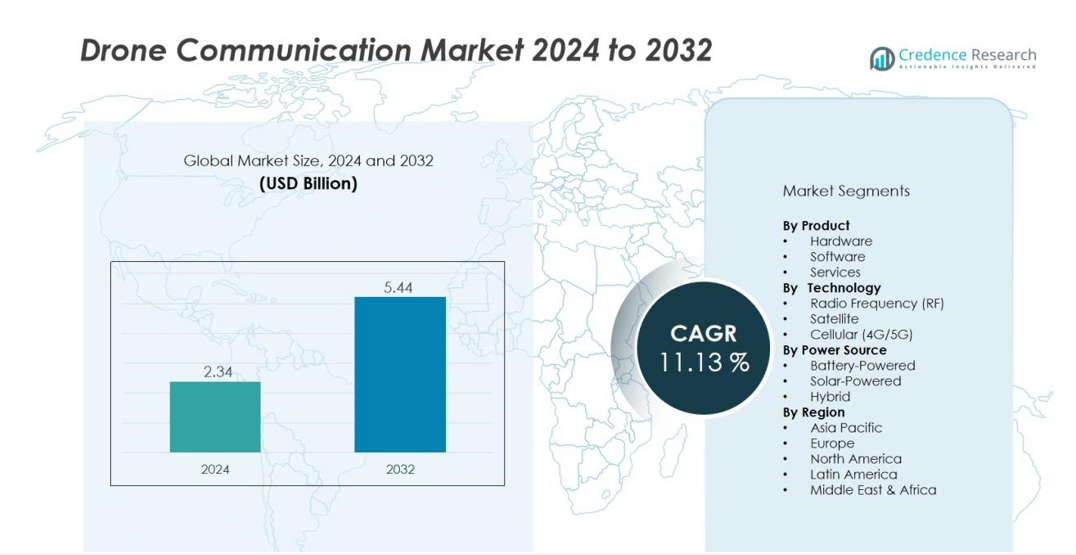

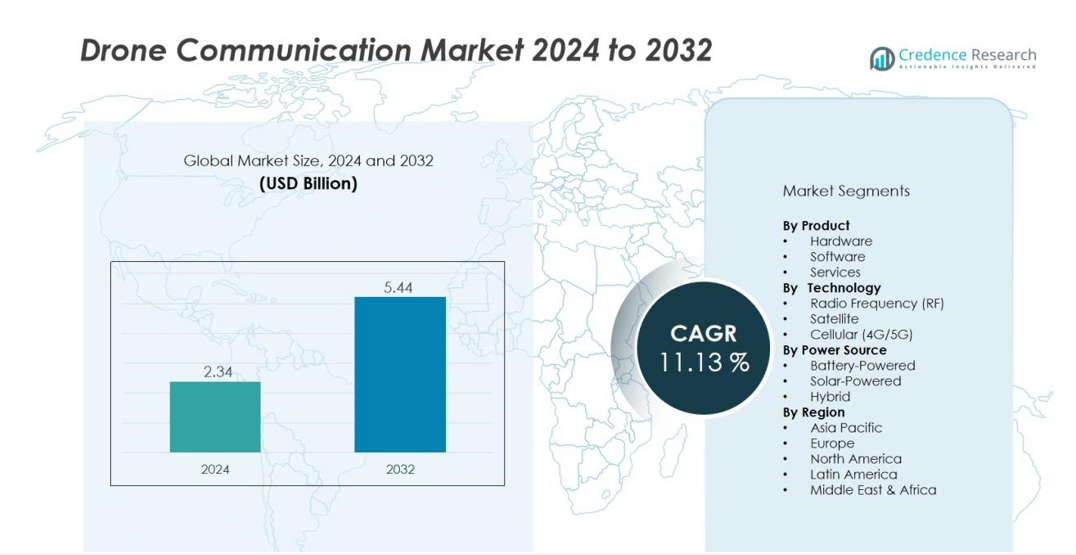

The Drone Communication Market size was valued at USD 2.34 billion in 2024 and is anticipated to reach USD 5.44 billion by 2032, at a CAGR of 11.13 during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drone Communication Market Size 2024 |

USD 2.34 billion |

| Drone Communication Market , CAGR |

11.13% |

| Drone Communication Market Size 2032 |

USD 5.44 billion |

Market growth is driven by increasing deployment of drones for beyond-visual-line-of-sight operations, growing demand for real-time data exchange, and the integration of advanced connectivity technologies such as 5G, LTE, mesh networks, and satellite communication. Expanding commercial applications, including logistics, infrastructure inspection, precision agriculture, and emergency response, also fuel demand for reliable and secure communication links. On the defense front, the use of drones for surveillance, reconnaissance, and coordinated swarm missions continues to boost investment in advanced communication systems.

Regionally, North America leads the global market due to strong defense budgets, mature drone infrastructure, and supportive regulatory frameworks. The Asia-Pacific region is projected to record the fastest growth, driven by expanding drone usage in agriculture, industrial inspection, and disaster management. Europe, Latin America, and the Middle East & Africa show steady progress, with increasing government and private sector initiatives to integrate drones into operational systems.

Market Insights:

- The Drone Communication Market was valued at USD 1.62 billion in 2018, reached USD 2.34 billion in 2024, and is projected to attain USD 5.44 billion by 2032, registering a CAGR of 11.13% during the forecast period.

- North America holds 38% share in 2024, driven by advanced defense programs, strong commercial drone adoption, and favorable FAA regulations supporting BVLOS operations.

- Asia-Pacific accounts for 32% share and represents the fastest-growing region due to rising agricultural automation, industrial inspections, and 5G-based drone deployment in China, India, and Japan.

- Europe captures 20% share, supported by technological innovation, stringent data protection policies, and increasing industrial applications in surveillance and infrastructure inspection.

- By product, hardware leads with 52% share due to strong demand for antennas, transmitters, and modems, while by technology, radio frequency communication dominates with 47% share, driven by its reliability in short to mid-range drone operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption of Unmanned Aerial Systems Across Industries

The Drone Communication Market benefits from rapid expansion in drone applications across logistics, agriculture, construction, and defense. Companies use drones for mapping, inspection, and delivery services that depend on stable and long-range communication systems. Demand for secure data transmission and real-time control accelerates the need for advanced networking solutions. It drives continuous innovation in hardware and software that improve range, latency, and reliability.

- For InstanceZipline’s Platform 2 (P2) drone system was commercially deployed in the U.S. in early 2025 with partners like Walmart. Unveiled and tested extensively in 2023 and 2024, the P2 system facilitates autonomous home deliveries over a 10-mile (16 km) radius round trip with a typical payload.

Advancement of 5G and Satellite Connectivity Technologies

The integration of 5G and satellite links transforms drone operations by enabling faster data transfer and improved coverage. It allows multiple drones to operate simultaneously with minimal delay, supporting complex missions in remote areas. High-speed networks enhance live video streaming, control precision, and automated flight coordination. The development of low-latency connections strengthens command accuracy for both commercial and defense applications.

- For Instance, China Mobile and partners, including telecom equipment manufacturers like Ericsson, have conducted extensive research and development into 5G-enabled drone applications for industrial inspections and emergency response scenarios since the mid-2010s. These efforts focus on leveraging the general low-latency capabilities of 5G networks (typically ranging between 1 to 10 milliseconds in ideal, real-world conditions) to enable real-time data transmission and remote operation of drones.

Expanding Defense and Security Deployments of Drones

Military and law enforcement agencies adopt drones for surveillance, border monitoring, and tactical communication. These applications require encrypted, long-distance, and interference-resistant communication networks. It encourages manufacturers to develop advanced systems with higher bandwidth and secure frequency management. Investments in battlefield connectivity and swarm drone coordination increase the use of high-performance communication modules globally.

Growing Commercial Applications Requiring Real-Time Communication

Commercial drone operations in delivery, disaster management, and smart city infrastructure rely on uninterrupted communication. It ensures operational safety, efficient route planning, and compliance with aviation regulations. Companies in energy, transport, and public services invest in intelligent communication platforms to improve situational awareness. The shift toward autonomous and networked drone fleets strengthens the market for robust communication systems capable of managing large-scale operations.

Market Trends:

Integration of Artificial Intelligence and Edge Computing in Drone Communication

Artificial intelligence and edge computing are reshaping how drones communicate, process, and respond to data in real time. The Drone Communication Market is shifting toward onboard intelligence that reduces dependence on ground-based command systems. It allows drones to make faster flight decisions, manage route adjustments, and share insights across fleets with minimal latency. Integration of AI-driven algorithms improves connectivity, collision avoidance, and mission accuracy. Edge computing supports instant data processing near the source, reducing network load and enhancing response time. This trend is vital for autonomous drone operations in logistics, surveillance, and industrial monitoring.

- For Instance, The DJI Matrice 300 RTK integrates AI vision and edge processing for features such as Smart Track to follow single moving subjects and achieve omnidirectional obstacle avoidance. The drone utilizes dual-vision and Time-of-Flight sensors for six-directional obstacle sensing.

Emergence of Swarm and Mesh Network Communication Models

Swarm communication is gaining attention for coordinated drone operations across defense and commercial sectors. It enables multiple drones to exchange information directly without centralized control, ensuring resilience even when one unit loses signal. The Drone Communication Market benefits from this trend through development of self-healing mesh networks that maintain connectivity in dynamic environments. It enhances mission reliability in agriculture, mapping, and disaster relief where coverage gaps are common. Continuous research in network topology and frequency management strengthens scalability and security. These advancements position swarm-based systems as a critical step toward large-scale, autonomous drone fleets capable of complex collaborative missions.

- For Instance, Parrot integrated 4G LTE and Wi-Fi connectivity in its Anafi Ai drones upon their initial release in late 2021/early 2022 (the drone was announced in June 2021 and started shipping in January 2022).

Market Challenges Analysis:

Regulatory Uncertainty and Frequency Spectrum Limitations

Evolving aviation and communication regulations create uncertainty for drone operators and manufacturers. The Drone Communication Market faces challenges from differing national rules on airspace usage, data privacy, and frequency allocation. It limits global standardization and complicates cross-border operations. Restricted bandwidth and congestion in communication frequencies hinder the development of stable long-range connections. Compliance with stringent safety and cybersecurity protocols increases costs for commercial operators. This fragmentation delays technology adoption and reduces the efficiency of drone network integration.

Cybersecurity Threats and Technical Reliability Concerns

The growing use of networked drones exposes communication systems to cybersecurity risks and signal interference. It creates vulnerabilities that can disrupt command links or compromise sensitive data. Drone operators must invest in encryption, anti-jamming solutions, and secure frequency management to maintain reliability. Hardware failures and connectivity loss under harsh weather conditions further limit operational trust. The Drone Communication Market continues to struggle with balancing performance, safety, and cost. Addressing these issues requires coordinated efforts between regulators, telecom providers, and drone manufacturers to ensure consistent and secure communication frameworks.

Market Opportunities:

Expansion of Beyond Visual Line of Sight (BVLOS) Operations

The growing acceptance of BVLOS operations opens new opportunities for advanced communication systems. The Drone Communication Market benefits from this expansion through the need for reliable, long-range, and low-latency networks. It supports applications such as pipeline inspection, precision agriculture, and logistics delivery over extended distances. Integration of satellite and 5G connectivity enhances real-time control and data sharing. Governments are gradually approving BVLOS regulations, creating a pathway for commercial-scale operations. This progress encourages telecom providers and drone manufacturers to collaborate on developing dedicated aerial communication infrastructure.

Rising Demand for Autonomous and Swarm-Based Drone Systems

Autonomous and swarm drone systems are creating demand for robust, self-adaptive communication frameworks. It enables drones to coordinate without human intervention, enhancing efficiency and mission scalability. The Drone Communication Market gains opportunities from the deployment of mesh networks that support decentralized control. Advancements in AI-driven flight coordination and predictive communication algorithms further strengthen operational reliability. Industrial automation, disaster management, and defense applications increasingly rely on such intelligent networks. Companies investing in autonomous communication solutions can capture new revenue streams in high-growth drone sectors.

Market Segmentation Analysis:

By Product

The Drone Communication Market is segmented into hardware, software, and services. Hardware includes antennas, transmitters, transceivers, and modems that ensure seamless signal exchange between drones and control stations. It plays a crucial role in enabling stable, long-range connectivity during flight operations. Software components manage data transmission, routing, and flight coordination, offering scalability and integration with cloud-based platforms. Services support maintenance, system upgrades, and network optimization, helping operators achieve better communication reliability and regulatory compliance.

- For instance, Collins Aerospace offers the CNPC-1000 UAS Command and Control Data Link or the ARC-210 (RT-2036) networked airborne radio, which enable reliable, secure, and long-range communication for unmanned aircraft systems, and are integrated into various U.S. military programs and platforms

By Technology

The market is divided into radio frequency (RF), satellite, and cellular communication technologies. RF communication dominates due to its widespread use in short to medium-range drone operations. It supports reliable, low-latency connections for mapping and surveillance. Satellite communication provides extended coverage for remote missions and BVLOS operations. Cellular networks, including 4G and 5G, are gaining traction for real-time data sharing and autonomous control. It creates opportunities for telecom providers to establish specialized drone connectivity solutions.

- For Instance, DJI’s OcuSync 4.0 is a radio frequency system operating on 2.4 GHz and 5.8 GHz, not a satellite system for control. Its maximum control range varies by region, reaching up to 20 km under specific conditions like FCC regulations, with shorter ranges in other areas.

By Power Source

The segmentation by power source includes battery-powered, solar-powered, and hybrid drones. Battery-powered systems lead the market due to compact design and cost efficiency. Solar-powered drones are expanding their use in long-endurance surveillance and environmental monitoring. Hybrid models combine multiple energy sources to extend flight duration and reduce downtime. It enhances operational flexibility across commercial and defense sectors, supporting continuous communication during extended missions.

Segmentations:

By Product

- Hardware

- Software

- Services

By Technology

- Radio Frequency (RF)

- Satellite

- Cellular (4G/5G)

By Power Source

- Battery-Powered

- Solar-Powered

- Hybrid

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Dominates with Strong Defense and Regulatory Ecosystem

North America holds 38% share of the Drone Communication Market in 2024, driven by high defense investment and strong commercial adoption. The United States leads with extensive research in unmanned aerial systems and networked communication protocols. It benefits from advanced regulatory support through the Federal Aviation Administration for BVLOS operations and integration of drones into national airspace. Leading companies focus on developing encrypted, long-range communication systems for both civilian and military missions. Canada follows with growing demand for drones in mining, agriculture, and environmental monitoring. The region continues to attract partnerships between telecom operators and drone manufacturers to advance real-time connectivity and operational safety.

Asia-Pacific Emerges as the Fastest-Growing Regional Market

Asia-Pacific accounts for 32% share in 2024 and is projected to record the highest growth rate during the forecast period. China dominates regional production and export of drone components, supported by large-scale industrial and agricultural use. It benefits from government initiatives promoting commercial drone applications in logistics, mapping, and energy inspection. India and Japan expand their focus on integrating 5G-based drone networks for smart city and defense projects. Rapid industrialization and infrastructure expansion increase the need for efficient communication systems. The region continues to attract heavy investment in R&D, creating opportunities for low-latency and long-distance drone connectivity solutions.

Europe Shows Steady Expansion Supported by Technological Innovation

Europe holds 20% share of the Drone Communication Market in 2024, supported by strong innovation in aerial connectivity and autonomous systems. The region emphasizes safety and data protection in drone communication frameworks through policies under the European Union Aviation Safety Agency. It leads in developing secure communication standards for delivery, emergency response, and border monitoring applications. Germany, France, and the United Kingdom drive significant research in 5G-integrated drone platforms. Growing use of drones for industrial inspection and environmental management sustains steady market growth. Collaborative projects between aerospace firms and telecom operators continue to enhance communication infrastructure across the continent.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SZ DJI Technology, Inc.

- 3DR, Inc.

- AgEagle Aerial Systems Inc

- Airware Limited

- Autel Robotics

- Mapbox

- Parrot Drone SAS

- Pix4D

- RedBird

- Skydio

- Teledyne FLIR LLC

- Yuneec International

Competitive Analysis:

The Drone Communication Market is moderately consolidated, with global and regional players focusing on innovation and integration of advanced communication technologies. Key companies include SZ DJI Technology, Inc., 3DR, Inc., AgEagle Aerial Systems Inc., Airware Limited, and Autel Robotics. These players emphasize secure data transmission, long-range connectivity, and AI-driven communication modules. It strengthens their presence across defense, logistics, and industrial applications.

Firms invest in 5G and satellite communication systems to support autonomous drone operations and beyond-visual-line-of-sight missions. Product differentiation through hardware optimization and real-time network management tools remains a core competitive strategy. Partnerships between drone manufacturers and telecom providers enhance communication reliability and operational safety. Continuous R&D in mesh networking, encryption, and multi-drone coordination is shaping the next phase of competition in this evolving market.

Recent Developments:

- In November 2025, DJI launched the Zenmuse L3, its first long-range, high-accuracy aerial LiDAR system, which is designed for enterprise and surveying applications.

- In September 2025, 3DR Labs acquired Strings to enhance its enterprise imaging and workflow automation capabilities in the imaging sector.

Report Coverage:

The research report offers an in-depth analysis based on By Product, By Technology, By Power Source and By Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Drone Communication Market will experience strong demand driven by rapid advancements in 5G and satellite networks.

- Autonomous and swarm-based drone operations will expand, requiring high-speed and secure communication frameworks.

- Integration of artificial intelligence and edge computing will enhance real-time decision-making and network efficiency.

- Defense and homeland security agencies will increase investments in encrypted, interference-resistant communication systems.

- Commercial applications such as logistics, inspection, and disaster management will adopt reliable communication modules for large-scale operations.

- Telecommunication companies will develop dedicated air communication infrastructure supporting beyond-visual-line-of-sight missions.

- Collaborations between drone manufacturers and cloud service providers will strengthen data management and connectivity reliability.

- Growth in energy, agriculture, and construction sectors will boost demand for advanced drone communication networks.

- Standardization of international regulations will promote safer, interoperable, and cross-border drone operations.

- It will evolve into an integrated ecosystem combining hardware, software, and AI-driven analytics to support fully autonomous aerial networks.