Market Overview

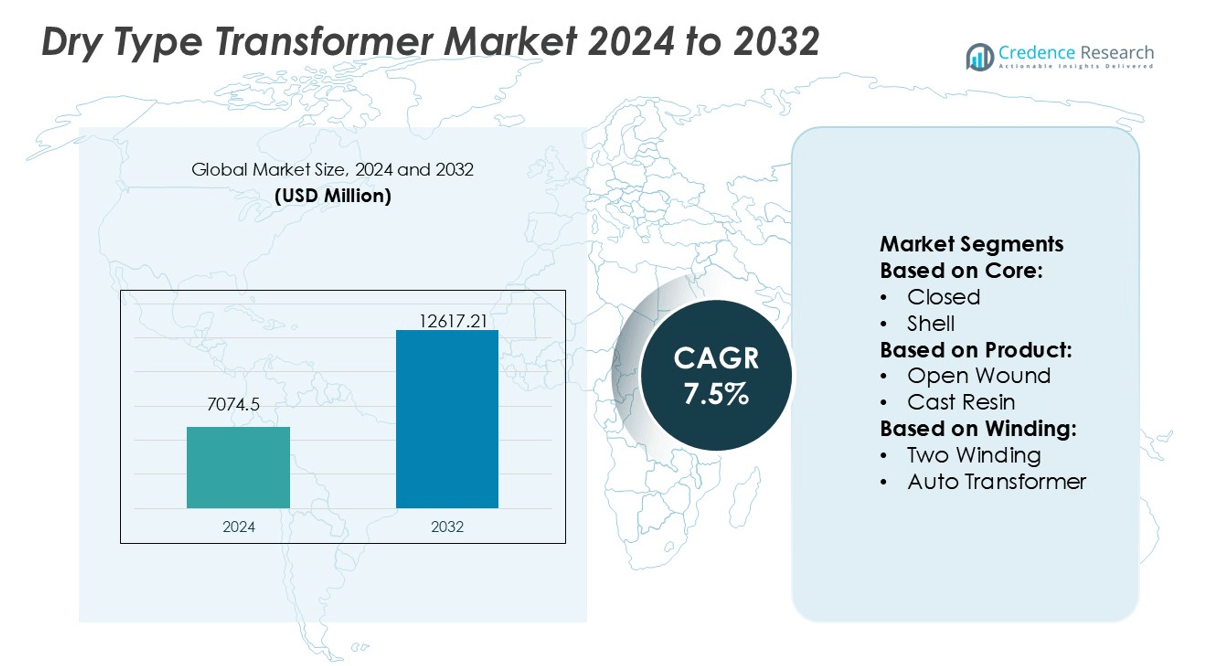

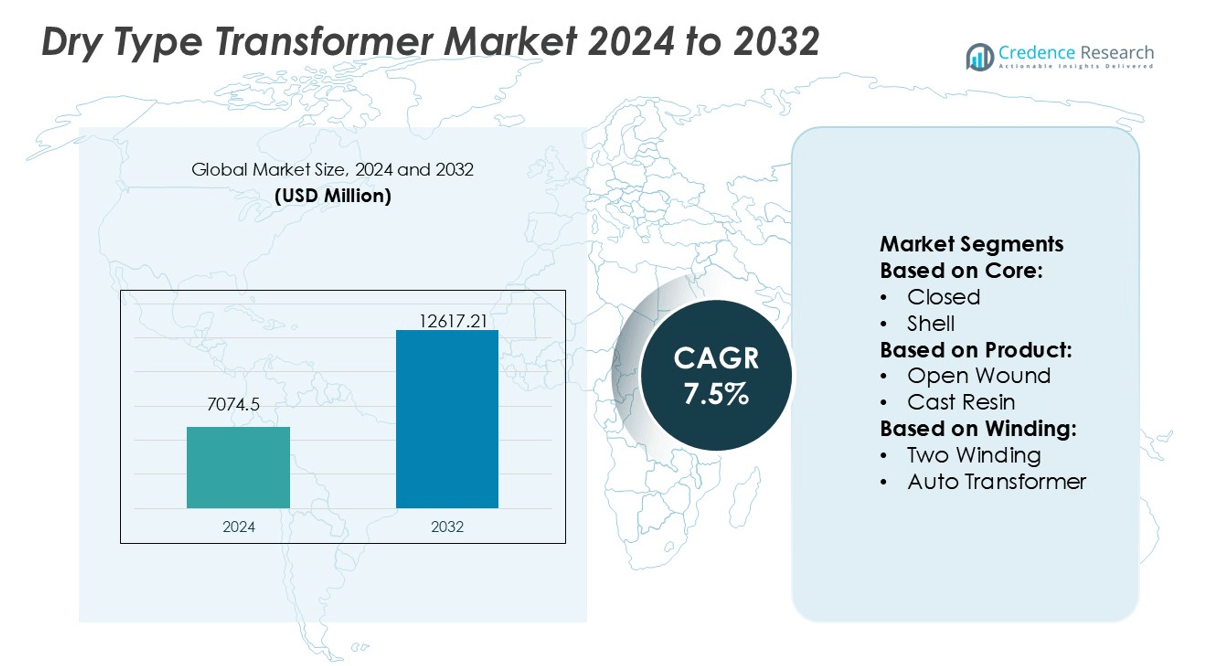

Dry Type Transformer Market size was valued USD 7074.5 million in 2024 and is anticipated to reach USD 12617.21 million by 2032, at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dry Type Transformer Market Size 2024 |

USD 7074.5 million |

| Dry Type Transformer Market, CAGR |

7.5% |

| Dry Type Transformer Market Size 2032 |

USD 12617.21 million |

The Dry Type Transformer Market is shaped by key players including ABB, GE, Hitachi Energy, Schneider Electric, Eaton, Fuji Electric, Bharat Heavy Electricals, CG Power and Industrial Solutions, Raychem RPG, and Instrument Transformer Equipment. These companies emphasize digital monitoring, energy efficiency, and sustainable insulation technologies to enhance reliability and operational safety. Strategic partnerships, regional manufacturing expansion, and R&D investments drive product innovation and global competitiveness. Asia-Pacific leads the market with a 34% share in 2024, supported by large-scale renewable energy projects, rapid industrialization, and urban electrification initiatives across China, India, and Japan, reinforcing the region’s dominant position in the global landscape.

Market Insights

- The Dry Type Transformer Market was valued at USD 7074.5 million in 2024 and is projected to reach USD 12617.21 million by 2032, growing at a CAGR of 7.5%.

- Market growth is driven by renewable energy expansion, grid modernization, and the demand for fire-safe, eco-efficient transformer solutions across industrial and utility sectors.

- Key trends include the adoption of IoT-based monitoring systems, sustainable resin insulation, and the development of compact, high-performance units for smart grids and data centers.

- The competitive landscape features strong participation from ABB, GE, Hitachi Energy, Schneider Electric, Eaton, Fuji Electric, and others focusing on technological innovation and global expansion.

- Asia-Pacific leads with a 34% market share, followed by North America and Europe, while the Cast Resin Transformer segment dominates with over 52% share, reflecting strong adoption in renewable, commercial, and urban electrification applications worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Core

The Closed Core segment dominated the Dry Type Transformer Market with a 48% share in 2024. This design provides uniform magnetic flux distribution, minimizing core losses and noise. Its robust mechanical strength and compact structure make it ideal for commercial and utility installations. Growth is driven by rising use in medium-voltage applications, renewable energy systems, and smart grid infrastructure. Manufacturers such as ABB and Hitachi Energy use advanced amorphous steel cores to enhance energy efficiency and reduce no-load losses by nearly 70%, strengthening their market presence.

- For instance, Hitachi Energy’s HiDry dry-type transformer family (originally ABB HiDry) offers ratings up to 63 MVA and high voltages up to 72.5 kV for standard applications, and leverages advanced technology for sub-transmission and specialized installations.

By Product

The Cast Resin Transformer segment held the dominant position with a 52% share in 2024. Cast resin designs provide superior fire resistance, moisture protection, and low maintenance needs, making them suitable for indoor and harsh environments. Growing adoption in metro stations, renewable power plants, and industrial facilities drives segment expansion. Key players like Schneider Electric and Siemens Energy have developed resin-encapsulated transformers capable of operating up to 36 kV with high thermal endurance and reduced partial discharge levels, improving reliability in demanding applications.

- For instance, BHEL manufactures dry-type transformers that feature copper windings encapsulated in class-F epoxy resin via a vacuum casting process. These transformers are typically equipped with temperature monitoring systems that use embedded RTD PT100 sensors to detect winding hot-spot temperatures.

By Winding

The Two Winding Transformer segment accounted for the largest share at 61% in 2024. These transformers ensure electrical isolation between primary and secondary circuits, which is essential in safety-critical and grid-distribution systems. They are preferred in renewable energy plants, rail systems, and industrial power distribution. The segment’s growth is supported by increased demand for decentralized energy systems and grid modernization. Companies such as General Electric and Eaton are introducing digitally monitored two-winding units with integrated sensors for predictive maintenance and enhanced operational efficiency.

Key Growth Drivers

Expansion of Renewable Energy Infrastructure

The increasing integration of renewable energy systems such as solar and wind is a major growth driver for the Dry Type Transformer Market. These transformers are widely used in renewable projects for their safety, compact size, and low maintenance. The adoption of cast resin and vacuum pressure impregnated types enhances reliability in humid or dusty environments. Governments worldwide are investing in grid modernization to accommodate variable renewable input, which further supports the deployment of dry type transformers in decentralized power networks and hybrid energy projects.

- For instance, Hyosung Heavy Industries delivered 400 kV ester-oil transformers to European utilities, including a supply agreement with Scottish Power. These transformers are designed with enhanced safety features.

Rising Focus on Fire Safety and Environmental Standards

Growing emphasis on fire safety, sustainability, and eco-friendly materials drives market demand. Dry type transformers use solid insulation instead of oil, reducing fire risks and environmental hazards. This design meets stringent fire-safety codes for high-density installations such as hospitals, metro stations, and data centers. Manufacturers like ABB and Schneider Electric are focusing on halogen-free resin systems that emit minimal toxic gases during faults, ensuring compliance with global standards such as IEC 60076-11 and EN 50541-1, thus accelerating product adoption in urban infrastructure projects.

- For instance, GE’s transformer and grid‑support portfolio spans medium through ultra‑high voltage domains. They offer power transformers ranging from 5 MVA up to 2,750 MVA, and voltage capabilities from 1200 kV AC to ±1100 kV DC.

Technological Advancements and Digital Monitoring Integration

The integration of IoT, smart sensors, and digital monitoring systems significantly boosts market growth. These technologies enable real-time fault detection, thermal monitoring, and predictive maintenance, reducing downtime and operational costs. Companies like Eaton and Siemens Energy offer transformers equipped with condition-monitoring platforms and data analytics tools. Such advancements align with the global transition toward smart grids and intelligent substations, improving performance visibility and lifecycle management. This digital evolution enhances the efficiency and reliability of dry type transformers across industrial, commercial, and utility sectors.

Key Trends & Opportunities

Growing Adoption in Data Centers and EV Infrastructure

Data center expansion and electric vehicle (EV) charging infrastructure are emerging opportunities. Dry type transformers are ideal for indoor, high-load environments due to their silent operation and fire-safe design. The surge in hyperscale data centers and nationwide EV network rollouts creates new demand for high-efficiency transformers. Leading manufacturers are developing compact, air-cooled units with improved thermal performance and load-handling capabilities, positioning them as preferred solutions for high-reliability, low-maintenance energy systems in digital and mobility-driven industries.

- For instance, Eaton’s catalog for medium-voltage dry-type transformers explicitly states that three-phase units are available in ratings from 112.5 kVA up to 32,000 kVA.

Increasing Investments in Smart Grid and Urban Electrification

Governments are heavily investing in smart grid infrastructure and urban electrification projects, creating substantial opportunities. Dry type transformers are essential in these systems for efficient, low-loss power distribution and easy integration with digital monitoring tools. The growing shift toward decentralized energy and microgrid installations further accelerates adoption. Urban modernization initiatives across Asia-Pacific and Europe, coupled with industrial automation, support large-scale replacement of conventional oil-filled transformers with dry type models for enhanced safety and environmental compliance.

- For instance, Kirloskar Electric Company Limited (KEC) offers cast-resin dry-type transformers up to 10,000 kVA at 33 kV class in its Special Transformers line.Their distribution transformers cover 160 kVA to 2,500 kVA up to 33 kV with designs compliant with IS:2026 / IEC:76 standards.

Key Challenges

High Initial Installation and Material Costs

Despite long-term operational advantages, dry type transformers have higher upfront costs compared to oil-filled alternatives. The use of premium materials, epoxy resin insulation, and advanced cooling systems increases capital expenditure. These costs can be restrictive for small-scale or budget-sensitive installations, especially in developing markets. Manufacturers are focusing on cost optimization and modular production techniques to mitigate this challenge and enhance market competitiveness without compromising performance or safety standards.

Limited Cooling Capacity and Overload Performance

Dry type transformers face performance challenges in high-load or outdoor applications due to limited cooling efficiency. Overheating risks can reduce lifespan and reliability, particularly in hot or enclosed environments. Unlike oil-filled transformers, they cannot sustain prolonged overloads without auxiliary cooling. To address this issue, manufacturers are innovating with air-blast cooling and high-temperature insulation materials. Continued R&D in thermal management and compact ventilation systems is essential to expand the operational range and scalability of dry type transformers.

Regional Analysis

North America

North America held a 28% share of the Dry Type Transformer Market in 2024, driven by robust investments in renewable energy, smart grids, and industrial automation. The United States leads the region due to modernization of transmission networks and expansion of data centers. Canada’s focus on sustainable energy and electric vehicle infrastructure also fuels adoption. Major players such as Eaton, General Electric, and Schneider Electric emphasize eco-efficient designs and digital monitoring. Increasing replacement of oil-filled units with fire-safe dry type transformers strengthens regional growth across commercial and utility installations.

Europe

Europe accounted for a 25% market share in 2024, supported by stringent environmental regulations and widespread renewable integration. Germany, the U.K., and France are leading markets owing to advanced grid infrastructure and growing demand for urban electrification. The European Union’s emphasis on carbon neutrality accelerates the shift toward dry type transformers. Key manufacturers like ABB, Siemens Energy, and CG Power & Industrial Solutions invest in sustainable resin-based insulation technologies. Expanding rail electrification projects and smart building systems also contribute to the region’s steady market expansion.

Asia-Pacific

Asia-Pacific dominated the global Dry Type Transformer Market with a 34% share in 2024. Rapid industrialization, urbanization, and renewable energy deployment in China, India, and Japan drive strong demand. Government programs promoting green infrastructure and smart cities boost adoption of cast resin and vacuum pressure impregnated transformers. Major companies like Hitachi Energy, Kirloskar Electric, and Bharat Heavy Electricals focus on manufacturing high-efficiency and compact units tailored for harsh conditions. Expanding manufacturing hubs, data centers, and EV infrastructure reinforce Asia-Pacific’s leadership in global market growth.

Latin America

Latin America captured a 7% share in 2024, supported by grid modernization and renewable energy investments in Brazil, Mexico, and Chile. Dry type transformers are increasingly used in commercial and public infrastructure due to their fire-safe and eco-friendly characteristics. Regional governments are focusing on sustainable power projects and industrial upgrades. Companies such as Siemens Energy and ABB have expanded local presence through partnerships and technical collaborations. The growing demand from mining, utilities, and renewable sectors contributes to the steady development of the regional transformer market.

Middle East & Africa

The Middle East & Africa accounted for a 6% share in 2024, with growing energy diversification and infrastructure expansion. Countries like the UAE, Saudi Arabia, and South Africa are investing in renewable projects and smart grid systems. Dry type transformers are increasingly adopted in oil and gas, commercial buildings, and power distribution networks. Local manufacturing and strategic partnerships enhance supply chain resilience. ABB and Eaton have introduced dry type solutions suited for high-temperature environments, supporting reliable operations and reinforcing the region’s gradual shift toward sustainable energy technologies.

Market Segmentations:

By Core:

By Product:

By Winding:

- Two Winding

- Auto Transformer

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Dry Type Transformer Market features leading companies such as Fuji Electric, Schneider Electric, CG Power and Industrial Solutions, Raychem RPG, Hitachi Energy, Eaton, Bharat Heavy Electricals, Instrument Transformer Equipment, GE, and ABB. The Dry Type Transformer Market is defined by continuous innovation, digital integration, and sustainability-driven strategies. Companies are investing heavily in research and development to design transformers with higher efficiency, reduced losses, and improved thermal management. The focus on IoT-enabled monitoring systems and smart grid compatibility enhances operational reliability and predictive maintenance capabilities. Manufacturers are also emphasizing eco-friendly materials and resin insulation systems that comply with global energy and fire safety regulations. Strategic partnerships, capacity expansions, and localization initiatives further strengthen global competitiveness and ensure reliable supply to industrial, commercial, and utility sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fuji Electric

- Schneider Electric

- CG Power and Industrial Solutions

- Raychem RPG

- Hitachi Energy

- Eaton

- Bharat Heavy Electricals

- Instrument Transformer Equipment

- GE

- ABB

Recent Developments

- In December 2024, SSE and Siemens Energy have announced a partnership “Mission H2 Power,” aimed at advancing gas turbine technology to operate on 100% hydrogen. This initiative supports the decarbonization of SSE’s Keadby 2 Power Station, which currently utilizes natural gas.

- In June 2024, Adani Power Ltd (APL) announced that its arm Mahan Energen Ltd has approved a proposal to merge coal mining firm Stratatech Mineral Resources with itself which will help improve fuel security.

- In June 2023, Hitachi Energy recently delivered a groundbreaking solution with the launch of the latest innovations in transformer insulation and components. The company presents its largest innovation in transformer insulation and a few components.

- In January 2023, Trafo Power Solutions specially developed dry-type transformers with protection class (IP) enable the use of dry-type transformers outdoors despite high levels of dust and moisture

Report Coverage

The research report offers an in-depth analysis based on Core, Product, Winding and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand due to rising investments in renewable and smart grid infrastructure.

- Demand for energy-efficient and fire-safe transformers will continue to strengthen.

- Digital monitoring and IoT-based transformer systems will gain wider adoption.

- Manufacturers will focus on developing compact and low-maintenance designs.

- Government regulations promoting eco-friendly power equipment will boost product replacement.

- The industrial and commercial sectors will increasingly adopt dry type solutions for safety.

- Technological advancements in insulation materials will enhance transformer reliability.

- Emerging economies will witness strong growth from urban and rural electrification projects.

- Integration with EV charging and data center networks will open new opportunities.

- Strategic alliances and regional manufacturing expansion will improve global market competitiveness.