Market Overview

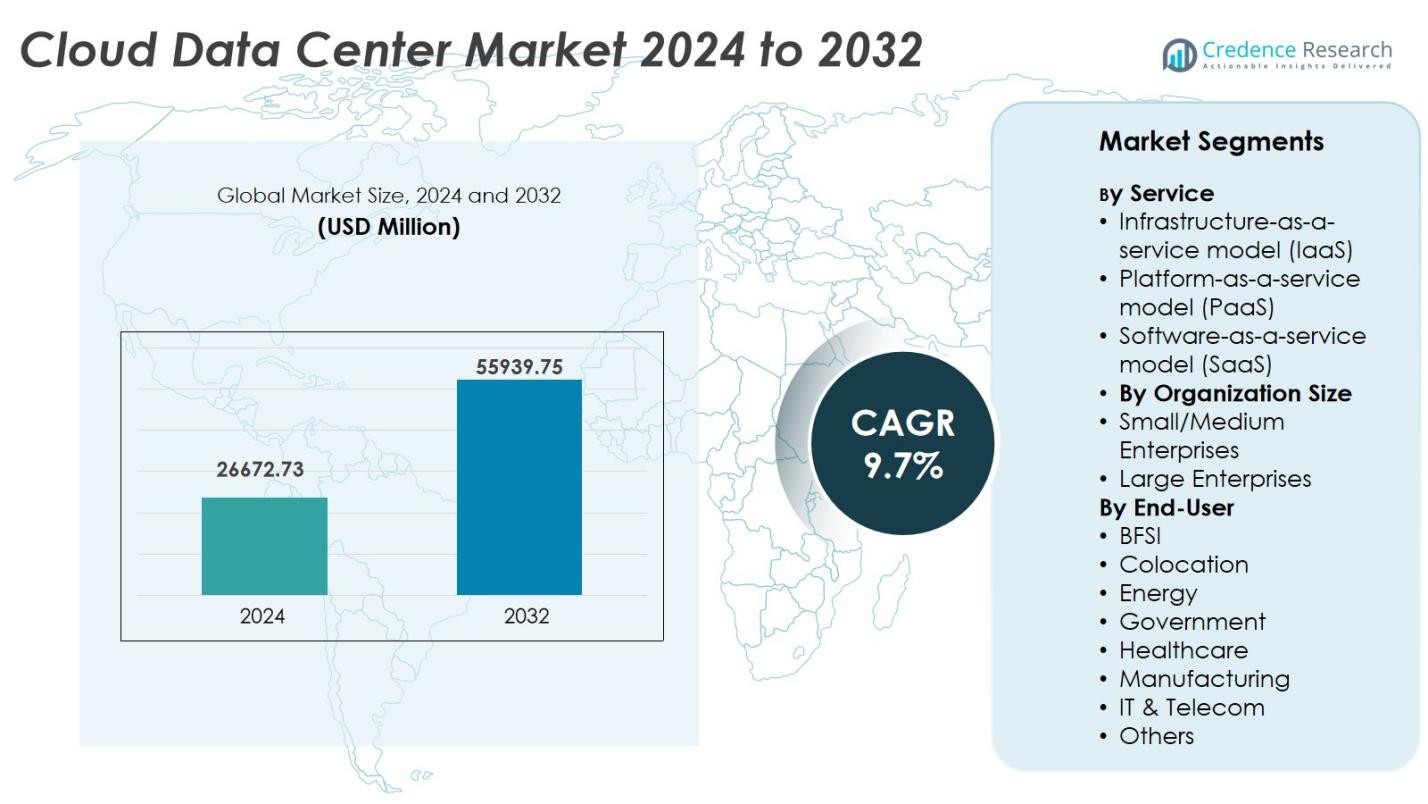

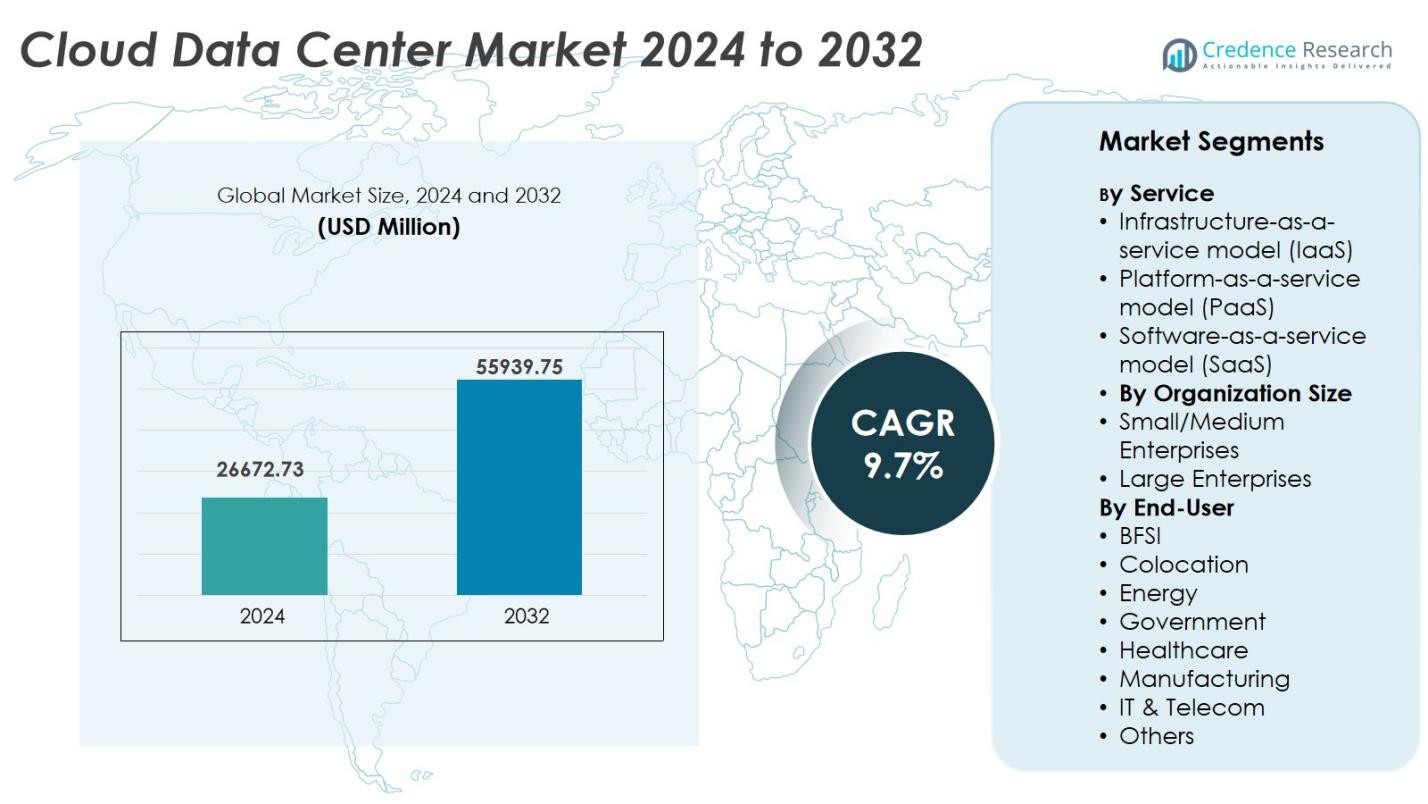

Cloud Data Center Market size was valued USD 26672.73 million in 2024 and is anticipated to reach USD 55939.75 million by 2032, at a CAGR of 9.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Data Center Market Size 2024 |

USD 26672.73 Million |

| Cloud Data Center Market, CAGR |

9.7% |

| Cloud Data Center Market Size 2032 |

USD 55939.75 Million |

Major participants in the Cloud Data Center market include Amazon Web Services, Microsoft Azure, Google Cloud Platform, IBM Cloud, Oracle Cloud Infrastructure, VMware, Cisco Systems, and Dell Technologies. These providers operate large hyperscale facilities, invest in renewable-powered campuses, and expand regional availability zones to support low-latency services and data-sovereignty compliance. Colocation specialists such as Equinix and Digital Realty strengthen the ecosystem by offering scalable space for enterprises that avoid self-built infrastructure. North America leads the market with a 35% share, driven by high cloud adoption, advanced telecom networks, and strong enterprise demand from BFSI, healthcare, and IT service providers.

Market Insights

- The Cloud Data Center market was valued at USD 26672.73 million in 2024 and is forecast to reach USD 55939.75 million by 2032, expanding at a 9.7% CAGR.

- Strong market growth is driven by digital transformation, workload migration, and the shift from legacy infrastructure to scalable cloud computing, supported by rising demand for data storage, automation, and secure application hosting.

- Key trends include rapid expansion of edge computing, energy-efficient green data centers, and multi-cloud adoption, as companies seek lower latency, sustainability, and enhanced flexibility in managing high-density workloads.

- Competitive activity intensifies as AWS, Microsoft Azure, Google Cloud, IBM, Oracle, and colocation providers invest in hyperscale facilities, renewable power, and security upgrades. Large enterprises lead adoption, holding the biggest segment share due to higher data usage and regulatory compliance needs.

- Regionally, North America holds 35%, followed by Europe at 28% and Asia Pacific at 25%, while Latin America and the Middle East & Africa collectively make up the remaining share, supported by cloud adoption in telecom, BFSI, and government sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Service

Infrastructure-as-a-Service (IaaS) held about 38% share of the Cloud Data Center market in 2024, leading due to strong enterprise demand for scalable computing, storage, and networking. Platform-as-a-Service (PaaS) accounted for 27%, while Software-as-a-Service (SaaS) captured 35%. IaaS remains dominant as businesses prioritize flexible infrastructure, cost efficiency, and rapid workload deployment across hybrid and multi-cloud environments.

- For instance, Amazon Web Services (AWS) offers Elastic Compute Cloud (EC2), allowing businesses to run server instances on demand without upfront hardware investments.

By Organization Size

Large enterprises lead the cloud data-centre market, holding the major market share over 83% owing to higher data usage, strong IT budgets, and the rapid shift toward digital transformation. Large corporations deploy hybrid and multi-cloud environments to run mission-critical workloads and maintain regulatory compliance. These enterprises benefit from high-performance computing, real-time analytics, and global data-centre networks. Small and medium enterprises (SMEs) also adopt cloud data-centres for flexibility and reduced infrastructure cost, yet many remain in early transition stages. Large enterprises drive the segment due to higher security needs and greater volume of hosted applications.

- For instance, Apple’s Mesa Data Center in Arizona serves as a core hub for services like iMessage and iCloud, powered entirely by renewable energy and designed to uphold privacy and operational reliability.

By End User

The IT & telecom end-user segment dominates, holding 40% of the market share because telecom operators and cloud service providers manage massive volumes of data traffic and enterprise workloads. The sector demands high storage capacity, low latency, and resilient architecture for global network operations. BFSI, healthcare, and government sectors increase adoption to secure sensitive data and meet compliance mandates. Manufacturing and energy industries use cloud data centres for automation and predictive maintenance. Colocation facilities gain traction as companies rent space instead of building private data centres. IT & telecom continues to lead due to heavy data transmission and cloud-native service expansion

Key Growth Drivers

Rising Digital Transformation Across Enterprises

Enterprises accelerate digital transformation initiatives, creating strong demand for cloud data centers to support scalable computing, storage, and application hosting. Businesses shift from legacy hardware to virtualized infrastructure to improve operational flexibility and reduce capital expense. Adoption of AI, analytics, and IoT generates massive data volumes, pushing organizations toward cloud-backed processing capabilities. Remote work models and SaaS-based collaboration platforms further increase cloud traffic, leading to higher investment in public and hybrid data centers. Governments and large companies also migrate core systems into cloud environments for faster service delivery and automation. Continuous modernization of IT infrastructure strengthens the market, as enterprises prefer pay-as-you-go computing and disaster recovery services.

- For instance, IBM helps enterprises migrate workloads from on-premises systems to cloud environments like IBM Power Systems Virtual Server, enabling flexible cloud-native operations and efficient workload management.

Surge in Data Generation from Connected Devices and Industries

Industries generate large datasets through automation, connected sensors, smart manufacturing, and enterprise mobility, which creates significant demand for cloud storage and computing power. Sectors such as BFSI, telecom, e-commerce, and healthcare rely on cloud data centers for secure data processing, analytics, and real-time decision-making. Growing online transactions, streaming platforms, and mobile applications also drive storage expansion. Data localization rules across many countries increase deployment of regional cloud facilities. Increasing security requirements encourage organizations to choose cloud centers with advanced threat monitoring and encrypted access. As industrial IoT expands, edge data centers and micro data centers support processing near device locations, reducing latency. This growth in data-hungry applications directly accelerates investment in modern cloud architectures.

- For instance, Dell Technologies deploys edge data center solutions through its PowerEdge servers and Edge Gateways, enabling processing close to device locations to reduce latency and support real-time operational insights.

Growing Adoption of Hybrid and Multi-Cloud Architectures

Businesses move toward hybrid and multi-cloud infrastructures to avoid vendor lock-in, optimize cost, and distribute workloads across different platforms. Hybrid systems allow companies to keep sensitive applications on private clouds while using public clouds for scalable computingpower. Multi-cloud strategies benefit enterprises that operate across regions, need uninterrupted availability, and require compliance with regional data regulations. The approach improves redundancy, cybersecurity, and application performance. Cloud data centers provide seamless orchestration tools to manage containerized applications, virtual machines, and AI workloads across multiple providers. Enterprises also shift disaster recovery setups to hybrid environments to ensure resilience. As organizations expand globally, they prefer distributed cloud centers that deliver low latency, better uptime, and flexibility in workload placement, fueling long-term market growth.

Key Trends & Opportunities

Growth of Edge and Distributed Cloud Data Centers

Edge computing emerges as a major trend because enterprises want real-time data processing near device and user locations. Latency-sensitive applications such as autonomous vehicles, smart factories, telemedicine, and 5G services require decentralized compute nodes instead of centralized infrastructure. Cloud providers build micro data centers near urban and industrial regions to support faster processing and bandwidth savings. Telecom operators integrate edge data centers with 5G networks to deliver quicker application response. Content delivery networks also rely on regional cloud sites to speed up streaming and gaming performance. Investments in distributed architectures create opportunities for hardware vendors, cloud service providers, and hyperscale colocation facilities.

- For instance, FedEx partnered with Dell Technologies and Switch Inc. to develop cloud-enabled edge data centers housed in FedEx-branded shipping containers, enhancing their network performance with localized compute, storage, and networking capabilities.

Increased Focus on Green Data Centers and Energy Efficiency

Sustainability becomes a top priority as data centers consume high electricity for servers, cooling, and networking equipment. Providers adopt renewable energy sources, liquid cooling systems, and AI-based power optimization tools to reduce carbon footprint. Green certifications attract enterprises that aim to meet environmental, social, and governance (ESG) standards. Hyperscale operators build solar-powered or wind-powered campuses and recycle waste heat for nearby facilities. Governments encourage sustainable data centers through energy efficiency regulations and incentives. These eco-friendly initiatives drive technological innovation and open growth opportunities for energy-efficient infrastructure suppliers.

- For instance, Microsoft has committed to powering its data centers with 100% renewable energy by 2030, backed by a $10 billion investment to develop 10.5 gigawatts of renewable capacity through solar, wind, and emerging carbon-free technologies, including fusion and small modular nuclear reactors.

Key Challenges

Rising Cybersecurity and Data Privacy Risks

Cloud data centers store sensitive enterprise and consumer data, making them targets for cyberattacks, ransomware, and network breaches. Companies must invest heavily in advanced security layers, encrypted access, intrusion monitoring, and strong identity management. Data privacy regulations such as GDPR, HIPAA, and national data localization laws require providers to implement strict compliance protocols. Multi-cloud environments also increase complexity, as managing policies across multiple platforms becomes difficult. Lack of skilled cybersecurity talent further widens the risk gap. Any breach can lead to financial losses and damage customer trust, making security a critical challenge for cloud operators.

High Energy Consumption and Infrastructure Costs

Cloud data centers demand continuous power supply, advanced cooling systems, and large-scale server deployment, leading to high operational expenses. Regions with expensive electricity face difficulty sustaining large facilities. Rising global energy prices impact service pricing and profit margins. Companies also need long-term investment in network equipment, redundancy planning, and disaster recovery infrastructure. Small enterprises face cost barriers when shifting large workloads to cloud platforms. Moreover, supply chain fluctuations in chips, power modules, and cooling systems can delay expansions. These financial challenges push companies to explore automation, renewable energy, and efficient cooling to reduce costs while maintaining performance.

Regional Analysis

North America

North America holds the largest share of the Cloud Data Center market, accounting for over 35% of total revenue. Strong adoption of public cloud platforms, advanced telecom infrastructure, and heavy investment in hyperscale facilities support regional leadership. The U.S. drives demand through large enterprises, federal digital programs, and rapid 5G deployments. Major cloud providers such as AWS, Microsoft Azure, and Google expand data center footprints to manage rising workloads from AI, streaming, and fintech. High cybersecurity standards and disaster-recovery mandates further strengthen cloud migration. Canada also invests in green data centers powered by renewable energy, improving regional capacity.

Europe

Europe captures nearly 28% of the market, led by Germany, the U.K., France, and the Nordic region. Strong data privacy laws, including GDPR, encourage enterprises to host data in regional cloud facilities. Demand rises from BFSI, telecom, healthcare, and manufacturing sectors focused on secure, compliant infrastructure. Hyperscale providers develop new facilities in Germany and Ireland due to favorable energy policies and proximity to major business hubs. The region also promotes green cloud initiatives through renewable-powered data centers and liquid cooling. Growing digital transformation in Central and Eastern Europe expands colocation and hybrid cloud adoption.

Asia Pacific

Asia Pacific is the fastest-growing market and holds over 25% share, driven by large populations, expanding internet users, and strong cloud investments in China, India, Japan, Singapore, and South Korea. E-commerce, telecom, fintech, and smart manufacturing generate massive data traffic that requires scalable storage and processing. Governments promote data localization and smart city projects, accelerating cloud infrastructure rollout. China leads regional deployments, while Singapore and India emerge as major colocation hubs. Rising adoption of 5G and edge computing strengthens the market outlook. Increasing demand from SMEs boosts public cloud usage across the region.

Latin America

Latin America accounts for nearly 7% of the Cloud Data Center market, with Brazil and Mexico leading deployments. Cloud adoption increases as enterprises modernize legacy IT and move toward hybrid environments. Telecom operators upgrade networks to support digital banking, streaming, and e-commerce. Colocation facilities expand as companies avoid high capital costs of self-built data centers. Government digitalization and fintech growth drive cloud investments. However, energy costs and regulatory constraints slow rapid expansion. Still, rising demand for AI-enabled applications and remote services strengthens long-term potential in Brazil, Chile, and Colombia.

Middle East & Africa

The Middle East & Africa region holds 5% of the market and shows steady growth due to digital government programs, smart city investments, and expanding cloud-based enterprise services. Gulf countries such as the UAE, Saudi Arabia, and Qatar attract hyperscale providers through data sovereignty policies and renewable-powered industrial zones. Telecom operators deploy cloud platforms to support 5G and IoT services. In Africa, South Africa, Kenya, and Nigeria emerge as cloud adoption hubs driven by fintech, e-commerce, and digital banking. Limited infrastructure and high power costs remain key restraints, yet demand continues to rise.

Market Segmentations:

By Service

- Infrastructure-as-a-service model (IaaS)

- Platform-as-a-service model (PaaS)

- Software-as-a-service model (SaaS)

By Organization Size

- Small/Medium Enterprises

- Large Enterprises

By End-User

- BFSI

- Colocation

- Energy

- Government

- Healthcare

- Manufacturing

- IT & Telecom

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cloud Data Center market is highly competitive, driven by global hyperscale providers, telecom operators, and colocation companies expanding infrastructure to support rising enterprise workloads. Leading players such as Amazon Web Services, Microsoft Azure, Google Cloud, IBM, and Oracle continue to invest in new data center regions, renewable energy usage, high-density servers, and AI-powered workload management. Their strategies focus on hybrid cloud adoption, security enhancement, and low-latency performance. Colocation providers, including Equinix, Digital Realty, and NTT Global Data Centers, gain traction as businesses prefer renting space instead of building private facilities. Telecom operators integrate cloud hosting with 5G networks to deliver edge computing and IoT services. Partnerships with chip manufacturers and cooling technology companies support energy-efficient operations. Startups and regional providers enter the market with specialized offerings in edge data centers, localized storage, and compliance-focused hosting. Continuous innovation in sustainability, automation, and security keeps competition strong and drives market advancement.

Key Player Analysis

- Microsoft Azure

- Amazon Web Services

- Alibaba Cloud

- IBM Cloud

- Google Cloud Platform

- Oracle Cloud Infrastructure

- Alibaba Cloud

- VMware

- Cisco Systems

- Dell Technologies

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In October 2025, AdaniConneX (via Adani Enterprises) and Google Cloud announced a partnership to build India’s largest AI data-centre campus in Visakhapatnam, Andhra Pradesh.

- In June 2023, a significant achievement was marked in Oman’s digital transformation by introducing the country’s first private cloud data center. This initiative was launched by the global technology company SAP SE in collaboration with Oman’s Ministry of Transport, Communications, and Information Technology (MTCIT).

- In November 2022, Equinix, Inc., a leading global digital infrastructure provider, and VMware, Inc. expanded their global partnership to offer advanced digital infrastructure and multi-cloud services. Together, they introduced VMware Cloud on Equinix Metal, a new distributed cloud service designed to deliver a high-performance, secure, cost-effective solution for enterprise applications.

Report Coverage

The research report offers an in-depth analysis based on Service, Organization End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cloud data centers will expand further as enterprises accelerate digital transformation.

- Hybrid and multi-cloud models will gain wider adoption for workload flexibility.

- Edge data centers will grow to support low-latency applications and 5G services.

- Green data center construction will increase to reduce energy consumption and emissions.

- AI-driven management tools will optimize power usage, cooling, and workload distribution.

- Colocation services will rise as companies avoid the cost of building private facilities.

- Cybersecurity investment will increase to counter evolving cloud-based threats.

- Industries such as BFSI, healthcare, and telecom will drive demand for compliant cloud hosting.

- Data localization rules will push providers to expand regional availability zones.

- Automation will streamline data center operations, reducing downtime and human error.