Market Overview:

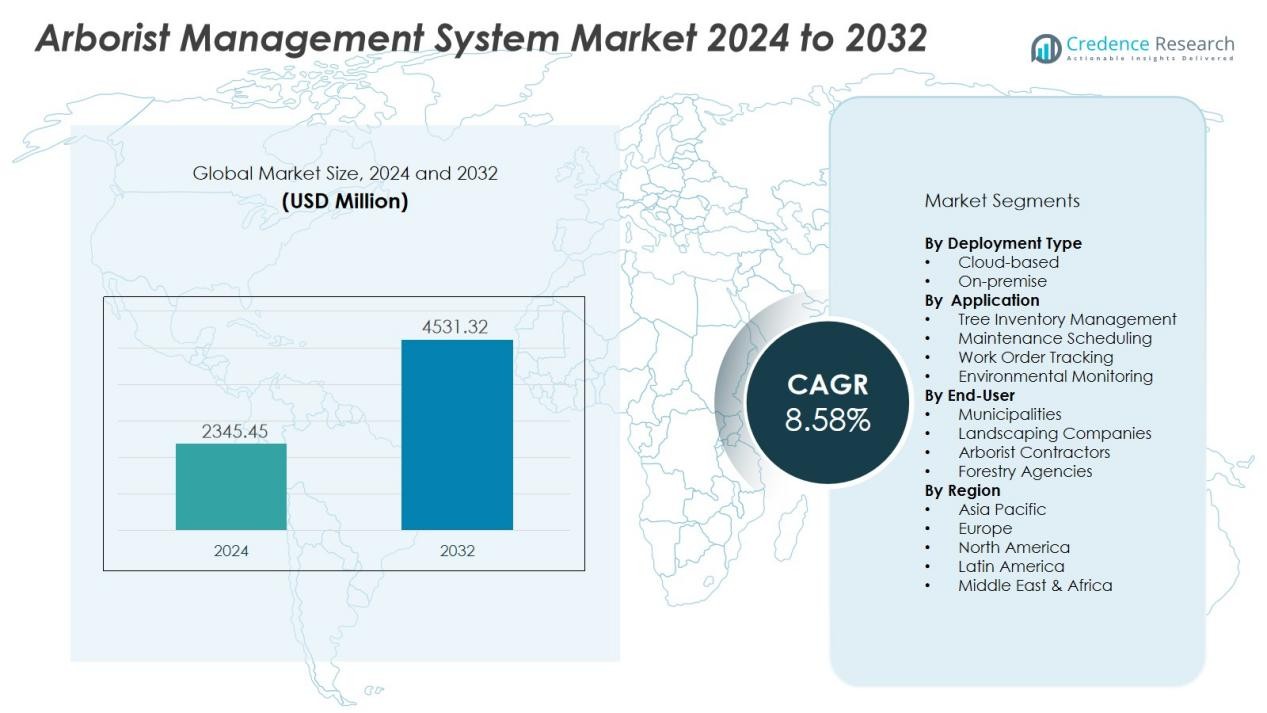

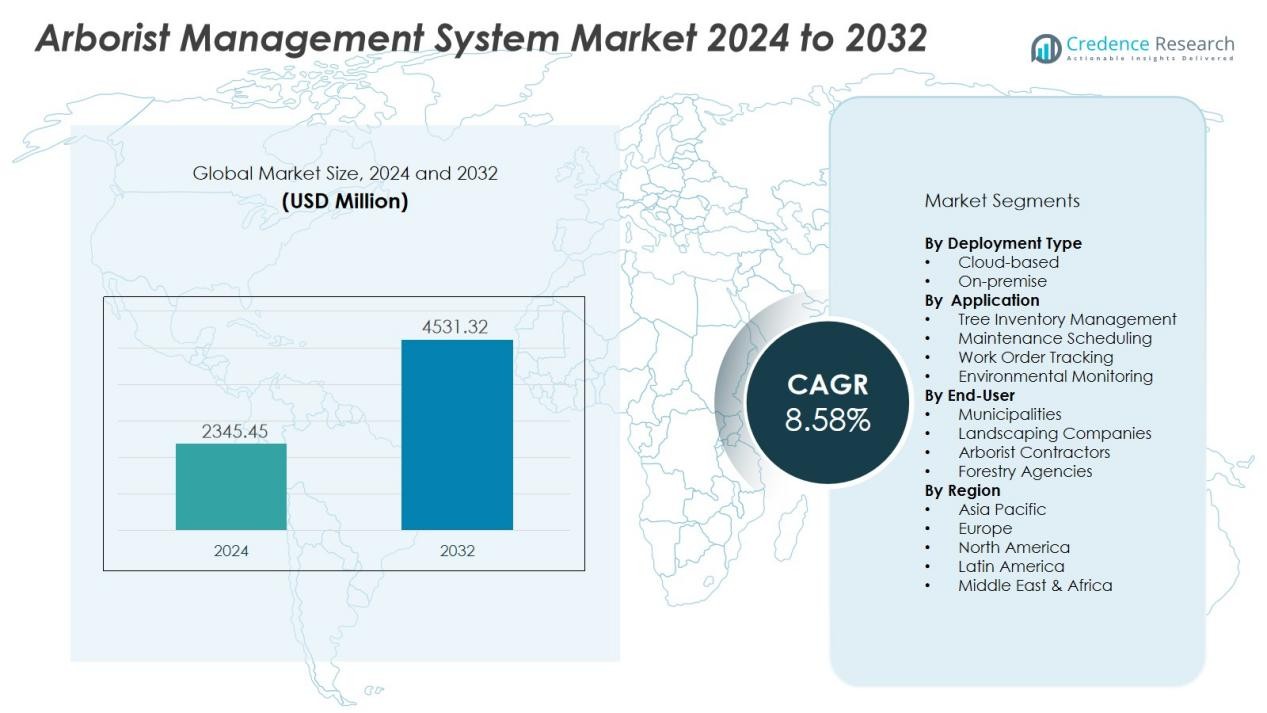

The Arborist Management System Market size was valued at USD 2345.45 million in 2024 and is anticipated to reach USD 4531.32 million by 2032, at a CAGR of 8.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Arborist Management System Market Size 2024 |

USD 2345.45 Million |

| Arborist Management System Market, CAGR |

8.58% |

| Arborist Management System Market Size 2032 |

USD 4531.32 Million |

Key drivers of the AMS market include rising urbanization and the expansion of green infrastructure projects, which create demand for efficient tree- and vegetation management systems. In addition, forest-management and municipal tree-inventory programs face growing regulatory and compliance pressures, bolstering interest in software that supports scheduling, asset tracking, and field-data collection. Finally, increased adoption of cloud-based solutions, mobile apps, and remote monitoring features enhances operational efficiency for tree-care service providers.

In terms of geography, North America currently leads the AMS market, owing to mature arboriculture services, high technology adoption, and extensive municipal tree-management programs. Europe follows as a significant market, driven by strong environmental regulations and landscaping standards. Meanwhile, the Asia-Pacific region is forecast to be the fastest growing, supported by rapid urbanization, rising environmental awareness, and expanding green-space initiatives in countries such as China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Arborist Management System Market was valued at USD 2,345.45 million in 2024 and is projected to reach USD 4,531.32 million by 2032, with a CAGR of 8.58% during the forecast period.

- North America holds the largest share at 35% in 2023, driven by high technology adoption and mature arboriculture services. Europe follows at 30%, benefiting from strict environmental regulations and efficient tree-management programs.

- The Asia-Pacific region, with 20% share, is the fastest-growing market due to rapid urbanization, rising environmental awareness, and expanding green-space initiatives, especially in China and India.

- Cloud-based solutions dominate the deployment type segment, with a significant share, followed by on-premise solutions that cater to organizations with strict compliance needs.

- The Arborist Management System Market’s top applications include tree inventory management, maintenance scheduling, and work order tracking, with tree inventory management holding the largest share.

Market Drivers:

Increasing Urbanization and Green Infrastructure Projects

The Arborist Management System Market is experiencing growth due to the rapid urbanization seen globally. As cities expand, there is an increasing demand for efficient tree management systems to ensure urban forests are maintained properly. Urban landscaping projects, including green roofs and parks, require the integration of effective tree-care practices. These projects drive the demand for Arborist Management Systems to track, schedule, and manage tree maintenance, ensuring the sustainability of green spaces in urban environments.

- For instance, the City of Midland, Michigan deployed AI-powered Smart Tree Inventory technology in partnership with Davey Resource Group to scan approximately 42,000 trees across the city using vehicle-mounted LiDAR and machine learning systems

Rising Regulatory and Environmental Compliance Requirements

Environmental regulations have become stricter in many regions, pushing municipalities and private organizations to adopt more advanced tree management solutions. Compliance with tree preservation and protection regulations necessitates efficient tracking and reporting systems. The Arborist Management System Market is expanding as businesses and municipalities use these solutions to manage tree inventories, track maintenance schedules, and ensure adherence to legal requirements, thereby avoiding penalties and promoting sustainability in urban forestry.

- For instance, the City of Seattle’s Urban Forest Management Plan uses TreeKeeper software by Davey Resource Group to track over 125,000 public trees, significantly improving regulatory compliance and reporting accuracy.

Advancement in Technology and Adoption of Cloud-Based Solutions

The Arborist Management System Market benefits from ongoing technological advancements. Cloud-based solutions and mobile applications are transforming how arborists manage data, making it easier to track work orders, monitor tree health, and schedule maintenance. The integration of IoT and remote monitoring features further boosts the appeal of Arborist Management Systems by enabling real-time data collection and reporting. These technological advancements increase operational efficiency, reduce costs, and improve service delivery in tree-care management.

Growing Demand for Asset Management and Cost Efficiency

The Arborist Management System Market is also driven by the growing need for asset management in tree care services. Organizations and municipalities seek more efficient ways to manage their tree assets, reduce costs, and improve overall service delivery. By automating workflows, tracking equipment usage, and optimizing resource allocation, Arborist Management Systems help reduce operational costs and enhance the profitability of tree-care service providers. These cost-saving benefits make the systems highly attractive to businesses seeking to improve efficiency.

Market Trends:

Proliferation of Cloud‑Based and Mobile Field Solutions

The Arborist Management System Market is moving toward cloud‑first deployments, which allow tree‑care providers to access management tools off‑site and in real time. It supports mobile applications that crews use to update inventory, track work orders and log field observations via smartphones. These interfaces enhance communication between dispatchers and field teams and help reduce travel time, manual data entry and administrative overhead. Providers of the system increasingly embed GPS tracking and offline mode functionality to meet varied field‑conditions and connectivity challenges. The shift toward Software‑as‑a‑Service models fosters flexible subscription pricing and faster implementation cycles across small to medium size arborist firms.

- For instance, ArboStar deployed offline functionality that enables field crews to track time, manage jobs and capture leads in remote areas without internet connectivity, with all data automatically syncing once connection is restored.

Integration of Advanced Analytics, IoT and Sustainability‑Driven Capabilities

The Arborist Management System Market shows strong uptake of analytics engines and Internet of Things sensors that monitor tree health, soil moisture or environmental conditions. It also embraces GIS‑enabled mapping features for asset‑tagging and spatial maintenance‑planning of urban tree helps. Service providers leverage predictive‑models to forecast pruning needs, pest risks or canopy changes and generate actionable alerts. Sustainability mandates push users to adopt modules that track carbon sequestration, green‑infrastructure metrics and regulatory compliance. These trends converge to create smarter, data‑driven tree‑management operations and strengthen the value‑proposition for system vendors.

- For Instance, PlanIT Geo provides a software suite, including TreePlotter INVENTORY and CANOPY, which enables municipalities and organizations to manage and analyze their urban forests using Geographic Information Systems (GIS), high-resolution aerial/satellite imagery, and AI-powered data analysis

Market Challenges Analysis:

High Initial Investment and Cost‑Barriers

The Arborist Management System Market faces notable resistance from smaller tree‑care firms that operate under tight budgets. Purchasing licences, hardware and training represent significant upfront expenses that many micro or small providers cannot justify. Limited financial flexibility leads some companies to postpone or avoid full system adoption. This investment barrier slows penetration in markets with many smaller service providers. Firms that have adopted the system still may face ongoing maintenance and upgrade costs that strain their operations.

Integration Complexities and Low Technology Readiness

The Arborist Management System Market also contends with technical hurdles around integration and user capability. Many tree–care businesses operate legacy systems or manual processes and find it difficult to link new software with those workflows. Skilled personnel may lack experience in digital platforms, which adds to training demands. Concerns over data security and cloud‑deployment reliability further restrain adoption. Some enterprises resist change‑management due to entrenched manual methods and uncertainty about system benefits. Integration and readiness challenges therefore hamper broader uptake in less technologically mature regions.

Market Opportunities:

Expansion through Smart City and Urban Green Infrastructure Initiatives

The Arborist Management System Market stands to gain substantial traction via smart‑city and urban green‑space programmes worldwide. Municipal authorities invest in tree‑inventory tools and tree‑health monitoring systems to meet sustainability targets. It provides software and hardware modules that track tree location, condition, and maintenance history for city forests. Growth in infrastructure funding for parks, street‑trees and landscaping offers system vendors fresh contracts and recurring services. Tree‑care experts will adopt digital workflows tied to these projects, boosting demand for comprehensive management solutions.

Opportunity in Advanced Analytics, Mobile‑Field Platforms and Sustainability Reporting

The Arborist Management System Market presents strong opportunities through analytics, mobile‑field solutions and sustainability tracking features. Firms face pressure to document carbon‑sequestration, canopy cover and pest‑risk data to fulfil regulatory and ESG obligations. It can embed IoT sensors, GIS mapping and mobile apps that give field staff real‑time access to asset data and job‑flows. Scale‑up of field‑deployable devices and subscription‑based models enables providers to reach smaller tree‑care businesses. Innovation in predictive maintenance and automated reporting enhances differentiation and draws new users to the market.

Market Segmentation Analysis:

By Deployment Type

The Arborist Management System Market is segmented into cloud-based and on-premise deployment models. Cloud-based solutions dominate due to their flexibility, scalability, and lower upfront costs. These systems are especially attractive for businesses that require remote access and mobile field solutions. They also offer ease of updates and integration with other technologies. On-premise solutions, while offering enhanced data security, are preferred by organizations with stringent compliance needs or those operating in regions with limited internet connectivity. Despite the higher upfront investment, on-premise deployment remains significant in large enterprises and government organizations.

- For instance, the Vivaldi Arborists from Sweden streamlined their administrative workflow by deploying GIS Cloud’s Mobile Data Collection application on-premise, which eliminated paper-based tree inspections while maintaining precise GPS pinpointing even in areas with weak satellite signals, allowing their team leader Sean Grant to focus on tree care quality rather than data management overhead.

By Application

The Arborist Management System Market caters to various applications, including tree inventory management, maintenance scheduling, work order tracking, and environmental monitoring. Tree inventory management is the most prominent application, as it helps municipalities and private firms maintain detailed records of tree species, health, and growth. Maintenance scheduling and work order tracking ensure timely interventions, while environmental monitoring capabilities enable real-time assessment of tree health, pests, and surrounding conditions. These applications are increasingly adopted in urban planning and green infrastructure projects, where proper management is essential.

- For Instance, San Francisco uses various data management tools, including an online interactive street tree map, to track its approximately 125,000 public street trees as part of the StreetTreeSF program and EveryTreeSF initiative

By End-User

End-users of the Arborist Management System Market include municipalities, landscaping companies, arborist contractors, and forestry agencies. Municipalities are the largest segment, as they require comprehensive systems for managing urban tree inventories and maintaining public green spaces. Landscaping companies and arborist contractors use these systems for efficient scheduling and service delivery. Forestry agencies leverage them for large-scale tree monitoring and environmental assessments. The adoption of these systems is expected to grow among smaller contractors as the market for digital tree care management continues to expand.

Segmentations:

By Deployment Type

By Application

- Tree Inventory Management

- Maintenance Scheduling

- Work Order Tracking

- Environmental Monitoring

By End-User

- Municipalities

- Landscaping Companies

- Arborist Contractors

- Forestry Agencies

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Region

This region captured 35% of the global revenue share for the Arborist Management System Market in 2023. High adoption rates of digital tree‑care solutions and strong municipal investments in green infrastructure support it. U.S. and Canada lead with mature arboriculture service markets and growing regulatory mandates for urban forestry. Technology providers in this region leverage robust infrastructure and established field‑service workflows. Local firms often partner with public bodies to deploy advanced tree‑inventory platforms and mobile field systems. These dynamics maintain North America’s leadership while mid‑sized contractors increasingly invest in cloud solutions.

Europe Region

This region held 30% of the global revenue share in the same period. It benefits from strict tree‑protection legislation and efficient public‑sector procurement of tree‑management tools. Major markets such as the UK, Germany and France host advanced service providers that adopt systems for scheduling, work‑order tracking and asset‑monitoring. Providers tailor the system to local languages and regulatory frameworks, which enhances usability. Market players emphasise integration of GIS mapping and inventory modules to meet European requirements. That focus helps the region maintain steady demand for management solutions.

Asia‑Pacific & Other Regions

The Asia‑Pacific region recorded 20% of the global revenue share in 2023 and presents the fastest growth rate within the market. Rising urbanisation in China, India and Southeast Asia drives demand for tree‑inventory coverage and digital maintenance workflows. Service providers enter these markets by offering scalable cloud‑based systems aligned with smart‑city programmes. Latin America and Middle East & Africa compose the remaining portion, with growth potential in infrastructure and arboriculture services. These emerging regions attract vendors through partnerships and regional deployment trials, creating future expansion avenues.

Key Player Analysis:

- Smartbe

- ArborTrak

- ArborMaster

- TreePlotter

- VueWorks

- GreenKeeper

- Citygreen

- Liveoak

- Arbio

- Arborgold

Competitive Analysis:

The competitive landscape of the Arborist Management System Market remains dynamic and fragmented, giving vendors opportunities to differentiate through niche capabilities and regional reach. Smartbe, ArborTrak, ArborMaster, TreePlotter stand among the prominent players vying for market share in this segment. These vendors deliver end‐to‐end tree‑care platforms that combine inventory workflows, scheduling, asset tracking and reporting functionality. They deploy both cloud‑based and on‑premise solutions depending on client size, regulatory requirements and technology maturity. It is clear that vendors with advanced analytics, mobile field apps and GIS integration gain higher traction among municipalities and large contractors. Some providers invest in strategic partnerships and acquisitions to broaden their geographic footprint and solution portfolio. Others focus on cost‑effective subscription models that target small and mid‑sized arborist firms to accelerate adoption. Competitive pressure remains high due to low entry barriers for software developers and the increasing demand for specialised tree‑management tools across global markets.

Recent Developments:

- In December 2024, PlanIT Geo launched the TreePlotter Projects feature, which enhanced the TreePlotter software suite by adding new capabilities for project tracking, reporting, and compliance with federal funding requirements.

- In April 2023, PlanIT Geo, the company behind TreePlotter, was acquired by Waverock Software, boosting development resources and accelerating new product releases and improvements.

Report Coverage:

The research report offers an in-depth analysis based on Deployment Type, Application, End-User and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Future Outlook:

- The Arborist Management System Market is expected to continue expanding as urbanization accelerates and municipalities invest in sustainable green infrastructure projects.

- The integration of IoT sensors and AI-driven analytics will enhance tree-health monitoring and predictive maintenance capabilities, improving service efficiency.

- Mobile-based applications and cloud solutions will become increasingly popular, providing arborists with real-time access to data and management tools while on the go.

- Increased focus on environmental regulations will drive the demand for compliance-focused systems, helping businesses track and report carbon sequestration and green cover.

- Smaller arborist firms will gradually adopt cloud-based solutions due to lower upfront costs and the scalability of subscription models.

- Integration with other city management tools, such as smart city platforms, will streamline urban forestry management and foster greater adoption of Arborist Management Systems.

- Vendors will focus on enhancing user interfaces and providing customizable features to meet the specific needs of various end-users, from municipalities to private contractors.

- Collaboration between Arborist Management System providers and environmental agencies will promote data-driven decision-making in urban forestry initiatives.

- Regional expansion, particularly in the Asia-Pacific region, will contribute to broader market penetration as urban green space projects gain momentum.

- The market will see innovation in asset tracking, scheduling, and reporting capabilities, with more solutions incorporating advanced GIS mapping features.