Market Overview

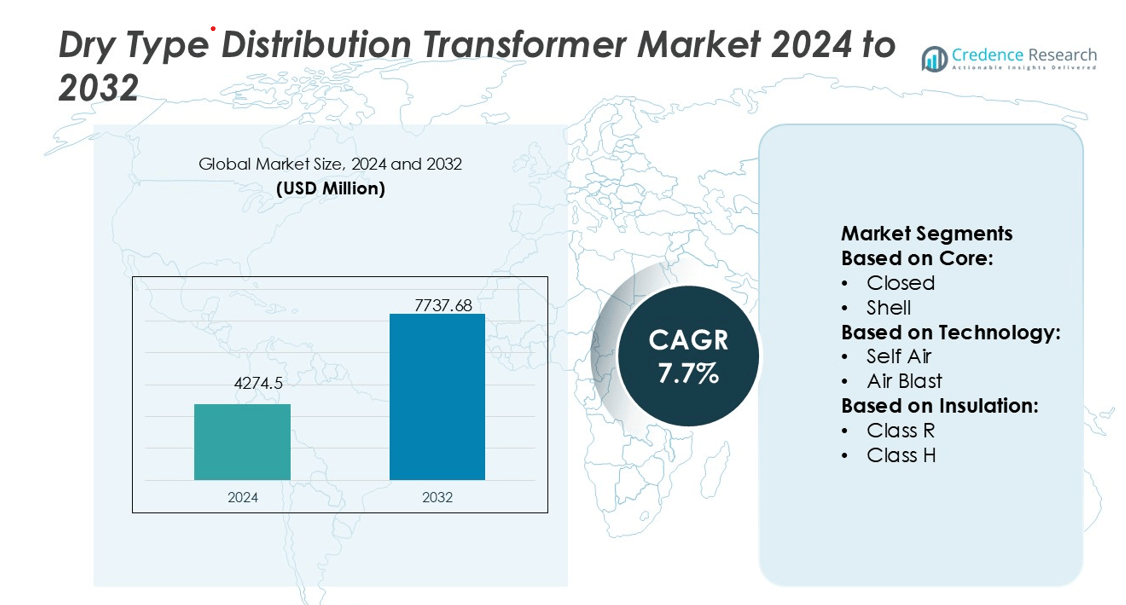

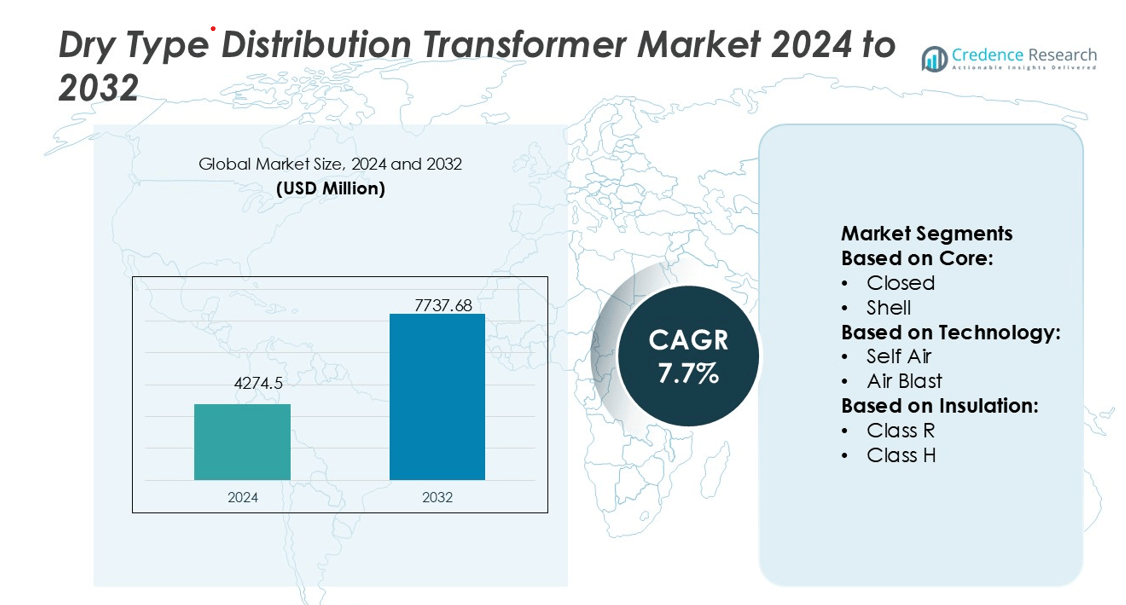

Dry Type Distribution Transformer Market size was valued USD 4274.5 million in 2024 and is anticipated to reach USD 7737.68 million by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dry Type Distribution Transformer Market Size 2024 |

USD 4274.5 million |

| Dry Type Distribution Transformer Market, CAGR |

7.7% |

| Dry Type Distribution Transformer Market Size 2032 |

USD 7737.68 million |

The Dry Type Distribution Transformer Market is shaped by major players such as ABB, Schneider Electric, Hitachi Energy Ltd., General Electric, Eaton, CG Power & Industrial Solutions Ltd., Crompton Greaves Consumer Electricals Limited, Bharat Heavy Electricals Limited (BHEL), Kirloskar Electric Company Limited, and Easun Reyrolle Limited. These companies emphasize product innovation, digital monitoring integration, and sustainable manufacturing practices to meet evolving energy efficiency standards. Strategic collaborations with utilities and industrial clients strengthen their market positions. Asia-Pacific leads the global market with a 34% share in 2024, driven by rapid industrialization, renewable energy expansion, and government-backed grid modernization programs, establishing the region as the key growth hub for dry type distribution transformers.

Market Insights

- The Dry Type Distribution Transformer Market was valued at USD 4274.5 million in 2024 and is projected to reach USD 7737.68 million by 2032, growing at a CAGR of 7.7% during the forecast period.

- Growing emphasis on energy efficiency, renewable integration, and eco-friendly designs drives strong adoption across industrial and commercial applications.

- Advancements in smart monitoring, IoT connectivity, and insulation technology are key trends enhancing operational reliability and performance.

- The market faces restraints from high initial costs and thermal limitations in high-voltage applications, restricting large-scale deployment.

- Asia-Pacific leads with a 34% share, followed by North America with 28% and Europe with 24%; the closed core segment dominates by design, supported by rising demand for safe, compact, and maintenance-free transformers across smart grid and renewable energy infrastructure projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Core

The closed core segment dominates the Dry Type Distribution Transformer Market with a 46% share in 2024. Its strong magnetic coupling and reduced leakage flux enable efficient energy transfer and minimal losses. Closed-core transformers are preferred for commercial and industrial applications where consistent voltage regulation is essential. The growing shift toward smart grids and renewable power integration boosts demand for compact, energy-efficient transformer cores. Manufacturers invest in advanced magnetic steel and vacuum casting processes to enhance thermal stability and performance reliability in varying load conditions.

- For instance, Hyosung Heavy Industries’ oil‑immersed transformers support voltage ratings up to 77 kV and power handling from 100 kVA to 80 MVA, and the company has shipped more than 150000 units to date.

By Technology

The self-air cooling segment leads the market with a 58% share in 2024, owing to its simple design, low maintenance, and reliable thermal performance. These transformers utilize natural air circulation for cooling, making them ideal for indoor and outdoor installations with limited ventilation. The increasing focus on eco-friendly and maintenance-free systems drives their adoption across utilities, commercial complexes, and industrial plants. Manufacturers are integrating IoT-enabled temperature sensors to monitor efficiency and extend operational lifespan, supporting their dominance over air-blast alternatives.

- For instance, Bharat Bijlee plans to boost transformer manufacturing capacity by 7,000 MVA at its Airoli facility in Navi Mumbai, raising total capacity from 28,000 MVA to 35,000 MVA. The board approved this expansion on August 25, 2025.

By Insulation

The Class F insulation segment holds the largest share of 41% in 2024, driven by its superior thermal endurance and safety compliance. Class F materials withstand temperatures up to 155°C, providing a balance between cost and durability for continuous operation in demanding environments. These transformers are widely used in manufacturing plants, renewable energy systems, and distribution substations. The rising adoption of fire-resistant epoxy resin and enhanced insulation coatings promotes reliability and extends service life, making Class F insulation the preferred choice for modern dry-type distribution transformers.

Key Growth Drivers

Rising Focus on Energy Efficiency and Grid Modernization

The global shift toward energy-efficient infrastructure drives demand for dry type distribution transformers. Governments and utilities are investing in smart grid modernization to reduce transmission losses and enhance energy reliability. Dry type transformers offer low maintenance, high efficiency, and safety advantages compared to oil-filled variants. Their fire-resistant design makes them suitable for densely populated and environmentally sensitive areas. Continuous upgrades in insulation materials and cooling systems further strengthen their adoption in sustainable energy distribution networks.

- For instance, GE’s transformer and grid‑support portfolio spans medium through ultra‑high voltage domains. They offer power transformers ranging from 5 MVA up to 2,750 MVA, and voltage capabilities from 1200 kV AC to ±1100 kV DC.

Expansion of Renewable Energy Integration

The growing renewable energy capacity, especially from solar and wind sources, accelerates the deployment of dry type distribution transformers. These transformers provide efficient voltage regulation and stability for distributed generation networks. Their ability to operate in fluctuating load environments aligns with renewable integration requirements. Governments worldwide are emphasizing green power infrastructure, leading to higher investments in dry type solutions. Manufacturers focus on developing compact, high-capacity transformers for renewable projects, ensuring reliability and minimal environmental impact.

- For instance, HPS unveiled EV Charging Distribution Transformers—three-phase units rated from 15 kVA up to 1000 kVA, with 220 °C insulation class (150 °C rise) and optional rugged 3RE+ enclosures tested to withstand blowing snow and rain at speeds up to 120 km/h.

Increasing Industrial and Commercial Power Demand

Rapid industrialization and urbanization across developing economies fuel the need for reliable and safe power distribution systems. Dry type distribution transformers are favored in commercial complexes, data centers, and healthcare facilities due to their non-flammable characteristics. The growing adoption of automation and electric-driven systems increases energy loads, requiring efficient and durable transformers. The segment benefits from rising construction of smart buildings and industrial parks, where energy reliability and operational safety remain key priorities for end users.

Key Trends & Opportunities

Adoption of Smart Monitoring and IoT Technologies

The integration of IoT-enabled monitoring systems and digital sensors is transforming transformer performance management. These technologies enable real-time tracking of temperature, load, and insulation health, improving maintenance efficiency and system reliability. Manufacturers are introducing smart transformers with cloud-based analytics and predictive diagnostics to minimize downtime. The trend toward digitalized energy infrastructure creates new opportunities for innovation in connected dry type transformer solutions.

- For instance, CG Power manufactures a wide spectrum of transformers, offering power transformers rated from 25 kVA to 1,500 MVA and voltage classes spanning 11 kV to 765 kV. The company also produces reactors, with a range of 10 MVAr to 125 MVAr, in voltage classes from 33 kV to 765 kV.

Development of High-Temperature and Compact Designs

The market is witnessing advancements in compact and high-temperature-resistant transformer designs. New insulation materials and thermal management techniques enhance performance under extreme environmental conditions. Compact dry type transformers are increasingly deployed in renewable installations, transport hubs, and space-constrained commercial buildings. This trend supports sustainability targets by reducing footprint and improving power density. Manufacturers leveraging advanced resin encapsulation and vacuum pressure impregnation technologies gain a competitive edge.

- For instance, Hyundai manufactures power transformers with ratings up to 1,500 MVA and voltage capability up to 800 kV—spanning generator step-up, transmission, and distribution transformers.

Growing Preference for Eco-Friendly and Fire-Safe Systems

Environmental regulations and safety standards encourage the shift from oil-filled to dry type transformers. These transformers eliminate the risk of oil leakage, fire hazards, and environmental contamination. Their suitability for indoor and underground applications offers significant advantages in urban energy systems. As global emission reduction goals intensify, the adoption of eco-friendly transformer materials and designs becomes a major opportunity for manufacturers to align with sustainability goals.

Key Challenges

High Initial Cost and Complex Manufacturing Process

Dry type distribution transformers involve higher production costs due to advanced insulation, vacuum casting, and cooling systems. These factors increase upfront investment compared to oil-filled alternatives, limiting adoption in cost-sensitive markets. Additionally, the manufacturing process demands specialized facilities and skilled labor. Small and medium-scale utilities often face budget constraints, which can restrict large-scale deployment despite long-term efficiency benefits.

Thermal Limitations and Restricted Power Range

While dry type transformers offer improved safety and environmental benefits, they face challenges in managing heat dissipation at higher capacities. The natural air or forced air cooling systems limit their performance beyond certain voltage levels. This restricts their use in heavy industrial or high-voltage transmission networks. Manufacturers are addressing this through material innovation and enhanced thermal design, but achieving cost-effective scalability remains a persistent technical challenge.

Regional Analysis

North America

North America holds a 28% share of the Dry Type Distribution Transformer Market in 2024. The region benefits from strong investments in grid modernization, renewable integration, and data center expansion. The United States leads with widespread adoption of energy-efficient transformers to comply with Department of Energy (DOE) standards. Canada follows, driven by infrastructure upgrades and urban electrification. Major manufacturers focus on introducing IoT-enabled monitoring systems and fire-resistant insulation solutions. The rising focus on replacing aging transformers and expanding electric vehicle charging infrastructure supports steady market growth across the region.

Europe

Europe accounts for a 24% market share in 2024, driven by strict environmental regulations and sustainability goals. Countries such as Germany, France, and the United Kingdom lead in adopting dry type transformers across renewable power grids and smart city projects. The region’s focus on reducing carbon emissions encourages the replacement of oil-filled transformers with eco-friendly alternatives. European Union directives promoting green infrastructure investments further boost demand. The market also benefits from technological advancements in cast resin insulation and compact transformer design suited for urban energy systems.

Asia-Pacific

Asia-Pacific dominates the global market with a 34% share in 2024, driven by rapid industrialization and rising electricity consumption in China, India, Japan, and South Korea. Government initiatives supporting renewable integration and smart grid deployment stimulate large-scale adoption. China leads production and export, supported by strong manufacturing capabilities and expanding renewable capacity. India experiences growth through rural electrification and industrial corridor development. The region’s focus on safety, efficiency, and local manufacturing expansion strengthens the dominance of dry type distribution transformers in both utility and industrial sectors.

Latin America

Latin America captures a 7% market share in 2024, with growth led by Brazil, Mexico, and Chile. The region’s increasing renewable energy projects, particularly solar and wind, enhance demand for dry type transformers. Governments are prioritizing grid reliability and rural electrification programs. Manufacturers are entering strategic partnerships to supply cost-efficient, maintenance-free transformers suitable for diverse climates. Brazil’s industrial modernization and Chile’s mining sector electrification contribute significantly. Despite economic fluctuations, investments in sustainable infrastructure and smart distribution networks continue to support moderate market growth in the region.

Middle East & Africa

The Middle East & Africa region holds a 7% share of the market in 2024, supported by power infrastructure expansion and urban development projects. The Gulf nations are investing heavily in smart grid systems and commercial buildings requiring fire-safe transformers. In Africa, countries such as South Africa, Egypt, and Nigeria are focusing on renewable energy integration and electrification programs. Dry type transformers are preferred for their safety and minimal maintenance needs in high-temperature conditions. Continuous government-backed infrastructure investments strengthen long-term market potential across the region.

Market Segmentations:

By Core:

By Technology:

By Insulation:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Dry Type Distribution Transformer Market is characterized by strong competition among key players including Easun Reyrolle Limited, General Electric, Kirloskar Electric Company Limited, Schneider Electric, Hitachi Energy Ltd., CG Power & Industrial Solutions Ltd., ABB, Crompton Greaves Consumer Electricals Limited, Bharat Heavy Electricals Limited (BHEL), and Eaton. The Dry Type Distribution Transformer Market features an increasingly competitive landscape driven by technological innovation, energy efficiency standards, and sustainability goals. Manufacturers are focusing on enhancing transformer reliability through advanced insulation materials, vacuum pressure impregnation, and cast resin technology. The integration of IoT-enabled monitoring systems and smart diagnostics improves performance tracking and predictive maintenance. Companies are expanding production capacities and establishing partnerships with utilities and industrial sectors to strengthen global reach. Continuous R&D investments support compact, fire-resistant, and eco-friendly designs that meet evolving safety norms. Rising adoption across renewable energy networks and smart city infrastructures further intensifies competition among global and regional manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Easun Reyrolle Limited

- General Electric

- Kirloskar Electric Company Limited

- Schneider Electric

- Hitachi Energy Ltd.

- CG Power & Industrial Solutions Ltd.

- ABB

- Crompton Greaves Consumer Electricals Limited

- Bharat Heavy Electricals Limited (BHEL)

- Eaton

Recent Developments

- In July 2025, power transformers utilizing advanced natural ester insulating fluids. These transformers offer enhanced thermal stability and safety features, supporting sustainable grid upgrades and reducing environmental impact across the utility and industrial sectors.

- In April 2025, Eaton inaugurated a state-of-the-art transformer manufacturing facility in Hai’an, Jiangsu, China, enhancing its collaboration with Jiangsu Ryan Electrical Co. Ltd. This facility integrates smart manufacturing and IoT technologies to support the global shift toward smart electrification.

- In January 2024, GE Vernova and IHI Corporation have initiated the next phase of their collaboration to develop a gas turbine combustion system capable of burning 100% ammonia, potentially transforming natural gas fired electricity generation.

- In May 2023, Huntsman worked with TBEA Group, a global leader in the production of power transmission and distribution equipment with an annual transformer capacity of 260 million kVA, on an Outdoor Dry Type Transformer (DDT)

Report Coverage

The research report offers an in-depth analysis based on Core, Technology, Insulation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness growing adoption of eco-friendly and fire-safe transformer technologies.

- Digital monitoring and IoT integration will enhance operational efficiency and predictive maintenance.

- Rising renewable energy projects will drive demand for compact and energy-efficient transformers.

- Urban infrastructure and smart grid development will strengthen product penetration across cities.

- Advancements in insulation materials will improve thermal performance and lifespan.

- Manufacturers will expand production capacities in Asia-Pacific to meet increasing demand.

- Government regulations promoting energy efficiency will accelerate replacement of oil-filled transformers.

- Industrial automation and electrification will create new application opportunities.

- Strategic collaborations and technology licensing will support innovation and market expansion.

- Ongoing R&D will focus on developing high-capacity dry type transformers for heavy-duty applications.